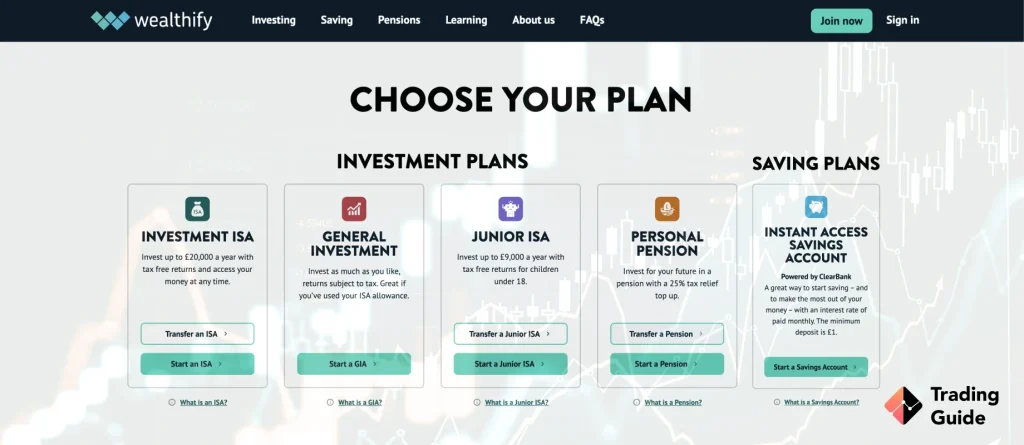

The investment plans Wealthify offers investors include general investment account, stocks and shares ISAs, junior stocks and shares ISAs, pension, and ethical investments.

- Invest from as little as £1

- Various investment plans to choose from, including shares ISA, Junior ISA, Wealthify stock, and general investment account

- £50-£200 cashback offer for customers who transfer at least £50 into the Wealthify pension

- 0.60% flat management fees

- User-friendly platform for all types of investors

- Limited control over your investment

- The more money you have in your portfolio, the more fees you get to pay

Wealthify is a robo-advisor company located in the UK. Its existence continues to make investing enjoyable for individuals who want to avoid taking a risk at trading various assets in the financial market. With Wealthify, you have various investment plans to choose from, all of which have original and ethical versions. Plus, there is no minimum investment amount limit, meaning you can start your investments with as little as £1.

So, are you looking for the best investment platform with minimal input? We review Wealthify below to give you a complete understanding of its operations. In the end, you should be able to decide whether this financial services company meets your investment needs and is worth investing with.

Wealthify – Who Are They?

Founded in 2016 by Richard Theo, Michelle Pearce-Burke, and Richard Avery-Wright, Wealthify is a UK-based independent robo-advisor financial company offering effortless investment options to UK clients. With the company, you get to choose your risk profile and then allow the platform to manage it for you. The investment plans Wealthify offers investors include general investment account, stocks and shares ISAs, junior stocks and shares ISAs, pension, and ethical investments.

Note that Wealthify is owned by Aviva — a transition made in 2020 to ensure its users get the best investment options. Plus, the platform is compatible with mobile devices, allowing you to manage your investments on the go. On top of that, Wealthify is user-friendly with an intuitive user interface, thus attracting newbies with minimum experience. Remember, the company is backed up by professionals to handle your investment with the money you deposit.

Compare Wealthify with Similar Brokers and Platforms

Compare brokers

Licenses and Security

Wealthify is one of the safest financial institutions in the UK since it is highly encrypted and regulated by the Financial Conduct Authority (FCA). All investment funds deposited by its clients are secured in segregated accounts so you can easily have access to them in case the company goes bust. Moreover, Wealthify ensures your investment worth more than £85,000 is protected under the Financial Services Compensation Scheme (FSCS). It also adheres to UK’s anti-money laundering policies.

Another element that makes Wealthify a credible investment platform is excellent testimonials from users on Google Play, the App Store, and Trustpilot. The fact that the company is backed up by Aviva proved its credibility even further. On top of that, Wealthify requires that you verify your information during the account sign-up process since this is one way to keep its investment platform free from imposters.

Securities Offered

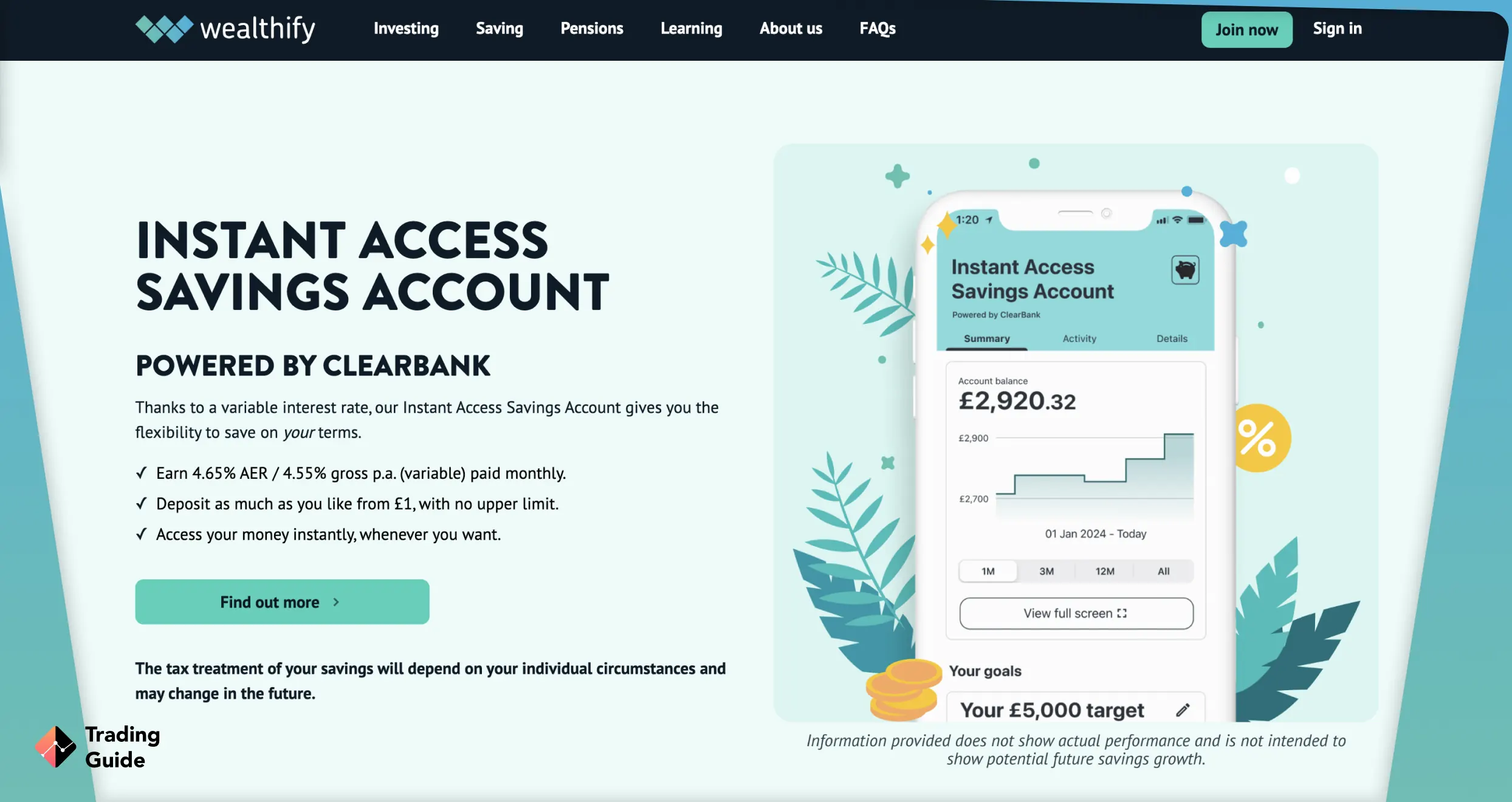

Wealthify allows you to decide on the type of investor you want to be and build an investment plan for you. Whether you prefer being adventurous or cautious, the company has a team of professionals to manage your investment for you. You will also have access to ethical plans so that you can make investments based on your values.

Take a look below at the investment plans offered by Wealthify.

- General investment account

- Stocks and shares ISAs

- Junior stocks and shares ISAs

- Pension

- Ethical investments

Keep in mind that Wealthify features robo-advisors that apply algorithms in selecting a pre-made portfolio that suits investors’ attitude to risk. It spreads your investments across cash, government bonds, shares, real estate properties, and corporate bonds.

Wealthify Fees, Commission, and Spread

As mentioned earlier, Wealthify has flat management fees of 0.60%. This fee applies irrespective of the amount you are investing. Overall, its fees are low compared to what some of its peers charge. Not only is this attractive to newbies but also budget-conscious investors. Moreover, the service provider doesn’t have a minimum deposit requirement, thus allowing you to invest with as little as £1.

| Minimum Deposit | £1 |

Besides charging management fees, investors also get to incur investment costs, including fund charges and market spreads. The only concern about Wealthify’s investment fees is that it keeps rising the more you invest. Therefore, ensure you confirm the rates to ensure it fits your budget.

| Type | Fee |

|---|---|

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | No inactivity fees |

| Annual Fee | 0.6% |

Deposit Methods and Supported Currencies

Wealthify allows you to make deposits and withdrawals using debit cards and bank transfer methods. Fortunately, all transactions are free, and there are no limitations on deposit or withdrawal amounts. When it comes to supported currencies, Wealthify accepts deposits in GBP since it so far accepts clients from England, Scotland, North Ireland, and Wales.

Platform and Research Tools

Wealthify offers robo-advisor services for the best investment option, meaning that all the legwork is done for you. Once you choose your risk level, you cannot control your investment since the provider will decide where to allocate your money. For this reason, Wealthify doesn’t offer research resources you will get to explore on other platforms that allow you to take complete control of your investment.

The good news is that you can still stay abreast with developing news on its blog section. Plus, the investment platform hosts adequate learning materials to help you improve your investment skills. On top of that, Wealthify has a well-detailed FAQ section that is easy to navigate thanks to its nicely arranged categories on the left side of the page.

How To Register a Wealthify Investment Account

Wealthify account registration process is straightforward and takes a few minutes to complete. Remember, the platform operates seamlessly on desktop and mobile devices. Therefore, ensure you install its app on your mobile device to monitor your investments on the go. Also, read and understand its terms and conditions before beginning the account registration process via the procedures below.

- Visit Wealthify official website via the links we’ve shared on this page and click “sign in” to begin the account registration

- Click “create account” and enter your name and email address to proceed

- An email will be sent for verification and to create a password for securing your account

- You will then be redirected to the Wealthify dashboard page, whereby you will click “create a new plan” to choose your preferred account.

- Once you select an account, choose an investment style using the provided sliders

- Participate in the provided questionnaire so that Wealthify can identify the best investment option for you.

- Once you make your deposit, monitor how your investment grows, then decide whether to top up your capital.

Editor’s note

Undoubtedly, we consider Wealthify a hassle-free investment platform that allows you to explore various stock assets with as little as £1. The financial service provider is user-friendly and has a modern interface for the best experience. Plus, its charges are low, especially for individuals with lower investments. For this reason, we recommend it for beginner investors with limited time to conduct research on the best investment options. Advanced investors are also free to use it, but ensure you can afford it before taking the plunge.

Keep in mind that Wealthify takes complete control of your investment, thus not suitable for investors looking to control where their money is going. The platform is safe since it is regulated by the FCA and adheres to FSCS and UK anti-money laundering policies. Regarding its support service, you can reach it via email, phone, and live chat from Mondays to Saturdays. Wealthify is definitely worth investing with thanks to its simple procedures, highly rated support service, and low fees for investments below £10,000.

FAQs

Wealthify was founded in 2016 and is currently based in London, England.

Absolutely. Besides being owned by Aviva company, Wealthify is regulated by the Financial Conduct Authority. It also adheres to the stringent policies of UK anti-money laundering and has your funds protected in segregated accounts and under the FSCS.

Aviva Group Holdings Limited is the current Wealthify owner. Aviva took over Wealthify in 2020, and since then, the company has grown tremendously in ensuring its clients get the best investment options in the UK.

Yes. Wealthify is a credible robo-advisor financial institution that allows you to deposit your funds for investment. With it, you only get to choose your risk profile and allow it to manage the best investments for you using the money you deposit.

Yes. You can invest with Wealthify using as little as £1. The investment options to choose from include shares ISA, Junior ISA, Wealthify stock, and general investment account.

Yes. Wealthify is approved by the FCA, meaning it secures your investment funds in segregated accounts. You also get to enjoy the best investment conditions as required by the financial regulator.

How we test?

Our test process is really based on two different aspects: our independent tests and research, as well as user reviews from Google Play, the App Store, and Trustpilot, etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than 200 hours on every article. We pay special attention to the specific function or the criteria that we’re comparing during the comparing stage. This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here.

It is the best option on the market and it’s very easy to work with and set up. Their stocks and shares ISA is outperforming any ISAs I have with other providers. The customer service is responsive and helpful.

Lovely app, easy to navigate. Wealthify has very good customer service - excellent response times and fantastic conduct. Recommend on the whole.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal