Gold is a financial asset that holds a prominent place in our economy. Not only because of its decades of existence, but because most investors see it as a store of wealth. If you are a new investor, it is essential that you understand how to invest in gold before you start making a purchase.

Our comprehensive guide will let you in on everything you need to know about investing in gold. We will also share with you some of the top brokers in the UK that offer gold investments. This way, you will have the right tools to get you started and hopefully succeed at it.

What is the Best Way to Invest in Gold

As a new investor with minimal experience in gold investment, you may believe that gold can only be purchased physically as either coins or bullion or as jewellery.

However, you should know that there are alternative methods of investing in gold, including buying stocks in gold mining companies, ETFs, CFDs, mutual funds, options, and futures contracts. You can even spread bet gold. Let’s see how each of these methods of gold investment works to ensure we all are on the same page.

1. Gold Bullion and Coins

Here, gold is purchased physically as coins and bars. While this method will give you all the satisfaction you need in touching and feeling its beauty, you need to secure the commodity by finding a safe place and insuring them. You will also have to figure out efficient means of transportation when selling. This can be costly and overwhelming for most investors, especially newbies with little experience in the commodity market.

Purchasing gold bars can be riskier than coins, considering they are heavy (approximately 400 ounces) and costly even when selling. This makes them illiquid assets since you can not cut off a piece of a gold bar to sell. Therefore, we highly recommend investing in small-sized bars or gold coins (10 ounces or less), which are liquid and popular among UK gold investors.

It is essential that you understand the best type of gold to invest in since there is also ancient or rare gold circulating the market. Therefore, we advise you to focus on the common or widely spread ones, especially when purchasing coins. Examples are the South African Krugerrand, the Canadian Maple Leaf, and the U.S. Eagle.

Additionally, you should always stay abreast of the latest market news to understand the current gold value. This will give you the green light on when to purchase or sell gold for a profit since the majority of the dealers usually update gold prices based on current spot prices.

2. Gold Futures and Options

Gold futures investment involves getting into a contract that specifies the amount of gold to be bought or sold on a particular date in the future regardless of market conditions. The amount of gold for futures contracts is not limited, and that is why it is a method that most experienced investors prefer.

In addition, futures attract low commissions, and the margin requirements also rank on the lower side than traditional equities. Note that futures contracts can either be settled in cash or gold commodity in this case. Therefore, we advise you to always confirm what’s entailed in a futures contract to avoid future inconveniences on the settlement date, especially if you have hundreds of ounces of gold to deliver physically.

You can also use options as an alternative to futures contracts. An option contract allows you to decide whether you will buy or sell gold if its price hits a certain level before a specified date. The best element about options is that it leverages the initial investment and minimises losses to the price paid. On the flip side, an option requires an investor to pay a premium to gold’s current value before taking ownership.

Options and futures are among the riskiest forms of investment basically because they are based on speculations (derivatives). Therefore, you need the best broker for futures and options in order to stand a chance of succeeding in these forms of gold investments.

Gold futures and options are volatile in nature, and for this reason, they can not be a suitable choice for most investors, especially newbies. However, they can be lucrative investments if you take your time to conduct thorough research on the market and track your activities before they expire worthless.

That being said, if you are investing in large amounts of gold, the best way to do so is through futures since it is way cheaper than options.

Check out our List of the Best Platforms for Options Trading.

3. Gold ETFs and Mutual Funds

Exchange-traded funds (ETFs) and mutual funds are excellent alternatives to purchasing gold physically as coins or bars. These methods will offer you more liquidity and diversification on various companies.

Gold ETFs consist of gold shares with which each share represents a specified amount of gold. They are bought or sold on a stock exchange, which is easily accessible via a brokerage firm. Additionally, investing in gold as ETFs is more straightforward and cost-effective compared to bullion.

For instance, you only need an ETF’s single share price as minimum investment, and their annual expense ratios are far less compared to what you will incur on other investments.

When it comes to gold mutual funds, they focus on beating the returns of passively managed index funds. Like ETFs and mutual funds, they are cost-effective but have high annual expense ratios. You can also use mutual funds for diversification across various companies, saving you the stress of researching individual companies.

To invest in gold mutual funds, you can seek the assistance of mutual fund brokers. These specialized brokers have access to a wide range of mutual funds, including those that focus on precious metals like gold.

All in all, gold ETFs and mutual funds are more straightforward forms of investments, and we highly recommend them to newbies or investors with minimum experience. You can easily invest in gold without possessing the costly physical asset, simply by purchasing gold ETFs that track the price of gold.

4. Gold Mining Stocks

This method of investing into gold allows you to purchase shares of gold from mining companies. Thus, it is an excellent way of getting exposed to the market without directly buying gold. We also like the fact that you will not have to only depend on the returns connected to the current price of gold. Instead, you can still earn from dividends, which most stocks pay.

The best place to buy gold stocks is via online brokerage companies, which we recommend some of the best below. You can also speculate on gold prices (CFD) and make a profit without owning the shares. Moreover, brokers for gold investments will give you access to diverse gold mining companies for stock purchase, including:

- Newmont Corporation, which is the world’s leading gold mining company. It is initially located in Colorado and bases its operations in North and South America and Africa.

- Barrick Gold Corporation, which is located in Toronto and extends its operations in various global regions.

- AngloGold Ashanti, a South African-based company with a global reputation. It is also the largest gold producing company in Africa.

- Polyus in Russia with close to 3 million ounces in production in the previous year.

One of the pitfalls of gold mining stocks is that their values are tied up to gold prices and a company’s fundamentals related to their profitability and expenses. However, with the necessary due diligence on your part, you can mitigate the challenges that come with gold stock investing and maximise your potential.

To learn more about Stock Brokers and Stock Trading Apps, please check our other guides.

5. Gold CFDs

Trading gold via contract for difference (CFD) is based on speculating on the asset’s price movements. The difference in price during the contract duration will be your profit or loss. Trading gold as CFD allows you to either go long or short on a trade. This means you can either trade the commodity when its price is rising or falling.

Trading gold in the falling markets allows you to short the asset. You will borrow gold from the broker and sell it hoping that its price will decline. You will then purchase the asset at a later date to return to your broker.

Gold CFD trading allows margin trading. Margin trading is whereby you get to deposit a specific amount of money as collateral to receive a loan for trading (leverage). It is a highly risky gold trading method and you need to be sure of your strategy before going for it. This is because in case your position doesn’t work as per your speculations, the losses you incur will be huge, hence leaving you with a loan to pay.

Learn more about UK CFD Brokers and UK CFD Trading Apps in our other guides.

Where to Invest in Gold

Trading commodities carries risks such as market volatility, leveraged positions, and the potential for substantial losses. To manage these risks, diversify your investments, use stop-loss and take-profit orders, and trade with funds you can afford to lose. Additionally, stay informed about market factors, adhere to a well-defined trading plan, and guard against emotional decision-making.

It is also crucial to comply with market regulations and be cautious of counterparty risk. Regularly reassessing your risk tolerance and trading strategies will help you trade responsibly and maximise profitability.

Now that you know the best forms of gold investment, you will have to choose the most suitable method that you are well-versed in. Once you make your choice, you also need a reliable and reputable company/broker to support you in making purchases or selling.

There are plenty of online brokerage firms to use for investments in gold. However, how guaranteed are you that they are convenient? As a new gold investor in the UK, you should consider your needs starting with security. This means that your broker should be regulated by the UK’s leading authority, the Financial Conduct Authority (FCA).

Additionally, pay attention to the fees charged by gold brokers. This is because fees vary from broker to broker, and a clear insight into a broker’s fee structure for gold investment will help you budget accordingly.

Other elements that you need to confirm in a broker for gold investment include platform performance, availability of gold, support service reliability, payment methods, and demo accounts.

Top Brokers for Gold Investment in the UK

The best brokers for gold investment will connect you to the right gold-selling vendors, keeping you from falling victim to unscrupulous ones. So while we have listed ways to choose the best broker for gold investment in the UK above, we thought we should also recommend a few to get you started on the right foot.

That being said, here are the top five brokers for gold investment that we have thoroughly tested and approved in the UK market.

1. Plus500

*Illustrative prices

Plus500 is another excellent choice for gold investors in the UK because it has various gold offerings across diverse financial markets to trade as CFDs. We were also impressed by its features, including free commission on gold investment, extremely low spreads, and a dedicated support service that runs 24/7.

Keep in mind that just like other brokers listed here, it is regulated in the UK market. In addition, it provides negative balance protection to UK investors.

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro

eToro hosts millions of users globally and is regulated by tier-one authorities, including The Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and more. Investing in gold using eToro gives you diverse opportunities in gold stock companies.

We believe it is suitable for new investors in the UK because of its unique features such as zero commission on stocks investment, copy and social trading and plenty of learning materials.

Step-by-Step Guide on How to Buy Gold with eToro

To get started trading gold you need to sign up with a broker such as eToro. The registration process is regulated and overseen by the FCA meaning the process is the same with every broker.

Below, we’ve provided a step-by-step guide on how to start trading gold with eToro but, as mentioned, the process is similar regardless of which broker you choose.

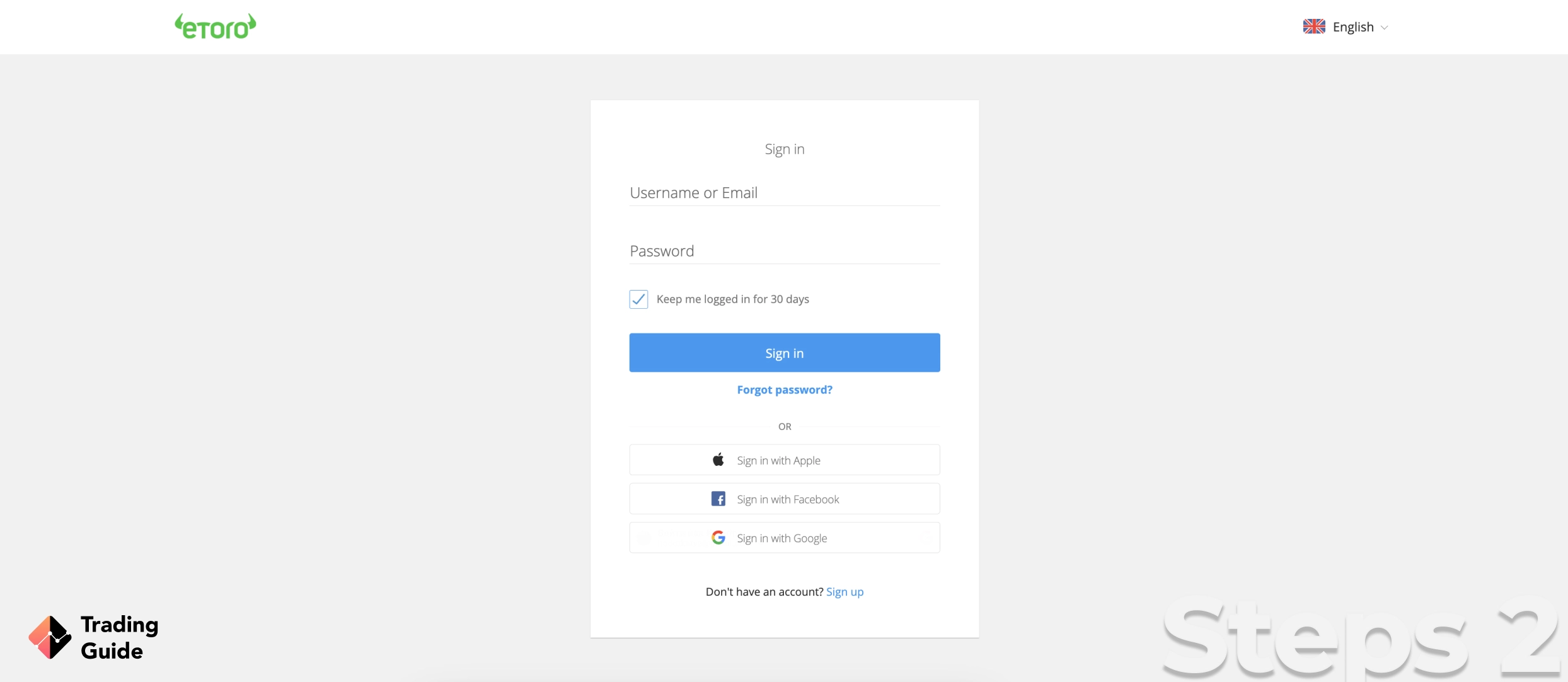

Start by following the links on the page to be redirected to the eToro website where you push the “Join Now” button to get started. You can register an account using your computer or mobile device. Personally, we think it’s easier to use a desktop or laptop computer, but it’s up to you.

The next step involves providing eToro with all the necessary information about you. This includes basic details such as name, address, phone number, and email address. However, you will also need to provide information about your income and trading experience.

Lastly, you will be asked to answer a series of questions concerning leverage trading. This is done to set a leverage limit suitable to your knowledge.

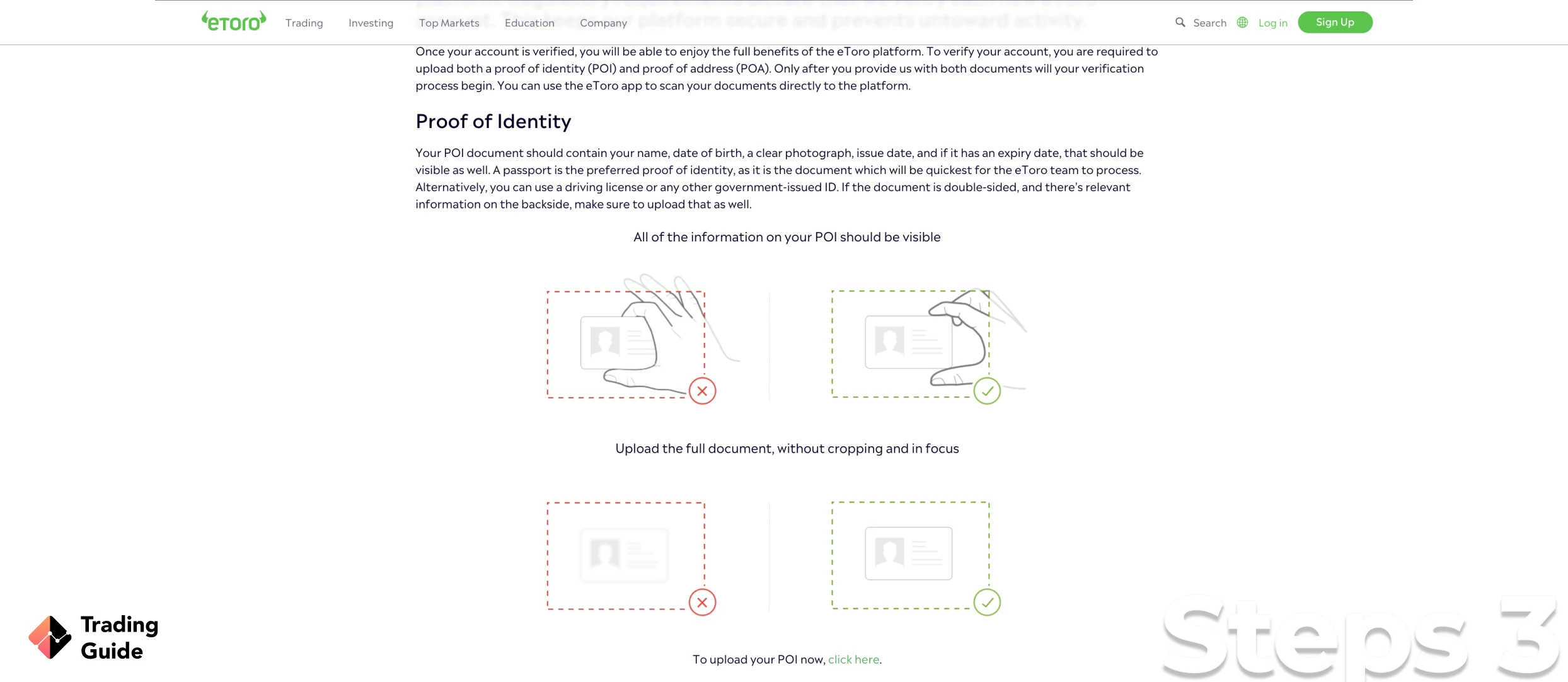

Since eToro is providing financial service, it’s obligated to verify the identity of all its clients. eToro has very clear guidelines on how to do this and it involves submitting proof of identity and proof of residency, ie. a copy of your ID and a recent utility bill or bank statement with your address clearly visible.

Once registered and verified you have to deposit in order to activate your account. Currently, eToro’s minimum deposit level is $100 which is quite high, although it does result in you having ample funds to trade gold with when you get started.

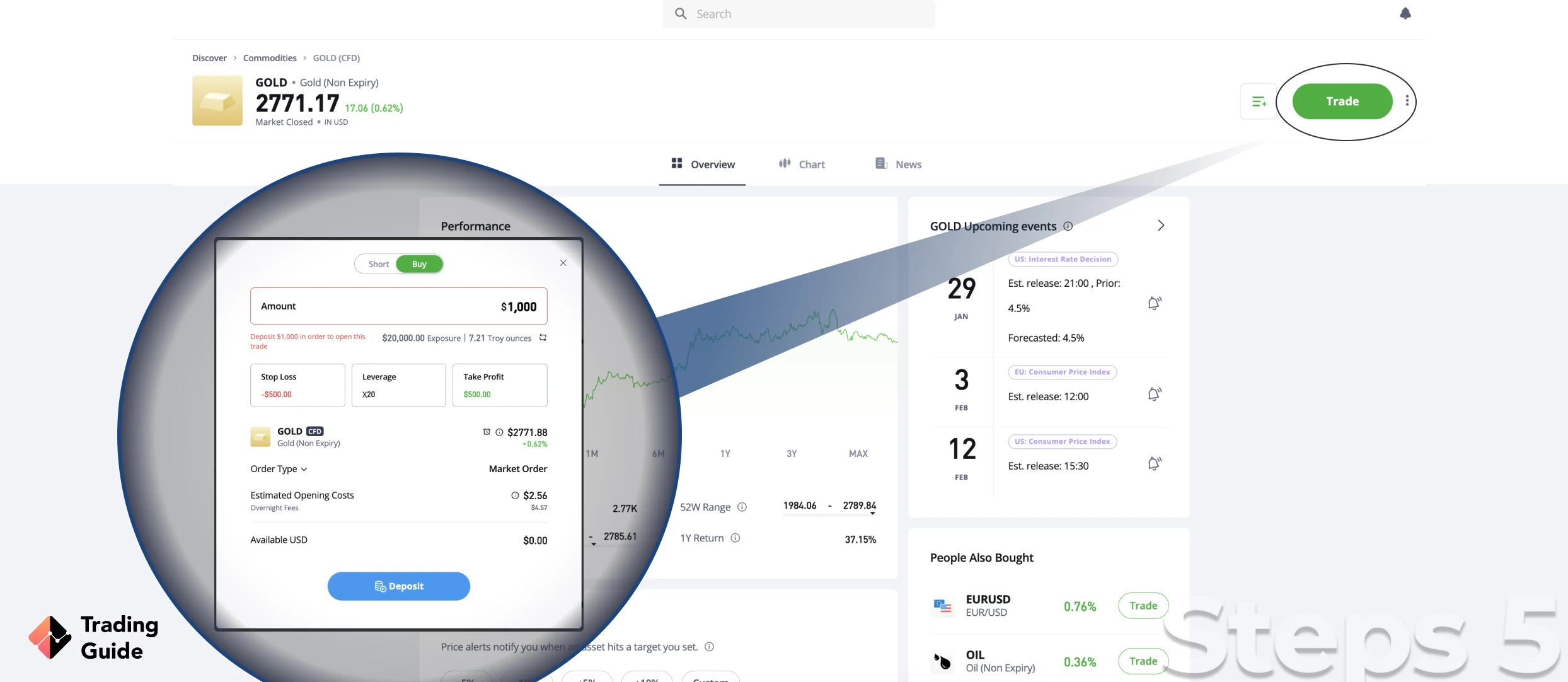

And that’s it! You can now start trading gold with eToro. Since eToro is a CFD broker, you will trade gold as a CFD, meaning that you will never own the underlying asset (gold) but rather speculate on its price movements.

We’ve written several detailed guides about CFD trading and encourage you to read them before you get started.

3. IG Markets

IG Markets will give you plenty of options in the financial markets, and gold is one of them. The pioneer broker allows CFD trading on intuitive design platforms. What’s more, you get to invest using advanced or quality resources, which are also available in plenty.

The unique features that kept us glued to this broker are the Direct Market Access, MT4 platforms, IG Academy, IG Community, and more. Although this gold investment broker can be costly, we primarily advise advanced investors to consider it.

Your capital is at risk

4. CMC Markets

CMC Markets is another pioneer gold investment broker with a global presence. Its services in the UK allows investors of all types to try their luck in various markets at low costs. For instance, the broker does not have the minimum deposit requirement like most brokers do.

Additionally, gold investment at CMC Markets attracts low fees, and you get to invest using its Next Generation cutting-edge platform. There is also the MT4 platform provided for investors looking for advanced tools.

GOLD Share Price

How to Buy Gold Stock

While buying gold as a physical asset can be profitable, most investors prefer buying gold stock because of the flexibility that comes with it. For instance, you will not have to secure or insure the commodity, nor will you worry about transportation costs if you decide to sell and have to deliver it to the buyer.

However, this does not mean that buying gold stocks doesn’t come with its fair challenges, but it all comes down to which form of gold investment works best for you. So, if you are looking for ways to buy gold stock, here is what you need to do.

- Educate Yourself

You cannot venture into gold stock with little knowledge of how to go about it. Therefore, learn how to invest in gold stock by understanding our methods above. You should also understand the markets, including the best companies selling gold shares and the best time to make a move.

- Choose a Gold Stock Broker

Online brokerage firms have given investors lots of opportunities than individual companies could ever do. For this reason, identify the most suitable broker for gold investment by considering elements such as security, charges, gold markets, and even demo accounts. The best thing about a demo account is that you can practice various tips on investing in gold before risking real money.

- Open an Account

Once you are done practising using a broker’s demo account, sign up for a real account and make the required deposit. Every broker has its own requirement ranging from low to high. Therefore, make sure you understand this element before choosing a broker for you to budget accordingly. After making a deposit, you will be given access to the gold stock offered by various global companies to choose from.

- Choose a Strategy

There are two common strategies for gold stock investment, including CFD and taking ownership of the asset. Whichever method you decide to go with, ensure you are confident and understand the risks involved. Remember to always use risk management controls to mitigate potential losses.

- Open a Position

You can now buy gold stock by choosing the stock you are willing to purchase and the investment amount. If a broker has a search tool, make use of it to quickly identify the commodity.

Find out about the Trade Nation broker with our other article.

Conclusion

Now that you have all the essential information on how to invest in gold, we believe that you are ready to take your first shot at investing in the commodity. From our guide above, it is evident that gold is not seasonal, and you can invest in it any time of the year. Furthermore, gold is liquid, which can benefit day traders even though other investors can also make profits with extensive technical analysis and market news coverage.

Our parting shot is that you should always have a plan, whether you intend on holding a short-term or long-term investment. If you are a newbie, we have recommended the best brokers to choose from above. Also, apply the above methods of investing in gold using a broker’s demo account before you decide to fully commit.

You can make a good profit and definitely, you can live with Gold trading.

And if you're not independent and depend on calls and tips then you will definitely not survive in the market for more than a year and that's true.

I get good daily inquiries and people ask for calls and tips and only a few like 1% of people ask for learning and sharing experience.

Gold, unlike stocks, are the solid real value in that they are NEVER worth nothing. its prices do fluctuate but there is no crash in their value. You can use gold anywhere in the world and its value is determined by spot prices as they occur daily. Most investors follow the gold market daily, or at least very frequently, and look to buy when prices are at a low. Sometimes the true investor won’t sell when prices are high, because the value is always certain. Governments can’t inflate the amount of gold as they can do with paper currency. ( They probably wish they could print gold and eventually ruin its worth as they’ve done with paper money. )