If you’re considering buying Pearson shares, I strongly recommend doing so, especially if you’re a novice in the world of investing. In my expert opinion, investing your money in this UK-based company is a wise move for several reasons. First and foremost, Pearson is a household name with a rich history. The company has been in operation since 1844 and has a long-standing reputation for paying consistent dividends.

I’ve bought and sold Pearson shares for many years with no regrets. I’d like to make your investment journey smoother by introducing you to a step-by-step guide to buying Pearson shares and the best brokers to use. I’ve tested and used each of the brokers recommended here and strongly attest to their credibility, reliability, and trustworthiness.

How to Buy Pearson Shares

Below’s a step-by-step guide to buying Pearson shares in the UK. It’s a standardised process that I’ve followed over the years when purchasing these assets from various service providers, such as eToro and IG Markets.

Research and understand what Pearson shares before risking a single dime. I’ll introduce you to Pearson PLC and the current price of this company’s stock in a jiffy. However, it’ll be just a highlight, as I can’t cover everything in a single guide. You should conduct independent research and check everything from Pearson PLC’s financial health to its share price performance over the years. I also recommend reading expert forecasts and analyst opinions.

You have to use a broker to buy Pearson shares. I’m not talking about just any broker but a reliable and trustworthy service provider. To ensure the safety of your money, data, and investments, choose a stockbroker that’s regulated by tier-1 authorities, such as the Financial Conduct Authority (FCA), the Financial Industry Regulatory Authority (FINRA), and the Australian Securities & Investments Commission (ASIC). Your chosen service provider should also have a strong track record, excellent support, and unwavering transparency.

After choosing a regulated and credible broker, read the T&Cs, then hit the sign-up button if everything meets your satisfaction. Most investment platforms require new clients to provide their full name, email address, and address at sign-up. You might also be required to submit information related to your employment and financial status. Finally, your chosen broker will request that you set up a password strong enough to prevent unauthorised access. Follow every step in the registration process and submit accurate details.

Regulated brokers require new signups to complete KYC verification. Based on what I’ve experienced while investing with different platforms, the first thing you’ll be required to do is verify your identity by taking or uploading a photo of your original ID. Some brokers also ask potential clients to take a selfie while holding the requested form of identification. Then, you’ll need to prove your UK residency with a proof of address (POA) document, such as a bank statement or utility bill.

Wait for the broker to verify your account, then make your first deposit. Use a supported funding method – most platforms allow bank transfers, debit/credit cards, and e-wallet deposits. Check if the service provider has an initial funding requirement and ensure you fund your account with nothing less than the mandated minimum. Once the money is deposited into your account, search for Pearson shares and make your first purchase.

Best Brokers to Invest in Pearson Shares in the UK

I’ve tested and used countless brokers over the years. Some of those I encountered were nothing short of excellent, while others were shoddy and frustrating. The last thing you want is to be stuck with a service provider that has critical shortcomings, such as high fees, poor support, and transaction issues. Fortunately, all you have to do to avoid them is commit to the exceptional brokers I’ve reviewed below.

The brokers I’m about to recommend are the cream of the crop. I consider them better than their counterparts in terms of what matters most, including security, reliability, affordability, and investment products. I’ve chosen them based on personal experience and feedback from other seasoned investors.

1. eToro

eToro is one of the best stock brokers you can use for buying Pearson shares in the UK. Besides having a user-friendly platform, the broker hosts one of the best learning and market analysis resources I’ve ever encountered. That includes a demo account funded with £100,000 in virtual funds to get you started. Additionally, I consider eToro the best social and copy trading broker because the platform lets you meet like-minded traders, copy trades with high-profit potential, and share ideas. You can also diversify your portfolio with additional assets from eToro, including cryptocurrencies, forex, commodities, etc.

- User-friendly platform interface

- A great wealth of educational resources

- 7,000+ financial assets, including Pearson shares

- Supports social and copy trading

- Ready-made investment portfolios available

- £10 monthly inactivity fee

- Doesn’t offer ISAs and SIPPs

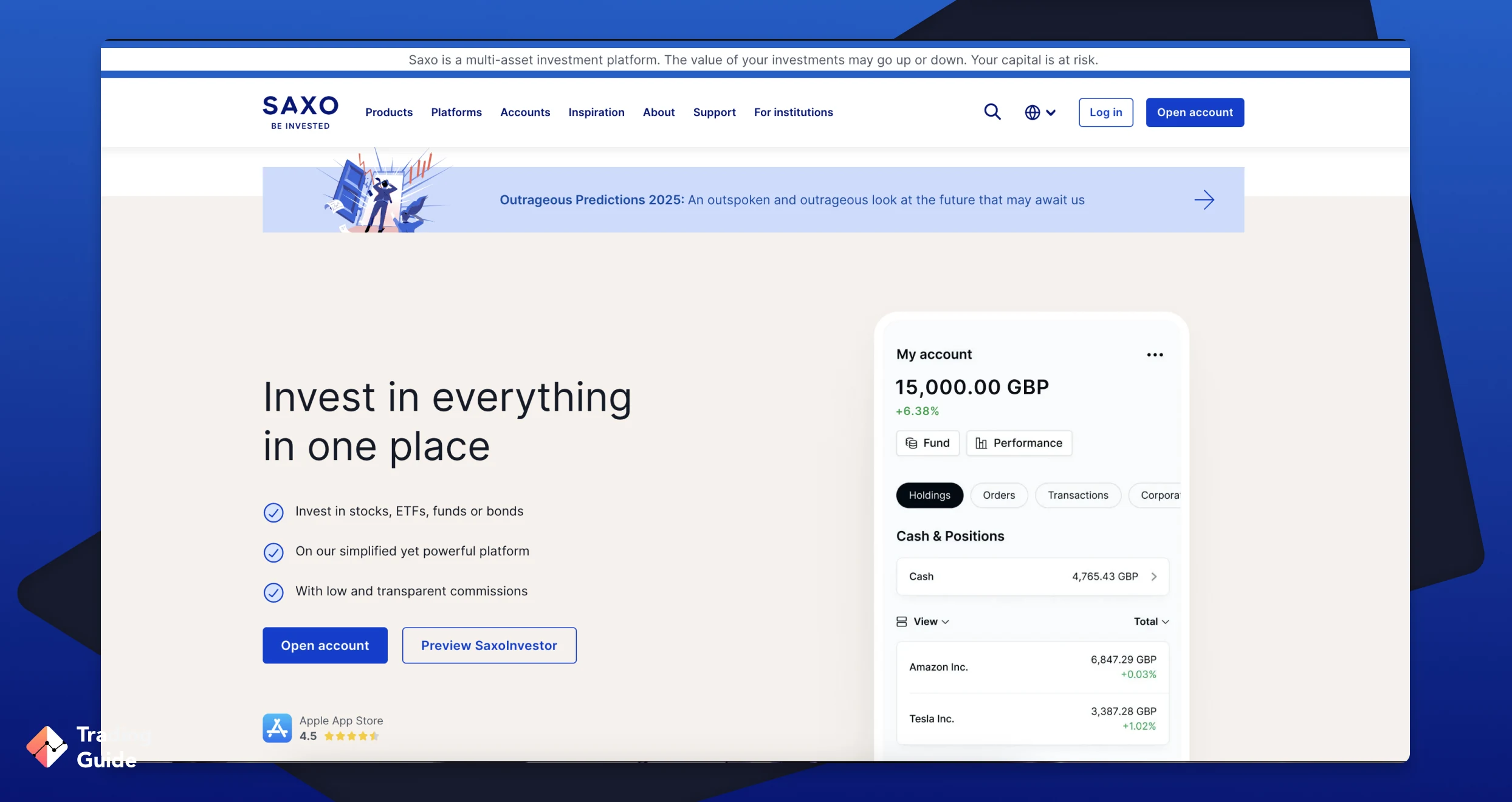

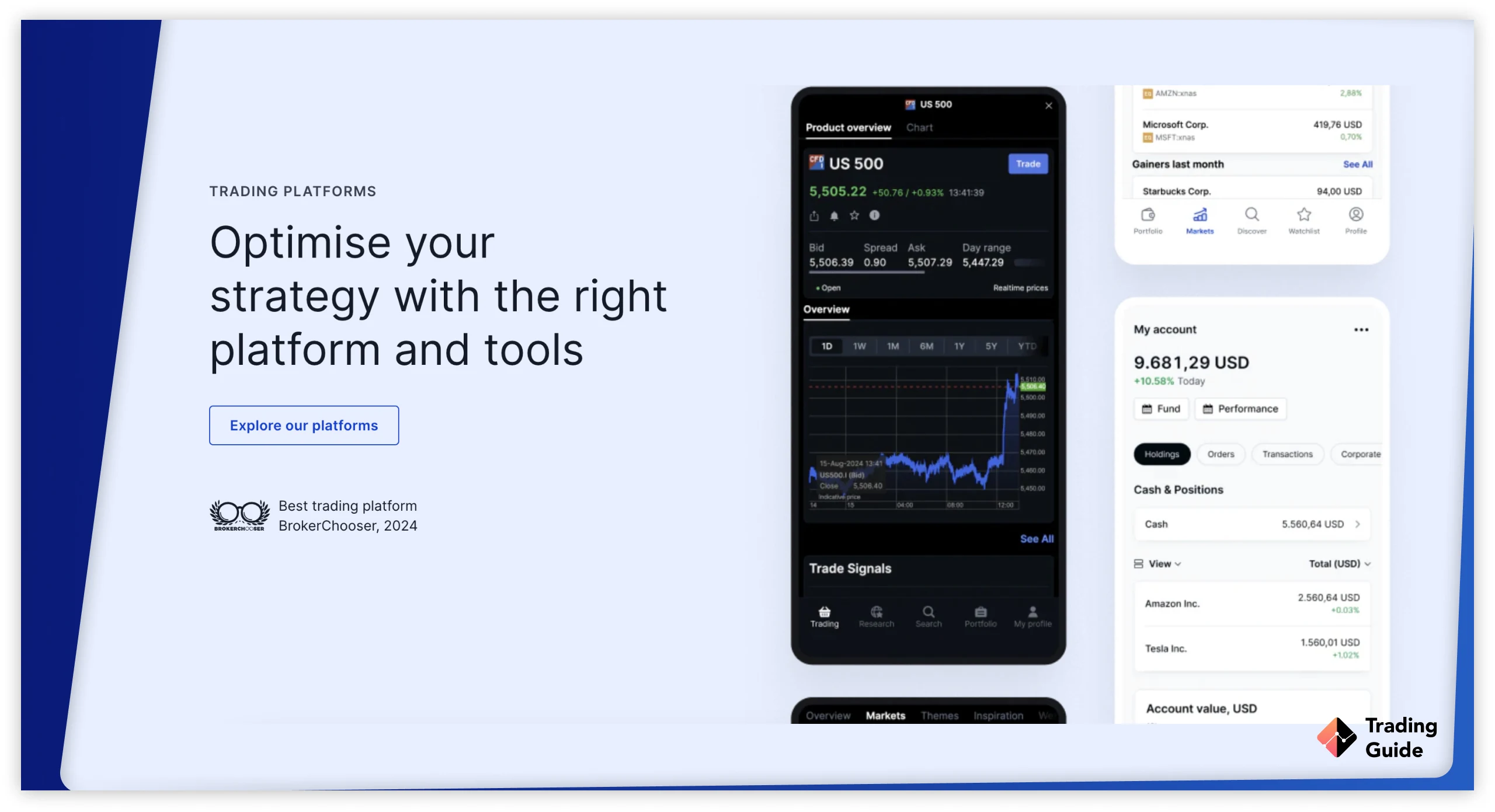

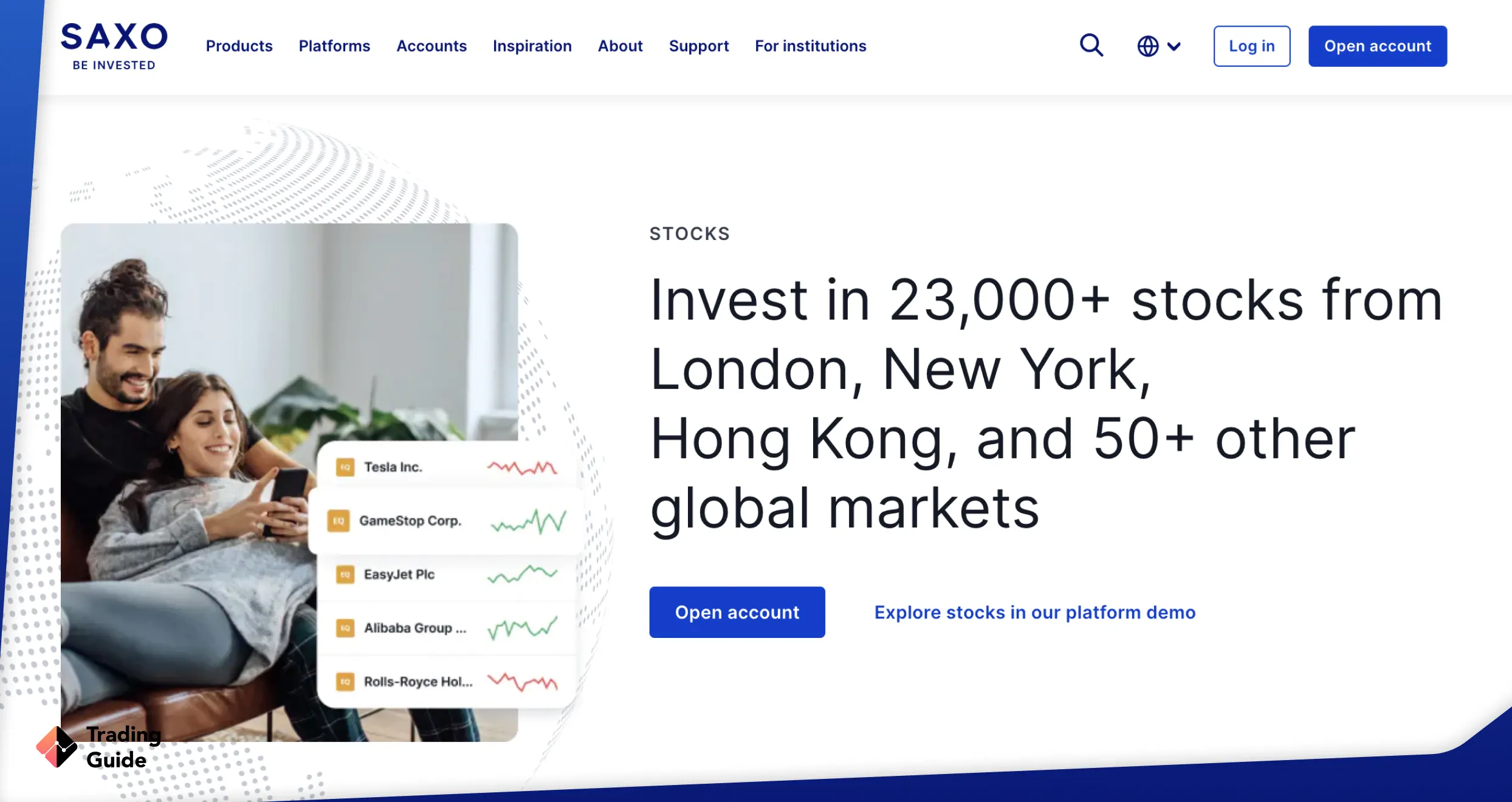

2. Saxo

Saxo is an exceptional broker that consistently goes above and beyond by offering more than its conventional peers. The platform has over 70,000 investment products that I discovered, from 23,000+ stocks from companies like Pearson and corporate/government bonds to CFDs on forex, commodities, etc. In addition, Saxo offers ISA and SIPP accounts. With these account options, you can buy Pearson shares and other financial assets and enjoy significant tax advantages. I also recommend this broker because it has no minimum funding requirement, low charges, and great offers for both individuals and institutions.

- Investors have access to 71,000+ products, including Pearson shares

- Low commissions from 0.08% on UK stocks

- No set minimum deposit requirement for Classic users

- Investors can leverage the tax benefits of SIPPs and ISAs

- Caters to both individual and institutional investors

- Up to 4% annual custody fees for Classic users

- £200k and £1 million minimum funding requirements on Platinum and VIP

3. IG Markets

IG Markets is an award-winning broker that I highly recommend because, first, it offers Pearson stock investment and derivatives trading on a user-friendly and intuitive platform. What’s more, the broker provides a demo account to prepare you before investing in the real market. IG Markets is also one of my favourites since it has a social trading platform perfectly tailored for like-minded traders who want to meet and share trading ideas. In addition to Pearson shares, you can invest in crypto and 11,000+ additional stocks on this platform. You can also trade CFDs and enjoy tax-free profits from spread betting.

Your capital is at risk

- 11,000+ stock products, including Pearson shares

- Investors can also buy crypto and ETFs

- Supports CFD trading and spread betting

- No minimum deposit requirement

- £0 commission on many shares, including UK assets

- £24 custody fee for all accounts with less than three trades per quarter

- £15 fee on same-day bank transfers of less than £100

4. CMC Markets

CMC Markets is another trusted broker that allows you to invest in PSON shares. I tested its NextGeneration platform and discovered it has an intuitive design and is easy to use, supporting all types of traders. Additionally, the broker offers the MT4 platform, which is best suited for forex traders. CMC Markets doesn’t have a minimum deposit requirement, and making deposits and withdrawals is also free of charge. However, you can only trade PSON stock as a CFD and through spread betting, as the broker does not have access to the LSE, where Pearson shares are listed. The support service offered also operates only five days a week.

- 12,000+ tradable financial instruments, including PSON

- Intuitive, user-friendly UI

- Supports CFD trading, options trading, and spread betting

- Resource-rich learning hub

- Traders have access to MT4 and TradingView

- Higher commissions and spreads than its peers

- £10 monthly charge for inactive accounts

5. XTB

XTB is qualified to be on my list of the best brokers for several reasons, with its diverse asset offerings at the top of the list. This broker’s users can invest in over 5,000 stocks from a broad range of companies, including Pearson PLC, Netflix, Apple, Tesla, and Anglo-American PLC. You can also buy ETFs and trade CFDs on forex pairs, commodities, indices, and more. The other reason I recommend XTB is that this broker has simplified things with Auto Invest and also allows its users to open stocks & shares ISAs. Not to forget, this service provider has no set initial funding requirement, low charges, and powerful trading and investment tools.

- 5,000+ stock products, including PSON

- Stock investors can also buy ETFs

- Supports forex and CFD trading

- Low commissions from 0%

- Investors can start with as little as £10

- £10 monthly inactivity fee for dormant accounts

- Withdrawals below £50 attract withdrawal fees

Pearson Stock Price Today

Pearson UK share prices have fluctuated throughout the years, primarily due to changing market conditions. However, the ability for Pearson to remain popular over the decades makes it a good buy. For this reason, I urge you to stay up to date with the company’s share price to create the best investment strategy. That said, I have included a live chart below, showing today’s Pearson’s share price in the UK, as well as historical information that can help you track the stock’s performance.

About Pearson

Pearson is a British multinational educational publisher founded in 1844 by Samuel Pearson. The company was originally founded as a construction business but switched to a publishing business in the 1920s. Today, it operates in over 70 countries and generates 60% of its sales from the US college education system. It provides learning technologies and educational materials to educational institutions, professional bodies, corporations and governments.

Pearson is also the owner of Addison-Wesley, Scott Foreman, Longman, Peachpit, eCollege, and Prentice Hall. The company has a primary listing on the London Stock Exchange and is a member of the FTSE 100 Index. It has a secondary listing on the New York Stock Exchange in the form of American Depositary Shares.

The company’s share price has increased significantly in the past six months. In fact, PSON is one of the best blue-chip performers in the FTSE 100 so far this year. To buy Pearson shares on the London Stock Exchange, you need a reliable stockbroker in the UK, like the ones we recommend above.

As you consider investing in Pearson shares, exploring the opportunities presented by Carnival shares and Spotify shares could be beneficial to enhance your investment strategy.

Is Pearson a Safe Investment?

My expert take is that Pearson is a safe investment. This company has been in operation for nearly two centuries and is one of the most trusted brands today. It serves millions from 70+ different countries and boasts billions in annual revenue. In 2024 alone, Pearson PLC’s reported annual revenue was a whopping 4.539B USD. This company’s dominant position and success make its shares a good buy in my opinion.

With that in mind, while assessing whether Pearson is a safe investment, factor in your definition of “safe.” If it includes a company with strong financials and extremely low odds of going bust, then yes, Pearson is a safe investment. You should also consider buying Pearson shares if your target is capital preservation and a steady flow of dividends.

If you’re looking to earn from short-term speculation, Pearson isn’t for you. I recommend searching for assets that often experience significant price fluctuations, such as small-cap tech stocks, forex pairs, and digital currencies.

FAQs

Yes. Pearson share price has been increasing in the past few months supported by the company’s solid financial health. The company is also on track to meet its full-year profit and sales expectations, despite the current inflationary environment.

Pearson shares keep fluctuating, and it can be a little challenging to know the exact PSON share price. However, you can use our live chart above to help you understand the company’s current share price and decide the best time to buy the stock.

Yes. Pearson shares are available for purchase via the London Stock Exchange. You can purchase Pearson stock using an authorised broker in the UK like those mentioned above.

Yes. Pearson paid a dividend of 6.6p per share on 20th September 2023. The stock has an annual dividend yield of 2.21%.

Expert Opinion

As a seasoned investor who has tracked countless stocks and shares across many sectors, including education and tech, I believe Pearson shares are worth buying. This asset may not be a classic high-yield stock, but it offers steady dividends, making it an excellent pick for income-focused investors. Plus, many believe it’s undervalued and will rise in value by up to 77% by 2030.

That said, if you choose to invest in Pearson shares, I recommend making your portfolio more aggressive by diversifying with high-growth assets, such as NVIDIA, Fevertree Drinks, and Darktrace stocks. You can allocate approximately 70% of your capital to PSON and invest the remaining 30% in high-growth stocks, such as the ones I’ve mentioned. That is the best way to ensure you enjoy long-term stability while putting yourself in the best position to rake in massive returns.