Coca-Cola is one of the world’s leading non-alcoholic beverage companies based in the US. The company owns some of the most popular soft drinks, and its rich history indicates that it has more growth potential. As a result, Coca-Cola attracts many investors looking for ways to buy Coca-Cola shares.

Fortunately, we have prepared this guide to take you through all the processes involved. You will also meet top brokers that we highly recommend for investing in the company’s shares. Additionally, we take you through a brief history of the company so that you can fully understand what to expect when you put up your money in Coca-Cola stocks.

Top 3 Brokers for Buying Coca-Cola Shares

For you to have the best investment experience on Coca-Cola shares, you need an online stock broker. The broker should host excellent features and, most importantly, have access to the New York Stock Exchange (NYSE), where Coca-Cola stocks are listed under the ticker KO. On top of that, you should be able to use the broker in trading the company’s shares as CFDs and indices.

Since the UK hosts plenty of stock brokers, investors find it challenging to select the best. In this regard, we make the choosing process more straightforward for you by listing the top three brokers for buying Coca-Cola shares based on our experts’ reviews and comparisons.

1. eToro

eToro has a user-friendly platform and hosts quality resources to give you an excellent experience. Moreover, it is the best broker for social and copy trading, meaning that using it allows you to meet professional and like-minded traders, learn more trading and investment tips from them, and mirror their positions with high profit potential.

Even though investing in Coca-Cola shares is commission-free, eToro charges a high spread. For traders looking to enjoy the social trading platform, note that the broker has a minimum deposit requirement of £300. This amount is relatively high for budget-conscious investors, so we advise you to budget carefully before considering eToro. All in all, investing using eToro is worth the high costs since you also get to trade KO stocks as CFDs and indices.

Disclaimer: {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Several millions of satisfied and active customer spread across the entire world, from Europe all the way to Asia and Africa

- Provides an investment platform to help you alternate between trading and investments, and to help you diversify your portfolio

- The number one copy trading broker in the UK with an impressive social trading platform

- One of the more expensive online brokers available in the UK at the moment, effectively excluding budget traders

- Not a suitable broker if you’re not looking to use the copy trading features

2. IG Markets

IG Markets is an award-winning broker that continues to offer quality services to clients globally. Using it to invest in the shares of coca-cola means you get to enjoy some of the best platforms featuring quality and advanced resources. These include the L-2 Dealer, ProRealTime, and MT4 platforms. On top of that, IG Markets is also a social trading broker that connects global traders and investors on its IG Community platform to interact and learn from each other.

On the flip side, the broker charges high trading and investment costs for KO shares. Additionally, its minimum deposit requirement is £300, which ranks among the highest. On top of that, the broker is suitable for active traders since it charges a quarterly subscription fee of £50 should you not invest at least three times within three months.

Your capital is at risk

- One of the largest selections of stocks offered by any stock broker in the UK right now

- Invest, trade, buy and spread bet stocks as you wish on several award-winning trading platforms

- Was founded in 1974 and is effectively one of the oldest brokers in the UK and a part of the FTSE 250 Index

- A staggering number of stocks that can be overwhelming to beginners, creating doubt leading to unnecessary mistakes

- An advanced broker that requires skill and experience to be handled in the right way

3. CMC Markets

Like IG Markets, CMC Markets is a pioneer broker with a global presence. The broker’s NextGeneration platform has an intuitive design and fast order execution speed to maximise your experience. In addition, there is no minimum deposit requirement with CMC Markets, meaning you get to deposit any amount you can afford to trade Coca-Cola stocks. Your research and market analysis activities are also fully supported with quality tools.

Unfortunately, CMC Markets does not have access to the NYSE, and you can only trade KO shares as CFDs and indices, where different company stocks are combined in an investment. The best element about trading using CMC Markets is that there are additional CFD assets to trade and diversify your portfolio with, including forex, cryptocurrencies, commodities, etc.

- No minimum deposit requirement means that you can start trading with as big or as small of a budget as you see fit

- The largest selection of international shares offered by any online CFD broker in the UK right now

- Multi-award-winning broker with all the tools and platforms you need to start trading professionally

- The massive selection of available stocks easily gets overwhelming to new traders that lack experience and knowledge

- Can be quite expensive to trade and invest with due to the high spread and fees

How to Buy Coca-Cola Shares With eToro

If you are a first-time investor with zero experience with a broker, you probably want to learn how to buy Coca-Cola shares with online brokers. Note that since the Financial Conduct Authority (FCA) regulates the UK market, all brokers overseen by it have similar investment procedures for KO stock. Below, we use eToro as an example to show you the step-by-step procedures of buying Coca-Cola shares.

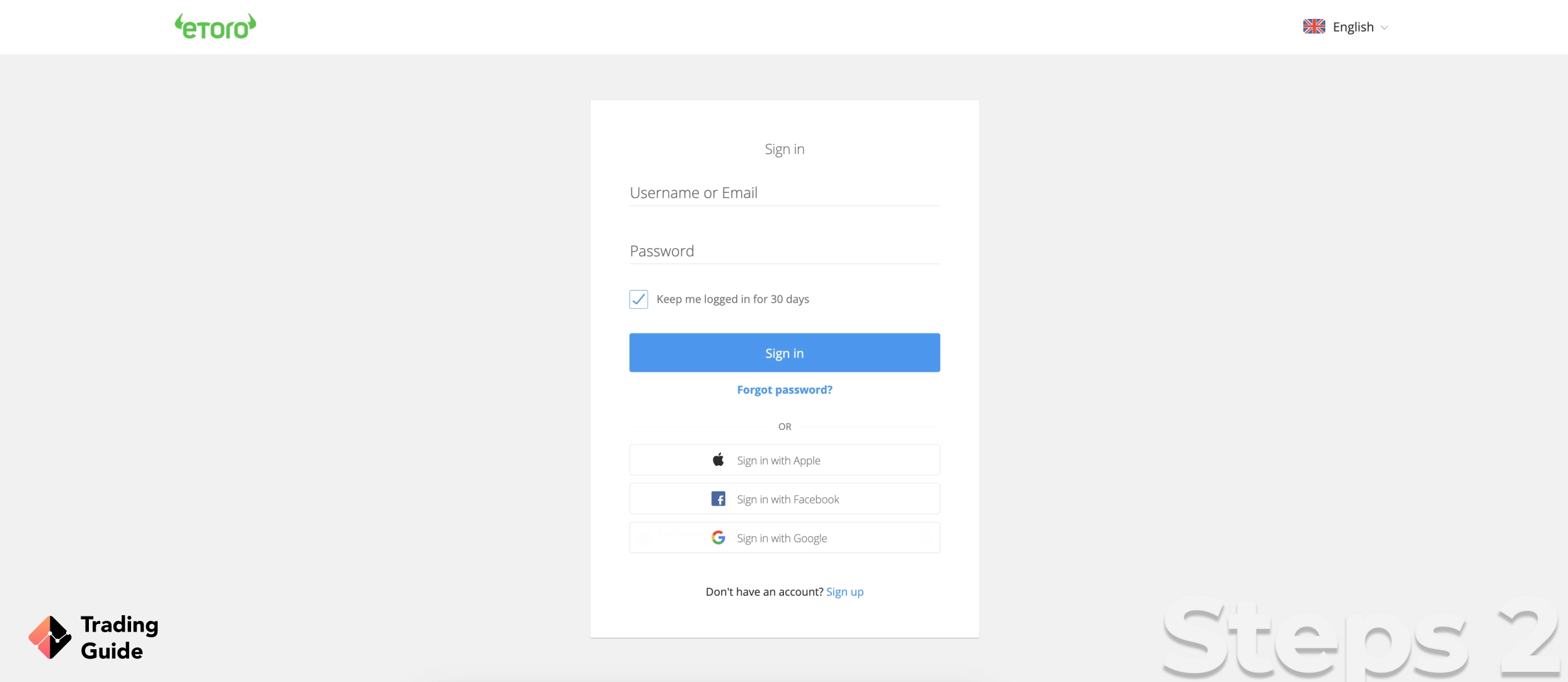

You cannot have a trading account without visiting eToro’s website and completing the account registration process. In this case, click the broker’s links we share on this page and be redirected to its website. Remember that eToro has a trading app, and if you are an active investor, consider installing it on your mobile device. This is so that you can manage your investment activities even while on the move.

eToro will require you to share your personal information and complete the account registration, which usually takes a few minutes. This information includes your full name, place of work and details, email, phone number, date of birth, etc. Since eToro strives to keep you and online investment safe, you will be required to create a username and password for your trading account’s security.

Once you have shared all the details required for account registration, eToro will provide you with a basic knowledge test to complete. Your performance in this test will determine the trading package to receive from eToro. The broker allows CFD trading, and for this reason, you will at some point trade using leverage. In this regard, a margin trading test will be provided to gauge your capabilities and determine the best leverage limit for you.

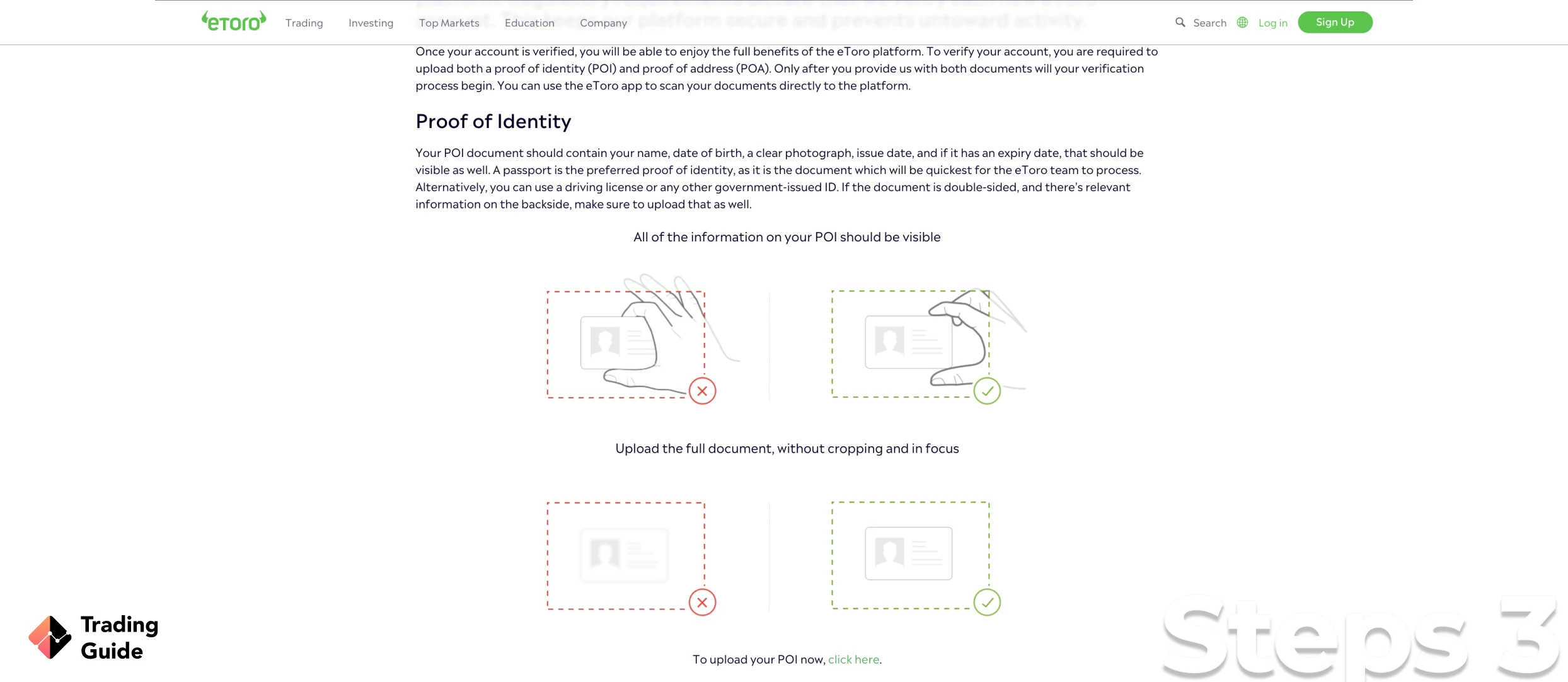

The FCA requires all brokers to verify traders’ identities before fully activating their accounts. eToro is no exception, and for this reason, it requires that you share copies of your documents, including your ID card, passport or driving license to verify your identity. Proof of location will also be needed via a copy of a recent bank statement or utility bill.

The verification procedure may take upto two days, and once your account is fully activated, eToro will notify you via email. You will then sign a virtual contract and be free to start investing in Coca-Cola stocks.

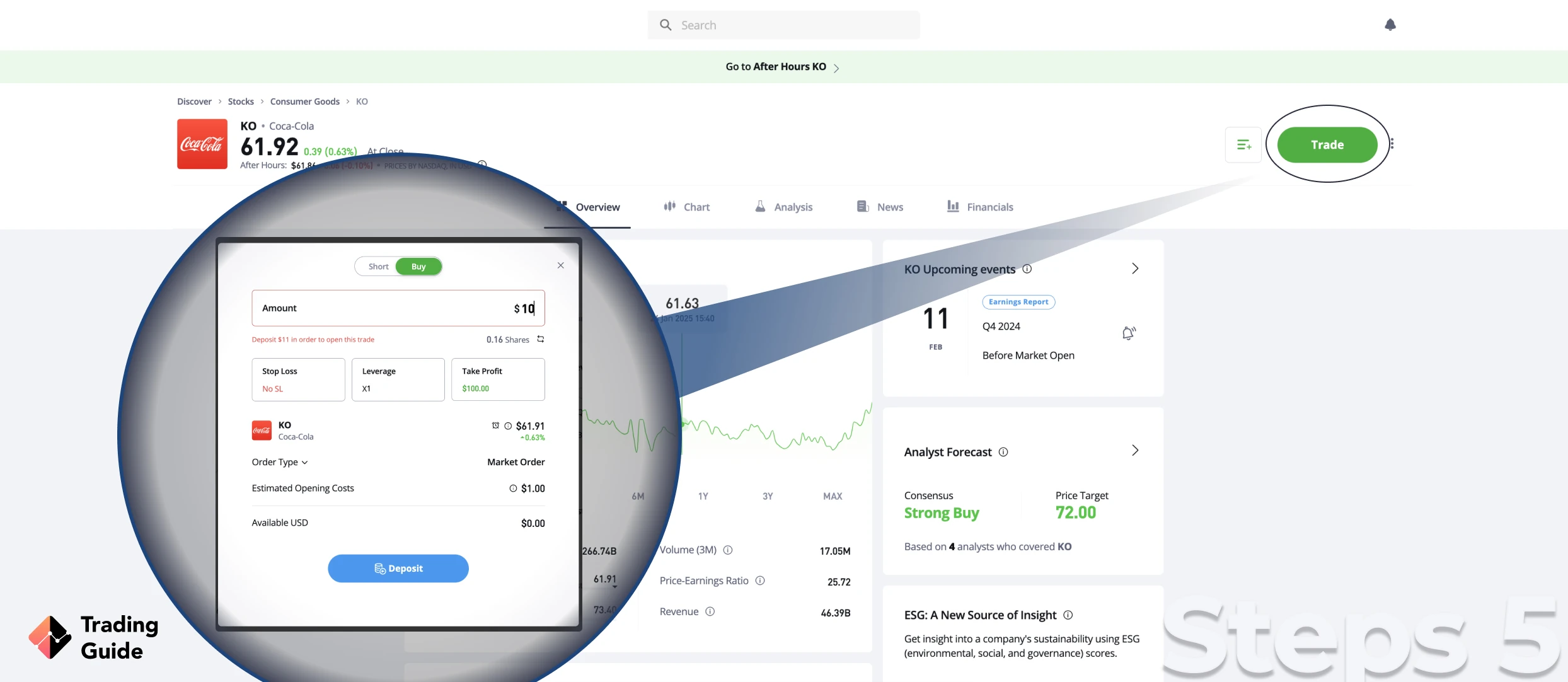

Now that your investment account is fully activated, the only thing left is for you to make a deposit and access the NYSE, where KO shares are listed. eToro has a minimum deposit of $100, which is among the lowest. It also allows you to make deposits using various payment methods, including e-wallet, bank transfers, and debit cards.

The broker will confirm your deposit and allow access to the NYSE, where Coca-Cola shares are listed. Remember, have a budget and select the right amount of shares you can afford. This means that you should put up money in KO shares that you are willing to lose in case you incur losses in your investment.

With eToro, you can also trade the company’s shares as CFDs or indices. Simply make sure you understand these methods and all the risks involved before taking a plunge.

Tips on How to Choose the Best Stock Broker to Buy Coca-Cola Shares

We have shared above the top three brokers that can potentially earn you profits by investing in KO stocks. However, should these brokers fail to meet your investment needs, you will have to find suitable ones by researching on your own. We understand how overwhelming and time-consuming the research process is and share below tips on how to choose the best stock broker to buy coca-cola shares.

Choose a stock broker that guarantees your safety and that of your trading funds. You see, the UK attracts many brokers who see opportunities to make money from traders and investors. Unfortunately, some of these brokers are not legitimate, meaning that you will be risking getting scammed should you commit to them.

The best and most trusted brokers are licensed and regulated by the FCA. Trading and investing with them is the only legal way to benefit from the financial assets in the UK. Moreover, with regulated brokers, it will be easier for you to take legal actions against them in case of unresolved conflicts.

To buy the shares in Coca-cola, make sure the stock broker you choose allows you to do so. This means that the broker should have the ability to access the NYSE, where KO stock is listed. In case you do not want to take ownership of coca-cola stocks, ensure you can still use the broker to trade the shares as CFDs or indices.

In addition, we advise you to try new financial assets, identify new potentials, and diversify your investment portfolio. To do so, you need a broker with additional assets like forex, commodities, cryptocurrencies, ETFs, and more.

Whether you are a beginner or professional trader, a broker’s platform should suit your trading and investment capabilities. Simply put, it should be user-friendly, host all the best tools for research and skills development, and have a mobile app to keep you managing your investments on the go.

In addition, consider a broker with a demo account, especially if you are a beginner. This way, not only can you test the broker but experiment with how share investing feels like when using the live trading account. You can also use a demo account to try out new assets and identify the ones you are confident with.

As mentioned earlier, it is good to have a budget and stick to it throughout your investment period. Do not rush to invest lots of money without experience since you may end up with a loss. Simply put, find a broker you can afford and fits your budget. Consider charges including commission/spread, minimum deposit, inactivity fees, etc. Furthermore, confirm the payment methods and ensure they are convenient for you.

Customer service in a broker helps you easily handle trading and investment problems. Without checking this element, you may find yourself with a broker that is not useful in times of need. Therefore, use a broker’s demo account to test how reliable and dedicated its customer service is before making a commitment. Additionally, ensure they have convenient communication methods.

Coca-Cola Shares Price Today

Coca-cola stock price has been fluctuating throughout the years based mainly on consumer demand. The ability for coca-cola to remain popular over the decades makes it a good buy. For this reason, you need to stay abreast with the company’s share price to create the best investment strategy.

That being said, we have created a live chart below showing today’s Coca-Cola’s share price and more historical information that can be useful in your investment.

About Coca-Cola

Founded in 1886 by John Pemberton, Coca-Cola is a multinational beverage corporation headquartered in Atlanta, Georgia. It manufactures, markets and sells non-alcoholic beverage drinks to consumers globally. With offices spread across the globe, Coca-Cola has remained popular and attracted investors looking to buy KO shares.

Since going public, the company strives to continue producing drinks that people love and has taken the necessary measures to be a market leader and knock out its competitors. For instance, the company recently bought full control of Body Armor, one of the leading sports drinks makers. This is the largest brand acquisition for the company, a clear indication that Coca-cola sees potential for growth in the coming years. Other Coca-Cola most notable acquisitions include Minute Maid in 1960, Monster Beverages in 2015, Costa Coffee in 2018, etc.

Keep in mind that Coca-Cola stock is listed on the NYSE under the symbol KO. In addition, it is part of various indices, including S&P 500, DJIA, and S&P 100. Therefore, investing in the company is worth a try, and you also get to earn quarterly dividends.

FAQs

Yes. Depending on your budget, you can buy one coca-cola stock or even a fraction of a share. All you need is to find the best stock broker with access to the NYSE to complete the purchase.

Coca-cola share price keeps fluctuating, and it is challenging to know the exact KO share price. However, with our live chart above, you can easily understand the current company’s share price, thus identifying the best time to make a move.

Absolutely. The Coca-Cola company has been existing for decades, and it is one of the largest soft drinks manufacturing companies globally. Its main competitor is Pepsi, and since Coca-cola is putting measures to lead in the industry, investing in shares of coca-cola could pay off in the long run.

You can easily buy coca-cola stock through online brokers. Make sure the broker you use suits your investment needs and has access to the NYSE, where KO shares are listed.

Normally, coca-cola pays dividends on a quarterly basis. These payments are made on April 1, July 1, October 1, and December 15.

Absolutely. With online brokers, it’s easy to buy shares of coca-cola. However, not all online brokers are legitimate, and you need to find one that the FCA regulates. Such brokers guarantee the safety of your trading funds and offer trading services under the best conditions.

Conclusion

If you were sceptical about buying coca-cola stock, we hope this guide has given you all the insights about the benefits of investing in coca-cola shares. The company is a low volatility stable dividend provider, and investing in its shares can be profitable for all investors.

Remember, do not invest in KO shares with amounts of money that you cannot stand losing. Instead, take note of the price you are paying and be serious in market analysis and choice of a broker if you want to maximise your chances of succeeding in investing in the shares of coca-cola.