As a result, Microsoft shares are among some of the most popular shares to trade. And with close to a 500% increase in the past five years, the Microsoft shares have also proven to be a profitable investment for countless traders.

Now, if you’re planning on benefitting from the Microsoft stock, you need to be prepared. In addition to analyzing the asset properly, you also have to understand how the stock works and what affects its price. This is why we created this guide to trading Microsoft shares.

Top Brokers for Buying Microsoft Shares

1. Plus500

*Illustrative prices

We like Plus500 for trading Microsoft shares in the UK. Although the broker does not support the buying and taking full ownership of the asset, you can trade it as CFDs or indices as CFD. Trading MSFT stocks as CFDs with Plus500 has many benefits. For instance, you get to enjoy commission-free trades, free transactions, and low spreads. There are also favourable leverage limits, extending up to 1:5 for retail traders and 1:20 for professionals, thus offering flexibility in trading strategies. On top of that, Plus500 has a straightforward account opening procedure and a low minimum deposit requirement of £100 to trade MSFT shares.

Besides Microsoft stocks, Plus500 is the home for additional trading securities, making it easier to diversify your portfolio without seeking another broker. Its support service team is one of the best as it responds promptly and offers relevant solutions to raised concerns. Additionally, Plus500 features a Professional Trading section, listing advanced trading resources for expert traders. For beginners, we advise you to take advantage of the broker’s demo account to learn more about the share market before transitioning to live trading.

- Commission-free share trading

- Highly rated trading app by users on Google Play, the App Store, and Trustpilot

- A user-friendly and customisable trading platform

- A reliable and responsive 24/7 support service

- No buying and taking ownership of MSFT stocks

- No third-party tools or platforms like MT5

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro

eToro is without a doubt one of the best online stockbrokers on the market right now. With millions of customers, thousands of stocks, and an award-winning trading platform designed for copy trading, eToro provides great trading opportunities for everyone.

With the broker, you can trade Microsoft Shares as CFDs but you can also profit from Microsoft shares by trading other assets where Microsoft is included, for example, the Dow Jones Industrial Average (DIJA/Dow 30) as an ETF.

eToro is the perfect choice for traders that like to copy trade and want to share trading ideas, concepts, and strategies with other traders on the eToro social trading platform. Just keep in mind that eToro is known for being a bit expensive when trading stocks.

- eToro has been driving the development of copy and social trading for over a decade

- 20+ million customers from all over the world uses eToro to trade regularly

- Also provides an investment platform to help you alternate between trading and investments

- Only provides access to blue chip stocks and has a limited selection of other assets and instruments

- The investment platform is still very basic and eToro is best suited if you want to speculate on Microsoft stocks

3. IG Markets

IG Markets is a UK-based online broker operated by the FTSE 250 company IG Markets. The broker has a reputation of being trustworthy and suitable to professional day traders trying to benefit from the Microsoft Share as well as 17,000+ other instruments.

When using IG Markets, you get the chance to choose between a number of different platforms. We suggest that you open a demo account to test them out, and remember that IG Markets offers Direct Market Access (DMA), CFD trading, and spread betting, so pick a platform that supports the method you’re planning to use.

With more than 40 years of experience in the industry, IG Markets has been providing access to Microsoft shares ever since the company’s Initial Public Offering in 1996.

Your capital is at risk

- Almost 40 years of experience offering brokerage services to UK traders and investors (founded in 1974)

- Several platforms to choose from so that you can pick the one that you are the most comfortable with

- In addition to Microsoft stocks, there is a massive selection of assets that can keep you occupied for many years ahead

- High minimum deposit requirement and advanced tools means that this is not a beginner-friendly broker

- The enormous amount of stocks on offer can make it hard to strategise properly

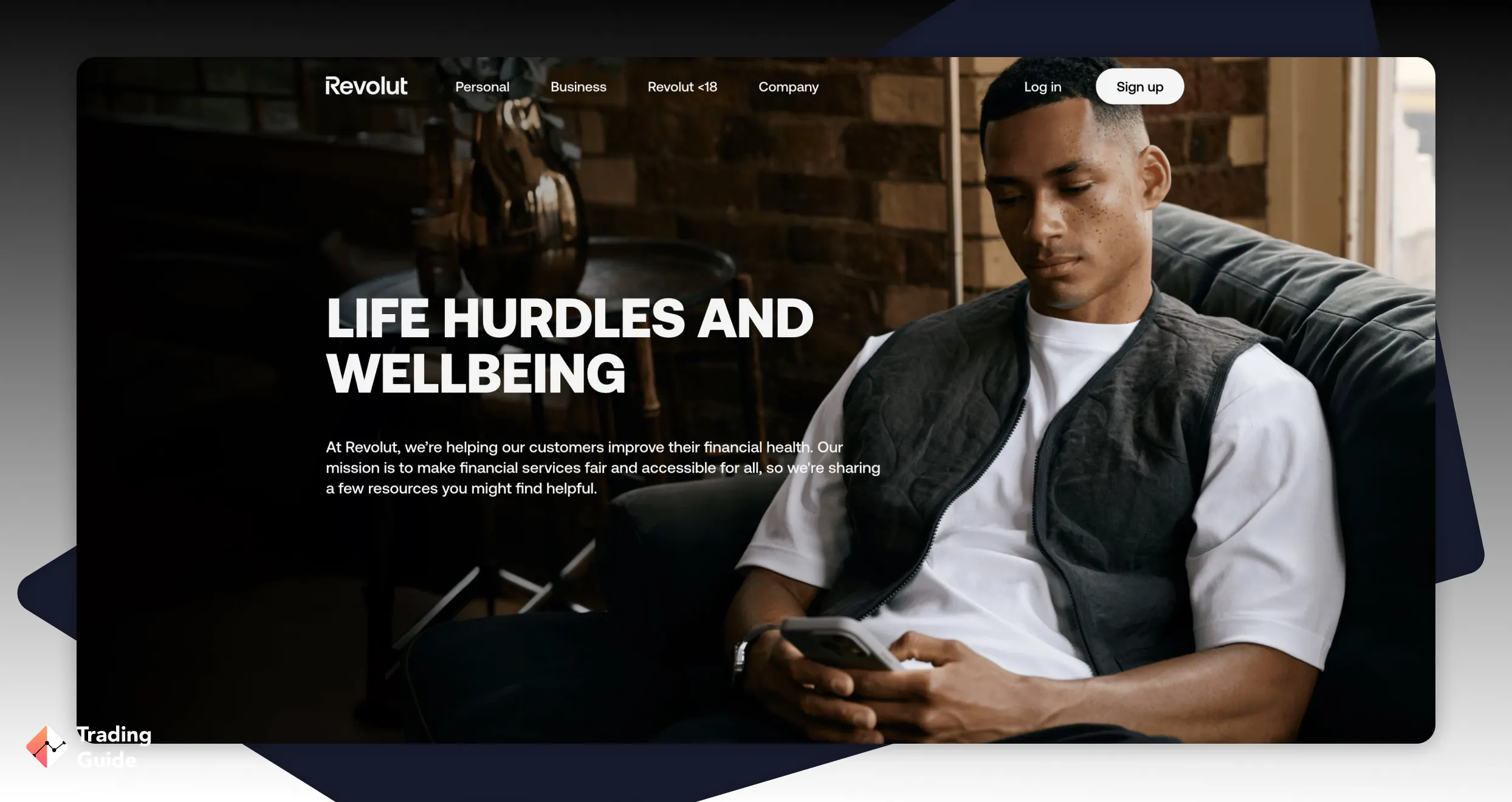

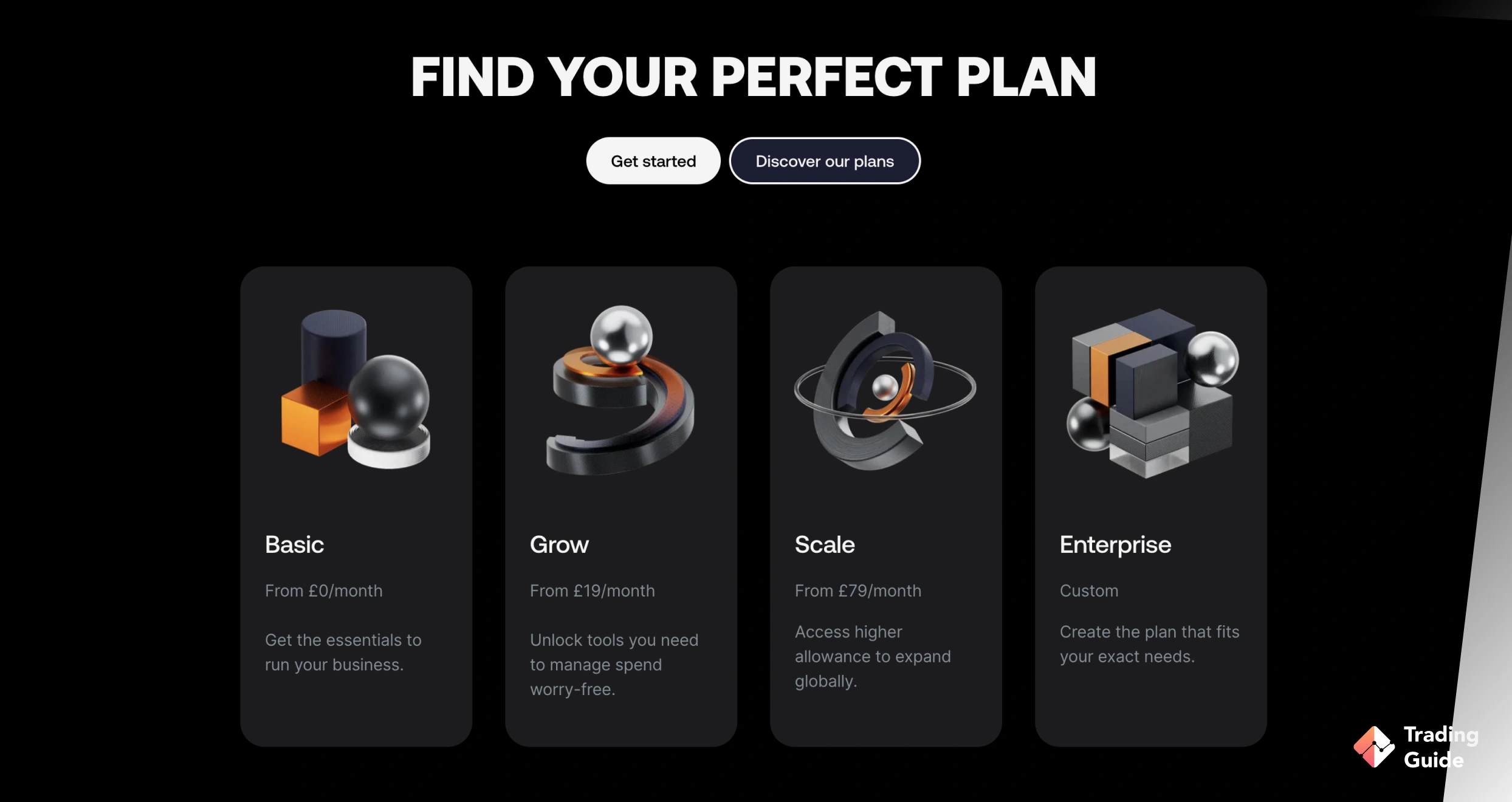

4. Revolut

Revolut is an online bank and investment broker in one. It’s also available online through the Revolut app that you download for free to your smartphone. In many ways, Revolut is best suited for mid-to-long-term investments and not for day trading. This means that there are many benefits to combining Revolut with one of the other recommended brokers.

Investing in Microsoft Shares with Revolut is very easy. All you have to do is register an account (with an associated bank card) and you get access to several leading stocks, cryptocurrencies, and other instruments.

Revolut’s bank services also provide other great benefits such as no currency exchange, instant international transactions, and a global presence.

Also, by combining the services of Revolut or Monzo with other recommended brokers, investors can enjoy the benefits of multiple platforms and maximize their investment opportunities.

- This is a bank first and a broker second, meaning it’s safe and reliable

- No-commission stock investments without other fees – you can invest in Microsoft stocks for free

- Also great for forex trading due to the lack of exchange fees

- Not as varied as an online broker when it comes to selection of assets and markets offered

- Registration is more like getting a bank account than a trading account

How to Buy Microsoft Shares With eToro?

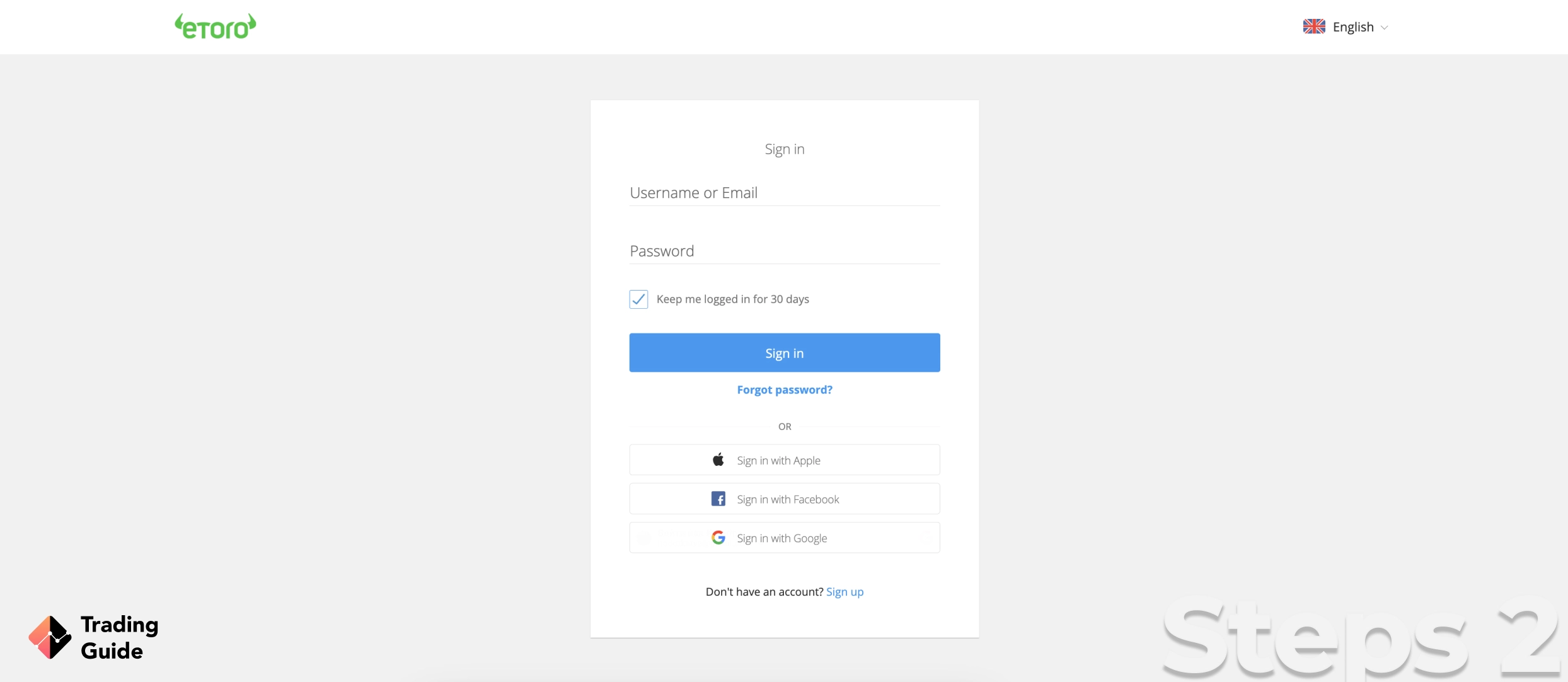

If you’ve decided to use eToro as your Microsoft stockbroker, you made a great decision. To get started, you need to visit the broker by using one of the links provided on this page – they will direct you to the registration page.

After you’ve visited eToro, you need to register your account by providing basic account information such as your name, address, email, and phone number. This information will later be verified so ensure that you submit correct personal data.

Since trading is associated with risk, eToro will also ask you about your income and have you answer basic questions about leverage trading to set a suitable leverage limit for you.

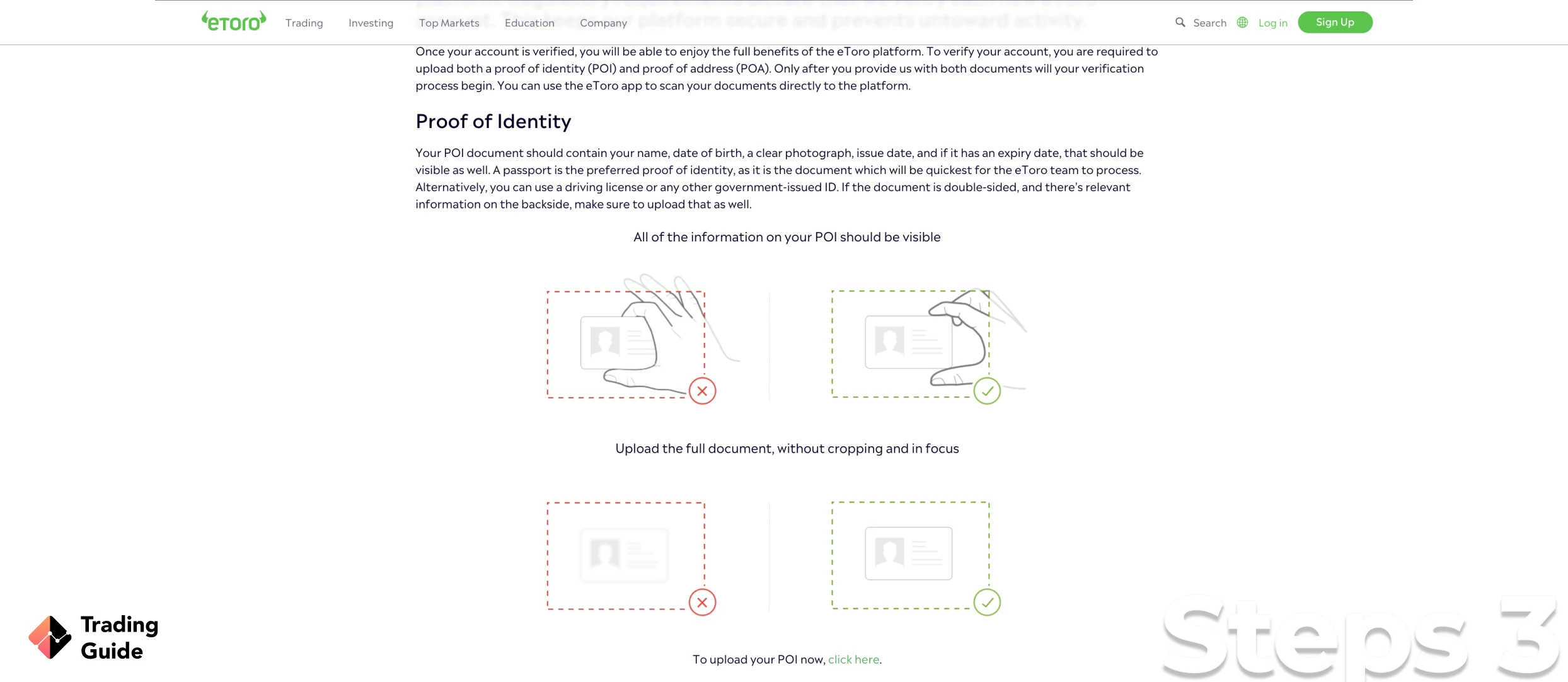

Once done with the registration process, you will have to verify your identity to gain full access to your new trading account. To do this, you submit Proof of Identity – a copy of your passport, driver’s license, or national ID – as well as Proof of Residence – a recent utility bill or bank statement.

These documents will be manually verified by eToro’s customer service before your account is opened.

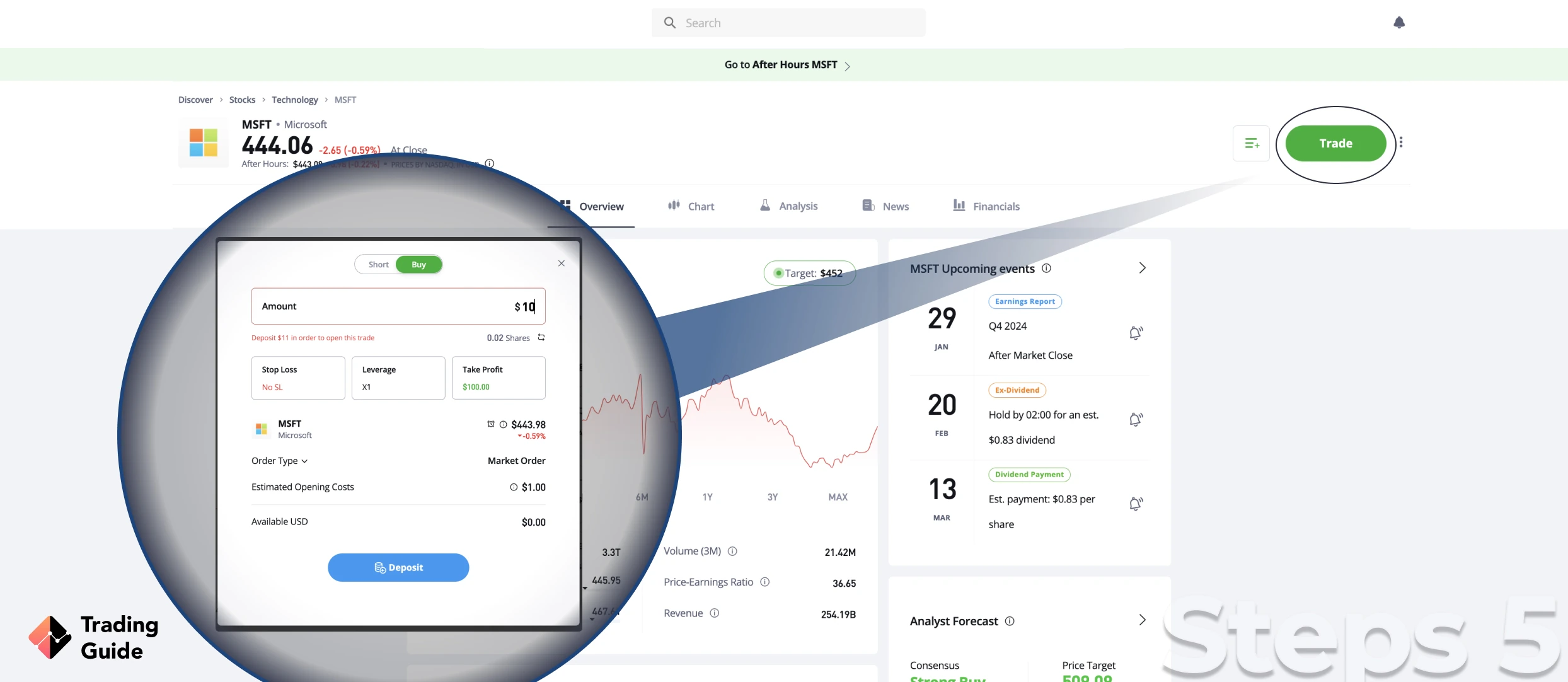

At this point, you will be able to access the eToro platform and browse around the different tools and assets. However, before you can start investing in Microsoft shares, you have to make an initial deposit.

eToro currently has a minimum deposit level of between $100 and $200 depending on the type of account you’re opening and where in the world you reside.

And that is all you have to do. You have now equipped yourself with an eToro trading account and can start trading and investing in Microsoft stock or other instruments provided by the broker.

Tips on How to Choose the Best Stock Broker to Buy Microsoft Shares

The easiest way to pick the best stockbroker to trade Microsoft shares is to use our recommendations. We have, for example, created comparisons and reviews of the leading stockbrokers, CFD brokers, investment brokers, and even trading apps. Furthermore, we have recommended the top Microsoft share brokers further up in this guide.

However, if you still want to find a broker on your own, there are a few things to keep in mind and the following factors are the most important to consider.

Trading and investing are associated with certain financial risks that you need to be aware of. Some of these risks – such as losing your invested funds – cannot be avoided while others – such as being ripped off by a broker – are easily avoided.

To make sure that you and your funds are safe while trading, you should only use licensed brokers that are regulated by the Financial Conduct Authority (FCA) for the UK market. Every broker that we recommend is licensed and can be considered safe to use.

Naturally, you have to ensure that your broker offers Microsoft shares and preferably also other related instruments such as the Dow 30. Moreover, you want the broker to be accessible on all the devices that you prefer, from desktop computers to smartphones.

Being the fact that Microsoft is one of the most influential companies in the world, most brokers provide its stock on their platforms. Making it rather easy to find a suitable Microsoft stockbroker.

All brokers charge some fees for their services. Many stockbrokers charge commission on every investment while online derivatives brokers usually use spread instead. And there is no way to avoid this which is why you need to find a broker that has reasonable fees that will not set you back too much.

In addition to trading fees, brokers also charge non-trading fees for transactions, certain services, and positions kept open overnight (when trading CFDs and forex).

Chances are that you will have questions or run into issues while using your broker. When this happens, it’s crucial that you can get the help you need in a timely and professional manner. Thus, finding a broker with great customer service is of the utmost interest to all traders.

Lastly, you do not want to rely solely on your own or our opinions and reviews of brokers, but you should also consider what other traders in your position think of the broker. This can easily be done by reading reviews on rating platforms such as Trustpilot.

In addition, you can find millions of user reviews for every top-tier broker in the UK on this website. You see, we have created all our guides based on tests performed by our experts as well as reviews from the App Store, Google Play, and Trustpilot.

We’ve done this to remain transparent and accurate in our recommendations.

Microsoft Shares Price Today

Follow live updates of the Microsoft share price below. Our tool also features historical data and several other data points that can help you analyze the trading potential of the shares.

About Microsoft and the Microsoft Stock

Microsoft is a software and technology company based in the United States. In fact, Microsoft is not just a software company but currently the world’s biggest software company with a global presence and a massive influence in our day-to-day lives. To many’s surprise, Microsoft was launched back in 1975, however, it would last until the 1990s and the introduction of Bill Gates before the company’s growth took off.

In many ways, the computer and the smartphone would not exist in the way they do if it wasn’t for Microsoft (and Apple, of course). For example, Microsoft has developed the Windows operating system, the Xbox game console, Microsoft Office as well as the American news outlet MSNBC. This means that Microsoft has changed how we live an experienced life.

Today, Microsoft produces and operates a range of software and hardware from computers and operating systems to cloud services, AI, and much more. A large part of the company is focused on research and development and is constantly breaking new ground in the field.

Read about the eBay stocks in our other article.

FAQs

At the time of writing, Microsoft shares were selling for 330+ USD and whether or not that is considered cheap is up to you to decide. However, Microsoft isn’t as expensive as some other popular tech stocks, making it a great investment for those with a limited budget.

Microsoft is publicly traded on Nasdaq in New York and yes, you can trade Microsoft shares directly. Either with a traditional stockbroker or bank or by using an online broker with Direct Market Access such as IG Markets.

Just keep in mind that there are several benefits to trading stocks as a derivative such as CFD or spread betting.

In 1998 Bill Gates owned more than 8 billion stock in Microsoft but since then, he has sold most of his ownership in the company. Therefore, he currently only owns a very small number of shares in the company that he operated for decades.

Yes, Microsoft does pay dividends to all its shareholders. Please note that if you trade Microsoft stocks as CFDs or any other derivative, you will not be eligible for dividends. Instead, you have to purchase actual stock from the company or directly from the Nasdaq exchange.

In 2021, Microsoft paid 0.62 USD cents per share in dividends, which are regular payouts that all shareholders get a part of. This number is set to change over the next quarterly payouts so if you’re a shareholder, we suggest that you keep track of the dividends through the company itself.

In 1990, Microsoft shares sold for roughly 0.5 USD which is incredibly low compared to today’s quote of over 330 USD. In other words, if you had invested a few thousand pounds in Microsoft back in 1990, you would be a billionaire today. Microsoft wasn’t introduced on the Nasdaq exchange until 1996, meaning you would have to purchase stock privately with the company before that.

Conclusion

Microsoft has been one of the biggest and most influential software companies in the world for several decades, and all the signs indicate that it will keep its role in the tech industry for many years. Thus, Microsoft has been and will continue to be a potentially fruitful investment opportunity.

Just keep in mind that you need to understand the company, its shares, and the factors that affect the price before you start trading.

When faced with a loss, Microsoft traders try to recover or average out their position in a hurry. When you face a loss, it means that the trade was wrong. Traders often overtrade to cover for the loss, which increases the risk level. Losses are part of trading, and when it happens, you need to take time out to analyze what went wrong. The earlier you accept and process the loss, the better you can avoid making more costly mistakes. When faced with a loss, traders try to recover or average out their position in a hurry. When you face a loss, it means that the trade was wrong. Traders often overtrade to cover for the loss, which increases the risk level. Losses are part of trading, and when it happens, you need to take time out to analyze what went wrong. The earlier you accept and process the loss, the better you can avoid making more costly mistakes.