Navigating the world of trading as a beginner can be a daunting task, but the right trading platform can make all the difference. However, how can you be certain that the platform you’ve chosen is the ideal fit for your trading endeavours? In a market saturated with numerous options, we cordially invite you to delve into this comprehensive guide, where we unveil the premier trading platforms tailored for beginners in the UK. We will not only present you with our expert recommendations but also show you features to look for when choosing one. Plus, you will be equipped with invaluable insights that every novice trader needs before embarking on their trading activities.

Essence

- Prioritise user-friendliness and ease of navigation when choosing a trading platform.

- The best trading platform UK for beginners has quality educational resources to enhance users’ trading knowledge and skills.

- Consider a trading platform with features aligning with your trading requirements.

- Choose a trading type and asset you are familiar with for maximum potential.

- The best trading platforms for beginners should supply you with risk management tools, as losses are inevitable in any trade.

- Explore demo accounts to test the platform’s functionality risk-free.

- The best trading platforms for beginners UK should feature quality research tools to aid in making informed trading decisions.

- Mobile applications can provide flexibility for trading on the go, so consider platforms with reliable mobile support.

List of the Best Trading Platforms for Beginners

- Pepperstone – Best Trading Platform for Beginners with 24/7 Customer Service

- eToro – Overall Best Trading Platform for Beginners in the UK

- Axi* – Beginner-Friendly Platform with the Lowest Minimum Deposit

- Plus500 – Low-Cost Trading Platform** For Beginners

- Forex.com – Best Forex Platform for Beginners in the UK

- Spreadex – Best With Spread Betting Options

*CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

**80% of CFD retail accounts lose money with this provider

How We Choose Brokers for Beginners

At TradingGuide, our commitment is to equip you with reliable, data-driven insights and impartial reviews of the most beginner-friendly brokers available in the UK. Our research methodology is thorough, ensuring that only the finest options make it to our recommendations list.

Our process begins with a comprehensive search for beginner-friendly brokers across the UK market. We prioritise safety by verifying their encryption technology and regulatory status, guaranteeing users’ security.

Once we have identified the brokers to test and compare, we take a hands-on approach by signing up for stock trading accounts using the brokers’ demo versions. This allows us to thoroughly test their performance without risking any capital. We also compare their features, ensuring they meet our stringent criteria before inclusion.

Since maintaining impartiality is paramount to us, we also analyse user feedback on platforms like Google Play, the App Store, and Trustpilot. This enables us to comprehensively understand each broker’s strengths and weaknesses. We then combine the findings from our research procedures to come up with the recommendations on this page.

As experts, we want to ensure you continue to get quality information and the best recommendations. Therefore, we remain attuned to the financial market, continuously updating our list and providing up-to-date learning resources. Rest assured that at TradingGuide, you get the best recommendations that guarantee maximum experience and potential.

In this guide

Best Trading Brokers for Beginners in the UK

- List of the Best Trading Platforms for Beginners

- Compare the Best Trading Platforms for Beginners

- Brief Overview of Our Recommended Brokers’ Fees and Assets

- Our Opinion & Overview of the Best Trading Platforms for Beginners

- What Do Other Traders Say?

- The Ultimate Guide About Online Trading

- How to Choose the Right Broker for Beginners

- FAQs

Compare the Best Trading Platforms for Beginners

Comparing the best investing platforms for beginners UK was not an easy process as we had numerous options to choose from. Below are some of the features we were considering in this process, and we thought to share them in the table below for informed decisions.

| Beginner-Friendly Trading Platforms | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, DFSA | 24/7 | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Capitalise.ai, Social Trading | Credit cards, Bank transfer, PayPal, Neteller, Skrill, Union Pay | Yes | Yes (up to £85,000) |

| eToro | ASIC, CySEC, FCA, FSAS | 24/5 | eToro investing platform, Multi-asset platform, Copy Trader | Debit card, Bank transfer, Neteller, Skrill, eToro Money, Online Banking | Yes | Yes (up to $250,000) |

| Axi | FCA, ASIC, CySEC | 24/7 | MT4 | Credit/debit cards, PayPal, International bank transfer, Domestic bank transfer | Yes | Yes (up to £85,000) under the Financial Services Compensation Scheme |

| Plus500 | FCA, CySEC, ASIC, MAS, FSA | 24/7 | Plus500 Webtrader | Bank Wire Transfer, Credit/debit cards, PayPal, Skrill | Yes | Yes (up to £85,000) |

| Forex.com | FCA, CFTC, NFA, CIMA, CySEC, FSA | 24/5 | MT4, MT5, TradingView | Bank transfer, Credit/debit cards, Skrill, Neteller | Yes | No |

| Spreadex | FCA, SEBI | 24/5 | IPHONE App, IPAD App, ANDROID App, TradingView | Bank Wire Transfer, Credit cards | No | Available for some clients |

Brief Overview of Our Recommended Brokers’ Fees and Assets

While all the platforms we recommend here are suitable for any new trader in the UK, it is crucial to select one with features aligning with your trading requirements. Some of the most important elements to prioritise are fees and asset availability. That is why we have prepared the tables below highlighting these features to help you make the best choice.

Fees

| Trading Platform | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Pepperstone | From 0.0 pips | £0 | Free | None |

| eToro | 2 pips | $100 | $5 withdrawal | $10 monthly |

| Axi | From 0 pips* on Pro accounts | £5 | Free | £10 monthly |

| Plus500 | From 0.0 pips | £100 | Free | £10 monthly |

| Forex.com | From 0.8 pips | £100 | Free | £15 monthly |

| Spreadex | From 0.6 pips | £0 | Free | None |

*Commission charges apply.

Assets

| Trading Platform | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | No |

| Axi | Yes | Yes | Yes | No | No |

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes |

| Forex.com | Yes | Yes | Yes | Yes | No |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best Trading Platforms for Beginners

As professional researchers and traders with decades of experience, we’ve gone to great lengths, conducting thorough assessments and comparisons of numerous trading platforms for beginners in the UK. Our evaluation process is not limited to examining features; we’ve also delved into user feedback from various sources, including Google Play, the App Store, and Trustpilot. Later in this guide, we’ll share insights from these user comments. But for now, let’s dive into our expert opinions and reviews of the best brokers for beginners in the UK.

1. Pepperstone – Best Trading Platform for Beginners with 24/7 Customer Service

In our hands-on exploration, Pepperstone’s user-friendly trading platform stood out, making it an appealing choice for those looking to make multiple daily trades. The inclusion of a social trading feature, which allows you to replicate expert traders’ positions, adds a unique layer of potential success. Pepperstone doesn’t stop at user-friendliness; it’s also dedicated to your education by listing plenty of articles, webinars, and videos to help you refine your trading skills.

When it comes to financial aspects, Pepperstone boasts low trading fees and a welcome absence of inactivity and transaction charges. Unfortunately, its minimum deposit of £500 for UK traders can be high to low-budget traders. You can rely on the platform’s exceptional 24/7 customer service via phone, email, and live chats. There is also a demo account for a risk-free trial, allowing users to experience its services firsthand. Taking all these factors into consideration, we are pleased to award Pepperstone a solid 4.8-star rating.

- Low trading charges

- Exceptional customer service

- Top-notch educational resources

- Variety of platforms to choose from, thus suitable for all types of traders

- Limited product portfolio

- High minimum deposit requirement for UK traders

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

| Features | Availability |

| Minimum Investment Amount | £0 for UK traders |

| Supported Assets Besides Forex | Shares, commodities, cryptocurrencies, ETFs |

| Mobile App | Yes (Google Play, App Store) |

| Payment Methods | Credit cards, Bank transfer, PayPal, Neteller, Skrill, Union Pay |

| Transaction Fees | £0 |

2. eToro – Overall Best Trading Platform for Beginners in the UK

We’ve conducted extensive research and personally tested various trading platforms in the UK, and based on our experience, eToro has emerged as the top choice for beginners. Our exploration of eToro revealed a user-friendly interface, ensuring a seamless experience for those starting their trading journey. Plus, the platform hosts an award-winning social trading platform, allowing you to interact with fellow traders, share ideas, and replicate expert strategies to enhance your profit potential.

What truly sets eToro apart is its focus on education and research tools, offering valuable resources for those interested in various asset classes. Beginners can easily get started with this platform as it has a minimum deposit requirement of $100 with no deposit charges*. Moreover, eToro is known to offer commission-free stock trading, making it easier for users to budget accordingly without worrying about other trading costs. The only pitfall with this platform is the ability to charge withdrawal fees. For the above reasons, we confidently award eToro a 5-star rating.

*Conversion fees apply.

- User-friendly platform

- Social and copy trading features

- Commission-free stocks trading

- Plenty of learning resources, including articles, guides, videos, webinars, and more

- Account base currency is in USD only

- A £5 withdrawal fees apply

| Types | Fee |

| Minimum Deposit | $100 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

| Features | Availability |

| Minimum Investment Amount | $100 |

| Supported Assets | Stocks, commodities, cryptocurrencies, ETFs, forex, indices, NFTs |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | E-wallets, Bank transfers, debit cards |

| Transaction Fees | $5 withdrawal fees apply |

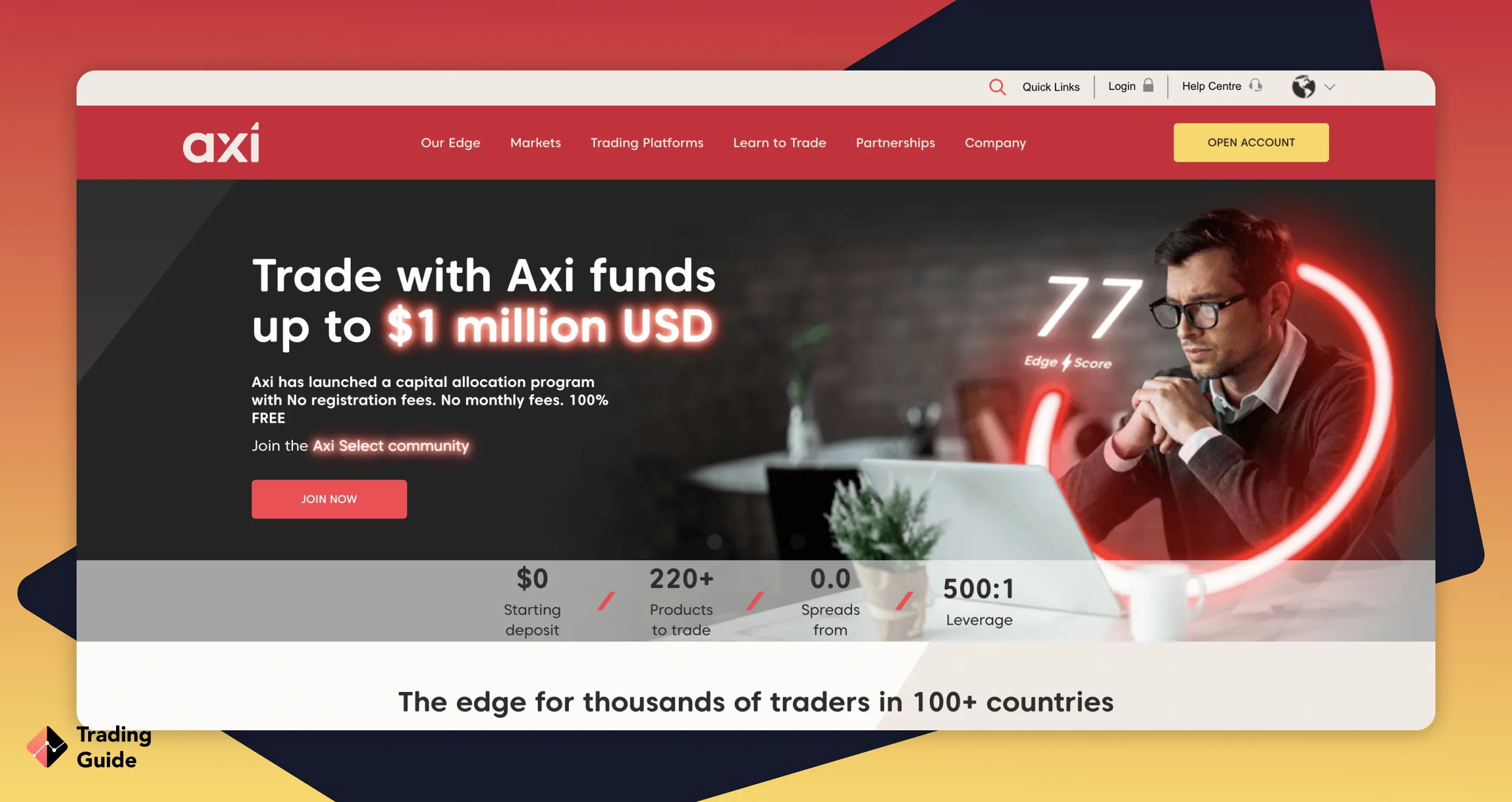

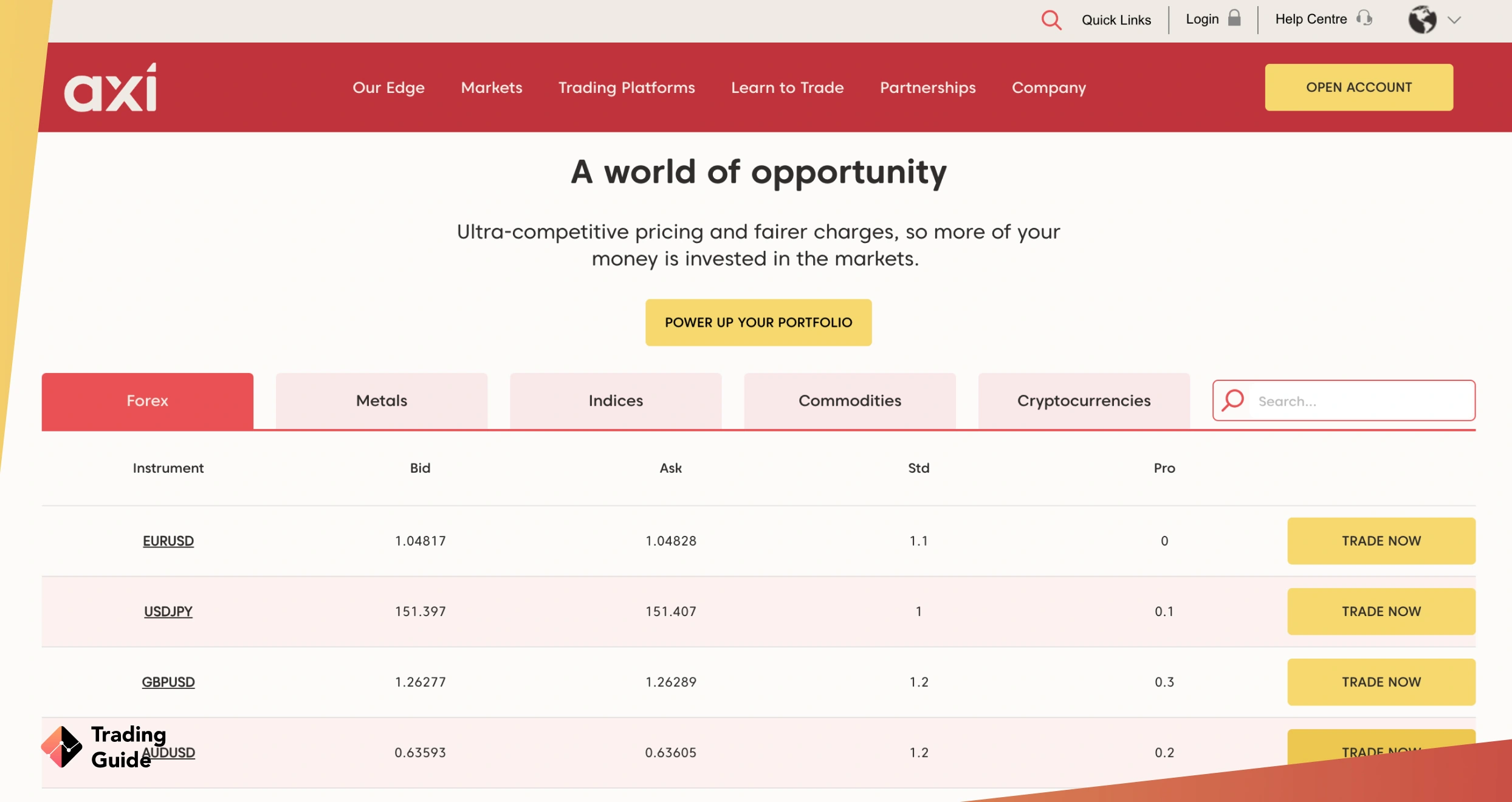

3. Axi – Beginner-Friendly Platform with the Lowest Minimum Deposit

Most newbies never get started because they are bombarded by ungodly minimum deposit requirements from the get-go. But you don’t have to worry about that. Allow us to introduce you to a broker with no set initial funding requirement: Axi.

Axi has made it easier for different types of traders to engage with the markets by not imposing a fixed minimum deposit requirement. What you can deposit after signing up with this broker depends on your budget and chosen payment methods. If you currently have limited capital, you can fund your account with as little as £5 using a debit or credit card.

Minimum deposit aside, Axi has a clean, user-friendly interface. You can familiarize yourself with it within minutes and find everything you need without being overwhelmed. Plus, the platform has a reasonable number of learning materials that can help you with your trading journey.

- No minimum deposit requirement

- Intuitive, user-friendly interface

- Supports demo trading

- Users can leverage MT4

- Excellent support service

- Limited financial products

- £10 monthly inactivity fee for dormant accounts

| Type | Fee |

| Minimum deposit | £5 |

| Overnight fee | Yes |

| Deposit fee | 3% |

| Withdrawal fee | $0 |

| Inactivity fee | $10 |

| Features | Availability |

| Minimum Investment Amount | £5 |

| Supported Assets | Stocks, commodities, forex |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | Credit/debit cards, PayPal, International bank transfer, Domestic bank transfer |

| Transaction Fees | None |

4. Plus500 – Low-Cost Trading Platform For Beginners

*Illustrative prices

Plus500 has made a name for itself in the financial industry by offering quality brokerage services for traders of all levels. As professional researchers and traders, we tested the broker and were impressed by its offerings for newbies. Not only is Plus500 user-friendly, but new traders get to enjoy low-cost trading services across various assets. We noted that there are no commissions, and spreads start as low as 0.0 pips. Moreover, all transactions are free, and you can explore the broker with a minimum deposit of £100.

One of the elements that make Plus500 beginner-friendly is its ability to offer a virtually funded demo account. Here, beginners do not need to risk real money. Instead, they explore the broker’s listed assets risk-free to select what suits them best. Moreover, a demo account is the best platform to gauge your skill level before deciding whether to trade with real money.

- Plenty of learning materials, including articles, guides, webinars, and more

- Low minimum deposit requirement

- Commission-free trades with low spreads

- Features one of the highly-rated trading apps on Google Play and the App Store

- Lists only CFD assets, thus limiting traders looking to buy and own physical assets

- Limited asset offering compared to its peers

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| Features | Availability |

| Minimum Investment Amount | £100 |

| Supported Assets | Stocks, commodities, options, ETFs, forex |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | E-wallets like PayPal and Skrill, Bank transfers, credit/debit cards |

| Transaction Fees | None |

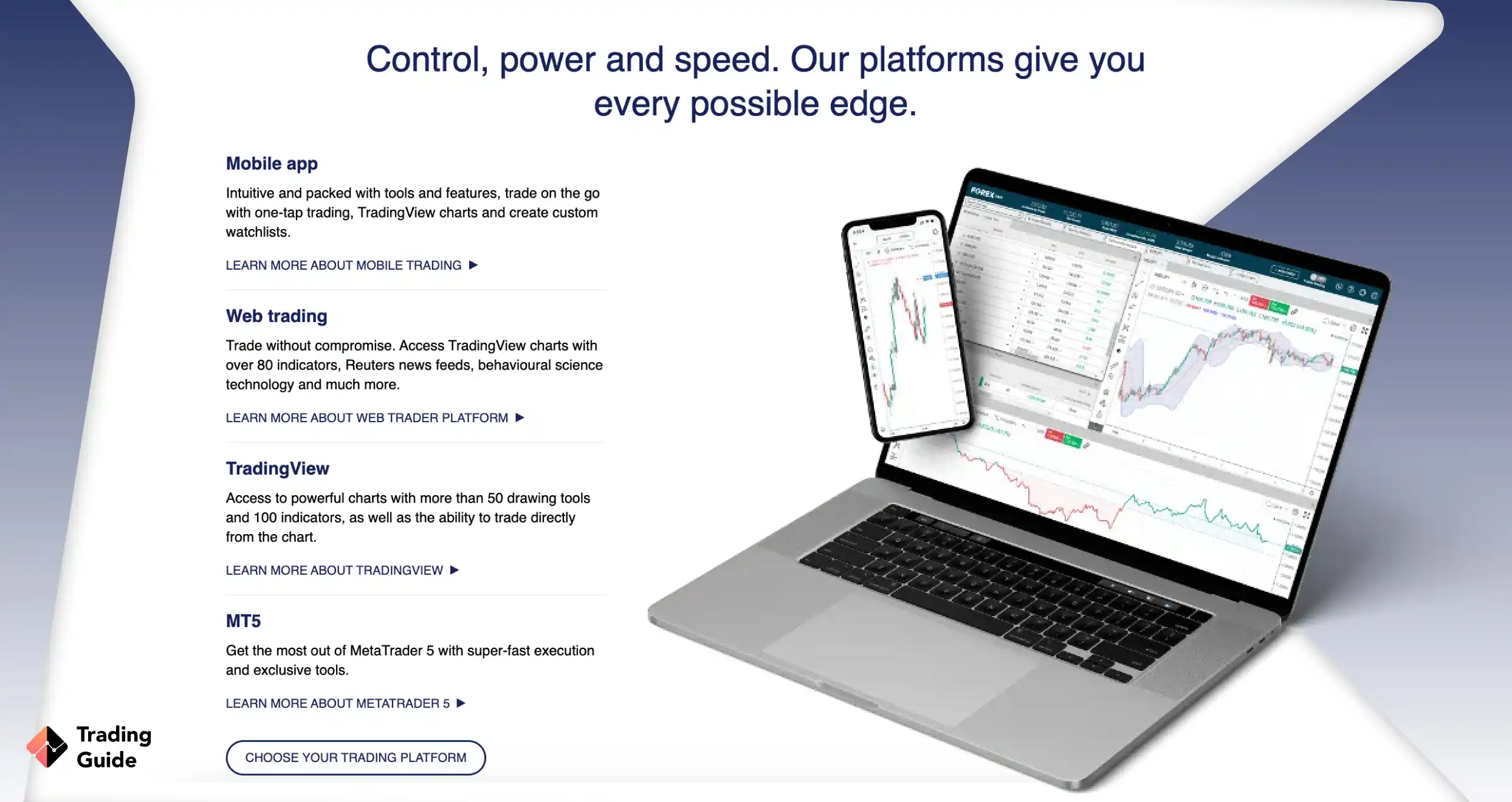

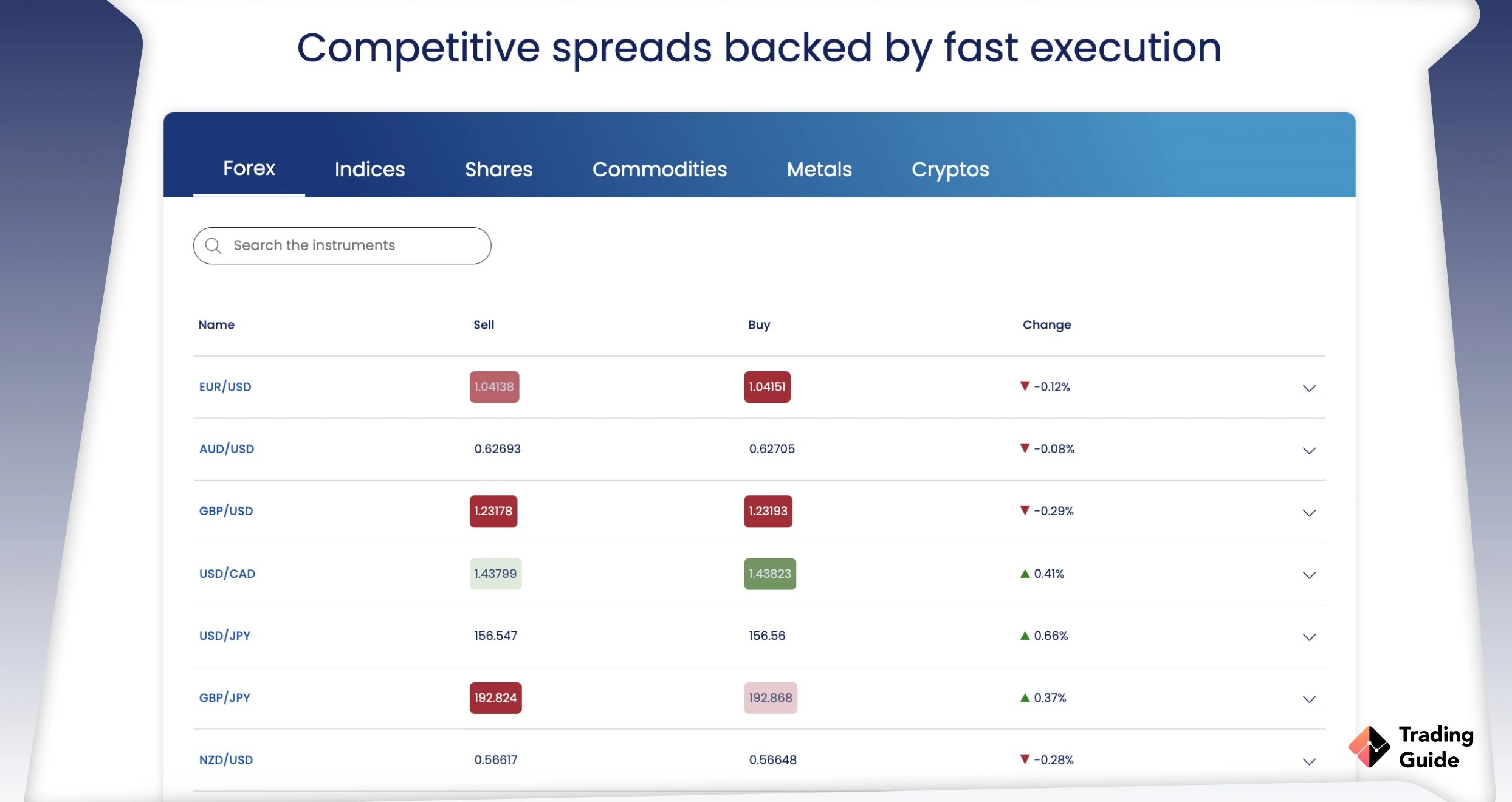

5. Forex.com – Best Forex Platform for Beginners in the UK

Our research journey uncovered compelling reasons that make it an ideal platform for those just embarking on their forex trading journey. Forex.com boasts an impeccable global presence and holds the esteemed title of being the largest MetaTrader globally, which instils confidence from the get-go. Plus, we discovered that the trading platforms offered by Forex.com provide the means to trade forex over extended periods. This is especially valuable for beginners aiming to hone their skills and access more advanced tools as they progress.

When it comes to trading fees, Forex.com impresses us with its affordability. For instance, it has a £100 minimum deposit requirement and spreads starts from 0.8 pips on major currency pairs. Offering access to over 4,500 global markets and a staggering choice of more than 80 currency pairs, it’s a compelling platform for forex enthusiasts. In light of our findings, we are pleased to give Forex.com a 4-star rating.

- Low trading costs

- Advanced technical trading tools

- +80 FX currency pairs

- Quality learning resources for skill development

- High stock CFD trading charges

- Limited selection of cryptocurrencies

| Type | Fee |

| Minimum deposit | $100 |

| Inactivity fee | $15 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Overnight fee | $0 |

| Features | Availability |

| Minimum Investment Amount | £100 |

| Supported Assets Besides Forex | Shares, commodities, cryptos, indices, ETFs |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | Bank transfer, Credit/debit cards, Skrill, Neteller |

| Transaction Fees | £0 |

6. Spreadex – Best With Spread Betting Options

Spreadex is another user-friendly broker I find worth recommending to newbies. From my analysis, it is one of the best spread betting brokers, listing over 10,000 instruments. These include over 60 forex pairs, shares, indices, commodities, and more. There is no minimum deposit requirement to access Spreadex features, and all trading charges are low compared to its peers.

Besides having a proprietary, user-friendly platform, Spreadex gives users access to the third-party TradingView platform. This is suitable for advanced traders looking for advanced resources to boost their experience. Beginners can also easily navigate TradingView and enjoy features like social trading. On top of that, I like Spreadex’s quality learning materials and dedicated support team, ready to address your questions and concerns.

- Lists thousands of spread betting instruments to explore

- No minimum deposit requirement to trade forex and other assets

- Quality learning materials to boost beginners’ skills

- Offers access to the TradingView platform with advanced features like social trading

- No demo account

- There are no MetaTrader platforms, even though TradingView is an excellent substitute

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

| Features | Availability |

| Minimum Investment Amount | £0 |

| Supported Assets | Forex, commodities, cryptocurrencies, indices, shares, ETFs |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | Credit/Debit Cards, Bank transfer, Skrill, Neteller |

| Transaction Fees | £0 |

What Do Other Traders Say?

As mentioned earlier, our comprehensive research process on the best trading platforms for beginners involved multiple procedures. Besides testing and comparing, we analysed user recommendations and ratings to ensure you get the best of the best to trade with. Take a look below at some of the comments we bumped into during our analysis.

Pepperstone

Users appreciate Pepperstone’s tight spreads and fast execution speeds. It’s often commended for its robust trading infrastructure and excellent customer support, making it a reliable choice for traders of all levels.

- “Despite the razor account, low spreads, efficient order placing back end, what I love about pepperstone is their support team.

I had an issue with my 2FA but Aniko was as quick as they come to resolve my issue. Huge thanks to Aniko and Pepperstone support in general for always being there for their clients.” – Aditya Bajaj - “I’ve used many trading platforms, and this is my favourite. Took me a while to get used to it, as it was slightly different from what I was used to, but now love it & all its features.” – Jana from Gold Coast

- “Easy to open. Easy to use. Easy to add money. Easy to withdraw money. Good customer service. Fast execution. Less spreads. Just learn how to trade and have fun.” – Pruthviraj Rathod.

eToro

eToro consistently receives praise for its user-friendly interface and social trading features. Users frequently highlight the ability to follow and copy experienced traders, making it an attractive option for beginners looking to learn and earn simultaneously.

- “I spoke with Mr. Abdul Muti, a reputable individual from a company with a good reputation. I gained some economic insights from him. Thank you, eToro, and thank you to Mr. Abdul Muti.” – Saleh Aloudhali.

- “Really I think it is amazing app” – AmirFerdos

- “I personally feel that this the most user friendly platform for new user yo trade. Especially on their chart, all basic functions even usual paid functions like volume profile visible range is there for reference. Thanks etoro!” – Joe Lee

Forex.com

Forex.com is frequently lauded for its educational resources, which are particularly beneficial for novice traders. Users find its trading tools and research materials valuable for expanding their knowledge and honing their trading skills.

- “It is a good app with very useful features . Edit:team actively solving the issues . Kudos to their tech team” – daniel hodge

- “Exceptional UI. Customizable, good for all levels of expertise from beginner to professional. Quick and easy, fingerprint login available, not heavy on phone. Processes fast, including news articles. All that u need here and best of all its powered by TradingView. Has zero ads btw.” – David Franco

- “I got a response almost immediately from a representative by the name of Krtin K.. I had questions regarding my account status, and they promptly responded with all the answers I needed to move forward with reinstating my closed account. If any other issues were to arise, I would utilize this contact feature again.” – Takeshi Stormer

The Ultimate Guide About Online Trading

Online trading is experiencing a rapid surge in popularity in the UK, with a growing number of individuals delving into this financial endeavour in pursuit of profits. While online trading can be a lucrative endeavour, it is essential to acknowledge that losses are an inherent part of the process. Therefore, it is paramount to acquire a comprehensive understanding of online trading in the UK before investing your hard-earned money. The good news is that we have prepared the following sections to provide you with invaluable insights to ensure you make informed decisions and embark on your trading journey with confidence.

How to Start Online Trading For Beginners

As a beginner, do not always rush into investing real money without understanding the strategies and tips for manoeuvring the market. We share below a few advice to keep in mind before kickstarting your online trading ventures.

- Educate Yourself – The first and most vital step for beginners is education. Before investing real money, take the time to learn the basics of online trading. Understand the market you wish to enter, familiarise yourself with trading instruments, and grasp fundamental concepts like market orders, stop-loss, and take-profit levels. There is a wealth of online resources, courses, and books available to help you gain the knowledge you need.

- Find The Best Online Trading Platform – Your choice of trading platform can significantly impact your experience. Seek out a reputable and user-friendly platform that aligns with your trading goals. Ensure it offers a wide range of assets and features that cater to your needs. We list above some of the best trading platforms in the UK that have been tested and approved by our professional researchers.

- Take Advantage of Demo Accounts – Many online brokers like the ones we recommend above offer demo accounts, which allow you to practise trading with virtual money. Utilise this invaluable tool to hone your trading skills, test strategies, and become familiar with the trading platform – all without risking real capital.

- Stay Informed About Latest Developments – The financial markets are dynamic and can be influenced by a myriad of factors. Stay updated on global economic news, market events, and geopolitical developments. Being informed about the latest developments can help you make informed decisions in your trading activities.

- Track Your Activities – Keeping a trading journal is a habit that can greatly benefit beginners. Record every trade you make, including the reasons behind your decisions, entry and exit points, and the outcome of the trade. This practice will help you learn from your experiences and refine your strategies.

- Apply Risk Management Controls – Risk management is a critical aspect of trading. Set clear risk parameters for each trade, including stop-loss and take-profit levels. Never risk more capital than you can afford to lose, and consider diversifying your portfolio to spread risk.

- Remain Disciplined and Patient – Emotions can play a significant role in trading. Avoid impulsive decisions driven by fear or greed. Stick to your trading plan, and be patient. Not every trade will be a winner, but a disciplined approach will increase your chances of long-term success.

How to Choose the Right Broker for Beginners

Selecting the perfect broker for your trading journey is a decision that shouldn’t be taken lightly. The UK market boasts numerous brokers, some trustworthy, and others not so much. As a beginner, your due diligence is crucial in ensuring that you choose a broker that aligns with your interests. Here are some essential factors to consider before making your decision:

When you’re on the hunt for a broker to kickstart your trading venture in the UK, the first and foremost aspect to verify is their credibility. It’s paramount to ensure that your funds will be secure. The gold standard for brokers in the UK is being overseen by the Financial Conduct Authority (FCA).

Some brokers even hold multiple regulatory licences from renowned financial regulators around the world, which further strengthens their trustworthiness.

A broker’s trading platform should be user-friendly, especially for beginners. Look for a platform that not only meets your current needs but is also customizable to accommodate your evolving skills.

Additionally, check if the broker provides educational materials and research tools. Having access to these resources ensures you can continue to improve your trading abilities without the need to switch to another broker.

For novice traders, it’s advisable to start with small amounts, unless you’re confident in your market research abilities. UK brokers vary in terms of trading charges, including minimum deposits, trading commissions or spreads, inactivity fees, and overnight charges, among others.

Create a budget for your trading activities and adhere to it diligently when choosing a broker. Be vigilant about hidden charges, as they can impact your trading performance in the long run.

Most brokers, including the ones featured in this guide, offer customer support services available either five or seven days a week. As long as the broker meets your requirements, don’t hesitate to commit. However, ensure that the customer support system is reliable during the broker’s operating hours to address any concerns or queries promptly.

Never underestimate the value of a demo account, especially as a beginner. It serves as a testing ground for assessing whether the broker aligns with your preferences. If the broker ticks all the right boxes, then consider opening a live trading account. The demo account allows you to verify all the aforementioned aspects of the broker before making a commitment.

Expect to find common payment methods such as credit/debit cards, bank transfers, and e-wallets as primary options with UK brokers. Choosing a broker that supports your preferred payment method is vital. Failure to do so might subject you to currency exchange hassles, which can be both cumbersome and costly.

Just like our team of researchers, you should also seek out user reviews on UK brokers before signing up for a trading account. Explore platforms like Google Store, App Store, and Trustpilot to sample user feedback. This firsthand insight from other traders can provide valuable guidance in making your decision.

5 Quick Steps To Start Online Trading

Starting your online trading adventure is a straightforward process when you have the right broker by your side. If you’re new to the world of trading, these five steps will help you get started with confidence.

To kick off your online trading journey, head over to your chosen broker’s website. You can conveniently access it by clicking on any of the links provided on this page. Before you dive into the account sign-up process, it’s essential to familiarise yourself with the broker’s terms and conditions.

Additionally, consider downloading and installing their mobile app, which allows you to keep track of your positions while on the go.

Once on the broker’s website, locate and click on the “Register” or “Sign Up” button to initiate your account registration. During this process, you’ll be asked to provide personal details such as your name, email, phone number, and date of birth. Don’t forget to create a unique username and a strong password to enhance the security of your account.

It’s important to note that all FCA-regulated brokers in the UK adhere to a standard verification procedure. This step is designed to confirm the identities and locations of traders, preventing imposters and potential fraudulent activities. To fulfil this requirement, your broker will request copies of your original ID card, passport, or driver’s licence.

Additionally, you’ll need to upload a recent utility bill or bank statement for address verification. Be aware that the verification process may take up to 48 hours, depending on your broker. Rest assured that you will receive an email notification once your account is fully activated.

With your newly created trading account, you’ll need to fund it in accordance with your broker’s minimum deposit requirements. For example, eToro’s minimum deposit requirement is £50 and offers multiple payment options. Be mindful of any deposit fees, so factor them into your budget as you prepare to dive into trading activities.

At this point, you should have a well-defined trading plan that outlines your trading goals, risk tolerance, and preferred strategies. Spend time practising on a demo account to build your confidence and become acquainted with how the broker’s platform operates. Once you feel comfortable and consistently profitable in your demo trading, it’s time to transition to live trading. Begin with a small amount of capital that you can afford to lose. As you gain experience and confidence, you can gradually increase your trading capital and position sizes.

Is This Right for You?

The decision to participate in online trading in the UK should hinge on your comprehension of the financial market and the associated risks. In reality, anyone can enter the world of online trading. It’s a matter of identifying a suitable broker that aligns with your needs and financial constraints. Moreover, opt for assets you have a deep understanding of to develop efficient strategies and make well-informed decisions.

Overall, a broker’s demo account serves as the optimal platform to address this question, as it provides an opportunity to practise online trading and assess your skill level. Therefore, consider selecting a broker from our recommended list above and commence your trading journey.

What Type of Trading Is Best for Beginners?

If you’re new to trading, you might be contemplating which trading approach suits you best. Here are some options that have demonstrated their effectiveness for beginners. Nevertheless, it’s crucial to gain a comprehensive understanding of the market you’re entering to maximise your experience and profit potential.

- Day Trading – Day trading involves buying and selling financial instruments within the same trading day. It requires a high level of dedication and a thorough understanding of technical analysis. While it can be profitable, it’s also one of the riskier trading styles due to its rapid pace and potential for substantial losses.

- Position Trading – Position trading, in contrast, is a longer-term approach where traders hold positions for weeks, months, or even years. It is more suitable for patient and risk-averse individuals, making it a good choice for beginners who prefer a more laid-back trading style.

- Swing Trading – Swing trading strikes a balance between day trading and position trading. Traders typically hold positions for several days to weeks, aiming to capture shorter-term price swings. It is less time-intensive than day trading, making it accessible to beginners with busy schedules.

- Scalping – Scalping is an ultra-short-term trading style where traders make many small, quick trades throughout the day to capture minor price fluctuations. It requires intense focus and discipline and may not be ideal for everyone, but it can be profitable for those who excel in this strategy.

Overall, all of the above trading styles are perfect for newbies, but the best should depend on your risk tolerance, time commitment, and interests. Regardless of the approach you choose, a strong foundation of knowledge and a willingness to learn and adapt are essential for success.

FAQs

You first need to figure out the type of broker you want to trade with. Whether it’s a forex, stocks, commodities, or other assets broker, make sure that what they offer matches your trading needs. Then, after choosing and testing it using a demo account, you can open a real one and get started.

You need a stock broker to buy stocks. This is because such brokers allow you to access diverse exchange markets and increase your profit potential.

Yes. You can actually invest without a broker, but many challenges come with it. Therefore, if you want an easy method of investing, simply find a broker like the ones we have referenced above.

No. Day trading in the UK is legal and there are many day trading brokers there. If you are interested in day trading, simply make a suitable broker choice.

Conclusion

Now that we have listed the best brokers to get you started in the UK market, feel free to make a choice. A good broker will make your experience seamless and exciting. The broker should also be regulated by the Financial Conduct Authority (FCA), the leading regulator in the UK’s financial market. These qualities are found in brokers like the ones listed in our above mini-reviews.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I can confidently say that Plus500 can compete with Oanda for the place of the best broker with the best educational materials. Both trading platforms are great.

I disagree! eToro the best trading platform

The article left a positive impression on me, and I highlighted many useful points for myself. Step by step, the article explains how to start online trading, from choosing a broker to completing the first trades. I recommend everyone who has not yet read this article to definitely give it a read.

I really enjoyed reading your blog post on the best brokers for beginners in the UK. It was very informative and I learned a lot. I especially liked the comparison section. It was very helpful.

Thank you for your feedback. We appreciate it.

This article is super helpful for beginners! eToro stands out to me