Marks and Spencer (M&S) has a rich history spanning over a century, and its stocks can be an intriguing option for investors looking to diversify their portfolios. If you have been looking to invest in this company. In that case, we will walk you through the fundamental aspects of getting started, from understanding the company’s background to exploring various investment strategies and considerations. We will also introduce you to the top stock brokers for investing in the shares on Marks and Spencer and share additional information for easier decision making.

5 Simple Steps for Buying Marks and Spencer Stocks in the UK

Buying the stocks of Marks & Spencer is a pretty straightforward process. Here is a brief overview of the procedures to note. We will get into in-depth details later in this guide.

- Identify the best stockbroker with features suitable for your investment needs

- Visit the broker’s website and create an investment account

- Verify your details and participate in the questionnaire provided by the broker

- Make a deposit per the stockbroker’s minimum deposit requirement

- Choose the amount of shares you can afford to buy, then initiate the purchase

Top Brokers to Invest in Marks and Spencer Stocks

Marks and Spencer is a publicly traded company with stocks listed on the London Stock Exchange (LSE) under the ticker MKS. It is also a constituent of the FTSE 250 index. Therefore, to effectively invest in the stocks of Marks and Spencer, you need a reliable and credible broker with access to the LSE. The broker should also allow CFD and indices trades so you can easily explore the asset without taking full ownership.

With so many stock brokers in the UK, investors find it challenging to identify suitable ones for buying and trading MKS shares. The good news is that our professional researchers did all the legwork and recommend below the top stock brokers in the UK. You simply have to compare their features to settle on the one guarantee an exciting experience.

1. eToro

eToro is a highly regarded stock broker that offers an excellent platform for investing in Marks and Spencer stock. With access to the LSE, the broker allows investors to purchase Marks & Spencer shares under the “MKS” ticker. Moreover, you can use the broker to trade the company’s shares and indices or CFDs should you want to explore the asset without taking full ownership.

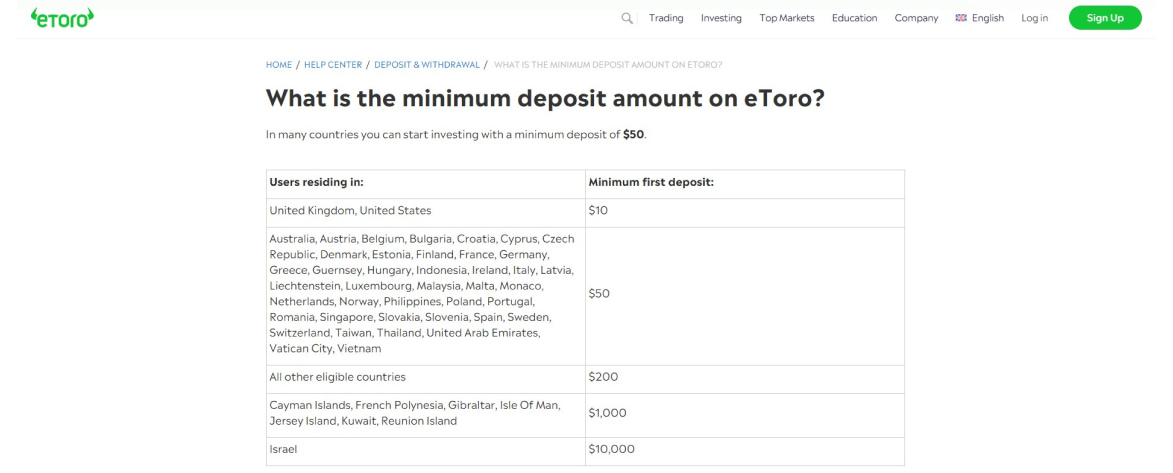

The best element about investing with eToro is that you can buy MKS shares in fractional amounts, making it accessible to many individuals. The platform also provides access to a wealth of educational resources, including an award-winning social trading platform where you can learn from and interact with other investors. Its minimum deposit requirement is $100, making it easier for low-budget investors to get started. Although share investment is commission-free, spreads are high, and you will incur a withdrawal fee.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- Commission-free share investment in Marks and Spencer stock

- Ability to purchase Marks & Spencer shares in fractional amounts

- User-friendly interface for a seamless investing experience

- Access to educational resources and a social trading platform for learning and collaboration

- Limited advanced trading tools for experienced professional traders

- Withdrawal fee of $5

2. Interactive Brokers

Interactive Brokers (IBKR) emerges as another top stock broker for purchasing the shares of MKS. Known for its low-cost structure, IBKR offers a cost-effective solution for trading globally-listed stocks. This makes it attractive, particularly for budget-conscious investors seeking advanced market analysis resources. With a wide range of learning materials, including videos, articles, webinars, and podcasts, IBKR provides ample educational resources to enhance your trading skills.

Note that IBKR does not have a minimum deposit requirement, offering flexibility for investors of all levels. There are also no transaction fees when making deposits and withdrawals. Plus, the broker ensures maximum safety for its users through robust encryption and regulation by the Financial Conduct Authority (FCA). The platform caters to retail and professional investors with its IBKR Lite and IBKR Pro plans, respectively.

- Low over-the-counter trading commissions

- No minimum deposit requirement

- Free deposits and withdrawals

- Excellent collection of learning and research materials

- Regulated and secure platform

- Platform navigation can be challenging for newcomers

- Customer service responsiveness could be improved

What is Marks and Spencer Group Plc?

Marks and Spencer Group PLC, commonly called M&S, is a prominent multinational retailer based in the United Kingdom. Established in 1884, the company has grown to become a household name known for its wide range of high-quality clothing, beauty, home products, and luxury food items. It also features Marks and Spencer online banking services, allowing you to benefit from its Marks and Spencer fixed rate ISA. With over a century of experience in the retail industry, Marks and Spencer has cultivated a reputation for its commitment to exceptional customer service, British heritage, and style.

As a socially and environmentally responsible company, Marks and Spencer is dedicated to sustainable practices and ethical sourcing. The company’s Plan A initiative exemplifies its commitment to reducing waste, minimising its carbon footprint, and supporting fair trade. M&S has embraced digital transformation, expanding its presence through online platforms, thus allowing customers to conveniently access and purchase their products from anywhere.

Note that Marks and Spencer is a publicly traded company with its stock listed on the LSE. The company continues to be an influential player in the retail sector, attracting investors who recognise its brand strength and ongoing efforts to adapt to changing consumer preferences.

How to Buy Marks and Spencer Stocks with eToro

Investing in the Marks and Spencer stocks can seem daunting for some investors, but it can be a straightforward process with the right knowledge and platform. While we have given you an overview of how to get started above, we decided to broadly explain the procedures for buying Marks and Spencer stocks for better understanding. Note that the process below is the same when investing with an FCA-regulated broker; we only use eToro as an example.

Visit the eToro’s website via any links we’ve shared on this page and initiate the sign-up process. Provide the required information, including your personal details and financial information. Then, complete the verification process by sharing copies of your documents, including your ID or passport and utility bill.

Once your eToro account is successfully activated, you need to deposit funds into it. Choose a suitable funding method from the available options, including bank transfer, debit cards, or e-wallet, and transfer the desired amount to your investment account. Ensure you have sufficient funds to afford a broker’s service and cover the Marks & Spencer shares investment.

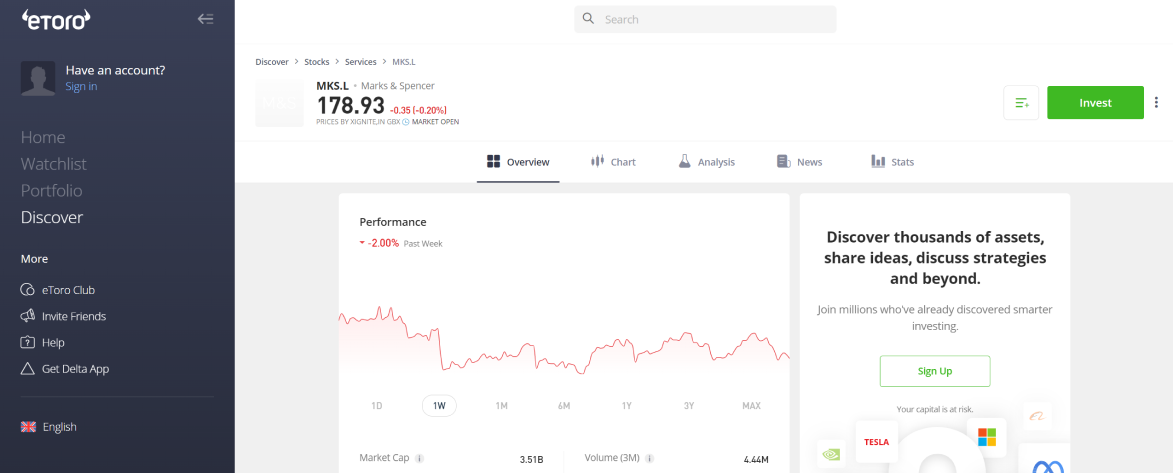

Navigate to eToro’s platform and use the search function to find the Marks and Spencer stock. It is typically listed as “Marks and Spencer Group Plc” or its ticker symbol “MKS.” Review the stock details, including the current price, market trends, and relevant news or analysis.

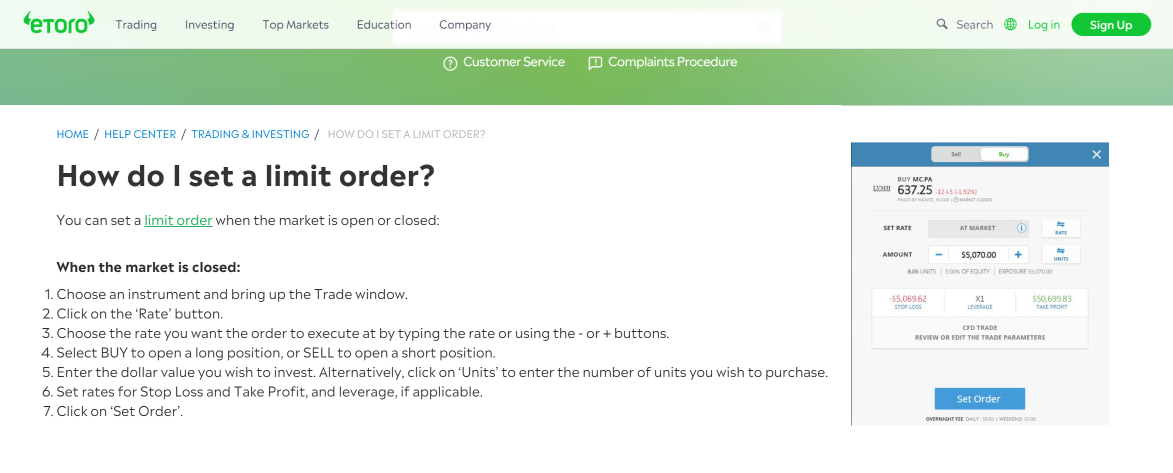

Once you are ready to proceed, select the appropriate order type on eToro’s platform. You can choose from options such as market orders, limit orders, and stop-loss orders. Specify the number of shares you want to buy and set your desired price if you are using a limit order. Double-check all the details before initiating the purchase.

Remember, if you do not want to buy the stocks of MKS, eToro also features CFD and indices trading to explore. Simply ensure you understand how a trading method works before making a move for increased potential.

After placing the order, keep a close eye on your investment in Marks and Spencer stocks. Fortunately, eToro provides tools and resources to monitor your portfolio’s performance and track market fluctuations. If desired, you can set alerts or place additional orders to buy or sell more shares.

Price Chart

As a prominent British retailer, Marks and Spencer’s share price is subject to market dynamics and various external factors. By referring to the live chart below, you can stay updated on the current price of Marks and Spencer shares, enabling you to plan your investment activities accordingly. The live chart also allows you to analyse the stock’s historical performance, empowering you to make informed predictions and potentially maximise profits

What Do You Need to Start Investing in Marks and Spencer Shares?

To start investing in Marks and Spencer shares today, there are a few key things you will need to have in place. By ensuring you have the following requirements, you can confidently begin your investment journey.

- Knowledge: It’s essential to learn about Marks & Spencer as a company, its financial performance, industry trends, and any relevant news or updates. Stay informed about the factors that can impact its stock price for effective strategy development.

- Stock Broker: As mentioned earlier, you need the best stock broker to buy and sell the shares of Marks and Spencer. The broker should have access to the LSE, where this company’s stocks are listed.

- Capital: Before investing in Marks and Spencer shares, you must have the capital to purchase the stocks. Determine the amount you are willing to invest, considering your financial goals, Marks & Spencer exchange rates and budget.

- Patience and Long-Term Outlook: Investing in Marks and Spencer shares requires patience and a long-term outlook. Stock prices can fluctuate in the short term, so focusing on the company’s fundamentals and long-term growth potential is essential. Aiming for quick profits can influence bad decisions that might leave you with losses.

Pros and Cons of Investing in Marks and Spencer Stocks

Deciding whether to invest in Marks and Spencer stocks requires careful consideration of the potential benefits and drawbacks. Like any investment security, there are pros and cons that come with investing in this renowned British retailer. Below, we will explore the key pros and cons of investing in Marks and Spencer stocks, shedding light on the factors that could impact your investment journey.

Pros

- Marks and Spencer is a well-known and established brand with a strong reputation in the retail industry. Its long-standing presence and loyal customer base can contribute to the company’s stability and growth.

- The company has a history of paying dividends to its shareholders and plans to resume making payments. By investing in its shares, you have an opportunity to supplement your income.

- You can make money from the shares you purchase if the value of Marks and Spencer stocks increases over time.

- Marks and Spencer shares are easy to purchase since they are listed on the LSE. All you need is a credible and reliable stock broker with access to this exchange.

- Buying MKS stocks via stock brokers attracts all types of investors, considering that most brokers allow purchasing of the shares in fractions.

Cons

- The retail industry is highly competitive, and Marks and Spencer faces challenges from both traditional competitors and the growth of online retailers. Changing consumer preferences and market trends could impact the company’s performance and profitability.

- The stock market is volatile, and Marks and Spencer’s value can be influenced by the volatility. Economic downturns or shifts in consumer spending habits can negatively affect the company’s financial performance and stock price.

- Marks and Spencer has been undergoing a significant business transformation in recent years, which can introduce uncertainty and potential risks, thus negatively affecting your investment.

FAQs

Yes. Based on our analysis, Marks & Spencer is a good buy because of its recent measures to increase its revenue and remain competitive in the British retail market. For instance, the company has seen an impressive turnaround since the appointment of its new CEO Stuart Machin in 2022.

Marks and Spencer shares are managed by individual shareholders who hold the stock in their investment portfolios. These shareholders include retail investors, institutional investors, or investment funds. The company’s management, including its operations and strategic decisions, is overseen by the executive team and board of directors.

Marks and Spencer is a publicly traded company, and its ownership is distributed among its shareholders. The company was founded in 1884 by Michael Marks and Thomas Spencer and continues to grow and remain competitive in the retail industry.

The number of shares that Marks and Spencer has can vary over time due to factors such as stock issuances, buybacks, and other corporate actions. At the time of writing this guide, the company’s share outstanding is around 982.42M. However, it’s crucial to check the most recent financial reports or consult reliable financial sources to obtain the updated number of shares issued by the company.

Conclusion

Investing in Marks and Spencer can open up exciting possibilities for those seeking to participate in the dynamic retail industry. By following the practical steps outlined in this guide, you can easily navigate the process and embark on your journey as a confident investor. Remember, investing in stocks involves both rewards and risks, so it’s essential to strike a balance between thorough research and calculated decision-making.

Simply put, always stay abreast with the latest market trends, Marks & Spencer exchange rate, seek advice from experts if needed, and keep an eye on the ever-changing landscape of the retail sector. With patience and diligence, investing in Marks and Spencer can be your ticket to potential financial growth and an exciting venture into the world of stock investments.

I found the broker comparisons helpful