For UK users managing their money through a smartphone, choosing the right digital bank is a practical decision with real impact. These apps are now part of everyday financial habits, whether that’s paying for groceries, saving for holidays, or monitoring spending.

Monzo and Revolut lead the pack, each offering slick interfaces and features that challenge high-street banks. But while both aim to modernise money management, they’re built for different users. The right choice depends not just on the app but on how you handle money, where you spend it, and what kind of support you value.

What Is Revolut?

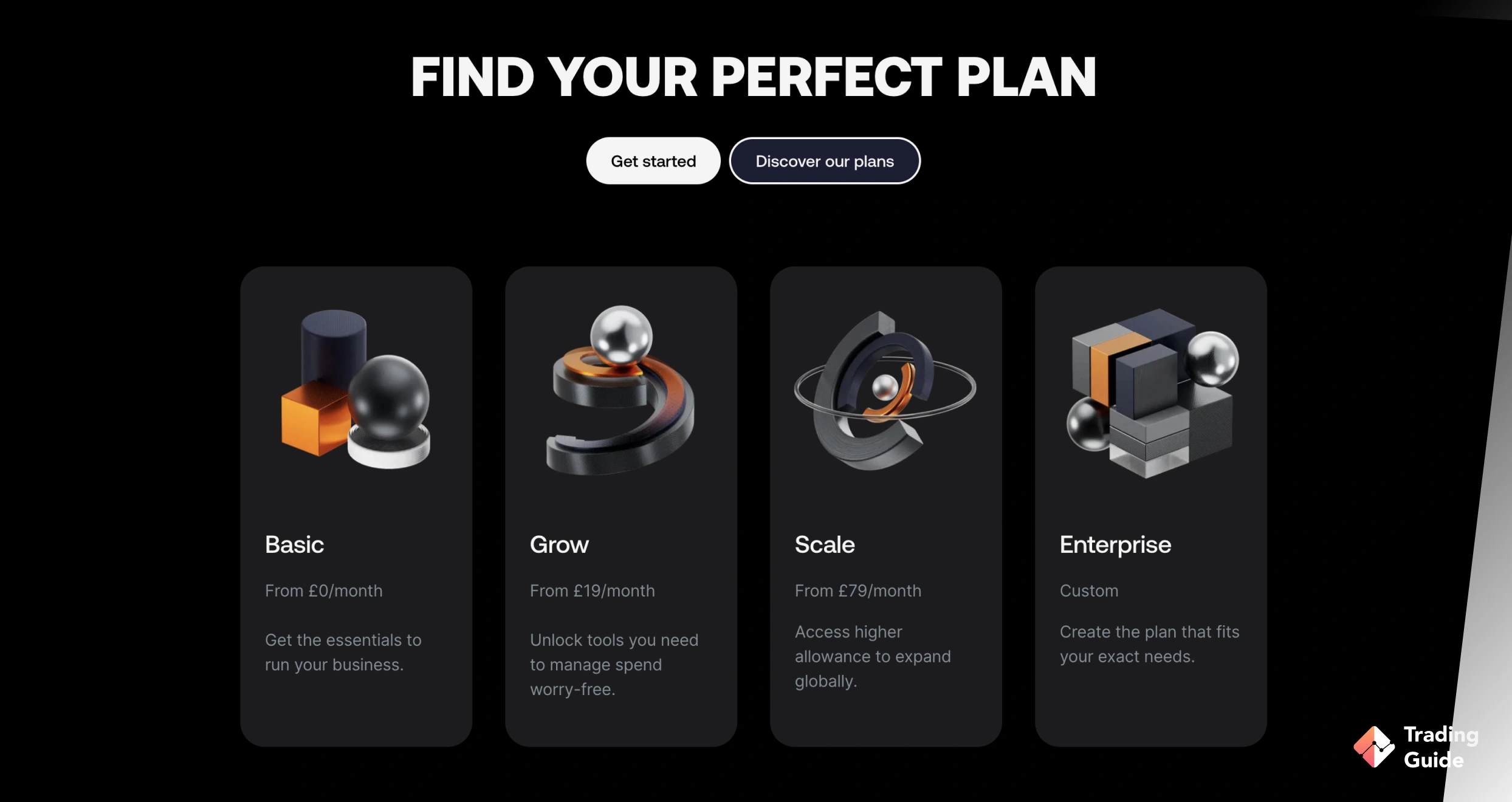

Launched in 2015, Revolut set out to reduce the cost of exchanging currency. Since then, it has expanded into a wide-ranging financial platform. Users can manage everyday spending, trade cryptocurrencies, access budgeting tools, and even order a metal debit card.

While Revolut does not hold a full UK banking licence, it is authorised under an e-money licence and regulated by the Financial Conduct Authority (FCA). Accounts come with IBANs and support for multiple currencies. Its international focus and travel-friendly features make it a popular choice for individuals who move between countries or manage money in different currencies.

Revolut offers four different accounts: Standard (free), Plus (£2.99/month), Premium (£7.99/month), and Metal (£13.99/month). Users can also save money, send money abroad, and trade stocks, commodities, and cryptocurrencies using the app.

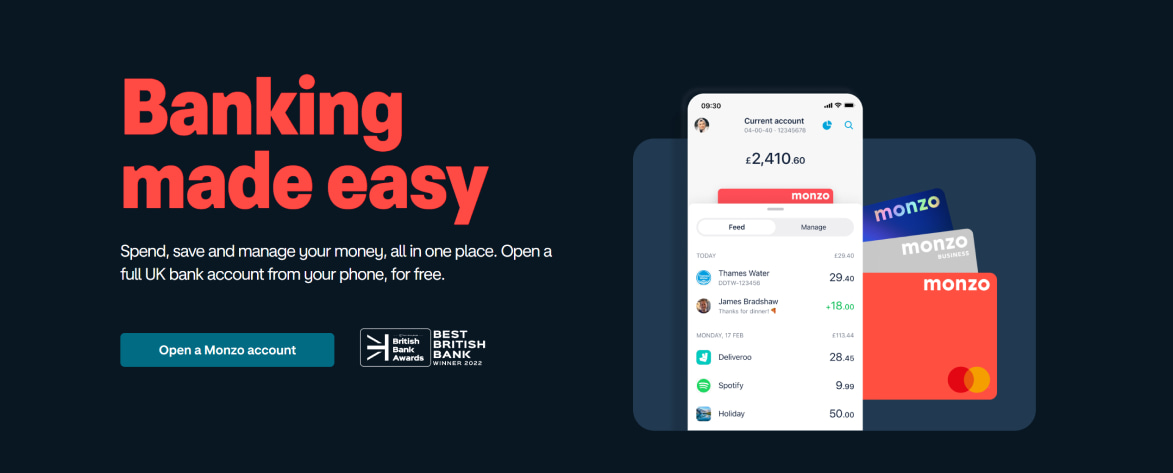

What Is Monzo?

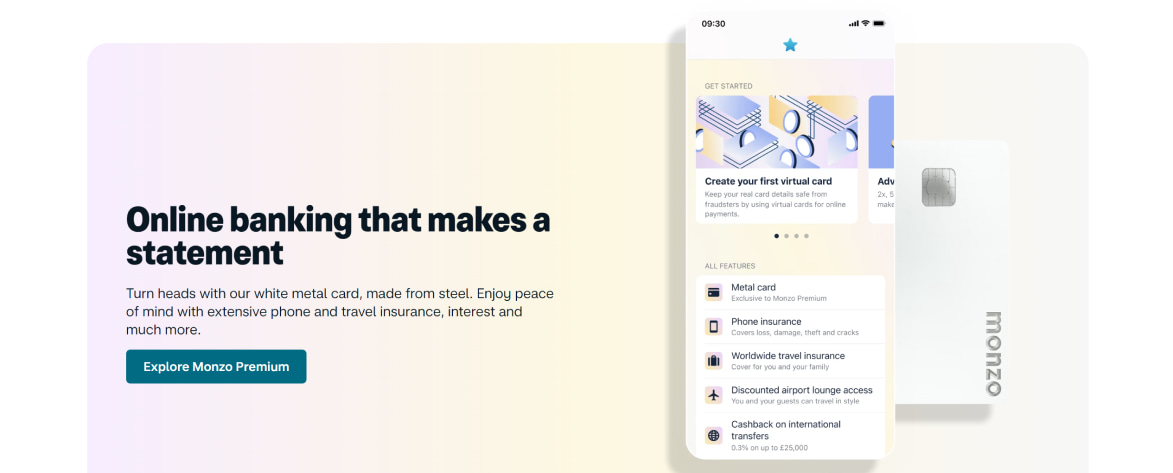

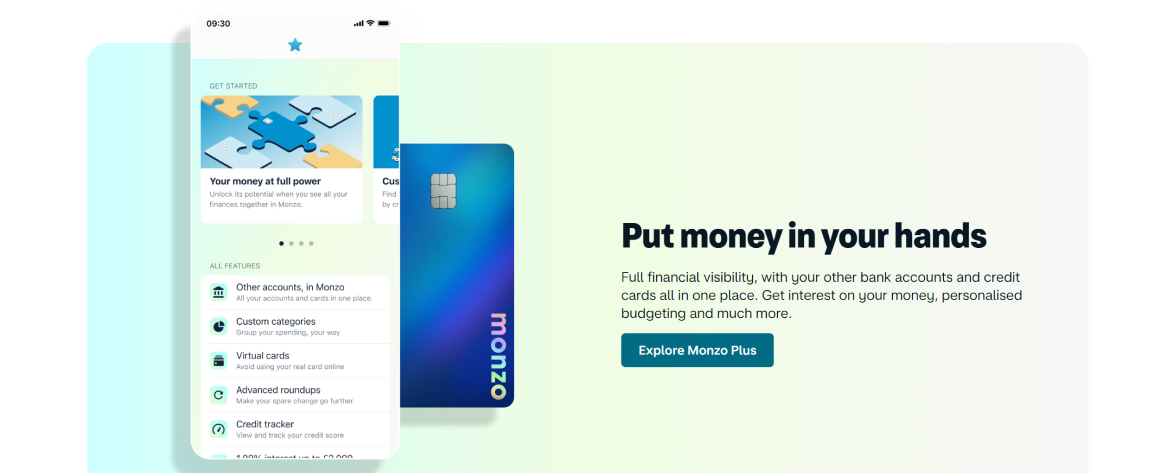

Monzo combines traditional banking functions with a modern, user-friendly interface. It offers tools for managing budgets, setting savings goals, and accessing wages early through its “Get Paid Early” feature. Designed for UK-based users, Monzo offers more stability than Revolut, but it’s less geared towards those who need international features.

The platform currently has three types of accounts: Free, Plus (£5/month), and Premium (£15/month). You can also open a business account, a 16-17 account and a joint account.

Read full Halifax Review in our other article.

Monzo vs Revolut: Comparison Tables

Fees

| Feature | Monzo | Revolut |

|---|---|---|

| Free current account | Yes | Yes |

| UK ATM withdrawals | Free up to £250 every 30 days, then a 3% fee | Free up to £200 per month, then a 2% fee |

| International ATM withdrawals | Free up to £200, then a 3% fee | Free up to £200, then a 2% fee |

| Currency exchange | Uses a Mastercard rate | Interbank rate up to £1,000/month, then a 0.5% fee |

| Premium plans | Plus (£5/month), Premium (£15/month) | Plus (£2.99/month), Premium (£6.99/month), Metal (£12.99/month) |

Services

| Feature | Monzo | Revolut |

|---|---|---|

| UK banking licence | Yes | No (operates under e-money licence) |

| FSCS protection (up to £85,000) | Yes | No |

| Overdrafts | Available | Not available |

| Personal loans | Available | Not available |

| Cryptocurrency access | Not available | Available |

| Stock trading | Not available | Available |

| Account for children | Yes (via Monzo Flex) | Yes (Revolut <18) |

| Bill splitting | Yes | Yes |

For Travelling

Revolut is built with frequent travellers in mind. The app supports over 30 currencies, and exchanges use the interbank rate, typically more favourable than traditional banks. On the free plan, users can convert up to £1,000 per month without extra charges.

Premium accounts unlock added benefits such as travel insurance and compensation for delayed flights. It also offers access to airport lounges, making it a strong option for those regularly on the move.

Monzo performs well for short breaks or occasional holidays. It applies the Mastercard exchange rate, which is widely accepted and generally competitive. Users can withdraw up to £200 in foreign currency without fees. However, Monzo’s travel features are limited unless you subscribe to a paid plan, which may not suit those travelling frequently.

For Spending Abroad

Both Monzo and Revolut make overseas spending straightforward, but there are key differences in how they handle exchange rates and customer service.

Revolut uses the interbank rate for currency conversion, which is often better than the rates offered by traditional banks or card networks. However, weekend transactions may carry an extra fee, typically around 1%, to cover market closures. This can catch travellers off guard if they’re converting money or spending outside standard trading hours.

Customer support is app-based and available 24/7. But users sometimes report a lack of personal touch when resolving urgent issues.

Monzo applies the Mastercard exchange rate, which is reliable and broadly in line with market rates. There are no added weekend markups. Its customer service is consistently rated among the best for digital banks in the UK, with fast response times and helpful, human support.

Monzo’s full banking licence can also make it easier to deal with local merchants, especially when verifying card transactions or resolving disputes abroad.

For Saving

Monzo offers savings pots with competitive interest via partner banks, covered by FSCS protection. Features like round-ups and salary splitting help users save without effort. You can also set clear goals and track progress directly in the app.

Revolut’s savings vaults are accessible to all, but better interest rates come with premium plans. It also offers access to crypto, commodities, and stocks, appealing to risk-tolerant savers. While not traditional savings tools, these options may suit users looking to grow funds beyond cash deposits.

Who Is Revolut Best For?

Revolut is suitable for users who travel frequently, manage money in multiple currencies, or want access to cryptocurrency and stock trading from the same app. It appeals to those who value flexibility, whether that means low-cost foreign exchange, virtual cards, or fast international payments.

Because it doesn’t offer overdrafts, loans, or FSCS protection, it’s better for people who don’t rely on traditional banking features. Tech-savvy users who are comfortable managing everything through a fast-moving app will get the most out of Revolut’s wide feature set.

Who Is Monzo Best For?

Monzo is a better fit for users who want a stable, UK-based current account with full regulatory backing. It’s ideal for people who prioritise FSCS protection, need access to overdrafts or personal loans, or prefer simple, effective tools for budgeting and saving.

Monzo’s interface is clean, and its customer support is UK-based and widely praised. For everyday spending, paying bills, managing income, and saving with minimal fuss, Monzo offers a more traditional banking experience, just delivered through a modern app.

Which One is Better?

There’s no universal winner in the Monzo vs Revolut debate. The best depends on how you manage your money.

Monzo is likely the better choice if your finances are mostly UK-based. It offers a stable current account, strong budgeting tools, FSCS protection, and responsive customer support. It’s built for everyday banking, with features that make managing your income and savings straightforward.

Revolut, on the other hand, is better suited to those who travel often, use multiple currencies, or want access to crypto and trading within a single app. Its exchange rates and international features offer value for users with a more global lifestyle.

Many people use both. Monzo for domestic spending and income, Revolut for travel and currency exchange. Used together, they can offer a balanced and flexible way to manage your money, so long as you keep track of what each account does best.

FAQs

Monzo is headquartered in London, United Kingdom.

Revolut is partially owned by Storonsky and Yatsenko. Other key investors in the company include private equity firm Tiger Global Management and Japanese conglomerate SoftBank.

Yes, you can transfer money from Revolut to Monzo. All you need to have is the recipient’s Monzo account and routing number.

There are no fees required to sign up or use Monzo within the UK, even when withdrawing from ATMs. This is also true if you are using the app abroad. However, you’ll be charged a 3% fee if you withdraw more than £250 in 30 days in the UK or European Economic Area.

No. Besides being available for UK nationals, Monzo is also available to US residents. The digital bank began offering its services to customers across the US in February 2022.

Absolutely. You can use both your Revolut app and card in the UK. You can also use Revolut in the US.

Although Revolut is not a regulated bank in the UK, customer money is held in segregated accounts with Lloyds or Barclays. Therefore, you would be able to claim your funds from these ring-fenced accounts in case Revolut becomes insolvent.

You have to be a UK resident to apply for a Monzo card. Monzo also has daily spending and withdrawal limits.

Conclusion

Choosing between Monzo and Revolut isn’t about which one is better overall, but which one aligns with how you manage your money. Monzo focuses on dependable, UK-based banking with strong support and familiar features. Revolut is designed for flexibility, offering tools for global spending, investing, and currency exchange.

As your financial needs change, so might the app that works best for you. But if you know what matters most, whether it’s stability, support, or international access, you’re already well-positioned to make a confident decision.

I've been using both Monzo and Revolut for years now, and honestly, they each have their place in my wallet – Monzo is my main account for bills and daily spending because I trust the full banking license and the customer service actually helps when I need it, while Revolut lives in my phone for travel and the occasional crypto purchase since those exchange rates genuinely save me money abroad.