The International Airlines Group company (IAG) is a parent company to various brands, including British Airways, LEVEL, Iberia, Aer Lingus, and Vueling. IAG share price growth began immediately after its establishment in 2011, the same year it merged with British Airways and Iberia companies. Although it experienced a massive setback in 2020 due to COVID-19 pressure, IAG was determined to get back up and maintain its position in the market.

International Airlines Group’s steady growth has attracted many investors to trade IAG shares. If you are also considering becoming a shareholder in the company, we will guide you on how to buy/sell International Airlines Group shares.

Top 3 Brokers for Buying/Selling IAG Shares

The easiest way to buy or sell IAG shares is through an online brokerage firm. Not only do brokers have access to the right exchanges where the company shares are listed, but they also allow trading of IAG shares off the exchange. This means that you can also trade the IAG shares as CFDs, indices, or even spread betting.

Keep in mind that brokers have different features, most of which won’t suit your needs. You must ensure that a broker complements your trading needs and has access to the exchanges where the shares are listed. We will guide you on how to choose a suitable stock broker for trading IAG shares later in this guide. But first, take a look below at the top three brokers for buying/selling IAG shares that we have tested and approved as experts.

1. Plus500

*Illustrative prices

Plus500 is a reputable CFD provider. It is an excellent choice for stock traders in the UK. Furthermore, the broker is highly reviewed as the best app* for CFD trading on Google Play and the App Store. You also have over 2,000 assets at your disposal to trade.

Plus500 trading charges are just heavenly. You need to make a minimum deposit of £100 to access IAG shares. The spreads you will incur rank among the lowest in the industry. However, Plus500 £10 monthly inactivity fee kicks in after only three months if your account doesn’t show any activity within that period. The broker also charges overnight, currency conversion, and stop-order fees. Its asset offerings can also be improved.

*Best rated mobile app

- Offers both CFD online trading through Plus500 CFD and investing through Plus500 Invest so that you can diversify your portfolio

- The platform, app, and all tools are developed in-house and designed to match their customers needs

- Very limited selection of assets offered, creating a risk for you to run out of options to trade and invest in

- Does not provide access to any third-party tools or platforms

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro

eToro is a world-renowned stock broker with an excellent reputation in copy and social trading. This feature makes it a perfect choice for newbies trying to understand the stock market before purchasing the IAG shares. eToro is also a considerable choice for expert traders since it hosts excellent trading tools to maximise your potential. There are also other assets to trade at eToro, including cryptocurrencies, commodities, forex, etc.

Trading shares as CFD on eToro is allowed after you make a deposit of at least $100. However, you will incur withdrawal charges and high spreads. What’s more, the copy trading platform requires a minimum deposit of $200 and at least $10 as the minimum amount per trade.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- The best option for everyone looking to start copy trading or making use of unique social trading features

- Established around the globe with millions of satisfied customers and licenses from some of the strictest financial authorities around

- Has a new investment platform which means you can use eToro to both trade and invest in IAG shares

- Customer service is only available five days a week (mon-fri) limiting the hours when you can get help and support

- Does not provide access to as many instruments and markets as some of the other top stock brokers

3. IG Markets

IG Markets is a pioneer and award-winning stock broker that allows you to trade IAG shares as CFDs. You will also trade over 17,000 assets across diverse global markets. Newbies and professional traders will benefit from the broker’s extensive offerings. This includes research tools, learning materials, and advanced platforms (L-2 Dealer, MT4, and ProRealTime). Like eToro, IG Markets hosts an IG Community platform where you will meet like-minded traders and share trading ideas to improve your experience.

On its downside, expect high fees while trading with IG Markets. You should also be active enough to trade at least three times within three months. Failure to do so will attract a quarterly subscription fee of £50.

Your capital is at risk

- More than 10,000 different international stocks on offer, including IAG shares

- Multi award-winning broker with several incredible trading platforms

- Has been around since the 1970s and offered trading services long before the internet

- High minimum deposit level that we think excludes a lot of traders for no good reason

- Aimed at advanced traders with complex platforms, tools, and features

Learn complete research that shows the best trading platforms on TradingGuide.

How to Trade IAG Shares With Broker eToro?

The above stock brokers are excellent choices to get you started. This is because trading or trading IAG shares is not as easy as it may seem, and you can lose your money if you do not choose the best broker. However, with a suitable broker, you have an increased chance of succeeding. You simply have to conduct a thorough market analysis and apply proper strategies.

That being said, let’s get into the step-by-step procedures of buying/selling IAG shares with eToro.

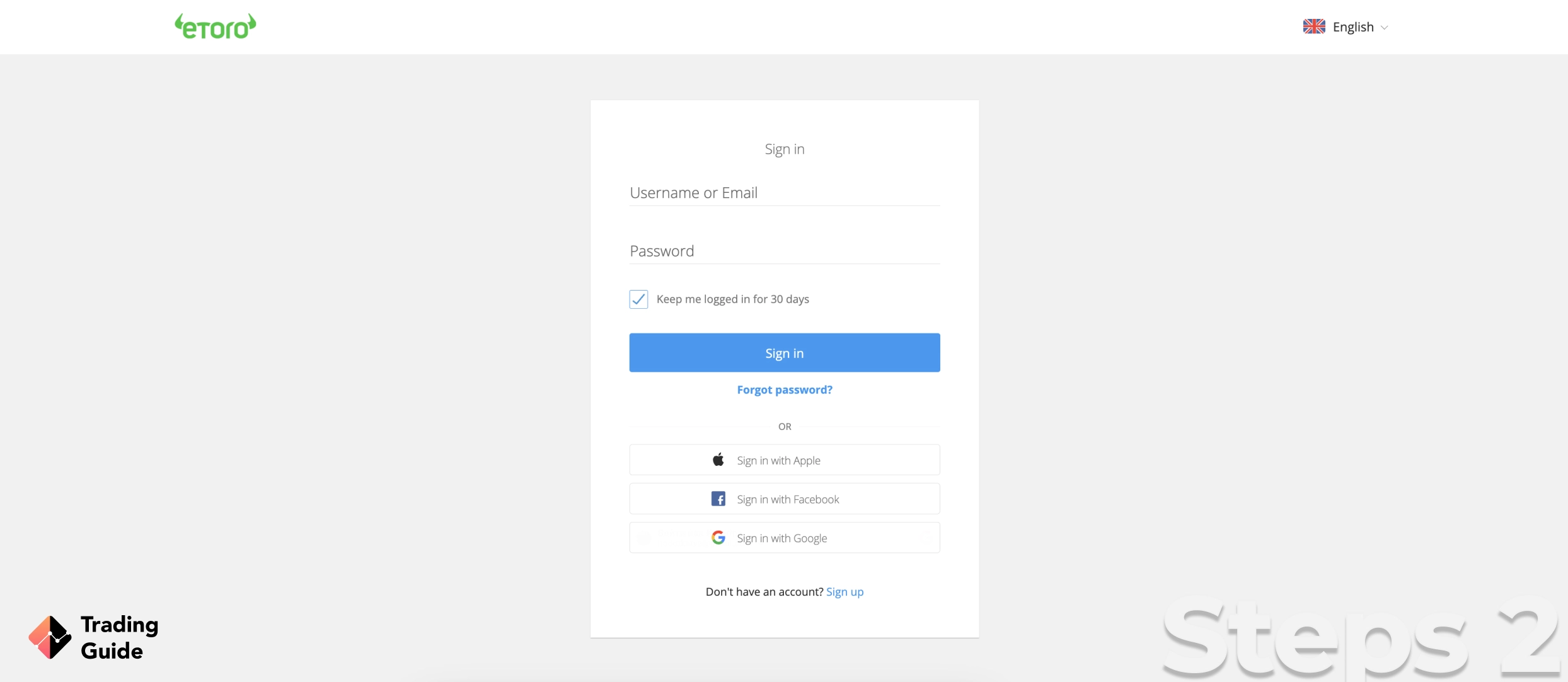

You will find links to redirect you to eToro’s website on this page. Before starting the registration procedure, ensure you go through the broker’s terms and conditions and agree to them. Also, ensure it is the right broker for you by looking at the features listed below. eToro also has a trading app. Therefore, while you can register through the desktop, it is also possible via your mobile device. You only need to download and install it on your phone.

To create a stock trading account to trade IAG shares, you will be required to provide your personal information. This includes your full name, email, location, address, phone number, etc. You will also be required to provide information about your income and create a user name.

Additionally, eToro will give you a basic knowledge test on margin trading to complete because of the potential risks of trading on leverage. The outcome of this test will determine your leverage limit.

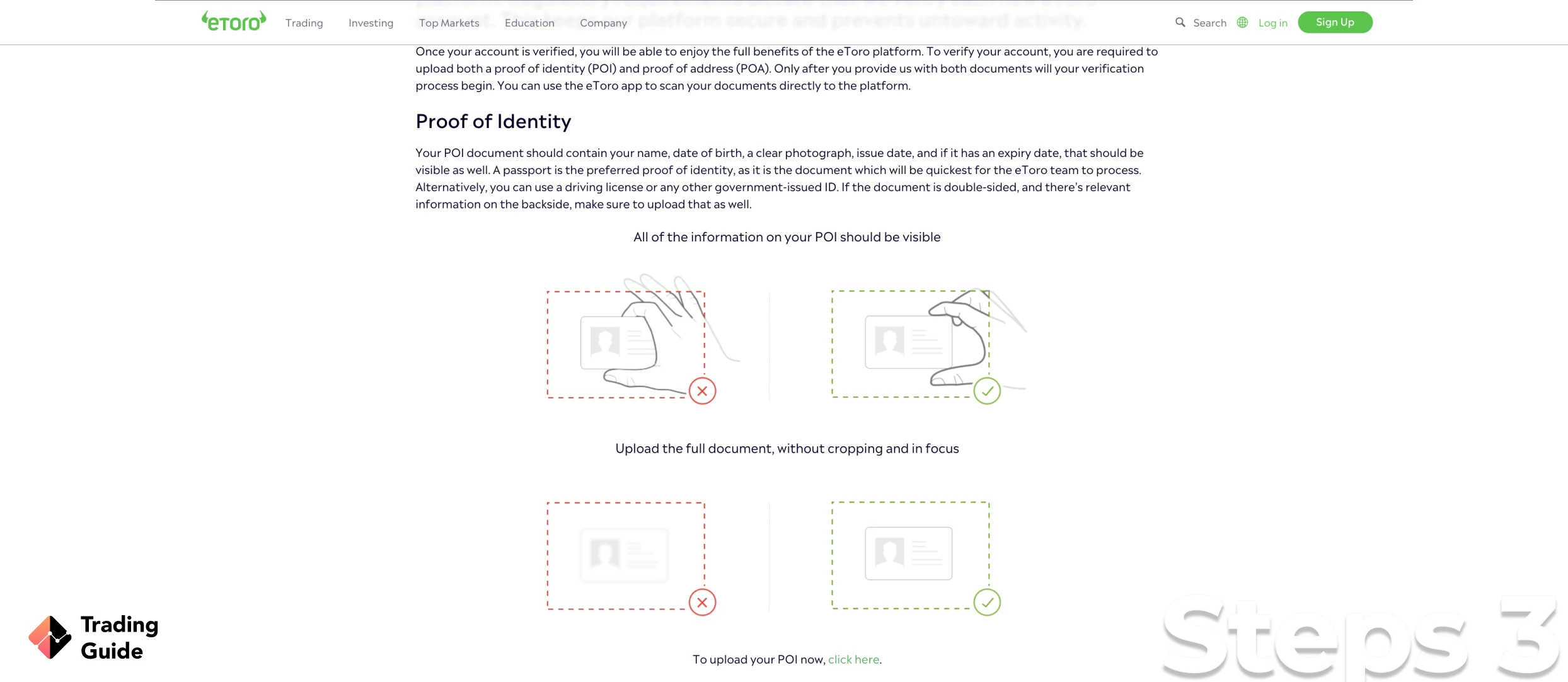

eToro must verify your identity and place of residence for you to start trading. This is one way to ensure your account is protected and is a standard procedure for all FCA regulated brokers. In this regard, a copy of your ID or passport and a utility bill or bank statement will be required. Your document will then be reviewed and verified after which your account will be fully activated. Additionally, a questionnaire is also provided for you to fill, determining the best package for your skills.

Once you receive a notification via email that your account has been activated, the next step is to make a deposit to trade International Airlines Group shares. With eToro, you will be required to deposit at least $100.

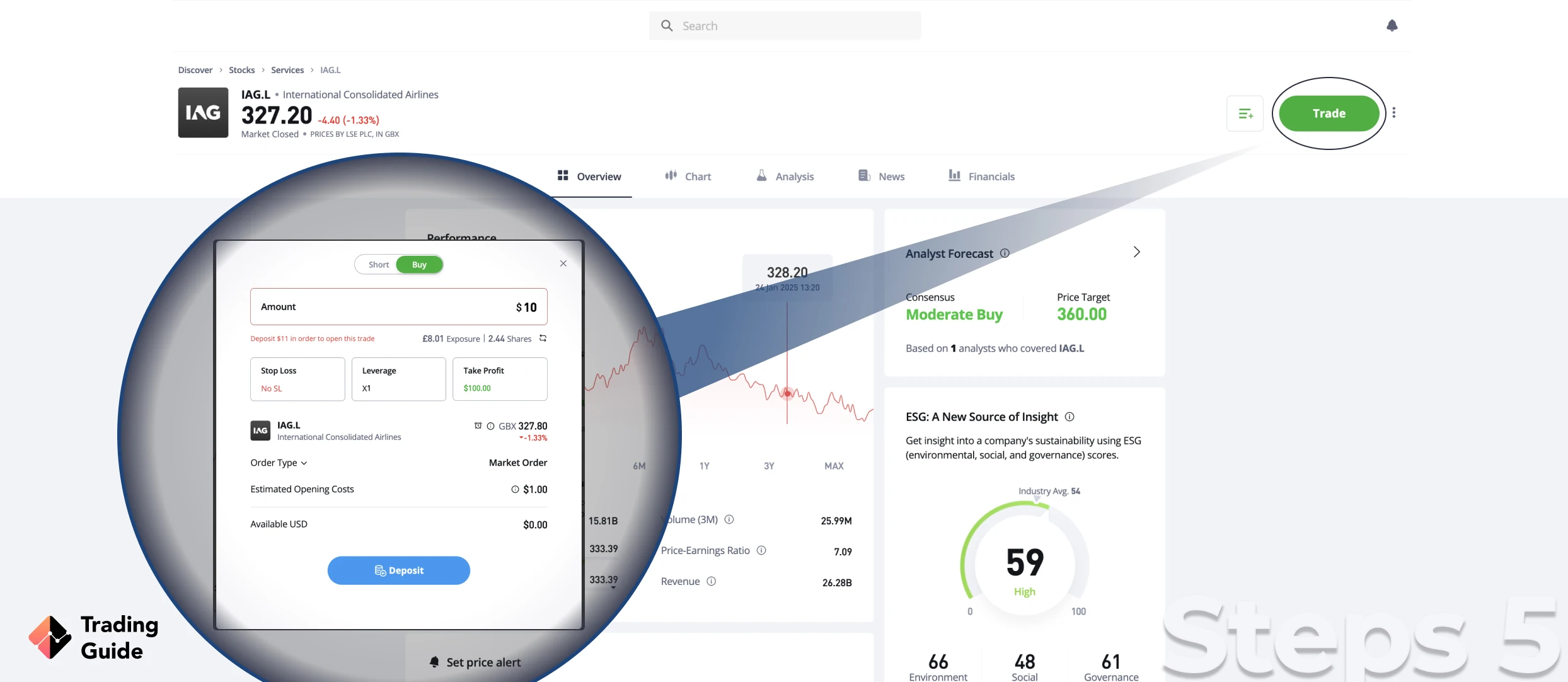

Find the IAG shares on eToro’s platform and decide how you want to trade them. You can trade them as physical assets by searching for the ticker symbol IAG or trade them as CFDs by speculating their price movements. Additionally, eToro allows index trading, meaning that you can combine several stocks in a single investment.

You need to have a budget and let it guide you in buying/selling the right amount of IAG shares. Also, whichever way you decide to trade this company’s shares, ensure you know the risks involved.

Tips on How to Choose the Best Stock Broker to Buy/Sell IAG Shares

There are many stock brokers in the UK, and you need to be meticulous when choosing one if you want to succeed in trading IAG shares. To maximise your potential, various factors must be considered when selecting the best stock broker to buy or sell IAG shares in the UK. These include:

For your funds’ safety and trading under the best conditions, ensure a stock broker is licensed and regulated within your jurisdiction area. In the UK market, the best stock broker should be licensed and regulated by the Financial Conduct Authority (FCA). Failure to choose a licensed and regulated stock broker means that you will be trading illegally, and there is no way you will acquire assistance from the government in case your broker goes against your agreement.

You shouldn’t limit yourself to trading IAG shares only. Try other markets as well, and you never know where your new interest will lie. Therefore, choose a stock broker that not only allows trading of IAG shares but other assets as well. You should also be able to trade the assets physically and as derivatives.

Nowadays, mobile trading is becoming popular since it allows you to manage your activities on the go. So, while you need a platform with an intuitive design and is user-friendly, ensure it features the same elements on its app. A stock broker’s platform should also host plenty of research and educational materials. Having a demo account is also a plus since you can practise how the broker works before taking the plunge.

Whether you are new to trading shares or are experienced, it is important to have a budget and stick to it. This means you should choose a stock broker that fits into your budget or one you can afford. It is a habit that will help you trade successfully without spending a lot of money. Therefore, confirm all the charges and requirements in a stock broker before committing.

Any stock broker you choose should have customer service to contact whenever you encounter any trading issue. You can test its response rate and reliability before making a commitment. Also, make sure the broker’s support service availability complements your trading schedule. They should also be contacted via different communication channels, including phone, live chat, WhatsApp, email, etc.

The way previous and current stock traders review a broker will help you make informed decisions. By analysing their comments on Google Play, the App Store, and Trustpilot, you will know what to expect before signing up for a trading account with a stock broker.

Find out TradeStation review in our other article.

International Airlines Group (IAG) Shares Price Today

As mentioned earlier, IAG share price has been fluctuating over the years and is currently valued at around £152. Do not worry if you want the accurate share price of IAG since we have attached this live chart below to help you track the performance of the company’s stock. You will also benefit from historical data and other information that will help develop the best trading strategy.

About International Airlines Group

International Airlines Group (IAG) is a multinational airline holding company that was established in 2011 as a result of a merger between British Airways and Iberia. To date, it is one of the largest airlines globally, thanks to its attractive revenue. The company has reached over 268 destinations and transports approximately 113 million passengers every year.

IAG is a Spanish-registered company with over 533 aircraft spread across different global regions. Its shares, which can easily be identified on a broker using the symbol IAG, are traded on the London Stock Exchange and other Spanish exchanges. It is a parent company to British Airways, LEVEL, Iberia, Aer Lingus, and Vueling.

Simply put, IAG depends on these operating companies, making it strive to create strategies that will deliver a long-term vision for the group. This simplifies the operations of these companies, allowing them to focus solely on providing the best services to clients.

Find out more about JLR IPO stocks in our other blog article.

FAQs

The same way you bought the IAG shares through a broker is how you will sell them. However, you need to wait for the IAG share prices to rise before selling for a profit. You can also sell them as soon as you realise that the stock price is going down to avoid extreme losses.

Yes. IAG share price has shown a steady growth from 2011 to 2020. Although the company underwent various challenges in 2020 due to coronavirus, it survived the pandemic. This is a clear indication that IAG has growth potential in the near future. A valid reason why you should be investing in it.

Qatar Airways owns over 25% stake in IAG company, making it the largest shareholder. Other shareholders include British Airlines, Iberia, LEVEL, and more.

No. Although IAG has been paying dividends to shareholders throughout the years, it withdrew from the program after the COVID-19 pandemic. We hope that the company will resume paying its shareholders dividends soon.

You can easily know if a share pays dividends by researching financial news sites. You can also use a broker’s screening tools to find information on shares that pay dividends.

Conclusion

Investing in International Airlines Group shares is a great opportunity to grow your money. But you need to take into account the fact that you need to be prepared for the fact that you may lose your money. You see, IAG stock prices have been performing well throughout the years, and its ability to protect itself during and after the COVID-19 pandemic speaks volumes. From our review, the company still has a lot to achieve in the coming years.

That being said, we advise long-term investors to trade IAG shares. Short-term traders should also try their luck with it, and who knows, it might just be one of the best investments to make. Lastly, always conduct thorough research and stock market analysis before trading. Do not rely on other traders’ opinions since one of the main goals of trading is to become independent.

Unfortunately, traders come to the market and try trading for a couple of months, get tired, and give up. What they don't realize is that trading is a skill and it requires time to learn.

Advice to every beginner is to learn the skill of trading first, it took 6 months at least to understand it, and don't give up before that!