Pets at Home is the largest pet supply supplier in the UK. The company was founded in 1999 and is already an FTSE 250 company, meaning it has provided incredible investment opportunities for many years.

Using the following guide, you will get all the information and data you need to start analyzing the stock to eventually buy Pets at Home shares like a professional.

Top 3 Brokers for Buying Pets at Home Shares

When looking for a broker to buy Pets at Home shares from, you have two options. Either you spend countless hours reviewing, testing, and comparing all the top brokers in the UK, or you rely on our recommendations.

Our team of experts has spent years reviewing all the top-tier brokers in the region and are convinced that the following three are the top three best PETS brokers right now. On a side note, we recommend that you open a demo account with your broker before you start trading. That way you can ensure that the broker is actually a good fit for you.

1. eToro

eToro is one of the top-ranking online brokers ever. With a groundbreaking copy trading feature, a solid selection of assets (including PETS Shares), and a phenomenal reputation, eToro is a great suit for most brokers.

The broker has a bespoke platform with sophisticated tools so we highly recommend that you start trading using your virtual demo account. Once you get a feel for the platform, you can start trading Pets at Home Shares, either on your own or by copying other traders.

The one downside with eToro is that it’s a rather expensive broker that not everyone can afford. Therefore, please check their spread and other fees before you start trading. That way you can avoid disappointments when taking home your first profit.

- Best broker for copy trading stocks in the UK

- Low minimum deposit requirement

- Extensive selection of learning resources on its Academy platform

- High stock trading fees

- Copy trading platforms’ minimum deposit requirement is high (£500)

2. IG Markets

IG Markets has been the number one online broker in the UK for many years. The broker is operated by IG Group which is an FTSE 250 company and has a reputation for being honest and transparent.

Generally speaking, IG Markets is a broker for professional traders since all the provided platforms are highly advanced. Although, using the IG Markets demo account you can practice trading and get up to speed with the different tools offered.

All things considered, if you want one of the best available experiences when investing in Pets at Home, we recommend that you give IG Markets a try.

Your capital is at risk

- Hosts a social trading platform to help you connect with like-minded stock traders

- A straightforward account opening procedure

- An IG Academy available hosting plenty of learning tools for the stock market

- High minimum deposit requirement

- Its platform can be challenging for newbies to navigate

3. CMC Markets

CMC Markets has managed to do something rather unique. Namely, offering a service that is both sophisticated and affordable. With a zero minimum deposit level and the advanced NextGeneration platform, CMC Markets caters to both those with limited budgets and professional day traders.

In addition, CMC Markets has a massive selection of more than 11,000 assets. Most of these are stocks traded as CFDs, including Pets at Home, but you can also enjoy forex, commodities, index, and cryptocurrency trading with the broker.

If that sounds interesting, we suggest you open up a CMC Markets demo account and take the platform for a spin before making your final decision.

- An award-winning stock broker that has been existing for over four decades

- Additional 9,000 shares plus indices, forex, commodities, and more for portfolio diversification

- Low minimum deposit requirement and trading fees, making it excellent for newbies and low-budget traders

- You can only trade Pets at Home shares as CFDs

- CFD positions left overnight attract a fee

How to Buy Pets at Home Shares With eToro?

To get started trading Pets at Home shares, you need to open a brokerage account. To explain this process, we will be using eToro as an example although the same process is used for every top Pets broker in the UK.

Also, the process is straightforward and if you’re prepared with the necessary documents, you can be done within minutes. The one thing that may take a little longer is the verification process (that we’ll explain shortly) since that is processed by the broker itself and, thus, out of your control.

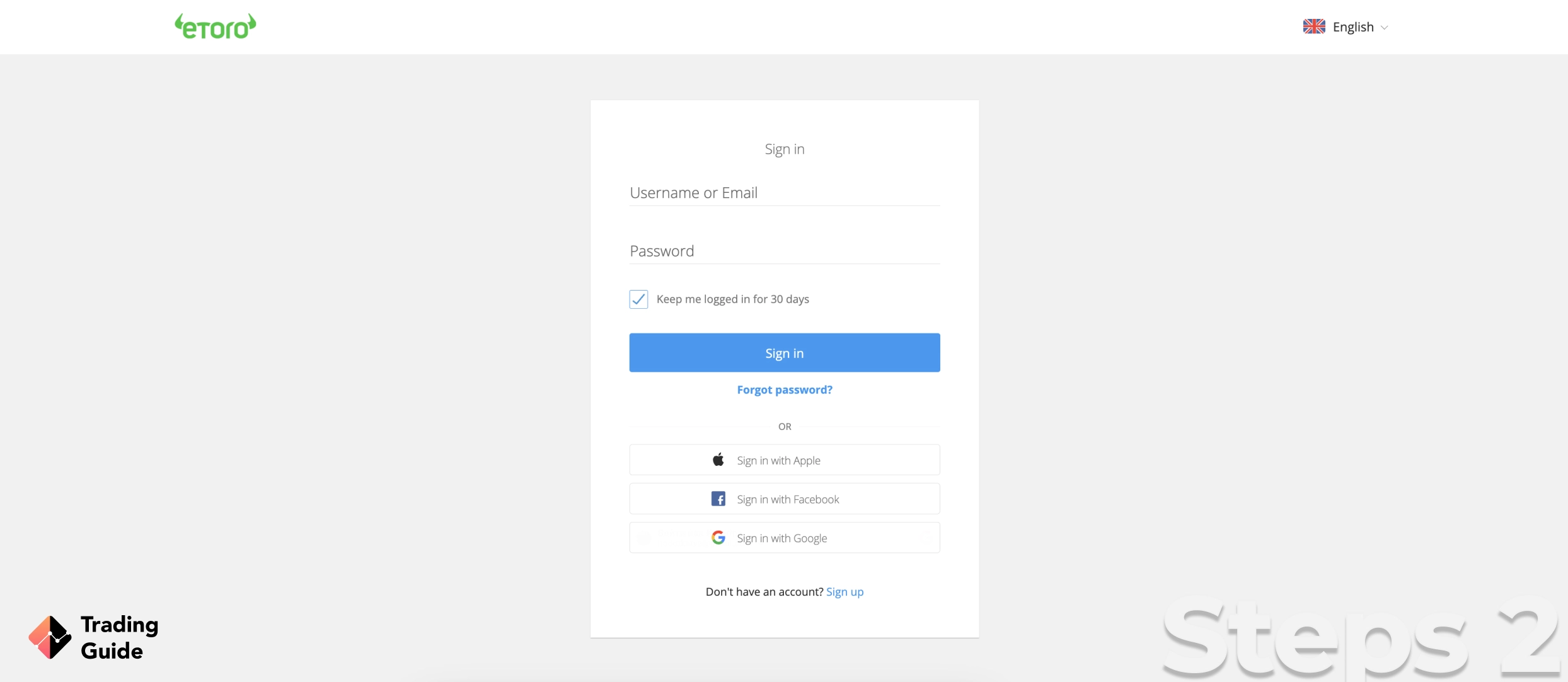

To get started, visit eToro using one of the links provided on this page or anywhere else on this website. By doing so, you will be directed directly to the registration page.

If the links, for some reason, don’t work, you can visit the broker’s website and click the “Join Now” button. Note that you can open an account using your computer or smartphone.

Once the process has been initiated, you will be asked to provide basic information about yourself such as your full name, address, line of work, email, etc. This will serve as the foundation for your account.

To protect you from unnecessary losses, eToro will ask you to answer a set of questions about leveraged trading, financial markets, and risk. This is later used to determine the level of leverage and margin that will be made available to you.

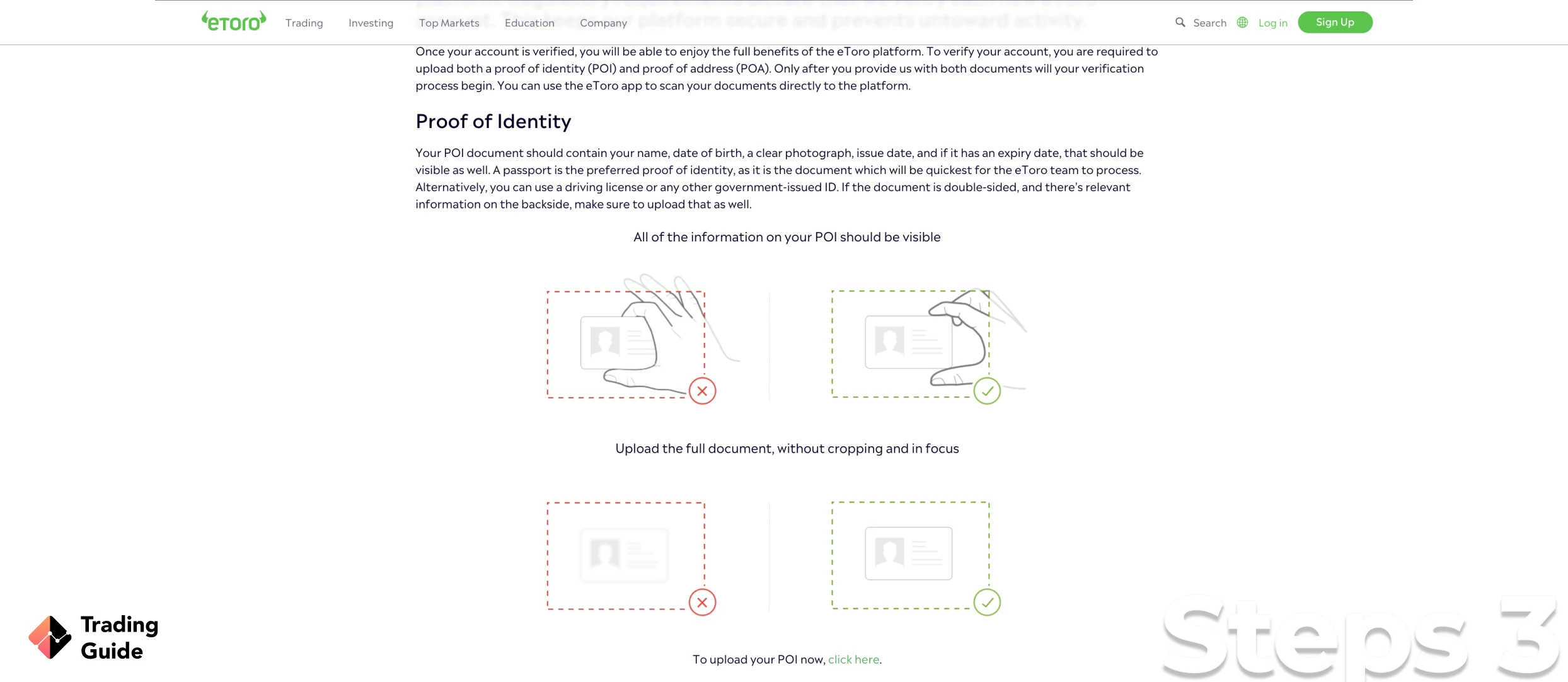

Every financial institution in the UK is regulated by the FCA and they have strict laws on customer registration. This means that you and everyone else will have to verify your identity before you can start trading.

There are two documents needed for this: a proof of identity (copy of your ID) and a proof of residence (copy of utility bill or bank statement). eToro will review these documents manually before you’re verified. And since every verification is handled manually, it can take up to 48 hours before it’s done.

The last step before your account is fully activated is to make an initial deposit. Now, eToro has a minimum deposit requirement of £200 (£500 for wire transfers) that has to be fulfilled to start trading.

If that amount sounds too high for you, we suggest you register with a broker that has a lower requirement or no requirement at all.

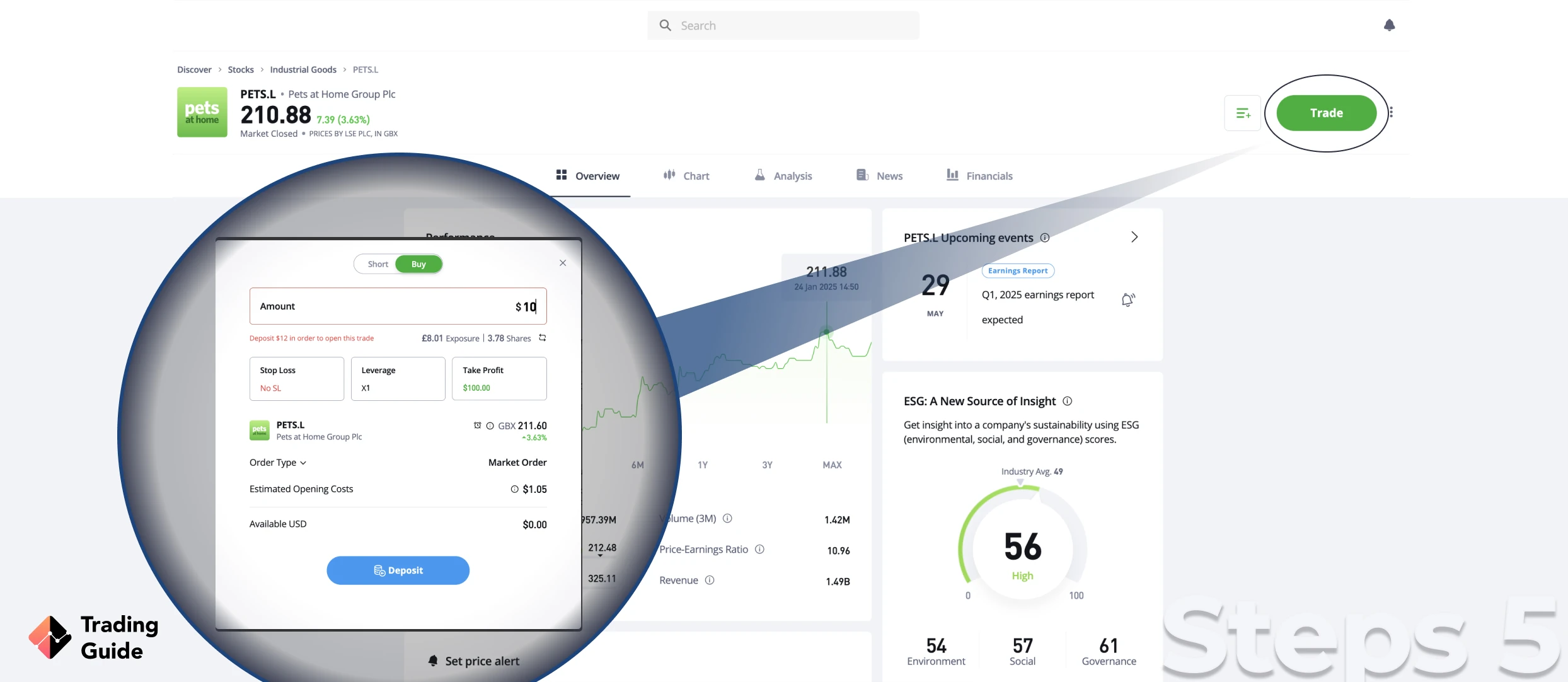

As soon as you’ve been verified and your first transaction is completed, you’re good to go. You can now start trading Pets at Home shares with eToro.

If you’re just getting started with trading, we strongly advise you to start small and slow and now invest larger amounts until you’re comfortable. And don’t forget that eToro’s demo account is a perfect tool for practice.

Tips on How to Choose the Best Stock Broker to Buy Pets at Home Shares

From experience, we know that the easiest way for retail traders to find a broker to buy PETS shares or any other form of share is to ask a set of easy questions. Of course, you could also rely on our detailed and unbiased reviews and comparisons, but if you want to find a broker on your own, start off by asking these questions.

Your main concern has to always be your own and your fund’s safety and the only way to ensure this is to only use regulated brokers with an FCA license since they’re responsible for the UK finance market. If you live somewhere else in the world, there are other regulators such as ASIC (Australia), CySEC (Europe), and CFTC (United States).

Naturally, you also have to find a broker that offers access to Pets at Home shares. But you’re most likely not only going to trade that share and should find a broker that also offers access to other markets that you’re interested in.

Moreover, you need a platform that you feel comfortable with and that is available both on desktop (for serious trading) and mobile devices for keeping track of price changes and your open positions wherever you are.

In the end, your choice of broker is a personal choice and you should pick the broker that you like the best. However, we still recommend that you check out what others have said about the broker.

For example, check out our in-depth reviews and check out customer feedback from Trustpilot, etc. To make this as easy as possible for you, we have combined both our experts’ opinions and millions of user reviews in all our broker recommendations.

Lastly, you need to set a budget that suits you and find a broker that fits within that budget. It will never be completely free to trade PETS shares, but by choosing the right broker, you can avoid a substantial part of the fees charged by others.

Most online brokers provide CFDs and therefore do not charge commission. Instead, they use a fee called spread which is the difference between the bid and the ask price.

Pets at Home Shares Price Today

One of the most crucial pieces of data that you need to invest in this company efficiently is the latest Pets at Home share price. Without this information, you will only be guessing which is a “strategy” that always leads to massive losses.

That’s why we have included this sophisticated and detailed stock price tool where you can find the latest Pets at Home shares price at any given time. Better yet, the tool also allows you to analyze the historic price to find trends and other investment options.

About Pets at Home

Pets at Home is a UK-based retail chain for all things that your pet might need. They provide everything from toys and accessories to pet food and medication. The company was launched in 1999 and has experienced incredible growth since, making the Pets at Home share one attractive investment.

Today, Pets at Home is the largest pet supply company in the UK and since being introduced on the London Stock Exchange (LSE), the company has grown into one of the UK’s top 250 companies and is thus included in the FTSE 250.

In 2020, Pets at Home had revenue that surpassed £1 billion and is on track to break that number by quite a bit in the coming years.

FAQs

Yes, Pets at Home Group PLC (PETS) is listed on the London Stock Exchange (LSE) which means you can trade and buy Pets at Home shares from online brokers. PETS is also a component in FTSE 250 which is an index that tracks the 250 largest corporations in the UK.

Companies of this size are typically more available than smaller stocks and you can trade Pets at Home shares with every top-tier broker in the UK.

Luckily for all Pets at Home shareholders, the company does pay dividends. This means that you and everyone else with PETS shares get a part of the company’s profit every year.

Please note that trading Pets at Home shares as CFDs or spread betting the company will not make you eligible for dividends. For that, you need to own physical stock in the company.

Since its initial public offering in 2014, Pets at Home has typically paid dividends twice a year. However, sometimes they make extra payments due to special reasons or events so keep an eye on the dividends plan so that you don’t miss the next payout.

In 2010, Pets at Home was acquired by the Private Equity House, KKR, and before that the company was owned by the European Private Equity firm, Bridgepoint. However, Pets at Home was originally launched and owned by Anthony Preston.

Not only is Pets at Home a UK business but are one of the 250 largest companies in the UK and a component of the FTSE 250 index. The company was launched in the UK (in Chester) and still has its headquarters in Handforth, Cheshire.

In addition, Pets at Home is the largest supplier of pets products in the country and one of the biggest in all of Europe.

Conclusion

Have you ever wondered if you can invest in or trade pets? Well, by trading Pets at Home shares you do get a chance to indirectly invest in and (potentially) benefit from animals all over the UK.

Pets at Home is the largest pet supply chain in the UK and the company stocks have proven a fantastic investment for many over the years. Just be aware of the risks involved in trading stock and ensure that you have the knowledge needed to analyze the company before you start trading.

If you’re not sure where to start, we suggest checking out our top three Pets at Home shares brokers further up on this page.