Beginners often overlook lot size, despite it being one of the first practical details a forex trader must understand. In the UK, where many retail investors are drawn to currency markets by the prospect of small price moves adding up, lot size determines how much money is at stake in every trade. Misjudge it, and a minor shift in the pound or euro can carry outsized consequences. Get it right, and you’ll have a clear handle on both risk and potential reward from the start.

What is Lot Size in Forex?

In forex, trades are placed in set units known as lots. A lot is simply the quantity of a currency pair you buy or sell. Unlike shares on the London Stock Exchange, where you can purchase a single unit of Tesco or Lloyds, forex deals are measured in far larger blocks.

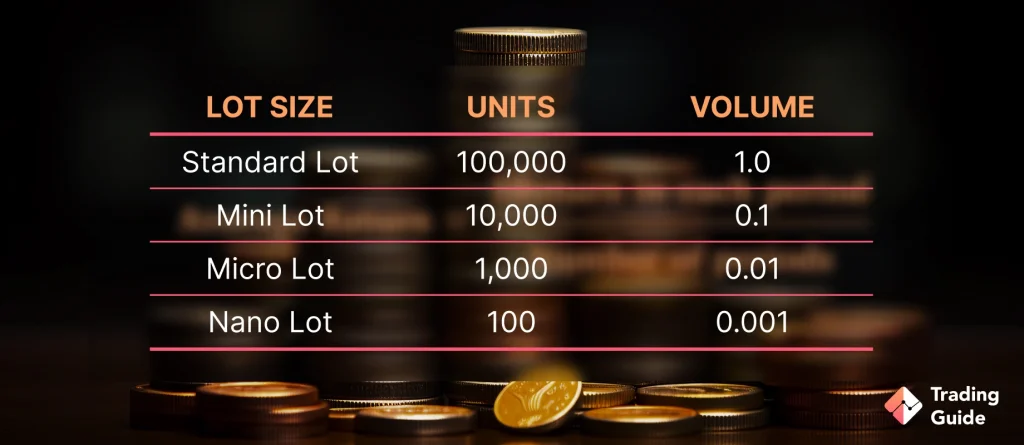

The most common lot sizes are as follows:

- Standard lot: 100,000 units of the base currency

- Mini lot: 10,000 units

- Micro lot: 1,000 units

- Nano lot: 100 units (offered by some brokers)

The base currency is the first in the pair. Buying one standard lot of GBP/USD means taking on 100,000 pounds against the equivalent in dollars. In practical terms, lot size money is what each price movement represents.

For beginners in the UK, this detail is crucial. A shift of just a few pips can be manageable with a micro lot but far more dramatic with a standard lot. Lot size sets the scale of every trade and influences how risk and reward play out.

How to Calculate Lot Sizes in Forex Trading

Lot size is not something to take lightly. It depends on three things: how big your account is, the share of it you are prepared to risk, and the number of pips you are willing to give a trade.

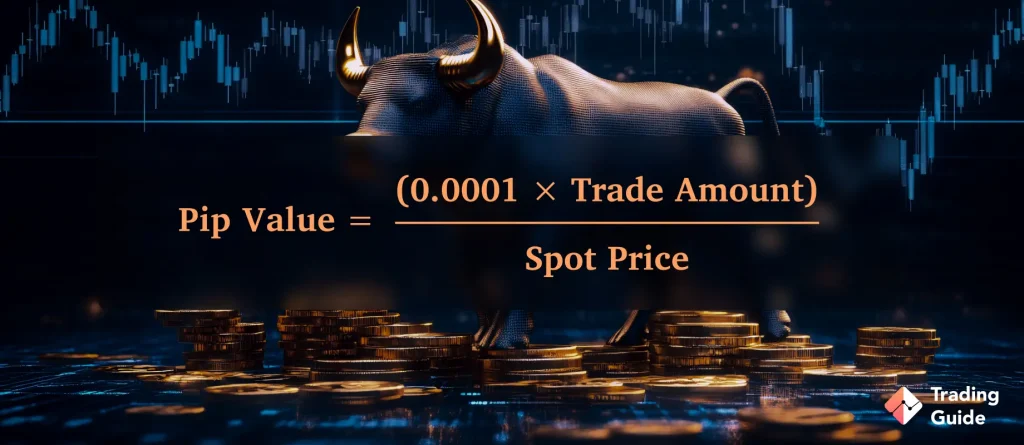

A pip (short for “percentage in point”) is the smallest unit of movement in most currency pairs. In GBP/USD, one pip is equal to 0.0001. To work out what each pip is worth, you multiply the pip size by the lot size you are trading.

- A standard lot in GBP/USD makes each pip worth about 10 US dollars

- A mini lot makes each pip worth around 1 US dollar

- A micro lot makes each pip worth about 10 US cents

Take an example. With a £2,000 trading account, you might decide to risk 2 per cent (£40) on one position. If you set a stop loss at 20 pips, that means £2 per pip. To stay within your risk, you could open around two mini lots.

The purpose of this calculation is not to chase the biggest possible gain. It is to keep control of your exposure and avoid positions that can erode your account when the market turns against you.

How to Choose Lot Size in Forex

There is no single formula for the right lot size. It depends on your circumstances and the way you trade. A few points matter most.

Smaller accounts benefit from micro- or nano-lots, which keep risk manageable and allow flexibility. Larger accounts can handle mini or even standard lots, but only with strict risk controls in place.

Every trader has a different comfort level. Many UK beginners follow the 1–2 per cent rule, which means risking no more than that share of their account on a single trade. It helps protect capital while leaving room to recover from setbacks.

Day traders, who place frequent short-term trades, often use smaller lot sizes and tighter stop losses. Swing traders, holding positions for longer, may take larger lots but with wider stops. Your strategy shapes the level of exposure that feels sustainable.

Not every forex broker offers the same lot size options. Some provide nano lots that suit cautious beginners, while others set a minimum of micro or mini lots. For UK investors, it is also essential that the broker is FCA-regulated and transparent about available trade sizes.

Not every forex broker offers the same lot size options. Some provide nano lots that suit cautious beginners, while others set a minimum of micro or mini lots. For UK investors, it is also essential that the broker is FCA-regulated and transparent about available trade sizes.

Lot size should never be about chasing the biggest possible return. It is about matching your account, risk limits, and style in a way that keeps trading sustainable. Just as a balanced ISA should not hinge on one small-cap stock, a forex account should not hinge on one oversized trade.

Pips in Trading

To make sense of lot size, you first need to understand pips. A pip represents the smallest price change in a currency pair. For most pairs, it appears at the fourth decimal place, while in Japanese yen pairs, it is shown at the second decimal place.

You can think of pips as the ruler for measuring market shifts. If GBP/USD moves from 1.2700 to 1.2710, that is a rise of 10 pips. The value of that move depends on your lot size: it might add or subtract £1, £10, or £100 from your position.

This link between pips and lot size is what shapes risk. A change that looks minor on a chart can have very different consequences depending on the trade size behind it. Many beginners are caught off guard by how quickly results build when larger lots are in play.

For those who want a fuller breakdown of pip values and their role in trading, the TradingGuide team provides a clear overview.

Read about forex signals providers in our other article.

FAQs

Not always. Standard and mini lots are widely offered, but some brokers also provide micro or nano lots. UK traders should check which sizes are available and ensure the broker is FCA-regulated.

It can, but it also means greater risk. Each pip is worth more when the lot is bigger. A 20-pip move on a standard lot can make or break a small account, while the same move on a micro lot is far less severe.

Trading too large for your account can wipe out funds with even a small market shift. Going too small may limit gains, but it lets you practise safely and build confidence without heavy losses.

Yes. Leverage increases both potential gains and potential losses. The lot size determines your starting level of exposure, while leverage expands it further. Beginners should treat both with care, as the combination can quickly magnify outcomes.

Conclusion

Lot size in forex is more than a figure on a platform. It is the link between ambition and discipline. The size you choose shapes how much room you have to learn, handle setbacks, and build consistency. For UK beginners, starting small is not a weakness but a strategy, much like testing the waters with a few shares before committing more.

What matters is balance. A sensible lot size keeps you active in the market without letting the market control you. Over time, that balance separates lasting traders from those who burn out. Treat lot size as your steering wheel, not a technicality, and you are already closer to navigating forex with confidence.