Trading and investing in index futures is one of the most popular activities UK investors engage in to speculate on the future performance of assets or hedge already existing investments to mitigate massive losses. The Financial Times Stock Exchange (FTSE) 100 Index is one of the UK’s popular share indices, listing the top 100 companies on the London Stock Exchange. Investing in it gives you exposure to multiple companies in a single investment, thus maximising your potential in the stock market.

If you have been looking for ways to invest in indices in the UK, this guide helps you get familiar with the FTSE 100 index. We will also look at FTSE 100 futures and list the top brokers to get started with.

What is the FTSE 100 Futures?

As mentioned above, FTSE 100 is a share index of the UK’s top 100 companies listed on the London Stock Exchange. Also referred to as “Footsie”, the index is a market-cap-weighted asset, meaning its components with high market capitalisation will broadly affect its value. This also means that the index’s components or companies with smaller market capitalisation carry less significance.

Regarding FTSE 100 futures, these are financial contracts or agreements whereby a buyer and seller agree to purchase or sell a specific asset at a set price on a predetermined date. With futures contracts, investors participating in the financial contract are obligated to buy or sell an asset, unlike options contracts, where participants have the right to buy and sell. Also, FTSE 100 futures do not have a specific underlying asset to exchange and take complete ownership since the index comprises multiple company stocks.

Fortunately, investors can trade FTSE contracts as CFDs, whereby you get to speculate on the asset’s price movements and make profits or losses with the price difference at the end of a trade. You can also buy the shares of the FTSE 100 index as ETFs, whereby you get to track the index or its constituents’ share value and make profits in sales at a specific predetermined date.

Note that predicting the value of FTSE 100 futures can be challenging, considering that the index’s value is influenced by its 100 constituents and futures pricing. This is because the futures market opens earlier than the London Stock Exchange, and the higher the futures price, the more likely the value of FTSE 100 will increase and vice versa.

Example

As an investor, you predicted that the price of FTSE 100 index valued at £5,000 is going to rise. For this reason, you decide to invest in the FTSE 100 index futures by taking a “buy” position since you can only trade index futures as CFDs. With the value of the FTSE 100 futures contract priced at £20 per index point, the contract is valued at £100,000 (5,000 x 20).

Note that you do not have to deposit this full amount to open a position since futures are leveraged. Simply make a small deposit called margin and open a CFD position. If the value of FTSE 100 increases as predicted, you will make profits from the price difference. However, if the index’s value drops, you get to incur massive losses, considering you applied leverage in your trade, which is highly risky.

For instance, let’s say the FTSE 100 index’s value rose by £500, making its new value £5,500. In this regard, the contract will be worth £110,000 (5,500 x 20), and you will have made a profit of £10,000 (110,000 – 100,000).

Based on the example above, if you believe that an FTSE 100 index value will fall, open a “sell” position. Remember, your profit or loss will depend on how the market moves in your favour. Therefore, ensure you conduct thorough market research before investing in FTSE 100 index futures to limit your chances of incurring massive losses. To ensure you trade safely, we advise you to invest with amounts you are comfortable losing.

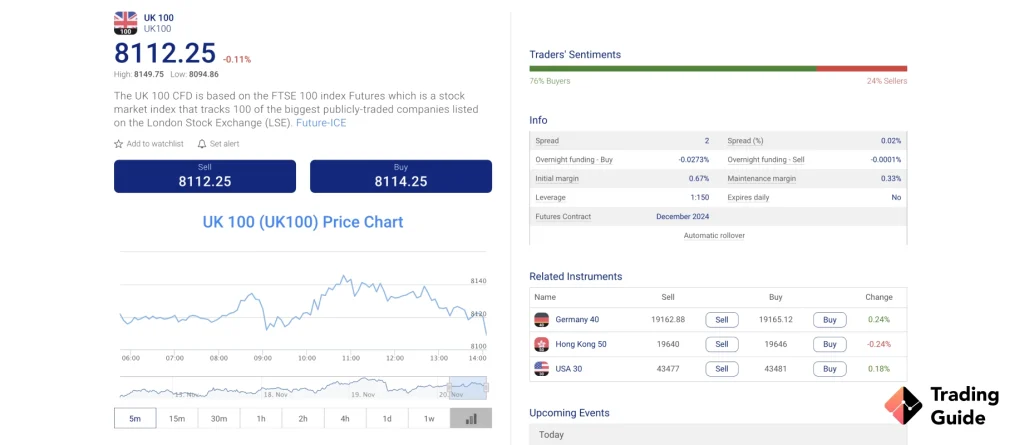

Live Chart of FTSE 100 on the London Stock Exchange (LSE)

Brokers For Trading FTSE 100 Futures

When considering futures and options trading, it’s imperative to understand that these markets are inherently highly leveraged and speculative. To navigate them successfully and mitigate risks, it’s crucial to familiarise yourself with the intricate contract terms and the potential for margin calls that could affect your positions.

These financial instruments demand a deep understanding of derivatives trading, and therefore, it’s advisable to engage in futures and options only if you possess the requisite knowledge and expertise. Prudent and informed participation in these markets is essential to safeguard your investments and capitalise on their potential benefits.

FTSE 100 index futures are traded on the London Stock Exchange and the Intercontinental Exchange (ICE). To trade the futures contracts, you need a broker allowing you to do so as CFDs since you cannot purchase the index and take full ownership.

Keep in mind that the UK financial market is vast, and finding the best CFD broker for trading FTSE 100 index futures can be challenging. For this reason, our experts researched the market, so you do not have to go through lengthy and overwhelming procedures. Below are their top three recommended CFD brokers to consider based on multiple tests and comparisons. You can select one that meets your trading needs for the best experience.

1. IG Markets

IG Markets is a world-renowned CFD broker regulated by multiple authorities, including the Financial Conduct Authority (FCA). The broker allows you to trade FTSE 100 index futures as CFDs, giving you an opportunity to open a position on both the rising and falling prices of the index. With futures trading, you get into a derivatives contract that gives you the obligation to trade FTSE 100 index at a specific price and date.

To get started with the broker, a minimum deposit of £300 is required. The broker also charges high CFD trading fees, making it a relatively costly broker for low-budget CFD traders. The good news is that IG Markets hosts some of the best market analysis and skills development resources. Advanced traders also get exposed to advanced trading platforms for maximum potential. On top of that, the broker features a social trading platform that connects you to other FTSE 100 index futures traders to socialise and share trading ideas.

67% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

2. Plus500

*Illustrative prices

Plus500 is another reputable broker allowing you to trade FTSE 100 index futures. With the broker, you can take short-term positions on the index. Besides futures contracts, Plus500 also allows options contracts trading and additional asset classes, including individual shares, cryptos, commodities, etc.

We list Plus500 as one of our top brokers for trading FTSE 100 futures because it is user-friendly and has a modern design interface perfect for newbies. Moreover, the broker charges commissions for futures contracts trading. The spreads you get to incur are also low, and traders also transact free of charge. With only a minimum deposit of £100, you can easily get started with the broker and trade FTSE 100 index futures.

Plus500 Futures trading is available to US residents only.

3. Forex.com

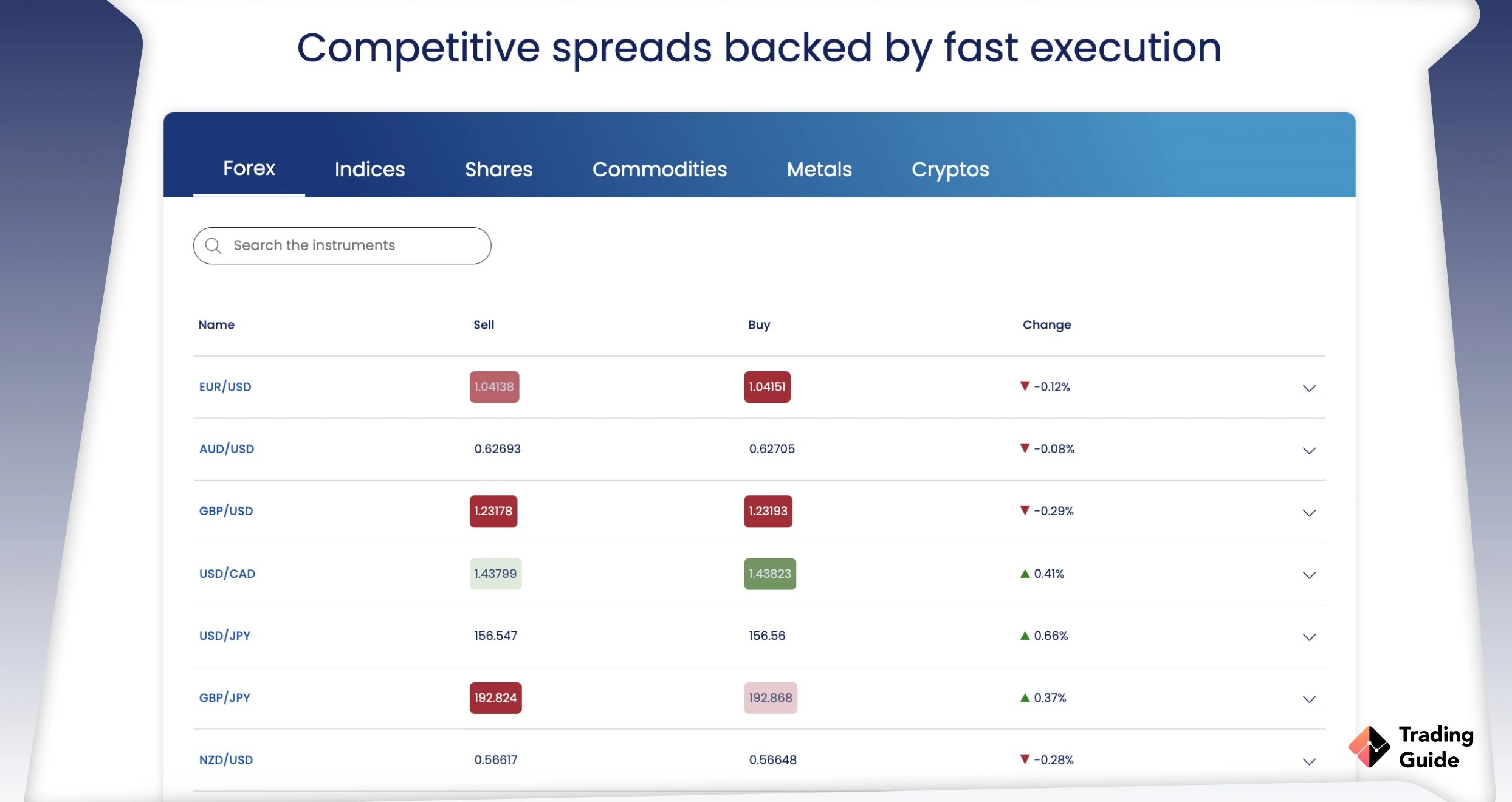

Many UK traders know Forex.com as one of the best forex and CFD brokers regulated by tier-one authorities, including the FCA. You can speculate on the futures markets with Forex.com and apply leverage in your position to increase your chances of earning huge profits. Like Plus500 above, Forex.com is a user-friendly broker, and you only need a minimum deposit of £50 to get started.

Besides futures contracts, Forex.com hosts additional 4,500+ assets you can try on its demo account and select the best for your portfolio diversification. Furthermore, traders are supplied with adequate learning resources for skills development. When it comes to research materials, Forex.com hosts great interactive charts, economic calendars, a news feed, and quality market reports. It is definitely an excellent option for futures contracts traders with additional interest in the forex market.

Factors Affecting FTSE 100 Index Futures Value

The price of FTSE 100 index futures is influenced by FTSE 100 performance. Since the index hosts various company stocks, the stock market performance plays a major role in the index’s futures value. Below are the major factors to note affecting FTSE 100 futures.

- Macroeconomic factors: These are external elements, including inflation, global economic growth, competition, demographics, supply chain dynamics, etc., that affect the demand and supply of an FTSE 100 constituent’s stocks.

- Fundamental factors: This mainly refers to the financial health of an FTSE 100 constituent. Remember, the index is a market cap-weighted asset, meaning its components with high market capitalisation will broadly affect its value and performance.

- Market sentiments: This involves the overall attitude of investors primarily influenced by fear and greed. You see, when investors’ sentiments regarding the index’s value are positive, its value is likely to rise and vice-versa. Therefore, it is crucial to examine investor opinions through sentiment analysis to get valuable insights into FTSE 100 index futures value.

Read about the futures brokers in the UK in our other article.

FAQs

FTSE 100 futures are financial contracts or agreements whereby traders agree to open a buy or sell position on the FTSE 100 index at a specific price within a predetermined date. Since the index hosts the top 100 companies listed on the London Stock Exchange, you cannot purchase it and take full ownership. The only way to benefit from the futures contract is by trading the index as CFD and profiting from the price difference.

There are numerous index futures you can trade in the UK, including FTSE 100, US 500, Wall Street, US Tech 100, and Germany 40. FTSE 100 index futures is one of the most highly traded indices in the UK. With adequate skills and brokers like the ones referenced above, you can increase your chances of succeeding in this venture.

As mentioned earlier, FTSE 100 futures are financial agreements or contracts that allow you to speculate on the index’s price movement set at a specific price and to be exchanged at a particular date. Note that FTSE futures are not based on the underlying asset since the index has components valued differently.

You can trade FTSE 100 futures as CFDs using a reliable and trustworthy broker. This means you get to open a buy position if you believe that the FTSE 100 index’s value will rise and a sell position if you believe the asset’s value will fall. Remember, futures contracts CFD trading involves buying or selling an asset at a specified price and date.

On the London Stock Exchange, FTSE futures opens at 8 am and closes at 4:30 pm UK time (GMT), Monday to Friday. The good news is that trading FTSE futures with brokers give you exposure to the index for an extended period, including the weekends. All you have to do is find the best CFD broker that suits your trading needs to get started.

Conclusion

It is crucial to understand the FTSE 100 index futures trading hours and days to effectively plan your trading activities. Before trading, research thoroughly, assess your risk tolerance, and choose an index broker wisely. Remember, before you start trading this instrument, always conduct thorough market research and analysis on FTSE 100 futures price and make a decision based on the risk tolerance involved and experience. Also, consider your trading requirements, including licenses/security, assets availability, costs, etc., when selecting a CFD broker to maximise your profitability and experience.

Overall, FTSE 100 index futures trading is risky since it gives you an opportunity to open CFD positions using leverage. In this regard, be familiar with CFD trading and its risks before opening a position. Most importantly, invest with money you are comfortable losing and be open to learning from your mistakes.