Taking your chances at trading can be beneficial when you use the right strategy at the right time. Your strategy should include risk management which prevents you from incurring huge losses.

Risk management is usually overlooked, yet it is an essential part of your trading activities. That is why we have gathered all the risk management information in this guide to help you create a technique to minimise loss while trading.

Understanding Trading Risk Management

Our experts team created this guide for all traders. Even if you are an expert trader who is always making the right moves, there is a point where you incur losses. When this happens during the time that you haven’t applied a risk management strategy, you will find yourself losing a great amount of money. It usually isn’t a good feeling, is it?

For beginners, you do not want to find yourself in a situation where you incur losses that you could have avoided. Therefore, we encourage you to find a comfortable spot and let’s understand how to manage risks before jumping on the trading bandwagon.

Note that risk management strategies are the same whether you want to trade or invest in forex, stocks, commodities, cryptocurrencies, and more. The common trading risks that you need to know are:

Market Risk

This is the probability of your trades giving you losses due to unexpected price fluctuations, which end up affecting the entire market. For example, if you expect the stock prices to keep rising and decide to invest in it, only to decline, you will incur losses. The primary factors that can bring about market risk include:

- Stock prices

- Foreign exchange rates

- Commodity prices

- Interest rates

Liquidity Risk

Trading assets do not have the same liquidity, and when you find yourself owning an illiquid asset, you may be forced to sell that asset at a much lower price than you had expected. This is mainly because there is low demand in the market, and finding a buyer has become a challenge.

Leverage Risk

Every time you trade using leverage, you are putting your investments into even bigger risks, although it can be profitable if you apply the right strategy. Losing a leveraged trade will cost you more than the amount you had initially deposited.

Risk of Ruin

This is the probability of losing all of your trading capital without recovering the amount. For example, a trader’s long-term strategy on an instrument’s value may go against what they had envisioned. If they do not have sufficient funds to sustain the price movements until it favours them, they lose all their trading capital.

Interest Rate Risk

Interest rate risk is the chances that an asset’s value will decline in price resulting from market volatility. This risk is mostly linked to fixed-income assets such as bonds, hence driving the prices of such assets.

Note that up to 89% of retail traders in the UK lose money while trading online. This is why risk management is so important.

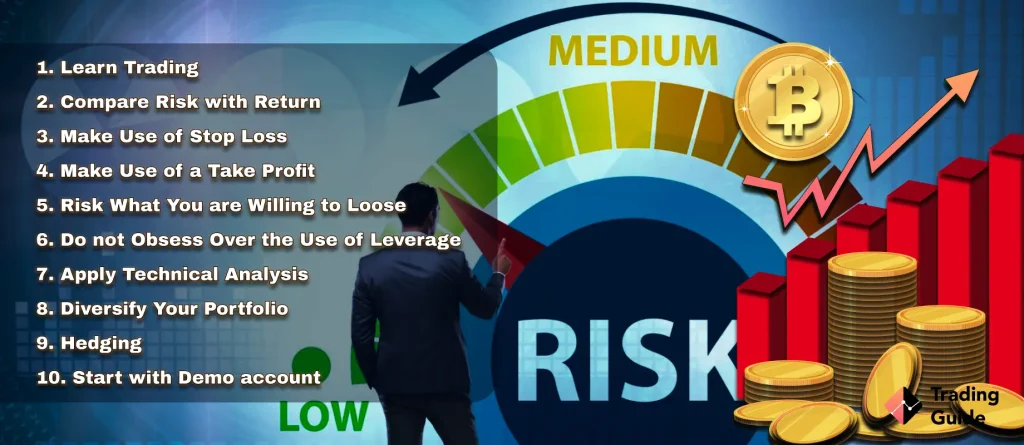

Tips for Trading Risk Management

Trading risk management is whereby you identify risks, analyse and minimise them in your trading activity. Simply put, it is a plan to help you decide what and when to trade. You will also be able to identify the points you need to place stop-loss orders.

Below are the tips to help you mitigate any trading risks and minimise your loss potential.

1. Learn Trading

Never begin trading without getting enough knowledge about how it works and what causes trading risks in the first place. Whether you want to major your trade on stocks, forex, cryptos, or more, it is essential to understand it deeper.

If you are an expert, you know that learning how to trade will never end because new trading techniques, risks, and ideas come up every day. So be sure to keep gaining the required knowledge for your strategy.

There are many ways to learn a trade, most of which are provided by brokers. You will find trading articles and webinars offered on most brokers’ platforms. Some brokers will also provide seminars, so do not turn a blind eye to such opportunities if you want to stay ahead of your trading activities.

2. Compare Risk with Return

When you apply strategies in your trade, you weigh potential risks against returns. It means that the riskier the trade, the higher the returns if you make the right moves.

For example, if you decide to apply leverage to trade, note that you are putting yourself at a higher risk of incurring huge losses. However, should you analyse the markets extensively and know when to make a strategic move, you will be smiling all the way to the bank.

3. Make Use of Stop Loss

The goal of every trader before beginning venturing in any security is to ensure the profits earned are more than the losses. To achieve this objective, using a stop loss is the smart move.

A stop-loss protects your trades from the effects of unavoidable market price movements. With a stop loss, you will be able to set a specific price by which when your trade reaches, it closes automatically. It prevents you from incurring greater losses and huge setbacks in your trading activities.

Note that sometimes slippage occurs hence affecting the stop-loss orders. As a result, the market will show price gaps, and the stop loss will not be a guarantee. This means that the stop loss will not apply at the set price but will be active again when the asset prices reach the stop loss level.

If you are a trader who has once tried using stop loss and has failed, then maybe you should consider changing the levels in which you set a stop-loss. Make sure that you set a favourable stop-loss and stick to it until you feel like it isn’t helpful.

4. Make Use of a Take Profit

Take profit order is a bit similar to stop-loss. When you apply a stop loss, you expect that an open position will close to save you from losing a huge amount of money. However, applying a take profit order is like the opposite of a stop loss. Here, you get to set a profit limit that your position will close once it hits it.

Before you apply the take-profit order, you need to be sure of your trade. Conducting thorough research on the markets will be essential if you want to fully benefit from this risk management strategy. In order to be safe with their trades, most traders set their reward twice the risk of each trade.

This risk management tip can go haywire if you make the wrong move. Therefore, while applying a take profit order, think of the profits you are likely to make if you are successful. Also, consider the amount of loss you are willing to take if your strategy does not favour you.

5. Risk What You Are Willing to Lose

Do not make yourself too vulnerable to losses by investing a lot of funds that will affect you in the long run. Unfortunately, this mistake is common among newbies who are not willing to be patient. They invest huge chunks of money in the hope of earning a lot of profit.

As much as some traders become successful, others end up losing, which leaves them emotionally unstable and unable to explore more trading options.

We advise you to always calculate the trading risks before you begin to trade. Stop trading if you feel that you do not have the potential to make profits. If you cannot wait until you have a better chance at earning profits, then maybe reducing your trade is an option. Trade with funds that, even if you lose, will not have a huge effect on your activity.

6. Do not Obsess Over the Use of Leverage

Trading with leverage is one of the strategies in the trading markets that can make you some good profits. As mentioned earlier, the higher the risk, the more profits you are likely to make if a trade favours you.

Leveraged trading is highly risky because you get the opportunity to trade using borrowed funds. This means that you trade with more than your original investment, which puts you in a more vulnerable position to lose a lot of money if the trade does not perform according to your plan.

Before you apply leverage, ensure that your strategy is based on the current market trends and analysis. If you are not sure about your trade, it is wise not to apply leverage as it may end up frustrating your entire trading activity.

7. Apply Technical Analysis

Technical analysis used for support and resistance levels will help you determine your trade’s entry and exit points. Find accurate support and resistance levels using trend lines and know when to apply for a stop-loss order or take profit order.

You can also use the Relative Strength Index (RSI) momentum indicator to measure the level of price changes that produce overbought and oversold conditions of an asset’s price. You can use it with support and resistance levels for your risk management.

8. Diversify Your Portfolio

If you have ever heard of the saying that goes, “Do not put your eggs in one basket”, then you need to apply this saying to your trade as well. When you trade in a wide range of instruments, it minimises the risks for losses and increases the profit potential. This is because when one trade goes against your strategy, another one might favour you, making it easier for you to cover the losses.

9. Hedging

Hedging will also help you manage the potential loss. You can hedge against market price and attain a price lock, thereby protecting yourself from adverse price movements.

The best thing about hedging is that it can be done using derivatives like futures contracts and options. This allows you to buy and sell an asset at a certain time within a specified period.

Find out more about the best options trading platforms in another guide.

For example, suppose you had a long open position on a certain asset, and you wish to short trade it because your analysis shows a potential price reduction. In that case, you may apply hedging and open another short position. This will ensure that you manage all the risk and cover any losses.

10. Start with Demo accounts

A demo account is the easiest way to start managing trading risks. The majority of world-renowned brokers have demo accounts that allow you to practice without spending real cash. Simply put, they are free for usage.

Most of the demo accounts have virtual funds to practice, so ensure that you fully take advantage and learn how to manage risks before opening a real trading account.

Elements of Successful Trading Strategy

A trading strategy is meant to keep you engaged in your activity and manage the risks involved. You will no longer have to worry about the losses but be focused on winning, which helps a lot for a peaceful mindset.

Below are the elements for a winning strategy. They are an essential part of every trade, so ensure that you fully understand each element.

Learning how to manage your trading funds is essential in every trade. However, do not invest with more than what you can lose because it will only frustrate your activities in the long run.

Good money management will also prevent you from taking a huge risk with your trade. So at the end of it, you will have managed to reduce the loss and maximise profits, which we can say is a big win for you.

The golden rule of money management is to never invest money that you cannot afford to lose. In other words, all your bills and necessities should be in order before you start trading.

Entering the trading market aware of the type of trading activity you plan to venture into will also reduce trading risks. Choose whether you want to trade forex, stocks, commodities, cryptos, CFDs, and more.

Plan the time you intend to trade, and don’t forget to understand better what will make you apply entry and exit orders. Lastly, stick to your trading plan and focus on how to strategise.

Sometimes fear, excitement, and greed can control your emotions, making you not stick to your trading plan. This is not good for your trading strategy and can lead to negative results.

Write down what you did on a previous trade, how you can improve on it, and your goals for the next activity. This will not just help you to improve mentally, but also physically, and technically.

It is important to have reliable tools before jumping into trading. The most essential tools are secure internet, desktops and mobile devices, which will be of great assistance in managing your risks successfully.

For example, when using a mobile device for your trade, it is easier to manage your activities even whenever you aren’t close to a desktop. Other traders also prefer using a desktop, so figure out your preference and get the ball rolling.

Conclusion

Trading risk management should be an essential part of every trader’s strategy. Advanced traders may understand how much to risk to minimise losses and maximise their profits.

However, is the knowledge enough if you do not know when to enter and exit a trade? Market analysis is very important in risk management, so make sure that your research is done extensively for successful trading.

If you are a beginner, you should start learning how to avoid extreme losses. You will never avoid losses in a trade. Therefore, the only way out is to learn how to manage it. Use the above risk management strategies and start enjoying your trading activities.

We advise you to start conservatively. Take advantage of the brokers’ demo accounts and practice freely how to manage losses with risk management tips. Lastly, check out our lists of the best forex brokers and forex trading apps, so you can be fully prepared to enter the trading industry and potentially make some good profits.

Honestly, safe trading is something subjective. It depends on how much is safe for you and how much is not. It is important to have your research done well and pick the right broker for yourself. Since many parameters must be considered, new investors may find it challenging to identify the best trading platform.

I recommend the agent I use through the MT5 platform.