Investing in Disney shares is not just investing in a brand name. For me, it is investing in a company that has stood the test of time. Through its cartoon classics, blockbuster franchises, and growing streaming kingdom, Disney has built an ecosystem that draws in viewers from all over the world.

Disney is a publicly listed company under the ticker DIS on the NYSE. It holds stakes in reputable brands, thus creating long-term value. So if you wish to invest in UK stocks, I’ll walk you through how to buy Disney stock and the best brokers to get started with.

How to Buy Disney Stocks

To effectively buy Disney shares in the UK, you need a reliable stockbroker with access to the New York Stock Exchange. With many options, conducting research on this will ensure you find a suitable option. I will introduce you to the top three stock brokers for buying this company’s shares. But first, here are the procedures involved in making the purchase.

After selecting an appropriate stock broker, the subsequent action is to open an account. Therefore, go to its official website and complete the given form with your personal information. It includes your name, address, phone number, source of income, etc.

You may also be requested to verify your information before your account is fully activated. The process requires submitting a copy of your recent bank statement or utility bill as proof of location and government-issued identification for identity verification. Plus, ensure you fill out the W8-BEN form to minimise your tax liability for this US stock. Some brokers will automatically handle this on your behalf.

Once your investment account is ready, it is time to deposit money into it. Deposits can be made via several payment channels for many FCA-regulated brokers, including bank transfer, debit/credit card, or e-wallet.

Check the broker’s minimum deposit requirement, as they vary from platform to platform. Some will let you open an account for as little as £50, but others may take more, depending on the type of account or features available.

Your broker will automatically redirect you to its listed shares and other assets. Go to the search bar and type in the Disney ticker symbol, DIS. This will lead you to the company’s stock page, where you will get the current price per share, recent performance, and possibly some news or analyst ratings.

Be sure to learn more before you initiate a trade. Therefore, utilise the interactive charts, earnings reports, and other resources at your disposal for that purpose.

Decide how you would prefer the buy to be done. You can choose a market order that allows you to buy Disney stock at the prevailing price. Alternatively, go for a limit order that allows you to set the price you are willing to pay. Your choice should be based on your risk tolerance and experience level.

Carefully review everything and ensure that the details, including the shares, total cost, and any fees that could apply, are correct. Once you are ready, go ahead and place the order.

Remember that investing in DIS stocks is not guaranteed to yield profitable returns. There are chances of losses if the market develops in an unexpected direction. To avoid incurring large losses, start small by investing in fractional shares. Also use risk management controls like stop-loss or take-profit orders.

Best Brokers to Invest in Disney Stocks in the UK

As mentioned earlier, not every broker in the UK gives you access to the NYSE, where DIS stock is listed. Plus, brokers have varying features, and it is crucial to identify the one with elements that align with your investment needs.

Over time, I’ve tested quite a few stock brokers in the UK. Below are my top three, which have not only proven to be secure but also easy to use and well-suited for buying Disney stocks.

1. eToro

eToro is one of the top stock brokers that lists DIS stocks for UK clients. I like that it has a user-friendly platform that hosts plenty of learning materials and research tools. To me, this is a great deal, as any user, whether new or experienced, is guaranteed access to resources that will maximise their potential.

For instance, eToro’s CopyTrader feature connects like-minded traders to share trading ideas. They can also mirror the positions of the advanced traders and make profits when they do. This feature is free but has a minimum amount of £200 to copy a trader.

For those new to this broker, a £100,000 virtually funded demo account is at your disposal to practise share investing before risking real money. And when you are ready to buy DIS shares using the live account, a minimum deposit of £50 is required. The best part is that eToro gives its users options to either invest in Disney stocks’ whole units or fractional shares, starting from £10.

Besides DIS stocks, this broker hosts an additional 6,000+ global shares to purchase or trade as CFDs. Plus, I discovered additional asset classes, including forex, commodities, ETFs, cryptos, and more. So, if you like diversifying your portfolio, you will not get enough of eToro. Note that investing in Disney stock is commission-free.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- Low minimum deposit requirement for UK clients

- A user-friendly and modern design platform

- Quality learning and market analysis tools

- An additional 6,000 stocks from 20 exchanges are listed

- Features social and copy trading

- High stock trading fees compared to its peers

- Has a £5 withdrawal fee

2. Interactive Brokers

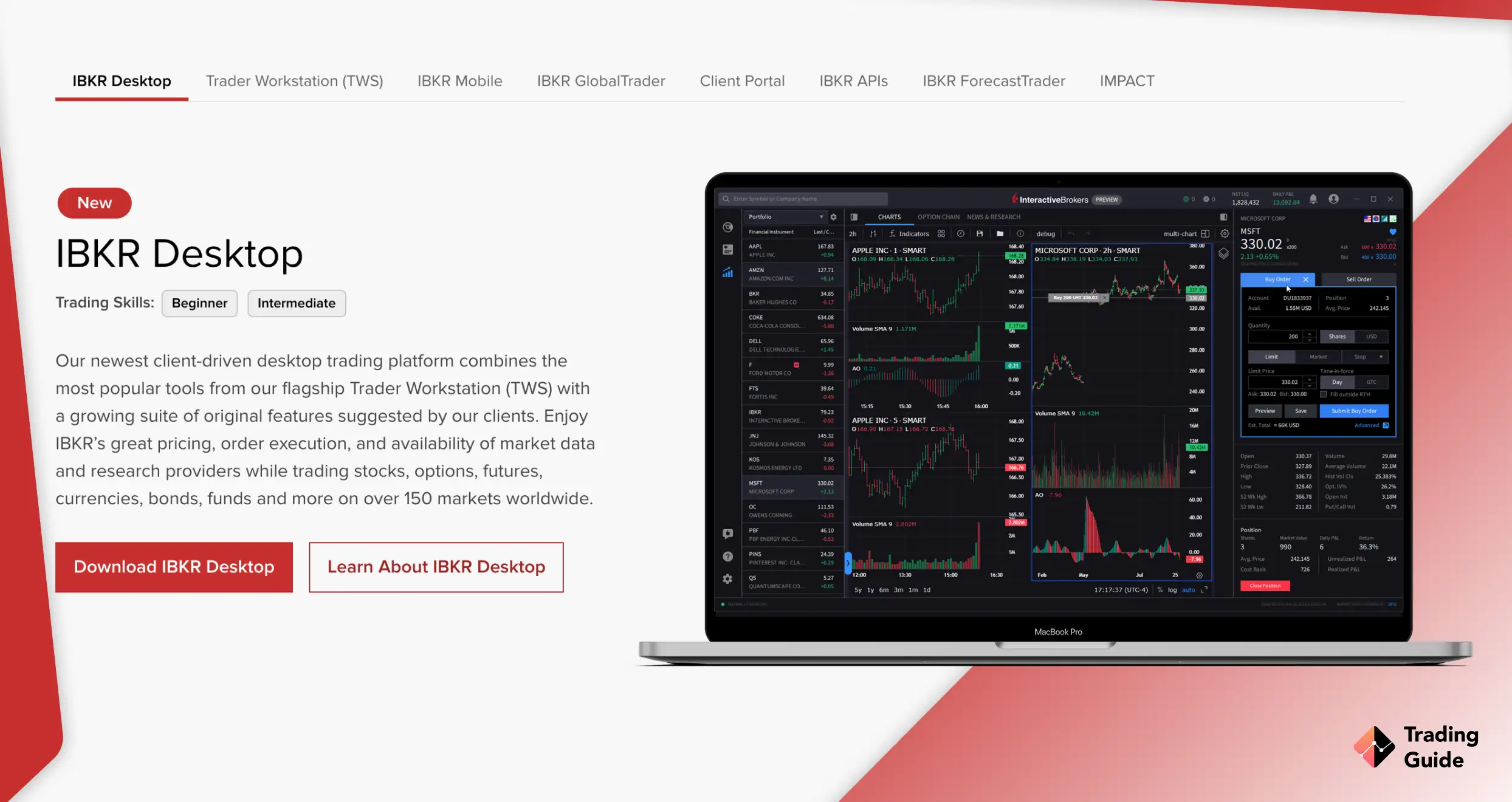

Interactive Brokers (IBKR) gives access to over 10,500 global stocks, including DIS shares, which you can purchase as a whole or in fractions. Creating an investment account here is straightforward, and there is no minimum deposit requirement.

I like that this broker charges low commissions for buying Disney shares and other stocks. The amount goes up to £0.0035 per share, capped at a minimum of £0.35 per trade if you go fixed-rate with IB SmartRouting. That means small trades cost very little. There are no added spreads and no platform fees, which I find refreshing.

Besides allowing users to buy Disney shares, IBKR supports CFD trading. So if you want leveraged exposure without purchasing the actual stock, it’s all there. However, ensure you understand the risks of CFD trading, as it could leave you with massive losses should the markets move in a different direction than anticipated.

For those looking to diversify their portfolios, IBKR supports you with other assets, including forex, commodities, futures, and more. Another selling point for this broker is that it offers users an opportunity to earn extra income on their fully paid shares. So, once you purchase Disney stocks, IBKR borrows them to lend to traders who want to short and are willing to pay interest.

- Access to thousands of global stocks with fractional purchases

- No minimum deposit and no platform fees

- Ultra-low commission on Disney stock trades

- Supports multiple trading platforms for every type of investor

- No inactivity fee

- The interface can feel complex for beginners

- Customer support response rate can be improved

3. IG Markets

Disney stocks are among the 11,000+ global shares listed at IG Markets for purchase. The best part is that you get to invest commission-free across multiple accounts, including IG Invest, web-based share dealing, and Smart Portfolios.

IG Markets is one of the best stock brokers hosting quality learning and market analysis tools to boost users’ experience. Plus, I noticed that it allows users to grow their wealth with variable interest of 4.25% AER on GBP cash balances in GIA, ISA, and SIPP accounts.

Besides buying DIS shares, this broker supports CFD trading and spread betting. Plus, there are additional asset classes, including forex, commodities, futures, ETFs, and more, for effective portfolio diversification.

When it comes to trading platforms, this broker has a variety of options to choose from. They include ProRealTime, L-2 Dealer, MT4, and TradingView, all with excellent features like automated and social trading.

Note that there is no minimum deposit requirement at IG Markets, and all transactions are free. However, an inactivity fee of £12 per month after two years of no trading applies.

Your capital is at risk

- Buy global shares, including Disney, with zero commission

- Access 11,000+ global shares and diversified asset classes

- No minimum deposit requirement

- Multiple trading platforms and accounts to choose from

- Quality market analysis and learning tools

- An inactivity fee of £12 monthly applies if there is no dealing activity for two years

- High stock CFD trading fees

Disney Shares Price Today

The price of Disney stock changes with the market. What you see today may not be the same tomorrow. That’s just how the stock market works. It reacts to news, earnings reports, shifts in consumer demand, and global events. While the current price gives you a snapshot, it does not tell the whole story.

That is why I always recommend looking at the stock’s historical performance. Tracking how Disney shares have moved over time can give clues about where it might be heading next. It won’t guarantee results, but it helps you set realistic expectations.

In this regard, I take advantage of our live chat below. Analyse Disney’s share price properly to identify the best entry and exit points.

About Disney

The Walt Disney Company is one of the most recognised names in global entertainment. It started in 1923 as a small animation studio and has grown into a giant with influence in film, television, theme parks, streaming, and merchandise. Most people know the brand for its classic characters like Mickey Mouse and animated films. However, Disney is much more than that now.

The company owns a range of major subsidiaries, including Pixar, Marvel, Lucasfilm, 20th Century Studios, and ESPN. It also runs popular services like Disney+, which has grown quickly in the streaming space. This mix of content and distribution gives Disney an edge, as it controls both what is created and where it’s shown.

I find it interesting how Disney continues to adapt. Even with cinema facing challenges, the company has pushed its content through new channels. Its parks and resorts also bring in a huge chunk of revenue, though they are more sensitive to global events.

The company’s stock trades under the ticker DIS on the NYSE. Over time, it has attracted investors who want long-term growth, backed by a strong brand and diversified income. Like any company, Disney has risks, but its reach and resilience are hard to ignore.

Is Disney a Safe Investment?

No investment, including Disney, comes with a profit guarantee. However, when I look at it from a long-term lens, I see a business that’s stood through cultural shifts, economic ups and downs, and massive changes in how people consume content.

Disney has several things working in its favour. For one, it’s not built on a single product. So if one area takes a hit, there are usually others that help balance it out.

But let’s not gloss over the risks. The media industry is competitive and always changing. Streaming platforms are fighting hard for attention, and Disney, despite a solid start, has to keep proving itself. Also, the parks business is sensitive to world events, from pandemics to inflation. A dip in travel or consumer spending can affect revenues fast.

There’s also market sentiment to consider. Share prices don’t just follow earnings. They move on news, investor mood, and global politics. Just because Disney is a strong brand doesn’t mean its stock will always go up.

That said, with the right approach, I believe it’s possible to see good returns over time. Personally, I treat stocks like Disney as part of a broader portfolio. I don’t go all in, and I keep some cash aside to buy more if prices dip. If you’re just starting out, maybe begin with a small position. Monitor it. Learn from it. And don’t stress if it moves up or down in the short term. That’s all part of it.

FAQs

The best way to invest in Disney is by buying its shares via a reliable and reputable stock broker. Such brokers are challenging to find, and luckily, we have recommended the best three above to get you started.

Yes. Not only can you buy one share of Disney stock, but you can also buy a fraction of it. To do so, you need a broker with access to the NYSE, where the shares are listed.

No. Unfortunately, Disney had to pause on paying shareholders semi-annual dividends in 2020. The reason was to conserve money to recover fully from the COVID-19 pandemic, which forced some of its lucrative businesses to close.

Yes. Disney’s recent announcement to reorganise its media and entertainment businesses clearly indicates that the company has excellent growth potential. This means investing in its shares could pay off in the long run.

The Disney company started as a cartoon studio in 1923 named Disney Brothers Cartoon Studios. It later changed its name to Walt Disney Studio and Walt Disney Productions before settling for Walt Disney Company in 1986. The company has evolved to incorporate theme parks, film production, television and internet streaming services, and more

Rober Igler is the main owner of Disney since he owns more than 500,000 shares of the company. He is also the current Disney’s executive chairman and chairman of the board.

Expert Opinion

Disney is a strong brand, but that doesn’t make the stock risk-free. Earnings can be hit by falling streaming numbers, box office flops, or global issues that impact theme parks. Currency shifts also affect UK investors buying US stocks.

For beginners, the key is to manage risk. Start with a small investment, use fractional shares if needed, and set stop-loss orders to protect the downside. Don’t chase the price, but buy with a plan. Additionally, invest with an FCA-regulated broker, review financials, stay updated on news, and diversify your portfolio instead of relying on one company. Think long-term, stay calm during dips, and always know why you’re holding a stock. That mindset matters more than timing the market.