In recent years, traders and investors have been relying on powerful tools like the Moving Average Convergence/Divergence (MACD) indicator. Developed by Gerald Appel in the late 1970s, MACD has become a cornerstone of technical analysis, aiding traders across stocks, currencies, commodities, and cryptocurrencies.

Our comprehensive guide below explores MACD meaning, working principles, and signals. You will also discover popular MACD trading strategies employed by traders to maximise their potential for success. The main objective is for you to gain valuable insights and practical knowledge for confident navigation through financial markets.

What Is Moving Average Convergence/Divergence (MACD)?

A Moving Average Convergence/Divergence (MACD) is a commonly used technical indicator among traders and investors when it comes to identifying trends, momentum, and potential reversal points in financial markets. Developed by Gerald Appel in the late 1970s, MACD is a flexible tool that can be applied to various assets, including stocks, currencies, commodities, and cryptocurrencies.

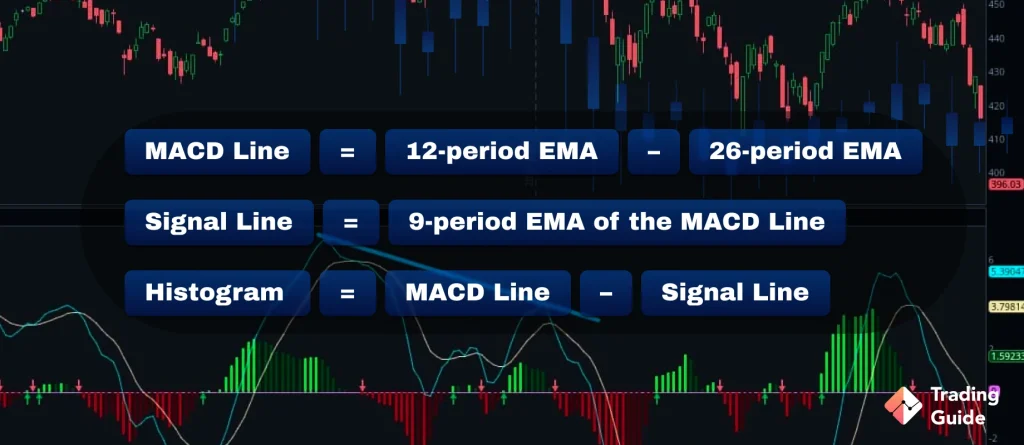

Note that the MACD technical indicator consists of two lines, including the MACD line and the signal line. The MACD line is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The signal line, also known as the trigger line, is a 9-period EMA of the MACD line. There is also a histogram that represents the difference between the MACD line and the signal line.

How Does MACD Work?

MACD operates based on the principle of moving averages and their convergence or divergence. When the 12-period EMA is above the 26-period EMA, the MACD line moves above the zero line, indicating a bullish trend. Conversely, when the 12-period EMA is below the 26-period EMA, the MACD line moves below the zero line, signalling a bearish trend.

Traders often look for crossovers between the MACD lines and the signal lines. A bullish crossover usually occurs when the MACD signal line moves above the signal line, suggesting a potential upward trend. On the other hand, a bearish crossover takes place when the MACD line crosses below the signal line, indicating a potential downward trend.

MACD Formula

To calculate MACD lines, traders need to subtract the 26-day exponential moving average of an asset from the 12-day EMA. You can spot the MACD signal line above or below the centre line on a chart to decide whether it is positive or negative.

Note that the MACD chart also has a 9-day EMA, also known as the Signal line. You can also spot a histogram, which represents the difference between the MACD and the 9-day EMA or Signal line.

That being said, below is a summary of how to calculate the Moving Average Convergence/Divergence.

MACD Line = 12-period EMA – 26-period EMA

Signal Line = 9-period EMA of the MACD Line

Histogram = MACD Line – Signal Line

Here, the EMA gives more weight to recent price data, thus making it more responsive to price changes. The MACD line represents the short-term momentum of the asset’s price movement. This means that when the MACD line is above zero, it indicates that the short-term EMA (12-period) is above the long-term EMA (26-period), thus suggesting a bullish trend. Conversely, when the MACD line is below zero, it indicates a bearish trend.

Note that traders can substitute exponential moving averages with simple or weighted moving averages. However, doing so can change how the MACD is interpreted with respect to short-term momentum.

How to Use MACD Indicator

There are various ways traders and investors can interpret the MACD indicator. However, the most common ways include crossovers, divergences, and rapid rises/falls. Let’s explore how these methods work using examples for better understanding.

Example of MACD Crossovers

Let’s consider a hypothetical example of a stock’s price movement with MACD crossovers.

Suppose we have a stock whose price has been in a downtrend, and the MACD line is also below the signal line, indicating a bearish sentiment. As the stock’s price begins to rise, the MACD line starts moving upward and eventually crosses above the signal line, generating a bullish crossover. This suggests that the MACD stock may be entering a potential uptrend, and traders might consider buying the stock at this point.

Example of Divergence

Divergence occurs when the price of an asset and the MACD technical indicator move in opposite directions. Note that there are two types of divergence, namely bullish and bearish.

In a MACD bullish divergence, the asset’s price makes lower lows, but the MACD indicator forms higher lows. This shows that the selling pressure is weakening, and a potential bullish reversal might be imminent.

Conversely, in a bearish divergence, the price of the asset makes higher highs, but the MACD indicator forms lower highs. This indicates that the buying momentum is fading, and a potential bearish reversal might be on the horizon.

Traders often use divergence signals to anticipate potential trend reversals and adjust their trading/investment strategies accordingly.

Example of Rapid Rises or Falls

MACD can also identify rapid rises or falls in an asset’s price momentum. When the MACD line moves sharply higher, it indicates that the bullish momentum is strong and the price is rising rapidly. Conversely, when the MACD line drops sharply, it indicates strong bearish momentum and a rapid price decline.

Such rapid movements can help traders spot potential opportunities for short-term trades or evaluate the intensity of the current trend.

MACD Trading Strategies

There are several popular trading strategies that incorporate MACD, including:

- MACD Crossover Strategy: As mentioned earlier, traders look for bullish or bearish crossovers between the MACD line and the signal line to identify potential entry and exit points.

- MACD Divergence Strategy: Traders use bullish or bearish divergence signals to anticipate trend reversals and make trading decisions accordingly.

- Rapid Rises/Falls: When the MACD line rises sharply, it indicates strong bullish momentum and a rapid increase in price. Conversely, a sharp decline in the MACD line suggests strong bearish momentum and a rapid price decline. Traders can use these rapid movements to identify potential trading opportunities.

- MACD Histogram Strategy: Traders analyse the histogram to gauge the current trend’s strength. A rising histogram suggests increasing momentum, while a declining histogram may indicate weakening momentum.

- MACD Overbought/Oversold Strategy: When the MACD line reaches extreme levels, it can suggest that the asset is overbought (if significantly above zero) or oversold (if significantly below zero), potentially indicating a reversal in the near future.

- MACD and Moving Average Strategy: Traders use the MACD setting in conjunction with moving averages to confirm trends and filter out false signals.

How to Use the MACD Indicator and Increase Your Winning Rate

The MACD indicator is a powerful tool that can significantly enhance a trader’s ability to identify trends, momentum shifts, and potential trading opportunities in financial markets. By understanding how to effectively use the MACD indicator and combining it with other analytical techniques, traders can increase their winning rate and make more informed trading decisions.

Here are some tips to maximise the utility of the MACD indicator and improve trading outcomes.

Before using the MACD indicator, it is crucial to understand its signals thoroughly. Pay close attention to MACD signal line crossovers with the signal line, as they generate crucial buy and sell signals. Additionally, observe the MACD histogram for changes in momentum and the potential strength of trends. By mastering these basic signals, traders can gain insights into the market’s direction and potential entry or exit points.

While MACD is a robust indicator on its own, combining it with other technical indicators can provide additional confirmation and reduce false signals. For example, traders may use the Relative Strength Index (RSI) or the Stochastic Oscillator to validate MACD signals. If both indicators show a similar signal, it increases the likelihood of a successful trade. However, traders should avoid overloading their charts with too many indicators, which can lead to confusion and analysis paralysis.

Divergence is a potent signal that can predict trend reversals. When an asset’s price moves in the opposite direction of the MACD indicator, it indicates a potential shift in momentum. A bullish divergence occurs when an asset’s price makes lower lows, but the MACD forms higher lows. On the other hand, a bearish divergence occurs when an asset’s price makes higher highs, but the MACD forms lower highs. Identifying these patterns can help traders spot potential trend reversals and modify their trading strategies.

To increase the accuracy of the MACD signal, consider analysing multiple timeframes. For example, if the MACD indicates a bullish crossover on a daily chart, check the weekly or monthly chart to confirm the long-term trend. Aligning signals across different time frames can provide a stronger conviction for potential trades.

The MACD indicator is not limited to a specific market or asset class. It can be effectively applied to stocks, currencies, commodities, and cryptocurrencies. Traders can benefit from using MACD across different markets to capitalise on a variety of trading opportunities. Simply apply the best settings for MACD, and you are good to go.

No trading strategy is foolproof, and losses are an inherent part of trading. To increase your winning rate with MACD, it is essential to implement sound risk management practices. Set appropriate stop-loss levels to limit potential losses and avoid risking more than a predetermined percentage of your trading capital on any single trade.

Pros and Cons of Using the MACD Indicator

Like any trading indicator, the MACD has its strengths and limitations, and understanding them is essential for informed decisions. Here are the main advantages and drawbacks of the MACD indicator.

Pros

- The MACD excels at identifying trends by analysing crossovers between the MACD line and the signal line, helping traders find entry and exit points.

- It measures momentum through rapid rises or falls in the MACD line, providing insights into price intensity.

- Divergence patterns between the MACD and price signal potential trend reversals, offering valuable trade signals.

- The MACD can be used in various markets, including stocks, currencies, commodities, and cryptocurrencies, catering to diverse trading interests.

- Easy interpretation and implementation make the MACD popular among traders of all levels.

Cons

- The MACD relies on past data, and this can cause delayed signals and potential missed opportunities.

- In choppy markets, the MACD may generate false signals, requiring additional confirmation tools.

- While it indicates overbought or oversold levels, it may not be ideal for extreme market conditions.

FAQs

To read the MACD, look for crossovers between the MACD line and the signal line. A bullish crossover occurs when the MACD line moves above the signal line, suggesting a potential uptrend. A bearish crossover occurs when the MACD line moves below the signal line, indicating a potential downtrend. Additionally, observe the histogram for momentum changes.

MACD is best used in trending markets, as it performs well when there is a clear and sustained price movement. In ranging markets or sideways trends, MACD signals might be less reliable.

The MACD strategy involves using crossovers, divergences, and histogram analysis to make trading decisions. Traders look for bullish crossovers and divergences for potential buy signals, while bearish crossovers and divergences can indicate potential sell signals.

The numbers “12, 26, 9” represent the periods used in calculating the MACD indicator. The first two numbers (12 and 26) indicate the periods for the two EMAs used to derive the MACD line, while the last number (9) represents the period for the signal line EMA.

Conclusion

The Moving Average Convergence/Divergence (MACD) is a versatile and widely used technical indicator that helps traders identify trends, momentum shifts, and potential trading opportunities in financial markets. By understanding how MACD works, interpreting its crossovers, divergences, and histogram, and applying various trading strategies, traders can gain valuable insights to enhance their trading decisions.

While MACD can be a valuable tool, it is essential to remember that no indicator can guarantee successful trading outcomes. Therefore, it is crucial to combine MACD with other technical and fundamental analysis tools, manage risk effectively, and develop a well-thought-out trading plan for consistent and successful trading.