Index trading allows you to get exposure to various company stocks in a single trade without the need to research and invest directly in a company. It is a method of trading that reduces the risks that come with stock trading. Simply put, index trading is not about buying individual company shares and selling them later for profits. Instead, you get to trade a compilation of shares and benefit from both upward and downward price movements.

This guide was prepared to help you fully understand how to trade indices in the UK. Since you need a broker to trade indices, we recommend the top three to simplify your search. As a result, you should be able to try your luck in the exciting world of index trading and hopefully trade like a pro.

Top Index Brokers in the UK

Trading indices requires a reliable broker with access to various stock markets where major indices are listed. You also need a broker to hedge your already existing position with a short-term index trade (CFDs).

Below are the top three index brokers in the UK that feature the best elements to get your index trading venture off to a good start. They are also regulated by the Financial Conduct Authority (FCA), guaranteeing safety and the best trading conditions.

1. eToro

eToro allows you to place an index trade using CFDs on a user-friendly platform. Alternatively, you can trade index using ETFs, which are investment funds designed to monitor an asset’s performance. Although ETF trading with this broker is commission-free, index CFD trading fees are relatively high. With eToro, you have access to major stock indices, including Dow Jones Industrial Average (DJ30), FTSE 100 (UK 100), S&P 500 (SPX500), NASDAQ 100 (NSDQ100), and more.

eToro also features a social trading platform that connects like-minded traders from different places. On top of that, the broker features copy trading, whereby newbies and traders with limited time for research and analysis can mirror the positions of professional traders. However, note that the copy trading platform can be costly for some traders to access since it requires a minimum deposit of $200 and a minimum amount per trade of $10.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

2. IG Markets

IG Markets allow you to trade indices as CFDs on an intuitive design platform that hosts quality resources to help in technical and fundamental analysis. You will get exposure to more than 80 indices, including US Tech 100, FTSE 100, US 500, and more. Furthermore, the broker is user-friendly, and its IG Community platform connects you to other traders where you will learn more index trading ideas, thus improving your skills. There are also over 17,000 assets to profit from, including individual company shares, forex, commodities, cryptocurrencies, and more.

Unfortunately, index trading at IG Markets attracts high spreads. Its no minimum deposit. IG Markets has a support service operating only five days a week. Therefore, ensure the broker’s availability aligns with your trading schedule before making a commitment.

Additionally, it’s worth considering checking a full IG broker review to determine if the platform aligns with your trading needs.

Your capital is at risk

3. Pepperstone

Pepperstone is user-friendly and executes trades fast, allowing you to quickly benefit from short-term positions. There are no commissions trading indices with Pepperstone, and spreads are as low as 1 point on AUS200, 2.4 on US30 and 0.9 on GER30. Moreover, you will be exposed to major indices globally, giving you plenty of opportunities to earn profits.

Like eToro and IG Markets, Pepperstone is also a social trading broker. You will enjoy the advanced cTrader, MT4, and MT5 platforms. Even though there are no transaction nor inactivity fees, getting started at Pepperstone requires a minimum deposit of £200. You can rely on Pepperstone’s award-winning support service that operates every day.

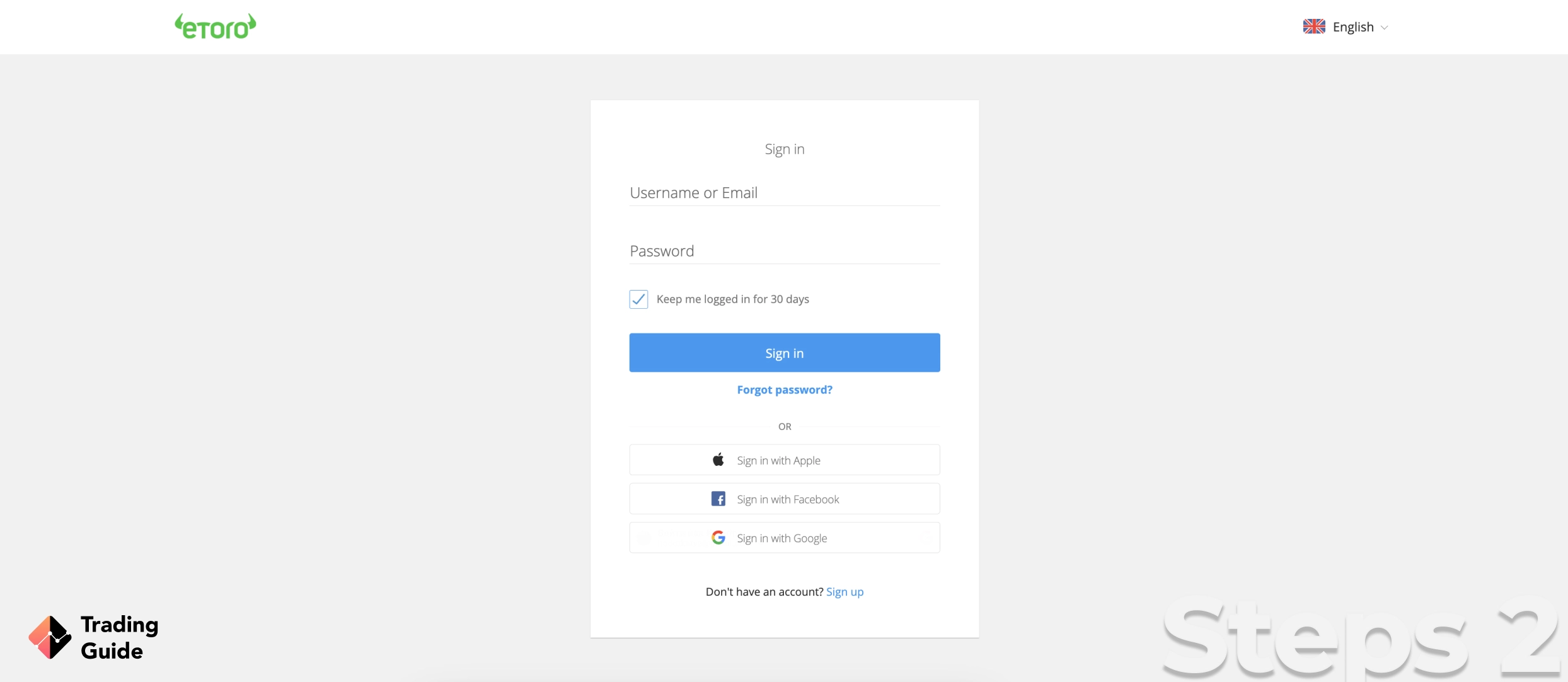

How to Trade Indices With eToro

Trading indices is easier when you master all the processes involved in getting started. Below we help you understand how to trade indices with eToro so that you can be fully prepared to dive into the real markets and start trading.

We have shared links on this page to easily redirect you to eToro’s website, where you will initiate the account registration process. Note that eToro is reliable and has a trading app that you can also use to trade indices. Therefore, feel free to install the app on your mobile device and switch between desktop and mobile trading. That way, you will never miss out on any opportunity that may earn you profits.

eToro will require you to share personal information to complete the account registration process. These include full names, address, email, phone number, etc. In addition, you will create a username and password and share your source of income details.

During the registration process, eToro will provide you with tests to gauge your skill level and determine the best trading package. Since you will be trading indices as CFDs, eToro offers margin trading. This means that the broker will also choose a suitable leverage limit for you after completing a margin trading test.

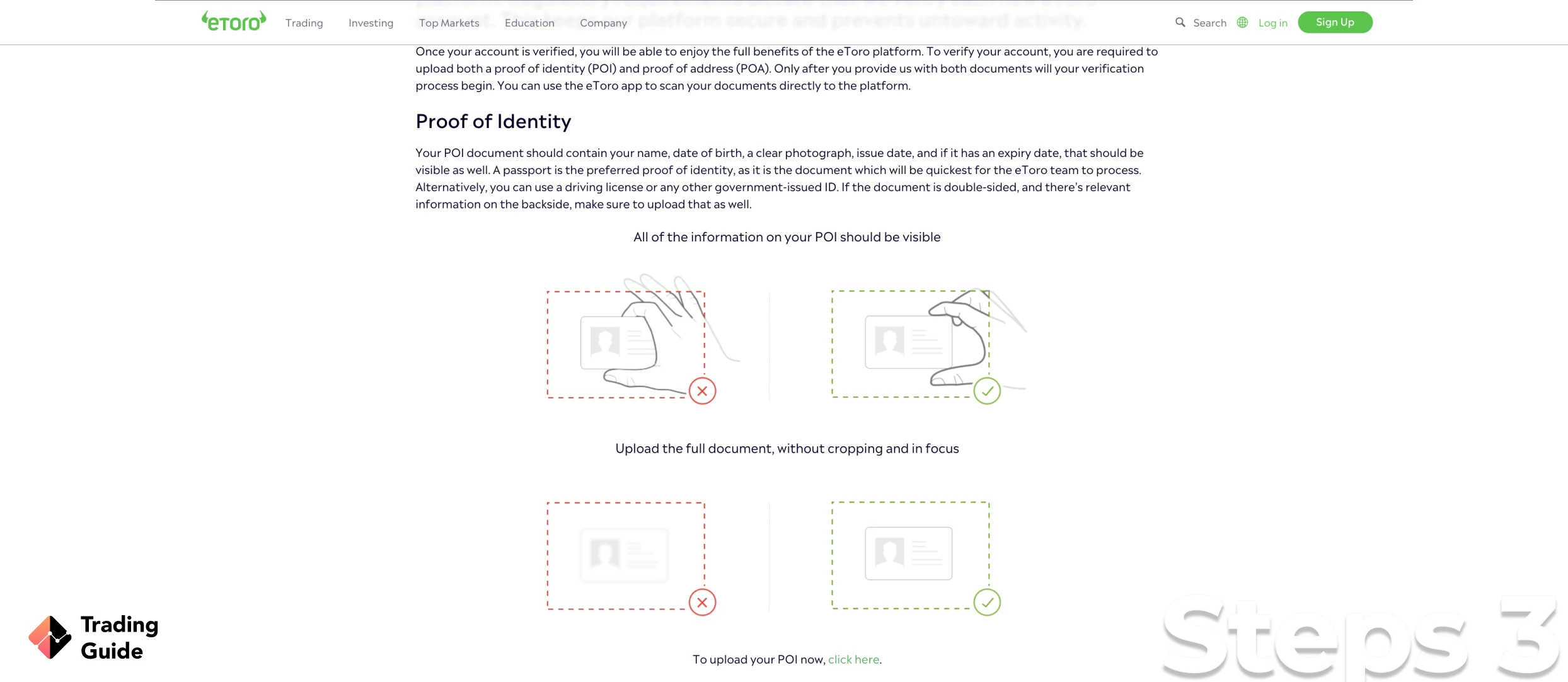

According to the UK trading laws and FCA regulations, all brokers must verify the identities of their clients to ensure they trade in a safe and secure environment. Proof of identity also indicates that you are a legitimate trader, thus keeping away individuals with fake identities. For this reason, you will provide a copy of your ID, passport, or driving license. Additionally, you will submit a copy of a recent utility bill or bank statement to verify your location.

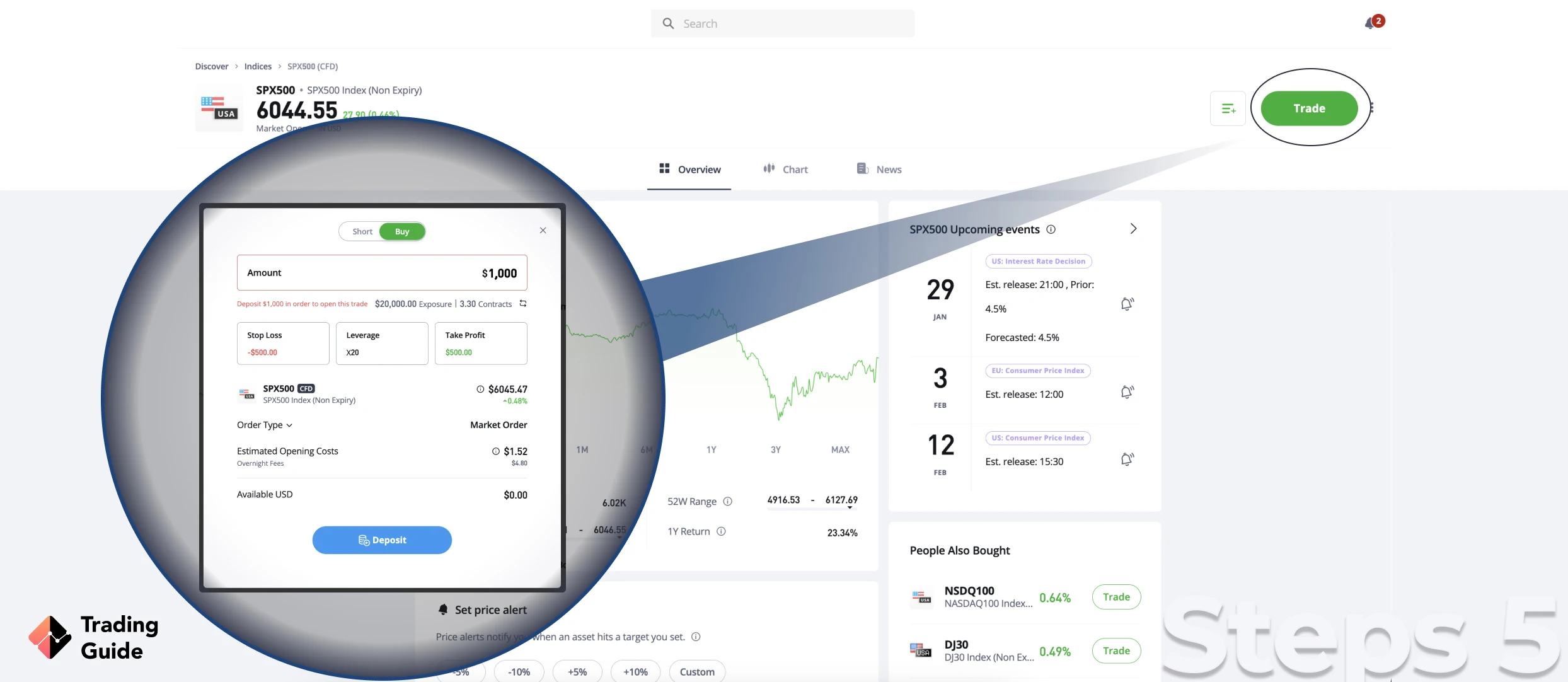

Once your account is fully active and ready to trade indices, the only thing left will be for you to make a deposit and trade indices. For eToro, a minimum deposit of $100 is required, but we encourage you to review the broker’s terms and conditions first to ensure you are on the same page. eToro allows deposits and withdrawals via various payment methods. Therefore, choose the one suitable for you.

Once eToro confirms your deposit, you will head to the markets page and select indices. Choose an index you are fully knowledgeable of from the list of indices and buy or sell depending on the direction you see the potential for profits. You can also trade indices as ETFs, whereby investment funds are used to monitor the performance of an index.

Always remember to select the number of units you can afford to trade. What’s more, consider applying risk management controls such as stop-loss or take-profit orders to mitigate the amount of losses you may incur.

Tips on How to Choose the Best Broker for Trading Indices in the UK

Choosing the best broker for trading indices in the UK is not easy since you need to analyse and compare brokers’ features before settling for the best one. While the research procedure can be lengthy, we have listed below the factors to consider to speed up the process.

Index trading is risky, and you need to put all your concentration into it in order to stand a chance of succeeding. This means that the broker you choose for trading indices should make you feel comfortable by securing your trading funds and allowing you to trade under the best conditions.

In this regard, find a broker that the FCA regulates. Trading indices with unregulated brokers is not only illegal in the UK but can make you lose your money to scammers claiming to be legitimate brokers.

The broker you choose should offer you access to the major indices that are commonly traded in the UK. These include Dow Jones Industrial Average (DJ30), FTSE 100 (UK 100), S&P 500 (SPX500), NASDAQ 100 (NSDQ100), and more. You should also be able to trade other financial assets, thus maximising your profit potential.

The best broker for trading indices should be available at all times so that it can be easier for you to take quick advantage of arising opportunities and profit from them. Note that you can’t always have access to your trading station, especially if you are always on the move. That is why choosing a broker with a trading app will allow you to trade indices anywhere you see fit.

Do not choose a broker for trading indices without confirming their charges and ensuring they fit in your budget. Brokers fees and deposit requirements vary, and overlooking this feature may inconvenience your trading activities in the long run.

We encourage new traders to always test a broker and practice index trading to gauge their skill level before venturing into the real markets. To do so, you need a broker with a demo account, which works the same as the live account. The only difference is that a demo account lets you trade using virtual funds.

As mentioned earlier, trading indices require the support of a broker. This includes the availability of reliable and responsive customer service to help you deal with any arising trading issues. You can confirm how a broker’s support service operates using a demo account and decide whether they fit into your trading requirements.

Best Stock Indices for 2026

A stock index monitors the performance of a group of stocks for a certain period. This makes it easier for traders to compare previous and current stock market prices. Simply put, there is no need for individual stock analysis.

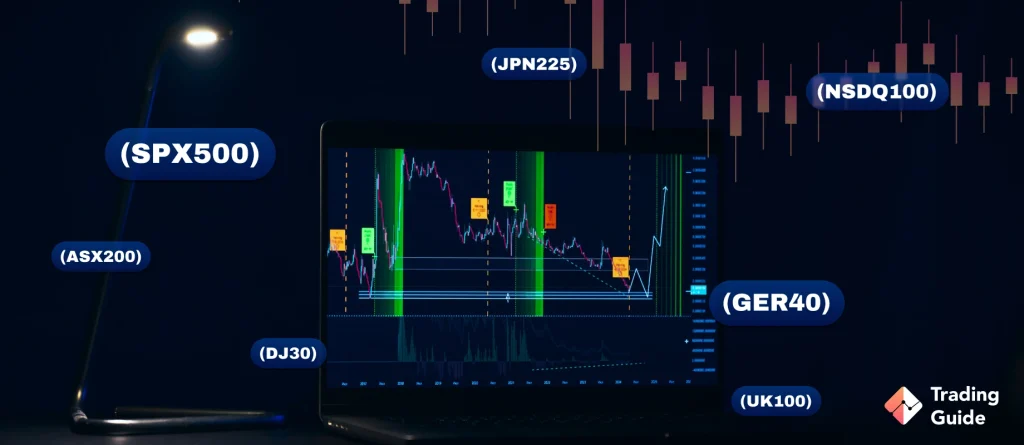

There are different types of stock indices in the financial markets today, and it is crucial that you choose the best stock indices that you can quickly profit from. Below are the best stock indices for 2026 that we believe offer high levels of liquidity and tight bid/ask spreads. With these stock indices, you will be able to easily enter and exit positions.

- The Dow Jones Industrial Average (DJ30): Dow Jones Industrial Average was launched in the 1980s and is one of the world’s oldest indices. The index tracks the performance of 30 large publicly owned companies in the US, such as Nike, Coca-Cola, Microsoft, Procter & Gamble, American Express, etc.

- The S&P 500 index (SPX500): SPX500 was founded in 1957, and it is considered a broad representation of the US stock market. This index lists 500 US publicly owned companies across various industries. Some of the stocks in this index include Amazon, Mastercard, NVIDIA, Starbucks, and more.

- The DAX 40 (GER40): Founded in 1988, the DAX 30 is a German stock market index that tracks the performance of Germany’s 40 largest companies on the Frankfurt exchange. Examples of company stocks tracked by this index include Volkswagen, Adidas, and Siemens.

- The Nikkei 225 (JPN225): This Japanese stock market index tracks the performance of 225 publicly-owned companies listed on the Tokyo Stock Exchange. It is a widely quoted index in terms of Japanese equities. Some of the prominent companies monitored by this index include Sony, Toyota, Nikon, Mitsubishi, etc.

- The NASDAQ 100 (NSDQ100): Established in 1985, NASDAQ 100 index tracks the performance of 100 non-financial publicly-owned companies listed on the NASDAQ exchange. The companies listed are both domestic and international, including Alphabet, NVIDIA, Netflix, Starbucks, etc.

- The ASX 200 (ASX200): This is an Australian blue-chip index tracking the performance of 200 public company stocks listed on the Australian Stock Exchange. The value of companies tracked by this index is based on their market capitalisation, which comprises more than 80% of Australia’s market capitalisation. Such companies include the National Australia Bank, Rio Tinto, and Qantas Airways.

- The FTSE 100 (UK100): This is another index established in the 1980s and comprises 100 companies listed on the London Stock Exchange. The companies have the highest market capitalisation, and the index is considered UK’s major stock index. This index includes Aviva, British American Tobacco, Unilever PLC, and more.

FAQs

The share price of stocks included in an index determines the index’s value. Simply put, if stocks’ price increases, the value of an index will also rise and vice-versa. Some of the share price driving factors include economic news, political instability, company news, and currency value.

Stock trading is buying and selling individual companies’ shares whereby you get to own the underlying asset. In contrast, index trading refers to trading a basket of different company’s stocks in a single instrument.

The best way to start trading indices is by learning how it works, including all the strategies involved in trading the asset. Once you are confident in your skills, choose the best broker that offers the most popular indices that are liquid. You will then follow the trading indices guidelines above to create a trading account and try your luck.

Yes and No. Even though index trading carries lower risks since they are diversified, it doesn’t mean you can’t lose money trading the asset. Therefore, trading indices or stocks successfully depends on how well you understand the market and strategise your efforts.

Conclusion

Index trading is popular because it offers traders many opportunities to profit from the stock market. For instance, trading indices allow you to benefit from both rising and falling prices (CFDs). Remember, your capital is at risk. Additionally, indices can be traded as ETFs and futures contracts, which you can use to hedge against an existing position.

To get started in indices trading, ensure you are fully knowledgeable about how indices trading works and what affects the asset’s prices. You should also be able to identify the best broker to help you manage your activities. Brokers like the ones we recommend above guarantee safety and host the necessary tools to maximise your potential.