Silver is one of the precious metals used in various ways, one of them being a store of wealth for investors. It is a rare and volatile commodity, making it more valuable globally. Silver stocks are listed in various exchanges, and trading the asset can make you good profits, especially if you always thrive in a volatile market. But remember, your capital is at risk. So, if you are looking for ways to invest in silver, this guide is meant for you.

Besides buying and taking ownership of silver as a physical asset, there are alternative methods to invest in silver. As a new investor with minimal experience, it is essential that you are fully aware of these methods before you get started.

Our comprehensive guide will take you through how to invest in silver using an online broker. We also recommend the top brokers for buying silver as a commodity and silver stock in the UK. By the time you finish reading this guide, you will be fully equipped with the right tools and knowledge to start investing in silver.

Brokers for Investing in Silver

Whether you want to buy silver bars or coins, trade the commodity as a stock, or derivatives, you must find a reliable broker. This means the broker should align with your trading needs and have access to the right futures exchanges where silver is listed. What’s more, the broker should let you trade silver as derivatives, whether as CFDs, ETFs, indices, spread betting, mutual funds, futures contracts, etc.

Below are the top brokers for trading silver in the UK. We have tested and reviewed them multiple times, so rest assured they have all the features and tools to give you the best experience.

1. Plus500

*Illustrative prices

Plus500 allows you to trade silver as CFDs. You can start trading the commodity while enjoying excellent trading tools with as little as £100. Additionally, the broker does not charge commission on silver trading, and the spreads are among the lowest in the industry. You will also not pay any transaction fees, whether while making deposits or withdrawals.

On the downside, you have to be an active trader or investor to enjoy Plus500. This is because its inactivity fee kicks in after three months should you fail to even log in to your trading account. The broker also charges overnight, currency conversion, and stop-order fees. There is also one single proprietary platform, limiting traders looking for advanced platforms like the MT4 and MT5.

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro

eToro offers you diverse opportunities in silver stocks. Founded in 2006, eToro’s popularity is primarily due to its user-friendly social and copy trading platforms. The broker also has excellent research and skills development tools, making it a suitable choice for newbies and expert traders.

To access eToro and buy silver stocks, a minimum deposit of $100 is required. eToro also allows you to trade silver as CFDs, ETFs, and futures contracts. Although eToro does not charge commission on silver stocks, spreads are relatively high. Accessing the copy trading platform can be expensive to most traders since a minimum deposit of $200 is required. Its minimum amount per trade is also $10.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

How to Buy Silver Stock With Broker eToro

Now that you know the brokers for investing in silver shares, it is time to learn how to buy silver stock with them. The procedures for purchasing silver with the above brokers are similar but slightly vary depending on a broker’s requirements.

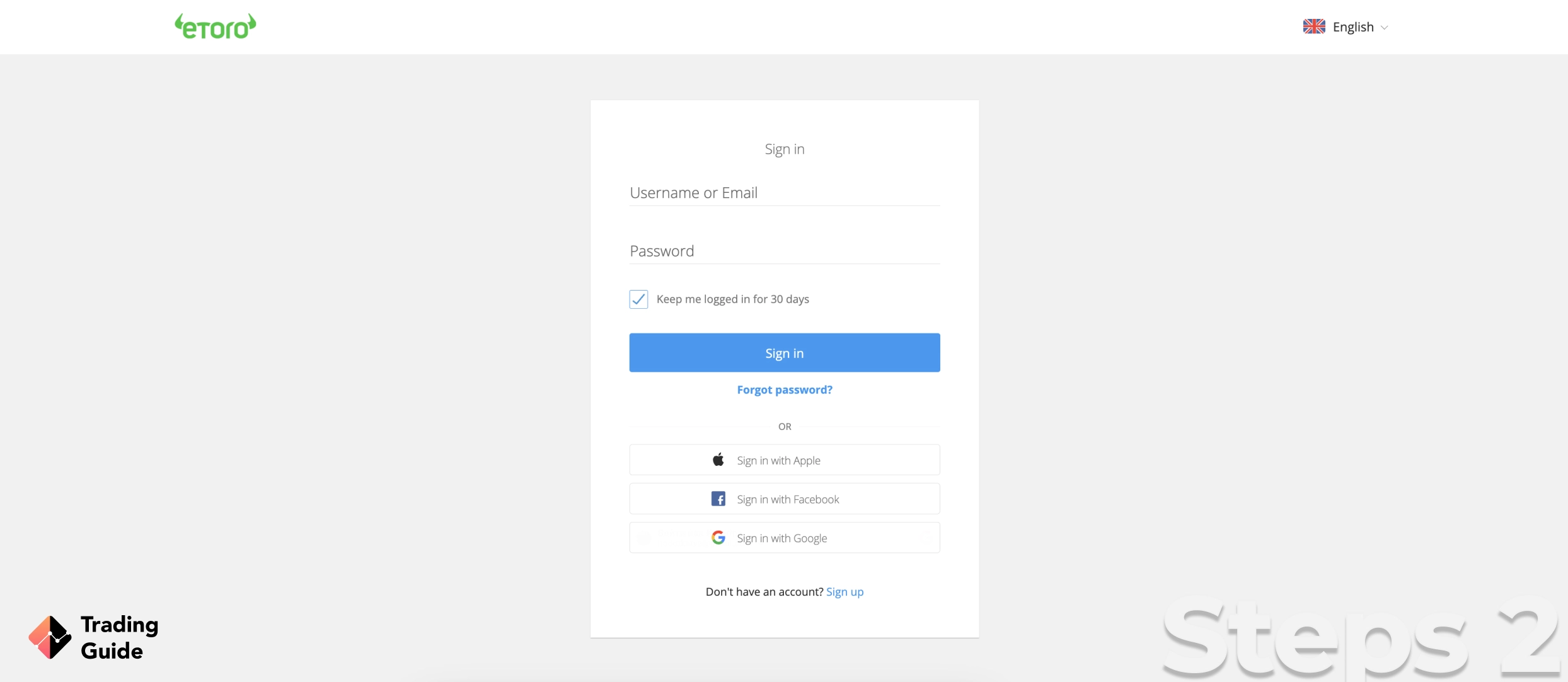

That being said, here are the steps on how to buy silver stock with eToro.

You need a trading account to buy silver stocks at eToro. Therefore, use the links on this page and be redirected to the broker’s website to sign up for a trading account. Make sure you read and understand eToro’s terms and conditions and agree to them before creating a trading account. eToro also has an app to use on mobile devices. Therefore, whether you sign up using a desktop or mobile device, simply ensure it is convenient for you.

This procedure is pretty simple and will not require any guidance. You will simply follow the commands and provide the needed information. To give you a heads up, eToro will require you to provide your personal information, including name, residential area, date of birth, phone number, email, and more. You will also create a username and share details about your source of income.

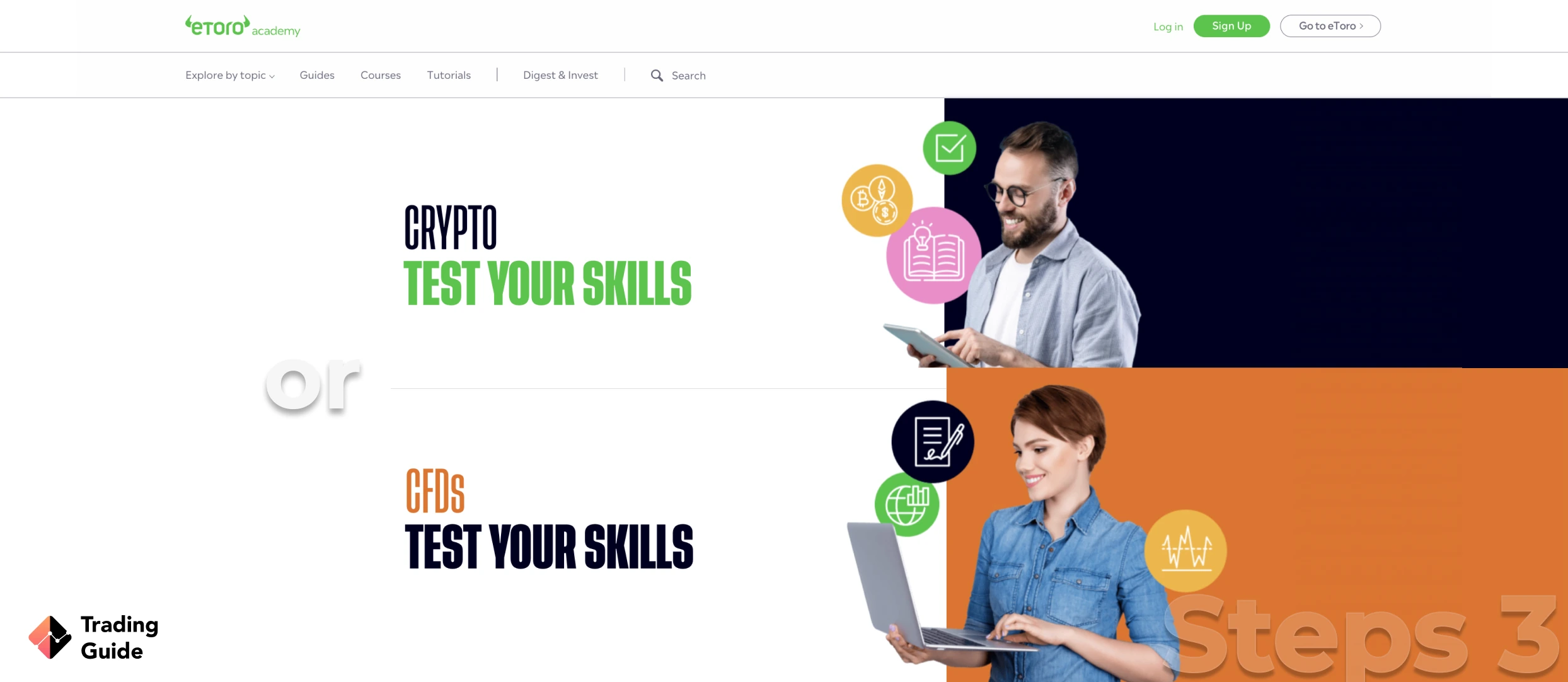

eToro selects a suitable package for you based on how experienced you are and your trading skills. In this regard, you will be given a basic knowledge test to determine whether you qualify for certain features on eToro. For instance, how you answer these questions will enable eToro to decide whether or not you are eligible for copy and social trading features.

In addition, eToro allows silver CFD trading, which carries high risks, especially if you trade using leverage. For this reason, a margin trading test is also provided to determine your leverage limit.

As a standard procedure, the Financial Conduct Authority (FCA) requires all the brokers it regulates to verify traders’ identities before their accounts are fully activated. This procedure protects traders’ accounts and keeps away traders with fake identities.

For this reason, eToro will request a copy of your ID card or passport as proof of identity.

You will also share a recent utility bill or bank statement (not older than three months) to verify your jurisdiction area. Your documents will then be reviewed, and an email notification sent once approved and the account fully activated.

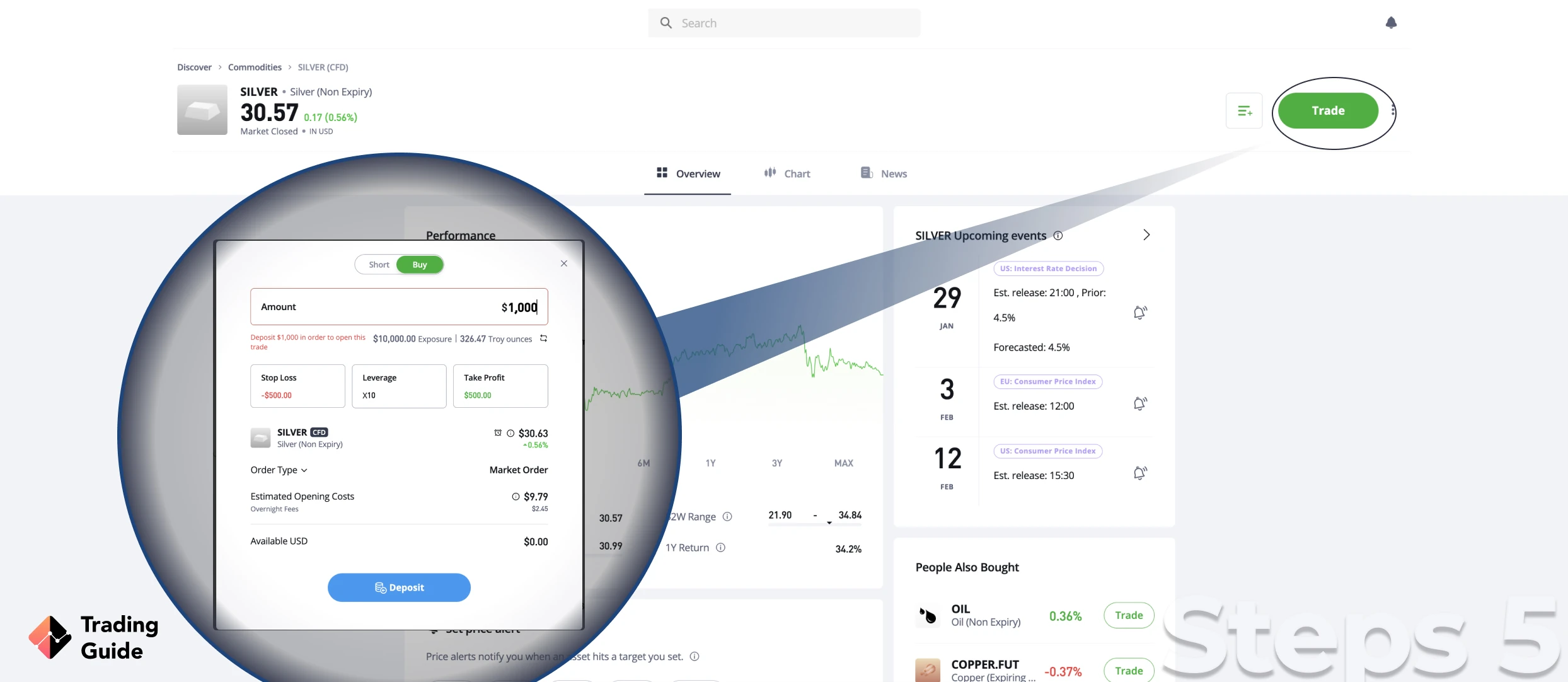

The minimum deposit requirement at eToro is $100 to access silver stock. Once you’ve made a deposit, the broker will redirect you to the exchange market where silver stock is listed. You can also trade silver as CFD, ETFs, futures contracts, and indices with eToro. Remember, always select the right amount of silver shares to buy and understand the risks before trading.

Read a comprehensive Halifax review in our other article.

Tips on How to Choose the Best Stock Broker to Invest in Silver

Trading commodities carries risks such as market volatility, leveraged positions, and the potential for substantial losses. To manage these risks, diversify your investments, use stop-loss and take-profit orders, and trade with funds you can afford to lose. Additionally, stay informed about market factors, adhere to a well-defined trading plan, and guard against emotional decision-making.

It is also crucial to comply with market regulations and be cautious of counterparty risk. Regularly reassessing your risk tolerance and trading strategies will help you trade responsibly and maximise profitability.

There are many stock brokers in the UK, and it comes to no surprise that most traders find it challenging to choose the best for investing in silver. Note that the best stock broker is the one meeting your trading needs and not what other traders recommend. So, here are the essential elements to look at when choosing the best stock broker to invest in silver.

The best stock broker in the UK should be licenced and regulated by FCA. Such brokers are safe and allow you to focus entirely on the activity at hand (investing in silver). Trading with unregulated stock brokers is illegal, and some of them are also scammers waiting to take off with your money once you commit to them. Therefore, choose a stock broker that offers the best trading conditions and can be held accountable in case of any conflict.

Since you want to invest in silver, make sure the broker you choose allows you to do so in various forms. Not only should the broker allow you to buy and own silver stock physically, but also trade the asset as CFDs, ETFs, futures contracts, etc. This encourages portfolio diversification, and you will also be able to hedge an investment that is decreasing in value. It is also best to choose a broker offering other financial assets like forex, cryptocurrencies, and more to give you more trading opportunities.

Stock brokers in the UK have varying trading and non-trading charges. Therefore, confirm the charges to expect once you commit to a broker and make sure all fees and costs align with your budget. We also advise you to ensure there are no hidden charges that may affect your activities in the long run.

The trading platform of a stock broker for investing in silver should give you the best experience. This means it has to offer adequate resources, whether for skills development or market analysis. You should also confirm via a demo account whether it executes trades fast and has user-friendly features.

Any stock broker you choose should have dedicated customer service to prove you can rely on it in case of any trading issues or challenges. It doesn’t matter whether they operate daily or five days a week as long as their availability aligns with your trading schedule. You should also confirm the methods of communication used to contact the support service and ensure they are convenient for you.

The opinions of a broker’s current or previous clients can be of great help in making the best decision. Although you shouldn’t entirely rely on traders’ reviews, the comments and ratings can help you understand where the broker excels and falls short. So, visit Google Play, the App Store and Trustpilot to analyse users’ opinions and ratings.

Silver Stock Price Today

Silver stock price keeps on fluctuating based on the market conditions. The live chart below shows the accurate silver stock price to help you track the performance of the commodity. The chart also lists additional data such as historical information that can be of importance when creating a trading strategy.

Best Silver Stocks for 2026

Silver is known to be the best electrical and thermal conductor among metals as well as a renowned material for jewelry. Because of its high value, especially in electrical applications, its demand in the industrial sector keeps rising. Silver is also considered a safe-haven commodity for investors since they can use it to hedge against inflation.

There are plenty of companies that mine silver out there. However, these companies primarily focus on mining other metals and minerals such as gold, lead, zinc, and copper. Silver will only be a byproduct of these other metals, thus generating a minor portion of the companies’ revenue.

That being said, let’s take a look at the best silver stocks for 2026.

First Majestic Silver

This silver stock is popular among investors of precious metals. It is a Canadian-based company that focuses its operations mainly on Mexico. This is because Mexico is a country with the highest production of silver in the world, giving the company more opportunities.

First Majestic expects silver to be its main revenue contributor in 2021, with more than 55% of the total revenue. The company even purchased the Jerritt Canyon Gold Mine in Nevada in 2021 to expand its operations. This has led to the company gaining more exposure to silver than other companies.

Wheaton Precious Metals

This is a precious metal streaming company, meaning it doesn’t operate physical mines. Instead, Wheaton provides cash upfront to mining companies seeking funds to cover their mining costs. Its exposure to silver is the highest among streaming and royalty companies. Wheaton currently operates over 21 mines across various global countries, including the US, Canada, Peru, Greece, Sweden, Mexico, and Brazil.

Pan American Silver

Pan American Silver is one of the largest silver producing companies globally. It is based in Canada, with other active mines operating in Mexico, Peru, Bolivia, Argentina, and Canada. Other than silver, the Pan American company also produces gold, lead, zinc, and copper. It is valued at around $4 billion, with over three million shares traded daily. Owning its shares allows you to earn yearly dividends, hence boosting your nest egg.

Fortuna Silver Mines

Fortuna Silver Mines specialises in silver mining across global regions, including in Africa, Mexico, Argentina, and Peru. It also operates lead, zinc, and gold mines and has a net income of more than $16 million in 2021. This is due to high sales volumes of its metals.

Endeavour Silver Corp

Endeavour Silver Corp engages in precious metals’ evaluation, acquisition, exploration, development and exploitation. It operates mainly in Mexico, where there are three silver-gold mines in different cities. The company also operates in Chile.

Learn how to invest in Royal Mail shares in our other guide!

FAQs

There are plenty of silver stocks in the market today, and we have listed the best two for 2026 above. Their popularity and increasing revenue make them a good investment.

Yes. Silver is a volatile asset, causing its demand to fluctuate rapidly. Although this seems like a highly risky asset, trading it can be lucrative as long as you are fully knowledgeable and can conduct extensive analysis.

Gold and silver are safe investments, and whether you trade silver or gold will depend on your preference and how well you understand the commodity.

Silver stock is represented using plenty of symbols across various exchanges. For example, in the UK, the stock symbol of silver is XAG.

Conclusion

The silver market gives you plenty of investment options, from buying the physical commodity to investing in its stocks, ETFs and more. However, before making a move, ensure you know the silver market and understand the risks of trading the commodity in various forms. The good news is that most brokers for trading silver host excellent trading tools, which you can use to maximise your potential.