Forex trading has been around for years and has become even more popular in recent years due to the rise of online forex brokers that make it easier for many people to trade. On top of that, the forex market has some unique attributes, such as long trading hours and high liquidity.

High liquidity allows for ease of trade, and provides numerous opportunities to potentially make profits quickly and easily. Forex is also one of the most cost-effective markets to trade due to the low transaction costs involved.

Currency pairs are commonly traded in specific amounts called forex lots. Today, we will explain what lots are in forex, why they are important, and how they are calculated. But before we get into that, let’s first discuss what forex is and how it works.

In This Article

Forex Trading Explained

Forex, short for foreign exchange, is an investment style where people buy and sell different currency pairs on the foreign exchange market (forex) at current exchange rates with the goal of making a profit. The forex market is the largest financial market in the world, with a daily average trading volume of around $6.60 trillion.

Unlike stock trading, forex trading is typically done electronically via computer networks where transactions are made directly between two parties, rather than on a centralised exchange. This is referred to as an over-the-counter (OTC) market.

The global forex market operates through a network of banks with four major trading centres in different time zones: London, New York, Sydney, and Tokyo. Since there is no central location for forex trading, you can trade currencies 24 hours a day, five days a week. The different time zones of the forex trading centres mean that at least one is always open.

Most Traded Currency Pairs

Currencies are always bought and sold in pairs. The first currency in the pair is referred to as the base currency, while the second is called the quote currency. The price of a currency pair represents how much of the quote currency you need to buy one unit of the base currency.

For example, in the GBP/EUR pair, GBP is the base currency, while EUR is the quote currency. Assuming the quote price is 1.3000, that means you need 1.3000 British pounds to buy one Euro.

That being said, the most traded currency pairs are listed below. These currencies are traded in high volumes and represent some of the world’s biggest economies.

What Is A Lot?

A lot is the standard unit for measuring the amount of a currency pair that you are buying or selling. When trading forex, these are the four types of lot sizes that you will often come across:

- Standard lots

- Mini lots

- Micro lots

- Nano lots

Let’s take a closer look at each one.

1. Standard lots

A standard lot in forex trade is equal to 100,000 units of the base currency. So, when a trader places a trade of 100,000 base units on EUR/GBP, this means that he trades 100,000 Euros.

2. Mini lots

If you are a beginner trader, it is often advisable to trade with smaller lots in order to avoid the risk of huge losses. A mini lot is 10% of the standard lot or 10,000 units of the base currency. Therefore, when someone opens an order of 0.1 lots or 10,000 base units on EUR/GBP, this means that he is trading 1 mini lot.

3. Micro lots

A micro lot is 1% of the standard lot or 1,000 units of the base currency. For example, when you trade USD/GBP with a micro lot, you are basically trading 1,000 US dollars or 0.01 micro lot.

4. Nano lots

This is the smallest lot size you can come across, representing 0.1% of the standard lot or 100 units of the base currency. Although nano lots are extremely rare in forex trading, they are the most flexible of the lot sizes.

Nano lots reduce the overall risks involved with forex trading, making them the recommended lot size for inexperienced forex traders. Additionally, experienced traders can use them to test their trading strategies in a live market environment without risking a lot of money.

What Is The Meaning Of a Pip In Forex?

A pip stands for price interest point or percentage in point. It is the smallest unit of price change in a currency pair. In other words, pip is the profit or loss that a trader receives when a currency pair moves 1 pip (point) in one direction or another.

Forex traders measure price movements in currencies using pips. Calculating the number of pips in a specific price movement is easy, but it varies depending on the currency pair being traded.

For example, if GBP/USD jumps from 1.1300 to 1.1305, that means that it has increased by 5 pips. Keep in mind that currency trade usually follows a four-decimal place convention.

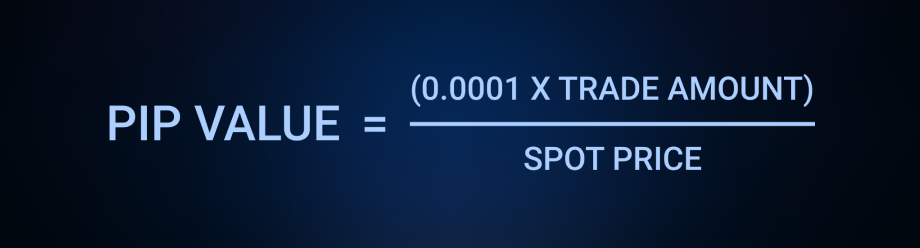

To determine the value of a pip for a currency pair with four decimal places, the following formula is used:

Pip value = (0.0001 x trade amount) / spot price

For example, if you place a $10,000 trade on USD/EUR when it’s trading at 1.3000. The value of USD/EUR jumps to 1.3010. Since one pip is a movement of 0.0001, you have made a profit of 10 pips (1.3010 – 1.3000 = 0.0010 which is equal to 10 pips).

So, the pip value is (0.0001 x 10,000) / 1.3010 = $7.65

How To Calculate Lot Size

It is quite easy to calculate lot sizes in forex. You can do this manually using this formula:

Lot size = Capital x Percentage risk per trade / SL x Value per pip.

Where;

Capital = Trading capital.

Percentage risk per trade = The percentage of your trading capital you are willing to risk.

SL = Stop loss.

Value per pip = The value of a currency per pip.

For example, let’s assume your capital is 50%. Since this is a small capital, you are willing to risk just 2% of your money. Therefore, you set your stop loss 10 pips away from your trading point. Value per pip of the GBP/USD currency pair = $10.

Lot size = 50 x 0.02/ 10 x 10 = 0.01.This indicates that you should use a micro lot size for your account.

You can also use a forex lot size chart or different online calculators to determine lot size. Some forex brokers also provide a lot size calculator for their customers.

Leverage In The Forex Market

Nearly all forex brokers offer leverage trading today, so let’s explain this important concept. Leverage is a form of credit that brokers usually give their traders to enable them open large trades. Brokers require collateral for this credit, which is called margin. Leverage is very important to people who want to make high returns from the financial markets.

Forex brokers offer different leverage ratios, which allow traders to trade more and maximise the opportunities available in the forex market. Leverage is mostly expressed as a ratio. Some of the leverage ratios that are commonly used in forex include 1:1, 1:10, 1:50, 1:100, 1:200, and 1:400.

Assuming you have a 1:100 leverage and a $1,000 account, you would be able to control up to $100,000 on the market, with all the funds in your trading account allocated as the margin for the trade ($100,000 x 1% = $1,000).

But while high leverage can boost your returns in forex trading, it is also highly risky. High leverage broker can be particularly detrimental to beginner traders who may be attracted by the prospect of huge profits without considering the potential for correspondingly huge losses. Therefore, it is crucial to learn leverage trading for beginners basics in order to fully understand the risks involved.

The bigger the lot size, the more leverage you’ll need to use. Therefore, you should choose a lot size and a level of leverage that you are most comfortable with. A leverage ratio of 1:100 is the most optimal leverage in forex trading.

What Is The Best Lot Size In Forex?

Well, there is no one-size-fits-all answer for the best lot size in forex trading, as it largely depends on the value of your trading account and financial goals. For example, if you have a trading account valued at $100,000, you would not typically use a nano lot size for your trades.

However, as a general guideline, if you have around $500 in your account, a nano lot size may be suitable. For accounts valued at $1,000 to $1,500, a micro lot size may work well.

Accounts valued between $5,000 and $10,000 may be well-suited for a mini lot size, and a trader with $15,000 or more in their trading account can use a standard lot size.

Keep in mind that these recommendations may vary depending on the country and the leverage offered by different brokers.

Read about forex signals providers in our other article.

FAQs

If you are working with a relatively small account balance, such as $1,000 it is advisable to trade micro lots, which are equal to 1,000 units of currency. This is because micro lots are less susceptible to being negatively affected by small fluctuations in the exchange rate, which could occur when using leverage to trade bigger lots.

A standard contract size in the forex market is referred to as a lot and represents 100,000 units of the base currency. On top of that, smaller trade sizes, such as micro or mini lots, are also available. A 0.01 lot size is a micro lot equal to 1,000 units of the base currency.

In the forex market, a standard lot size is 100,000 units of currency, a mini lot is 10,000 units, a micro lot is 1,000 units, and a nano lot is 100 units of currency.

If you’re just starting out with forex trading, it is advisable to trade in micro lots or nano lots and start with a relatively small account size of a couple of hundred dollars. This will allow you to gain experience and a better understanding of the ins and outs of the forex market without putting a significant amount of your money at risk. As you gain more experience, you can gradually increase your account size and trade larger lot sizes.

Conclusion

We hope you’ve understood what lot size is in forex trading and the calculations involved. Forex trading promises bountiful rewards if you spend your time and effort learning and consistently executing trades. One of the main reasons many investors are drawn to the forex market is the potential to earn good profits.

To maximise your success in forex trading, ensure to use a demo account before investing real money in the market. Also, it is essential to familiarise yourself with the trading platform and tools offered by your forex broker, such as real-time charts and indicators, to test and refine your own forex trading strategy.