The advancing technology and post-COVID trends have increasingly made tech stocks popular and attractive to investors. Snap Inc (Snapchat) is one of the tech stocks to consider investing in, considering it is one of the most popular messaging apps globally. Snap is a faster-growing social media company, and putting your money into its shares now could be the best decision for considerable returns in the long run.

Unfortunately, many investors do not know how to kickstart their Snap stock investment ventures. Overall, you need the best stock broker with features aligning with your investment needs and money as capital. You should also be fully knowledgeable about Snap stock and know the best time to make a move for maximum profit potential. Luckily, our comprehensive guide below helps you get familiar with everything you need to start investing in the shares of Snap.

Top Brokers for Investing in Snap Stocks

Finding the best stock broker for investing in Snap Stock in the UK can be an uphill climb. This is because the research procedures involved are lengthy and overwhelming, and you can even end up with a wrong choice.

To simplify things for you, we list below our top stock brokers based on expert recommendations. Note that they have access to the New York Stock Exchange (NYSE), where the company shares are listed under the symbol SNAP. You can also use them for trading the stocks of Snap as CFDs or indices.

1. eToro

eToro has access to the NYSE, where Snap stocks are listed for purchase. With the broker, you also have access to additional popular stocks and assets, including forex, commodities, cryptos, etc., for portfolio diversification. All you have to do is register for an investment account and make the required deposit of at least $100 to get started. The broker is user-friendly, and beginners will definitely have the best experience.

Note that besides buying SNAP shares, eToro allows you to trade them as CFDs or indices. When trading SNAP as CFDs, ensure you understand the risks that come with this trading method and put up money you are willing to lose. Moreover, the broker hosts quality learning and research materials, and you can also explore its social and copy trading platforms for maximum potential.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

2. IG Markets

IG Markets has made a name for itself since its establishment in the 1970s. As a pioneer broker, IG Markets is trusted by millions of traders globally. Although it doesn’t have access to the NYSE and you cannot use it to buy SNAP stock, it is one of the best brokers for CFD and indices trading. Besides Snap shares, over 17,000 assets are listed across various asset classes to try and diversify your portfolio with.

Unfortunately, IG Markets is a relatively costly CFD broker with high trading fees and a minimum deposit requirement of £300. However, with the quality and plenty of resources the broker hosts, the amount to be incurred is worth it. Simply ensure it fits your budget to enjoy your experience. We primarily recommend IG Markets to expert CFD traders looking to explore advanced platforms like L-2 Dealer, ProRealTime, and MT4.

Your capital is at risk

How to Buy Snap Stocks With eToro

Now that you have the best brokers for buying and trading Snap stock, we believe it is best if you also become familiar with the procedures involved in buying the company’s stocks. Since our recommended stock brokers above are regulated by the Financial Conduct Authority (FCA), the process for buying and trading SNAP is the same. Simply ensure you settle for one suitable for your investment needs.

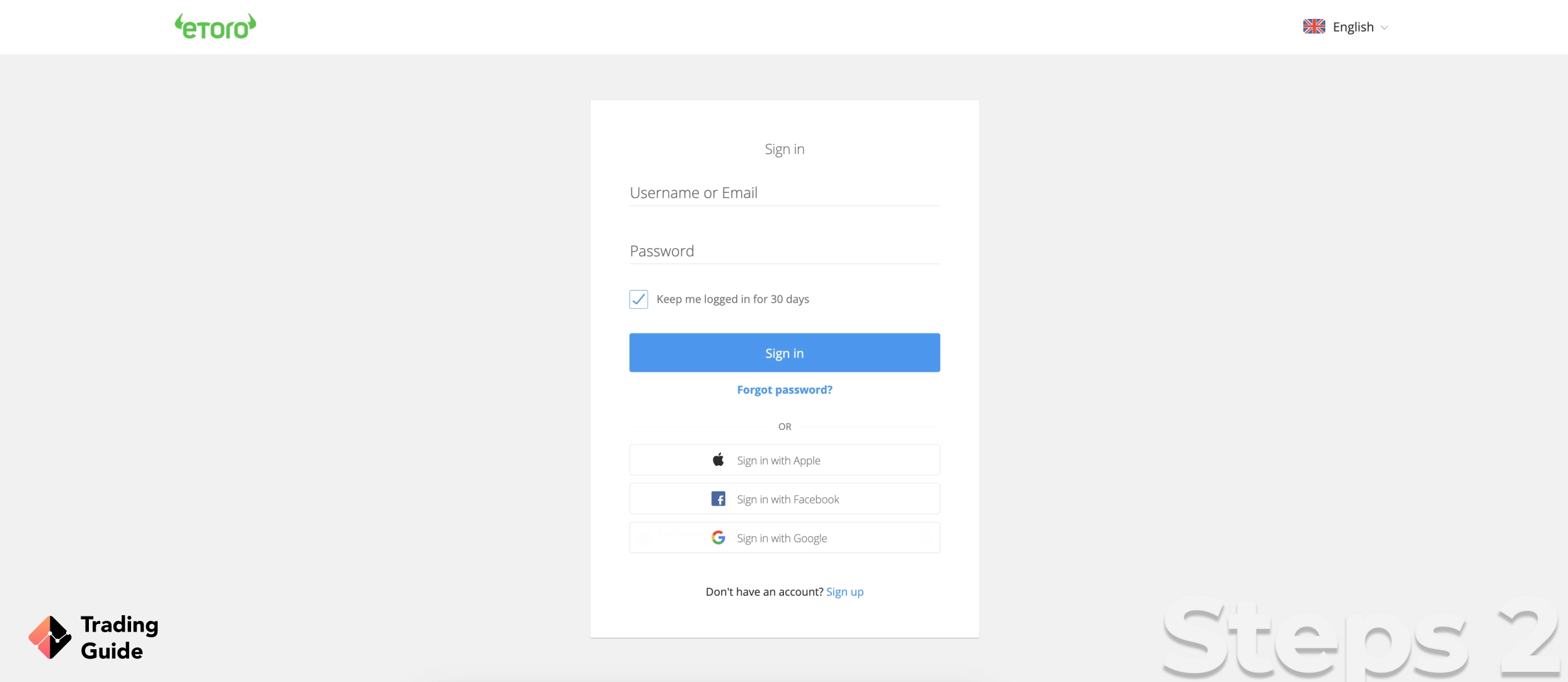

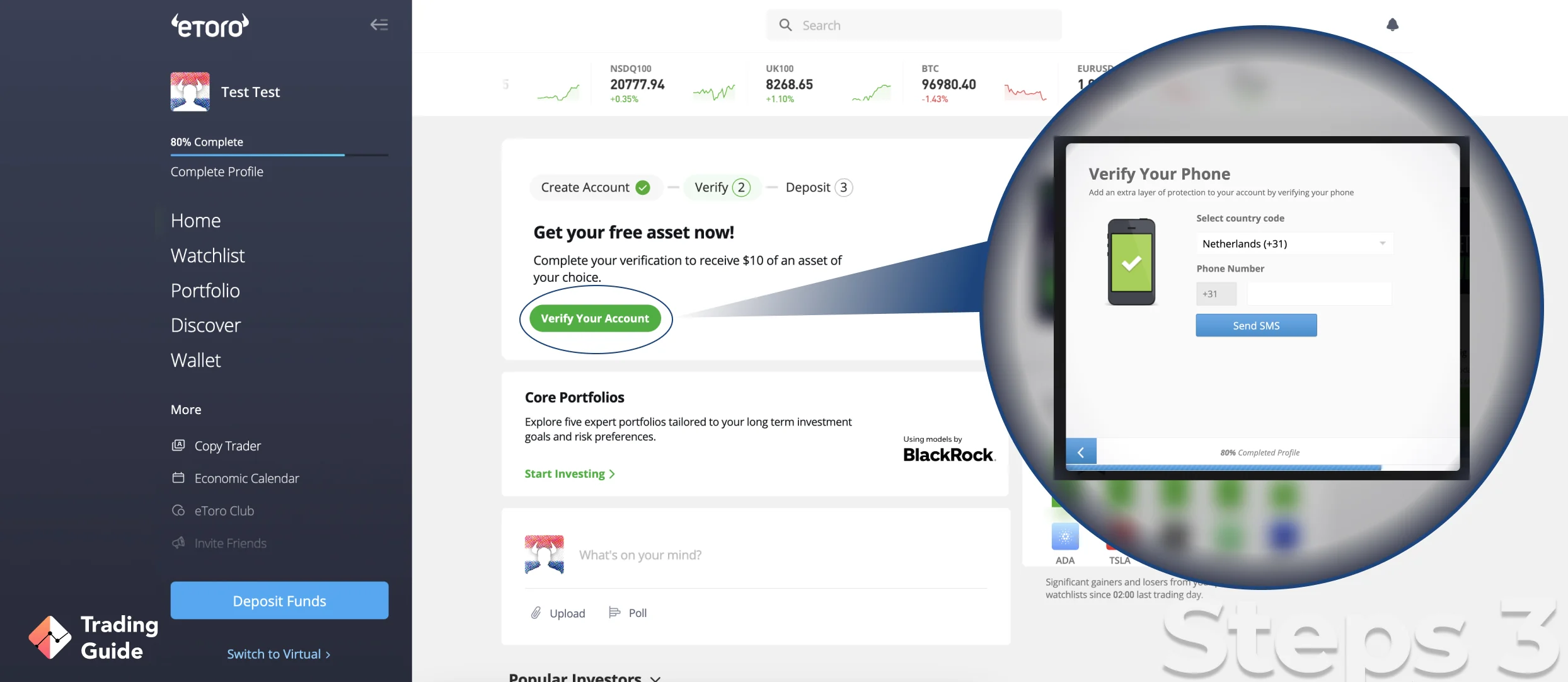

To create an account with eToro for buying SNAP, you need to create an investment account with the broker. In this regard, visit eToro’s website by clicking any of the links we’ve shared on this page for quick access. Once you are on the website, understand the broker’s terms and conditions before beginning the registration process. If you are always on the move, consider installing eToro’s trading app from Google Play or the App Store so you can easily manage your investments on the go.

Start the registration process by providing your personal details, including your name, email, phone number, date of birth, tax details, source of income, etc. To ensure your investment account is fully protected, eToro will require that you create a username and password.

To ensure online trading platforms are secured, all FCA-regulated brokers, including eToro, are required to verify traders’ and investors’ personal details before fully activating their accounts. Therefore, once you provide your personal details, eToro will require you to verify your identity by sharing a copy of your original ID, passport, or driver’s license. You must also verify your location by sharing a copy of your recent utility bill or bank statement.

eToro will then review the documents you’ve shared and send you an email notification once your account is fully activated. At this point, you can proceed to make the required deposit of at least $100 to access NYSE and buy Snap shares. Remember, making deposits with eToro is free, and you can transact using various payment methods, including debit cards, e-wallets, and bank transfers.

eToro will confirm your deposit and redirect you to the NYSE where the shares of Snap are listed for purchase. Note that with eToro, you can buy the company’s shares as fractions if you do not want to spend a lot of money purchasing multiple shares. For traders taking CFD or indices positions, you can also do so once your deposit has been confirmed. However, ensure you are familiar with how your prefered trading method and the risks involved for maximum potential.

Tips on How to Choose the Best Stock Broker to Invest in Snap Stocks

The best stock broker for buying or trading Snap stock must have features aligning with your requirements for the best experience. Our recommended two stock brokers above have varying features, so ensure you compare them to settle for a suitable one. However, should you not find a suitable broker from our list above, use our tips below to find the best broker during your research.

The first element to consider when searching for a stock broker to buy SNAP is credibility. It is crucial to find a broker that guarantees your funds’ security since some of them are scammers waiting to take off with your hard-earned money. To ensure a stock broker is safe, check whether they are licensed and regulated by the Financial Conduct Authority (FCA). With such brokers, you also get an opportunity to invest under the best conditions, thus enjoying your experience.

Another crucial element to consider is a broker’s fees or charges. Make sure the fees fit your budget to avoid overspending and exhausting your nest egg. So, when searching for a stock broker, consider fees, including minimum deposit requirement, commissions or spreads, inactivity fees, transaction costs, etc. Moreover, the broker you select must allow you to transact with convenient payment methods, whether credit/debit cards, e-wallets, or bank transfers.

The best stock broker for buying Snap shares must have a user-friendly platform to enjoy your experience. It should also host all the resources you need to effectively conduct market analysis and boost your skill level. If you are a beginner, check whether a broker has a demo account for testing it with and gauging your skill level before diving straight into the live market.

It is crucial to select a stock broker with access to the NYSE if you are planning to buy Snap stock and take full ownership. However, if you want to trade the asset as derivatives, ensure the broker you choose allows you to do so. For instance, if you are a CFD trader, ensure a broker you select hosts the shares of snap and allows CFD trading. Having a broker that also supports additional asset classes is a plus since you can easily try them via a demo account and choose the best for portfolio diversification.

If you are a beginner, it is advisable to find a stock broker for buying SNAP with a reliable and dedicated support service. You see, before you become an independent trader and investor, having all the support is crucial. This can only be possible with quality guidance from a broker’s support service. However, keep in mind that brokers’ availability differs, so ensure you find the one that fits your trading schedule. It should also be contacted via convenient communication channels, including phone, email, or live chat.

Before rushing to sign up for an account with a stock broker, consider reviewing user testimonials. Although you should apply the tips above to find a suitable broker, ensure you leave no table unturned to ensure you only settle with the best. With user testimonials, it’s easy to understand a broker’s strengths and pitfalls, thus deciding whether it is worth investing with. That being said, visit Google Play, the App Store, and Trustpilot for honest user reviews and testimonials.

Snap Stock Price Today

Although Snap’s stock price today isn’t as high as it was during its IPO, the company is taking measures to ensure its share value rises even higher. So far, the company’s share price keeps fluctuating, meaning getting its accurate value can be challenging. In this regard, we provide a live chart below indicating SNAP’s accurate value. You can also use the chart to analyse the asset’s historical price to determine the best entry and exit points.

About Snap

Founded in 2011 by Evan Spiegel, Bobby Murphy, and Reggie Brown, Snap Inc is an internet content and information business company headquartered in California, the United States. The company owns the popular messaging app Snapchat and other products, including Spectacles and Bitmoji, which drive its revenue. Its shares were introduced to the public in 2017 under the ticker SNAP, and you can purchase them from the NYSE using a stock broker with access to the exchange.

Note that Snap’s messaging app, Snapchat, was initially named Picaboo and was later renamed to avoid confusion in the marketplace. Snap has provided value to over 300 million users since they can easily interact through videos, images, and disappearing messages. Like any other stock, Snap is a risky investment; only time will tell whether it lives up to expectations.

FAQs

Yes. Snap has really transformed over the years, and its measures to increase revenue make it a potentially profitable investment. As an investor, we advise you to conduct further research on the company to ensure you make the best investment decision.

To invest in Snap in the UK, you need a reliable stock broker like the ones referenced in our mini reviews above. Ensure the broker has access to the NYSE, where the shares of Snap are listed under the symbol SNAP for purchase. If you want to trade the asset without taking full ownership, find a stock broker offering derivatives trading, such as CFDs or indices.

No. Unfortunately, Snap does not pay dividends to its shareholders. You can only benefit from the company through the selling of your shares for profit.

Yes. According to the company’s developers and analysts, Snap stock’s value is expected to go up in the coming months. With an increased share price, you can make a substantial amount of profit if you invest now that its value is low.

Conclusion

It’s a no-brainer that the tech industry is competitive, and Snap is facing intense competition in the market. Although its share price is still low compared to its competitors, many investors see an investment opportunity since they are hopeful for the company’s growth. All in all, it is crucial to conduct further research on Snap and decide whether it is a risk you want to take. If you decide to invest in the asset, our guide above will help you get started on a good note. Simply ensure you are fully knowledgeable about the stock market and invest with amounts you are comfortable losing.