Individual Savings Accounts (ISAs) are long-term savings accounts issued to UK residents by banks, credit unions, building societies, and other financial institutions. The best element about ISAs is that you get a tax-free savings account, meaning you will not pay capital gains or income tax on any gains from your ISA.

If you are considering opening an ISA account, we take you through the best ISAs to consider in the UK. In the end, you should be able to figure out which ISA is best for you and whether signing up for one is worth it.

Types of ISAs

To ensure we are on the same page, let’s take a quick overview of ISA types in the UK. Remember, all ISAs are tax-free, and you get to save up to £20,000. Here are the four types of ISAs to note.

1. Cash ISAs

Cash ISAs are available for UK residents aged at least 16 years. With this account, you can save up to £20,000 and earn tax-free interest. Simply put, Cash ISA members are given an annual ISA allowance every tax year that sets the maximum amount (£20,000) to be paid tax-free. As a Cash ISA member, it is crucial to make full use of this allowance failure to which all will be lost and cannot be carried over to the next tax year.

Note that Cash ISAs come in different types, including easy access, fixed rate, and notice. Each type of Cash ISA has its own benefits, so ensure you confirm the best for your needs. In addition, you can only have one active Cash ISA annually to benefit from the tax-free allowance that comes with owning this account.

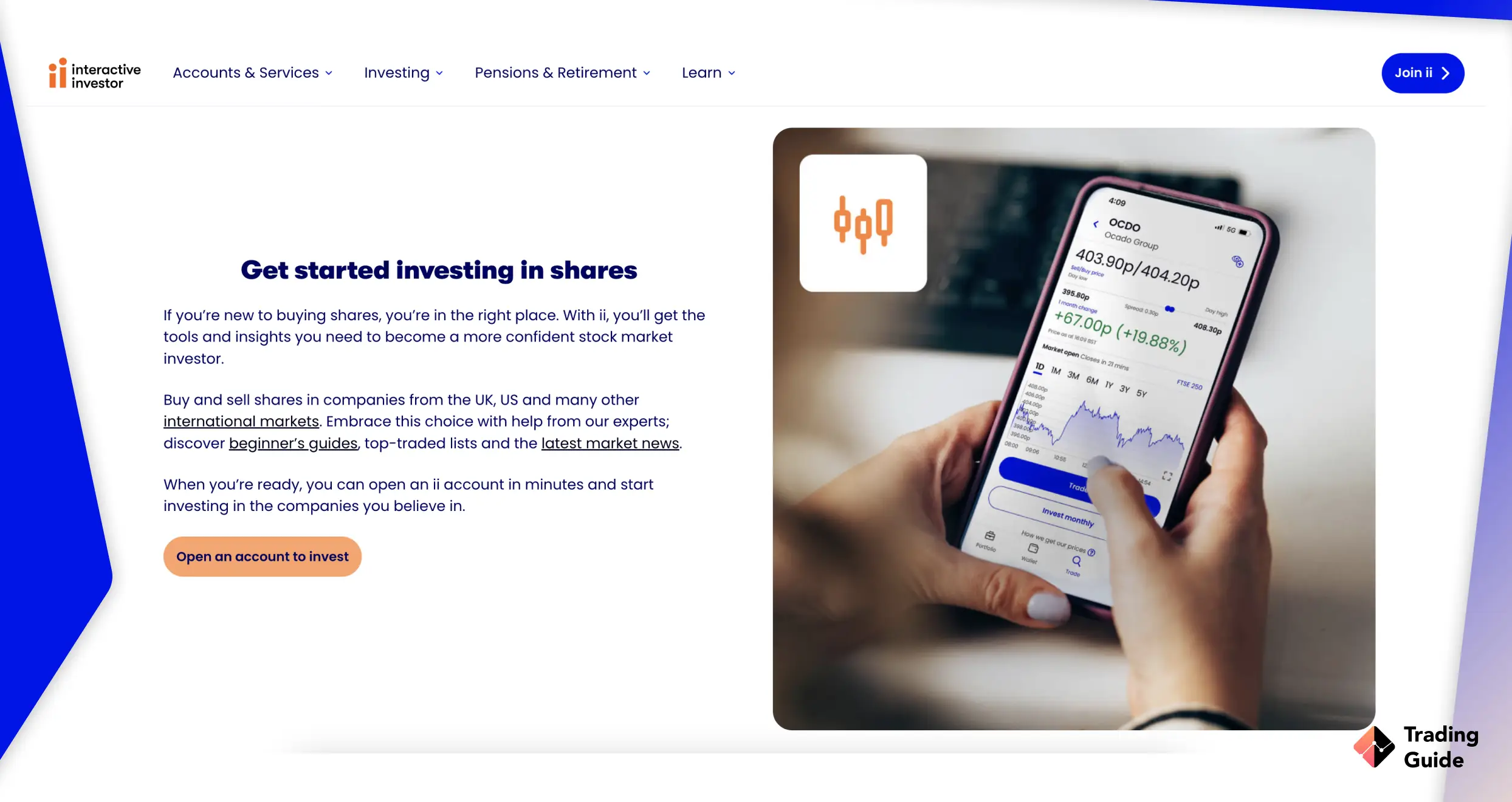

2. Stocks and Shares ISAs

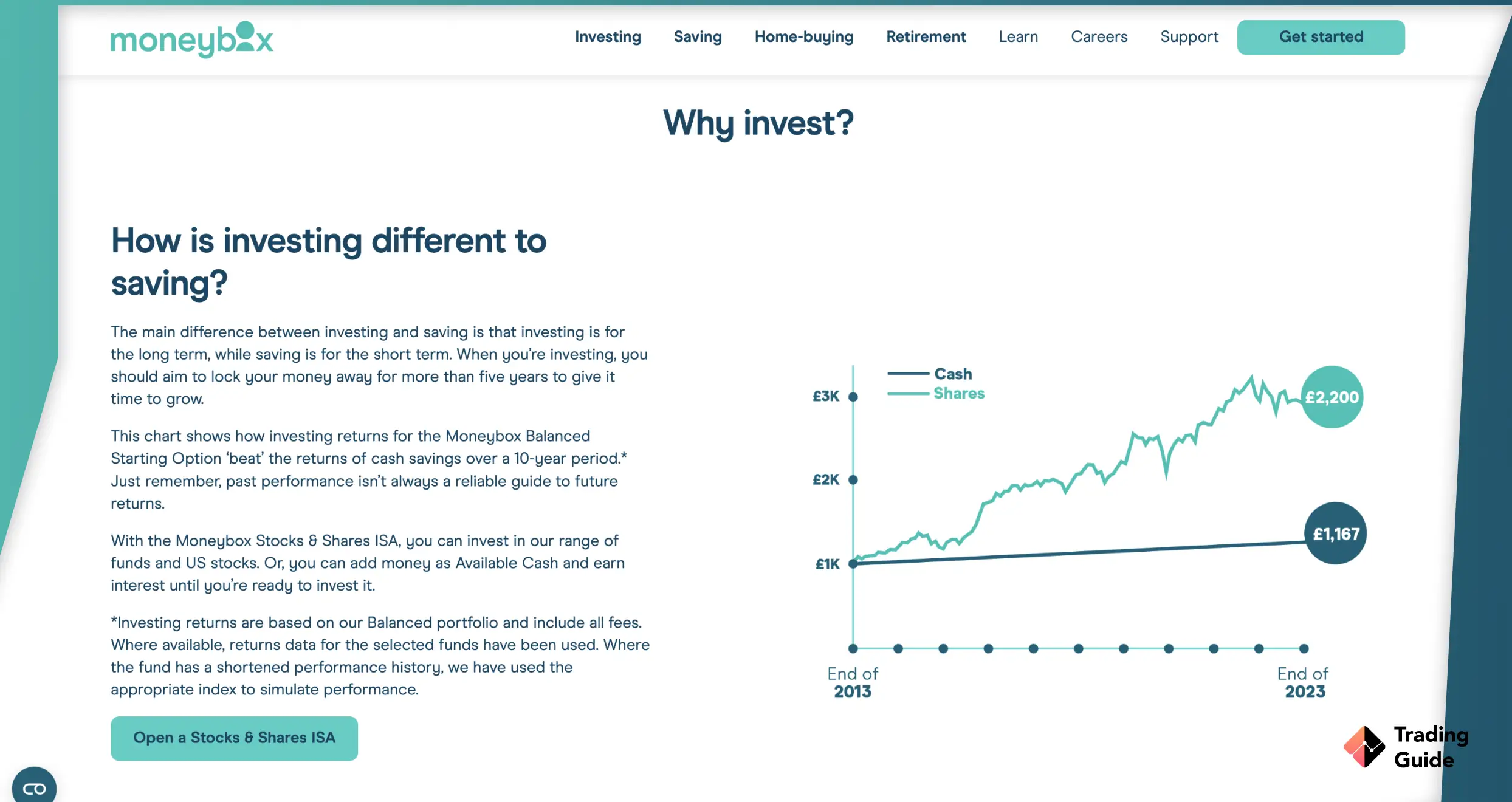

Also known as investment or share dealings ISAs, stocks and shares ISAs are accounts tailored to protect your investment from owing taxes. This means that your money is used to invest in various assets, and you get to keep all the capital gains and income, like dividends and interest, without paying taxes. Some of the assets to invest using your money in stocks and shares ISAs include commodities, bonds, ETFs, shares, and properties.

To sign up for the stocks and shares ISA, you must be at least 18 years and be a UK resident. Like investing using stock brokers, there is no guarantee for profits since the financial market is unpredictable. However, investing in various assets using this account can earn you more profits than cash savings. Remember, there are investment fees and commissions to incur, so choose a provider you can afford.

3. Innovative Finance ISAs

With an Innovative Finance ISA, you become a lender whereby you provide loans to approved individuals and businesses. The lending is done via an online peer-to-peer platform for a fixed tax-free interest within a set period.

Remember, always consider having a financial institution, such as banks acting as middlemen. For your own interest, you must gauge your risk appetite by ensuring your money is protected by the Financial Services Compensation Scheme (FSCS). This way, it will be easier for you to make a claim for compensation on defaulters.

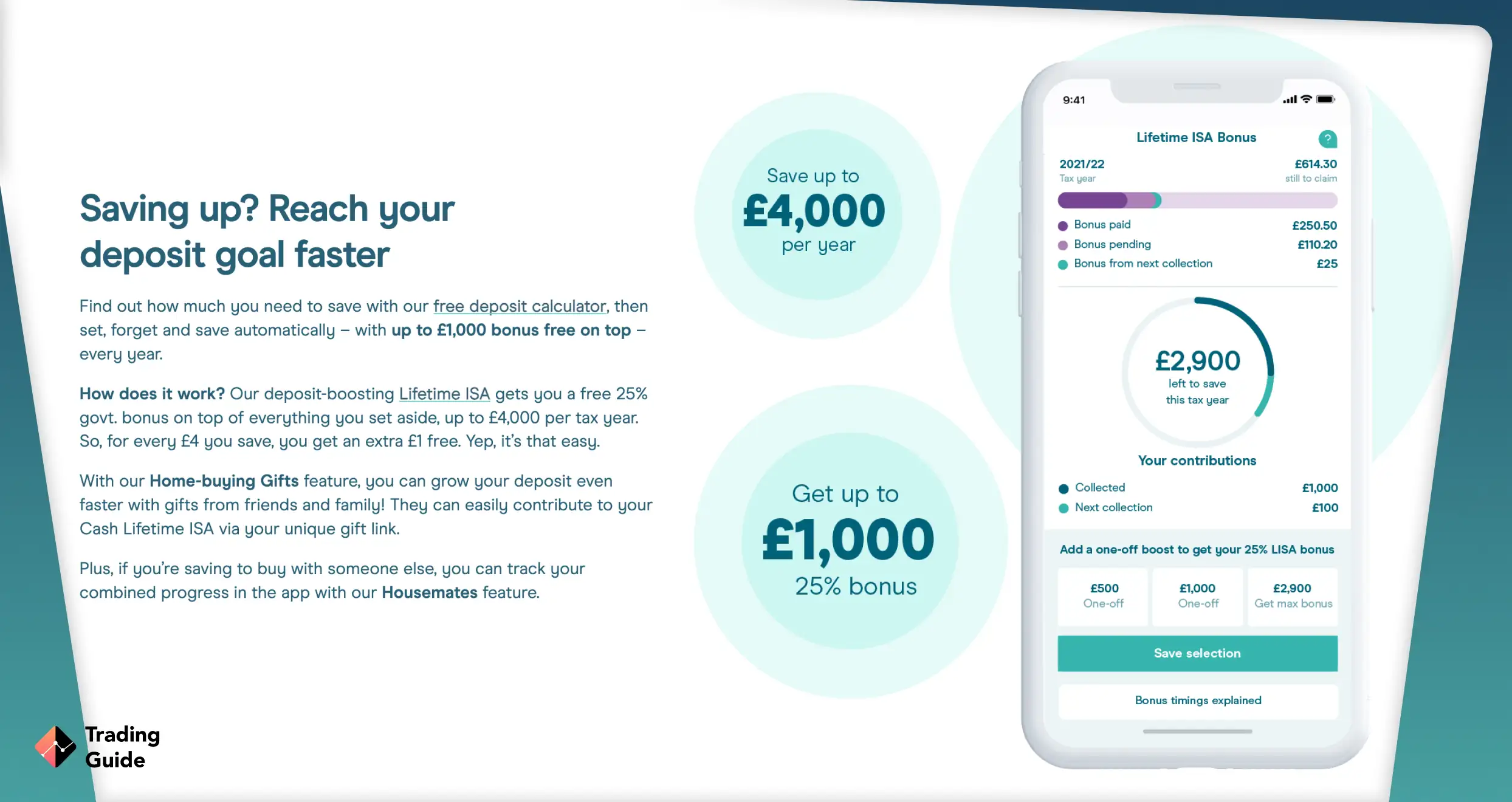

4. Lifetime ISAs

Lifetime ISAs are more flexible and give you an opportunity to focus on saving for the future. With this tax-free savings account, you can save to purchase your first home or retire with enough money. Note that this Lifetime ISA (LISA) is ideal for UK residents aged between 18-39 years. The best element about LISA is that you get to earn a 25% bonus on any amount you save. This means that for every £4 you save, you earn £1. You can only save £4,000 in each tax year.

With LISA, it is up to you to decide whether you want to hold cash, invest in a house or combine both. The home to purchase must cost at most £450,000, and you must hold your account for at least 12 months before making your first deposit for the mortgage.

Compare Best ISA Providers in the UK

We did thorough market research to identify the best ISA providers to choose from. Note that the research procedure was overwhelming and time-consuming since we leave no table unturned to ensure our readers invest with the best.

Some of the elements we considered while testing and comparing UK ISA providers include costs and fees, reputation, level of transparency, support service, etc. This means that we also analysed user recommendations on Google Play, the App Store, and Trustpilot. Take a look below at our list of the best ISA providers in the UK.

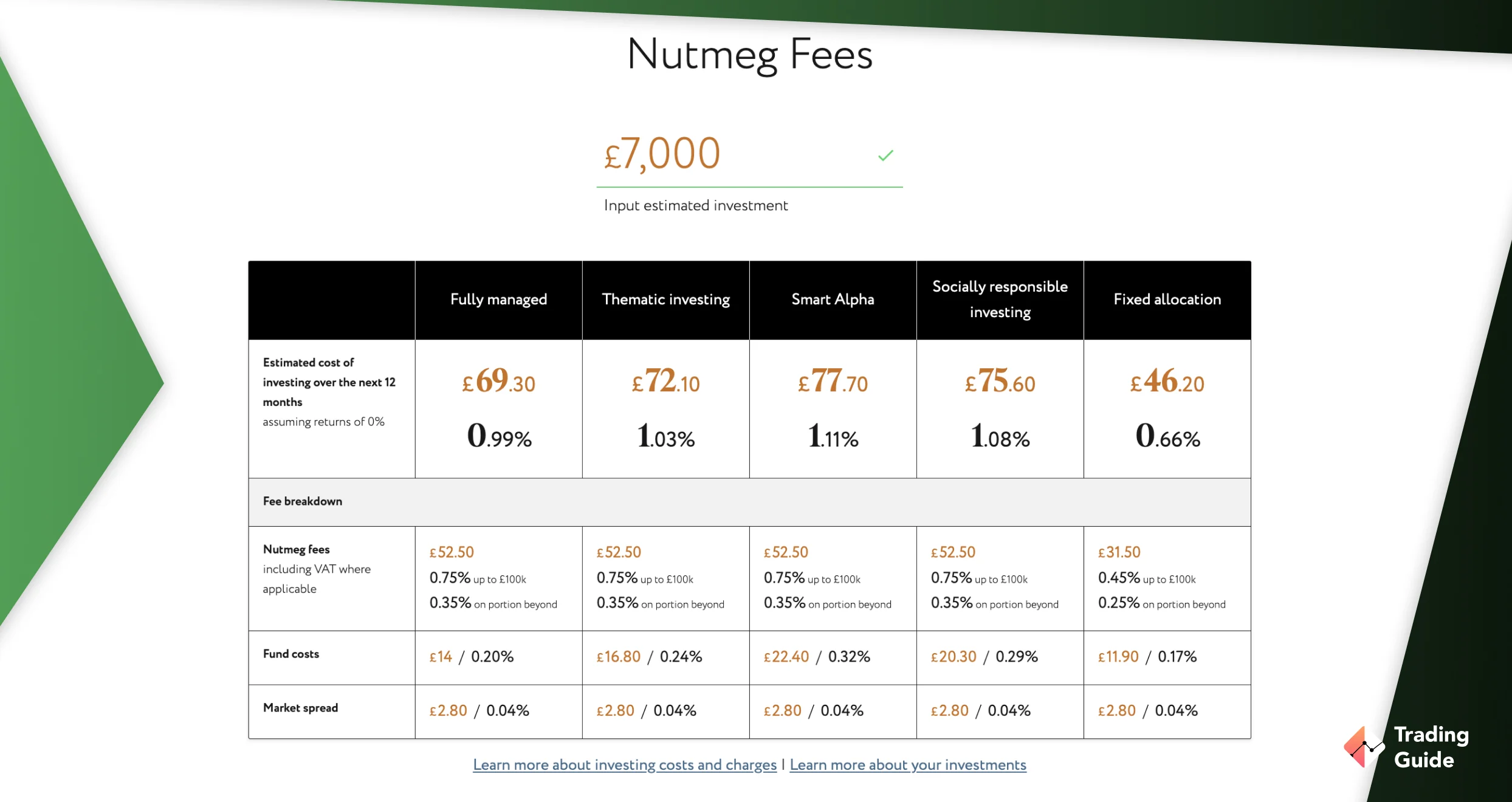

1. Nutmeg – Overall Best ISA Provider in the UK

Nutmeg is one of the most popular ISA providers in the UK managed by professionals. With this provider, you can sign up for Lifetime ISA, stocks and shares ISA, and Junior ISA. Keep in mind that Nutmeg is only available for UK residents aged 18-39. You also need at least £100 to invest using the Junior or Lifetime ISAs. When it comes to stocks and shares ISA, the minimum initial investment is £500.

The best element about Nutmeg is that it has quality and advanced features to maximise your experience. For instance, the provider has Robo-advisor that enables you to make an investment based on the amount you are willing to risk. In addition, the ISA provider is compatible with mobile devices, and you can download it from Google Play or the App Store to invest on the go.

- Nutmeg ISA is safe since it is not only regulated by the Financial Conduct Authority (FCA), but it is also a member of the UK’s Financial Services Compensation Scheme (FSCS)

- Its minimum initial investment requirement is low compared to most ISA providers

- Features a user-friendly and intuitive design platform

- You get to choose between fixed allocation and fully managed accounts

- There is a 25% penalty fee if you withdraw funds for other reasons than the stated

- Does not offer cash LISA

2. Vanguard – Best ISA Provider in the UK With the Lowest Fees

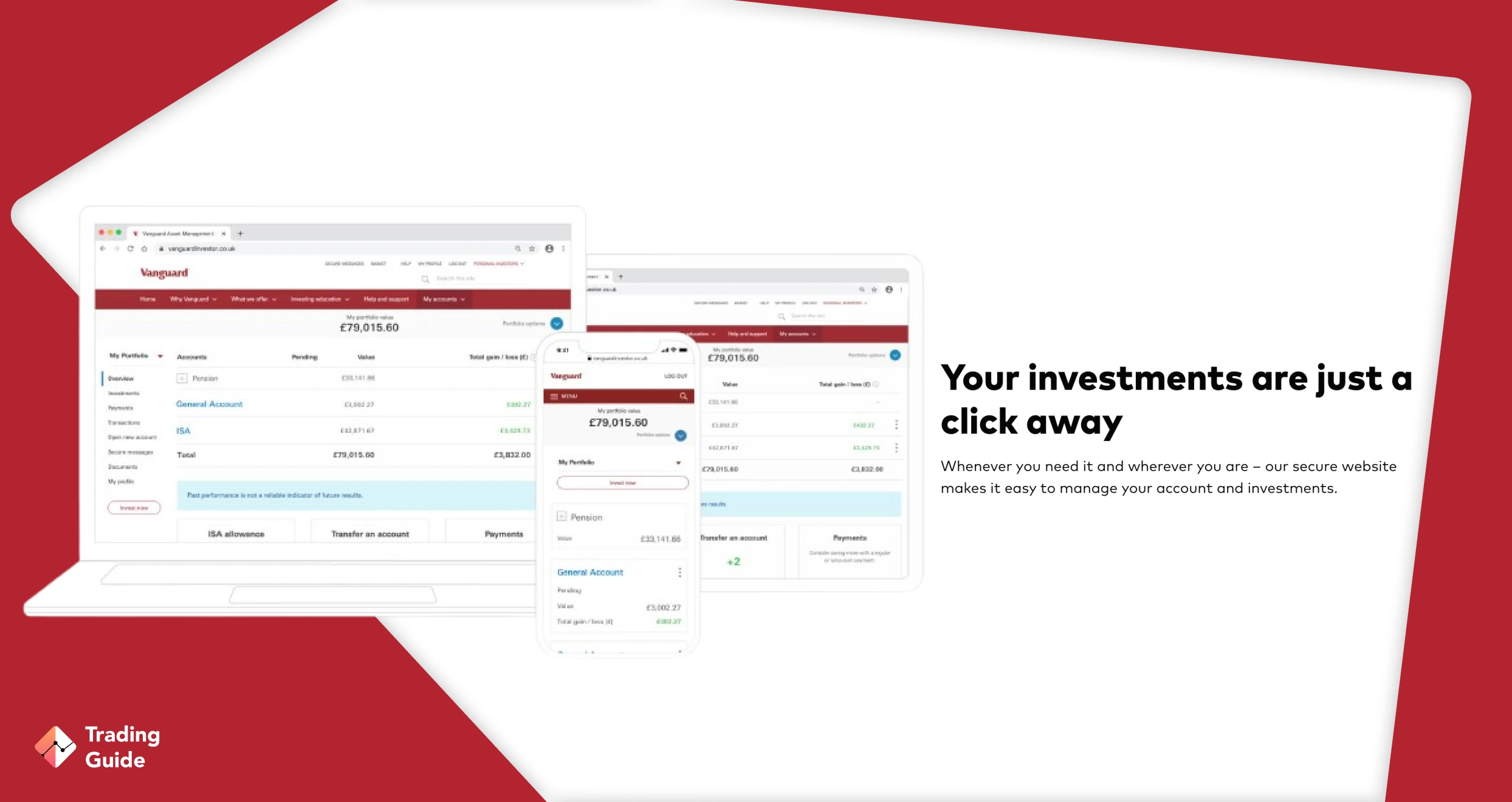

If you are looking for a low-cost ISA provider in the UK, Vanguard is a viable option. The provider is safe since the FCA regulates it and is a member of the FSCS. With over 40 years of experience, rest assured of getting the best investment service that will benefit your future. You can open a Junior ISA, stocks and shares ISA, General account and Personal Pension. All you need is a minimum investment amount of £500 for a single investment and £100 when you invest in monthly instalments.

Like Nutmeg ISA above, Vanguard also has quality features to boost your experience. For instance, its Vanguard Managed ISA allows you to remain comfortable while letting the provider’s professionals manage your investments for you. You will also have access to quality learning resources and reliable support service operating round the clock.

In addition to the various investment options offered by Vanguard, it’s worth noting that Vanguard also provides the option to invest in popular funds like the Vanguard S&P 500. This allows investors to gain exposure to a diversified portfolio of U.S. stocks.

- Low initial investment requirement and fees

- Highly secured with decades of experience

- Various investment accounts to choose from

- A user-friendly and intuitive design platform

- Does not support the Cash ISA

- Does not have a mobile app

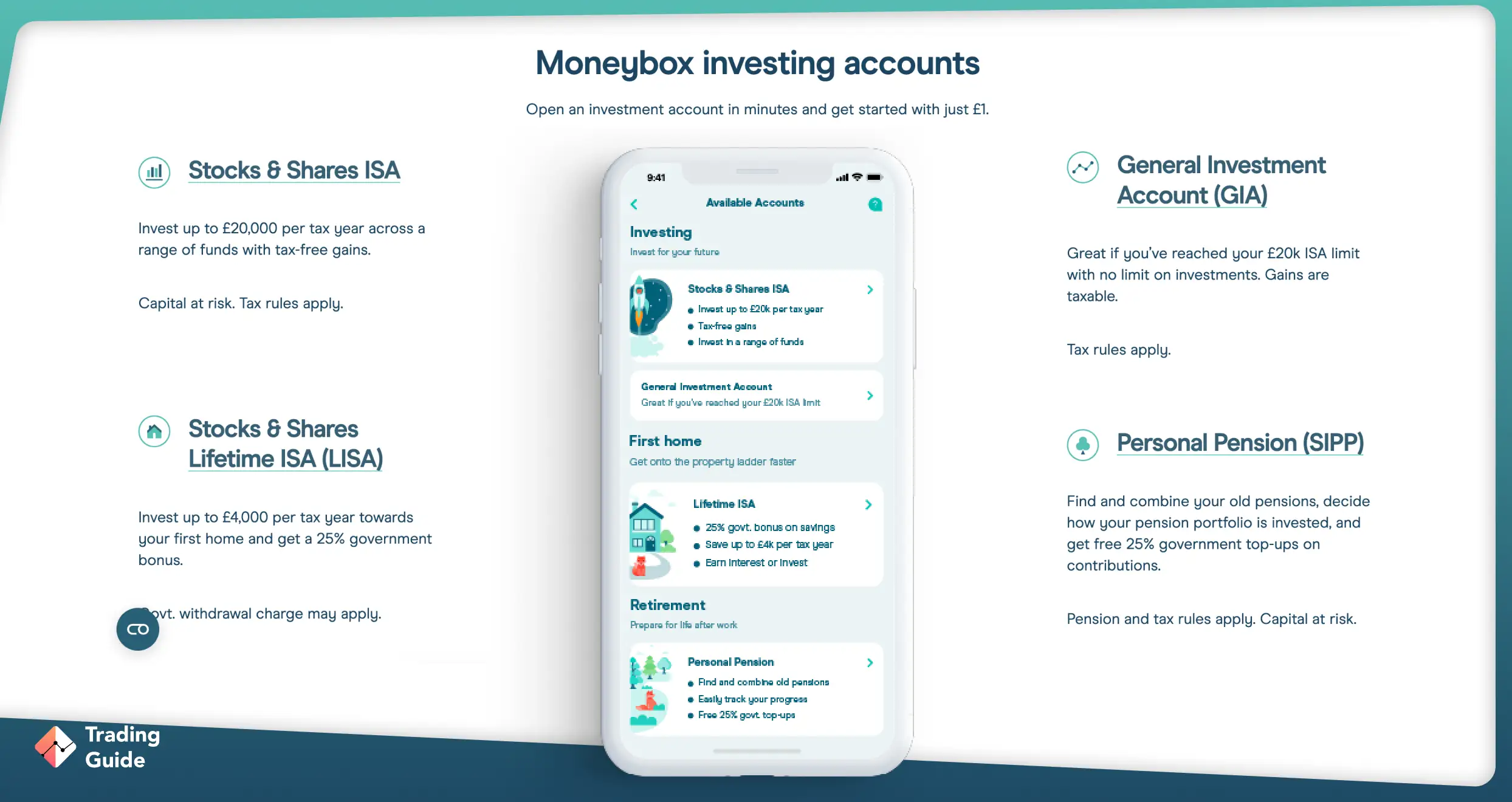

3. Moneybox – Best Lifetime ISA Provider in the UK

Moneybox is an excellent choice when looking for a Lifetime ISA provider in the UK. Not only is it safe, but it charges low fees for its services. For instance, you only need £1 as your minimum initial investment. Its annual fee is also £1 per month, and a platform fee of 0.45% is paid monthly. Besides offering the Lifetime ISA, Moneybox also supports Junior ISA, stocks and shares ISA, personal pension accounts, and General Investment account.

Note that Moneybox is mobile-friendly, and you can download its app from Google Play or the App Store. Its user-friendly and modern design platform will enable newbies to enjoy their experience. Moreover, you can choose from three investment options based on the risk you are willing to take, including cautious, balanced, or adventurous. On top of that, this ISA provider allows you to automatically invest your spare change by rounding off an amount you spend in making purchases to invest the difference.

- Straightforward account sign-up procedure, making it perfect for newbies

- You can easily link your account and invest more money to add up to your savings

- Charges one of the lowest fees and has a low initial investment requirement

- Various savings and investment accounts to choose from

- No Cash ISA

- Savings accounts’ interest rates are high

4. AJ Bell – Best Stocks and Shares ISA Provider in the UK

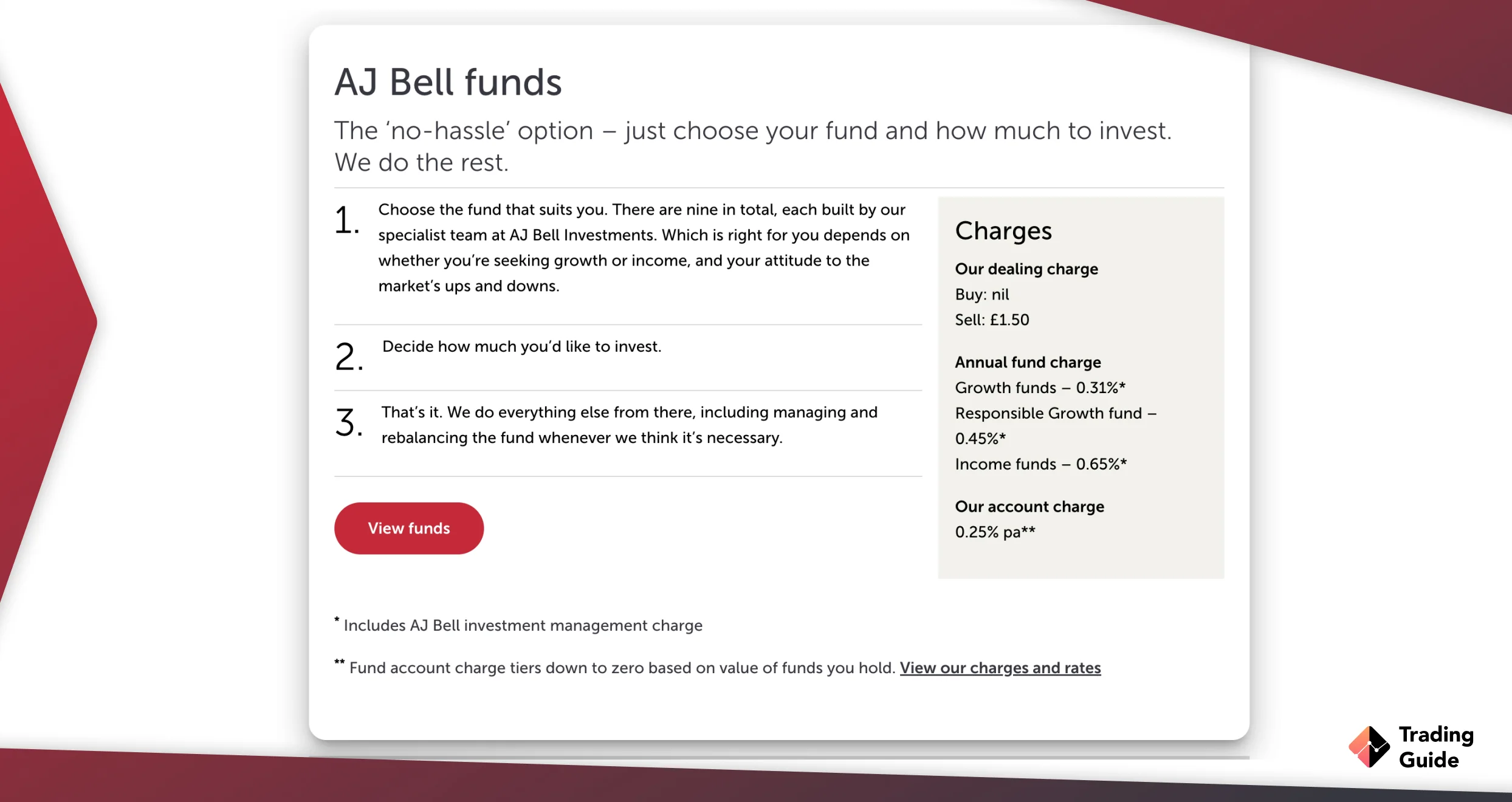

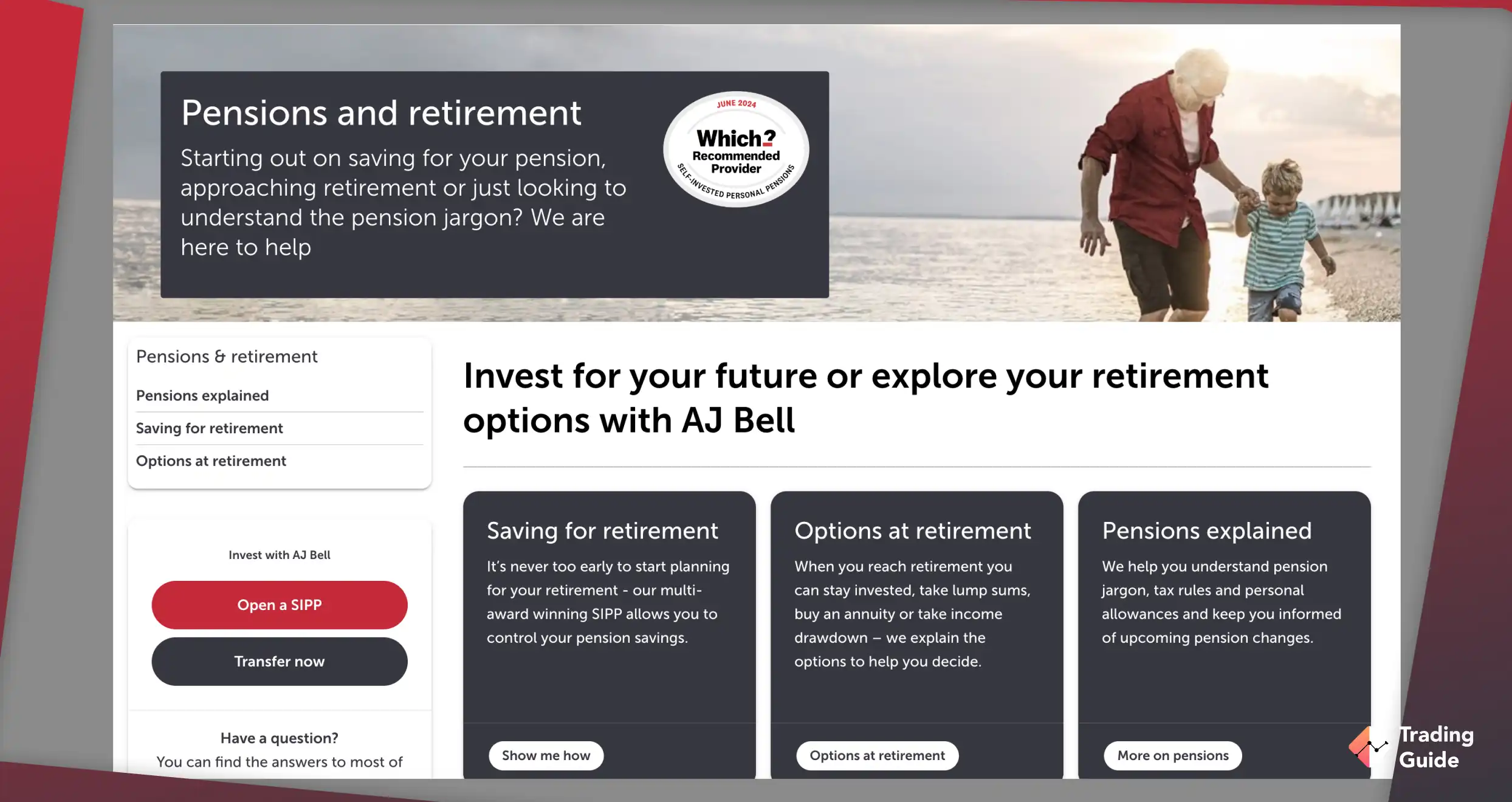

AJ Bell is one of the highly rated ISA providers by users on Google Play, the App Store, and Trustpilot. We consider it the best for stocks and shares ISA because it charges low fees not exceeding 0.25% for holding your account. Plus, AJ Bell allows you to make new purchases and sales for as little as £1.50. On top of that, you have plenty of investment options to choose from, including over 2,000 funds and shares across 25+ markets.

AJ Bell is a flexible ISA Provider since it is compatible with desktop and mobile devices. You can download its app from Google Play or the App Store to manage your investment on the move. The provider also features regular investing, whereby you get to gradually grow your ISA with as little as £25 per month. If you have over £4,000 in your ISA, AJ Bell rewards you with free access to its shares magazine, thus boosting your experience and potential.

- Easy to set up ISA on a modern-design platform

- Besides stocks and shares ISA, you have access to Lifetime ISA, Junior ISA, SIPP, etc.

- Low-cost ISA provider with investments starting as low as £1.50

- Highly-rated mobile app for managing your ISAs on the go

- No financial or investment advice offered

- A 25% penalty fee applies if you withdraw your funds before the maturity date.

5. Interactive Investor – Best Junior ISA Provider in the UK

While it is paramount to invest for yourself, it is also crucial to consider your dependents, such as children. Interactive Investor ISA provider offers one of the best Junior ISA for your children’s future. Note that the provider has been existing for almost three decades and has over 400,000 users trusting it with their money. Plus, many users highly review it on Trustpilot, Google Play, and the App Store.

Interactive Investor prides itself on charging low fees for its Junior ISA. Its professional experts with decades of experience offer a wide range of investment options for your Junior ISA. On top of that, the provider features five model portfolios to help you meet your Junior ISA objectives.

- Various investment accounts to choose from, including Junior ISA, stocks and shares ISA, SIPP, and a trading account

- Supported on mobile devices via apps downloadable from Google Play or the App Store

- You can open as many Junior ISAs with Interactive Investor

- You can dissolve membership at anytime if you do not feel satisfied

- No Cash and Innovative Finance ISAs offered

- Primarily tailored for advanced investors

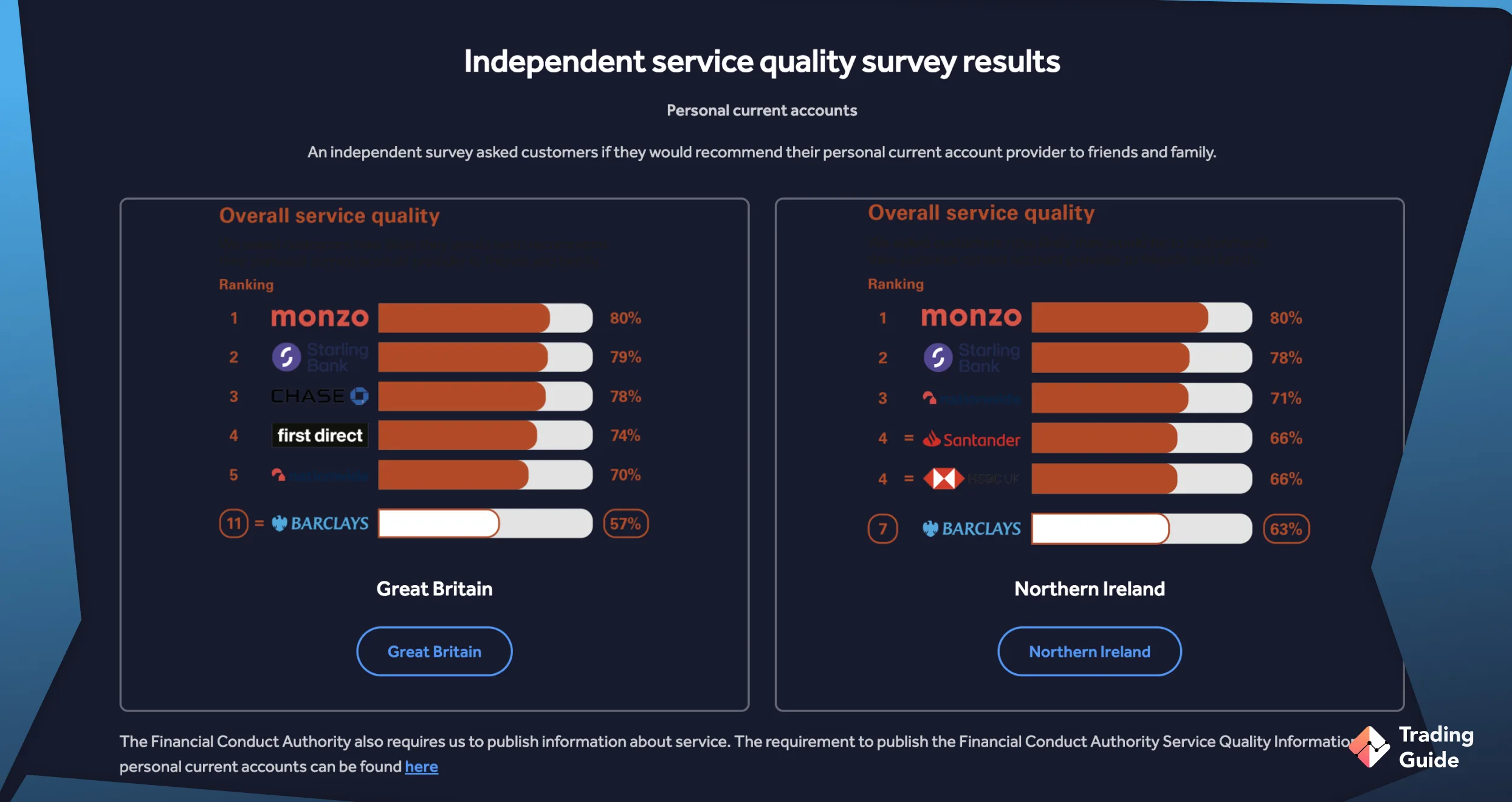

6. Barclays – Best Cash ISA Provider in the UK

Although there are numerous Cash ISA providers to consider in the UK, Barclays seems to top the list. The provider has a user-friendly and intuitive design platform perfect for all types of investors. Plus, Barclays offers multiple cash ISA to choose from depending on your investment needs.

To qualify for Barclays Cash ISA, you must be a UK resident aged at least 16 years old. You also must not have subscribed to another Cash ISA or used your total ISA allowance in a stocks and shares ISA or Innovative Finance ISA during the same tax year. The best element about Barclays Cash ISA is that you can withdraw and replace funds within the same tax year without counting towards your annual ISA allowance.

- Compatible with desktop and mobile devices

- Reliable support service and a detailed FAQ section to help you get answers to common questions

- Various Cash ISAs to choose from, including instant and flexible

- The ISA provider also offers banking services

- Does not offer Innovative Finance ISA

- The service is only available to UK residents above 16 years

7. Kuflink – Best Innovative Finance ISA Provider in the UK

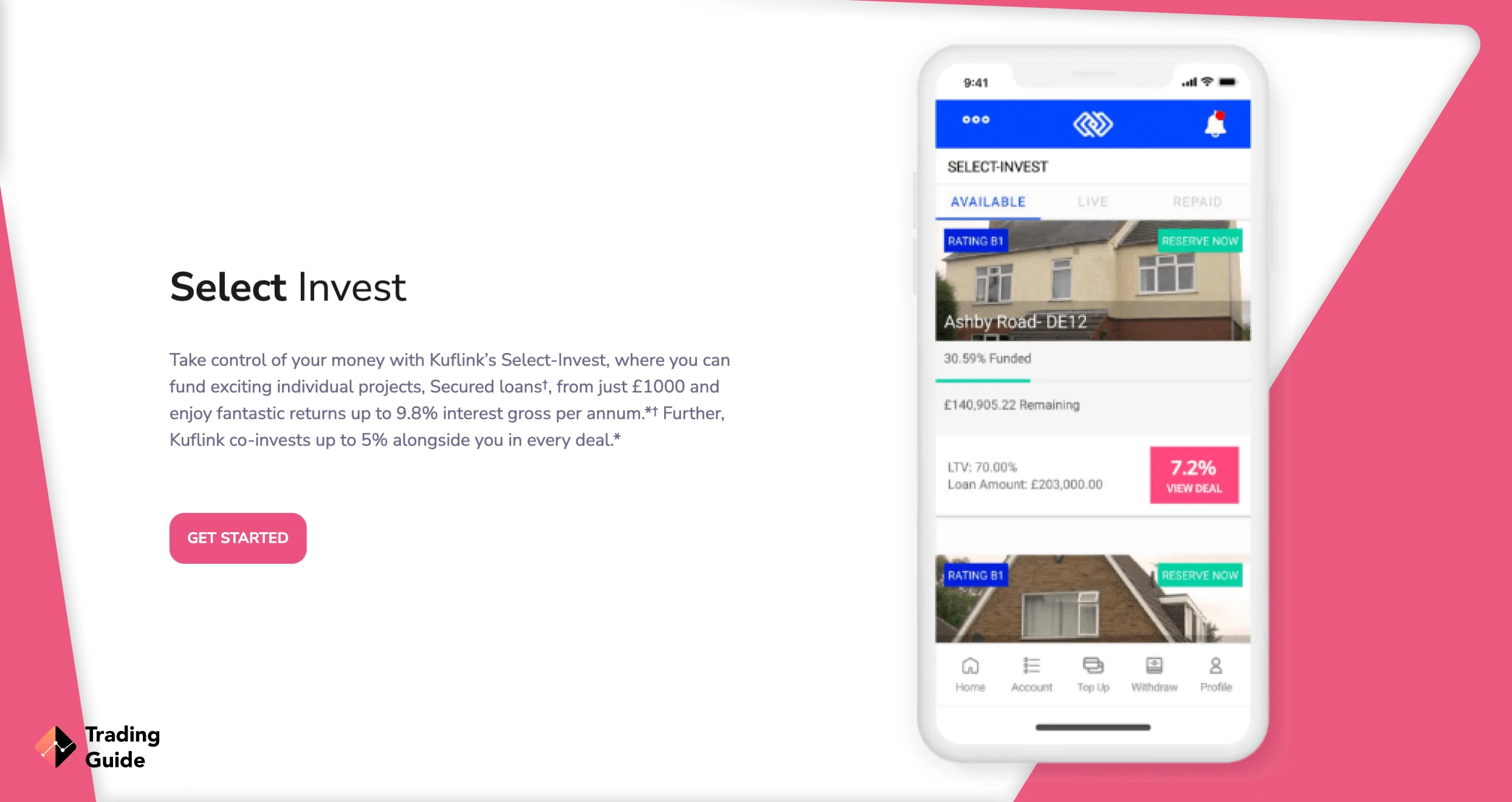

Kuflink is a user-friendly ISA provider we primarily recommend to investors looking to open an Innovative Finance ISA. With it, you get to benefit from various features, including earning up to 8.05% tax-free interest per annum. The best part about Kuflink is that users only need an initial investment amount of £100 to lend a diverse range of loans, which are secured against UK properties. There are also no management fees, making it a considerable ISA provider for newbies and low-budget investors.

Kuflink was established in 2011 and has a peer-to-peer platform for its users’ lending activities. The provider is safe since it complies with all FCA regulations. Besides the Innovative Finance ISA, Kuflink also hosts the Select-Invest and Auto-Invest, thus maximising your experience. Kuflink’s Innovative Finance ISA allows you to diversify your investments across multiple UK property loans.

- Secure and user-friendly ISA platform

- Low initial investment amount compared to its peers

- Supported on desktop and mobile devices

- Regulated by the FCA

- Reasonable interest rates

- Limited selection of investment products

- Interest rates paid aren’t the highest in peer-to-peer lending

FAQs

Various UK banks like the ones featured above offer ISA services, and the best depends on your investment needs. So, to find the best ISA provider, consider choosing from our recommendations above. Remember, compare their features to find the one that will boost your experience and maximise your potential.

Most UK ISA providers pay the best interest, thus attracting more investors. From our list above, Barclays and Kuflink take the lead, although you will also earn good money with other recommendations.

Most ISA like the ones referenced above allows you to get 5% or more interest on savings. However, note that the rates might change annually, and confirming a provider’s interest rate is crucial before taking a plunge.

Yes. With the ongoing rise in inflation, ISA interest rates are most likely to go up in 2026. However, the market is unpredictable, and it is always best to be prepared for any outcome.

Conclusion

While many investors focus on investing in the financial markets via brokers, ISA gives young individuals an opportunity to plan for their future. The best element about ISAs is that you not only profit from an investment, but you also earn interest from your savings. However, if you are investing your money in various assets via ISAs, losses are inevitable, so ensure you invest where you see profit potential. With our above-referenced ISAs, you have plenty of opportunities and are guaranteed maximum safety and experience.