Amazon shares have skyrocketed in value throughout the years, and it is every investor’s wish to trade its shares and hopefully make huge profits. The company is one of the biggest tech companies in the US alongside Facebook, Microsoft, Google, and Apple, with over a trillion dollars in valuation. Amazon’s growth has caught many investors’ attention, with most of them wondering whether to invest in its shares.

This ultimate guide is meant to explain in detail how to buy or sell Amazon shares. The guide includes tips and procedures to help you kickstart your investment on a good note. We also recommend a few brokers with excellent track records when it comes to purchasing Amazon shares in the UK.

In this guide

How to Buy Amazon Shares?

Brokers for Buying/Selling Amazon Shares

The shares of Amazon are listed on the NASDAQ exchange under the ticker symbol AMZN. Trading this company’s shares requires you to identify the best broker with access to NASDAQ and meets your needs. Simply put, you should be comfortable investing with the broker, thus increasing your chances of making profits. In addition, find a broker that allows you to trade Amazon shares as CFDs or indices and hosts additional assets for portfolio diversification.

TradingGuide experts did research on hundreds of brokers in the UK to ensure you have the best to kickstart your Amazon investment ventures. Below are the brokers we handpicked based on our findings and user recommendations.

1. eToro

eToro is one of the user-friendly brokers for Amazon share trading in the UK. So if you are a beginner trying to access the Amazon share market, this is the right broker for you. You will enjoy a low minimum deposit requirement of $100, free commission on Amazon shares, copy and social trading, etc. Additionally, eToro has excellent learning resources ranging from comprehensive guides to webinars and seminars.

Unfortunately, this broker charges high spreads for AMZN share trading and investing. In addition, you will pay for withdrawals and accessing the copy trading platform requires a minimum deposit of $200. On top of that, the minimum amount per trade in the broker’s Smart Portfolio is $500.

Disclaimer: {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Additional global shares and asset classes, including forex, commodities, cryptos, and more, for portfolio diversification

- $100 minimum deposit requirement

- Extensive learning materials and a social trading platform to help you become more independent

- Using the copy trading feature requires at least $500, which may seem high to low-budget stock investors

- A $5 withdrawal fee applies

2. Plus500

Plus500 is a broker that hosts powerful trading tools to help you to trade Amazon shares as CFD. You will incur zero commissions and low spreads. On top of that, its minimum deposit requirement is £100, which is made free of charge. Plus500 also hosts extra CFD instruments you can try, including forex, commodities, ETFs, and more. In addition, learning resources and research tools are adequately offered to give you the best experience.

Recently, Plus500 launched Plus500 Invest, where traders can invest in shares, include Amazon.

- The fact that Plus500 is FCA regulated and has received excellent user testimonials makes it trustworthy

- £100 minimum deposit requirement and low spreads attract low-budget share traders

- A highly reviewed mobile trading app that is compatible with both Android and iOS devices

- It has a single proprietary platform hosting tools that might inconvenience share traders looking for advanced resources

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How to Trade Amazon Shares With eToro

Now that you have made up your mind and decided to buy/sell stocks in Amazon, there are plenty of challenges ahead for you to succeed and become Amazon’s shareholder. However, with the below step by step procedures for first time stock buyers and traders, you can fully prepare yourself for a worthwhile experience. Keep in mind that this procedure for purchasing Amazon shares works for any broker we recommend above or one regulated by the Financial Conduct Authority (FCA). We only use eToro as an example.

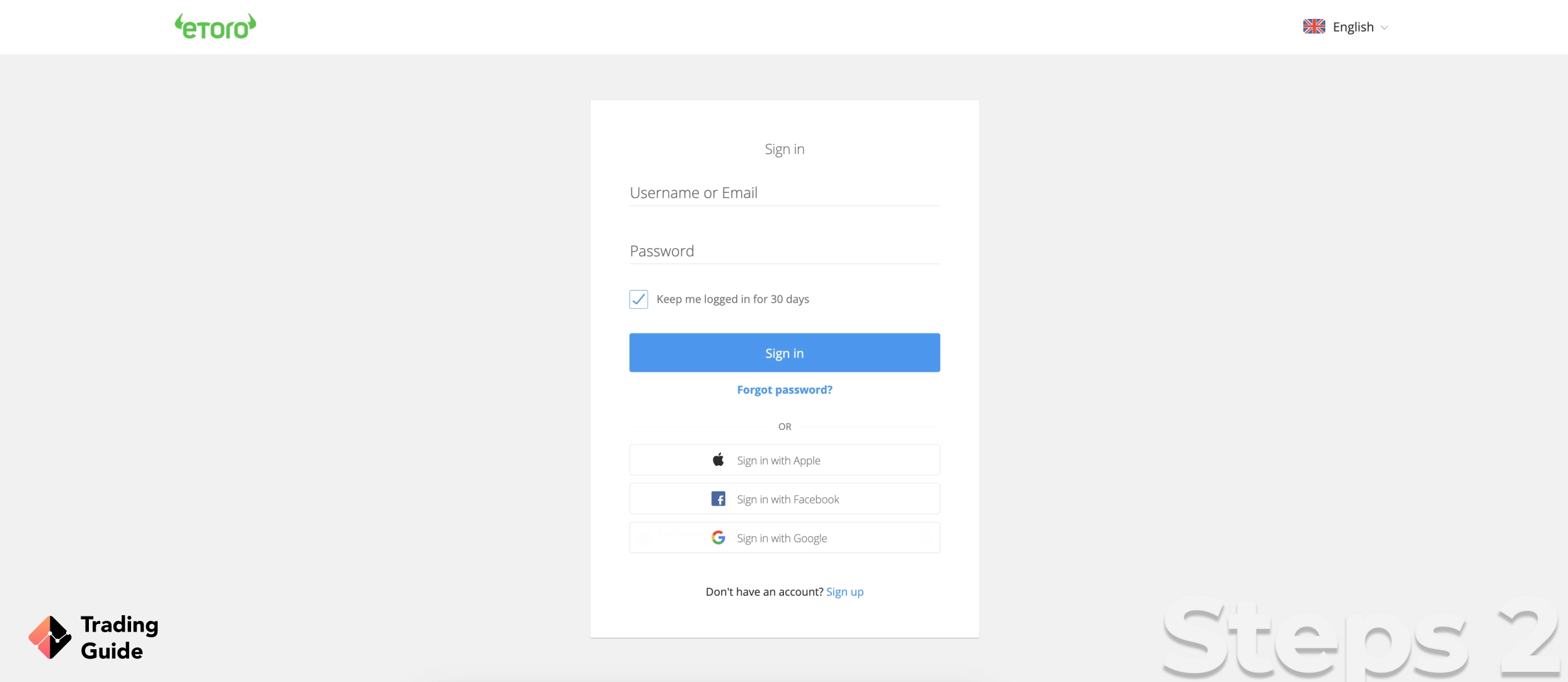

You first need to visit eToro’s website and register for a trading account to buy shares in Amazon. For easier access, we share links on this page to redirect you to the website. Remember that eToro has a trading app that can help you monitor your activities on the go, so install it on your mobile device for a seamless and exciting trading experience.

At this point, we believe that you already understand how the share market works and can conduct a thorough analysis to create the best trading strategy. You will then complete the account registration by sharing personal information per eToro’s requirements. These include full names, date of birth, phone number, email, employment details, etc.

In addition, eToro will require you to complete a simple test to gauge your knowledge on share investment and determine the best package for you. You will also complete a basic test for margin trading that enables the broker to select a suitable leverage limit.

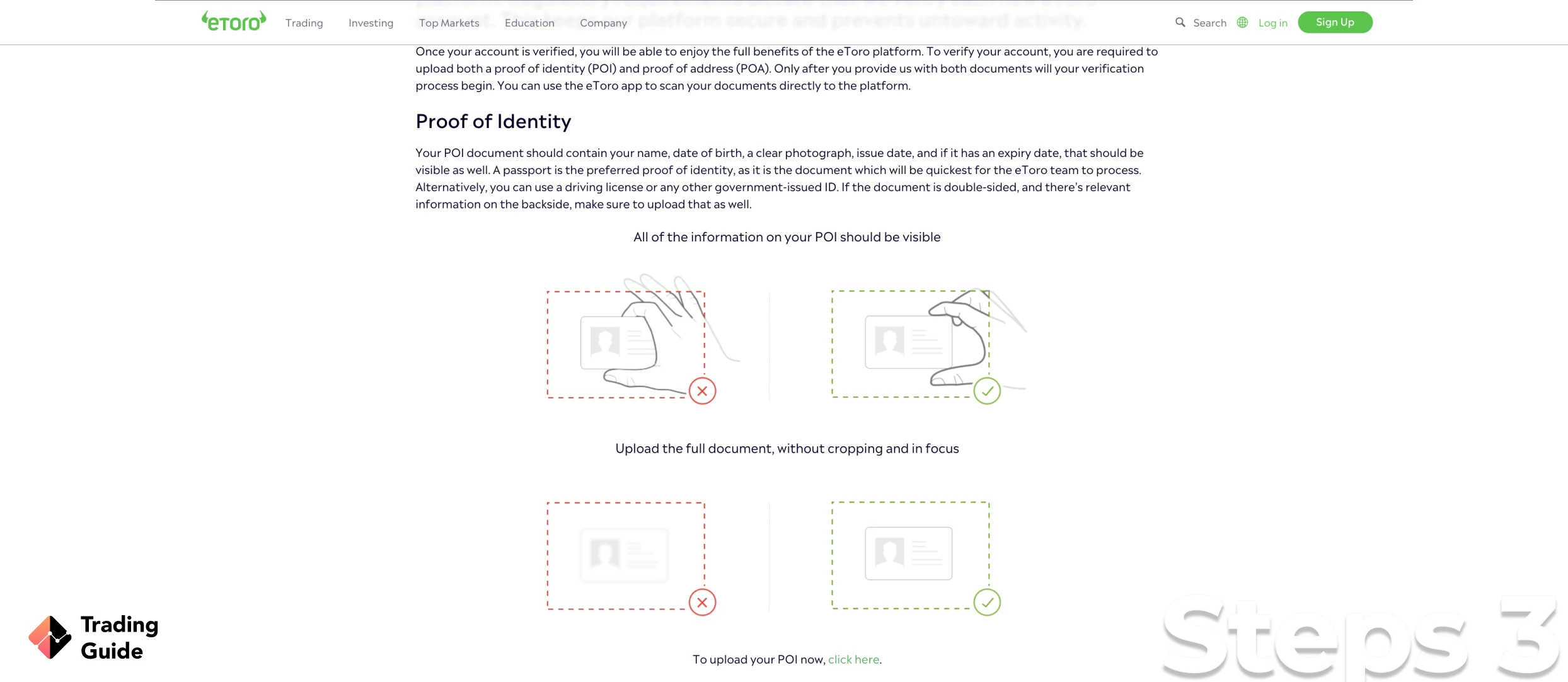

It is a standard procedure for all FCA regulated brokers to verify the identities and location of their clients to fully activate their investment accounts. Since eToro adheres to FCA stringent regulations, you must prove your identity and location. In this regard, eToro will request a copy of your ID card, passport or driver’s licence and a utility bill or bank statement, respectively.

Keep in mind that eToro’s verification process may take upto two days to complete, so wait for an email notification from the broker before making a deposit.

Making deposits with eToro can be done via various payment methods, including debit cards, bank transfers, and e-wallets. So, choose a payment method that will not lag your activities and deposit a minimum of $100 as the broker requires. The good news is that deposits at eToro are free of charge*.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

eToro will confirm your deposit and redirect you to the NASDAQ exchange that lists Amazon stock under the ticker AMZN. Remember, have a budget and choose the number of shares you can afford to buy. Alternatively, you can trade the shares in Amazon as CFD or indices. Indices trading allows you to combine various company stocks in a single investment, limiting the risks that come with individual share investing. However, make sure you fully understand how a trading method works before risking your money.

Tips on How to Choose the Best Stock Broker to Buy/Sell Amazon Shares

As mentioned earlier, finding the best stock broker that offers Amazon stocks in the UK is a daunting task. First, you need to conduct thorough research, which from experience is time-consuming and overwhelming. Additionally, conduct multiple tests and review other users’ comments and ratings on Google Play, Trustpilot, and the App Store before making a choice.

To help you with the process, we list below the important factors to consider when choosing the best stock broker to trade Amazon shares in the UK.

Buying stocks in Amazon requires a stock broker that guarantees your funds’ safety so that you can fully concentrate on your activities. To be safe, find a stock broker that is licensed and regulated by the Financial Conduct Authority (FCA). Such brokers also offer the best trading conditions to give you an exciting experience. Moreover, it’s easier to take legal actions against FCA regulated brokers in case of a severe conflict.

If you are new to share investment, consider a stock broker with a demo account so that you can be able to test a broker and analyse its platform performance. For instance, a broker’s platform should be fast in executing trades and support you with all the tools for market research and analysis. On the other hand, expert investors should go for platforms with advanced features such as expert advisors, automated trading, etc., to maximise their potential. Furthermore, consider a stock broker that helps you develop your skills with learning resources, whether articles, guides, webinars, or seminars.

Investing in the shares of Amazon does not guarantee profits, and it is essential that you prepare yourself for losses. Therefore, have a budget and invest the amount you are willing to lose. For newbies trying to understand the share market, start investing with small amounts and gauge your skills. This means that you should choose a stock broker that complements your budget by considering trading and non-trading charges, including commissions and spreads, transaction costs, overnight fees, etc.

You need to consider spreading your money on various assets to minimise huge losses. So, find a broker offering additional securities for investment, whether forex, cryptocurrencies, commodities, other stocks, etc. Using a demo account, learn how they work and identify the ones you can include in your investment portfolio. Simply put, while Amazon stocks can be profitable, you do not want to take the risk of losing your money in a single investment.

Customer service can help resolve investment problems or clarify relevant information to keep you on the right track. Without reliable and responsive customer service, you will not get enough guidance to potentially profit from your investment. So, find a stock broker with a dedicated support service, whether operating daily or five days a week.

Amazon Shares Price Today

Amazon share price is relatively high for most investors, and for this reason, the company allows you to invest in fractional shares using online brokers. Fractional shares are pieces of a share and are way cheaper, allowing all traders to try their luck with the company. Note that Amazon’s share price keeps going up and down, making it challenging for investors to identify its accurate price.

Fortunately for you, we share a live chart below indicating today’s share price of Amazon. You can also access historical data and extra information on the company’s share price to develop the best investment strategy.

About Amazon

In 1995, Amazon was founded as a bookseller company by Jeff Bezos. Since then, the company has grown tremendously and is to date known to offer additional services in e-commerce, digital streaming, cloud computing and artificial intelligence. Amazon’s compelling growth over the years and its current strategy to continue growing shows that you can potentially make huge profits* by investing in its shares.

If you are in doubt of this and believe that Amazon’s tremendous bull run will end at some point, then remember when it suffered a recession in 2008. The company also survived the internet bubble in the ’90s, Jeff Bezos resignation, and the COVID-19 pandemic. So, what else could set Amazon back? The company is worth the risk, so take your shot and be hopeful for success.

*Don’t invest unless you’re prepared to lose all the money you invest.

FAQs

Although a share of Amazon costs more than £3,000, you can easily purchase a fraction of the company’s share through online stock brokers. Simply ensure that the broker is regulated by the FCA and has access to NASDAQ, where AMZN stock is listed.

Yes. Amazon share investment can be profitable if you are dedicated to conducting research and market analysis before putting up your money. But, most importantly, you need the best stock broker that meets your investment needs, like the ones we recommend above.

No. Unfortunately, Amazon does not pay dividends to its shareholders. Instead, the company focuses on growth and expansion into new markets, making it a potentially profitable investment.

Absolutely. You can buy Amazon stock in the UK through FCA licensed and regulated brokers with access to NASDAQ. The good news is that most of these brokers also allow you to trade AMZN shares as indices or CFDs and offer more financial assets to diversify your investment portfolio.

Amazon is headquartered in Washington, United States. It is currently under the leadership of Andy Jassy, who took over as the CEO in 2021. Amazon also has various subsidiaries, including Whole Foods Market, Audible, Zappos, etc.

Conclusion

Trading Amazon shares may seem challenging for the first time, but you should be willing to dedicate your time and practise more. Start with a broker’s demo account and practise share investment for as long as you are allowed. You can also practise derivatives trading to identify a method that works best for you.

Amazon shares have the possibility of growing in value in the coming years, even though there is a debate that they could be overvalued. If you are sceptical about going all in on Amazon shares, we advise you to consider investing in fractional shares. Note that the company does not pay dividends so, do not go into this venture hoping for additional income.