Starbucks Corporation is the biggest coffee chain globally and the second largest coffee company after Nestle, thanks to its high-quality products offered at an affordable price. The company’s aggressive growth keeps attracting investors’ attention looking to buy Starbucks shares. Note that Starbucks shares are volatile and profitable if you have a strategic plan to trade them. Most importantly, you need the best stock broker to maximise your potential.

We have prepared this guide to walk you through the steps of buying Starbucks shares. At the end of it, you will understand what it means to be a shareholder of Starbucks and whether they are a good investment. Additionally, we have recommended the top brokers to use for purchasing the Starbucks shares. And if you want to find a stock broker on your own, we also guide you through the elements to look at.

Top Brokers for Buying Starbucks Shares

If you have trading experience, you probably know that you need the best stock broker to buy Starbucks shares. Keep in mind that Starbucks shares are purchased on the NASDAQ exchange, and using an online broker means that you can trade Starbucks shares off the exchange or as derivatives (CFDs).

We understand that finding the best stock broker in the UK is a challenge that most traders experience. For this reason, we conducted extensive research and multiple tests to recommend the following brokers for buying Starbucks shares with.

1. Plus500

*Illustrative prices

Plus500 is among the most reliable brokers for trading SBUX shares, offering a seamless experience through CFDs and indices as CFD. Although the broker does not support direct ownership of the asset, there are numerous benefits to partnering with it. For instance, Starbucks share trading is commission-free with low spreads. Plus500 also offers leverage limits of up to 1:5 for retail traders and 1:20 for professionals, thus providing flexibility in trading strategies. On top of that, you will enjoy a straightforward account opening process and a low minimum deposit requirement of £100.

We like that this broker offers its users the opportunity to diversify their portfolios using additional CFD assets besides SBUX. These assets include more shares as CFD, forex as CFD, commodities as CFD, indices as CFD, and more, all of which you can trade commission-free. We are also impressed with the broker’s 24/7 reliable support service, coupled with a user-friendly and customizable trading platform. If you are a beginner, feel free to gauge your share trading skill level using the Plus500 demo account, as it provides a risk-free trading environment.

- Low minimum deposit requirement

- A virtually-funded demo account for getting started with

- Commission-free share trading

- Higher leverage limits for professional traders

- No buying and taking full ownership of the asset

- No third-party trading platforms

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro

eToro is an excellent choice for newbies and expert traders alike. It is the best for copy trading and allows you to interact with other global traders on a social platform. You can diversify your portfolio using different assets offered, including forex, commodities, cryptocurrencies, and more.

On the downside, eToro’s spreads are relatively high compared to what other stock brokers charge. Although eToro’s minimum deposit requirement is $100, accessing the copy trading platform requires a deposit of at least $200. The minimum amount per trade is also $10. What’s more, the broker also charges withdrawal fees.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- Thousands of additional global assets are featured to choose from and diversify your investment portfolio with

- $100 minimum deposit requirement

- Award-winning copy and social trading platforms to mingle with other traders

- High minimum deposit requirements to access the copy and social trading platforms

- You will pay withdrawal fees

3. CMC Markets

CMC Markets allows you to spread bet or trade CFDs on Starbucks shares commission-free. There is no minimum deposit required, meaning that you can trade Starbucks shares with any amount you can afford. Additionally, CMC Markets hosts excellent research and educational materials on its Next Generation and MT4 platforms to improve your trading experience.

Other than the Starbucks shares, CMC Markets hosts additional 8,000+ shares. You can also trade other assets, including forex, indices, commodities, ETFs, cryptocurrencies, and more.

Unfortunately, CMC Markets does not allow you to buy and own Starbucks shares since you can only trade them as derivatives. Its customer service can also be improved as it operates only five days a week.

- No minimum deposit requirement, which makes it a viable choice for newbies and low-budget traders

- Additional 10,000+ securities offered, including over 8,000 shares, commodities, cryptos, and more

- Excellent collection of learning and research tools, making it suitable for all types of share traders

- Only over-the-counter trading allowed

- Some transactions attract a fee

How to Buy Starbucks Shares With eToro

Buying or trading Starbucks shares is a challenge, but it can be easy when you have the best stock broker in your corner. The above-referenced stock brokers are reliable and have straightforward buying procedures. Let’s discuss how to buy Starbucks shares with eToro.

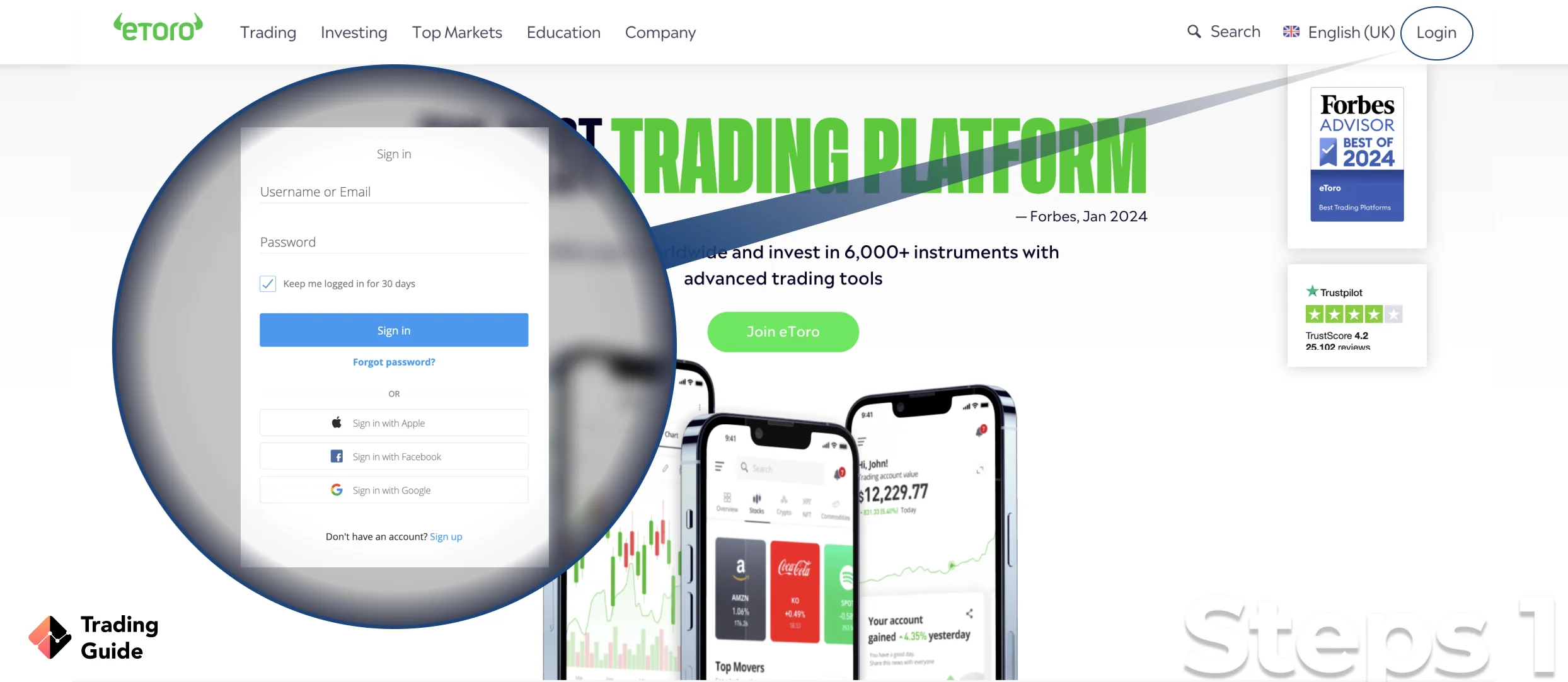

It’s easy to sign up for a trading account with eToro*. Therefore, follow the links provided on this page and be redirected to eToro’s website. You can also download the broker’s app from Google Play and the App Store. You will then start your registration by entering your personal details such as name, age, phone number, email, and more. You will also choose a username.

*{etoroCFDrisk}% of retail CFD accounts lose money.

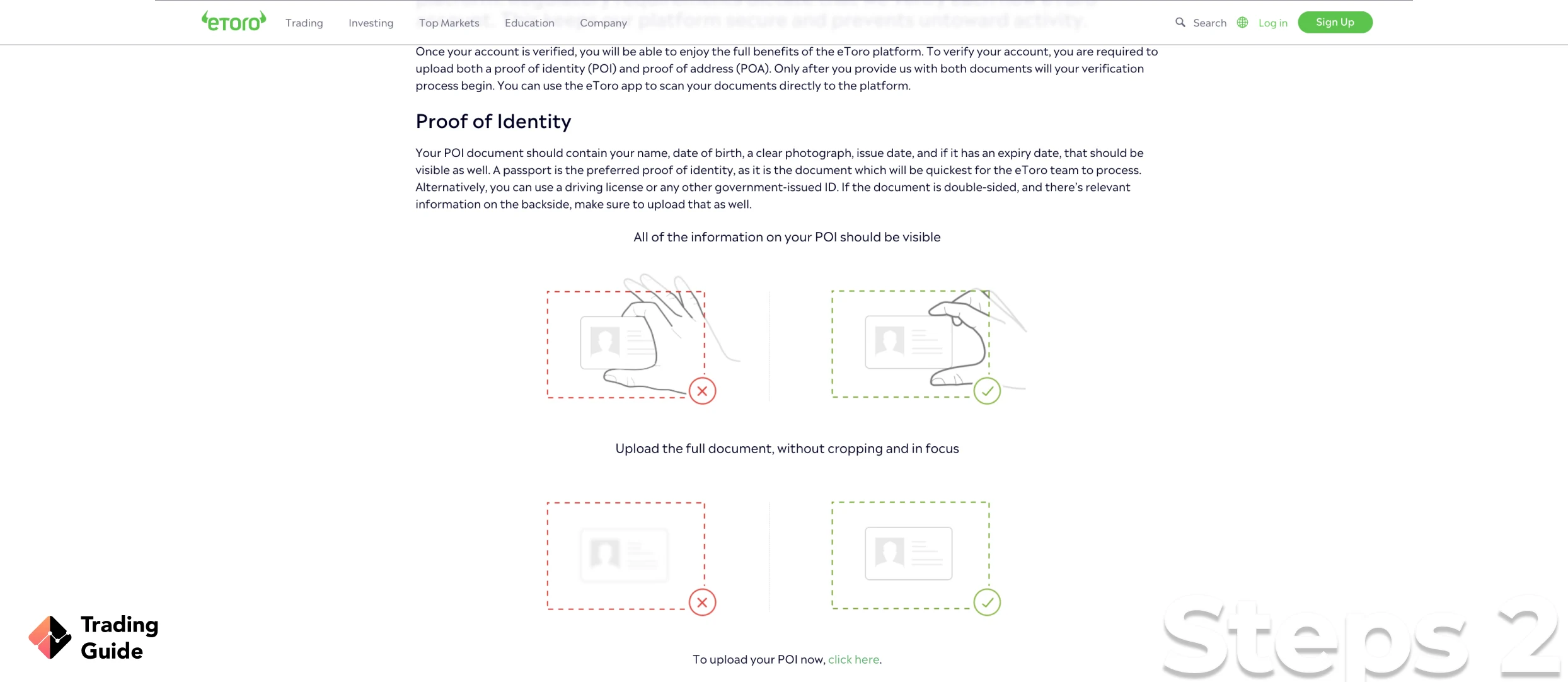

To ensure that your account is protected, eToro will require you to verify your identity to start trading, which is a standard procedure for all FCA regulated brokers. This is in regards to the stringent regulations of the Financial Conduct Authority (FCA). Therefore, you will upload a copy of your ID, passport or any other officially issued photo. Additionally, eToro will require a copy of your recent utility bill or bank statement to prove your place of residence.

eToro also has a questionnaire to fill in order to select the best service package for you. There is also a basic knowledge test regarding margin trading to determine your leverage limits. Keep in mind that verification can take up to two days to complete, and a notification will be sent to your email upon approval.

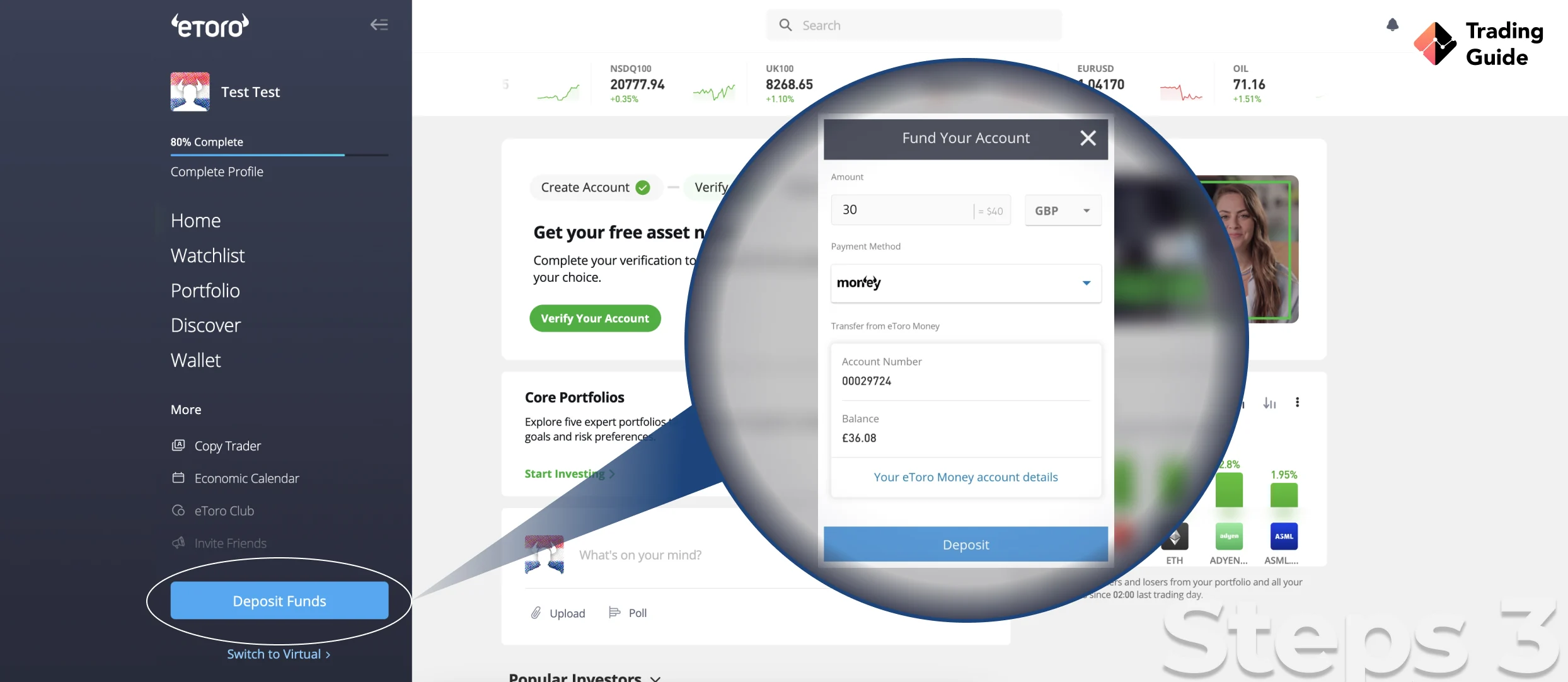

Once your account is verified, you will be free to make a deposit and start trading the Starbucks shares. For eToro, only a $100 minimum deposit is required to access the shares. Do not worry about your personal information or deposited funds getting exposed because eToro is highly encrypted and regulated.

You will then find the Starbucks shares on eToro’s platform and decide how you want to trade them. eToro allows you to buy the shares and take ownership or simply trade them as CFDs or in the shape of an index combining several stocks in the same investment.

When buying Starbucks shares, you need to select the number of shares you can afford. If you want to trade the shares as CFDs or indices, set aside the right amount of money and ensure you are aware of the risks involved before trading.

Tips on How to Choose the Best Stock Broker to Buy Starbucks Shares

Choosing the best stock broker goes a long way in determining your success in trading Starbucks shares. Stock brokers in the UK feature various elements, meaning that not all of them will match your trading needs. To avoid committing to a wrong broker, here are the essential factors to consider when choosing a stock broker to buy Starbucks shares in the UK.

It is crucial that you choose a broker that is reputable and observes all the security measures to safeguard your trading funds. In this regard, the best stock broker in the UK should be licensed and regulated by the FCA. Trading with unlicensed and unregulated brokers is illegal and risky for your trading funds.

The way a stock trading platform executes trades matters when trading Starbucks shares. You want a broker with a fast order execution speed and hosts different research and learning resources. If you are a newbie, a demo account is necessary for practising stock trading and testing a broker before creating a live account.

Make sure the stockbroker you choose allows Starbucks shares trading, whether as physical assets or derivatives. You also want a broker that will enable you to trade any time of day. So, consider one that allows trading using desktop and mobile devices.

A broker’s trading and non-trading charges should fit into your budget. Therefore, confirm commissions and spreads, transaction charges, minimum deposit requirement, margin rates, and more. Some brokers in the UK have hidden charges, so ensure you leave no table unturned until you are sure of all the costs to incur.

The best stock broker should have dedicated customer service representatives to help you manage any trading issues quickly. Make sure their availability matches your trading schedule and can be contacted via convenient channels.

The choice of a stock broker will solely depend on your trading needs. However, consider the opinions of other traders before making the final decision. Previous and current traders’ experiences will help you understand a stock broker’s strengths and weaknesses, hence making the right decisions.

Find out about TradeStation broker in the UK in our other article.

Starbucks Shares Price Today

Currently, Starbucks share price is valued at around £112. By using the live chart below, you can easily track the performance of Starbucks (SBUX) stocks. With this chart, you will also access historical information and other data that will help you make informed decisions.

About Starbucks

Starbucks corporation is a coffee roaster and retailer company founded in 1971 in Seattle, Washington, United States. At first, the company offered fresh-roasted coffee beans, tea, and spices gathered from various global regions. However, after Howard Schultz joined Starbucks in 1982, it began experiencing steady growth and expanded to Chicago, Vancouver, California, New York and Washington, DC.

Starbucks services became a favourite to many, making it extend its services to other global regions. To date, the company has over 33,000 coffee houses scattered across over 83 markets worldwide. In fact, it is the biggest specialty coffee marketer globally, offering ready-to-drink beverages, food products like pastries and sandwiches, whole roasted coffee beans, ground coffee, iced tea, and more.

Learn how to invest in Royal Mail shares in our other guide!

FAQs

Yes. Starbucks revenue has been increasing throughout the years, and we believe buying its shares is a good investment. However, always conduct extensive analysis first and not depend on other investors’ predictions. A choice of a stock broker is also imperative to your success, and luckily, we have recommended the best four above.

Yes. Starbucks pays all of its shareholders cash dividends on its common stocks. Currently, shareholders are paid £0.49 per share on a quarterly basis.

Yes. Starbucks is a good dividend stock thanks to its excellent track record and increased revenue.

Since its establishment in 1971, Starbucks has been committed to sourcing and roasting high-quality coffee until 2010, when it saw the need to start paying dividends to its shareholders. The company increased its quarterly cash dividend every year and is currently at £0.49 per share.

The Vanguard Group, Inc. is currently the top shareholder of Starbucks stocks with a 7.91% stake of the total shares.

Starbucks corporation was founded in 1971 by Jerry Baldwin, Gordon Bowker, and Zev Siegl, near the Pike Place Market in Seattle, Washington, United States.

Conclusion

The thought of investing in Starbucks shares can be exciting, considering the company’s success and regular recognition. Its ability to constantly update its menu to suit popular tastes keeps it ahead of the competition. As a result, investors continually monitor its stock price performance, with the majority looking to own a piece of the company.

Luckily, Starbucks shares can also be purchased as fractions through a brokerage firm. This means that regardless of the amount of money you have, you can become a shareholder of Starbucks and earn dividends like any other shareholder.

Generally, Starbucks shares are a perfect investment since the company is expected to grow even further based on its achievements and our predictions. However, you need to conduct thorough research and analyse the Starbucks stock before putting up your money. Also, make sure you trade with the amount you can afford to lose.