If you want an in-depth review of how leverage trading works, our ultimate guide features everything about leverage trading.

The financial trading markets across the globe are increasingly dominated by new traders every day. As a result, they find ways to improve their experience using many strategies available on brokers’ platforms. One of these strategies is leverage trading, which we are going to discuss in this guide.

As a beginner, you must know what leverage trading is, how it works, and when to apply it in your trade. For this reason, we have gathered the necessary information you need about leverage trading so that you may be able to get better results while trading.

What is Leverage Trading?

In a nutshell, leverage trading means trading with funds exceeding your initial deposit. It works by allowing you to borrow trading funds from your broker, which of course, you will pay with interest.

Leverage trading interests keep increasing the more a position remains open. This means that you are likely to earn more profits if a trade favours you. In the same time trading is a risky activity, and losses could occur. This also benefits the leverage trading broker since their interests will be increasing.

Note that while leverage trading can earn you good profits, it is a double-edged sword and can also bring about huge losses if you do not make the right moves. Therefore, before you decide to apply it in your trade, make sure that you have thoroughly analysed the markets and are confident that your trade will favour you.

How Leverage Works in Trading

The amount to leverage is always offered by a broker based on European Securities and Markets Authority (ESMA) regulations on leverage. The amount you will be eligible for will also depend on your level of experience.

ESMA regulations on leverage trading apply to all retail traders in the European Union and the UK. The best thing about ESMA-regulated brokers is that they offer negative balance protection on your trading funds. This means that your account balance will never go below zero even after losing a trade using leverage.

In addition, leverage ratios are capped at certain limits, including:

- 30:1 for major currency pairs

- 20:1 for minor currency pairs, gold and major indices

- 10:1 for commodities except than gold and minor equity indices

- 5:1 for stocks

- 2:1 for cryptocurrencies

Whether you succeed in trading with leverage or lose your investments, remember that you still owe your broker the amount you leveraged. This can be a huge setback for you, especially if you have leveraged a considerable amount of money.

For example, a broker may notify you that you qualify for leverage of 10:1. In this case, it means that for every one dollar you own, you have the buying power of 10 dollars. Therefore, if your investment deposit is $1,000, you can trade with as much as $10,000.

Also, if you wanted to place trades worth $10,000, a broker will require you to make an initial deposit of $1,000. This amount of capital needed to open a position is what is commonly known as margin.

That being said, we advise traders to leverage small amounts of money, meaning that you should trade with leverage that is lower than the initial leverage allowance.

Take your time to understand how to properly analyse the markets and price trends before taking a deep dive. It also puts you in a position to trade full size even if your trades work against you.

Read about the forex brokers with high leverage in our other complete guide.

What is Margin?

To fully understand what leverage trading is and how it works you also have to understand margin and what buying on margin entails. In fact, margin and leverage go hand in hand and one cannot exist without the other.

You see a leverage ratio such as 30:1 is a number used to explain how much you can borrow from a broker in order to open profitable leverage positions. However, margins are the funds that you borrow from the broker.

Due to the increased risks of margin trading and the fact that the broker has to lend you money, margin accounts are usually more expensive to open than regular cash accounts. And there is nothing that forces you to use a margin account unless you want to. In fact, by using the right strategy on the right market, one can make decent profits without margin and leverage.

Understanding the nuances of profit margin is equally crucial for making sound financial decisions in your trading journey.

Initial Margin Requirement

The initial margin requirement is a requirement set by brokers that you have to meet to get access to margin. In most cases, this is referred to as an “initial deposit” and it’s the amount that you have to deposit to activate your brokerage account.

Generally speaking, CFD brokers have minimum deposit levels of between £10 and £300. Although, for more advanced margin accounts you may have to deposit as much as £2,000.

Leveraged Products

Leveraged products are financial securities that enable you (the trader) to gain vast market exposure without spending a lot from your investment funds. Simply put, their market value is worth more than your initial outlay. Examples of leveraged products include forex, stocks, ETFs, spread betting, cryptocurrencies, and CFDs.

Leveraged products work differently, but they all give you a chance to make large profits and incur huge losses. While trading any leveraged products, you will be required to pay an initial part of a leveraged amount, which is like collateral to cover the credit risk. Let’s take a look at how each leveraged products and their ratios.

What is Leverage in Forex Trading

Forex or currency trading is the buying and selling of currencies across global markets. When using forex in leverage trading, you are trying to profit from small price changes in currency pairs.

The leverage ratios for forex trading are usually limited at 30:1 for major forex currency pairs and 20:1 for minor forex pairs. Still, they can go as high as 500:1 and 200:1, depending on your area of jurisdiction. However, this ratio will vary based on your trading experience. A forex leverage ratio gives you a much higher chance of making profits or incurring losses while trading currencies.

Leverage Stock Trading

In the financial stock market, leverage trading allows you to borrow funds from your broker to increase the size of your position. The main goal is to make more profits than you would have done while trading with your initial capital only.

The leverage ratio for individual stock trading is relatively low compared to trading other financial securities. For example, the UK market ratio is usually capped at 5:1 or a 20% margin rate for major international stocks such as Tesla and Amazon. However, it can go as high as 10:1 on other brokers that are not ESMA-regulated.

Trading Leveraged ETFs

A leveraged ETF allows traders to borrow funds from brokers and use financial derivatives to increase their returns on a particular underlying instrument. Traders use leveraged ETFs to speculate on an asset in the hopes of earning more profits than they could have trading traditional ETFs.

Leveraged ETF ratio usually ranges between 2:1 to 3:1, depending on your experience. Like regular stocks, you can trade ETFs as leveraged CFDs.

Leveraged Cryptocurrency Trading

If you have a history of trading cryptocurrencies, then you should know that they are very volatile. This means that their prices tend to fall easily, which can negatively affect your trade. For this reason, traders need to be very cautious before applying leverage on cryptocurrencies because a bit of a mistake could bring about significant losses.

Because of the risks that trading traditional cryptocurrency brings, its ratio on most brokers’ platforms is 2:1, with the highest being 5:1. This ratio is relatively low compared to trading other financial securities.

Leverage Trading Risks

As mentioned earlier in this guide, leverage trading is highly risky. Although the traditional methods of trading securities also carry risks, using leverage can put your trades at more risks.

It is always tempting to maximise your chances of making more profits with leverage. However, you should also know that a trade can go against you, and once it does, you will incur a huge loss.

Our advice to beginners is never to rush for a large amount of leverage for trading. Instead, start small, no matter how tempting the leverage ratio may be. As you get to familiarise yourself with the trading activities, you can then take as much risk as you can for your trades.

Before you trade using leverage, plan your trading strategy in advance. This way, you are guaranteed that your trades are going to work in your favour. Determine the amount of risks you want to take daily and per trade, which will only lead to determining the amount you are willing to lose.

Leverage Trading Risk Management

Since leverage trading is risky, the only way you can minimise huge loss is by implementing risk management controls. One of the most commonly used tools for risk management, especially for beginners, is stop-loss and take-profit orders.

Stop-loss and take-profit orders will limit the amount of loss you are likely to incur. This is best for your leveraged trade since the losses, if any, will be limited compared to trading without managing the risks. Other risk management tips include:

Understand Leverage Trading

When buying and selling an asset or speculating on assets’ prices using leverage, you must understand how leverage applies in every trade. Do not risk trading on the margin because as much as it can bring you lots of profits, you can also incur huge losses.

Start With Demo Accounts

The majority of leverage trading brokers have demo accounts that allow you to test and familiarise yourself with how leverage trading works. Take advantage of the virtual funds they offer and practice leverage trading as much as you can before opening a live trading account.

Start with Smaller Investments

As a beginner in leveraged trading, you should put all your eggs in one basket. Start with small amounts for margin trading. This will protect you from huge losses in case a trade does not favour you. If you gain profits from it, you can gradually increase your capital as you gain more experience.

Focus on a Specific Market

Trade using leverage on the financial markets that you are fully aware of and know how to analyse. Do not be seduced by the leverage ratios and risk on another trading security. If you are more knowledgeable on buying and selling assets or speculation on price movements, focus on it only to increase your profit potential.

Set Risk/Reward Ratios

The risks you take in every trade should be worthwhile. This means that as you calculate the profits you might earn, also consider the losses and ask yourself if the amount you are investing is worth losing.

By setting a risk-reward ratio, you are comparing the funds you are risking in a trade to potential earnings. For instance, if you are risking £300, which might be your maximum loss in a trade and expect to earn a maximum profit of £900 if the trade favours you, the risk-reward ratio will be 1:3.

Choosing a Leveraged Trading Broker

When trading leverage, you need a broker that allows you to use your preferred financial asset. Above all, the leveraged trading broker should be regulated within your area of jurisdiction.

For example, for UK markets, make sure that your broker of choice complies with the rules and regulations of the Financial Conduct Authority (FCA). Once you confirm the credibility of a broker, you can then consider the following elements:

Brokers do offer varying leverage rates and margin requirements for you to trade using leverage. Therefore, make sure that a broker you are choosing has limits that will favour your trades.

Even though leveraged trading can bring about huge profits, you still need to check if a broker’s trading commission or spreads align with your budget. Understand all the available charges before opening a position.

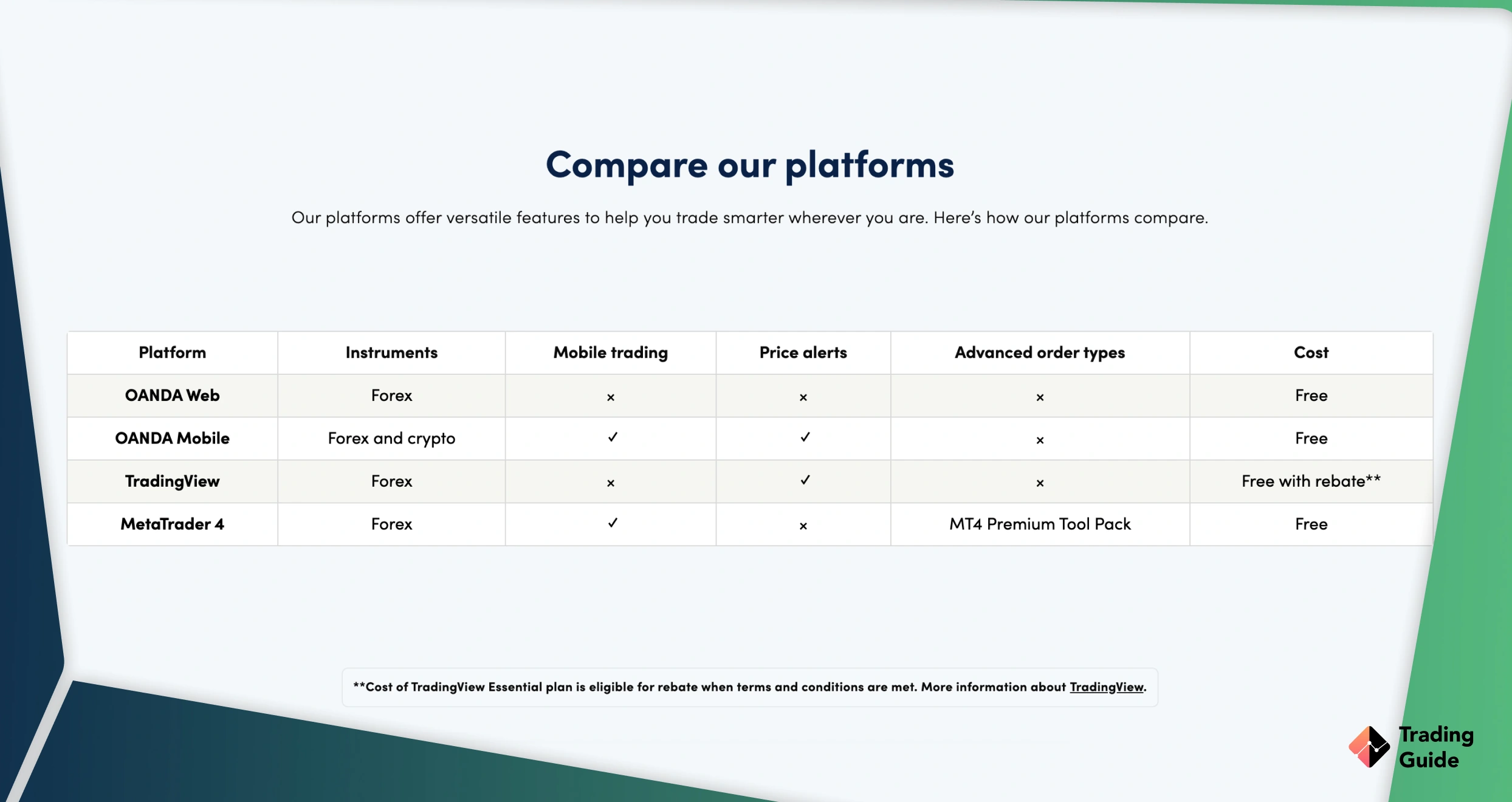

Leveraged trading is supported on various trading accounts. Therefore, depending on your level of expertise, consider a broker offering a leveraged trading account that matches your skills. It doesn’t have to be the standard proprietary account. You can also consider cTrader and MT4 accounts.

While some brokers may charge you low trading fees and commissions, surprisingly, their account minimum amount needed to start leveraged trading is high. Therefore, check the minimum deposit requirement and confirm that it suits your budget.

Top Leverage Brokers in the UK

Most online brokers that provide CFDs, forex and/or spread betting also provide leverage & margin. As mentioned in this guide, leverage and margin have been limited in all of Europe meaning you cannot get more than 30x leverage on selected assets.

In turn, this means that you can’t pick the broker with the highest leverage since all of them follow the same system and limitations. Instead, you should pick the best broker in general and currently, the best leverage brokers are.

1. Plus500*

Among the leverage trading brokers we have tested, Plus500 stands out for its user-friendly interface and quality learning resources for newbies. While testing the broker, we had access to over 2,800 CFD assets, including forex, commodities, shares, indices, and more. These assets are available for trade with a minimum deposit of only £100. Moreover, there are no commissions on trades but spreads that start from as low as 0.0 pips.

When it comes to leverage limit, Plus500 adheres to ESMA regulations as mentioned above. However, the broker extends its limit up to 1:30 for professional traders. While the limit can be attractive, note that there are risks of losing money when trading using leverage. Therefore, always conduct extensive research for solid strategies and track your activities. You should also get started on Plus500’s demo account before transitioning to the live account.

*Plus500 is not suitable for beginner traders

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. IG Markets

IG is, without a doubt, one of the biggest, most established, and most popular online brokers in the UK. Founded in the 1970s, this broker also has unparalleled experience in the industry, having trailblazed online trading since the 1990s.

With more than 17,000 assets on offer and several of the best trading platforms available, IG is a tremendous online broker suitable for almost everyone.

If you’re looking for advanced and varied investment and trading opportunities, then IG Markets is the perfect option for you.

Your capital is at risk

3. eToro

eToro is a one-of-a-kind online broker that has been breaking ground for the entire industry for years. Specializing in copy and social trading, eToro has been (and still is) using innovation to establish itself.

This broker is well-suited for both beginners and experts, although it is one of the more expensive brokers in the industry. So keep that in mind.

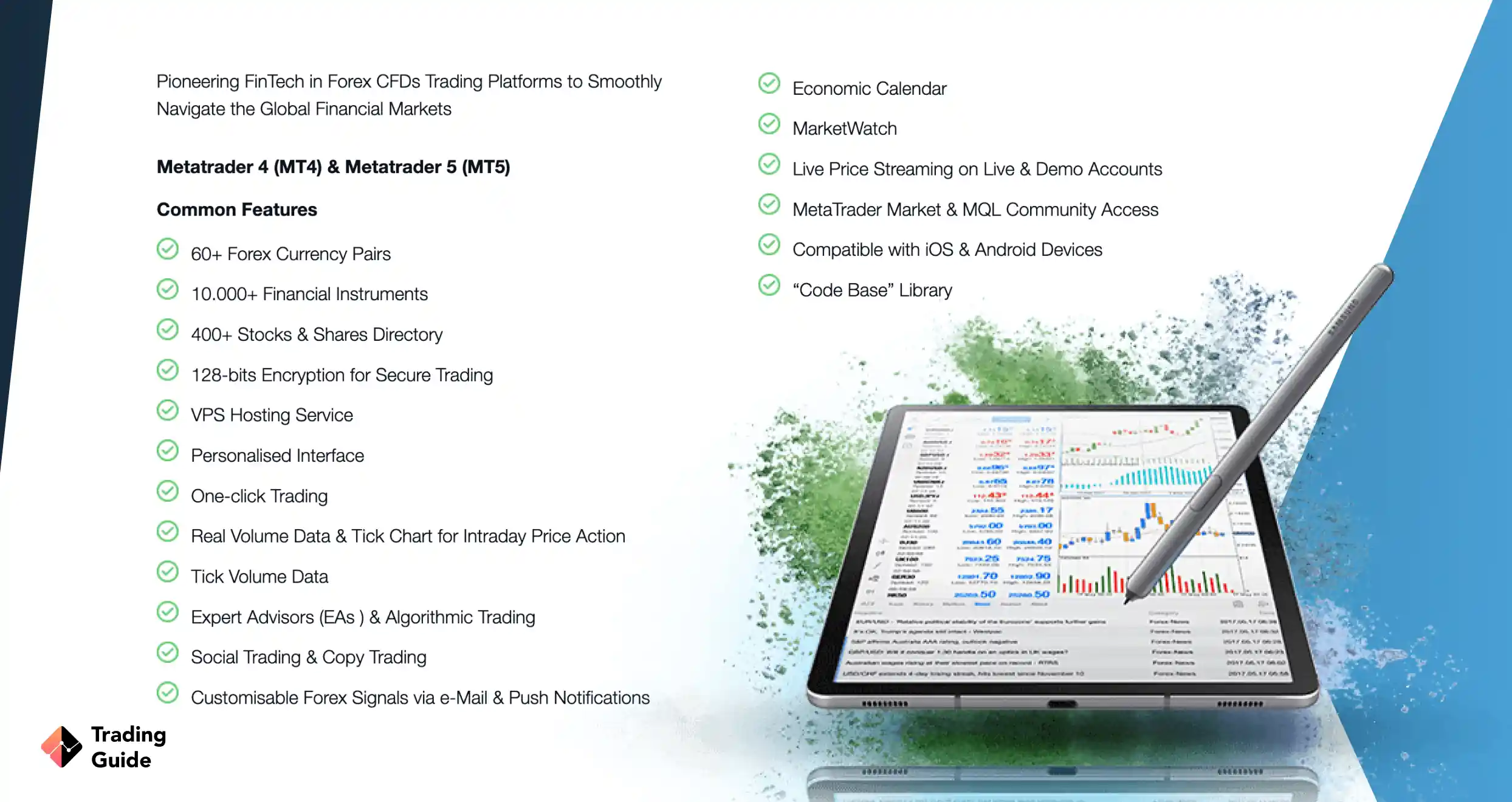

4. FP Markets

FP Markets is a well-regarded broker for leveraged trading, offering over 10,000 financial instruments across different markets, including forex, indices, commodities, cryptocurrencies, shares, etc. With FP Markets, you will enjoy flexible leverage options up to 30:1 for retail UK investors and 500:1 for professionals. As a result, you can trade with larger capital and maximize your profit potential while managing risk exposure.

Note that you can apply leverage on FP Markets’ multiple trading platforms, including MetaTrader 4, MetaTrader 5, and IRESS. Therefore, regardless of trading preference, the broker ensures every trader gets an opportunity to earn good profits with margin trading. Overall, FP Markets charges low spreads starting from 0.0 pips on all CFD trades. It also has a low minimum deposit requirement of £100, and there are no hidden charges, making it easier for you to budget and plan your activities.

5. OANDA Europe LTD

OANDA Europe LTD offers a wide range of CFD assets, which you can trade using leverage and maximise your profitability. This FCA-regulated broker has built a reputation for its exceptional trading services, advanced trading platforms, and competitive pricing. Additionally, OANDA Europe LTD offers its clients a variety of advanced trading tools, including technical analysis tools, economic calendars, and news feeds, making it easier for traders to make informed trading decisions.

There are also margin rates of up to 100:1 for professional traders. You can apply leverage on various assets OANDA hosts, including forex, commodities, indices, bonds, and more.

Note: 76.6% of retail investor accounts lose money when trading CFDs with this provider.

Pros and Cons of Leveraged Trading

Leveraged trading has plenty of advantages and a few disadvantages. Therefore, it is up to you to decide whether it is worth trading with or not. Take a look at its pros and cons below:

- It boosts your initial trading capital.

- Expect to earn magnified profits if a trade favours your strategy.

- Increases your chances of making good profits even when the market’s volatility is low.

- Leverage allows you to trade some of the most expensive and prestigious financial instruments.

- You can lose a considerable amount of money trading leverage if a trade goes against you.

- Huge losses can affect your entire trading account.

How to Register an Account

As you may already know, the registration process for online brokers is regulated by the Financial Conduct Authority (FCA). This means that the process is the same regardless of which broker you sign up with.

With that said, the process for signing up with a leverage broker is more detailed than a “regular” stockbroker, for example. The reason for this is the added risk that’s involved in leveraged trading that requires brokers to ensure that you have the knowledge needed to use leverage and margin in a safe manner.

To start the process, visit the broker on a device that you prefer. All top leverage brokers have support for both desktops and mobile devices. Then follow the instructions provided by the broker.

In some cases, you might have to download a trading app from the broker before you can get started if you want to trade on your smartphone.

You will now register your account. This is done using a similar process as when registering an account on any other online platform, ie. you must submit information such as your full name, date of birth, email address, home address, etc.

All of this information will later have to be verified so please ensure that it is correct and verifiable.

To verify your identity and the information that you have provided, you need to submit a copy of your identification as proof of identity and submit a copy of a recent utility bill (or bank statement) to verify your address.

Brokers can also ask you to provide complementary documents to verify your identity.

Lastly, you have to make a deposit matching the broker’s minimum deposit requirement. This is the last step needed to activate your account. However, as soon as you’re verified you get full access to the account and tools. In other words, the deposit is only needed for activation and to fund your account so that you can start trading.

Conclusion

Leveraged trading is a trading strategy that requires total commitment to maximise the chances of earning good profits. However, if you are unsure how a trade will turn out, do not apply leverage since your trade may not favour you, bringing about extreme losses.

This trading strategy is highly risky and lucrative at the same time. Therefore, apply risk management orders such as stop-loss to help mitigate any losses.

The explanation of how margin requirements work and the ESMA regulations is actually helpful context - those 30:1, 20:1, 5:1 limits aren't arbitrary numbers, they're the result of real regulatory experience with what causes problems.