Tesco, one of the largest household names in the UK, has experienced significant growth since its founding in 1919. It has grown from a market stall operated by Jack Cohen to a merchandise retailer with branches in multiple nations. The company’s total revenue is now over 70 billion, which is quite commendable.

With Tesco’s position and projected growth in mind, you are likely wondering if investing in this company through shares is a good idea. This article will help you arrive at a solid answer. I’ve also discussed crucial topics like how to buy Tesco shares and the best brokers to use below.

How to Buy Tesco Shares

Buying your first shares in Tesco may sound complicated, but it’s actually quite straightforward. I’ve been in this field for a long time and have noticed that brokers are continually simplifying everything over time. Now, all you have to do is follow these straightforward steps:

You must first find a regulated and credible broker that offers Tesco shares. That is crucial for a variety of reasons, including your safety and peace of mind. There are plenty of shady brokers in the UK, and investing with them exposes you to complications like manipulated asset prices and withheld withdrawals.

While searching for a good broker for your investment needs, check licensing and regulatory status. I avoid unnecessary headaches by sticking to service providers regulated by multiple tier-1 authorities, such as the FCA, CySEC, and ASIC. Also, vet each brand’s reputation, asset collection, and costs.

Visit your chosen broker’s website and create an account for buying or trading Tesco stock. I have shared links to easily redirect you to the best brokers’ website, where you will be required to provide your personal information to create a trading account and choose a username and password.

Note that brokers have different trading terms and conditions; therefore, I recommend that you always review the stipulations and accept them before committing to the chosen provider. Additionally, most brokers offer a trading app for both Android and iOS devices, and it will be in your best interest to install it on your mobile device to keep track of your investments on the go.

It is a standard procedure for all FCA-regulated brokers to have all traders verify their identity to keep online trading safe and secure. For this reason, your broker will require you to verify your identity by providing a copy of your ID card or passport. In addition, you have to submit a copy of your recent bank statement or utility bill to verify your jurisdiction area.

To avoid getting stuck here, verify your identity and address with clear photos and scans. Also, verify the information you used to sign up against what is on your documents. Use the recommended channels only. Don’t email your documents to your service provider’s support team unless you’re asked to with a good reason.

Brokers have different funding mandates. For instance, the minimum deposit requirement at eToro is $50 for you to access the LSE and buy TSCO shares. Also, the service providers I’ve recommended allow transactions via different methods, including bank transfers, debit cards, and e-wallets. Therefore, ensure that the payment method you choose is reliable and processes transactions quickly.

If you want to invest in Tesco shares instantly, pick funding methods that allow you to deposit money and trade within minutes, like credit and debit cards. Since this is your first rodeo, start with a small amount you can lose without crippling your investment plans.

Find the part of your broker’s site where you can search for Tesco shares using the symbol TSCO. To complete your purchase, choose the number of Tesco shares you can afford. You should also ensure that you have conducted the necessary due diligence and are aware of all the risks associated with buying the company’s stock.

Many brokers also allow you to trade the TSCO shares as derivatives. As a result, you can either benefit from rising or falling prices (CFD) or combine Tesco stock with other companies’ stocks in a single investment (indices). Review the available options and select the ones that best suit your goals.

Best Brokers to Invest in Tesco in the UK

My goal is to help you avoid questionable platforms and find the best sites to buy Tesco shares. Sifting through hundreds of options can be frustrating and challenging, so avoiding this task is in your best interests. Just review the top 3 providers I picked from the crown and invest in your favourite assets, including Tesco shares.

1. eToro

eToro is an excellent choice for both traders and investors. Besides having a user-friendly platform, the broker hosts one of the best learning and market analysis resources. This includes a demo account funded with £100,000 in virtual funds to get you started.

Moreover, eToro is the best social and copy trading broker, allowing you to meet like-minded traders, share ideas, and copy trades with high-profit potential. You can also diversify your portfolio with additional assets from eToro, including currencies, commodities, cryptocurrencies, etc.

Buying or trading TSCO shares at eToro is commission-free, with a minimum deposit of $50. After signing up and funding your account, you’ll get the chance to pick the best assets to invest in from a collection of over 7,000 financial instruments. Beware of the broker’s $10 inactivity fee that kicks in after 12 months of inactivity.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- Users can invest in 7,000+ financial products

- Supports trading and investing

- Low minimum deposit requirement

- A wealth of educational resources

- Supports copy trading

- $10 monthly inactivity fee

- Higher conversion fees than most of its peers

2. Interactive Brokers

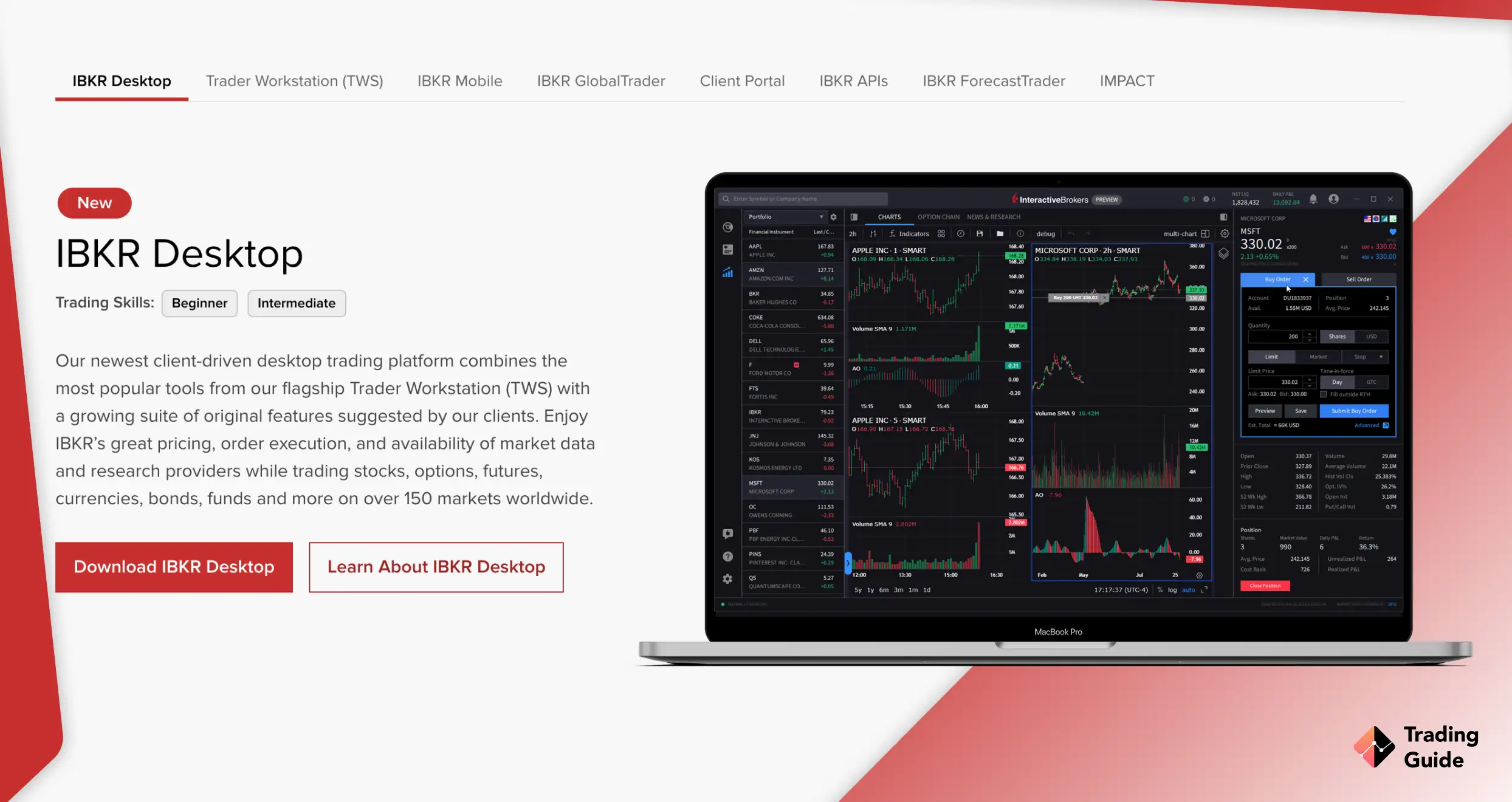

Interactive Brokers (IBKR) is a pioneering stock broking firm offering quality trading tools and platforms to support your activity. Trading shares in Tesco is commission-free on the IBKR Lite platform, and you can also buy fractional shares. Plus, if you’re a newbie, you can learn the basics on this broker’s resource-rich education portal.

Additionally, there is no minimum deposit requirement or transaction fees. This makes IBKR an excellent option for low-budget and novice traders. The broker also offers an opportunity to diversify your portfolio with other assets that come with super-low spreads, including currencies, options, futures, cryptocurrencies, and more.

Unfortunately, newbies may find Interactive Brokers’ platform challenging to navigate. But you don’t have to worry about your account staying dormant and getting penalised since IBKR has no inactivity fees.

- No minimum deposit for new accounts

- Dormant accounts don’t get charged

- Wide variety of financial instruments

- Low spreads and commissions

- Multiple robust trading platforms

- Can overwhelm beginners and novices

- Only proprietary systems are available

3. IG Markets

IG Markets allows trading of TSCO stock commission-free. The broker features an IG Community social trading platform, where you can interact with and learn trading tips from other traders. IG Markets provides high-quality research materials on its MT4, ProRealTime, and L2 Dealer platforms. There is a demo account funded with £20,000 virtual funds to help you get familiar with the share market before putting up real money.

I also recommend IG Markets because it supports both investing and CFD trading. You can buy Tesco shares as well as other stocks and ETFs. The broker also offers its clients the opportunity to buy, hold, and trade various crypto assets, including Bitcoin, Ethereum, and Solana. In addition, with IG, you can trade forex and CFDs on shares, commodities, indices, etc.

IG scrapped off its minimum deposit requirement, so this shouldn’t be a problem. I also rank this broker among the best in the UK because it has offerings for a wide variety of traders, including individuals, professionals, and institutions.

Your capital is at risk

- No initial funding requirement

- Investors have access to shares, ETFs, and crypto

- CFDs on forex, commodities, etc., are available

- Caters to all categories, from individual to institutional traders

- MT4 and TradingView are hosted

- Higher spreads than its peers

- 1.49% for all crypto trades

About Tesco

Tesco PLC is a multinational grocery and general merchandise retail company headquartered in the UK. Founded in 1919 by Jack Cohen, the company has grown to become one of the leading multinational retailers, with approximately 330,000 workers. It has a solid presence in many countries outside the UK, including Ireland, the Czech Republic, and Slovakia.

The company is listed on the London Stock Exchange under the symbol TSCO. To access the exchange and buy shares, you need a reliable stockbroker in the UK, such as the ones we recommend above. You don’t need a large amount of capital to get started, as many brokers offer fractional Tesco shares.

Tesco is one of the safe businesses, making it an attractive investment in terms of security. Although it is not immune to market conditions like inflation, there is always demand for Tesco’s products. If you analyse its sales history, you will notice that Tesco’s revenue continues to grow across all the regions in which it operates. Moreover, the company’s dividend yields are enticing, offering shareholders attractive returns. The company is definitely worth considering for both short-term and long-term investments.

Learn how to invest in Royal Mail shares in our other guide!

Tesco Share Price Today

If you’re fretting over Tesco share prices in the UK and the possibility of getting deterred by high numbers, I have good news. This asset doesn’t cost much. It’s been trading for a little over 350 GBX for many months, with occasional dips and increases here and there. Currently, the price is a few pence above the 400 GBX mark. That makes it one of the most affordable assets you can invest in. Below’s a live chart of Tesco share value today:

Is Tesco a Good Stock to Buy?

Before you invest in any asset, ask yourself if it’s a good investment. When it comes to Tesco, I believe this asset is a good buy for people looking to invest in stable, defensive businesses. The company sells products that consumers can’t live without, such as food and household essentials, so it’s likely to grow and stay in business for a long time. If your target is reliable income through dividends and long-term financial growth, consider adding this asset to your portfolio.

FAQs

You can find the price of Tesco shares on the company’s official website or on the London Stock Exchange. To access the LSE, you must find a reliable broker like the ones recommended in our mini-reviews above.

Yes. Tesco plans to pay its shareholders dividends in 2025, which are done in two installments. The payment months are June and November, with an annual dividend yield of 5.43%.

Yes. If you sell your Tesco shares in the UK, the profits you earn from the sale are subjected to capital gains tax.

Absolutely. You can easily buy Tesco shares via a stock broker regulated by the FCA and has access to the London Stock Exchange, where the shares are listed under the ticker TSCO. We recommend the top three stock brokers for buying Tesco shares above. All you have to do is compare their features and select a suitable one for you.

Tesco was founded in 1919 by Jack Cohen, and it is owned by Tesco public limited company. Tesco is headquartered in the UK, and has other stores across Europe and Asia.

Tesco PLC has many shareholders, but the majority shareholder is BlockRock Inc, with 6.9% of shares outstanding.

Yes, Tesco is expected to pay dividends by 27th June 2025. Please note that the company’s ex-dividend date is 15th May 2025.

Expert Opinion

After spending a considerable chunk of my time assessing Tesco’s current position and financials, I’ve concluded that investing in this company is a good idea. I believe that Tesco shares can be incredibly beneficial to investors seeking regular, consistent income and steady growth. The company’s dedication to growing and cornering over 30% of the market is admirable. That said, before you invest in Tesco shares, consider the challenges common to businesses like this one, including fierce competition, small profit margins, and rising operational costs.

I found this article helpful for understanding the mechanics of buying Tesco shares, especially the broker comparisons and step-by-step process