If you want to diversify your UK portfolio by buying shares of popular American technology companies like Apple (AAPL), Tesla (TSLA) or Microsoft (MSFT), you will need to create a trading account with an online broker that can directly access the Nasdaq stock exchange where these stocks are listed.

The good news is that we guide you on how to invest in stocks and maximise your potential. We will take an in-depth look at the Nasdaq stock exchange, including how it works, its listing requirements and trading hours. Furthermore, you will get to know the top three stock brokers that you can use to trade Nasdaq-listed stocks in the UK.

What is Nasdaq?

The Nasdaq is a stock exchange based in New York, United States. Nasdaq, an acronym for National Association of Securities Dealers Automated Quotations, is the second-largest stock exchange globally, second only to the New York Stock Exchange (NYSE).

Nasdaq also refers to a stock market index. Therefore, it is used in two different ways, i.e. an exchange and also an index that tracks the share movements of some publicly traded companies.

The stock exchange was founded by the National Association of Security Dealers (NASD) and it opened its doors on the 8th of February 1971. In 2007, it partnered with a Scandinavian exchange group called OMX, becoming the world’s biggest stock exchange.

How Does the Nasdaq Work?

The Nasdaq is one of the most popular stock markets and probably one of the most talked about exchanges largely because it handles one in every ten global security transactions. It mainly offers a market for stocks, but also caters for commodities, options, fixed income, and derivatives for investors from across the globe.

The Nasdaq has a computerised system where instant quotes are provided for stocks and does not rely on the traditional way of buying and selling securities on a trading floor. It is also incorporated into the over-the-counter market (OTC), thus allowing a trader’s broker to enter the quotes and stock quote information for the stock being considered into the computer.

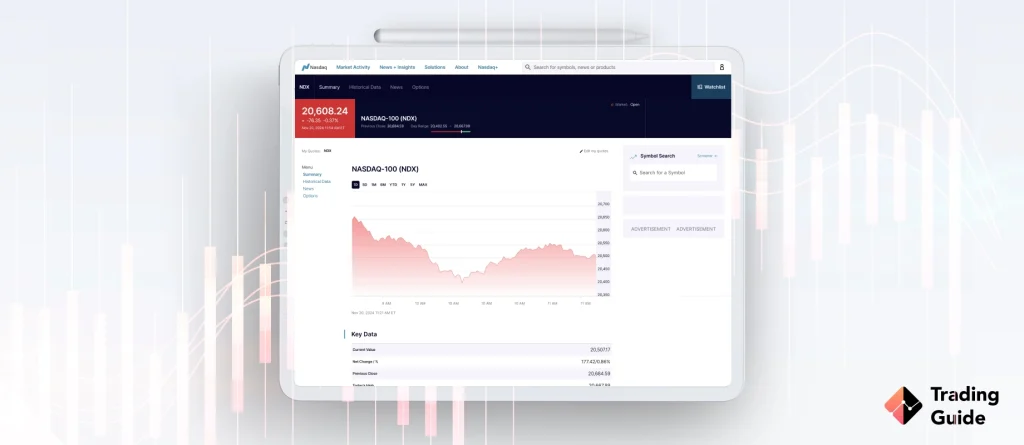

What is Nasdaq 100?

The Nasdaq 100 is the Nasdaq’s equivalent of the UK’s FTSE 100. To keep it short, it is an index that includes 100 of the world’s biggest non-financial companies listed on the wider Nasdaq stock market.

Nasdaq Listing Requirements

If a company wants its stock to be listed on the Nasdaq, it has to have an asset holding of at least $1 million and at least 100,000 publicly held shares. Moreover, companies must have a minimum of 500 shareholders to be listed on the Nasdaq. Companies seeking to be listed on the Nasdaq also have to register with the U.S. Securities and Exchange Commission (SEC) and have at least three market makers.

What Time Does the Nasdaq Open and Close?

The Nasdaq is open on weekdays from Monday to Friday. The regular session begins at 14:30 and closes at 21:00 UK time (GMT). However, investors can also buy and sell stocks in special sessions before the start and after the end of the regular session. Premarket trading sessions begin from 09:00 GMT and run through 14:30 GMT Monday through Friday. After-market trading sessions start at 21:00 GMT to 01:00 GMT each weekday.

Top 3 Brokers for Buying Nasdaq-Listed Stocks

The Nasdaq is home to more than 3,500 stocks, including many of the biggest companies in the world by market capitalisation. You need the best stockbroker matching your trading requirements to access the exchange and buy some of the stocks.

Unfortunately, many traders experience challenges searching and choosing the best stockbroker to invest in Nasdaq stocks. We understand that the process can be overwhelming and time-consuming, leading to wrong choices. For this reason, we have recommended the best three stock brokers below that you can use to invest in the Nasdaq from the UK.

1. eToro

eToro is a user-friendly brokerage firm that offers a hassle-free way to purchase NASDAQ-listed stocks from the UK. With eToro, you can begin investing with as little as $100, meeting its minimum requirement. This broker excels in social and copy trading, allowing you to connect with fellow traders on the platform, exchange trading ideas, and even replicate the positions of experienced traders. Furthermore, eToro offers a wealth of learning resources that will expedite your skill development, enabling you to quickly enhance your trading abilities.

- Low minimum to fund an account and begin trading

- User-friendly and intuitive design platform

- Excellent learning resources

- Charges fees for withdrawal

- High spreads

2. CMC Markets

CMC Markets is one of the most popular stock brokers offering excellent trading tools that suit all traders. For example, you can use the broker to trade U.S.-listed shares as CFDs and trade indices on its Next Generation and MT4 platforms. Moreover, there are no commission charges. The broker also offers more securities to try if need be, including cryptocurrencies, commodities, ETFs, and more.

What’s more, CMC Markets does not have a minimum deposit requirement, making it easier for users to trade some popular stocks on the Nasdaq. However, its customer support service is available only five days a week.

- Massive number of stocks to choose from when trading and/or investing

- No minimum deposit

- Hosts an MT4 platform for advanced traders

- Customer support is only available during weekdays

- Its mobile app does not have a two-step safe login

3. IG Markets

IG Markets facilitates trading of Nasdaq-listed shares as CFDs while using quality resources. Furthermore, the broker offers different trading platforms to give users the best trading experience. The platforms include the ProRealTime, MT4, and the L-2 Dealer which gives traders direct access to NASDAQ’s order books.

Trading Nasdaq-listed stocks at IG Markets is commission-free. However, you will pay spreads, which are a little high compared to what other brokers charge. On top of that, the broker charges a subscription fee if you fail to trade more than three times within three months. IG Markets also has a minimum deposit requirement of $300.

67% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

- Top-notch and plenty of research materials

- Advanced platforms, including the MT4, ProRealTime, and L-2 Dealer

- Numerous Nasdaq-listed stocks available to trade

- High minimum deposit requirement

- Stock trading charges are relatively high

Find out our LCG review in our other article.

FAQs

Nasdaq is known for its innovation and for being the world’s first fully electronic stock market.

Dow, short for the Dow Jones Industrial Average, is a stock market index that tracks the share price movements of 30 publicly traded, blue-chip companies. Nasdaq, on the other hand, tracks more than 3000 companies.

The Nasdaq is owned and operated by an American multinational financial services corporation called Nasdaq Inc. It also owns the Boston and Philadelphia stock exchanges.

To buy stocks that are listed on the Nasdaq, simply open an investment account with a stockbroker that has access to US stock markets.

Yes. If you are in the UK, it is possible to buy stocks that are listed on the Nasdaq. To do that, simply open an investment account with a broker that offers access to US stock markets.

Some brokers may charge you a commission on every trade you make, while others will only charge you a foreign exchange fee when you make your initial pound deposit and then charge zero commission on your trades.

Conclusion

Nasdaq is an exchange where companies can list shares of their stock. UK investors can access this exchange through the brokers we have recommended. Many of the world’s top companies are currently listed on the Nasdaq, and you can buy or sell their shares from the UK.

Related Articles:

How we test?

Our test process is really based on two different aspects: our independent tests and research, as well as user reviews from Google Play, the App Store, and Trustpilot, etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than 200 hours on every article. We pay special attention to the specific function or the criteria that we’re comparing during the comparing stage. This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here.