For most people, caring about social and environmental issues doesn’t mean doing a complete overhaul of their lives. It simply means incorporating these values in the way they invest their money.

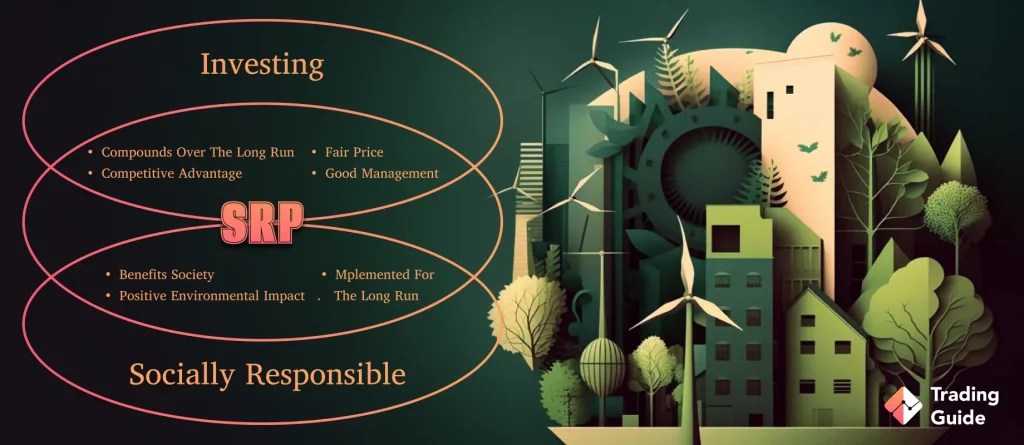

This is where socially responsible investing (SRI) comes in. SRI is an investment strategy that offers the benefit of helping out a cause that aligns with your values and beliefs. In recent years, it has been a major topic as the number of individual investors looking to align their financial goals with their social and environmental values continues to increase.

If you are looking to invest in ethical companies, it is important to understand what are socially responsible investments and how they work. In this blog post, we will explain what SRI is all about, who it might be for, and the benefits and risks of this investment strategy.

What is Socially Responsible Investing?

Socially responsible investing is an approach that focuses on putting money in companies that positively impact the world while generating adequate profit. It is also known as impact investing, ethical investing, sustainable investing, or socially conscious investing.

Adopting a responsible investment strategy is about ensuring you are reducing your exposure to the financial risks increasingly linked to exploitative labour practices, climate change, water shortages or changing energy needs.

SRI is closely related to ESG investing, which is an investment strategy that considers traditional financial analysis, as well as a company’s performance on environmental, social, and corporate issues.

SRI has been around since the 1700s. John Wesley, one of the earliest adopters of SRI, urged his Methodist followers not to harm their neighbours by investing in industries like chemical production and tanning.

In the 1960s, it began gaining traction when investors opposed to the Vietnam War staged a boycott of American weapons manufacturers. Later in the 1970s and 80s, investors pulled their money from South African companies to protest against apartheid.

SRI has grown exponentially in the last three decades. Today, more and more investors are supporting businesses that respect human rights and implement measures to protect the environment. This strategy is about using the power of your investment to make a positive impact on the world.

How Socially Responsible Investing Works

SRI investors proactively seek to invest in companies that are committed to working towards furthering society in a responsible manner. Common approaches to SRI investing, targeting companies that are doing good, include:

- Climate change: Investing in securities issued by companies that have implemented strong measures to tackle climate change and extreme weather.

- Human capital: Investing in companies that aggressively champion diversity and gender equality.

- Natural resources: Investing in securities of companies that are promoting responsible forestry, as well as preserving clean air and water.

- Waste and pollution: Putting money in companies that are eliminating or reducing waste and pollution.

SRI investors usually undertake a rigorous review process to ensure their money is invested in companies that fit their values. They use a screening approach that allows them to independently analyse investments based on socially responsible behaviours and ethical considerations.

For example, an investor can screen securities such as stocks or bonds to see whether the companies they are tied to truly align with your morals and values. If you are focussed on taking direct stock ownership in a company, you can check important information publicly traded companies often display on their websites, such as reports on how they are addressing the climate crisis, environmental sustainability, and social issues.

Socially responsible mutual funds and exchange-traded funds (ETFs) are also popular among investors who are looking to align their financial goals with their social and environmental values. If you are interested in a certain fund, you can check its prospectus to see whether its investment strategy takes RSI into account.

Basically, SRI portfolios exclude securities of companies that are involved in certain industries or activities that are deemed as detrimental to the environment or society. This may include companies in industries like tobacco, fossil fuels, adult entertainment, and production of firearms and weapons. Many socially responsible investors also keep away from companies that have a history of exploitative labour practices within their supply chain.

Benefits of Socially Responsible Investing

If you are planning to put your money in securities issued by socially responsible companies, here are some of the benefits you are likely to enjoy:

- SRI allows you to align your investments with your values

Everyone wants to make money and feel good doing it. Socially responsible investing allows you to align your investments with your own values and beliefs. By investing in companies with eco-friendly policies, you will be at peace knowing that you are contributing to making a positive impact on the world.

- You can achieve sustainable returns on your investment

Besides using your money to improve society and the environment, you are also likely to make a high return on your investment. Many socially responsible funds and companies have achieved good results. Studies have shown that these investments can make you more profit in the long term, compared to companies with questionable practices.

- Can de-risk your portfolio

Many companies are starting to recognise that focusing on environmental and social issues is not just about being ethical, it is essential for their long-term survival and ability to support future returns.

For this reason, socially responsible businesses are set to dominate the world in some years to come. In the future, it is likely those companies that fail to address social and environmental issues will find it hard to survive. And if that is the case, it would be wise to begin investing in socially conscious companies now to help you avoid the risk of losing money in the future.

Drawbacks of Socially Responsible Investing

Socially responsible investments experience the same market fluctuations like any other financial asset. Although many socially conscious companies have achieved great results, there are risks you should be aware of.

- Limits your investment options

Perhaps the most significant risk associated with SRI strategy is limited investment options. If you shun well-performing companies because their social responsibility does not meet your ethics criteria, you could compromise your portfolio. This means you could miss out on high-rewarding investment opportunities while carrying on extra volatility and risk.

- Not all socially responsible companies succeed

Despite their good intentions and efforts, not all socially responsible companies are successful in the long run. Simply because a company has implemented measures to make the world a better place, it does not guarantee high returns for investors or financial success.

Companies may encounter additional challenges including changing consumer tastes, higher operating costs, and increased regulatory scrutiny. There is also the possibility that a company could go bankrupt.

- Can be very time-consuming

With so many companies claiming to be socially responsible, it may take a lot of time to separate the wheat from the chaff. Some investors often spend many hours per day trying to determine which companies are truly committed to making a positive impact and which ones are just using it as a marketing strategy.

Is SRI Right For You?

Investing in socially responsible companies is all about your values and how well you understand a company, as well as the risks you are willing to take.

If you are truly concerned about certain social or environmental issues, socially responsible investing may be the right investment for you. For example, you can invest in companies that have enacted measures to tackle climate change, support women’s rights, or to improve the lives of poor people in developing countries.

Just ensure to screen the companies that you are considering to avoid including companies that don’t represent your beliefs in your portfolio.

FAQs

Yes. Investing your money in socially responsible companies can be financially rewarding while also having a positive social and environmental impact. However, investing is risky and there’s no guarantee that your investment will appreciate in value. Ultimately, it depends on your values, priorities, and your financial situation.

No. Although SRI and ESG are often used interchangeably, they are not the same. SRI is more about an investor’s individual values, while ESG is a methodology that identifies environmental, social and governance matters that are financially material for companies.

The main difference between ESG investing and socially responsible investing is that SRI focuses on the impact that a company has on society and the environment. On the other hand, ESG looks at a wide range of factors, including how a company ranks on issues such as climate change, social justice, and corporate governance.

The main objective of SRI is to provide investors with an investment option that generates financial returns and aligns with their values.

Conclusion

Many investors are looking to support socially responsible investing companies that promote positive social and environmental outcomes through their business practices. Socially responsible investing is an important way for you to put your money where your mouth is.

As SRI research continues to grow and more companies commit to disclose their social and environmental practices, it is easier than ever for investors to support businesses that work for positive change while making profitable returns. However, always conduct your own research when investing in any company to ensure you are making informed decisions.