SSP Group is one of the companies in the food service industry that has been gaining popularity over the years. For this reason, the company keeps attracting investors looking to buy its stock and also benefit from its annual dividend payments. Unfortunately, the SSP Group share price fluctuates, and only investors with solid plans and strategies earn good profits from this investment.

The good news is that we help you understand how to efficiently buy the shares of SSP Group using stock brokers. You will also learn a brief history of the company, thus deciding whether it is a good investment. On top of that, we recommend the best three stock brokers to get you started when purchasing the shares of SSP Group.

Top 3 Brokers for Buying SSPG Shares

The shares of SSP Group are listed on the London Stock Exchange (LSE) under the ticker symbol SSPG. Buying this company’s shares requires you to identify the best broker with access to the LSE and meets your needs. Simply put, you should be comfortable investing with the broker, thus increasing your chances of making profits. In addition, find a broker that allows you to trade SSP Group shares as CFDs or indices and hosts additional assets for portfolio diversification.

TradingGuide experts did research on hundreds of brokers in the UK to ensure you have the best to kickstart your SSPG investment ventures. Below are the top three we handpicked based on our findings and user recommendations.

1. eToro

eToro is one of our highly recommended stock brokers for investing in the shares of SSPG. It is highly encrypted, regulated, and hosts millions of users globally — a clear indication that it is trustworthy. Moreover, the broker has access to the London Stock Exchange, thus making it easier for you to purchase SSPG shares. You can access the broker by registering an account and depositing at least $100 per its requirements.

Besides allowing you to purchase SSPG stock, investors can use eToro to trade the asset as CFDs. For index investors, you can get exposure to the asset by investing in the FTSE index, which also allows you to explore additional shares. Note that trading shares with eToro is commission-free, and you get to connect with other traders on its highly reputable social trading platform.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- Plenty of learning resources and a demo account to gauge your skill level

- You can buy SSP Group shares in fractions or trade them as CFDs

- Highly rated copy and social trading platforms offered

- Withdrawal charges apply

- High SSP Group share trading spreads

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

2. CMC Markets

CMC Markets is a pioneer stock broker with an outstanding reputation not only in the UK but globally. Many users praise it for hosting numerous quality trading resources to maximise your experience. Moreover, CMC Markets has an intuitive design, and its NextGeneration platform is user-friendly and perfect for newbies. You can use it on your desktop or download and install its app on your mobile device to manage your investments on the go.

Besides the NextGeneration platform, CMC Markets hosts the MT4 platform for advanced investors looking to explore advanced trading resources. Unfortunately, you can only trade the shares of SSP Group as CFDs since the broker does not have access to the LSE where the shares are listed for purchase. The best element about using CMC Markets to invest is that you can explore additional shares and trade at low fees. Moreover, the broker does not have a minimum deposit requirement, making it easier for budget-conscious traders to invest in the shares of SSP Group.

- No minimum deposit requirement

- Commission-free SSPG shares trading

- User-friendly and intuitive design platform

- Numerous trading resources for newbies and expert traders’ market analysis

- Only CFD trading allowed

- Limited trading platforms for advanced traders to explore

| Type | Fee |

| Minimum Deposit | £0 |

| Inactivity fee | £10 monthly |

| Withdrawal fee | £0 |

| Deposit fee | £0 |

3. IG Markets

IG Markets has made a name for itself in the financial space by offering superior services for all types of traders. Like CMC Markets, the broker only allows you to trade the shares of SSP Group as CFDs, meaning that you only get to speculate on the asset’s price movements. You can also invest in the FTSE index that lists SSPG shares and explore additional shares in the index.

The best element about using IG Markets to invest in SSPG stock is that it allows professional investors to explore quality market research tools. Depending on your skill level, there are also various platforms to select from, including the L-2 Dealer, ProRealTime and MT4. If you are a newbie, IG Markets offers you a social trading platform to connect with other traders. There are also plenty of learning resources on its IG Academy for skills development.

Your capital is at risk

- Offers L-2 Dealer, MT4, and ProRealTime accounts with advanced features

- SSP Group share trading is commission-free

- CFD trading allowed across more than 12,000 shares

- Allows after-hours SSPG share trading

- Charges high spreads

- A £50 quarterly subscription fee applies if you don’t trade more than three times using your share account

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | £18 monthly after 24 consecutive months of inactivity |

| Advanced graphs (ProRealTime) | £30 per months |

How to Buy SSP Group Shares With eToro

Buying the shares of SSP Group is challenging. However, the process can be easy if you master all the procedures involved. Below, we use eToro as an example to help you understand how to buy the shares of SSPG using an FCA-regulated broker.

You need to visit eToro’s website* and register for an investment account. On this page, we share links to give you quick access to the site and begin the registration procedure using your personal details. These include your name, phone number, email address, age, and more information for account safety purposes. You must also create a username and password for your account’s safety. Once complete, the account is up for real-time trading upon completing your profile.

*{etoroCFDrisk}% of retail CFD accounts lose money.

This step is vital for your account protection and ensures all trading platforms remain safe from imposters. In this procedure, you will be required to upload and submit proof of identity using a copy of a valid passport or any other form of an officially issued photo. A confirmation of your residence is also mandatory, whereby eToro will require you to share a copy of a valid utility bill or bank statement dated to the last three months.

In addition to verifying your personal details, eToro will provide you with a questionnaire to fill out to determine the best investment package for your skill level. You will also participate in a margin trading test to determine the best leverage limit for you.

The next procedure is funding your account, which is pretty easy with eToro. This is because the broker supports multiple payment methods to choose from, including debit cards, e-wallets, and bank transfers. Moreover, you get to make deposits for free, and the broker’s minimum deposit is also low ($100 for UK investors).

Before you begin investing, it is advisable to understand how eToro works before putting up your real money. Fortunately, the broker hosts a demo account to test it with and gauge your skill level. Once you are fully ready to dive into the live market, you can switch from the demo account to the real account by clicking an icon under your profile name.

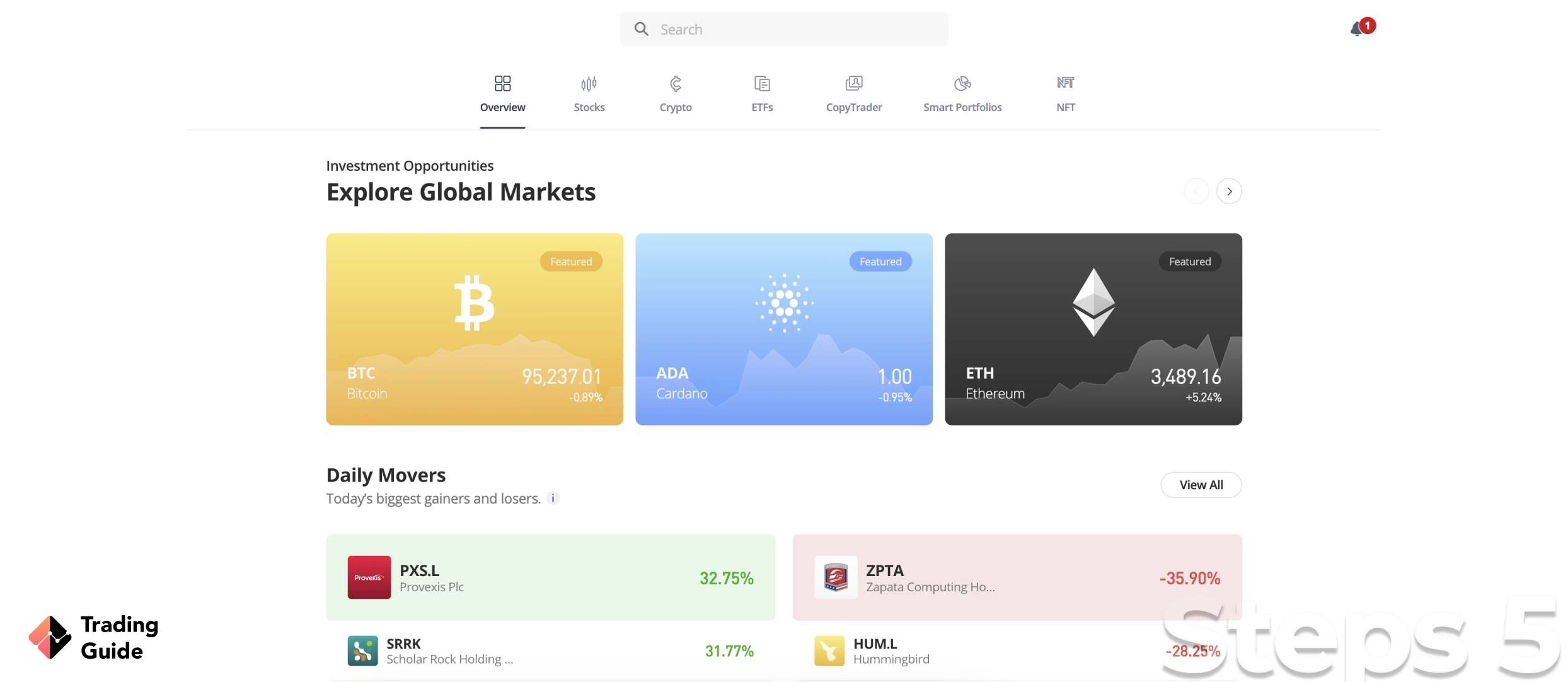

At this point, nothing should stop you from finding the shares of SSP Group using the ticker SSPG and completing your purchase. With eToro, you can also trade the asset as CFD or indices. Simply ensure you select the number of shares you can afford and the best order types for maximum experience.

Tips on How to Choose the Best Stock Broker to Buy SSPG Shares

UK investors, especially newbies, find it challenging to select the best stockbroker for buying the shares of SSP Group. With the best broker with features meeting your investment needs, you get to enjoy your experience, thus maximizing your profit potential. Below, we shed light on some essential factors to consider in your research to find a credible and reliable broker for your needs.

It is crucial to find a stock broker that is licensed and regulated by the Financial Conduct Authority (FCA). With such brokers, you trade in a safe environment free from fraudsters who have dominated the UK market. Plus, you can easily take legal action against FCA-regulated brokers in case of misunderstanding.

As an investor, it is advisable to explore various options in the financial market to discover where your other strengths lie. Therefore, while searching for a broker allowing you to invest in SSPG stock, ensure it also offers additional asset classes. Remember, portfolio diversification is paramount in limiting the risks of losing a lot of money in a single investment.

While you should choose a stock broker with a user-friendly platform, ensure it has a trading app for managing your investment on the go. A stock broker’s platform for buying SSPG stock should also host plenty of research and educational materials. Having a demo account is also a plus since you can practise how the broker works before taking the plunge.

Whether you are new to trading shares or are experienced, it is important to have a budget and stick to it. This means you should choose a stock broker that fits into your budget or one you can afford. It is a habit that will help you trade successfully without spending a lot of money. Therefore, confirm all the charges and requirements in a stock broker before committing.

Many investors experience various challenges with brokers, thus limiting their potential. Fortunately, a broker with a reliable and dedicated support service will help you manage any arising issues so you can go back to managing your activities. Remember, some stock brokers for buying the shares of SSPG operate 24/7 while others are only available five days a week. This means that you should select one with a support service complementing your investment schedule. Most importantly, the broker should be contacted via different communication channels, including phone, live chat, WhatsApp, email, etc.

To ensure you have the best choice, complete your research process by analysing other users’ experience and testimonials on legit platforms like Google Play, the App Store, and Trustpilot. This way, you know what to expect before signing up for a trading account with a stock broker.

SSPG Shares Price Today

SSPG shares are traded on the London Stock Exchange. Unfortunately, many investors fail to succeed in the share investment due to the inability to determine the company’s accurate share value. The good news is that we provide a live chart below indicating the SSP Group share price so you can easily identify the best entry and exit points. Plus, you can use the chart to analyse SSPG’s historical value for accurate price predictions.

About SSP Group Shares

Founded in 1961 as a result of a division of the Scandinavian airline under the name SAS catering, SSP Group is a multinational contract food service company. It is headquartered in London, England, while serving other regions globally, including Europe, North America, etc. note that SSP Group PLC is a publicly traded company, meaning you can purchase its shares using stock brokers with access to the London Stock Exchange where the shares are listed under the symbol SSPG.

So far, SSP Group’s revenue has been rising, especially after Patrick Coveney took over as the company’s CEO in April 2022. SSP Group operates beverage and food concessions in travel locations, and it has over 2,800 branded catering and retail units across hundreds of airports and railway stations globally. Besides having its shares publicly traded on the LSE, SSP Group is a constituent of the FTSE index. So if you are an index trading expert, you can get exposed to the asset by investing in the FTSE.

Investors interested in SSP Group share may also find AstraZeneca share and Marks & Spencer shares to be appealing options for their investment portfolio.

FAQs

Yes. SSP Group’s revenue has been increasing throughout the years, and we believe buying its shares is a good investment. However, always conduct extensive analysis first and not depend on other investors’ predictions. A choice of a stock broker is also imperative to your success, and luckily, we have recommended the best three above.

SSP Group came into existence as a result of a division of the Scandinavian airline under the name SAS catering. It was then acquired by the Compass Group in the early 90s, after which it got merged with other companies owned by the Compass Group.

SSP is a food service company with various subsidiaries, including Upper Crust, Millie’s Coffee, Caffe Ritazza, etc.

SSP Group has been creating and running its own local and international brands for decades. Some of its popular brands include Upper Crust, Haven, Camden Food company, Cabin, and Ritazza.

The easiest way to invest in the shares of SSPG is by purchasing them through a stock broker with access to the LSE. You can also trade SSPG stock as CFDs or invest in its indices. Above, we recommend the top three brokers to consider in the UK. They feature varying elements, so ensure you select the one suitable for your investment needs.

Conclusion

The thought of investing in SSP Group shares can be exciting, considering the company’s success and regular recognition. Its ability to constantly strategise to increase its revenue keeps it ahead of the competition. This has attracted many investors who hope its share value will increase and allow them to earn profits for their capital.

Generally, we advise you to conduct thorough market research before investing, whether in SSPG shares or any other stock. You should also select a reliable and credible broker and be open to learning from your mistakes. With patience and dedication, it will only be a matter of time before you become an independent stock investor.