Cardano (ADA), one of the most popular crypto tokens in the UK, has proven to be an excellent investment tool. The crypto was launched into the financial space in 2017 by one of Ethereum’s co-founders, Charles Hoskinson. By being more environmentally friendly than proof-of-work protocols, its aim was to remove the limitations of the former blockchains.

While ADA crypto continues to yield income for investors, its value fluctuates. The volatility that comes with this investment warrants the need to learn more about ADA. You should also understand the best investment approach that will maximise your potential. Thanks to my guide below, you will learn the simple steps for buying ADA. Plus, I will introduce you to top brokers for investing in the token.

In this guide

How to Buy Cardano?

How to Buy Cardano

Many investors, especially newbies, do not know where to buy Cardano and the proper procedures involved. As an expert in this field, I would like to share the process with you. Do not fret, as setting up an account is pretty straightforward.

Here is how to buy Cardano in the UK.

You will need a reliable cryptocurrency broker or exchange to make this purchase. So, conduct thorough market research to identify what aligns with your investment needs.

I prioritise my funds’ safety when considering a crypto trading platform in the UK. The best brokers or exchanges must apply high security measures. These may include top encryption protocols, biometrics, and more. They must also adhere to the regulations of tier-one authorities like the FCA and CySEC, to name a few.

I understand how lengthy and overwhelming the research process can be. So, take advantage of TradingGuide recommendations for top options that our experts approve.

Once you have selected your preferred crypto broker, proceed to its official website. You will create a trading or investment account using your personal details. Part of the information you will provide is your name, address, source of income, and so on.

Your broker may request a copy of your government-issued ID card. Others will also need a copy of your recent utility bill for account verification. Please have all these documents prepared to activate your account on time.

Verification may take hours or days, depending on your location and the broker. When you receive the email confirmation that your account is completely verified. In this case, the next step is to fund your account.

The good news is that most trustworthy brokers support payment using various methods. They vary from credit/debit cards, e-wallets, and bank transfers to crypto payments. Choose the most suitable one for you.

Your broker will redirect you to its listed assets once it approves your deposit. Search for ADA and click on it to open the purchase screen. Then, select the amount you want to spend in GBP, after which you can finalise your purchase and be a Cardano owner!

Cryptocurrency is largely unregulated in the UK. As a result, the majority of exchanges have experienced attempts at hacking. These phishing attempts have resulted in significant losses for their clients. To protect your tokens, I advise against leaving them in an exchange. This is especially if you’re a long-term investor. Research ways to transfer them to a reputable wallet that is compatible with your exchange or broker.

Use software or a hot wallet to store your tokens for the short-term period. For long-term storage, a hardware or cold wallet should be your best bet.

Note: While the steps above will guide you in purchasing ADA, thorough research is crucial. This is so you can determine the best time to make a purchase. Remember, the cryptocurrency market is highly volatile. With prices constantly changing, you want to make informed decisions to maximise your chances of earning profits.

Brokers to Buy Cardano in the UK

There are hundreds of cryptocurrency brokers and exchanges in the UK. The huge numbers make it challenging for investors to identify the best options.

For this reason, I decided to conduct thorough market research, so you don’t have to. After multiple tests and comparisons, I have identified the top three crypto platforms for buying Cardano in the UK.

Let’s explore their mini-reviews below.

1. eToro

eToro emerges as one of the top cryptocurrency brokers for UK crypto investors. I have used it to invest in various assets for an extended period, and I must admit that it is one of the most user-friendly platforms. Its account setup procedure is straightforward, and users are required to deposit as little as $50 to get started.

When it comes to cryptocurrency asset offerings, eToro is home to over 100 digital tokens. These include Cardano (ADA), Bitcoin (BTC), and more. The best part is that eToro allows users to buy and store ADA in its built-in wallet or even trade them as CFDs.

However, it is essential to note that CFD trading is risky, and you can lose your money without a diligent approach. Therefore, before you trade ADA as derivatives at eToro, understand how CFD trading works. Also, learn the risks involved and how to mitigate them.

Another element worth sharing is the fact that eToro supports crypto staking. This feature offers you the opportunity to grow your crypto holdings and earn monthly rewards. Plus, eToro features CopyTrader. I like it because it connects global traders to learn from one another. Plus, users get to mirror potentially profitable trades from experts.

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

- Low minimum deposit requirement

- Over 100 cryptocurrencies offered

- Has an in-built crypto wallet to store Cardano

- Highly rated social and copy trading platforms

- High Cardano trading fees

- Withdrawal charges apply

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

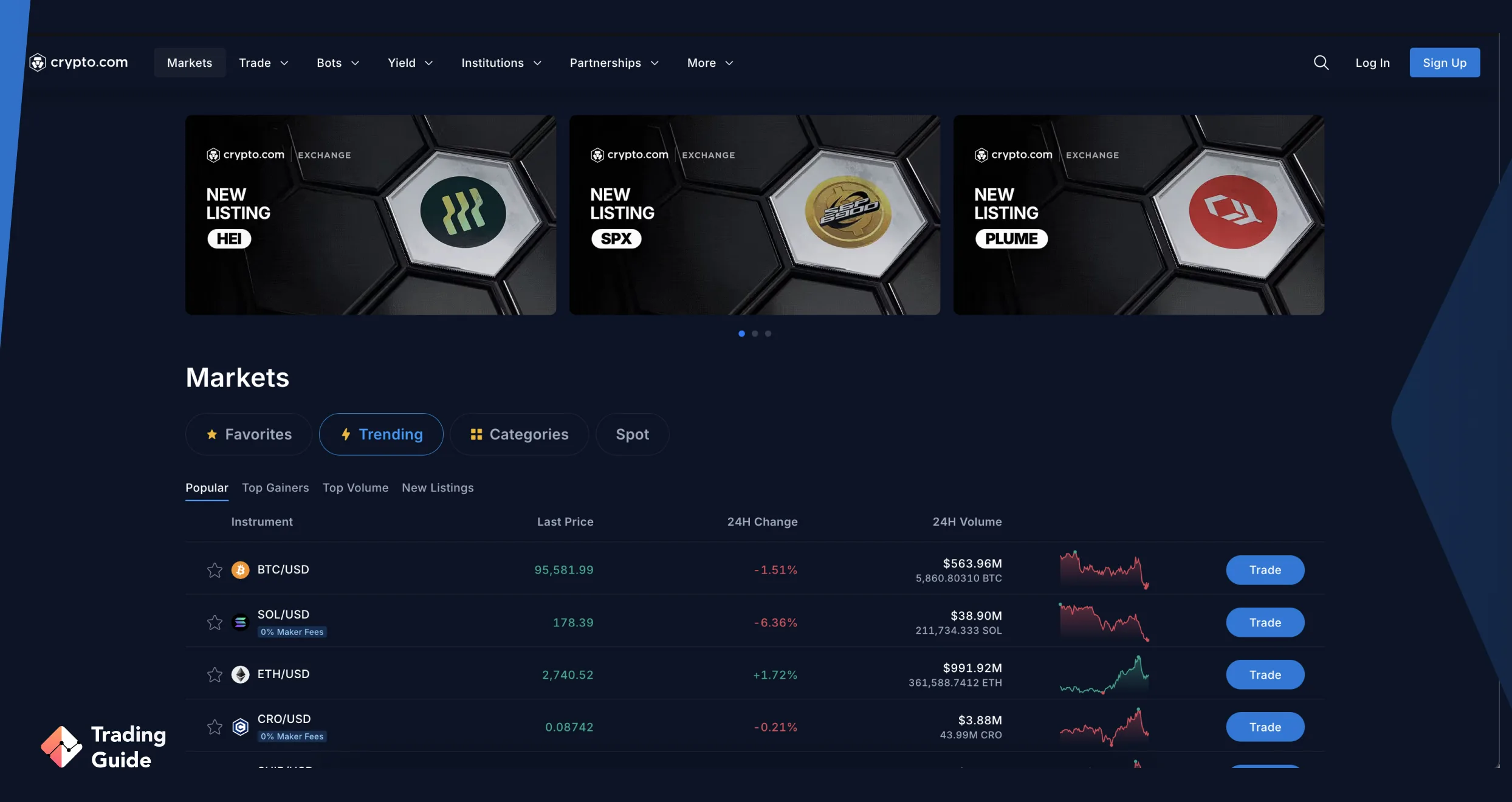

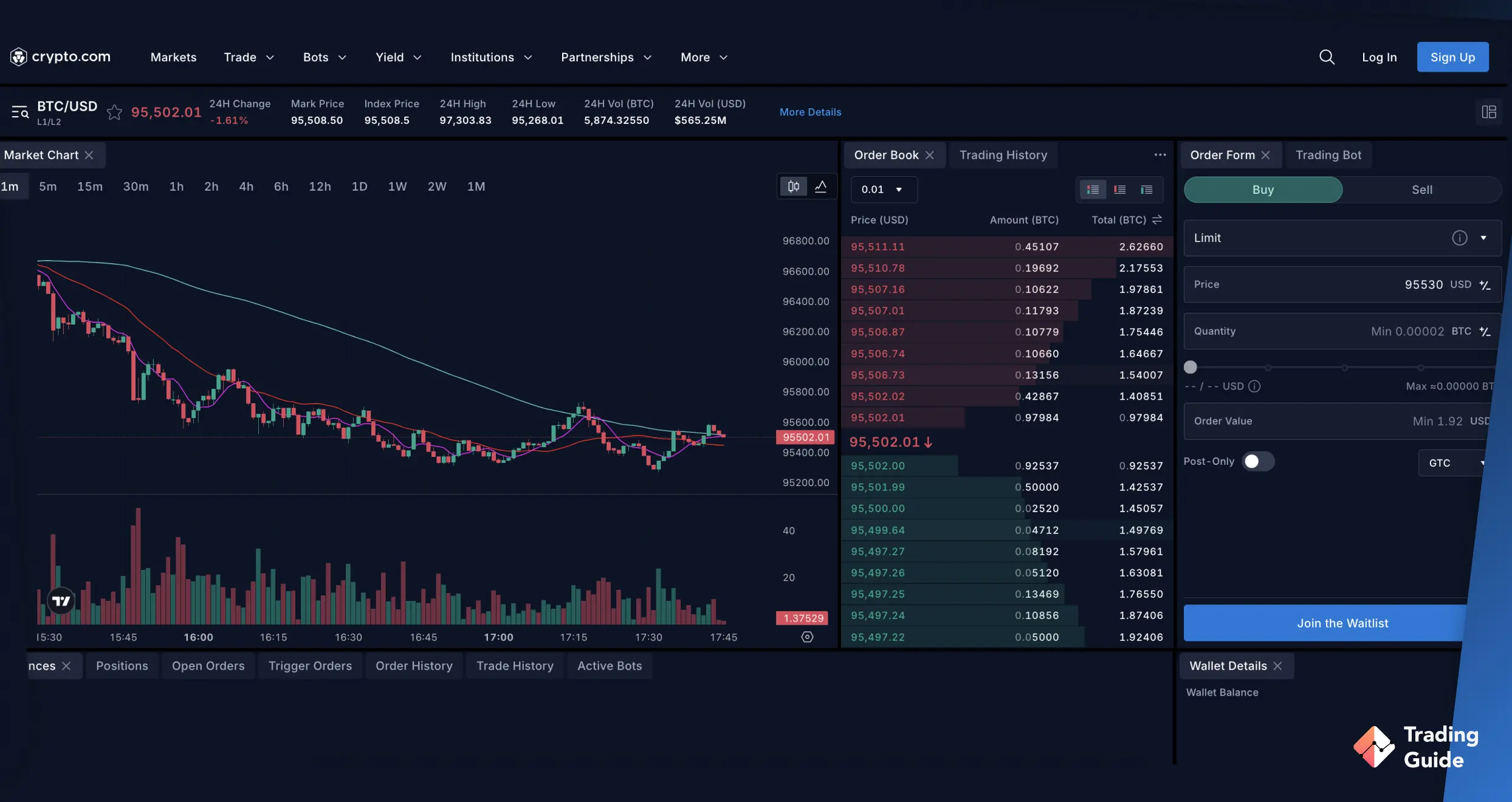

2. Crypto.com

Crypto.com is home to over 400 digital tokens, including Cardano. It’s a no-brainer that using this exchange gives you plenty of options for your crypto portfolio diversification. I explored ADA using Crypto.com, and I was impressed with how seamless navigating the platform is. You can make the purchase using over 20 currencies. I find this to be flexible for every trader or investor.

I like that this exchange features thematic baskets, which allow users to invest in multiple selected tokens with a single click. This means you can explore Cardano alongside other securities in a basket. As a result, you get to limit the risks associated with investing in a single token.

For those who are into staking tokens for rewards, Crypto.com offers variable rates. For Cardano, the rates can go up to 4.5%. All crypto deposits are free, although you should expect extra charges when you withdraw Cardano to an external address.

The good news is that Crypto.com has its inbuilt DeFi wallet. It also integrates with external options like Ledger and Metamask.

- Low Cardano trading fees

- Offers the opportunity to buy Cardano in the UK using over 20 currencies

- Free crypto deposits and exchange

- Lists over 400 cryptos for portfolio diversification

- Operates seamlessly on Android and iOS mobile devices

- It only lists cryptocurrencies, unlike brokers like eToro that host additional asset classes.

- Bank payments take several days to clear.

| Type | Fee |

| Minimum deposit | £1 |

| Deposit fee | No |

| Withdrawal fee | Depending on the crypto you trade |

| Maker fee | 0.04 – 0.20% |

| Taker fee | 0.10 – 0.20% |

| Inactivity fee | £5 |

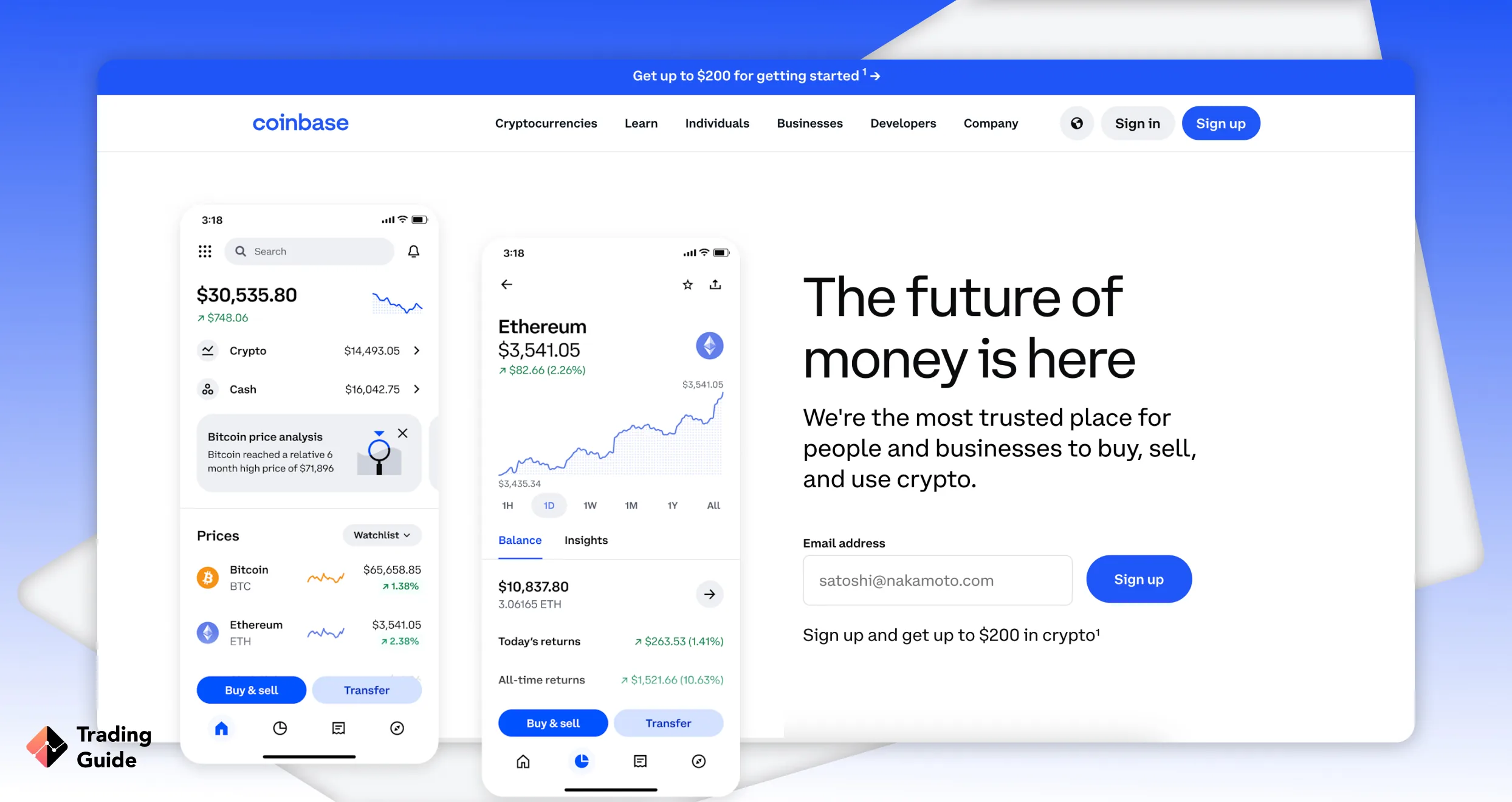

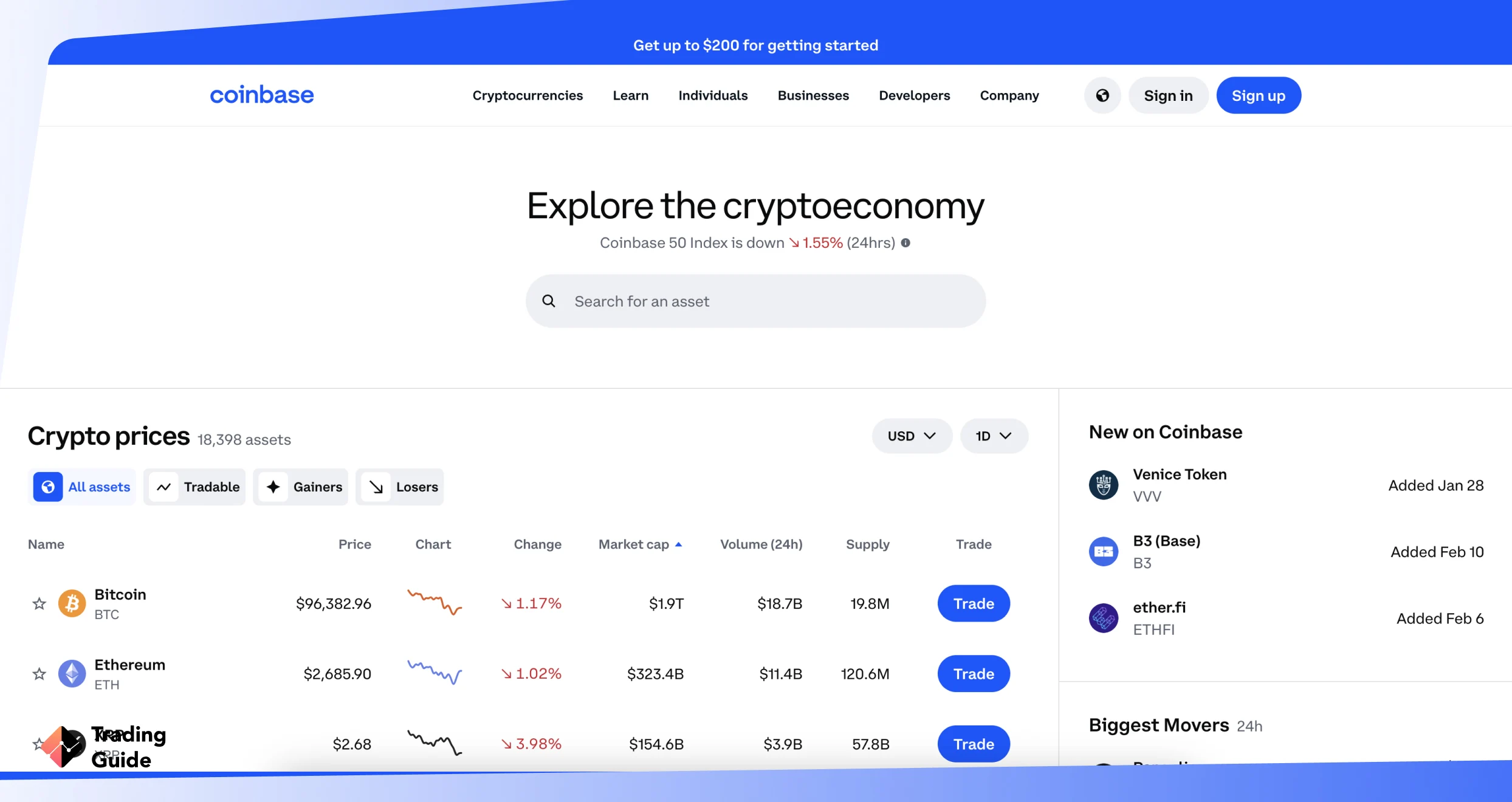

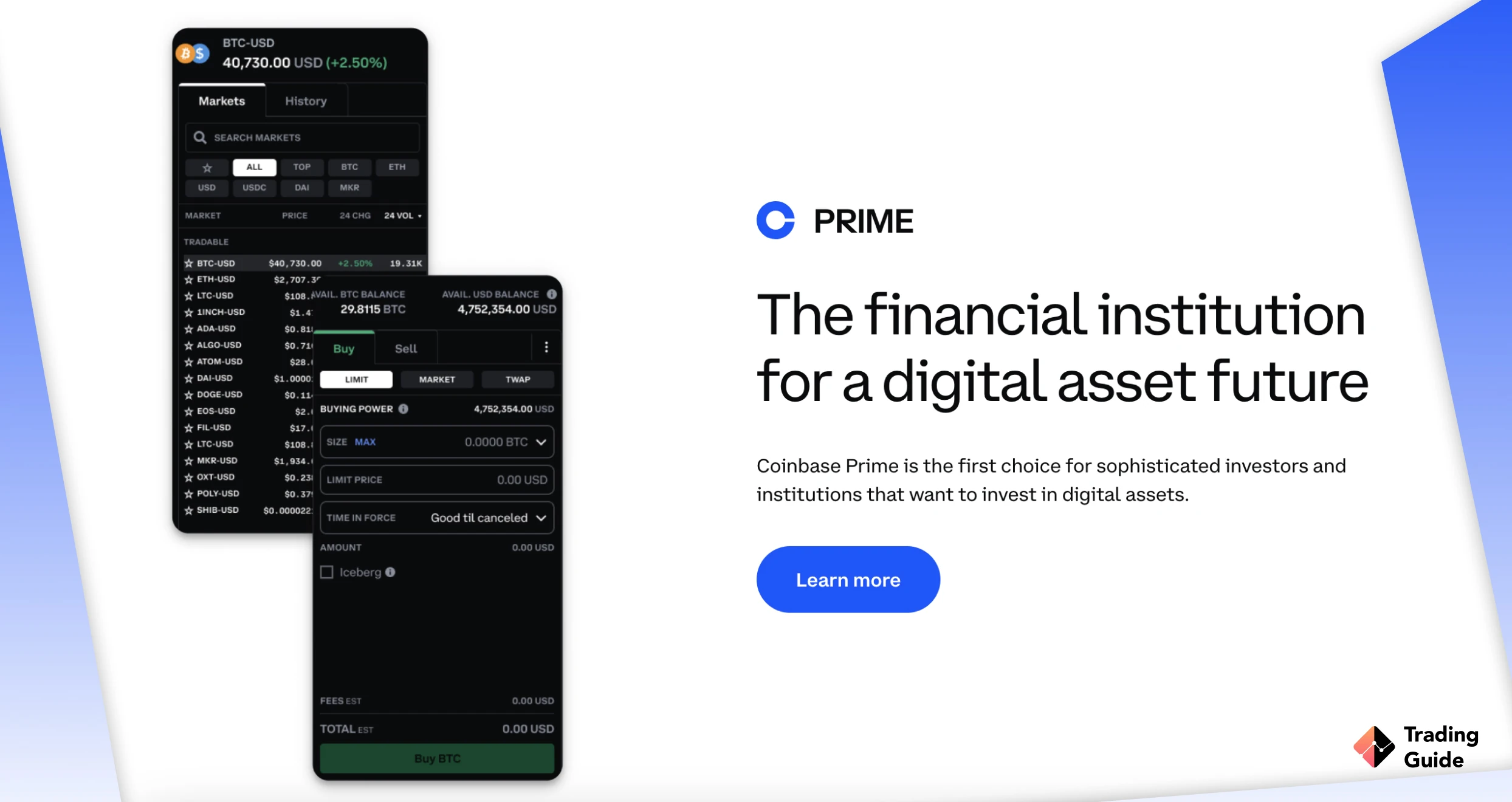

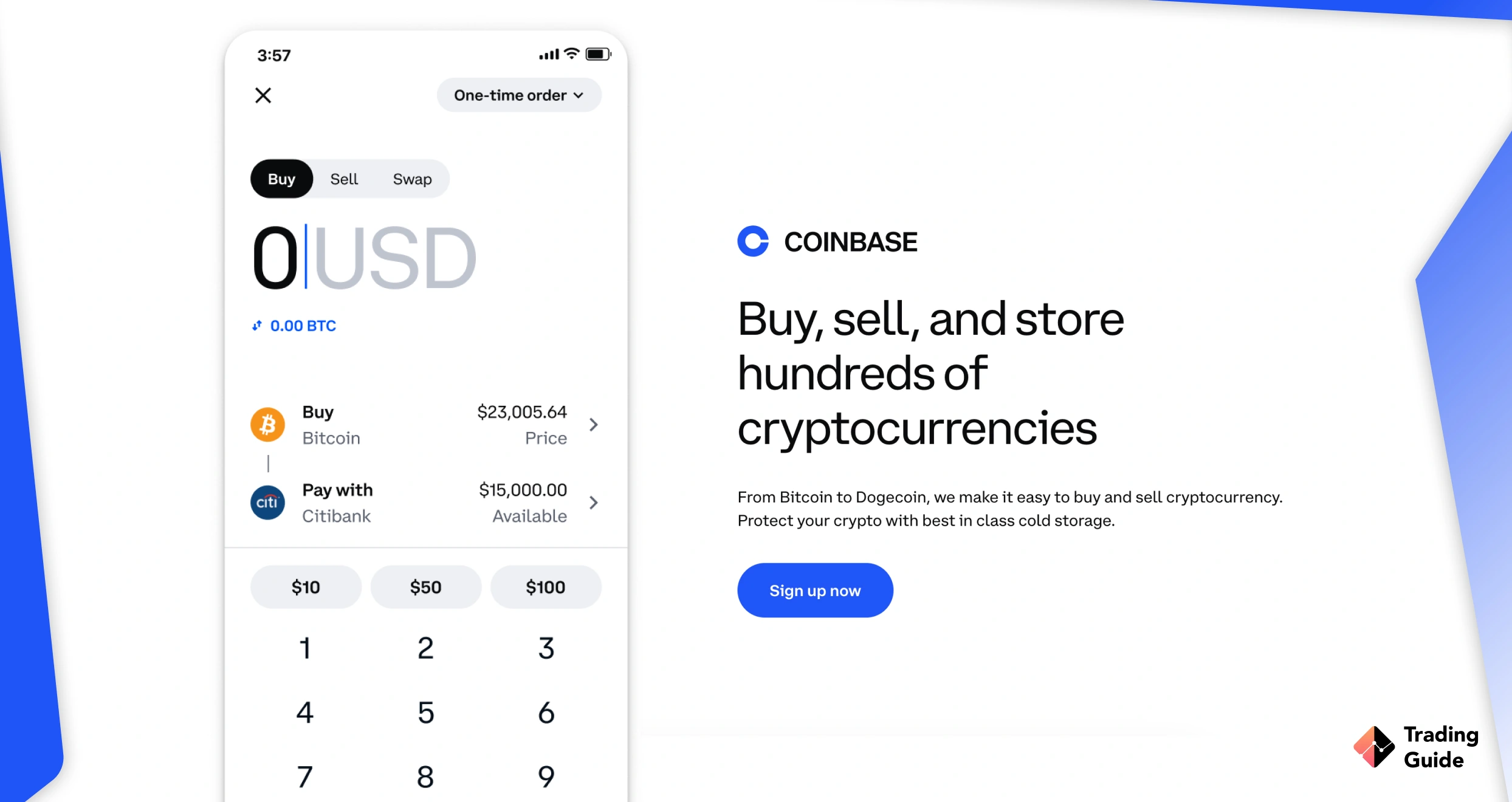

3. Coinbase

Another excellent crypto investment platform on my list is Coinbase. I appreciate that this crypto exchange prioritises the security of its users. Besides employing high encryption protocols, Coinbase adheres to FCA regulations. I signed up for a trading account using my desktop and mobile device, and my experience was exciting.

I discovered more than 240 digital tokens, among them Cardano. Getting started was easy, as the account setup was completed within minutes. Additionally, topping up my Coinbase account was free with the bank transfer method. And the best part is that I got to secure my tokens in its cold storage.

Like the two cryptocurrency brokers mentioned above, Coinbase also supports crypto staking. This feature allows users to earn monthly rewards of up to 14% APY on their tokens. And if you prefer an exchange with powerful market analysis tools. In this case, Coinbase offers advanced trading tools. There are also many order types and a Coinbase One platform with exclusive benefits.

- It has a straightforward staking programme

- A user-friendly platform that operates seamlessly on desktop and mobile devices

- Offers monthly staking rewards of up to 14% APY

- A highly secure and FCA-regulated crypto exchange

- High Cardano trading and investing fees compared to its peers

- High minimum withdrawal requirement

| Type | Fee |

| Minimum deposit | $2 |

| Transaction fee | 1% |

| Credit transactions | 2% |

| Inactivity fee | Free |

| Maker fee | Yes |

| Taker fee | Yes |

About Cardano (ADA)

When engaging with cryptocurrencies, it’s crucial to recognise that these digital assets are characterised by their extreme volatility and speculative nature. This can result in swift and substantial price fluctuations. To safeguard your crypto holdings, it is imperative to utilise reputable wallets and exchanges, prioritising the security of your investments.

Also, exercise vigilance and due diligence to guard against crypto-related scams and fraudulent schemes that can potentially threaten your financial well-being. You can also spread your investments across multiple digital tokens and avoid making decisions based on emotions.

Cardano is a public blockchain platform that was initially released in 2017. Its development began in 2015, led by Jeremy Wood and Ethereum’s co-founder Charles Hoskinson. Cardano is a programmable blockchain ecosystem that developers use to build decentralised applications.

The programme aims to address some of the issues Ethereum experiences, ensuring all transactions are streamlined. This public blockchain platform uses ADA cryptocurrency to facilitate transactions.

ADA is an online digital token that aims to provide a reliable platform for the development of decentralised applications (dApps) and smart contracts. Cardano utilises a unique proof-of-stake consensus algorithm called Ouroboros. It is backed by a team of researchers, scientists, and engineers.

Since its release, the Cardano token has experienced significant price fluctuations. This is from its peak in 2021, valued at £3.09 to £0.51 more recently. Its value continues to fluctuate due to market conditions.

Risks of Investing in ADA

Cardano has a strong market presence, having once reached an all-time high of £3.09 in 2021. Its past performance cannot determine how the future will be. So, to maximise your profit potential, you need to learn the risks involved.

One of the risks of investing in Cardano is market volatility. ADA can experience price fluctuations, which can result in losses to your investments. You should always conduct market research and analysis before investing in this token.

Additionally, the regulatory environment surrounding the crypto landscape is still evolving. With uncertainty surrounding what the future regulations could be, ADA’s value could be affected. I advise you to stay informed about current crypto market developments. Expect potential regulatory changes.

Another risk of investing in ADA is the potential for security breaches. While the token is built on strong blockchain technology, it is still prone to hacking. So, ensure you adhere to the best practices for online security. Also, store your tokens in secure, reputable wallets.

Lastly, there is a risk of not fully understanding how Cardano works. Remember, the token operates on complex technology. So, you need a good understanding of everything surrounding it, including how to buy ADA. This way, you will be able to make informed decisions that will increase your profitability.

FAQs

The best place to buy Cardano is via a crypto brokerage firm or an exchange. I have recommended the top three above, which are reliable and credible.

The best time to buy Cardano is when its value is in a dip or when it is expected to rise significantly. This is where the need for market research and analysis comes in, ensuring you understand the best entry and exit points.

Yes. We believe Cardano is a good investment since it is one of the top 10 cryptocurrencies by market capitalisation. However, you must be dedicated to market research and analysis for maximum potential.

If you are looking to invest short-term, secure your tokens in a software or hot wallet. These wallets are online-based, making it easier and quicker to access your tokens. However, for long-term storage, consider a hardware or cold wallet. They are offline-based and free from hackers’ attention.

Expert Opinion

Cardano aims to challenge Ethereum and establish itself as a leading platform for smart contracts. Its coin, ADA, is one of the best in the market with growth potential, making it an excellent investment tool. However, you must conduct a thorough market analysis before investing in Cardano.

Remember, the cryptocurrency space is highly volatile, and you can lose your money without full commitment and dedication. That being said, take advantage of my recommended cryptocurrency brokers above. Choose the best for your needs to explore the crypto market using the Cardano token.