Aviva is the UK’s largest insurer and a leading pension and life provider. Its global presence and proven track record in customer experience make Aviva stock an excellent investment option. So, if you want to learn how to buy Aviva shares using an online broker, this guide will show you all the procedures. In addition, we review the top three stock brokers that our professional researchers have tested and approved for buying Aviva stock.

Top 3 Brokers for Buying Aviva Shares

Aviva share price has been fluctuating since its establishment in the year 2000. Currently, the shares are listed on the London Stock Exchange under the ticker AV. To buy AV stock, you should find a broker with access to the London Stock Exchange and offer stock derivatives.

There are many stock brokers in the UK, and choosing the best one that aligns with your investment needs can be a challenge. Worry not, though, because we did all the research for you and recommended below the top three stock brokers we believe will give you the best experience when buying shares in Aviva.

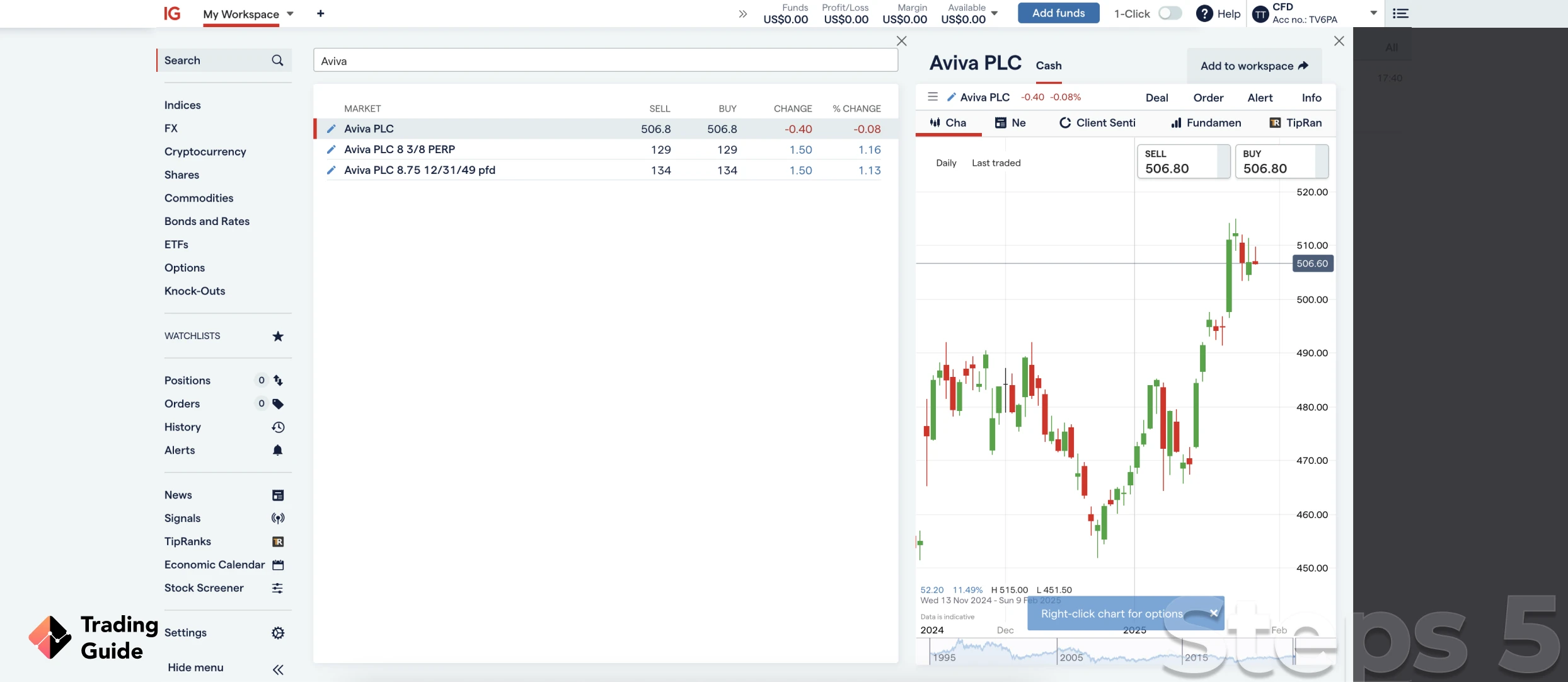

1. IG Markets

Over the past four decades, IG Markets has been offering quality services to clients globally. Trading Aviva shares with the broker allows you to explore different platforms such as the MT4, L-2 Dealer, and ProRealTime. On top of it, you also get to trade an additional +17,000 assets, including forex, commodities, cryptocurrencies, and more. You will also be supported with one of the best trading resources for research and skills development.

On the downside, IG Markets has a high minimum deposit of £300. Commissions and spreads are also high. On top of it, the broker charges a subscription fee should you fail to trade at least three times within three months. This means you need to be an active trader to enjoy what IG Markets has to offer.

Your capital is at risk

- Close to 300,000 satisfied and active traders, most of the based in the UK

- First established in 1974 and one of the most experienced online brokers in the industry

- More than 12,000 stocks offered as CFDs and through the IG spread betting platform

- Minimum deposit requirement of £250 which excludes a lot of the low-budget traders in the UK

- Designed and developed for experienced traders and therefore not very useful for beginners with limited skills

2. CMC Markets

CMC Markets offers the excellent NextGeneration trading platform for investors looking to buy Aviva shares. Other than investing in the shares of Aviva, CMC Markets also offer additional assets such as forex, cryptocurrencies, and commodities. It also hosts the MT4 platform for traders looking to explore advanced resources and venture into forex trading.

CMC Markets charges low spreads for Aviva stock trading. There is also no minimum deposit requirement, making it a viable option for traders on a low budget. Additionally, beginners will enjoy excellent educational materials. This includes a demo account to help you understand the share market before trading the real market.

Unfortunately, you only get to spread bet or trade Aviva shares as CFDs or indices. There is no buying of Aviva stock as a physical asset. Its customer service is also reachable only five days a week.

- No minimum deposit requirement allowing everyone to trade with a budget that suits them

- Tens of thousands of international shares offered on the same platform creating and abundance of opportunities

- Multi-award-winning broker that is respected both by professionals and competitors alike

- The incredible selection of available stocks easily gets overwhelming to traders that are just getting started

- Unreasonable fees and high spread for certain types of instruments, markets, and features

3. eToro

eToro is an excellent choice for traders and investors alike. Besides having a user-friendly platform, the broker hosts one of the best learning and market analysis resources. This includes a demo account funded with £100,000 virtual funds to get you started.

What’s more, eToro is the best social and copy trading broker, whereby you get to meet like-minded traders, share ideas, and copy trades with high-profit potential. You can also diversify your portfolio with additional assets from eToro, including currencies, commodities, cryptocurrencies, etc.

Buying or trading AV shares at eToro is commission-free, with a minimum deposit of $100. Unfortunately, eToro’s spreads are high, and you will pay fees for funds withdrawal. While copy trading can be of great importance in your activities, accessing the copy trading platform requires a minimum deposit of $200. Its minimum amount per trade is also $10.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- The best online broker for those looking to make use of copy trading feature

- Fine-tuned social trading feature that creates unique opportunities for all traders

- Allows you to both invest and trade stocks and cryptocurrencies, for a great and diverse portfolio

- Limited selection of stocks offered compared to both CMC Markets, IG Markets, and other major online brokers

- Famous for being one of the most expensive brokers in the industry, with high fees and a high minimum deposit requirement

How to Buy Aviva Shares With IG Markets?

The above-recommended stock brokers in the UK are regulated by the Financial Conduct Authority (FCA). This means that their procedures for buying Aviva stock are similar since they comply with the strict regulations of FCA. They only vary with a few requirements, such as a minimum deposit. That being said, let’s look at how to buy AV stock with IG Markets.

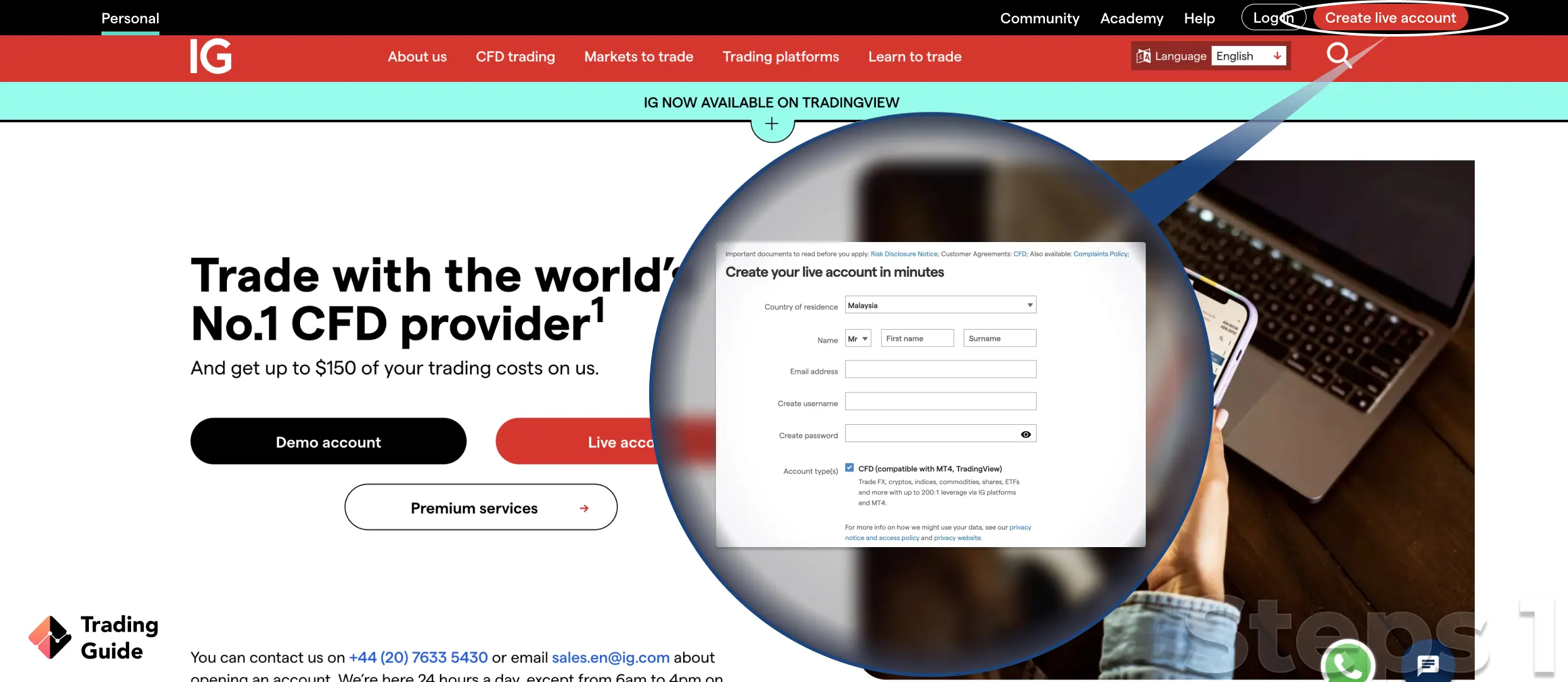

On this page, we have shared various links to redirect you to the IG Markets website, where you will sign up for a share dealing account. Once on the website, ensure you understand and accept IG Markets terms and conditions to avoid being inconvenienced in the future. You can also sign up using a mobile device, but first, you need to download and install the IG Markets app on your mobile device.

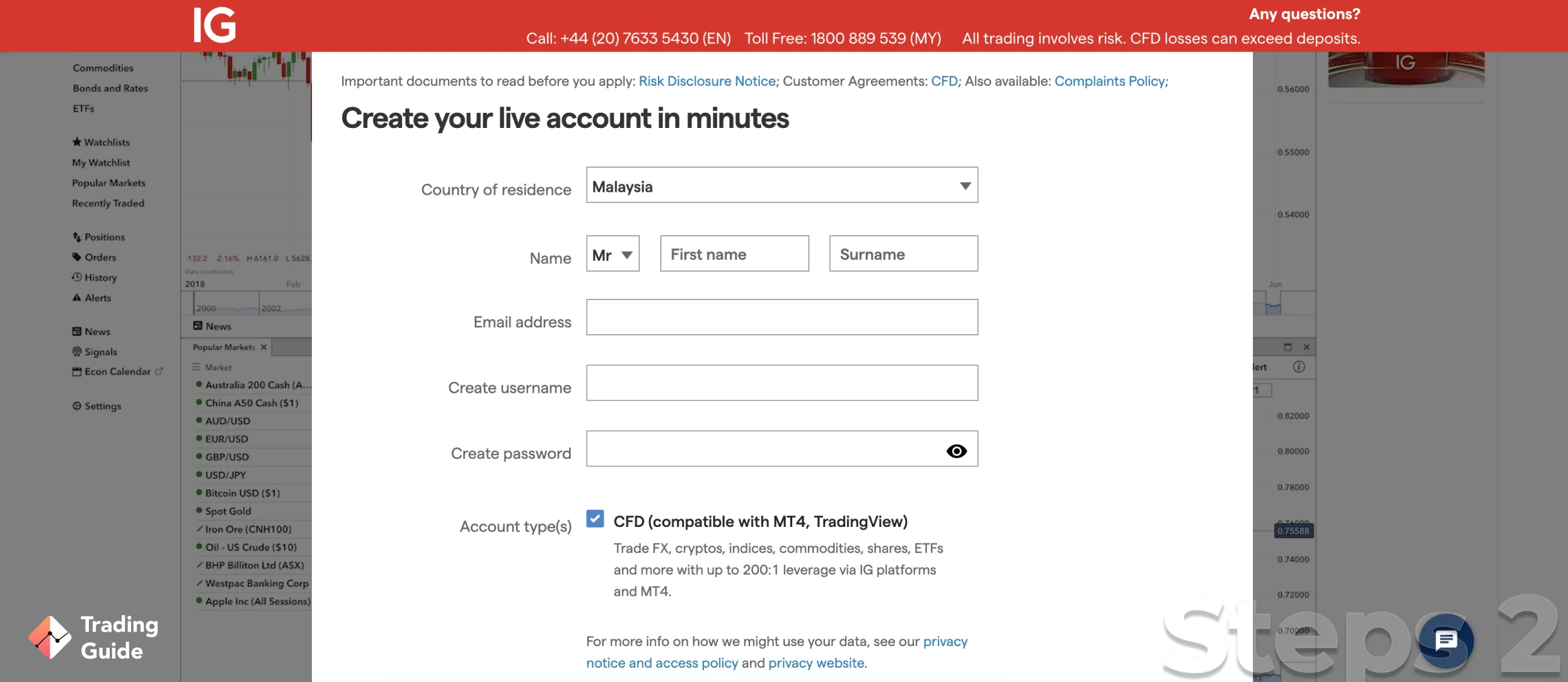

Create a trading account by providing your personal details as the broker requires. These include name, email, phone number, source of income details, etc. You will also create a username and complete margin and basic knowledge tests for IG Markets to choose the best trading package and leverage limit for you.

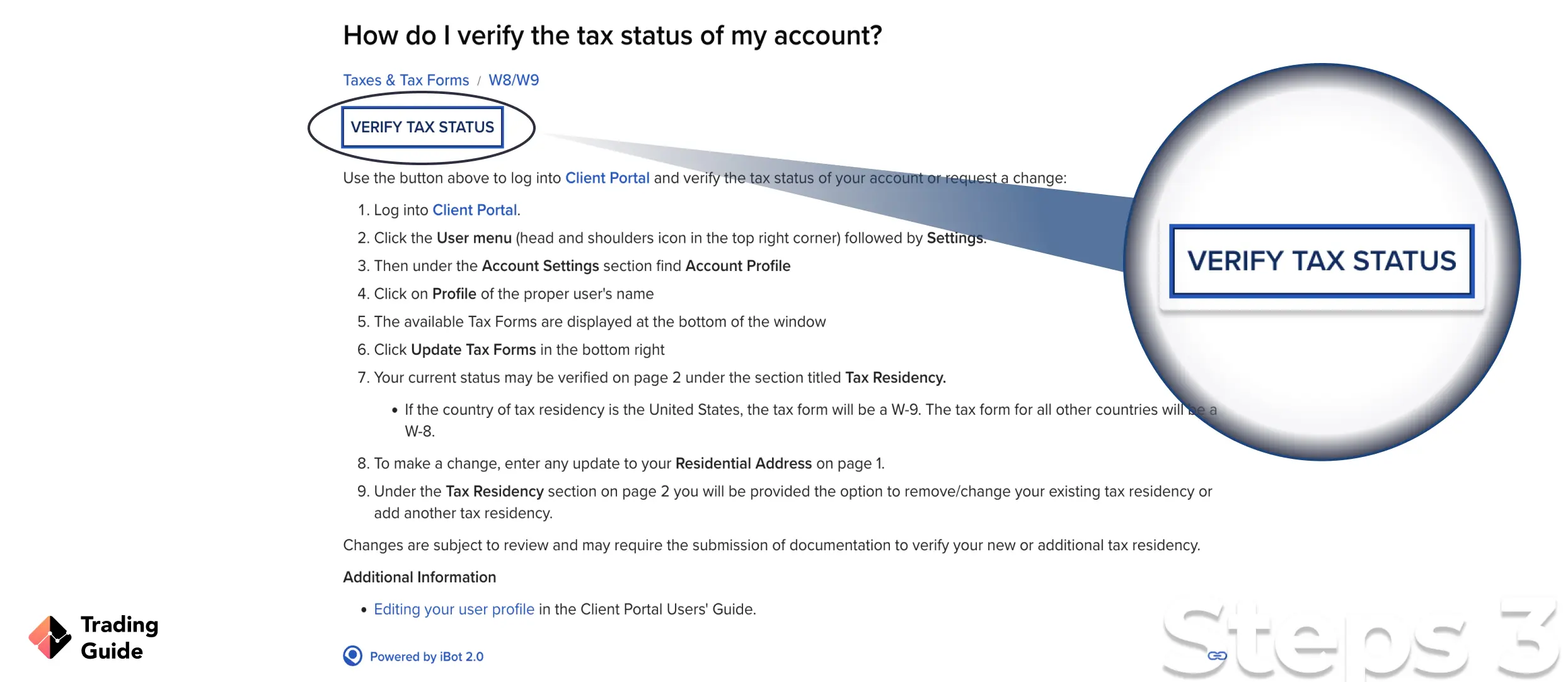

As a standard procedure by all FCA-regulated brokers, traders must verify their identities and locations to secure their accounts and keep off traders and investors with fake identities. For this reason, IG Markets will request a copy of your ID card or passport as proof of identity. You will also share a recent bank statement or utility bill to prove your jurisdiction area.

Once you have uploaded all the required documents, IG Markets will review them and send you an email notification once your account is fully activated. The verification process may take upto two days, so use the waiting period to learn more about Aviva stock.

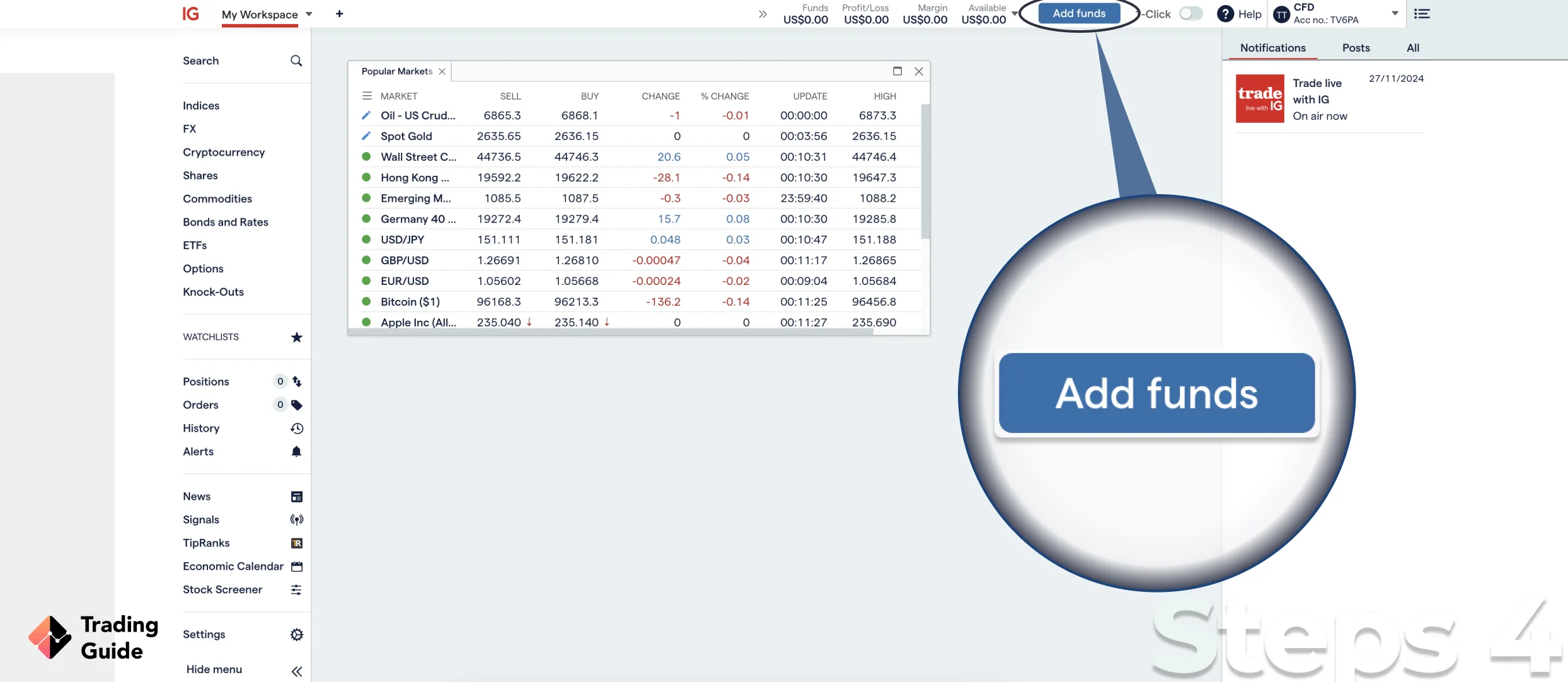

After creating a share dealing account, you will have to make a deposit to buy Aviva stock. As mentioned earlier, trading with IG Markets is costly, with a minimum deposit of £300. Fortunately, there is no deposit fee for this transaction. You can also deposit funds using various payment methods, including debit/credit cards, bank transfers, and e-wallets like PayPal and Neteller.

Aviva is a UK-based insurance company, and buying its shares using IG Markets means that you will pay commissions starting from £3. Therefore, after making a deposit, you will search for Aviva shares using its ticker, AV, and select the right amount to buy. The best element about investing with IG Markets is you can also trade the AV shares as CFDs and indices. With indices, you will be combining several stocks in a single investment. All in all, ensure you understand a trading method before applying it in your activities to maximise your profit potential.

Tips on How to Choose the Best Stock Broker to Buy Aviva Shares

Several stock brokers in the UK allow you to buy Aviva stock and invest in the company. However, choosing the best one that meets your trading needs can be challenging. For this reason, we have listed below the significant factors to consider when selecting a stock broker to buy Aviva stock in the UK.

The most important element that qualifies a broker as the best to buy AV shares is its credibility. The broker should be licensed and regulated by the FCA since trading with unlicensed and unregulated brokers in the UK is illegal. Such brokers also guarantee your trading funds safety. In addition, you will trade under the best conditions and take legal actions in case your agreement with the broker is violated.

Brokers have varying fees, and failure to confirm their charges may lead to spending more than you had budgeted for. So, using your budget as guidance, find a stock broker with affordable fees and charges. These include commissions/spreads, minimum deposit, transaction charges, financing costs, etc. The best broker should also be transparent and have no hidden charges.

The best stock broker to buy shares in Aviva should allow access to the London Stock Exchange, where AV stock is listed. However, as a trader, you may want to try other markets and diversify your portfolio. Therefore, choosing a broker with diverse offerings allows you to trade different markets and decide where your interest lies.

Some UK brokers host different trading platforms to choose from based on your level of experience. This should be a determining factor since there are good brokers with only a single proprietary platform. You need to check the performance of a platform and see if it is user-friendly, executes trades fast, and offers all the necessary tools to maximise your potential. There should also be a demo account to practise share trading and a mobile app to keep you managing your activities on the go.

It is unfortunate that many stock traders overlook this element when it is essential in choosing a broker to buy Aiva shares in the UK. You see, trading comes with challenges, and as a newbie, you need a support system that will be at your beck and call to guide you and provide relevant solutions to any trading issues. So, contact a broker’s support service using a demo account and test their reliability and response rate. They should also be easily reachable via convenient channels, whether phone, email, or live chat.

To get honest opinions from traders about a broker’s features and services, visit Google Play, the App Store, and Trustpilot. By reviewing user comments and ratings on a broker, you will understand where the broker excels and falls short, thereby deciding whether you can still use it to trade or buy AV stock.

Aviva Shares Price Today

Aviva has had some healthy gains throughout the years, even though its share price fluctuates. Therefore, it is essential to understand Aviva’s current share price to decide whether to invest in AV stock. Below is a live chart table showing Aviva share price. Use it to monitor the performance of Aviva and find additional historical data to create the best trading strategy.

About Aviva

Aviva is the UK’s largest insurer for homes and cars and a leading provider of life insurance, asset management and general insurance services. The company was established in 2000 through a merger between Norwich Union and insurer CGU. Today, Aviva shares are traded on the London Stock Exchange under the symbol AV.

Aviva’s headquarters is located in London, where it provides insurance services for individuals worldwide, including Europe, Australia, New Zealand, Asia, etc. Aviva services include life insurance policies, pensions and asset management services.

As an international finance leader based out of London, investors in Aviva shares have enjoyed good and bad times since its IPO in 1995. However, with new leadership and strategies to improve Aviva’s performance, investors’ hopes are high that Aviva’s share value will increase in the years to come.

Investors looking at Aviva shares might discover added potential by exploring the possibilities presented by Sector SPDR Industrial and Unilever stock.

FAQs

Yes. Aviva shares are available for purchase via the London Stock Exchange. You can purchase Aviva stock using an authorised broker in the UK like those referenced above.

Yes. Aviva has declared to pay its shareholders an interim dividend of 7.35 pence per share.

The Aviva dividend is currently at 7.35 per share for 2022, which are good returns for individuals investing in Aviva stock.

Aviva has two types of shares, including Ordinary Shares and cumulative irredeemable preference shares.

Yes, Aviva is a British multinational company that provides insurance services to individuals worldwide.

Conclusion

Aviva’s ability to sustain its presence across various regions globally puts it in the limelight for investors looking to buy AV stock. Although its share price has been fluctuating, investing in the AV stock today when the price is still low might work out for you in the long run, especially now that Aviva is under the guidance of a new CEO, Amanda Blanc.

Ultimately, you need to conduct extensive analysis before buying or trading Aviva shares. By doing so, together with the assistance of the best stock broker, you have a good potential of succeeding in purchasing the shares in Aviva.