Are you interested in investing in Unilever, a multinational consumer goods company with a history of impressive growth and stability? Whether you are a professional investor or just starting your investment journey, buying Unilever stocks can be a great addition to your portfolio.

We have prepared this guide to provide you with all the necessary information on how to buy Unilever stocks and become a shareholder in this renowned company. With our easy-to-follow steps and tips, you can confidently start investing in Unilever stock and potentially earn profits along the way.

Top Brokers for Buying Unilever Stocks

Investing in Unilever stocks in the UK requires a stockbroker with access to the London Stock Exchange (LON), where they are listed under the symbol ULVR. With numerous options available in the region, it can be challenging for you to choose the right one. That’s why we have taken the time to conduct thorough market research on your behalf.

Below, we list our top recommended stock brokers to choose from based on your preference or investment needs. Our findings are based on extensive analysis and comparison, considering factors including fees, trading platforms, customer support, and more. Rest assured that these stock brokers meet the highest standards and guarantee a seamless trading experience.

eToro

eToro is another top broker to consider when investing in the stocks of ULVR. Besides offering a unique and innovative social trading platform, the broker is user-friendly and hosts a modern design investment platform for maximum experience. With eToro, investors have the opportunity to not only buy and take ownership of ULVR shares but also trade them as CFDs. You can also trade the asset as indices, whereby multiple shares are listed in a single investment (Unilever FTSE 100). This attracts all types of investors looking for long-term or short-term investment opportunities.

To invest in the shares on Unilever with eToro, you must make a minimum deposit of $100. Deposits are free* using the supported payment methods, including debit cards, e-wallets, and bank transfers. Withdrawals attract a fee, and you need to pay high spreads.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

- Features award-winning social and copy trading platforms

- Low minimum deposit requirement

- Commission-free Unilever share investing

- Additional 2,000+ shares for portfolio diversification

- Limited research and analysis tools compared to other brokers

- eToro charges withdrawal fees, which can impact investors frequently withdrawing their funds from the platform

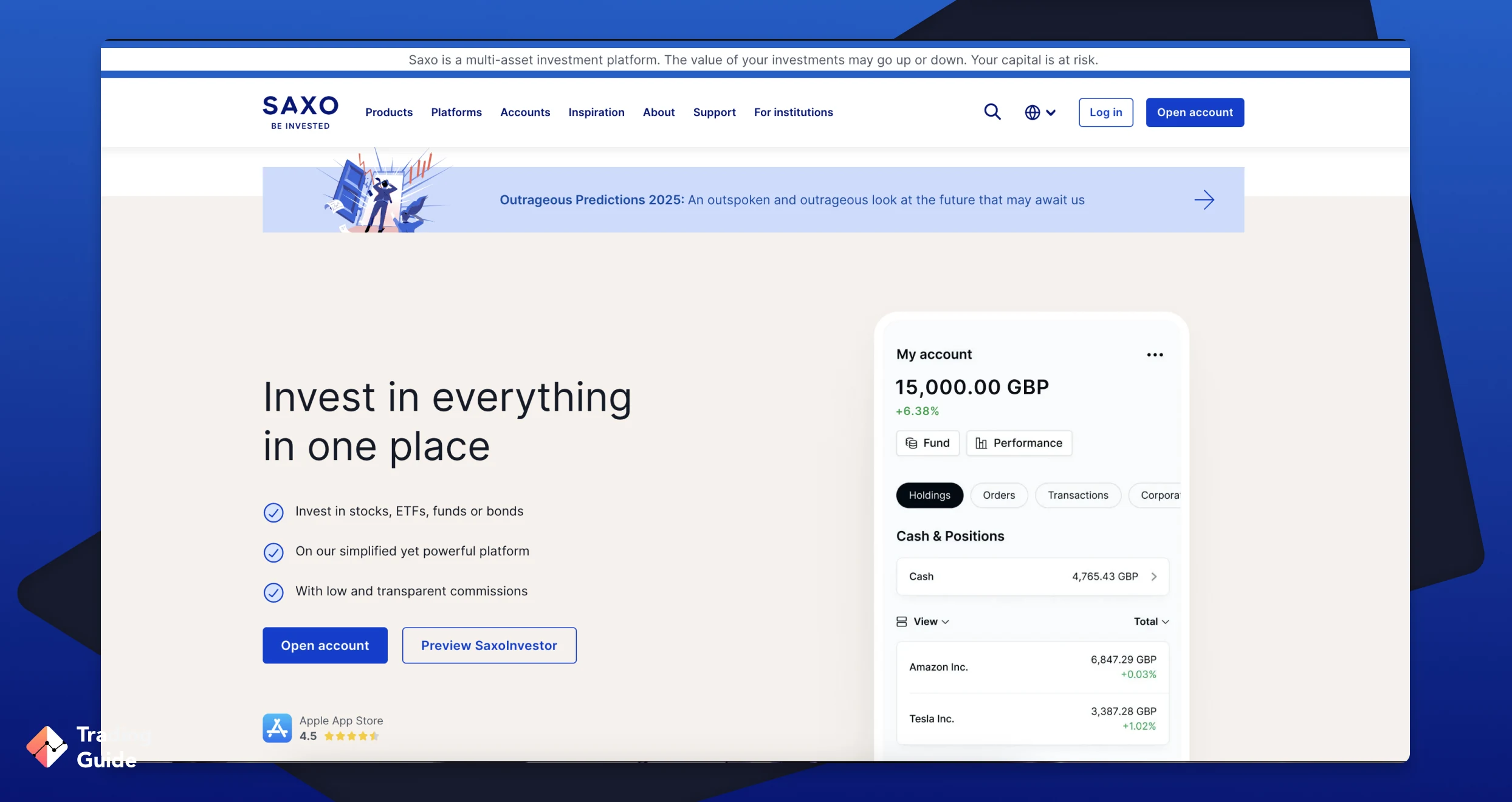

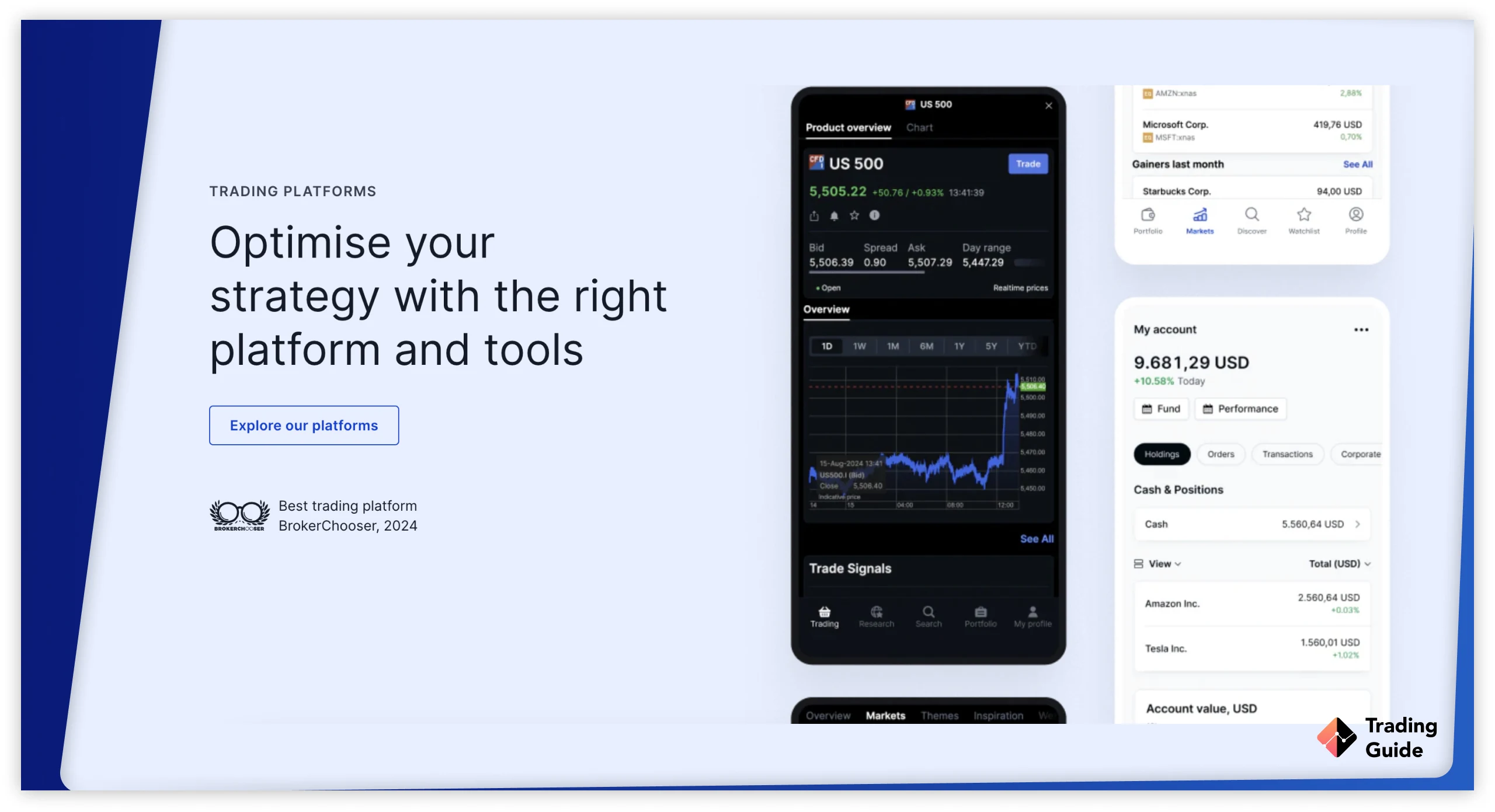

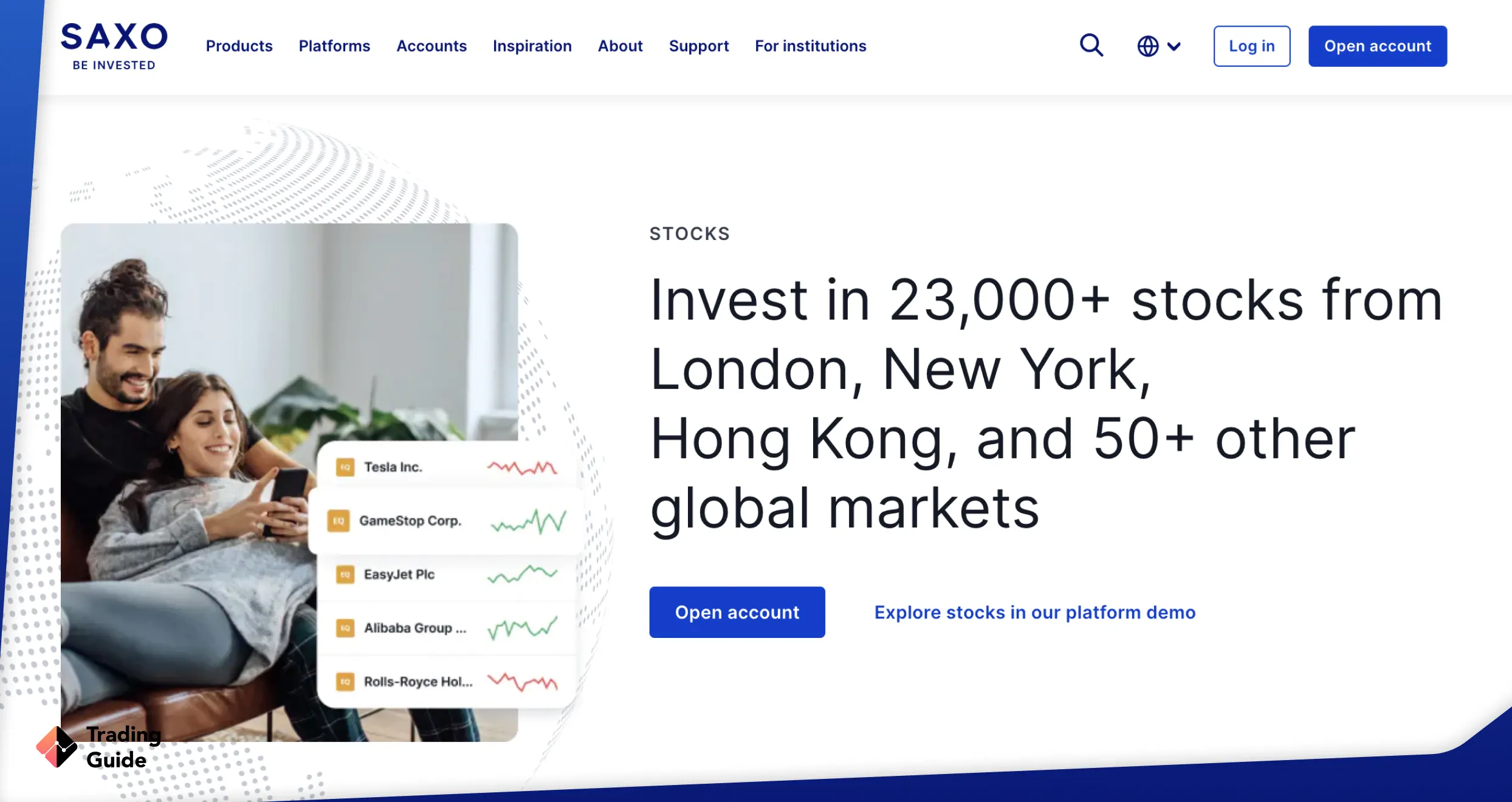

Saxo

Saxo is a highly reputable stock broker with a global presence, offering a wide range of financial products, including additional stocks, ETFs, options, futures, and more, for portfolio diversification. The broker’s platform is user-friendly and gives investors access to in-depth market analysis and research tools to help them make informed investment decisions. It also offers competitive pricing and low commissions, making it an affordable option for low-budget individuals looking to invest in ULVR stocks.

Note that Saxo has no minimum deposit requirement, which might seem high to some investors. The broker is available via desktop and mobile devices, making it accessible to investors at all times. Saxo also offers a range of educational resources, including webinars and market insights, to help investors stay up-to-date on market developments and make informed investment decisions.

- Highly reputable broker with a global presence

- Offers a wide range of financial products for portfolio diversification

- User-friendly trading platform with access to in-depth market analysis and research tools

- Available on desktop and mobile devices

- Limited learning tools compared to its peers

Tips on How to Choose the Best Stock Broker to Buy Unilever Stocks

When it comes to buying Unilever stocks, choosing the right stock broker is crucial for your investment success. With numerous options available in the UK market, it can take time to determine which broker will best meet your trading needs. To help you simplify your research process, we list below essential tips to consider when choosing the best stock broker to buy LON ULVR stocks.

It is crucial to select a broker regulated by the Financial Conduct Authority (FCA) in the UK. Regulation ensures that the broker follows strict financial and operational standards, providing a higher level of safety for your funds. FCA-regulated brokers keep your trading funds in separate accounts, reducing the risk of loss in case of any financial issues.

Different brokers have varying fee structures, including minimum deposit requirements, commissions or spreads on trades and additional charges such as withdrawal or inactivity fees. Consider your budget and investment goals, and choose a broker that offers competitive pricing and aligns with your financial capabilities.

A reliable and user-friendly trading platform is essential for executing trades efficiently. Look for a broker that provides a fast and stable platform with features such as real-time market data, advanced charting tools, and order execution capabilities. Additionally, consider brokers offering diverse financial instruments, including stocks, ETFs, and other assets, allowing you to build a well-rounded investment portfolio.

Ensure that the stock broker offers reliable customer support and technical assistance. Look for brokers with responsive customer service teams available to address any concerns or issues you may encounter during your trading journey. Also, check if the broker provides a mobile trading app, allowing you to access and manage your investments on the go.

Some brokers support demo accounts, which allow you to practice trading and gauge your skill level with virtual funds before investing your real money. Utilising a demo account can help you familiarise yourself with the broker’s platform, test different trading strategies, and gain confidence before entering the actual market.

Unilever Stocks Price Today

Investing in Unilever stocks requires staying updated on its current share price, as it can significantly impact your investment decisions. Note that the stock market is always volatile, and Unilever stocks are no exception. To help you stay informed and make the best trading choices, we have provided a live chart below that displays the current price of Unilever shares.

By referring to the live chart, you can monitor the fluctuations in Unilever share price in real-time. This will enable you to identify trends, assess market sentiment, and determine optimal trade entry or exit points. Additionally, the chart includes historical data, allowing you to analyse past performance and identify patterns that may assist you in making more accurate predictions.

About Unilever Plc

Unilever Plc is a multinational consumer goods company with a rich history and a global presence. Founded in 1930, Unilever has grown to become one of the largest companies globally, operating in over 190 countries. The company is known for its diverse portfolio of well-known brands across various sectors, including food and beverages, personal care products, cleaning agents, and more.

With a strong focus on sustainability and corporate social responsibility, Unilever has positioned itself as a leader in promoting sustainable business practices. The company has set ambitious goals to reduce its environmental impact, enhance people’s livelihoods in its value chain, and contribute to societal well-being. Unilever’s commitment to sustainability has earned it recognition and accolades, making it an attractive choice for investors prioritising ethical and responsible investing.

As a publicly traded company, Unilever Plc is listed on the London Stock Exchange (LSE) under the ticker symbol “ULVR.” Investors can participate in the company’s growth and success by buying shares of Unilever. With its strong brand portfolio, global presence, and commitment to sustainability, Unilever offers investors a potentially rewarding investment opportunity in the consumer goods sector.

FAQs

Yes. Investing in the stocks of Unilever can be a good opportunity for long-term investors seeking stability and growth. Unilever is a well-established multinational company with a diverse portfolio of popular consumer brands. Its global presence, strong brand recognition, and commitment to sustainability make us believe you can earn profits from it.

As of May 2023, Unilever has a market capitalisation of over $130 billion. This makes it fall among the world’s most valuable companies, and investing in it now can pay off in the long run.

Yes. While it’s challenging to predict the exact movement of Unilever stock prices, the company’s long-term growth prospects and solid financial performance may indicate the potential for stock appreciation over time. As an investor, it is advisable to conduct your own analysis to make informed investment decisions based on your understanding of the company’s growth and the risks that come with it.

Unilever has a history of stock splits to adjust its share price and make it more accessible to investors. So far, the company has undergone 3 stock splits throughout its history, with the most recent one happening in September 2006.

It is challenging to tell whether Unilever is a buy, sell, or hold since the share market is volatile, and the company’s share price keeps fluctuating. However, based on our analysis, we consider Unilever shares UK a hold since the company has growth potential that might bring about good profits.

Conclusion

Investing in Unilever shares UK has proven profitable to many investors. If you want to be part of this investment community, our ultimate guide above will help you get started on a good note. Remember, having the best stock broker for buying or trading the shares of ULVR doesn’t guarantee profits. You still must conduct thorough market research and analysis for the best decisions.

For newbies, have a budget and stick to it. You should also avoid emotional trading and only make a move based on your research findings. With time, you will reap the benefits of investing in the shares of Unilever.