Solana (SOL) is one of the fastest-growing digital tokens in the UK. It is known for its speedy transactions, low fees, and cutting-edge blockchain design. Like many other third-generation tokens, SOL has been dubbed an Ethereum killer. It strives to improve on Ethereum’s shortcomings, thus streamlining transactions.

But what makes Solana different from other altcoins? Could it be the fact that its ecosystem supports DeFi apps and NFTs, or is there more to it?

Personally, I am drawn to Solana due to its efficiency, especially for smaller transactions. I also like its potential for long-term growth, which makes it an excellent investment tool.

If you are here to learn how to buy Solana, keep reading to discover the simple steps. I will also introduce you to the top platforms for buying this token. Ultimately, you should be confident to buy Solana while managing all the risks involved.

How to Buy Solana

The steps below shed light on how to buy SOL in the UK.

Buying Solana with a broker is more efficient and safe. However, since there are many scammers in the market. In this case, ensure you confirm a broker’s regulatory status or reputation. I always check whether they are regulated by top-notch authorities such as the FCA, CySEC, and more.

Additionally, I confirm SOL’s availability, fees, reliability, and digital wallet compatibility. When I started this venture, I chose eToro and was never disappointed. Some of its features are beginner-friendly, although it also serves the experts.

I will share some of the best investment platforms for buying Solana later in this guide.

Visit your broker’s or exchange’s official website to create an investment account. Once you click the “sign up” or “register” button, the process begins. For a broker, you will be required to share your personal details, including your name, email, phone number, location, and more. When it comes to exchanges, an email and password will be required.

To comply with the UK’s financial regulations, your broker or exchange will engage you in a Know Your Customer (KYC) procedure. You will share a copy of your government-issued ID card to verify your identity. Plus, a copy of a recent utility bill will be needed as proof of your current location.

Note that the verification process takes a few minutes to days, depending on the broker. But once you receive an email confirmation, you are free to explore the available features and buy SOL.

I believe that the broker or exchange you will have chosen fits your budget. Therefore, proceed to make a deposit per its minimum deposit requirement. Also, choose a convenient payment method. Most reputable cryptocurrency platforms accept payments via credit/debit cards, e-wallets, bank transfers, and cryptocurrencies.

You will automatically gain access to your platform’s features and assets once your deposit is confirmed. Search for Solana using its ticker symbol, SOL. In most exchanges, you will find trading pairs like SOL/USD, SOL/GBP, SOL/BTC, and more.

Place a market or limit order and select the number of Solana you want to purchase. A market order allows you to buy Solana at the current price. In contrast, a limit order allows you to set a specific price that you are willing to pay.

I remember making my first purchase after conducting thorough research. I opted for market orders, as I wanted to immediately own this token. This was the best decision, as it was the fastest and simplest option for buying SOL.

I don’t recommend leaving your Solana on exchanges, given their history of hacking incidents. Secure them in a private wallet where you own the keys. As an investor, I prefer securing my tokens in a software or hot wallet when engaging in short-term investments. This leaves hardware or cold storage for long-term investments.

Brokers to Buy Solana in the UK

Having thoroughly conducted market research, below are my top 3 brokers for buying SOL in the UK.

1. eToro

Whether you are new to cryptocurrency investing or are experienced, I highly recommend eToro. After testing and comparing it to its peers, I find it to be user-friendly with a highly customisable interface. Additionally, eToro has a simple account opening procedure, with a minimum deposit requirement of £50 for UK investors.

I like that eToro features stop-loss and take-profit orders to protect your investments. On top of that, users can buy SOL and take full ownership or trade the altcoin as CFDs. But CFD trading carries a high risk of losing money, especially while applying leverage. Therefore, learn more about this derivative trading method before risking your hard-earned money.

Besides Solana, eToro is home to an additional 100+ cryptocurrencies. These include popular options like Bitcoin and Ethereum. It also supports other asset classes like forex, commodities, stocks, options, and more. It is an excellent platform for portfolio diversification.

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

- Features a CopyTrader platform for social and copy trading

- Low minimum deposit requirement for UK clients

- Quality learning materials and a £100,000 virtually funded demo account

- Has an in-built crypto wallet

- Solana trading and investing fees are relatively high compared to its peers

- Charges fees for fund withdrawals

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

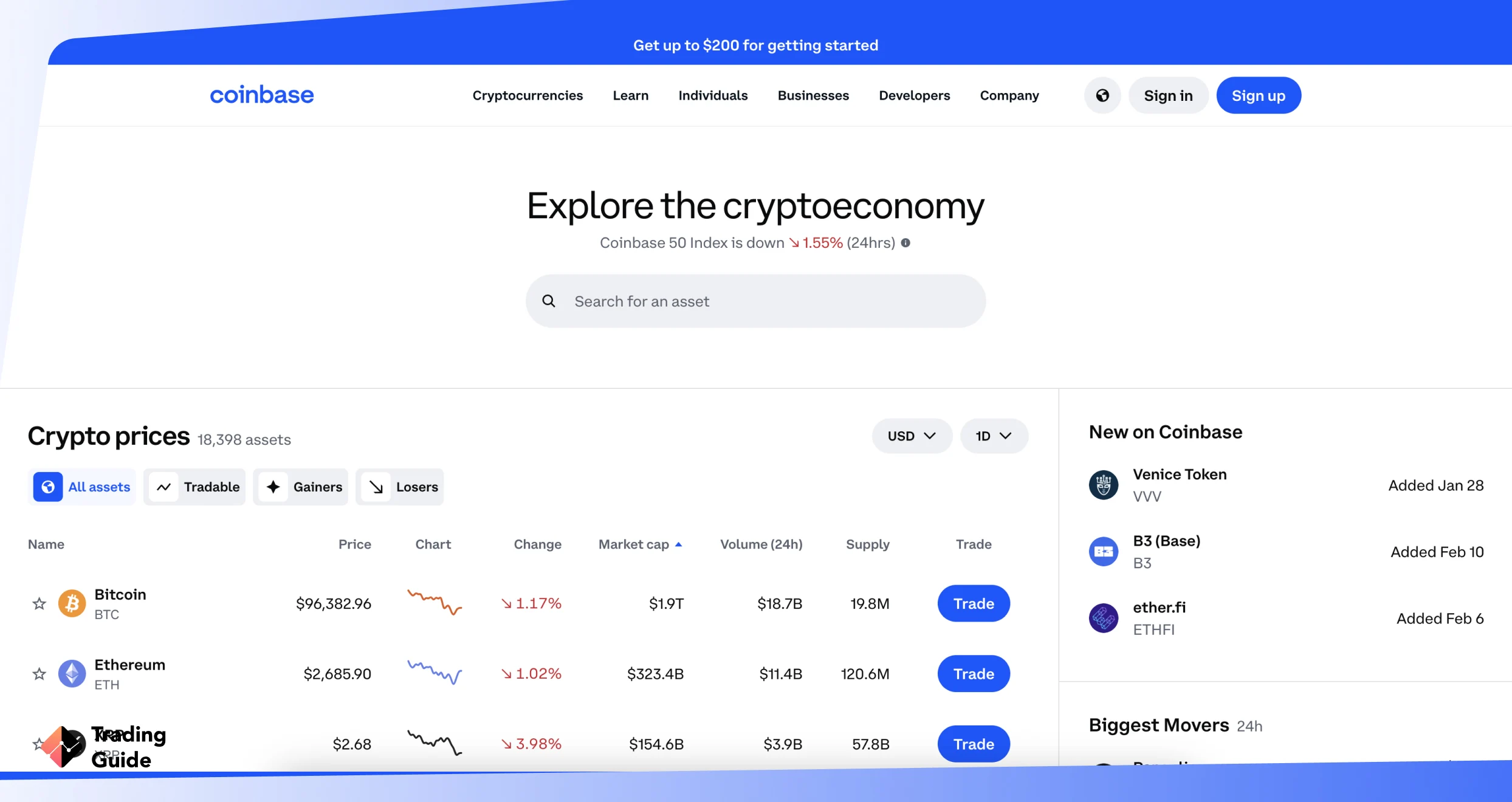

2. Coinbase

Coinbase is one of the cryptocurrency exchanges that employs robust security measures to secure users’ tokens. Plus, I discovered an in-built digital wallet, which makes it easier for users to transfer their tokens. On top of that, Coinbase adheres to the FCA’s stringent regulations.

One of the most attractive features at Coinbase is the ability to reward users for staking cryptos, including SOL. You will earn up to 14% APY on your holdings. And besides Solana, the exchange hosts over 240 additional digital tokens. This makes it easier for you to diversify your portfolio. You will mitigate the risks that come with investing in a single security.

While users can transact using credit/debit cards and other cryptos, I had an opportunity to make deposits using the bank transfer method. Making deposits directly to Coinbase from a bank is free. Plus, I explored powerful trading tools from TradingView charts to sophisticated order types and APIs. These features and more streamlined my experience, making purchasing Solana a breeze.

- No minimum deposit required to access Solana

- Lists over 240 digital tokens

- Reliable and responsive support service

- Has an in-built crypto wallet

- Fees are not transparent.

- High SOL trading fees

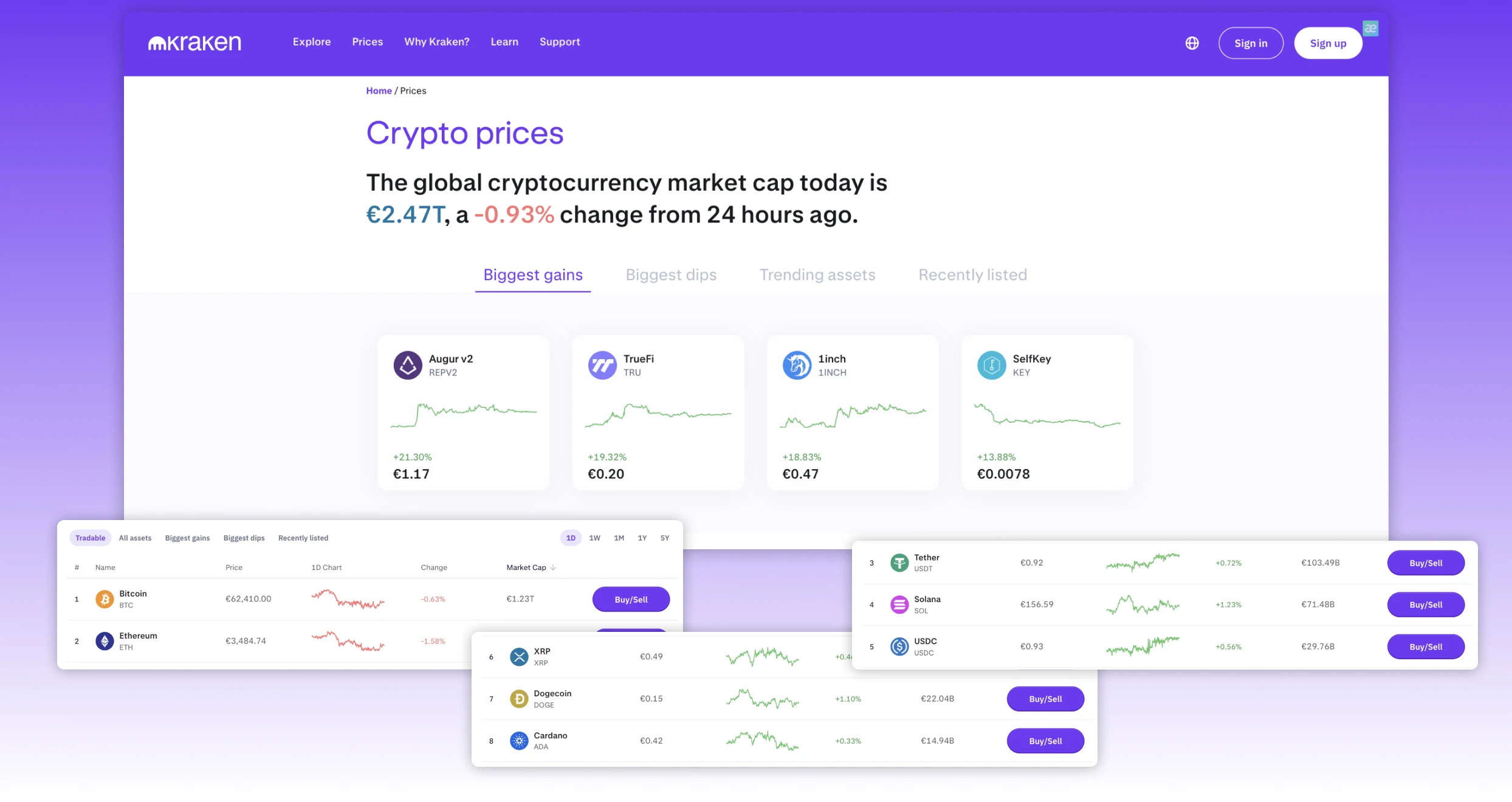

3. Kraken

Kraken has made a name for itself in the UK financial space. Today, it is one of the most preferred crypto exchanges based on user testimonials on Google Play, the App Store, and Trustpilot. Besides, it has over 15 million users—a testament to its trustworthiness among users.

I tested this exchange and uncovered many features. For instance, it lists over 350 cryptos, including Solana. This means you will have plenty of options for your portfolio diversification. Deposits are accepted using multiple methods, and users get to transact using the UK’s GBP.

In my opinion, Kraken takes the needs of its users seriously. There are plenty of learning resources about various blockchains, cryptos, NFTs, and trading in general. These materials, together with the exchange’s reliable support service, make Kraken a go-to platform for investors of all levels.

- Quality learning materials

- Low fees for advanced traders

- Solana’s weekly rewards for staking go up to 6% APR

- Has a secure self-custody Kraken wallet to secure your tokens

- Limited funding options

- Its support service response rate can be improved

*Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Solana Price Today

Solana’s price is always fluctuating with demand and supply. It is a volatile asset, so you must stay abreast with its current value to identify the best entry and exit points in your investment. Below, we share a live chart indicating Solana’s current price so you can easily strategise. You can also take advantage of the chart to analyse its historical value and make the best predictions regarding its future performance.

About Solana

Solana is a blockchain platform that was launched into the financial space in 2017 by Anatoly Yakovenko. The open-source project was designed to host decentralised, scalable applications and solve the slow transactions affecting other networks like Bitcoin and Ethereum.

The Solana blockchain was built by San Francisco-based Solana Labs. So far, it has proven efficient, as its transactions are way faster than those of its rival blockchains like Ethereum. Scalable decentralised applications (dApps) and crypto projects can now easily launch without incurring a lot of cost. Moreover, its transaction fees are low.

Note that Solana has its native token, which is under the ticker SOL. The token powers the Solana network and is used as a primary currency for user transactions. So far, the token has become one of the most popular, with its value constantly fluctuating.

At the time of writing this piece, SOL trades at around £147.65. So far, its total supply is £599.47 million SOL with a market cap of £76.05 billion. In 2025, Solana remains one of the largest cryptocurrency tokens by market capitalisation. Its value has surged by over 250% in the past year.

Risks of Investing in SOL

Solana, like other crypto tokens, carries risks. It is essential to be familiar with these risks to develop a solid strategy that will maximise your potential. Let’s explore them below.

- Volatility

One of the most significant risks associated with investing in Solana is market volatility. This means that the token’s value significantly fluctuates over a short period.

As an experienced investor, I always widen my risk levels on such trades. I apply stop-loss orders or reduce my exposure to minimise the overall risk of a trade.

- Liquidity

Liquidity gives traders an opportunity to enter and exit their investments without moving the market’s price. For example, if you decide to invest in SOL but there are fewer sellers to match your buying size. In this case, the market price will have to increase to attract more sellers.

In contrast, if you want to sell your Solana, but there aren’t enough buyers or liquidity to fill your position. In this case, the crypto price will have to fall to attract more buyers.

Whenever I invest in such securities, I start by breaking large trades into multiples or smaller sizes. By placing the divided trades separately into the market, the market gets time to digest the larger volume of trading.

- Regulatory Risks

There is little regulation of the crypto market. So, if you fall prey to cybercrime, there is no governmental or regulatory body (such as the FCA) to seek assistance from.

I advise you to always prioritise your funds’ safety before investing in SOL. Conduct thorough research on where to buy Solana. Confirm a broker’s regulatory status and encryption protocols and read user testimonials.

FAQs

You can buy a Solan token from a cryptocurrency broker or exchange that lists the asset. Above, we recommend the top three crypto brokers for buying and trading Solana as CFD. However, ensure you choose the best for your investment or trading needs to enjoy your experience.

Yes. Every broker listing Solana has trading or investment charges you must pay when buying or trading Solana. So, while finding the best broker, ensure all the fees and requirements fit your budget.

Yes. According to information on its website, Solana NFTs have gas fees paid for minting. The fees are low, making it an attractive investment for low-budget NFT investors.

The first step regarding investing in Solana is learning the asset and how the crypto market works. You also need the best broker and identify how you want to invest in the asset, whether by purchasing and taking full ownership, investing in its NFTs, or trading Solana as CFDs. Most importantly, have a plan and budget for a worthwhile experience.

Yes. We believe Solana is a good investment since many investors earn good profits from the asset. However, you must be willing to learn the crypto market and conduct thorough market research for maximum potential. In our guide above, we share a live chart to help you with strategising, thus making the best investment decisions.

Solana is a blockchain platform hosting decentralised, scalable applications. It is one of the networks with high speed, processing transactions within seconds at a lower fee. Besides offering a crypto token, Solana also has an NFT platform that lists various collectables to explore, buy or sell.

Expert Opinion

If you are a first-time buyer of Solana, I understand how intimidating investing can be. I was once a newbie, but that didn’t stop me from chasing my goals (profits). Start by investing a small amount of capital as you become familiar with this investment.

Additionally, conduct market research. I stay abreast of the latest Solana market trends. Plus, I frequently visit the token’s website to fully understand its ecosystem.

Lastly, ensure you avoid common mistakes, as they can cost you a lot of money. These include making decisions based on emotions or market hype and failing to transfer your tokens to reliable digital wallets. If you follow my advice above, I am confident that you will set yourself up for success.