The UK has long been a hub for financial innovation, yet Bitcoin still feels unfamiliar to many first-time investors. Despite years of headlines and price swings, knowing how to approach it safely isn’t always easy.

In 2026, clearer regulations and the rise of FCA-regulated platforms have made Bitcoin more accessible to UK residents. But successful investing still requires good judgment, awareness of the risks, and a clear understanding of the process.

This guide explains what Bitcoin is, how to invest through trusted UK platforms, and what beginners should keep in mind.

Steps for Investing in Bitcoin in the UK

Investing in Bitcoin doesn’t require specialist knowledge or advanced financial training. But a structured and sensible approach makes all the difference. Here’s how UK investors can get started in 2026:

Pick a cryptocurrency investment platform regulated by the Financial Conduct Authority (FCA) for security and transparency. Besides FCA regulations, look for clear fees, easy interfaces, and optional built-in wallets.

We’ll cover the top choices later in this guide.

Participate in account registration by filling out the provided form using your personal details. Plus, verify your identity by sharing copies of your passport or driver’s licence. Your broker may also request proof of address, similar to what is required when opening an online bank account. This includes a copy of a recent utility bill or bank statement.

Most UK brokers accept deposits in pounds via bank transfer, debit card, or other common methods like PayPal. Watch out for deposit or conversion fees, especially if your platform trades in US dollars or euros.

With your account funded, head to the cryptocurrency section and select Bitcoin (BTC). You can invest any amount you choose, as there’s no need to buy a full coin. Most platforms allow you to buy a portion based on how much you want to spend.

After purchasing, decide where to keep your Bitcoin. You may choose to keep it within your broker’s platform or transfer it to an independent digital wallet for added control. There are two main types:

- Hot wallets – online and convenient for regular use

- Cold wallets – offline and more secure for long-term holding

Your choice of storage method should reflect both your investment horizon and how regularly you intend to trade.

Best Bitcoin Brokers for UK Traders in 2026

Choosing the right broker can make all the difference, especially when entering a volatile market like crypto. These three platforms stand out in 2026 for their reliability, regulation, and user experience, making them well-suited for UK-based investors.

1. eToro

eToro is a top choice for beginners thanks to its user-friendly platform and FCA regulation. You can buy Bitcoin directly or trade CFDs, depending on your strategy. A standout feature is CopyTrading, letting users mirror experienced investors. eToro also includes a built-in wallet, removing the need for third-party storage. Its clean interface, mobile app, and learning tools make it ideal for first-time crypto buyers. However, it comes with higher spreads and limited charting tools, which may not suit technical traders. Still, for a simple and regulated entry into Bitcoin, eToro remains a strong option.

*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

- Low minimum deposit requirement

- Plenty of learning resources for new Bitcoin traders

- A user-friendly and intuitive design platform

- Additional 3,000+ securities for portfolio diversification

- £5 withdrawal charges apply

- Limited number of cryptocurrencies compared to its peers

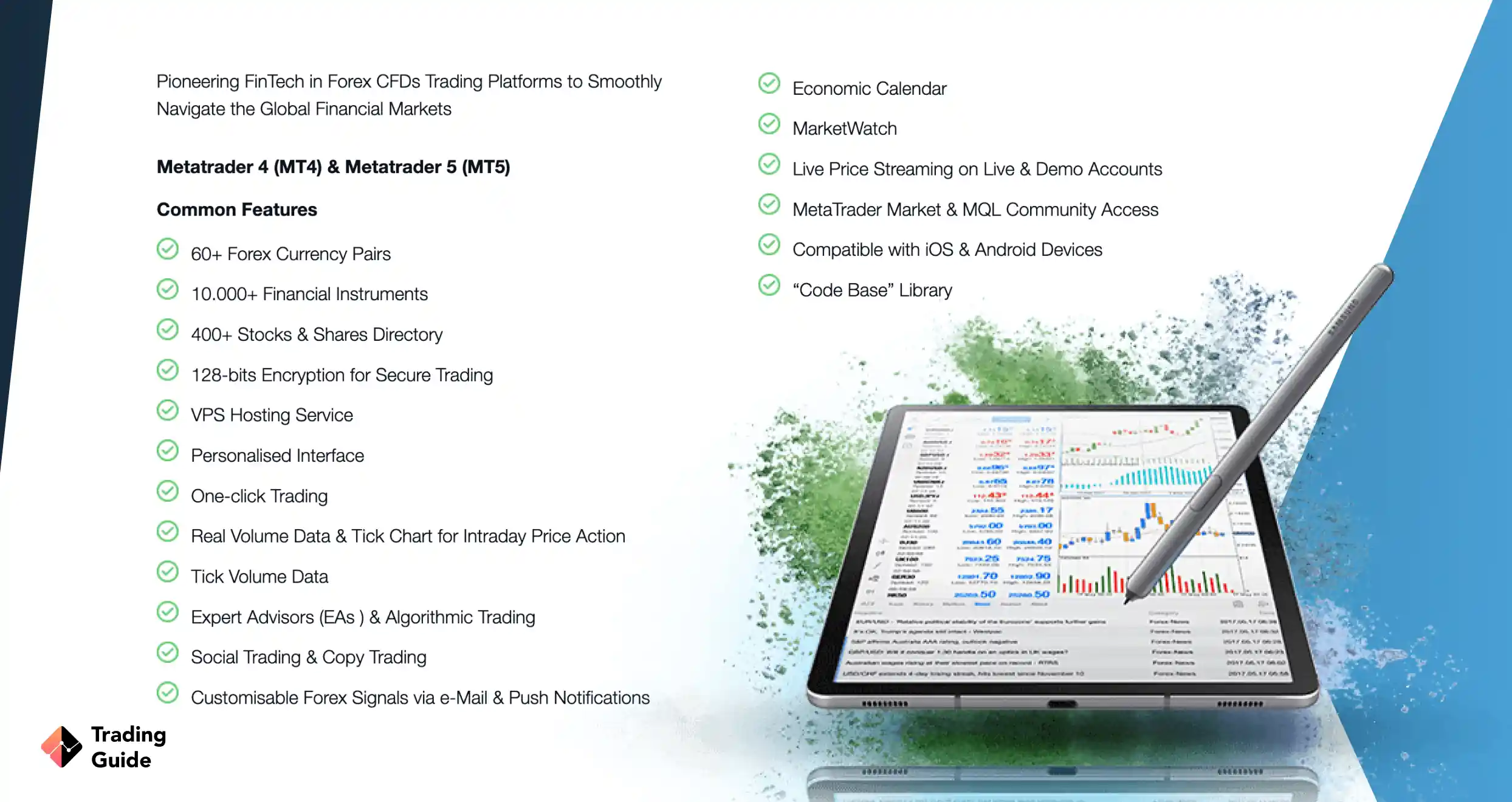

2. FP Markets

FP Markets specialises in CFD trading and suits experienced investors seeking low-cost Bitcoin exposure. It supports MetaTrader 4 and 5, offering advanced charting, automation, and tight spreads. The FCA-regulated platform suits active traders seeking speed and control. However, it doesn’t support direct crypto ownership or built-in wallets, which may limit its appeal for long-term holders. If you understand leverage and CFD risks and want a professional trading environment, FP Markets offers strong tools and competitive pricing.

- Low minimum deposit requirement of £100

- Lightning-fast execution for rapid trading

- Advanced trading tools and analysis resources on MT4 and MT5 platforms

- Low Bitcoin trading fees

- Limited cryptocurrencies available compared to its peers

- No price plans

3. Saxo

Saxo offers Bitcoin exposure via exchange-traded products (ETPs), ideal for strategic or wealthier investors. Fully FCA-authorised, Saxo provides robust security, portfolio tracking, and deep market research. Since you’re not buying coins directly, there’s no need for a crypto wallet. This appeals to investors seeking Bitcoin as part of a broader, managed portfolio. However, the high minimum deposit and lack of direct ownership make it less suitable for casual investors. If you want a traditional, regulated route to crypto with premium tools, Saxo is worth considering.

- FCA-authorised and highly regulated

- Rich research and tracking tools

- Great for strategic investors

- No need for a crypto wallet

- Higher minimum deposit

- Less suited to small investors

- No direct Bitcoin ownership

For a full comparison of features, fees, and account types, visit our guide to the best Bitcoin brokers UK.

What is Bitcoin?

Bitcoin is a form of digital money that doesn’t rely on banks or central authorities. It runs on a decentralised network of computers, with every transaction verified and recorded on a public ledger called the blockchain.

What makes Bitcoin unique is its limited supply. Only 21 million coins will ever exist. This scarcity has led some investors to compare it to gold, viewing it as a potential store of value.

Some use Bitcoin as a hedge against inflation or currency risk, while others are drawn to its price swings for short-term speculation.

Risks of Investing in Bitcoin

While Bitcoin has delivered strong returns in the past, it remains a high-risk asset. UK investors should be aware of several key concerns before putting money in:

- Price volatility: Bitcoin’s value can rise or fall sharply within hours. Double-digit moves in a single day are not uncommon, which can test even experienced investors.

- Regulatory changes: Though legal in the UK, the regulatory landscape is evolving. Future policies could impact how platforms operate, how Bitcoin is taxed, or how it can be accessed.

- Security risks: Coins kept on exchanges are vulnerable to cyberattacks or failures. Secure storage is essential.

- Emotional decision-making: Sudden price swings can trigger panic buying or selling. Without a clear strategy, it’s easy to react impulsively, often to your own detriment.

As with any speculative asset, Bitcoin should only make up a small part of a diversified portfolio. Only allocate funds you’re prepared to part with, and approach every decision with careful risk management.

Bitcoin Price Today

Bitcoin’s price fluctuates depending on global demand, how investors feel about the market, and wider economic events. It can rise or fall quickly in response to significant news, new economic data, or changes in regulations.

For UK beginners, watching how the price moves can help you spot patterns, notice when the market may be overreacting, and feel more confident about when to buy or sell. In our live chart below, you can see both past and current prices.

Pros & Cons of Bitcoin Investment in the UK

Like any speculative asset, Bitcoin brings both opportunities and challenges. A clear understanding of both is essential before deciding how it fits into your portfolio.

Pros:

- Accessible investing: UK residents can buy Bitcoin through FCA-regulated platforms, making entry relatively straightforward.

- Growth potential: Despite volatility, Bitcoin has delivered significant long-term gains since its launch.

- High liquidity: Major exchanges operate around the clock, allowing investors to enter or exit positions at any time.

- Inflation hedge: Some view Bitcoin as a digital alternative to gold, useful in times of currency depreciation or market stress.

- Portfolio diversification: For those heavily weighted in traditional assets, Bitcoin can offer exposure to a non-correlated class.

Cons:

- Severe price swings: Bitcoin’s volatility can be extreme, which may not suit investors with a low risk appetite or short time horizon.

- Regulatory uncertainty: Future UK policies may influence how Bitcoin can be accessed, traded, or taxed.

- Fraud risk: A rise in public interest has led to more scams, particularly involving unregulated platforms and fake investment schemes.

- Limited adoption: While growing, Bitcoin is still not widely used as a payment method in day-to-day life, which limits its practical utility.

Bitcoin may appeal to those seeking long-term potential or portfolio diversification, but it demands discipline, secure storage, and a clear investment strategy.

FAQs

Trading Bitcoin requires knowledge and before you make your first investment, ensure you are completely familiar with how this investment works. Then, you should find a reliable Bitcoin broker like the ones recommended above and make the required deposits. Remember, there are various ways to invest in Bitcoin, including buying and owning the cryptocurrency, investing in its shares, and trading it as CFDs. Therefore, identify which method works best for you to maximise your profit potential.

Yes. Many investors are buying Bitcoin online through online brokerage firms. However, ensure that the broker you invest with is regulated by the FCA since there are many scammers trying to swindle investors of their hard-earned money. We recommend some of the top Bitcoin brokers, so choose the one that complements your Bitcoin investment requirements.

You will need a crypto digital wallet to store your Bitcoin once you make a purchase. Note that online brokers like eToro that support purchasing of the physical asset have crypto wallets for storing your Bitcoins.

Absolutely. 2026 looks promising for many Bitcoin companies, especially those that were hit hard by the 2020 COVID-19. Good examples of top Bitcoin stocks to invest in are listed above. However, ensure you conduct additional research on the companies to ensure that you are making the right investment.

Yes. Bitcoin trading in the UK is considered federal activity, and as such, the profits you incur from Bitcoin investments must be subjected to capital gains tax.

Yes. Bitcoin investments can easily be hacked if you are using a Bitcoin exchange. That is why we highly advise investors to always contact their Bitcoin investment ventures on FCA regulated brokers. Not only is this the only legal way to invest in Bitcoin in the UK, but you also enjoy the best investment conditions offered by the brokers.

Yes, Bitcoin is legal in the UK. The Financial Conduct Authority oversees firms offering crypto services. While cryptocurrencies themselves aren’t classified as legal tender, it is entirely legal to buy, hold, and trade Bitcoin in Britain through regulated platforms.

Conclusion

Bitcoin is more accessible than ever in the UK, thanks to regulated platforms, secure storage, and better tools for investors. But accessibility doesn’t remove the need for caution.

It won’t suit every portfolio. If you’re quick to react to price swings or unsure about risk, it may not be the right fit. For those with a clear strategy and long-term view, however, Bitcoin can play a useful role within a balanced investment approach.

As with any high-risk asset, invest only what you can afford to lose, avoid emotional decisions, and stay focused on the bigger picture.