Glencore, one of the world’s largest commodity trading and mining companies, has been making headlines for years. With a market capitalisation of over $70 billion, it’s no wonder that investors are keen to get in on the action. But if you are new to investing, the thought of buying Glencore shares might seem daunting.

If you are a beginner looking to find your way and start investing in the shares of Glencore, we have prepared this guide for you. Not only will you be familiar with the top brokers for buying the company’s shares, but you will also understand the procedures involved in making the purchase. Simply put, our comprehensive guide below ensures you are fully prepared and confident to start investing in the stocks of Glencore.

Top 3 Brokers for Buying Glencore Shares

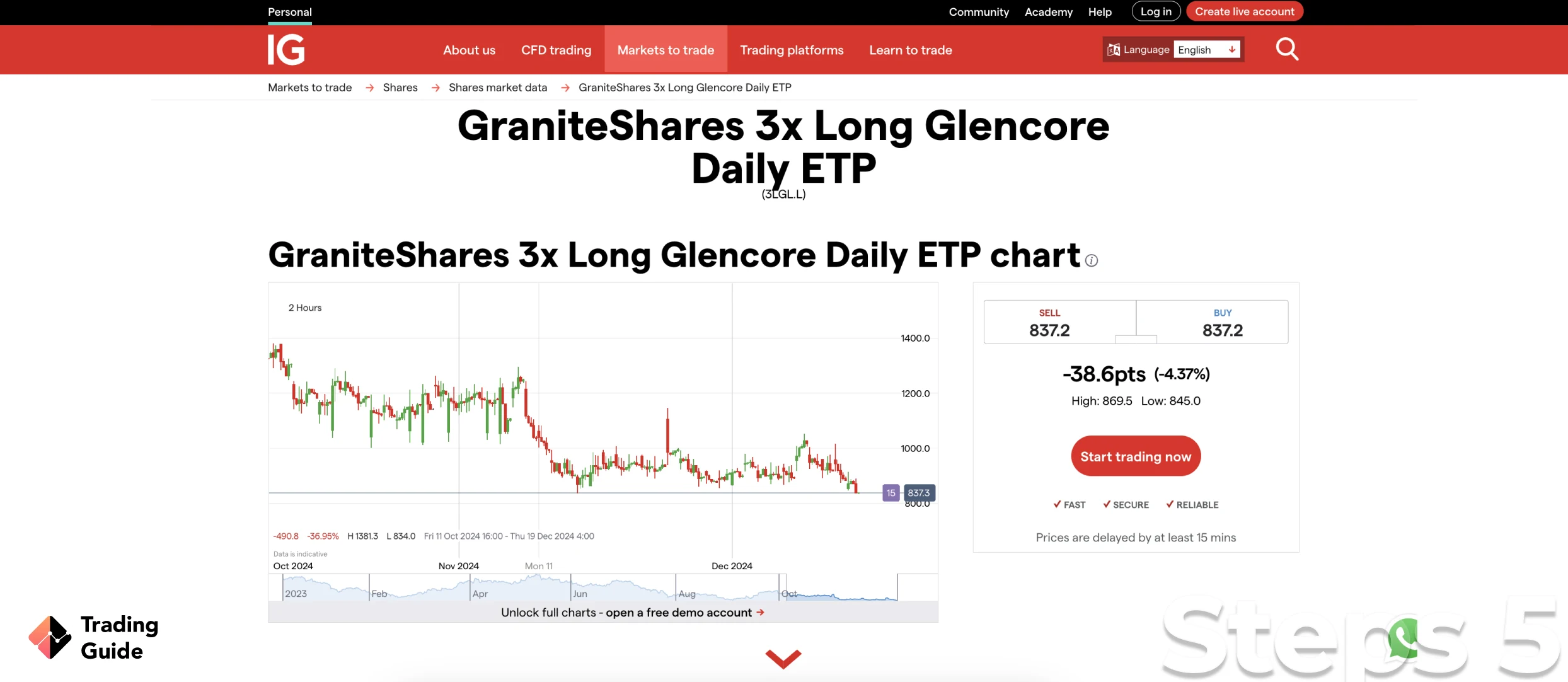

Glencore stock is listed on the London Stock Exchange under the symbol GLEN and is a member of the FTSE 100 index. To buy the ordinary shares of this company, you need the best stock broker with access to the LSE. If you prefer taking short-term positions on this company’s shares, consider finding a stock broker featuring index and CFD trading on GLEN shares.

Sadly, there are hundreds of stock brokers in the UK, and the last thing you want is to pick the wrong broker that does not fit your investment needs. The good news is that our professional researchers spent time testing and comparing hundreds of stock brokers in the UK and list below the top three that can maximise your potential and experience. Simply compare their features to identify the best for you.

1. IG Markets

IG Markets is a well-established online broker that has been around since 1974. The broker is highly secured and licensed by various top authorities, including the Financial Conduct Authority (FCA). With IG Markets, you will have access to over 18,000 trading instruments along with an excellent collection of trading tools for strategy development. Sadly, IG Markets does not have access to the LSE, meaning that it only allows traders to explore GLEN stocks as CFDs. You can also trade the shares of Glencore as indices, whereby you combine various company stocks in a single investment.

Although you will trade Glencore stock as CFDs with IG Markets, newbies will benefit from plenty of learning materials on its IG Academy. The broker also has a social trading platform that enables you to interact with other global traders to learn from one another. The only challenge you might experience with IG Markets is its high stock trading fees and a minimum deposit requirement of £300.

Your capital is at risk

- Hosts plenty of learning and research materials

- Features an award-winning social trading platform

- World-recognised broker with regulations from multiple authorities

- Additional 18,000+ assets for portfolio diversification

- High stock trading fees and minimum deposit requirement

- You can only explore GLEN stocks as indices or CFDs

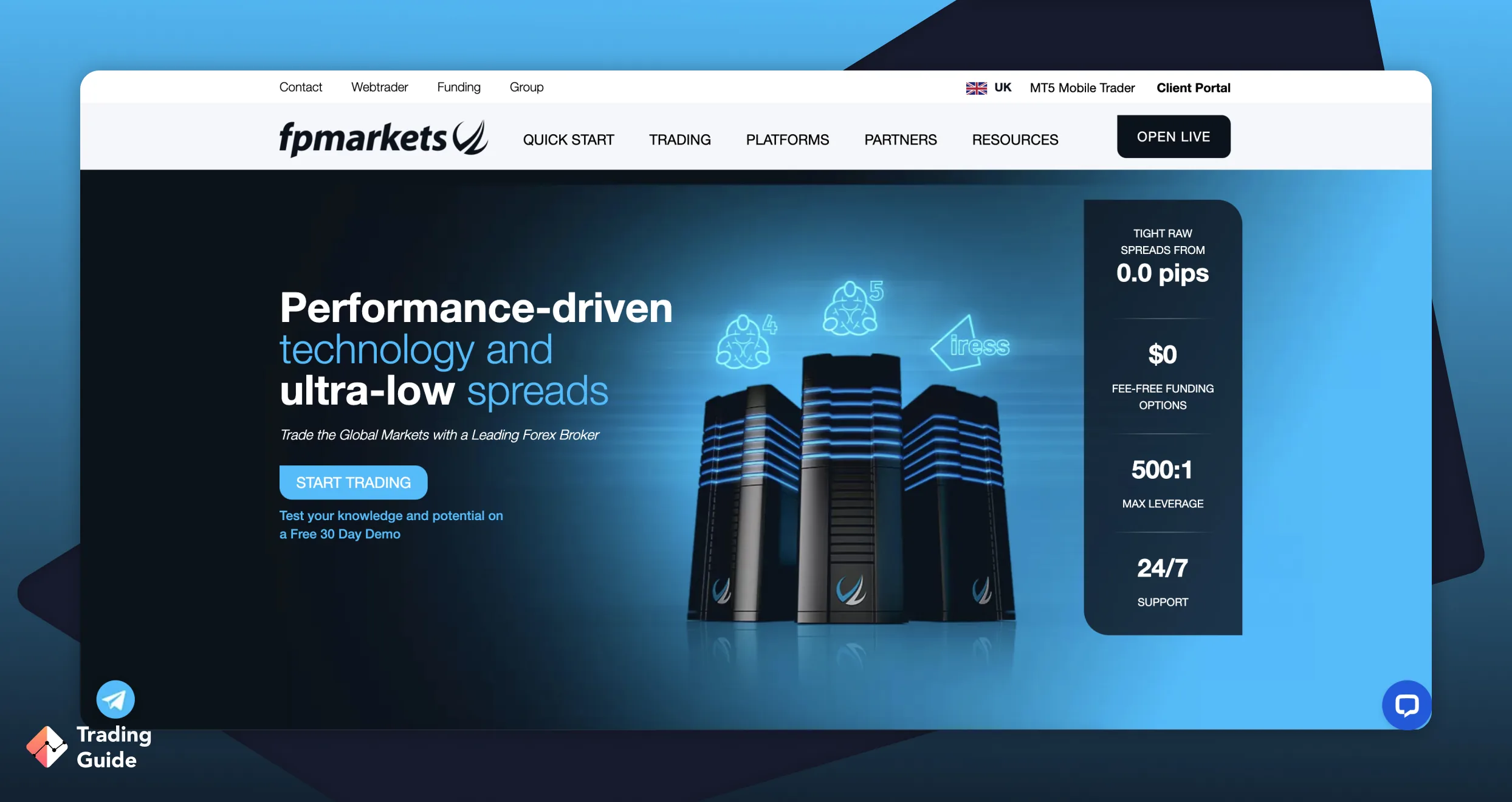

2. FP Markets

Another top broker to consider when investing in the shares of Glencore is FP Markets. Like IG Markets, you will trade Glencore stocks as CFDs and indices. FP Markets lists over 10,000 global shares on powerful platforms compatible with desktop and mobile devices. These include the Iress platform, which we highly recommend for share trading and the MT5 platform. The best element about this broker is that it has a low minimum deposit requirement of £100 and charges low spreads starting from 0.0 pips.

Besides the Iress and MT5 platforms, FP Markets also hosts MT4 and cTrader platforms you can use to explore additional featured securities. All these platforms are compatible with desktop and mobile devices, allowing you to efficiently manage your positions anywhere, anytime. For beginners, FP Markets offers numerous learning resources, a social trading platform, and a demo account to improve your skill level.

- Low minimum deposit requirement

- Over 10,000 global shares to try and diversify your portfolio with

- Features DMA on its Iress platform for maximum experience

- Leverage options of up to 500:1 for professional traders

- Glencore shares are offered for CFD and index trading only

- Withdrawal fees for international transfers apply

3. eToro

If you are looking for a reliable stock broker for buying and taking ownership of GLEN stocks, eToro is your best bet. The broker has a user-friendly and intuitive design platform that any trader will find interesting. Moreover, it hosts an award-winning social trading platform, where you can socialise with other traders to grasp various stock trading ideas. When it comes to buying the shares of Glencore, eToro charges spreads. We advise you to confirm whether you can afford the charges as we believe that they can be high for low budget investors.

To get started on eToro’s investment platform, you need a minimum deposit of $100. All deposits are free* but expect to incur withdrawal charges. The broker also hosts limited research tools and platforms, which may inconvenience professional investors looking for advanced trading resources. The best element about eToro is that newbies have access to plenty of learning materials and a demo account for practising share trading free of charge.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- Low minimum deposit requirement

- You can buy Glencore stock or trade them as CFDs and indices

- Plenty of learning tools for boosting your skills

- High spreads

- Limited advanced resources compared to what its peers offer

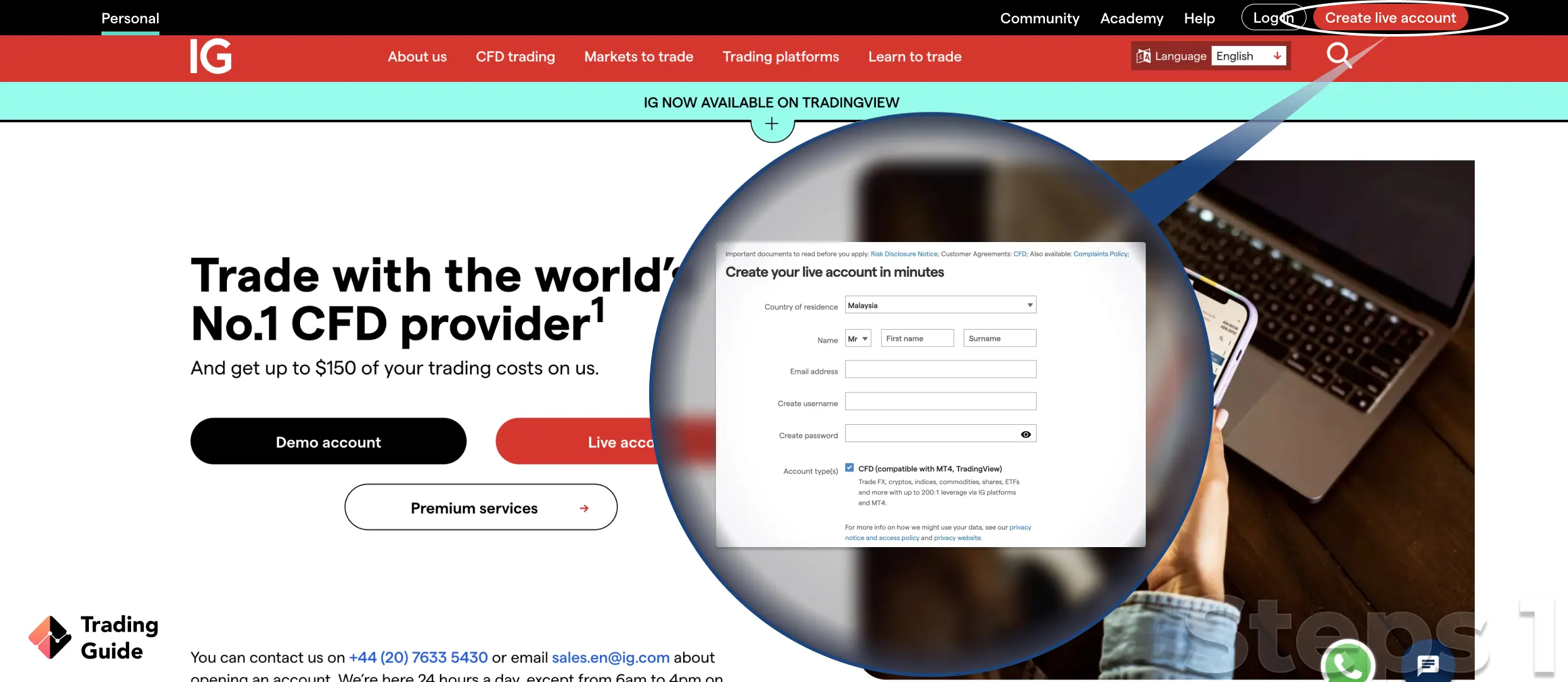

How to Buy Glencore Shares With IG Markets

Now that you are familiar with the top 3 stock brokers for investing in the shares of GLEN, you probably must be wondering how to get started. Note that the process involved in registering for an account with a broker and getting started is easy and only takes a few minutes. Below, we help understand how to buy the stocks of GLEN using IG Markets as an example.

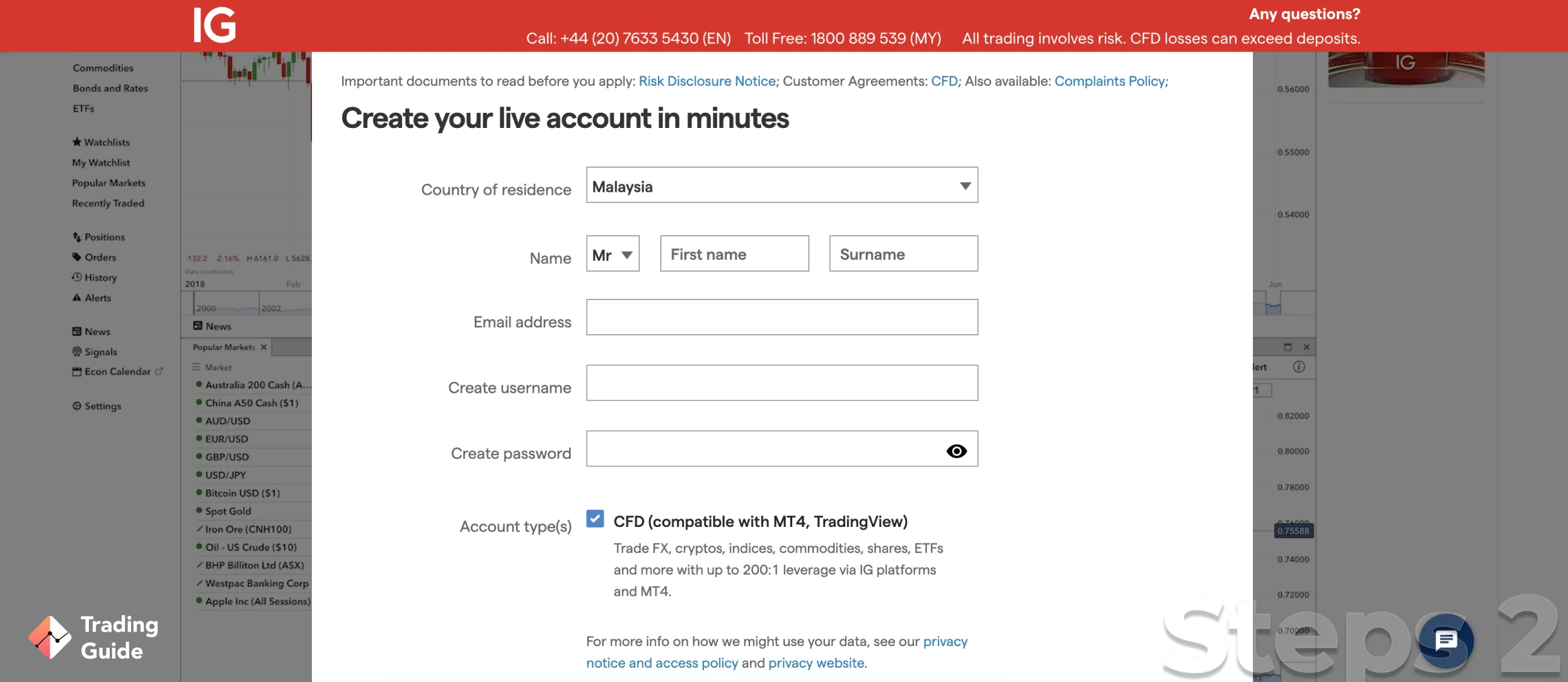

The first step is to go to IG Markets’ website and create an account if you haven’t done so already. You can do this by clicking on the “Create Account” button on the homepage. Before you get started, ensure you understand the broker’s terms and conditions and install its trading app to easily manage your positions on the go.

Once you are on the registration page, fill in your personal information as required by IG Markets. This will include your full name, date of birth, address, and contact details. You will also need to choose a username and password. Note that IG Markets has a margin trading test and a questionnaire you must participate in to determine the best trading package for you.

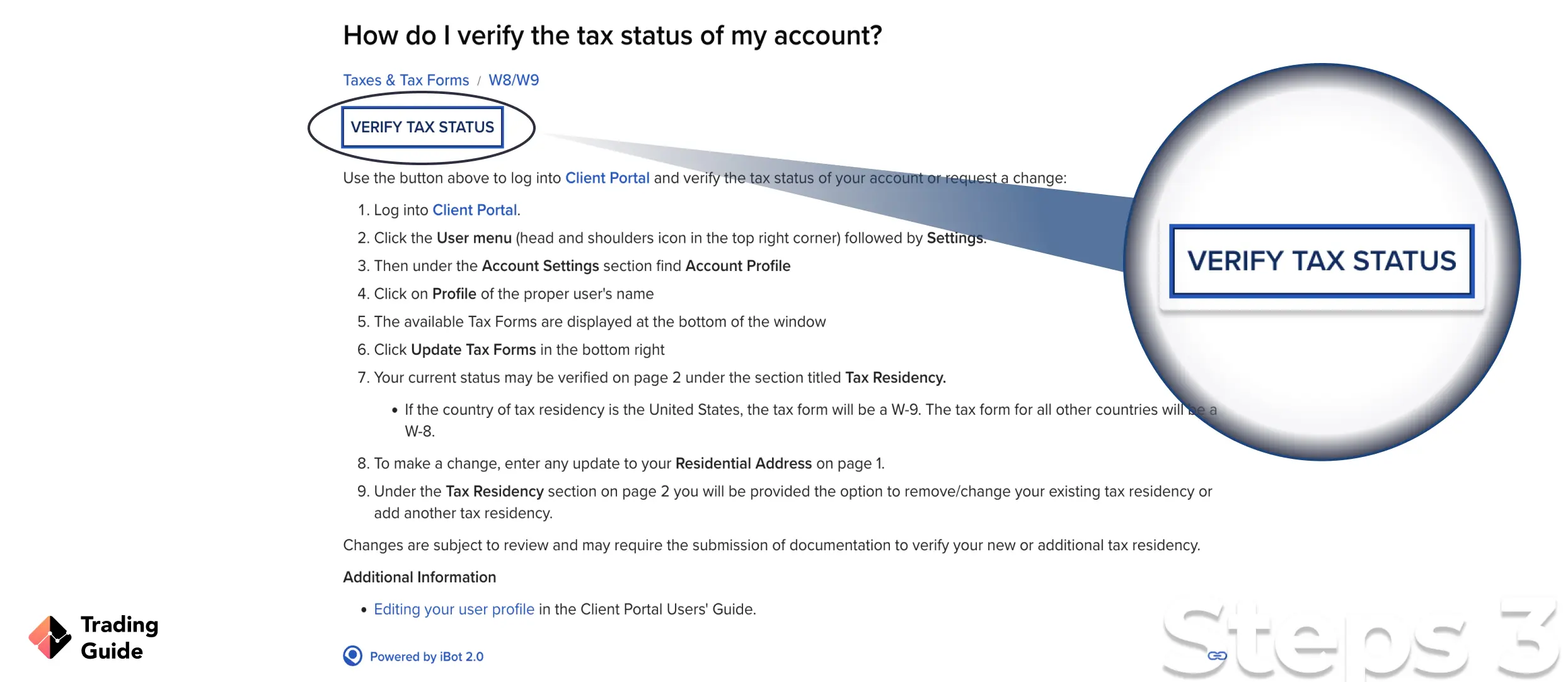

IG Markets is regulated by the Financial Conduct Authority (FCA), which means they have to follow strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. As part of this process, you will need to provide a copy of your ID card or passport and a recent utility bill or bank statement to verify your identity.

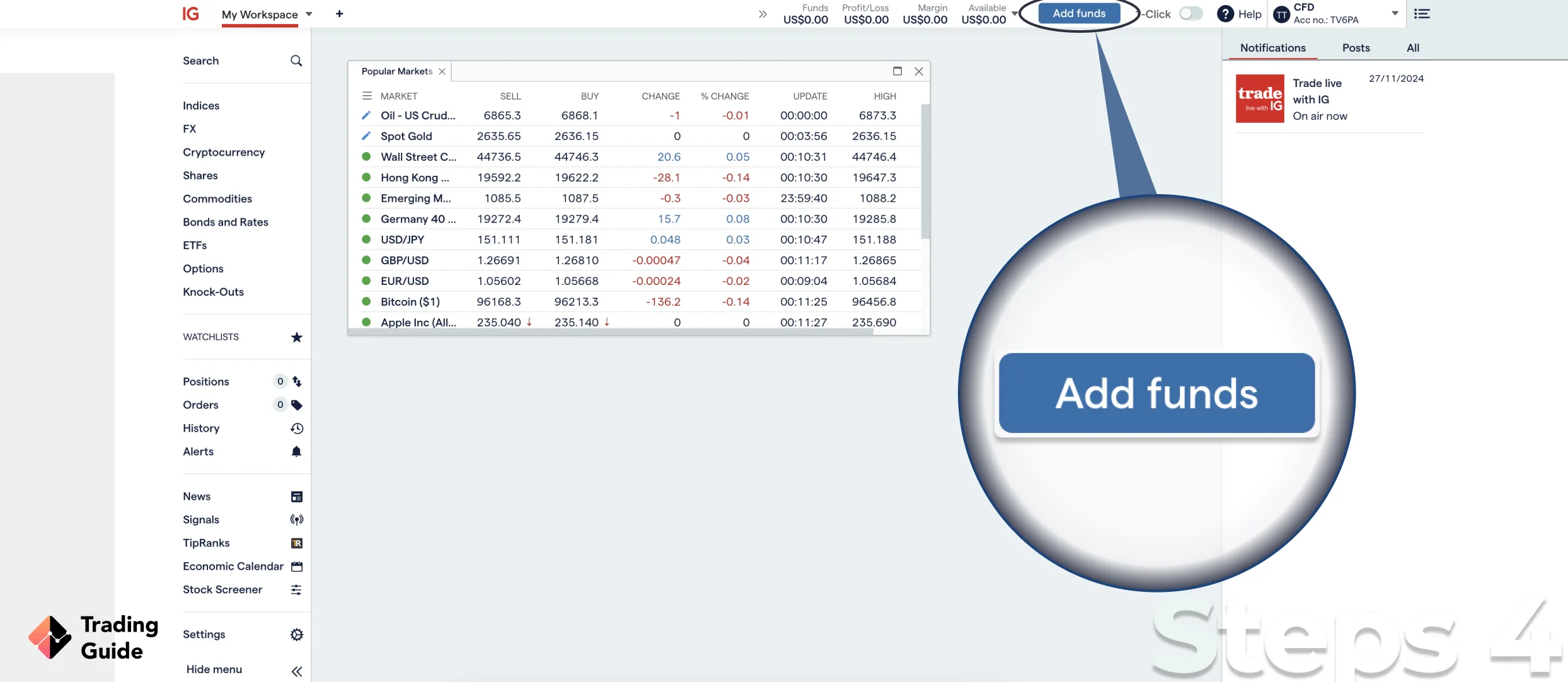

Once your account is verified, you can fund your account using a variety of payment methods, including credit/debit cards, bank transfers, and e-wallets. The minimum deposit amount is £300, which you will make free of charge.

Once your account is funded, you can search for Glencore shares by typing “GLEN” in the search bar. You can then select the CFD or index option, depending on your preference. Before placing your CFD trade, you need to decide whether you want to go long or short on the asset. If you believe the price of Glencore shares will rise, you can go long, and if you believe the price will fall, you can go short. Once you have made your decision, you can enter the trade size and place your trade.

Remember, brokers like eToro allow you to buy the stocks of Glencore and take full ownership. Therefore, if eToro suits your investment needs, simply follow the procedures above to get started but remember to open a “buy” order to fully take ownership of GLEN shares.

Tips on How to Choose the Best Stock Broker to Buy Glencore Shares

If you are planning to invest in Glencore shares, choosing the right stock broker is crucial to ensuring that you make informed decisions and maximise your returns. With so many brokers out there, the process of finding the best one can be overwhelming. However, by considering the following factors, you can make the best choice that will increase your chances of succeeding.

The best stock broker to invest in should be licensed and regulated by the relevant authorities, such as the Financial Conduct Authority (FCA) in the UK. This guarantees that your funds are safe and that the broker follows the best trading practices. You should also ensure that the broker has robust security measures in place to protect your personal and financial information.

It is essential to choose a stock broker with a user-friendly and reliable trading platform to trade seamlessly. The broker’s platform should offer real-time data and charting tools to help you make informed decisions. It should also host advanced features such as stop-loss orders, trading alerts, and access to research reports. Consider trying out the broker’s demo account to get a feel for the platform before committing.

When investing in Glencore stock, you should factor in the costs of trading and other charges. Look for a broker offering competitive fees, low spreads, commissions, and other transaction costs. Additionally, consider the non-trading charges such as withdrawal, inactivity, and account maintenance fees.

While Glencore shares may be your primary investment focus, diversifying your portfolio is also essential. Therefore, find a broker that offers additional securities such as forex, commodities, cryptocurrencies, and other stocks. This gives you a chance to invest in other assets and spread your risk.

Investing in shares can be challenging, especially for beginners. Therefore, you need a broker that offers excellent customer service. The broker should have a responsive customer support team to help you with any queries or concerns. Additionally, the broker should have resources such as educational materials, webinars, and seminars that can help you improve your investment skills.

About Glencore

Glencore is a multinational commodity trading and mining company based in Switzerland. The company was founded in 1974 by Marc Rich, and has since grown to become one of the largest commodity trading companies in the world, with operations in more than 50 countries.

Glencore’s primary focus is on producing and trading commodities such as copper, zinc, nickel, coal, oil, and agricultural products. The company operates mines and processing facilities around the world, including in Australia, Africa, South America, and Europe. Moreover, Glencore has a number of other business units, including a marketing division that is responsible for selling its commodities to customers around the world. The company also has a number of investments in other industries, including agriculture and renewable energy.

Despite its size and global reach, Glencore has been the subject of controversy in recent years. The company has faced accusations of environmental damage, human rights abuses, and tax avoidance. In 2011, the company was investigated by the US Department of Justice for alleged violations of the Foreign Corrupt Practices Act, and in 2018, it was fined by the UK government for failing to prevent bribery.

The good news is that Glencore still remains a major player in the commodities industry. Its size and scale give it significant leverage in negotiations with suppliers and customers, and its diverse operations help it weather fluctuations in commodity prices. The company is publicly traded under the symbol GLEN on the LSE.

FAQs

Yes. Although Glencore share price keeps fluctuating with certain market conditions, the asset has growth potential. Therefore, we consider it a good buy in 2023. However, before making an investment, conduct a thorough market analysis on Glencore to ensure that your decisions will bring about profits in the long run.

Yes. Glencore is publicly traded, with its shares listed on the London Stock Exchange under the ticker GLEN. The company also has a secondary listing on the Johannesburg Stock Exchange, and you can purchase its shares via credible brokers like the ones we recommend above.

A wide range of institutional and individual investors hold shares in Glencore. According to its latest annual report, Glencore’s largest institutional shareholders are Ivan Glasenberg, BlackRock, Qatar Investment Authority, and Norges Bank Investment Management.

Yes. You can buy Glencore shares online through a brokerage or online trading platform with access to the LSE. However, note that buying shares comes with risks, and investors should always consider their personal financial situation and investment objectives before making any decisions.

Conclusion

Investing in Glencore shares can be an attractive opportunity if you are looking to gain exposure to the commodities market. However, conducting thorough research and proceeding with caution is essential to maximise your potential. If you are a newbie, start investing with small amounts and gradually increase your investments as you gain experience and confidence. Most importantly, choose the best stock broker like the ones referenced in our mini reviews above. Remember, while you can earn profits by investing in GLEN stocks, losses can occur. That is why you must remain dedicated and be open to learning from your mistakes to quickly become independent and successful in the long run.