Google, a subsidiary company of Alphabet, is a common household name globally because of its impeccable services. You might know Google as the most preferred search engine globally, but the company offers additional internet services. These include Gmail app, YouTube, Google Play, cloud storage, and more. It is also one of the big five companies in America’s IT industry alongside Amazon, Meta/Facebook, Apple, and Microsoft.

Google’s share price keeps rising, and the company is currently valued at over £1 trillion. This immense growth continues to attract investors across the globe to buy Alphabet stock. If you have been looking for ways to buy Google shares, worry not because we will guide you through the procedures. We also recommend the best stock brokers in the UK to buy Google shares. Furthermore, you will learn how to choose the best broker for buying Google shares.

Top Brokers for Buying Google Shares

Google shares are listed in the NASDAQ exchange under the symbol GOOGL. You need the best stockbroker matching your trading requirements to access the exchange and buy Google shares. Using a broker also allows you to trade shares off the exchange or as derivatives (CFD, spread betting, indices, etc.). A proof that you get more opportunities to earn money* using Alphabet stocks.

Many traders experience challenges searching and choosing the best stockbroker to buy Google shares. We understand that the process can be time-consuming and overwhelming, leading to wrong choices. For this reason, we have recommended the best Google stock brokers below to get you started.

*Your capital is at risk.

1. Plus500

*Illustrative prices

Plus500 stands out as one of the top brokers offering a seamless trading experience through CFDs. While direct ownership of Google/Alphabet shares isn’t supported, the broker’s user-friendly platform and swift trade execution speed ensure efficient trading. Moreover, we like that Plus500 has a low minimum deposit requirement of £100 and offers commission-free trades on GOOGL stock. This makes it easier for budget-conscious traders to explore the share market with little capital.

Another advantage of trading Google CFD shares at Plus500 is the ability to enjoy favourable leverage limits. This extends up to 1:5 for retail traders and 1:300 for professionals, if they meet specific criteria: sufficient trading activity in the last 12 months, a financial instrument portfolio of over €500,000, and relevant experience in the financial services sector. For beginners, you will benefit from Plus500’s virtually-funded demo account, making it easier to explore the financial space and gain confidence without financial risk. Plus500 also has a dedicated 24/7 support team and additional assets for portfolio diversification.

- Reliable support service team via phone, email, and live chat

- Commission-free GOOGL share trades

- No deposit and withdrawal fees

- A user-friendly and intuitive design trading platform

- No buying and taking ownership of the Alphabet stocks

- Inactivity fee kicks in after only three months, making Plus500 a suitable option for active traders

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro

eToro is a simple and easy-to-use broker that allows you to buy Google shares or trade them as CFDs. There are no commission charges at eToro, and its minimum deposit requirement is only $100. In addition, the broker is known as the best in social and copy trading. This allows you to network and share trading ideas with other traders on a platform while copying positions that can make you profits.

Other than Alphabet stocks, you can diversify your portfolio with other financial assets, including other companies’ shares, currencies, cryptocurrencies, commodities, etc. However, note that the broker charges high spreads, and unlike most brokers, eToro also charges fees for withdrawals.

Disclaimer: {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- A low minimum deposit requirement of $100

- Allows you to buy Google shares as fractions. You can also trade the asset as CFDs or indices

- Award-winning social and copy trading features newbies can take advantage of and maximise their experience

- Limited resources for professional stock investors and traders

- Accessing the copy trading feature requires a minimum deposit of $200, which can be high for most investors

3. IG Markets

IG Markets allows trading of Google shares as CFDs while using quality resources. The broker also offers different trading platforms to help you have the best trading experience. They include the MT4, ProRealTime, and the L-2 Dealer that provides direct access into NASDAQ’s order books.

Trading Google shares at IG Markets is commission-free. However, you will pay spreads, which we believe are high compared to what other brokers charge. IG Markets also charges a subscription fee should you fail to trade more than three times within three months. On top of it, its minimum deposit requirement is $300.

Your capital is at risk

- Hosts over 17,000 CFD instruments from popular global markets for portfolio diversification

- A cutting-edge social trading platform and plenty of learning materials for newbies

- Availability of advanced share trading L-2 Dealer platform. You can also explore its MT4 and ProRealTime platforms

- High stock trading fees

- Its sophisticated resources are primarily suitable for professional traders

4. CMC Markets

CMC Markets is one of the most popular stock brokers hosting impeccable trading tools that suit all traders. For example, the broker allows trading of Google shares as CFD and indices on its Next Generation and MT4 platforms. What’s more, there are no commission charges but spreads. It also offers more securities to try if need be, including commodities, ETFs, cryptocurrencies, and more.

CMC Markets does not have a minimum deposit requirement, making it easier for you to get started trading Google shares. However, there is no purchasing and owning of these Alphabet stocks. Its support service also functions during weekdays only.

- Licensed and regulated by top-tier authorities, including FCA and more

- No minimum deposit requirement, allowing you to start stock trading with any amount you can afford

- Numerous learning and research tools, making it suitable for newbies and professional traders

- You cannot use CMC Markets to buy the shares of Google and take full ownership

- Only over-the-counter trading is allowed on CMC Markets

How to Buy Google Shares With eToro

Now that you know the top stock brokers to buy Google shares, it is time to understand the procedures of how to buy Google shares. Below, we have listed the step-by-step procedures of buying Google shares with eToro. This is to help you prepare all the necessary documents beforehand, thus creating a trading account quickly and seamlessly.

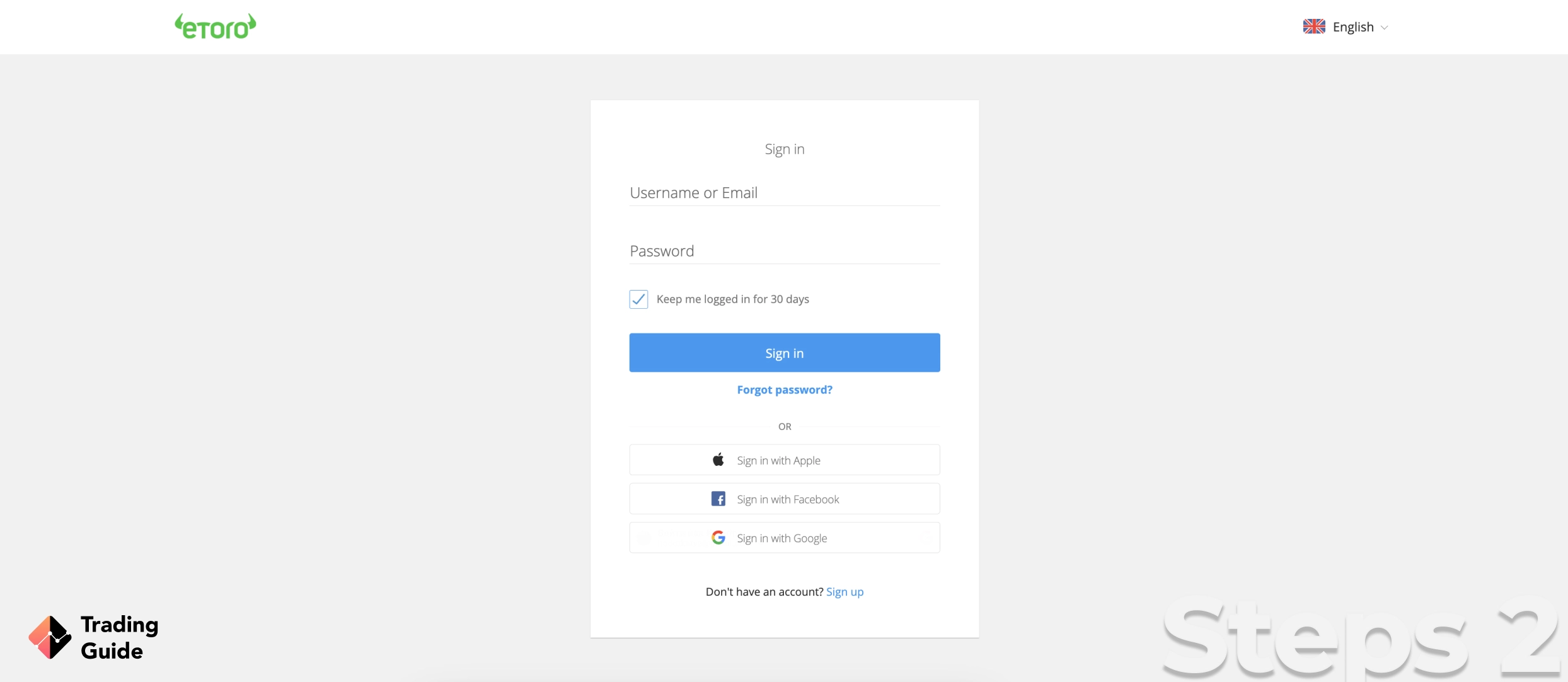

The first step towards buying Google shares is visiting eToro’s website via desktop or mobile devices. Luckily, we have links on this page to redirect you to eToro, making the process much easier.

You need to have a live trading account at eToro to buy Google shares. However, if you are new with the broker, we highly advise you to start by practising how to trade shares using eToro’s demo account. To sign up for a trading account, eToro will require you to provide your personal details, including name, email, phone number, date of birth, physical address, source of income, etc. You will also create a username and password for logging in to your account.

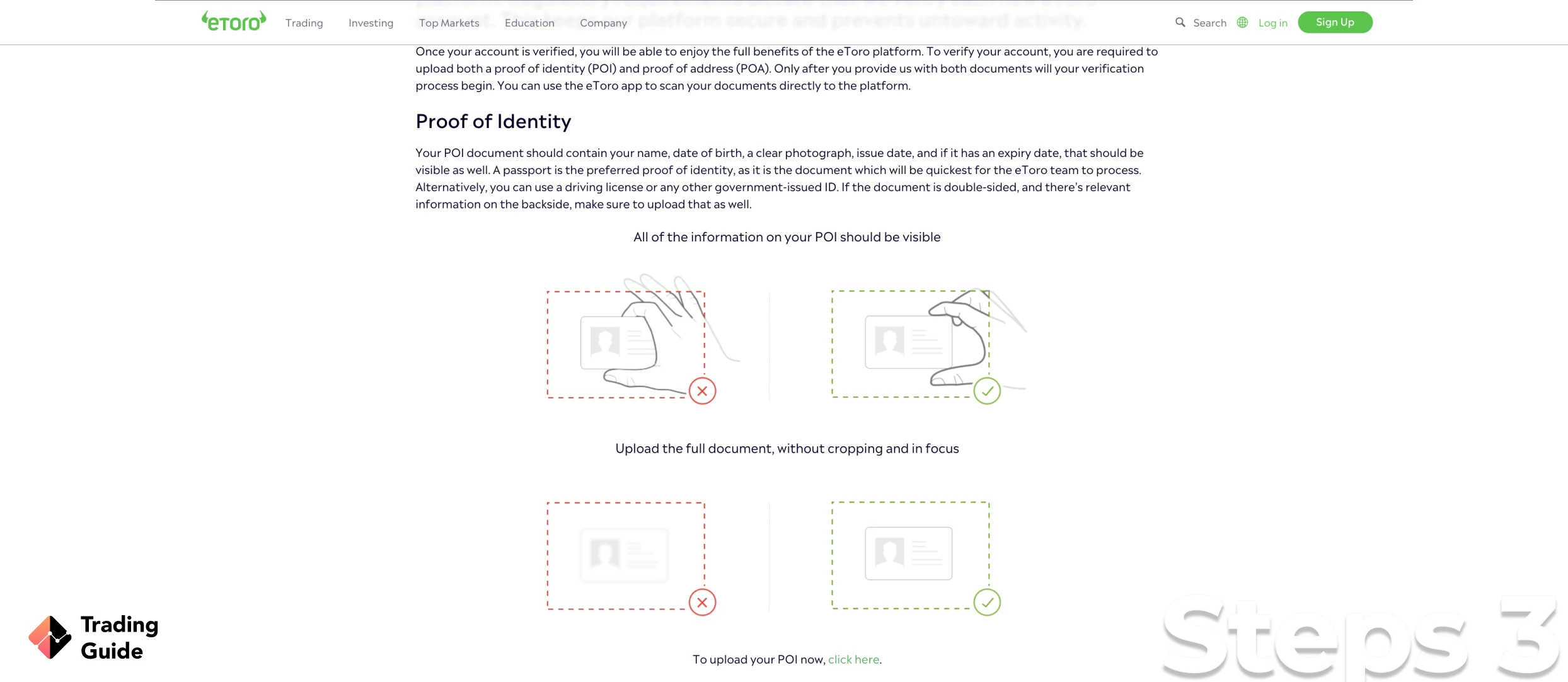

It is a standard procedure for all FCA regulated brokers to have all clients verify their identity to start trading. This helps to protect you and keep away traders with fake identities. In this regard, eToro will request you to upload a copy of your original ID or passport. You will also have to verify your place of residence by sharing a recent utility bill or bank statement showing transactions within the last three months.

Additionally, a basic knowledge test on margin trading will be provided to determine the best leverage limit for you. There is also a questionnaire to fill, thus determining whether you qualify for certain features like copy trading. eToro will send you an approval notification via email once your account is fully activated.

At this point, you are free to buy Google shares, and eToro will require you to deposit at least $100. You shouldn’t worry about the safety of your trading funds since the broker is not only regulated by the Financial Conduct Authority but is also highly encrypted to keep hackers away.

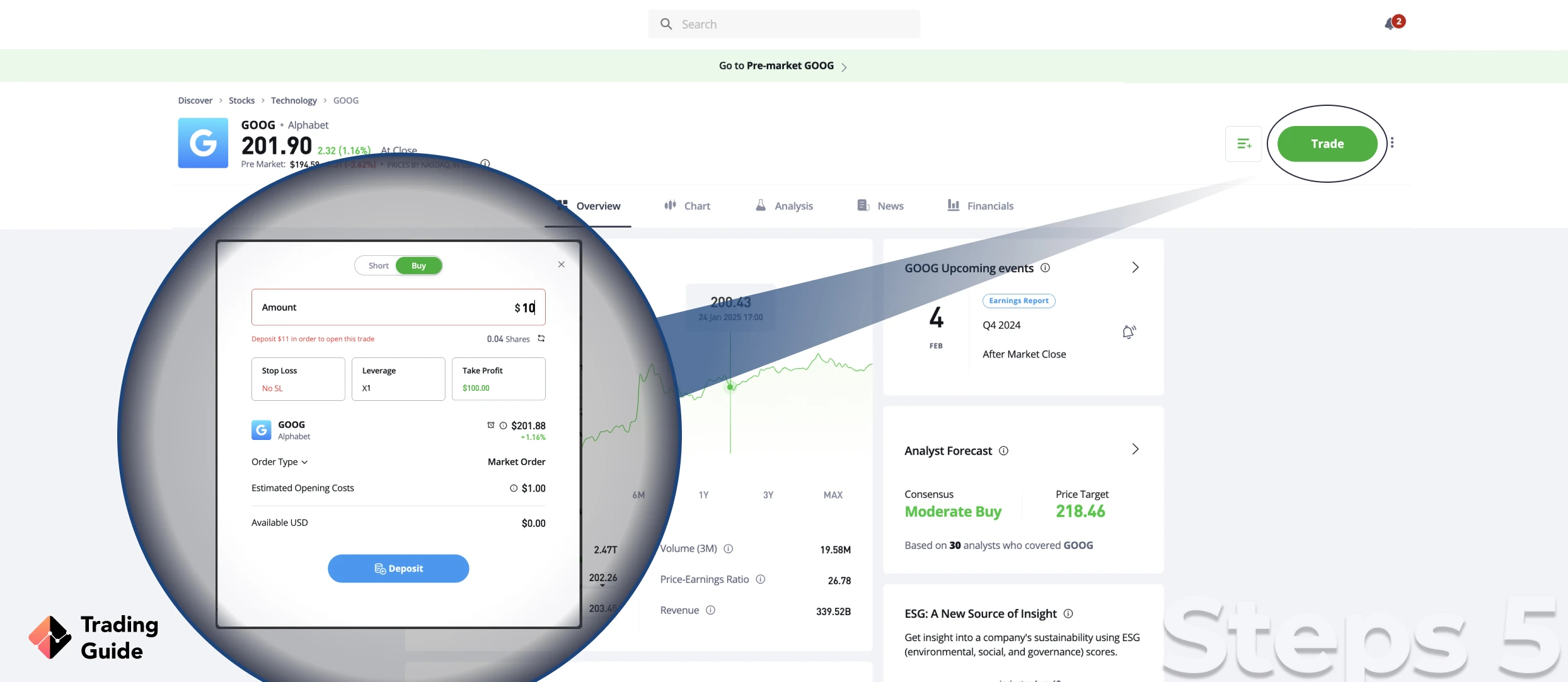

Once the deposit has been confirmed, you will access the NASDAQ exchange and select the number of shares you can afford to purchase. The best element about eToro is that it also allows you to trade Google shares as derivatives or indices by combining several stocks in a single investment. However, before you decide how to trade these Alphabet stocks, ensure you are fully aware of the risks involved.

Tips on How to Choose the Best Stock Broker to Buy Google Shares

You probably must be wondering how we got to conclude that the above brokers are the best for buying Google shares. Our research procedure was lengthy, with many processes involved. This included reviewing and comparing the brokers’ features to see which ones suit our set requirements.

Below are the features we looked at when reviewing and comparing stock brokers in the UK. You can use them to find the best broker for buying Google shares quickly should you decide to forego our recommendations.

A stock broker for buying Google shares must guarantee your safety and that of your trading funds. Note that many unregulated brokers pretend to offer brokerage services, but in reality, they aim to lure you into committing to them hence stealing your money. To be safe, settle for a broker that is regulated by the Financial Conduct Authority (FCA).

We always advise traders to choose a broker with diverse offerings and not stick to one with a particular asset. For example, while buying Google shares can be lucrative, you can diversify your portfolio with other assets. Also, you can use other assets offered to short your original investment hence benefit from the falling prices. Therefore, consider a stock broker that also offers forex, commodities, cryptocurrencies, ETFs, and more.

You need to ask yourself how reliable is a broker you intend to buy Google shares with. This means that a stock broker should have a platform that improves your experience. It should also execute trades fast and offer the necessary trading tools to maximise your chances of benefiting from trading Google shares.

Additionally, make sure a broker has a demo account, especially if its trading charges are high. You should also be able to effectively manage your trading activities via desktop and mobile devices.

Broker charges vary, and you must have a budget to quickly identify a suitable one for you. There are also brokers with hidden costs, and failure to confirm this may lead to you spending more than you had budgeted for. For this reason, confirm all charges, whether minimum deposit requirement, spreads, commissions, inactivity fee, transaction costs, etc.

Trading Google/Alphabet stocks is challenging, and you should choose a broker that supports you fully to increase your chances of succeeding in the activity. This includes hosting a committed support service that provides relevant solutions to any arising issues. It is also important to ensure the support service fits into your trading schedule and can be reached via different channels.

The best stock broker for buying Google shares should match your trading needs. However, consider reviewing what current and previous traders had to say about their experiences with a broker. You might discover some strengths and weaknesses of a broker that you couldn’t during research and make the best choice. To analyse user comments and reviews, visit Google Play, the App Store, and Trustpilot.

Google Shares Price Today

Google share price today is valued at around $2,900. You can use the live chart of share price below to monitor Google’s accurate price movement, whether from day to day or minute to minute. The chart will also help you identify additional information like historical data that can be useful in making the best investment decisions.

About Google

In 1998, Google was founded by Sergey Brin and Larry Page to offer internet-related services and products. These include cloud computing, search engines, advertising technologies, software, and more. Google is the most visited search engine globally, with other owned websites like Blogger and YouTube highly rated.

In 2004, the company went public through an initial public offering with a share price of only $85. Since then, Google share price has been on a consistent rise even after restructuring in 2015 and becoming a subsidiary company to Alphabet.

To date, Google remains Alphabet’s largest subsidiary, holding Alphabet’s internet interests and properties. The company’s market capitalisation is over $1 trillion and has a share price of around $2,900. The best thing about the shares is that you can also buy them as fractions.

Today, Google is run by Sundar Pichai, who is also Alphabet’s CEO. The company has partnered with leading electronics manufacturers to produce various products, including Google Nexus, Google Pixel, Google Nest, and more. Its wide range of products and services keeps it ahead of the competition.

Read about how to buy eBay stocks in our other guide.

FAQs

Yes. You can buy one share of Google and also a fraction of a share. However, you need the best stock broker with features matching your trading needs to complete your purchase. Examples of such brokers are eToro, IG Markets, and CMC Markets.

Yes. Google remains a safe investment because of its excellent performance throughout the years. However, you still need to conduct a thorough market analysis to be confident with your investment.

No. Unfortunately, Google does not pay dividends to its shareholders since it prefers reinvesting its profits to more products and services.

No. Google shares are listed on the NASDAQ exchange, and the only easy way to buy them is through an online broker. Simply ensure you use the best broker with quality tools to help you succeed in the activity.

Google shares are currently valued at over $2,900 a share. The good news is that Google allows you to purchase its shares as fractions, meaning that with as little as $10, you can own a part of Google share. You can also trade Google shares as derivatives (CFD) with any amount you can afford.

In 1998, Google was founded by Sergey Brin and Larry Page to offer internet-related services and products.

Conclusion

You might know the proper procedures on how to buy Google shares, but are you ready to take the bull by the horns? Well, for some tips to get you started, make sure you have the best stock broker to buy the Alphabet stocks. We have listed above how to identify one that will boost your trading experience.

Additionally, make sure you are fully knowledgeable of the share market and conduct your own analysis. Do not follow other traders’ opinions regarding when to trade or purchase Google shares. The company’s ability to stay on top of innovation shows that it has a promising future.

I am trading for many years and I knew how exactly the process works. As a beginner, we start trading and take bigger risks with very less knowledge of trading and market. But one thing that made me win the battle by overcoming all the challenges was my passion and the thing I used was never give up theory. Once when I made regular losses and felt nervous, the trading and market us to look like a big mountain to me. But finally, after taking all the good hard lessons I am fully satisfied and happy that I can live my life better with only trading.