BDSwiss has grown into a global leader in investment and online trading in recent years. As an online broker, BDSwiss provides a wide selection of investment opportunities to its users.

- Strict regulation

- Several trading platforms to choose from

- Daily trading alerts

- Poor selection of cryptocurrencies

- No fixed spread accounts

BDSwiss is a multi-regulated and award-winning broker, with a great variety of tradable instruments. BDSwiss is the perfect place for investors to get started with trading. They provide traders with one of the simplest and user-friendly platforms on the market today.

We have spent over 150 hours researching all the pros and cons of BDSwiss’s trading platforms. We have analysed their work in detail, studied active users’ reviews, and paid special attention to the broker’s security. You can see the results of our work below.

BDSwiss – Who Are They?

BDSwiss is a European forex and CFD broker that was founded in 2012. They offer trading accounts regulated under the FSC and the Financial Services Authority (FSA). BDSwiss offers a wide range of trading tools for traders, including a demo platform for practising and developing their trading skills.

Unlike other brokers who focus on stocks or forex, BDSwiss provides a wide range of financial instruments that you can use to trade and invest your money. They provide customers with more than 1000 underlying instruments from six asset classes, including commodities, metals, currencies, bonds, and stocks from all over the world.

BDSwiss is a forex trading platform with advanced charting and data tools. Its super user-friendly interface allows newcomers to get familiar with trading principles quickly. Whether you are a seasoned trader or brand new to the trading environment, BDSwiss’s unique trading tools give you all the information and control you need to trade with confidence.

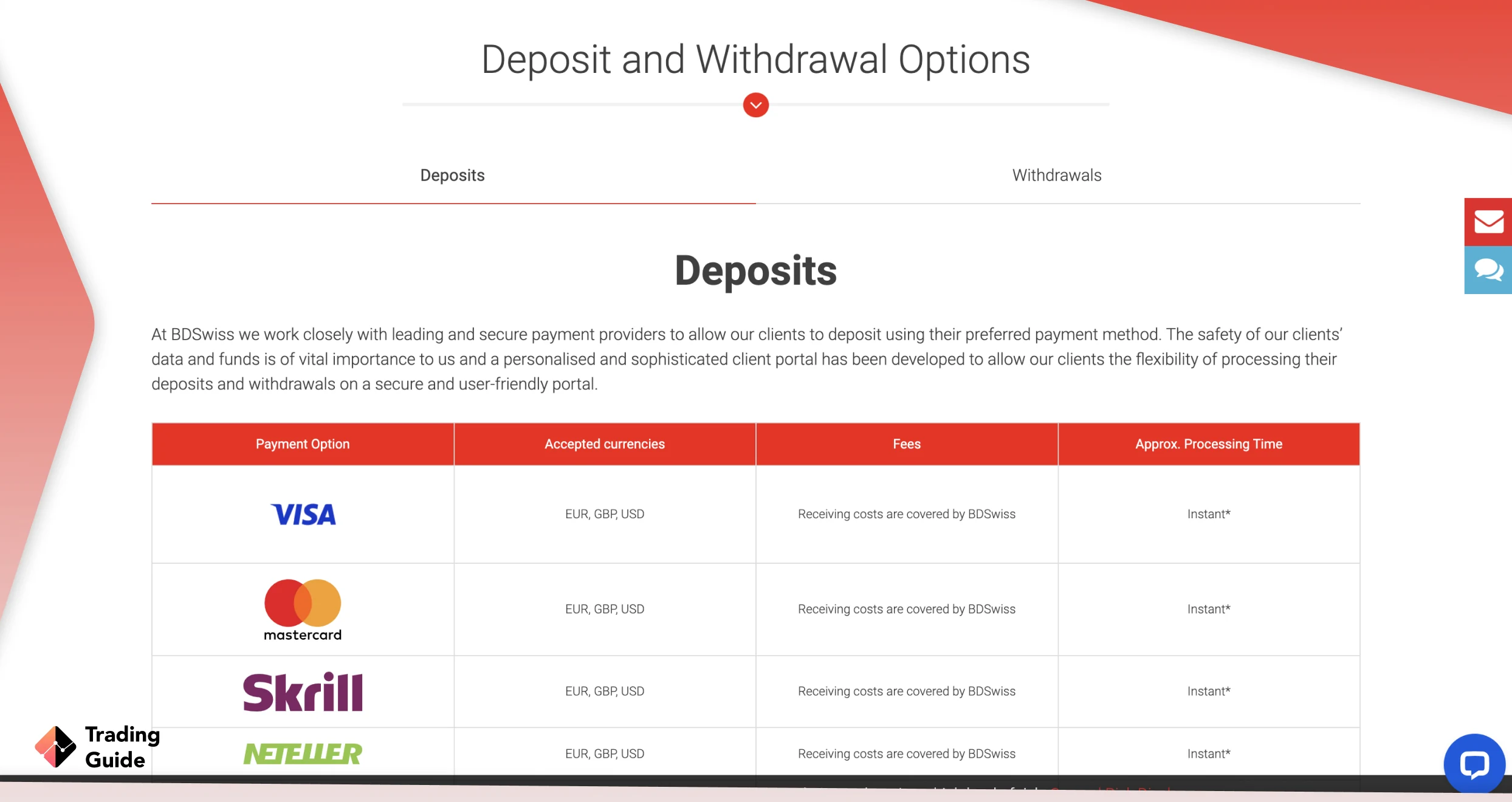

| Type | Fee |

|---|---|

| Minimum deposit | $100 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | 10% of your account balance |

| Overnight fee | Yes |

| Type | Cent | Classic | VIP | RAW |

|---|---|---|---|---|

| Spreads from | 1.5 | 1.5 | 1.1 | 0.0 |

| Commissions* | $0 | $0 | $0 | $5 |

| Assets | 70+ | 250+ | 250+ | 250+ |

| From** | $10 | $10 | $500 | $500 |

* Please note that BDSwiss does not charge commissions on forex, crypto and commodity pairs. For all other CFDs including indices and shares, a fixed commission fee will apply depending on your account type and trading account currency.

** Please note that minimum deposit thresholds are calculated as fixed amounts regardless of base account currency. Minimum first deposit amounts may differ depending on your country of residence and whether you have accessed our website through a third party or using a referral link.

Compare BDSwiss Features With Other Brokers

Compare brokers

Our Opinion About BDSwiss

BDSwiss has rightfully earned a reputation among traders, offering them not only great trading conditions, but the ability to trade with platforms that are easy to use and reliable.

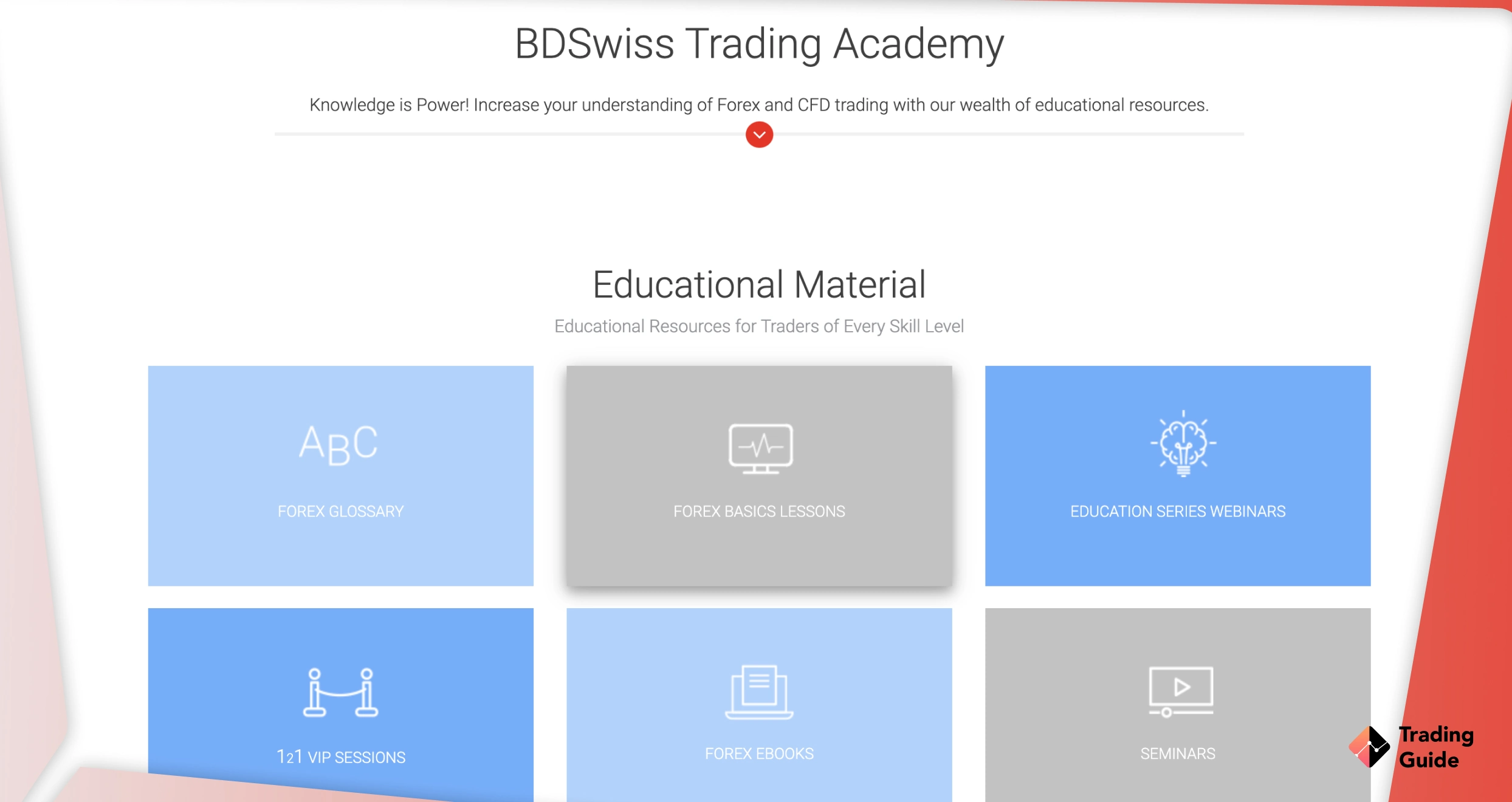

BDSwiss offers educational tools based on three levels of trader experience: beginner, intermediate, and advanced. The wealth of information can help those who have just started trading to build their own strategies, whilst helping expert level traders who are interested in testing new strategies and developing new tactics.

FAQs

Yes. BDSwiss is a safe and trustworthy broker. It is regulated by several authorities, including the Financial Services Commission (FSC) and Financial Services Authority (FSA). Therefore, you can rest assured that your funds and personal information are safe with BDSwiss.

No. Unfortunately, BDSwiss is currently not available in the United Kingdom. The broker is not regulated by the Financial Conduct Authority (FCA), UK’s financial regulator.

Yes. BDSwiss allows you to engage in scalping, a trading strategy designed to profit from small price fluctuations as often as possible within a day. Additionally, the broker supports traders with quality tools for this strategy. BDSwiss’ demo account is an excellent way for beginners to try scalping without risking their money.

Yes. BDSwiss has a copy trading feature where you can mirror professional traders’ positions and benefit from their strategies. Copy trading is a suitable strategy for beginners interested in learning the basics of trading by imitating other traders while earning profits.

The strategy is also ideal for seasoned traders with little time for analysis and market research. Note that when you copy professional traders’ positions, expect to earn profits when they do and incur losses if the trades work against their strategies.

BDSwiss is the trading name of BDSwiss Holdings Ltd., a leading financial group of companies headquartered in Cyprus. The broker itself was founded in Zurich, Switzerland, in 2012.

Can I invest with BDSWISS? Is it good?

I am a bit confused about this broker as it does not offer you a regulated and secured service. But parallelly, it is regulated by the European authority and to some standardized level, it offers you certain safety so as to make your transactions easy. I guess you can take the risk.

If you are looking for a long-term, then it is good to opt for a more low spread. There are many online brokers out there and you can choose the one that meets your financial goals and requirements.

That is the broker which constantly improves. BDSwiss is one of a few brokers which always changes to the better and it is great. They have already added up more financial instruments to trade like metals, indices, cryptos and what's not.

I also like the fact that they are not going to include stocks in that list. I mean that I have a perception that each broker should specialize in some limited number of assets to trade because all of the instruments have their own peculiarities and as a rule, forex brokers don't create any special conditions for stocks which makes trading them not quite profitable. What is more, BDSwiss supports Metatrader4 platform which is regarded as a certain standard in trading, so many traders will find it convenient to switch to this broker because they won't face any difficulties. Finally, their trading conditions are awesome. The charges are really low and they will not affect your profits.

Kind of pleasant broker with all needed trading conditions. I friend of mine invite me here so I trade here for about 1,5 years. I trade using Metatrader4 platform - classic. Spreads here are floating from 0.10% and you don't pay for trading commissions. I use negative balance protection, because sometimes I use big leverage sizes and it is fits my strategy and risk management. There are many trading instruments so you can trade non stop.

Great service and fast responses. Once I had an issue with my withdrawal and I asked for help from the support team so my problem was resolved quickly. I can say I recommend them. I think that they are very responsible.

BDSwiss, a great platform for trading. The trading software is ok, though I trade with MT4 mobile. Fast withdrawals, but huge spreads. BTW, they have very good and really fast customer service!

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal