Automated trading plays a pivotal role in cryptocurrency investments, offering precision, efficiency, and the elimination of emotional bias. In a market flooded with diverse options, selecting the right platform can be daunting. To simplify this process, our guide presents thoroughly researched insights. We conducted extensive tests and comparisons to narrow down the options below, ensuring only the best make the cut. Learn about the top automated trading platforms and gain valuable insights on choosing the ideal one for your needs. You will also discover the benefits of embracing automated tools and kickstart a seamless journey through crypto investments.

Essence

- Automated crypto trading ensures discipline by removing emotional biases from decision-making.

- Automated systems enable crypto trades to be executed at optimal prices, maximising profits and minimising losses.

- While many online automated cryptocurrency platforms provide a valuable service, our curated toplist options go the extra mile.

- Testing automated crypto platforms in the UK is paramount. It allows users to assess the platform’s functionality, reliability, and compatibility with their trading strategies.

- In addition to testing, incorporating user testimonials into the decision-making process is essential.

- The best automated crypto trading platform should align with users’ specific trading needs. Our experts at TradingGuide carefully evaluate platforms based on their flexibility, allowing users to customise strategies, set risk parameters, and adapt the automation tools to their unique preferences.

- The best automated cryptocurrency trading platforms in the UK should adhere to the Financial Conduct Authority (FCA) regulatory framework to secure users’ funds and provide a safe trading environment.

List of the Best Automated Crypto Trading Platforms in the UK

- AvaTrade – Overall Best Automated Crypto Trading Platform in the UK

- FP Markets – Best Automated Crypto Trading Platform With Excellent Support Service

- Saxo – Best Automated Crypto Platform For Professional Traders

In this guide

Best Automated Crypto Trading Platforms UK

- List of the Best Automated Crypto Trading Platforms in the UK

- Compare the Best Automated Crypto Trading Platforms in the UK

- Brief Summary of The Fees and Assets Offered By Our Recommended Automated Crypto Trading Platforms

- Our Opinion & Overview of the Best Automated Crypto Trading Platforms in the UK

- What do Other Traders Say?

- How to Start Trading with Automated Crypto Trading Platform in the UK

- How to Choose the Right UK Automated Crypto Trading Platform

- How Does Automated Crypto Trading Work?

- FAQs

Compare the Best Automated Crypto Trading Platforms in the UK

We have prepared a table below, spotlighting the features of the top automated cryptocurrency trading platforms in the UK. Our objective is to empower you with comprehensive information, enabling you to make informed decisions that will enhance your experience and maximise your potential returns.

| Best Automated Crypto Platform | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| AvaTrade | CBI, CySEC, ASIC, BVIFSC, FSA, SAFCSA, ADGM, ISA | 24/5 | MT4, MT5, AvaTradeGO, AvaOptions, AvaSocial, DupliTrade, Capitalise.ai | Credit/debit cards, Wire transfer, Paypal, Skrill, NETELLER, WebMoney | Yes | Yes, up to $1,000,000 |

| FP Markets | CySEC, ASIC, FCA | 24/7 | MT4, MT5, cTrader, Iress | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust FasaPay | Yes | Yes, up to $500,000 |

| Saxo | FSA, FCA | 24/5 | SaxoTraderGO, SaxoTraderPRO | Bank Wire Transfer, Debit cards | Yes | Yes, up to £100.000 |

Brief Summary of The Fees and Assets Offered By Our Recommended Automated Crypto Trading Platforms

When considering a cryptocurrency trading platform in the UK, you must confirm its features to ensure it fits your requirements. We will take you through these elements later in this guide, but first, here is a brief summary of the fees and assets offered by our best crypto auto trading platforms.

Fees

| Best Automated Crypto Platform | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| AvaTrade | 0.03 pips | £100 | Free | £50 quarterly |

| FP Markets | From 0.0 pips | £100 | Free | None |

| Saxo | From £0.01 commission | £0 (for Classic account) | Free | £0 |

Assets

| Best Automated Crypto Platform | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| AvaTrade | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | No |

| Saxo | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best Automated Crypto Trading Platforms in the UK

Before endorsing any broker or trading platform in the UK, we undertake rigorous research. This process involves comprehensive testing and comparison of numerous options, taking into account various elements that align with our specific criteria. Below, we provide insights into our top automated crypto trading platforms in the UK, informed by our firsthand experience. You can trust that the information we share below accurately reflects what you can expect when trading with these platforms.

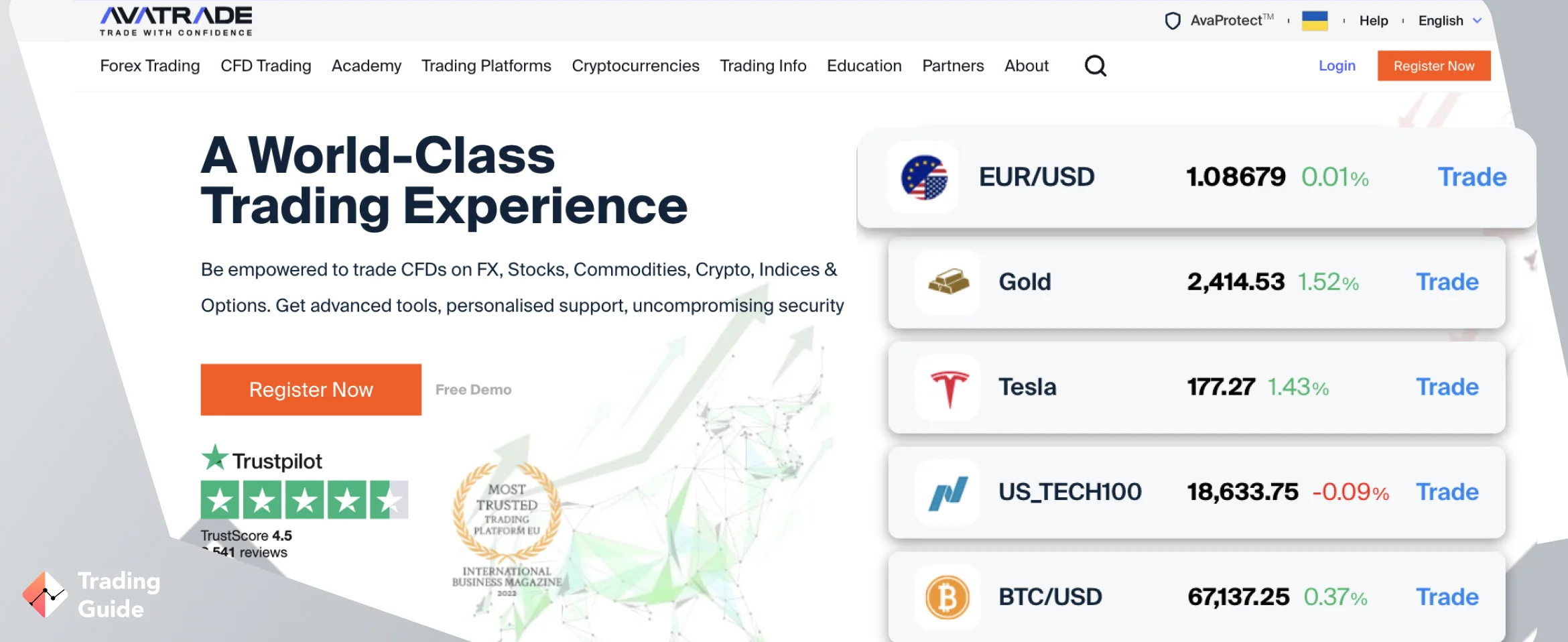

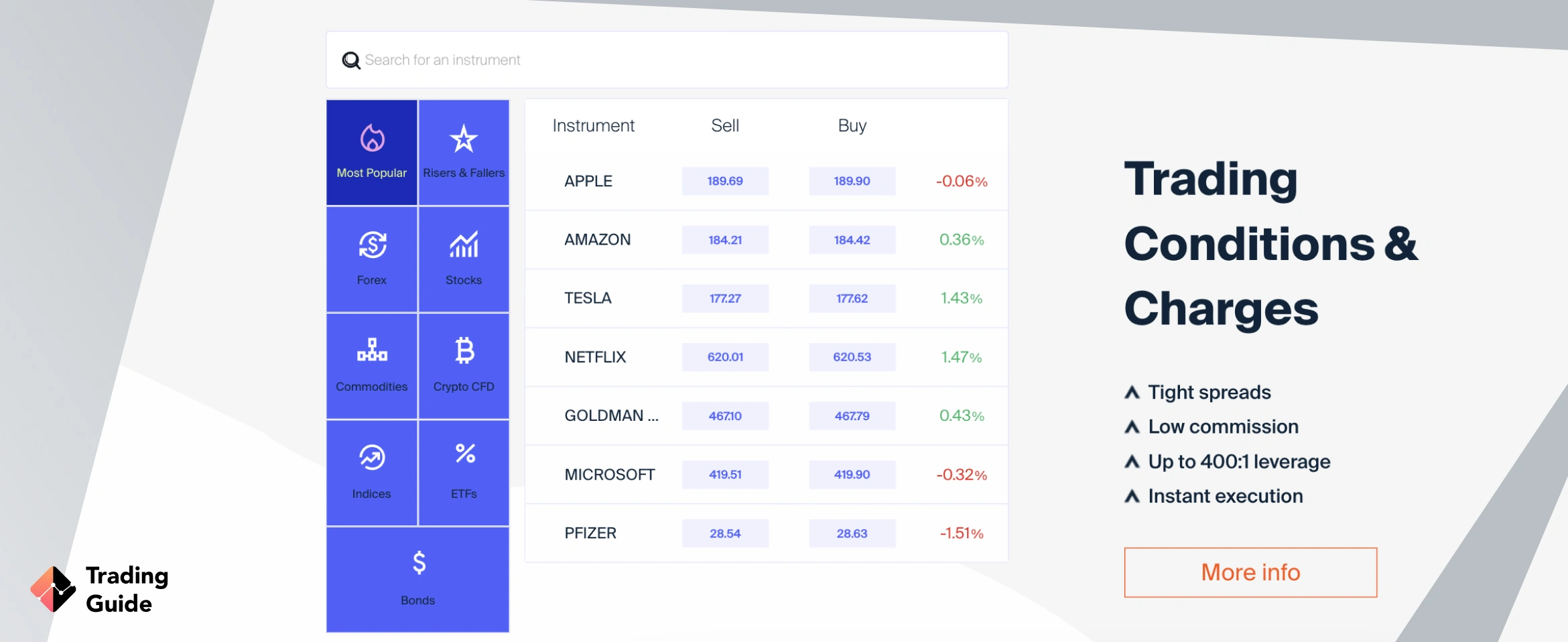

1. AvaTrade – Overall Best Automated Crypto Trading Platform in the UK

From our experience, we find AvaTrade to be the overall best automated cryptocurrency trading platform in the UK. Our testing revealed the platform to be nothing short of remarkable, solidifying its status as the top contender in harnessing automation in crypto trades. For instance, AvaTrade has a user-friendly platform with fast trade execution speed. This allows cryptocurrency traders to quickly enter and exit positions, thus maximising any arising profitable opportunities.

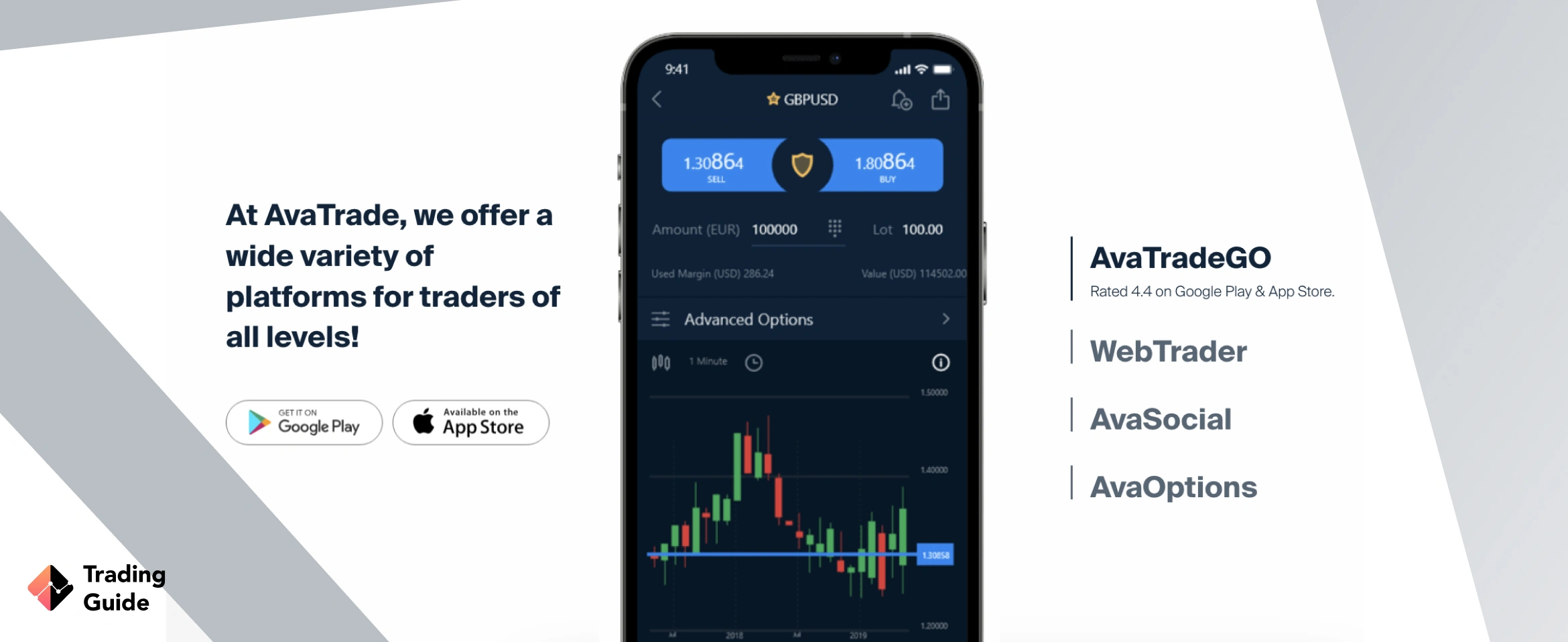

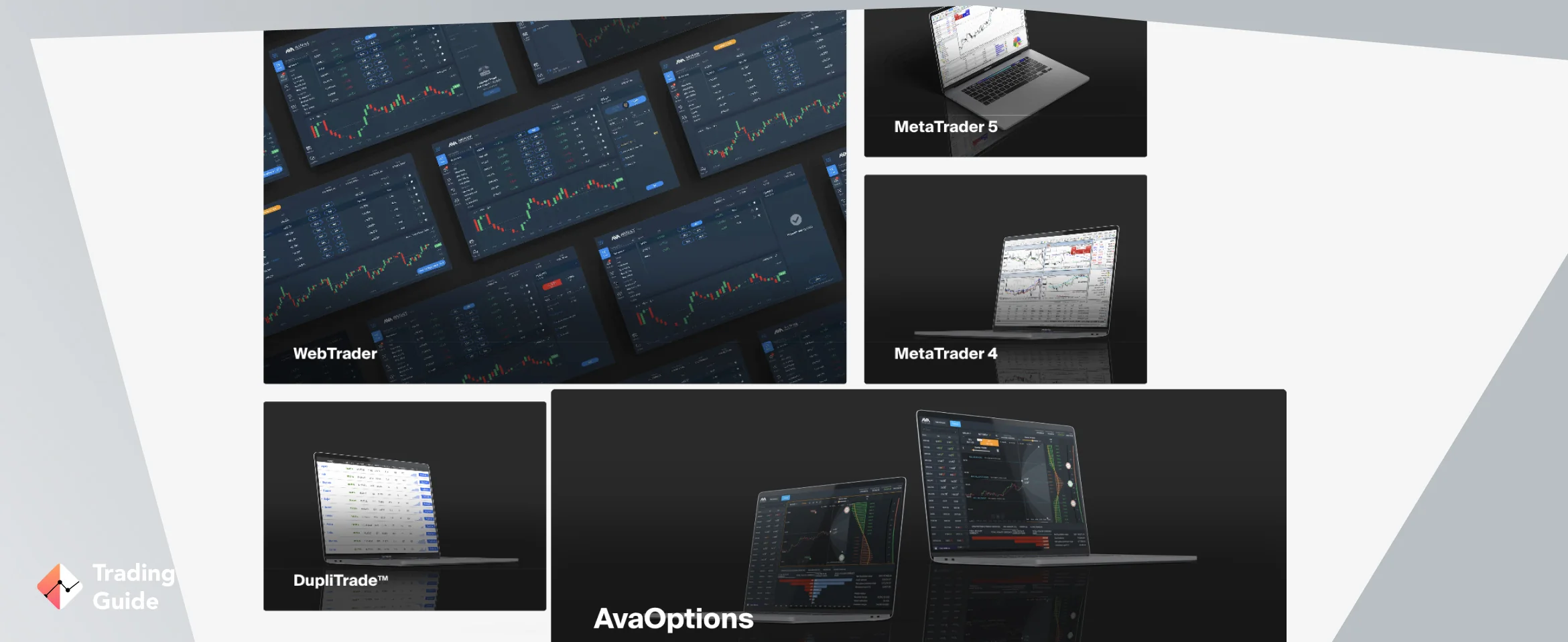

AvaTrade’s automated cryptocurrency trading is available on its MT4 and MT5 platforms. The best element about these platforms is that you are guaranteed quality trading tools and adaptive algorithms that easily adjust to market shifts, empowering users to trade confidently. We also like AvaTrade’s mobile app, which is highly rated by users on Google Play, the App Store, and Trustpilot. Besides cryptos, AvaTrade is a home for an additional 1250+ securities you can use to diversify your portfolio. The broker is also one of the best in social and copy trading, making us give it a 5-star rating.

- Comprehensive learning resources and responsive support

- One-time purchase for long-term use

- A user-friendly automated cryptocurrency trading platform with fast order execution speed

- Features copy and social trading

- Limited asset offerings compared to its peers

- Cryptocurrency trading is offered as CFDs only

| Type | Fee |

| Minimum Deposit | £100 |

| Inactivity Fee | USD Account: $50 EUR Account: €50 GBP Account: £50 |

| Administration Fee | USD Account: $100 EUR Account: €100 GBP Account: £100 |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

2. FP Markets – Best Automated Crypto Trading Platform With Excellent Support Service

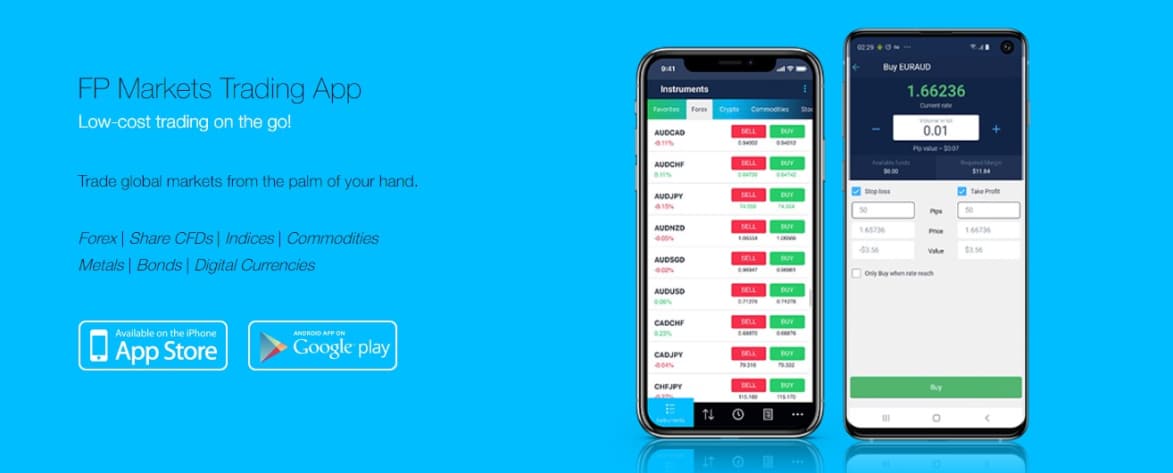

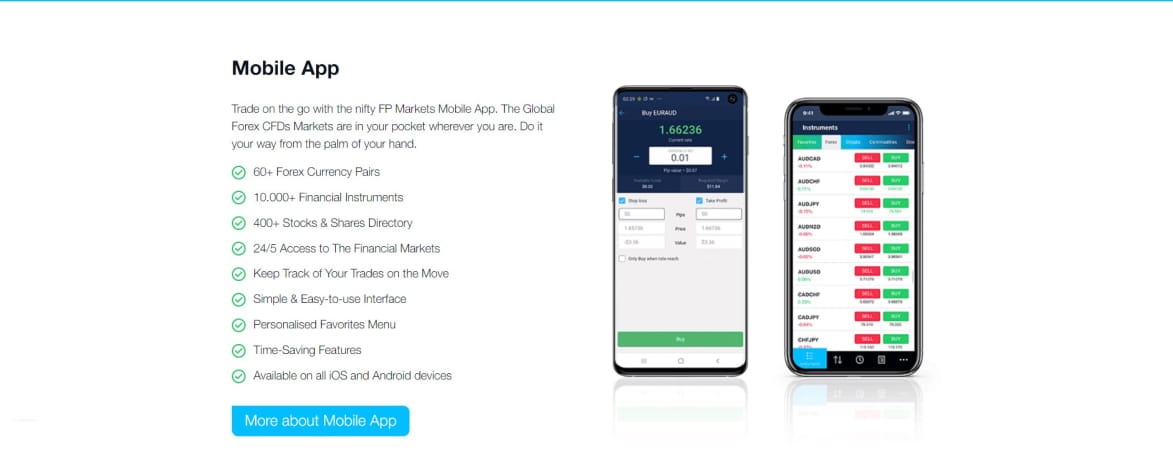

FP Markets is another automated cryptocurrency trading platform that won our hearts with its impressive offerings. One of the standout features that caught our attention is its reliable and efficient support service. Operating daily round the clock via email, phone, or live chat, this platform’s support team offers relevant assistance to keep you engaged in your activities longer. There is also a FAQ section on the platform’s website where users can get quick answers to the commonly asked questions by traders in the UK and beyond.

At FP Markets, we traded numerous cryptocurrencies, including popular ones like Bitcoin, Ethereum, Litecoin, and more. There are also an additional 10,000+ securities for portfolio diversification. You can get started with as little as £100 deposit to enjoy these features and more, such as leverage of up to 500:1 for professional traders. With unparalleled support and comprehensive trading features, FP Markets is one of our best platforms for automated crypto trading. We give it a 4.8-star rating.

- Low cryptocurrency trading fees starting from 0.0 pips

- Additional 10,000+ asset classes for portfolio diversification

- Features customisable alerts and expert advisors for an ultimate experience

- Low minimum deposit requirement (£100)

- Limited cryptocurrency offerings compared to what its peers host

- You can only trade cryptocurrencies as CFDs

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

3. Saxo – Best Automated Crypto Platform For Professional Traders

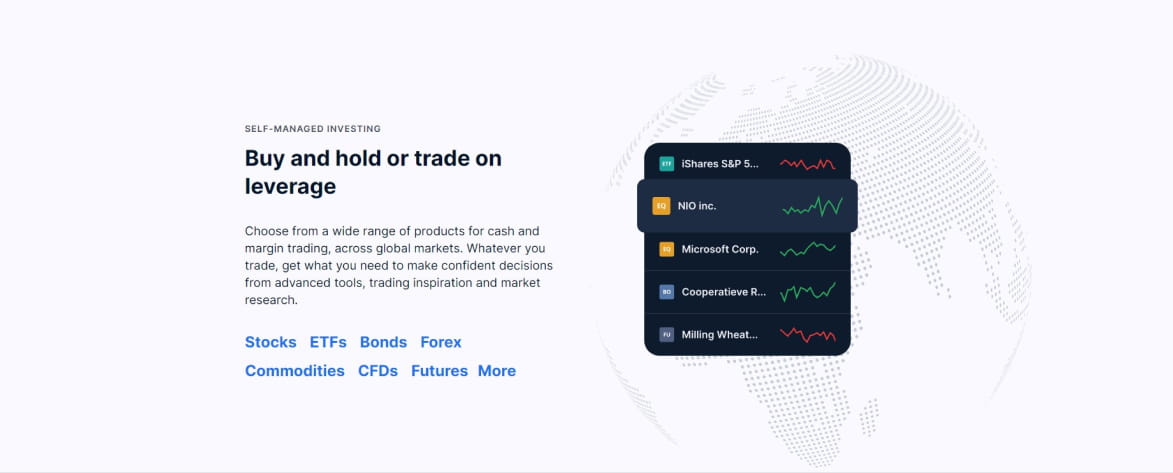

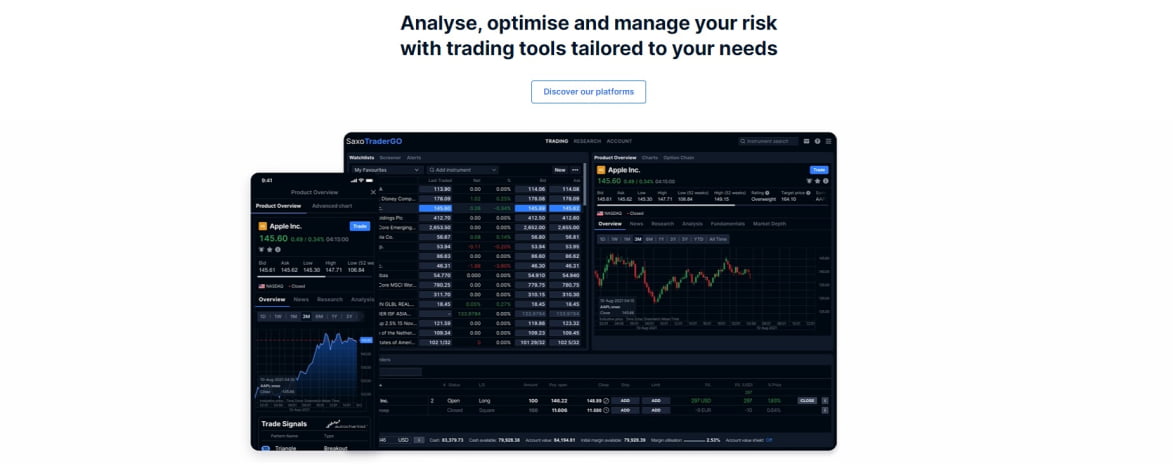

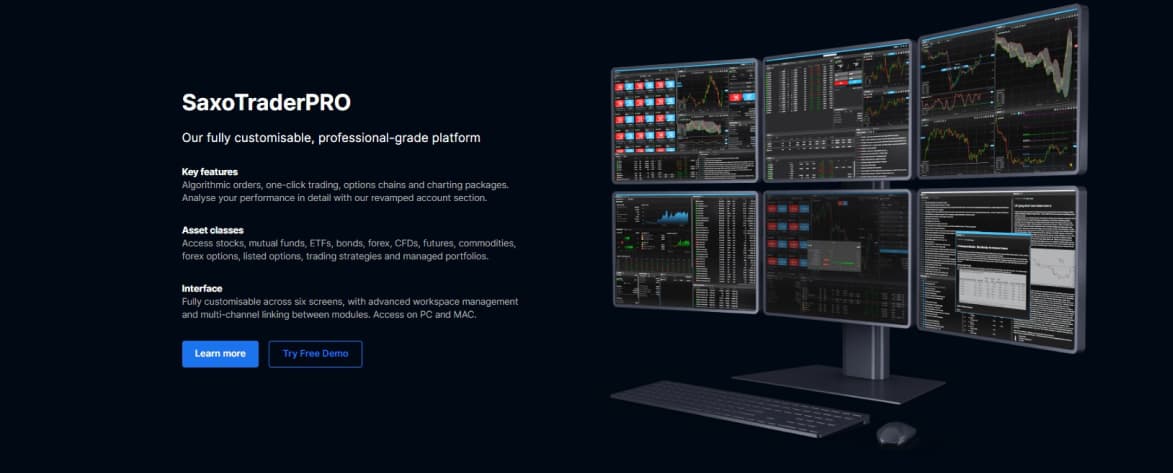

For professional UK traders looking to automate their cryptocurrency trades, Saxo is a considerable choice. With automated cryptocurrency trading available on its SaxoTrader PRO, SaxoTraderGO, and supported third-party platforms like TradingView, Saxo offers unparalleled flexibility and accessibility. Traders can access over 6 cryptocurrencies, including Bitcoin and Ethereum, against major fiat currencies, eliminating the need for currency exchanges during cash-outs.

We also like that Saxo provides options for long-term investment through unleveraged exchange-traded products like ETFs and ETNs, allowing traders to invest in cryptocurrencies like Bitcoin and Ethereum with the same ease as stocks. With no minimum deposit requirement and access to over 70,000 securities for portfolio diversification, this platform ensures a comprehensive trading experience. Users will benefit from quality learning and research materials for skills and strategy development.

- A user-friendly and customisable automated cryptocurrency trading platform

- Offers traders an opportunity to trade cryptocurrencies against fiat currencies and as ETFs/ETNs

- Quality research and learning resources

- Dedicated support service via phone, email, and live chat

- Limited number of cryptocurrencies for trade

- Does not support MetaTrader platforms

| Type | Fee |

| Minimum deposit | $0 (for Classic account) |

| Inactivity fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Manual order fee | €50 per order |

| Stocks | from $1 on US stocks |

| Futures | $1 per lot |

| Listed options | $0.75 per lot |

| ETFs | from $1 |

| Bonds | from 0.05% on govt. bonds |

| Mutual funds | $0 |

What do Other Traders Say?

As previously stated, we diligently test and compare numerous automated crypto trading platforms before offering recommendations. However, our research doesn’t conclude there. We augment our findings by incorporating user feedback from Google Play, the App Store, and Trustpilot. Below, you will find a selection of comments from fellow traders regarding their experiences with our top automated cryptocurrency trading platforms.

AvaTrade

AvaTrade receives positive feedback for its diverse asset selection, robust security measures, and seamless trading experience. Most users value the platform’s regulatory compliance, ensuring the safety of their funds, and its user-friendly interface, facilitating hassle-free trading.

-

“Mobile application is best to use because it is easy for me rather than working on a computer my phone is often on my hand and easy to use” – Andile M

-

“I was assisted by Alev Nazli. She was very friendly and helpful. Made sure I understood the platform and confirmed that I’m all set to go. She followed up the next day as well. Much appreciated.” – Michael S

-

“Best Broker with the best app for easy and quick deposits and withdrawals. Search feature on the app has for me the latest market news to date. Proactive Account Manager who is ready to go the extra mile. I’m happy at AvaTrade, best broker for sure!” – Menfret M

FP Markets

Many traders speak highly of FP Markets for its tight spreads, fast order execution, and extensive range of trading tools. Others commend the platform’s professional customer service, customisable trading platforms, and comprehensive educational resources.

-

“Customer support is really marvelous, my problem was taken seriously and solved within no time. Thanks to the team for their efforts. Great!” – Tariq

-

“The app is user friendly. Even for beginners, it is easy to use, and the customer service live chat is quick in replying.” – Wayne K

-

“Awesome! I’ve been trading with their mobile app for a while now and no issues or lags have occurred; their UI is also clean and smooth.” – Edwina G

Saxo

Saxo garners praise for its extensive product offerings, innovative trading platforms, and reliable market analysis tools. Users appreciate the platform’s research capabilities, diverse asset selection, and commitment to providing a premium trading experience.

-

“SAXO offers an outstanding platform with easy to use tools, informed up to date analysis, education tools and articles, among many other features.

SAXO continues to advance its products with the user success at its core.

Trading with SAXO is a full experience of excellence.” – Francesco Nicolo -

“Took a bit to get used to, but now I can really appreciate the slick UI and great performance. Wide range of products and their support replied in a timely manner the few times I had questions. Also never had any problems with outages which is a huge relieve” – Chistoph Muller

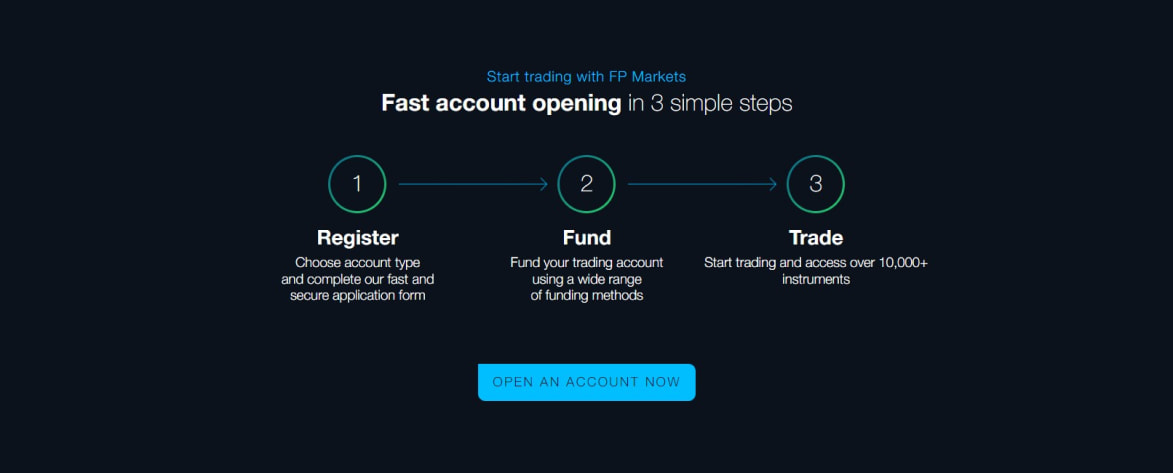

How to Start Trading with Automated Crypto Trading Platform in the UK

Utilising automated trading platforms for cryptocurrency trading in the UK is a straightforward process. Nonetheless, many traders, particularly newcomers, may feel unsure about how to begin. Below, we outline the steps involved, with the aim of helping you master them and kickstart your crypto trading journey with confidence.

Once you have selected the best automated crypto trading platform from our list above, visit its website to begin the registration process. You can click on any of the links we have shared on this page for quick access. On the website, read and understand the broker’s terms and conditions, and install its mobile app on your mobile device to easily trade cryptocurrencies whenever you step away from your trading station.

Once you have completed the first step above, locate the “Sign Up”, “Join”, or “Register” button and click on it. You will be directed to a registration form where you will need to provide personal details such as your name, email address, phone number, and more. You must also create a strong password to secure your account from unauthorised access. Make sure to use a strong password to protect your account. After filling out the form, submit it for review.

After registering, the next step is usually to verify your account. This process is essential for security and FCA regulatory compliance purposes. Your broker may require you to upload identification documents, such as a passport or driver’s licence, as well as proof of address, like a utility bill or bank statement. Follow the platform’s instructions carefully to complete this step. Verification typically takes a short time, after which you will receive confirmation of your account status.

With your account verified, you can proceed to fund it by making a deposit. Most automated cryptocurrency trading platforms like the ones we recommend offer various payment methods, including bank transfers, credit/debit cards, and sometimes even cryptocurrency deposits. Choose the option that suits you best and follow the instructions to initiate the deposit. Be mindful of any fees associated with deposits and ensure you deposit an amount you are comfortable trading with.

Once your account is funded, you are ready to start trading cryptocurrencies using a newly created automated platform. Start by exploring the platform’s interface and familiarise yourself with its features, such as market analysis tools, trading pairs, order types, and more. Then, decide on your trading strategy, whether it’s day trading, swing trading, or long-term investing, and execute your trades accordingly. Keep an eye on market trends and adjust your strategy as needed to optimise your trading performance.

How to Choose the Right UK Automated Crypto Trading Platform

Selecting the appropriate automated cryptocurrency trading platform in the UK demands thorough deliberation. Several factors warrant consideration during this decision-making process, and we outline some below to assist you in discovering the ideal fit.

The security of your funds and personal information is paramount when selecting an automated cryptocurrency trading platform in the UK. Look for platforms that implement robust security measures such as SSL encryption, cold storage for funds, and two-factor authentication (2FA) to safeguard your account. Additionally, ensure that the platform complies with the regulations of the Financial Conduct Authority (FCA) in the UK. Regulatory compliance instils trust and provides assurance that the platform operates within legal frameworks, protecting your interests as a trader.

Understanding the fee structure of a crypto trading platform is essential to managing your trading costs effectively. Evaluate the various fees charged by the platform, including trading fees, deposit and withdrawal fees, and any other miscellaneous charges. Transparent fee structures are preferable, as they allow you to accurately calculate the cost of your trades and avoid unexpected expenses. Consider the overall cost of trading on the platform relative to the services and features provided to ensure you are getting value for your money.

The range of cryptocurrencies available for trading on an automated platform can significantly impact your trading options and strategies. Assess the variety of assets offered by the platform and ensure it includes the cryptocurrencies you are interested in trading. A diverse selection of assets allows you to explore different markets and diversify your portfolio. This will potentially enhance your trading opportunities and risk management strategies.

Look for platforms that provide comprehensive charting tools, technical indicators, and order types to assist you in analysing the market and implementing your trading strategies. Intuitive user interfaces and customisable trading dashboards can also enhance your trading experience by providing a seamless and user-friendly interface for managing your trades. The best automated platform for trading cryptocurrencies must also have quality learning resources, including articles, guides and a demo account for gauging your skill level.

Reliable customer support is crucial for resolving any issues or inquiries that may arise during your trading journey. Evaluate the responsiveness and accessibility of the platform’s customer support team, including the availability of live chat, email support, and telephone assistance. Prompt and helpful customer support ensures that you can seek assistance whenever needed, reducing downtime and potential frustrations associated with technical difficulties or account-related issues.

Feedback from other users can provide valuable insights into a platform’s reliability, performance, and overall user satisfaction. Analyse user reviews on Google Play, the App Store, and Trustpilot and pay attention to both positive and negative feedback. This can help you assess the platform’s strengths and weaknesses more objectively for informed decisions.

How Does Automated Crypto Trading Work?

Automated cryptocurrency trading operates through computer algorithms designed to analyse market data, identify trading opportunities, and execute trades without human intervention. These algorithms are developed based on specific trading strategies, which can range from simple rule-based approaches to complex mathematical models.

The automated trading system continuously monitors cryptocurrency markets, collecting data such as price movements, trading volumes, and market sentiment. Using this data, the algorithms generate buy or sell signals according to predefined criteria and then execute trades based on these signals through connections to cryptocurrency exchanges via APIs.

Once deployed, automated trading systems undergo rigorous testing and optimisation to ensure their effectiveness and profitability. This includes backtesting the algorithms using historical market data to simulate performance, as well as ongoing monitoring and adjustment of trading parameters in response to changing market conditions. By leveraging automation, traders can execute trades more efficiently, capitalise on market opportunities, and manage risk with greater precision. This is all while minimising the emotional biases and limitations often associated with manual trading.

What Are the Benefits of Using an Automated Crypto Trading Platform in the UK?

Utilising an automated cryptocurrency trading platform in the UK offers numerous benefits to traders, including the following.

- Automated crypto trading platforms operate around the clock, allowing traders to execute trades at any time, even when they’re not actively monitoring the markets.

- By relying on pre-programmed algorithms to execute trades based on objective criteria, automated platforms remove the influence of fear, greed, and other emotions that can cloud judgement and lead to irrational trading decisions.

- These platforms can execute trades with lightning-fast speed, enabling traders to capitalise on fleeting market opportunities and take advantage of price movements before manual traders can react.

- They allow traders to backtest their trading strategies using historical market data, providing valuable insights into strategy performance and potential profitability.

- Automated platforms for cryptocurrency trading enable traders to diversify their trading strategies across multiple assets, markets, and timeframes.

- With user-friendly interfaces and support services, automated trading platforms are accessible to traders of all experience levels, from beginners to seasoned professionals.

- The platforms often offer competitive fee structures, with lower trading commissions and fewer overhead costs compared to traditional brokerage services.

Disadvantages of Automated Crypto Trading Platforms

While automated cryptocurrency trading platforms offer several advantages, it’s essential to consider potential drawbacks before using them. Here are some disadvantages to be aware of.

- Automated platforms for cryptocurrency trading are prone to glitches and connectivity problems, potentially causing missed opportunities.

- Relying too much on past data for strategy development may lead to strategies that don’t perform well in real-time markets.

- Without human intervention, automated systems may struggle to adapt to changing market conditions effectively.

- Cryptocurrency markets’ volatility can challenge automated systems’ ability to navigate sudden price swings.

- Entrusting sensitive data to automated cryptocurrency platforms may expose traders to hacking or data breaches.

- Setting up and configuring automated systems can be complex, particularly for novice traders.

FAQs

Automated cryptocurrency trading involves using algorithms to execute trades on cryptocurrency platforms automatically, based on predefined criteria. It eliminates the need for manual intervention and allows for efficient and disciplined trading strategies.

Yes. Automated cryptocurrency trading is legal in many jurisdictions, including the UK. However, it is crucial to trade using an FCA-regulated platform to ensure your funds and personal information remain safe. We recommend above some of the best automated cryptocurrency trading platforms to choose from.

Absolutely. Automated crypto trading can be profitable with effective strategies and risk management. Profitability varies based on market conditions and algorithm performance. This means that you must conduct extensive research and apply prudent risk management to maximise your success potential.

The best platform for automated cryptocurrency trading depends on individual needs and preferences. We recommend on this page some of the most popular options offering various features like advanced tools and secure API integration. Simply compare them to select the best for your needs.

Conclusion

When trading cryptocurrencies using an automated trading platform in the UK, keep in mind that the journey is just as significant as the destination. This means that you should begin by prioritising platforms that not only provide security but also offer tailored features to suit your needs. Also, embrace innovation and fearlessly explore new strategies, remaining vigilant with every move. Let each trade serve as an opportunity to refine your approach, drawing lessons from both triumphs and challenges. With dedication and a commitment to continuous improvement, you will harness the power of automation to navigate the cryptocurrency market with unwavering confidence.

How we test?

Our test process is really based on two different aspects: our independent tests and research, as well as user reviews from Google Play, the App Store, and Trustpilot, etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than 200 hours on every article. We pay special attention to the specific function or the criteria that we’re comparing during the comparing stage. This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here.

As for me, I have been using the XTB platform for a long time.

The interface is very convenient and understandable for me, the platform also has many different sets of trading tools and very good support service.