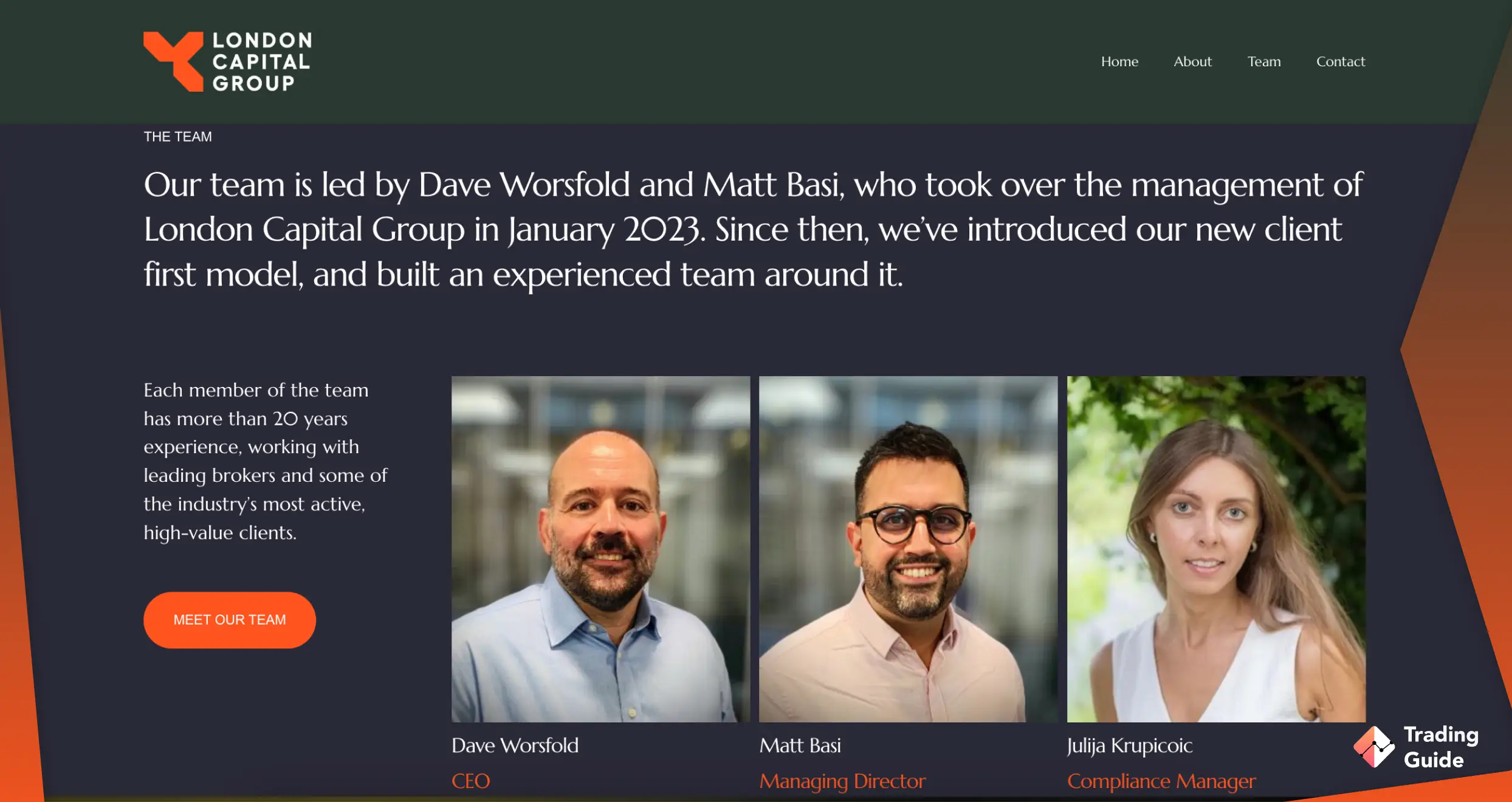

London Capital Group (LCG) is a UK-based brokerage firm that provides online trading services to traders worldwide. Founded in 1996, LCG has established itself as a well-respected and reputable trading platform, offering a wide range of trading products, including forex, stocks, indices, and commodities. With more than 20 years of experience in the financial markets, LCG has built a strong reputation for its reliability, transparency, and customer service.

We have prepared this review to closely examine LCG’s trading platform, trading conditions, customer support, regulatory status, and more. This is so that you can easily decide if it is the right broker for your trading needs.

LCG – Who Are They?

London Capital Group (LCG) is an award-winning forex and CFD trading broker that has been existing since 1996. Headquartered in London, the company is publicly listed on the London Stock Exchange under the ticker LCG. It is also regulated by the Financial Conduct Authority (FCA), one of the most reputable financial regulators in the world.

London Capital Group offers access to over 7000 markets across 9 different asset classes, including forex, commodities, shares, indices, bonds, options, ETFs, and cryptocurrencies. You will also enjoy a seamless trading experience through its web and mobile trading platforms, thus increasing your profit potential.

Overall, London Capital Group is a user-friendly broker with reliable support service. Its advanced LCG Trader and MetaTrader 4 (MT4) platforms offer a range of advanced tools and features for maximum experience. There is also the ECN (Electronic Communications Network) trading feature, which allows traders to trade directly with other market participants rather than through a dealing desk.

Compare LCG Features With Other Brokers

Compare brokers

Licenses and Security

London Capital Group (LCG) is a regulated and secure online trading platform that provides its clients with a safe trading environment. The broker is licensed and regulated by the Financial Conduct Authority (FCA) in the UK and the Securities Commission of the Bahamas. Simply put, LCG is held to high safety and security standards for customer funds and trading practices.

In addition, LCG provides additional asset protection to its clients through the Financial Services Compensation Scheme (FSCS). The FSCS is a UK government-backed scheme that provides up to £85,000 of protection per client in the event that the broker becomes insolvent. Sadly, this broker does not offer two-factor authentication or biometric scanning for login, which may be a concern for some traders.

Assets Offered

London Capital Group offers over 7,000 CFD products to explore and discover diverse investment opportunities. These assets include Indices, Commodities, Forex, Spot Metals, Shares, Vanilla Options, Bonds & Interests, ETFs and cryptocurrencies. This wide range of trading products allows traders to easily diversify their portfolios on a single platform.

Note that traders cannot use this broker to purchase and take ownership of any underlying asset. Instead, you can only trade contracts for difference (CFDs) which allow you to speculate on an asset’s price movements and benefit from the price difference.

LCG Fees and Commission

LCG has a minimum deposit requirement of £0 for their standard account. However, its ECN account requires a minimum deposit of £10,000, which may be a barrier for some traders. When it comes to CFD trading fees, the broker’s spreads are relatively high, and you may end up paying more than you would with other brokers.

Additionally, LCG charges an inactivity fee of £15 per month after 6 months of no trading activity, which can add up over time. On the bright side, deposits and withdrawals are free, except for credit card deposits that attract a 2% commission fee.

| Type | Fee |

|---|---|

| Minimum deposit | £0 |

| Minimum deposit for ECN account | £10,000 |

| Deposit fee | Free, but credit card deposits 2% fee |

| Withdrawal fee | Free, but credit card deposits 2% fee |

| Inactivity fee | £15 |

Deposit and Withdrawal Methods

There is a range of fast and secure payment methods for deposits and withdrawals at London Capital Group. As mentioned earlier, the broker does not charge any fees for deposits and withdrawals, except for credit card deposits that attract a 2% commission fee. You can make deposits and withdrawals using bank transfers, Visa, MasterCard, UnionPay, Skrill, and Neteller.

Note that deposits are processed quickly, and most methods take up to 30 minutes to reflect in your account. However, bank transfers may take up to 24 hours to process. Withdrawals are also processed within 24 hours, ensuring traders can access their funds quickly and efficiently.

LCG also offers traders the ability to hold accounts in different currencies, including GBP, EUR, USD, and CHF. This allows traders to avoid the costs and hassles of currency conversion. Also you can choose the currency that best suits their trading needs.

Platforms and Educational Tools

London Capital Group provides its clients with a range of trading platforms, including LCG Trader and MT4, suitable for all types of traders. The LCG Trader is a multi-asset platform that offers unique resources for strategy development, including advanced charting, technical analysis tools, and real-time news and market data. The platform is also customisable, allowing traders to tailor it to suit their trading needs.

MT4 is another LCG platform available in 39 languages and provides free signals, automated trading, and an advanced charting package. While the learning resources are not as comprehensive as expected, traders can still use online trading videos, webinars, and support guides to boost their skills. There is also a basic FAQ section and a demo account, which enables traders to gauge their skill level and practice trading strategies without risking real money.

How To Register an LCG Account

If you are considering LCG for your trading ventures, you need to start by creating an account with the broker. We list below the simple procedures to note.

- Visit the London Capital Group website using the links we’ve shared on this page.

- Click “OPEN LIVE ACCOUNT” and share your personal details, including your email, current location, and phone number. You should also choose your preferred platform, whether MT4 or LCG Trader and currency to trade with.

- Create a strong password for your account. Check the box underneath to confirm that you initiated the broker’s services for your own interest.

- Click “NEXT” and fill in additional personal information, including your name, date of birth, Nationality, place of birth, physical address, employment status, and financial experience. You should also indicate your experience in trading.

- Agree to the user agreement and terms of use, then click “SUBMIT”.

- Upload documents to verify your shared data. These include copies of your original ID card or driver’s licence and a recent utility bill or bank statement.

- Your account is now ready for deposits and trading.

Editor’s Note

Based on our professional view, London Capital Group is an excellent forex and CFD broker for newbies and expert traders alike. Although it has limited learning resources and a basic FAQ section, beginners can still boost their skill levels with available resources. Plus, the broker has a user-friendly and customisable trading platform that provides users with adequate resources for strategy development.

We also like the fact that LCG has expert traders in mind, thus hosting the MT4 platform with advanced features such as free signals, automated trading, and an advanced charting package. There is also the ECN feature and an Islamic account, thus attracting users from diverse religions. We hope that the broker will someday host physical assets to purchase and take full ownership since you can only trade CFD instruments.

FAQs

Yes. London Capital Group is a good broker since it has been around for over 2 decades. Moreover, the broker has a license from the FCA, thus making it a trustworthy option among UK traders. It also lists 7000+ CFD instruments you can explore and diversify your portfolio with.

Yes. London Capital Group is one of the forex and CFD brokers licensed and regulated by the Financial Conduct Authority (FCA) and the Securities Commission of the Bahamas. With such regulations, rest assured that your funds are secure and you get to trade under the best conditions.

Absolutely. We can confidently say that London Capital Group is a legit broker since many users on Google Play, the App Store and Trustpilot rate it highly. Besides, the broker is highly encrypted to secure your data against unauthorised access.

London Capital Group brokerage firm is a subsidiary of the London Capital Group Holdings plc, a company founded in 1996. The broker is headquartered in London, UK and serves millions of clients across various global regions.

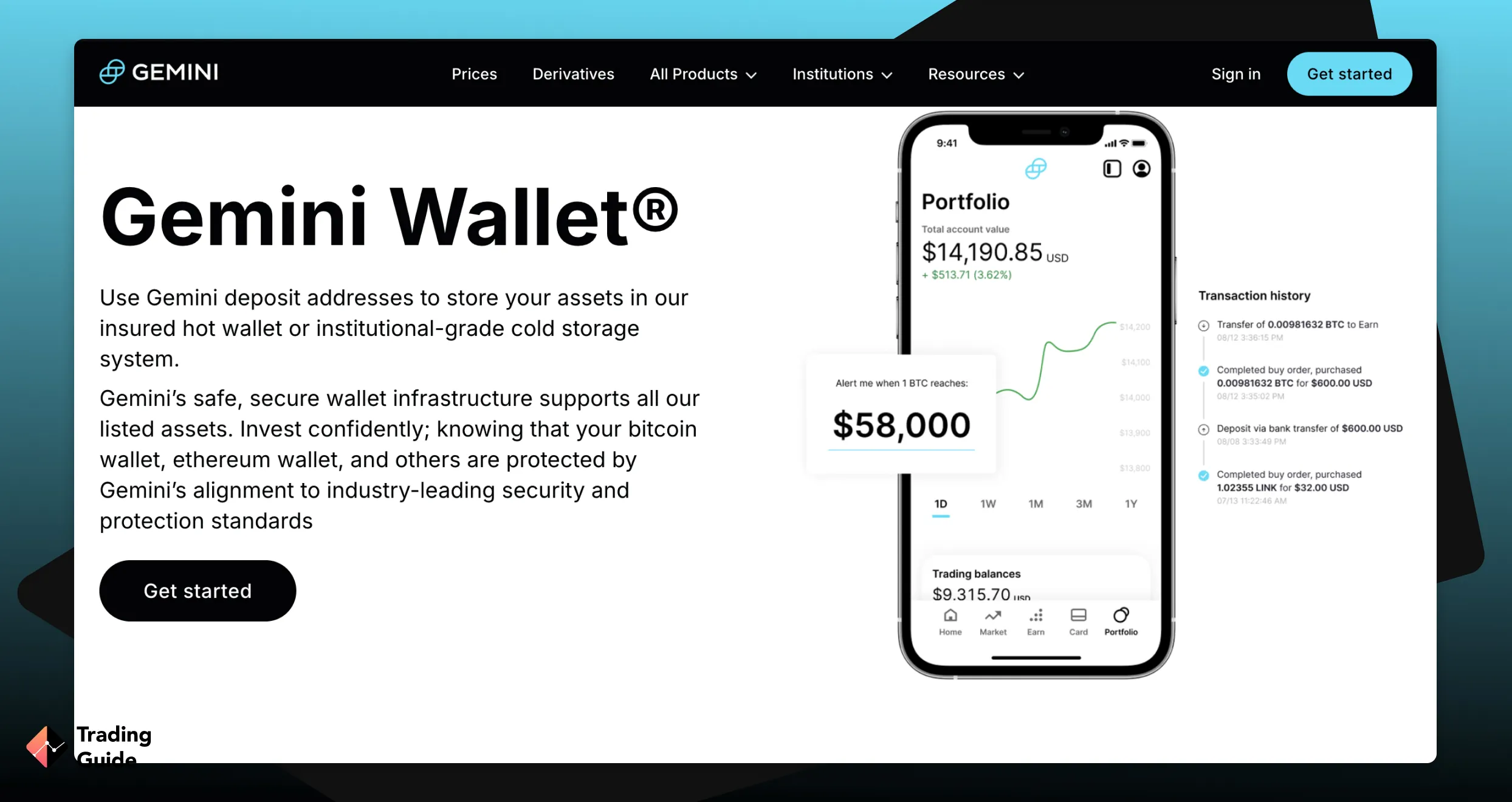

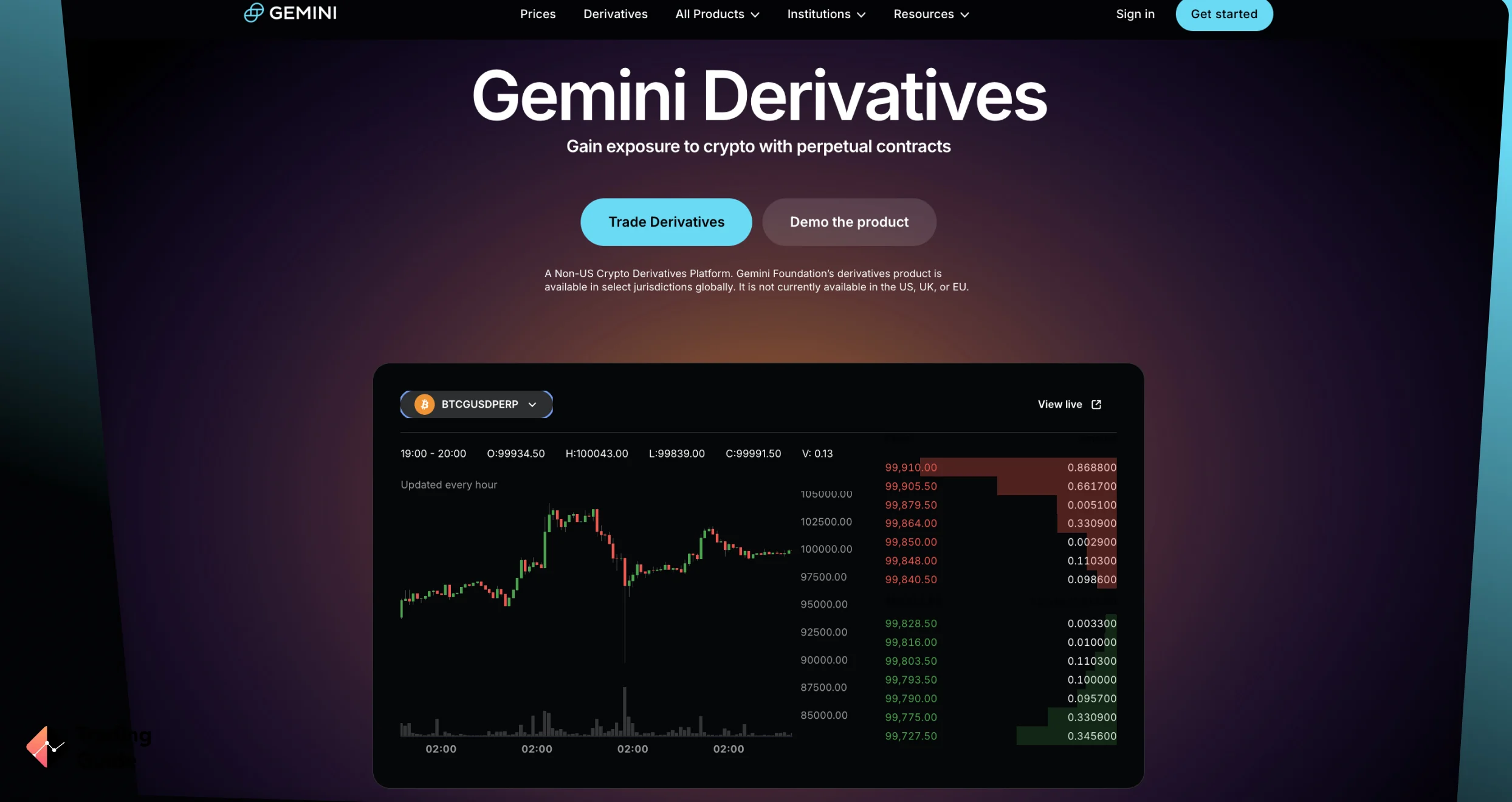

The Gemini wallet is a popular choice for UK cryptocurrency investors, offering a secure way to store and manage digital assets. The wallet is a part of Gemini, a trusted and regulated crypto exchange for buying and selling digital currency. Gemini wallet also offers a range of features such as multi-signature security and the ability to store, send and receive cryptocurrency.

With its robust security, intuitive user interface and comprehensive customer support, the Gemini wallet is an excellent choice for UK users looking to safely store and manage their digital assets. In this review, we closely review Gemini wallet’s features and benefits to help you decide whether it’s the right choice.

Overview

Founded in 2014 by Cameron and Tyler Winklevoss, Gemini wallet is a cryptocurrency digital storage platform offered by the Gemini exchange, one of the most reputable and regulated cryptocurrency exchanges in the industry. The wallet is designed to offer users a secure and user-friendly way to store, manage, and trade their cryptocurrencies.

One of the key features of the Gemini wallet is its security. The company reserves most of its funds in cold storage, meaning they are kept offline and are, therefore, less susceptible to hacking. The wallet also features an insured hot wallet, guaranteeing your digital assets’ protection against certain losses. On top of that, the platform offers two-factor authentication and is highly encrypted to protect your data.

Gemini providers pride themselves on creating a digital wallet that is backed up by superior technology. The wallet is constantly updated to support new currencies and optimise users’ experience. Plus, the wallet delivers exceptional 24/7 support service you can contact via email and live chat.

Compare Gemini with Other Wallets

Services and Features

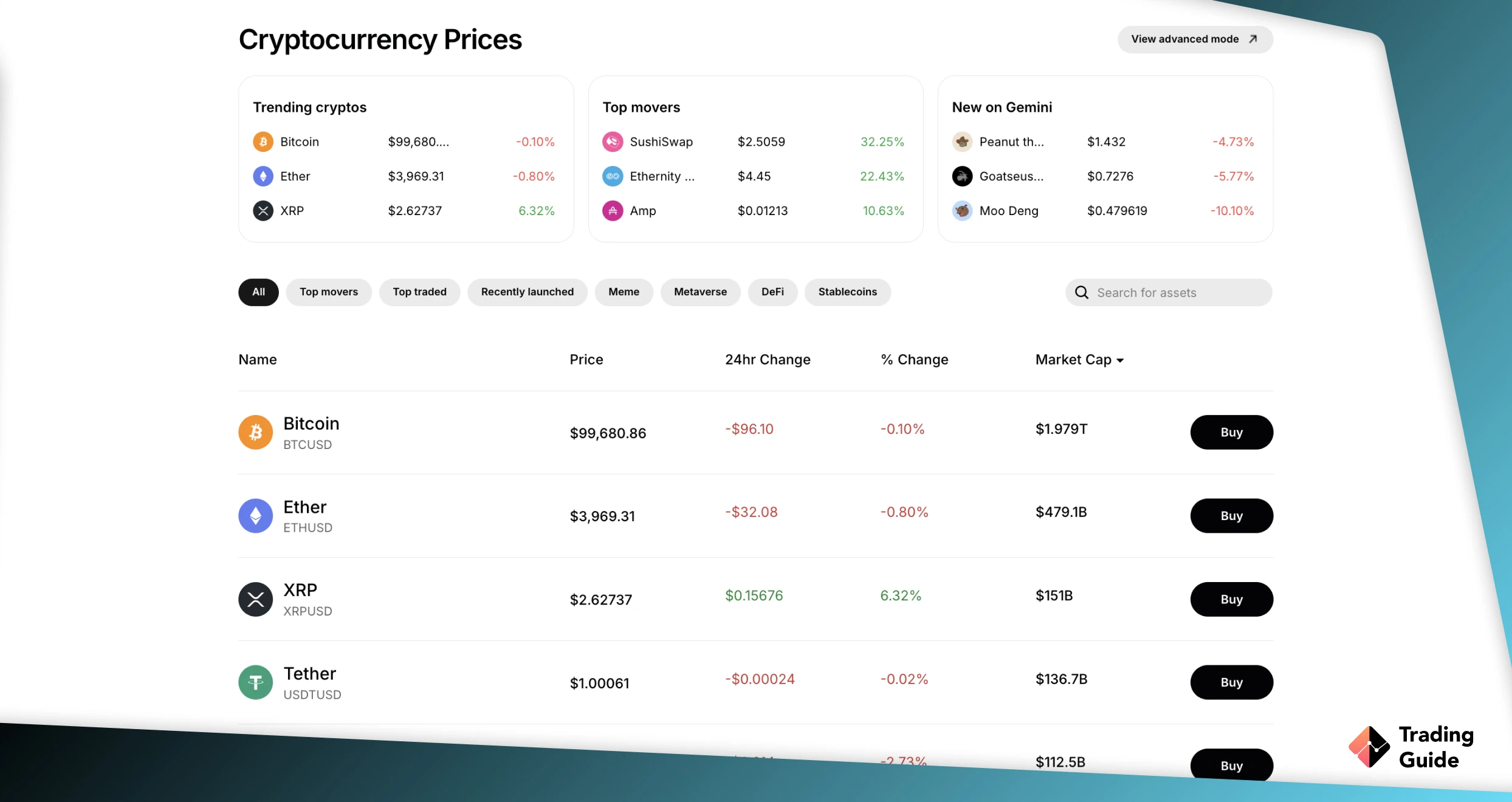

Gemini is a popular cryptocurrency wallet supported by Gemini exchange. With this wallet, you can securely store, buy, sell, and manage your cryptocurrency tokens in one place. Gemini wallet services and features make it an excellent choice for those looking to take their cryptocurrency portfolio to the next level. These services and features include a secure and reliable cold and hot wallet, low transaction fees, availability of adequate cryptocurrencies across multiple blockchains, and a user-friendly interface.

Besides accessing the Gemini wallet using your desktop, it is also compatible with mobile devices. This flexibility allows you to access the wallet and manage your digital currencies on the go. Moreover, the wallet allows users to earn via staking, although it will stake on your behalf and take a small commission for the service.

Fees

The Gemini wallet charges a small fee for every transaction, both for buying and selling cryptos. You will incur the costs based on the type of transaction and the coin you are dealing with. If you want to use Gemini custody, expect a 0.4% charge of your asset balance or £30 per asset per month. There is also an administrative withdrawal fee of £125.

Depositing fiat currency and cryptocurrency into your Gemini Wallet is free through ACH or wire transfer. If you’re seeking more convenience, you can deposit with your debit/credit card or Paypal, but expect to incur a fee of either 3.49% or 2.5% of the total purchase amount respectively. When withdrawing crypto to another wallet, you won’t be charged extra if you make 10 or less withdrawals in a month. More than that, you’ll be subject to an additional fee plus either a dynamic or flat fee, depending on the ERC-20 token.

Supported Coins

Gemini wallet is a custodial wallet, meaning all assets are stored on its servers. This offers the benefit of security and the ability to access your funds from anywhere, but it also means you don’t have full control over your assets. Overall, this wallet is highly secured and supports over 90 cryptocurrencies, including:

- Bitcoin (BTC)

- Gemini Dollar (GUSD)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- Tether (USDT)

- Shiba Inu (SHIB), etc.

Besides listing the above tokens, the wallet allows you to transact using 7 fiat currencies. These include USD, GBP, EUR, CAD, SGD, HKD, and AUD. However, note that the supported fiats might be limited based on your jurisdiction area.

Security

Gemini’s security features start with two-factor authentication, which requires a unique code to access your account. You can also enable whitelisting to ensure that only withdrawals to specific wallets are allowed. The best element about Gemini is that it stores most of its digital assets offline in secure, cold storage. This helps to protect your assets from unauthorised access. The wallet also insures users’ funds on its hot storage to guarantee protection against certain losses.

If you’re looking for even more security, Gemini offers a “multi-signature” feature. This allows you to require up to three unique signatures to approve any transaction. As a result, only you can authorise and execute fund transfers. Overall, Gemini has completed various compliance tests and focuses on compliance. For this reason, it is considered a qualified custodian under the New York State Department of Financial Services regulations. It is also regulated by the Monetary Authority of Singapore (MAS) and the Financial Conduct Authority (FCA).

Privacy and Anonymity

Gemini prides itself on valuing its users’ privacy, and therefore it has set measures to keep its platform as secure as possible. For instance, before activating accounts, the provider will require all users to participate in the Know Your Customer (KYC) procedure to verify every detail. Plus, you cannot carry out anonymous transactions with Gemini wallet, thus removing any layer of anonymity.

Customer Support

Gemini wallet has a dedicated support service operating round the clock. You can reach its team via email and live chat. Unfortunately, there is no phone support. Fortunately, Gemini also has a FAQ section where you can get answers to commonly asked questions.

How to Start with Gemini Wallet*?

When engaging with cryptocurrencies, it’s crucial to recognise that these digital assets are characterised by their extreme volatility and speculative nature. This can result in swift and substantial price fluctuations. To safeguard your crypto holdings, it is imperative to utilise reputable wallets and exchanges, prioritising the security of your investments.

Also, exercise vigilance and due diligence to guard against crypto-related scams and fraudulent schemes that can potentially threaten your financial well-being. You can also spread your investments across multiple digital tokens and avoid making decisions based on emotions.

Setting up a Gemini wallet is a straightforward process that will probably take a few minutes to complete. Below, we take you through how to set up and use your Gemini wallet in just a few steps.

To get started with a Gemini wallet, the first step is to visit its official website and begin the account registration procedure. All you need is your name, a valid email address and a password. Once your account is created, accept is user agreement and have access to your wallet, where you can start buying, selling, and storing digital currencies.

To ensure the safety of your digital assets, you’ll need to back up your wallet using a recovery phrase. This recovery phrase is a series of 12 randomly generated words you need to save in a secure place. You’ll need this phrase in order to access your wallet in case of a forgotten password or other technical issues.

Once you’ve created your account and backed up your recovery phrase, you’re ready to start using your wallet. You can start buying and selling digital currencies, sending funds to other wallets, and more. Gemini also provides various tools and services to help you manage your digital assets and stay informed of market trends.

*Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Editor’s Note

As the cryptocurrency industry evolves, so does the need for secure and reliable wallets for storing digital assets. Users must have a place to store and manage their digital assets, which is where Gemini Wallet comes in. Based on our analysis, Gemini Wallet is a secure, cloud-based wallet provider that offers its users a simple, safe, and secure way to store and manage their digital assets.

Gemini Wallet was designed with security as the priority. It uses advanced encryption technology to keep all user data and digital assets safe and secure. Additionally, the wallet applies multiple security measures to protect user accounts from malicious attacks.

We also like the fact that Gemini Wallet offers its users a variety of features that make it easier to manage and store digital assets. You can view your digital asset balances, make transfers, and receive funds all in the same place using various currencies. Its user-friendly and intuitive design interface that makes it operate seamlessly on desktop and mobile devices is another element that makes it stand out.

FAQs

Numerous cryptocurrency exchanges are introduced in the financial space as the use of digital currencies increases. One of the leading exchanges today is Bitstamp, which has been providing reliable and secure trading services since its establishment in 2011. With many investors venturing into cryptocurrency, we thought it is best to take a closer look at Bitstamp’s offerings and see how they stack up against the competition.

In this Bitstamp review for 2025, we’ll explore the platform’s features, security, fees, and more to help you make an informed decision when choosing an exchange.

Bitstamp Overview

Bitstamp is one of the oldest and most reputable cryptocurrency exchanges, having been in operation since 2011. It is headquartered in Luxembourg and operates globally, providing a platform for buying and selling over 80 cryptocurrencies, such as Bitcoin, Ethereum, Litecoin, Ripple, and more.

Although Bitstamp has a history of hacking in 2015, the exchange has taken measures to strongly focus on protecting user accounts from hacks and breaches. It uses a two-factor authentication procedure and secures most of the assets on a cold wallet. Bitstamp’s platform is also user-friendly, any trader can benefit from the platform without experiencing challenges navigating it.

Overall, Bitstamp serves over 4 million cryptocurrency traders globally. It prides itself on being one of the most regulated crypto exchanges globally. Besides having an office in Luxembourg, the exchange has other branches in the UK, Slovenia, Singapore, and the US.

Compare Bitstamp with Other Exchanges:

Cryptocurrencies Available*

There is a growing list of cryptocurrencies at Bitstamp to buy, sell, and trade. Although the collection is not as comprehensive as what other popular crypto exchanges list, you will never lack an option to invest in.

Some of the popular cryptocurrencies you will receive, transfer, or store at Bitstamp include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Bitcoin Cash (BCH)

- USD Coin (USDC)

- Chainlink (LINK)

- Dai (DAI)

The best element about trading or investing using Bitstamp is that it allows you to trade the supported assets using fiat currencies and your already own crypto tokens. Some of the fiats listed for trading include USD, GBP, and EUR.

*Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Fees

Bitstamp is a relatively low-cost exchange when it comes to trading fees. Its minimum trade amount is £10. The charges are based on a tiered system determined by a user’s 30-day trading volume. The more you trade, the lower the fees you pay. There are no fees for trades up to £1000, and expect a 15% commission on your earnings when you use the exchange for staking.

Note that Bitstamp does not charge deposit fees for cryptocurrencies, Faster Payments, ACH, and SEPA. However, if you deposit funds via international wire, there may be a fee charged by your bank or payment processor. All withdrawals attract a fee except for the ACH payment methods. Other fees to expect on this exchange are currency conversion fees.

Payment Methods

Bitstamp is a flexible cryptocurrency exchange that accepts various payment methods for deposits and withdrawals. To transact efficiently, ensure you confirm availability and select the most suitable one for you. Here are the options available at this crypto exchange.

- Cryptocurrencies

- International Transfers

- SEPA

- ACH

- Faster Payments

Unfortunately, you can not transact using e-wallets like Neteller and Skrill on Bitstamp.

Security

Bitstamp prioritises the security of its users by setting stringent measures to maximise their experience. For instance, the exchange has two-Factor Authentication (2FA) for users to securely log into their accounts and make withdrawals. In addition, it features cold storage, which is not accessible via the internet. This helps to prevent hacking attempts and protects user funds from theft.

When it comes to securing users’ data, Bitstamp is highly encrypted and has a dedicated team of security professionals who monitor the platform for suspicious activity and potential threats. It also complies with international anti-money laundering (AML) and know-your-customer (KYC) regulations, which helps to prevent fraudulent activity and protect users. On top of that, the exchange undergoes regular audits to ensure its security practices and protocols are up-to-date and effective.

Customer Support

Bitstamp’s customer support has gained excellent testimonials from users on Google Play, the App Store, and Trustpilot. The exchange support team is reliable and strives to assist users with any issues or questions they may have 24/7. You can reach out to the team via phone and email.

Bitstamp also has a comprehensive help centre with articles, FAQs, and guides on a wide range of topics related to using the platform. Users can search for specific topics or browse through the categories to find the information they need. The exchange is also active on its social media platforms, including Twitter and Facebook.

Education

Bitstamp provides numerous educational resources on its “Learn Center” for users who want to learn more about cryptocurrencies and the Bitstamp platform. A wide range of topics are covered in the form of blogs, courses, and webinars. You can also learn more about the cryptocurrency space using website blogs, podcasts, and youtube channels.

How to Open a Bitstamp Account

When engaging with cryptocurrencies, it’s crucial to recognise that these digital assets are characterised by their extreme volatility and speculative nature. This can result in swift and substantial price fluctuations. To safeguard your crypto holdings, it is imperative to utilise reputable wallets and exchanges, prioritising the security of your investments.

Also, exercise vigilance and due diligence to guard against crypto-related scams and fraudulent schemes that can potentially threaten your financial well-being. You can also spread your investments across multiple digital tokens and avoid making decisions based on emotions.

Opening a Bitstamp account is a relatively straightforward process that can be completed in a few simple steps, as below.

- Go to the Bitstamp website and confirm whether it hosts your preferred asset to invest in.

- Click on the “Get Started” button at the top right corner of the homepage.

- On the registration page, enter your name, email address and date of birth. Also, create a strong and unique password for your account and ensure you read and accept the terms of service and privacy policy before proceeding.

- Once you have entered your email and created a password, Bitstamp will send a verification email to the email address you provided. Follow the instructions in the email to verify your email address.

- After verifying your email, you’ll need to participate in the Know Your Customer (KYC), where you will upload a copy of your original ID, driver’s license, or passport to verify your identity. Bitstamp will also request you to share a copy of a recent utility bill or bank statement as proof of residency.

- Once your account is fully verified, you can deposit funds into your Bitstamp account using one of the supported payment methods.

- Start trading with funds in your account.

Editor’s Note

Based on our review, Bitstamp is a highly respected and reliable cryptocurrency exchange that has been around for over a decade. It provides users with a user-friendly platform, a wide selection of trading pairs, robust security measures, and responsive customer support. For these reasons, we recommend the exchange to new and intermediate investors looking for a reliable platform for their crypto investments.

We also like the exchange’s comprehensive educational resources, which newbies should take advantage of to learn more about cryptocurrencies and trading strategies. Unfortunately, its inability to support margin trading is disappointing since it will inconvenience professional traders looking to take more risks in the crypto space. It will also be great to see an expanded list of crypto tokens on Bitstamp’s platform and a more powerful active platform for advanced investors.

FAQs

Halifax is a leading banking company in the UK offering a wide range of financial products and services to its customers. Established in 1853, Halifax has a rich history of providing innovative and reliable banking and investment solutions to individuals, families, and businesses. Whether you want to find a mortgage, invest for the future, or apply for loans, Halifax is your one-stop online platform.

Below, we review Halifax to help you get familiar with how it can benefit your investment plans. You will understand its security measures, asset offerings, fees, and more. Ultimately, you should be able to decide whether Halifax is the right investment partner for you.

Halifax – Who Are They?

Halifax, formerly known as Halifax Building Society, has a network of branches and ATMs across the UK known to offer a convenient and easy-to-use online banking and investment platform. With a strong focus on customer service and a commitment to responsible banking and investment practices, Halifax is trusted by millions of clients. Undoubtedly, the company is a reliable choice for those seeking a financial partner.

Besides featuring various bank accounts for UK individuals, Halifax also helps you with your mortgage plan. There are also ISAs that allow you to invest in stocks and potentially earn profits in the long run. Other services you get to benefit from using Halifax include insurance on home, car, and life, wealth management, retirement, loans, car finance, and more.

Compare Halifax Features With Other Brokers

Compare brokers

Licenses and Security

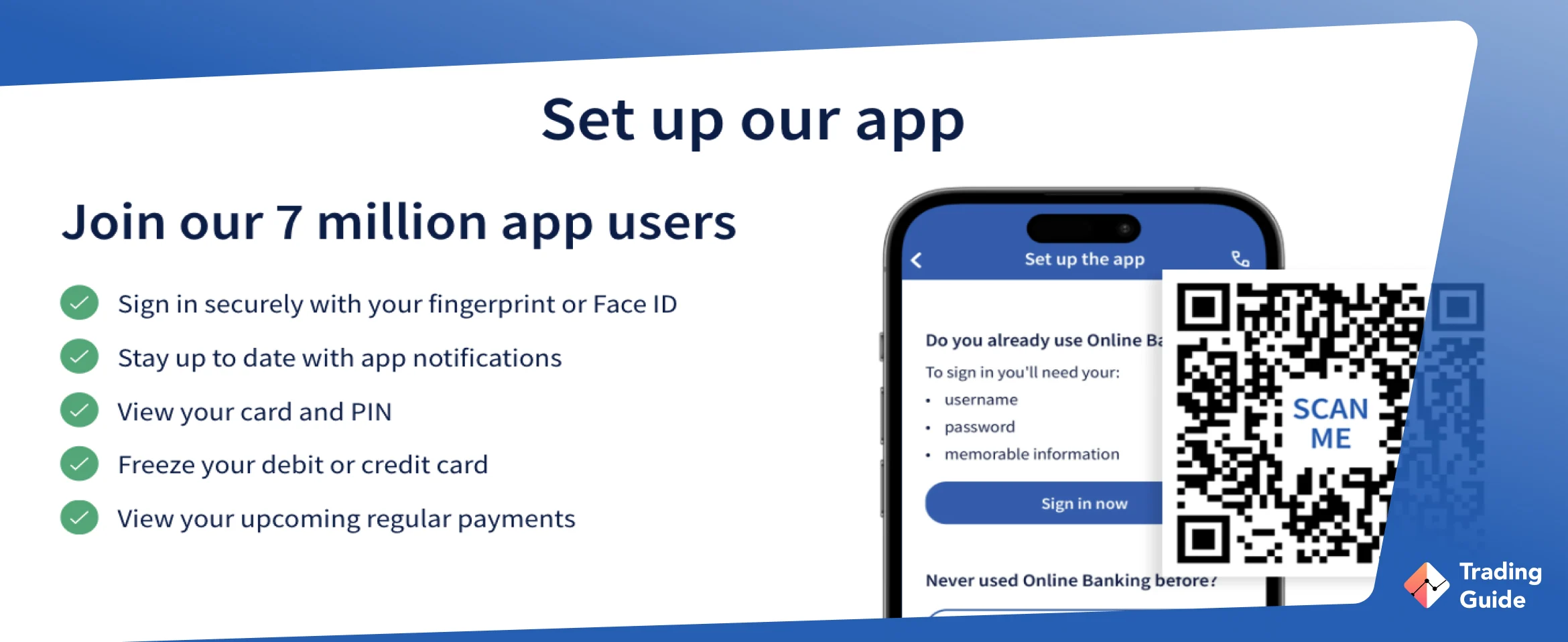

Halifax financial services company is secured and regulated by the Financial Conduct Authority (FCA). All eligible investments at Halifax are also protected by the Financial Services Compensation Scheme (FSCS). The licenses ensure that Halifax adheres to strict rules and regulations regarding its operations, including those related to consumer protection, anti-money laundering, and financial crime prevention.

Halifax places a high priority on the security of its customers’ information and finances. The company has implemented advanced security measures, such as multi-factor authentication, encryption, and firewalls, to protect its online banking systems and prevent unauthorised access to customers’ accounts. In addition, the company has a robust fraud detection system that monitors transactions for unusual activity and alerts customers if any suspicious activity is detected on their accounts.

Assets Offered

There are numerous products and services at Halifax to meet the financial needs of its customers. These include current accounts, savings accounts, mortgages, personal loans, credit cards, insurance, and investment products.

With these products, UK customers can easily invest or save for their future. For instance, Halifax’s current accounts are designed to give customers an easy and convenient way to manage their day-to-day finances. The savings accounts also offer a range of options for customers to save for their future goals.

Regarding mortgage products, Halifax offers a variety of options for customers. You can also take advantage of the personal loans offered to improve your home, consolidate debts, or make large purchases. If you are looking for financial assets, Halifax allows you to grow your wealth by investing in a range of asset classes, including stocks, bonds, funds, ETFs, Gilts, and investment trusts.

Halifax Fees, Commission, and Spread

Like many banking companies, Halifax charges fees for certain products and services. Some of the fees that Halifax charges include overdraft fees for exceeding the agreed limit on a current account, annual fees for credit cards, and early repayment charges for personal loans. The company also charges a fee for transferring money from one account to another and for services such as replacing a lost or stolen debit card.

In addition to fees, Halifax also earns revenue from spreads and commissions earned on stocks, bonds, ETFs, and funds investments. However, note that international trades are commission-free, and you will not incur deposit, withdrawal or inactivity fees. Although Halifax’s investment fees are relatively low compared to other brokers, expect an annual £36 administration fee on your ISA and share dealing account. Regarding SIPPs cost, a £22.50 per quarter applies if the SIPP value is £50,000 or less, or £45 if the value is above £50,000.

| Type | Fee |

|---|---|

| Minimum deposit | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Foreign currency transaction fee of 2.99% of the amount of the transaction |

| Inactivity fee | $0 |

| Administration fee | Annual £36 |

Deposit Methods and Supported Currencies

Halifax has no minimum deposit requirement and offers several methods for customers to deposit funds into their accounts. These methods include debit/credit cards, bank transfers, and over-the-counter deposits at a Halifax branch.

In terms of supported currencies, Halifax primarily deals in GBP UK currency. However, the company may also allow customers to hold and transact in other major currencies, such as USD, EUR, and JPY. The availability of other currencies may vary depending on the customer’s location and the type of account they hold. Also, currency conversion fees apply when transacting with currencies besides the GBP.

Platform and Research Tools

Halifax has a user-friendly web trading platform to cater for newbies and professional investors. You can also download its mobile banking app from Google Play or the App Store to easily manage your funds on the go. When it comes to the broker’s research page, you will find many useful resources, including fundamental data and trading ideas. However, accessing these resources can be challenging, especially for newbies.

To easily find Halifax research tools, locate its share dealing platform, then click “Research the market”. From there, you will access various investment ideas, market news, watchlists, and many more. There are also tutorials for newbies looking for how to use its account. On top of that, Halifax features general educational content in the form of videos, webinars, articles, and quizzes.

How To Register a Halifax Account

Registering for a Halifax share dealing account is a pretty straightforward process. If you want to invest with Halifax, we take you through the procedures below.

- Visit the Halifax website by clicking one of the links we’ve shared on this page. You can also Google Halifax and access its platform.

- On the top navigation bar, click “investing” to access the platform. At this point, we advise you to read and understand the broker’s terms and conditions so you can be sure of what you are getting into.

- Click “start investing” and be redirected to a page showing all accounts option to select the share dealing account.

- Scroll down the page to open a share dealing account using your personal details, including your name, date of birth, occupation, nationality, contact details, etc.

- Verify your identity by providing proof of your address and identity. This can be done using your passport, driving license, or National Insurance number.

- Choose any additional features or products you would like to add to your account, such as overdraft protection, insurance, or online banking.

- Review and agree to the terms and conditions of the account.

- Submit your application and wait for a confirmation from Halifax.

- Once your account is approved, you will receive a welcome pack with all the information you need to start using your account.

Editor’s Note

Being a well-established financial institution in the UK, we consider Halifax an excellent choice for individuals looking for a reliable banking and investment partner. Its online banking offers a range of products and services to meet the needs of individuals and businesses. Plus, the bank is known for its low-interest rates, convenient online and mobile banking services, and highly encrypted platform.

We also like Halifax’s investment options, although they are not as comprehensive as what other UK brokers offer. The investment platform is suitable for stock, ETFs, funds, and gilt investors. By investing in these products, rest assured of receiving quality professional assistance. As a result, you will easily improve your skill level and hopefully grow your wealth over the long term.

Overall, Halifax is a secure investment partner regulated by the FCA and protected by the FSCS. Its trading fees are low, and you will not incur deposits, withdrawals, or inactivity charges. Sadly, we weren’t impressed by its support service since it doesn’t operate 24/7. There is also no live support; you can only get in touch with the team via phone, email, and social media platforms. We recommend Halifax for long-term investors.

FAQs

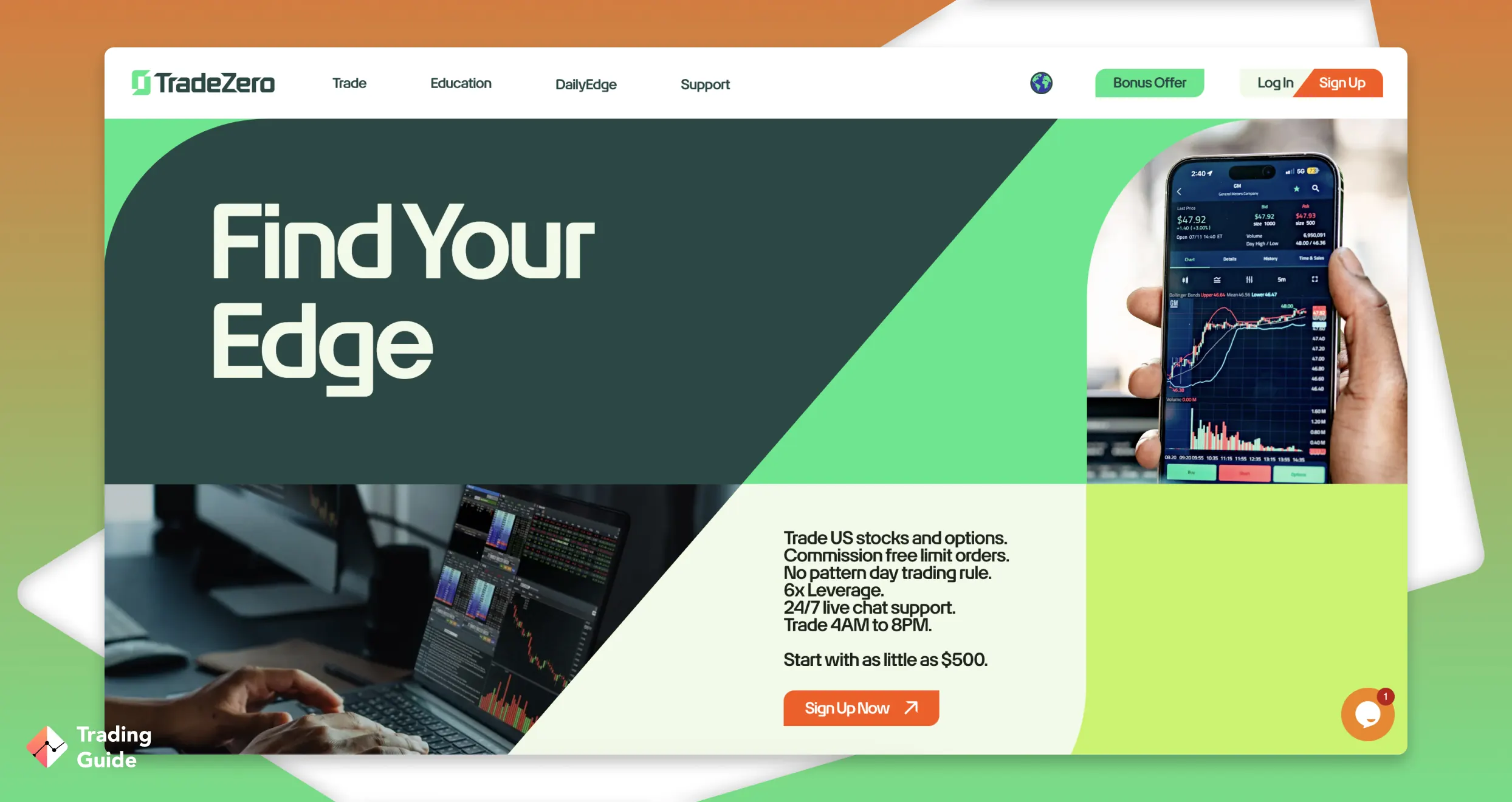

Active or day traders looking for a reliable broker offering a variety of trading tools should consider TradeZero. The broker features a trading platform that provides stock, ETF, crypto, and options trading at affordable rates. If you are a newbie, we help you understand TradeZero features, including its fees, trading tools, security, etc., to decide whether it is worth investing in. Remember, a broker must meet all your trading requirements for you to enjoy your experience and increase your chances of succeeding.

TradeZero – Who Are They?

Founded in 2015 by Daniel Pipitone, TradeZero is an online brokerage firm offering stocks, cryptocurrencies, ETFs, and options trading services. It is headquartered in the Bahamas but offers its services to traders globally. The broker has a user-friendly platform and a straightforward account opening procedure. In this regard, we primarily recommend it for newbies since it also features adequate learning resources to boost your skill level.

TradeZero is a safe stock broker since it is licensed and regulated by world-renowned authorities. It features three branches, including TradeZero America, TradeZero International, and TradeZero Canada, all of which traders get to choose based on their jurisdictions. On top of that, the broker hosts different platforms for traders, including ZeroPro, ZeroWeb, ZeroFree, and ZeroMobile. You can get started with the broker with as little as £250.

Compare TradeZero with Other Brokers

Compare brokers

Licences and Security

TradeZero is a trusted broker since it is highly encrypted to secure your trading data and personal information. Besides securing your funds in a separate account, the broker is also licensed and regulated by top-tier authorities, the Securities and Exchange Commission (SEC), The Securities Commission of The Bahamas, and the Financial Industry Regulatory Authority (FINRA).

Besides being licensed and regulated, TradeZero America offers standard protection to US traders through the Securities Investor Protection Corporation (SIPC). TradeZero international clients also get to benefit from the Excess SIPC insurance protection, thus guaranteeing their funds’ safety. On top of that, the company continues to receive excellent testimonials from users on Google Play, the App Store, and Trustpilot.

Assets Offered

Unfortunately, TradeZero doesn’t host as many trading assets as most of its peers. With it, you only get to trade stocks, options, ETFs, and cryptocurrencies. Therefore, if you are a trader looking for platforms offering assets like mutual funds, forex, indices, futures, etc., you may want to consider other options.

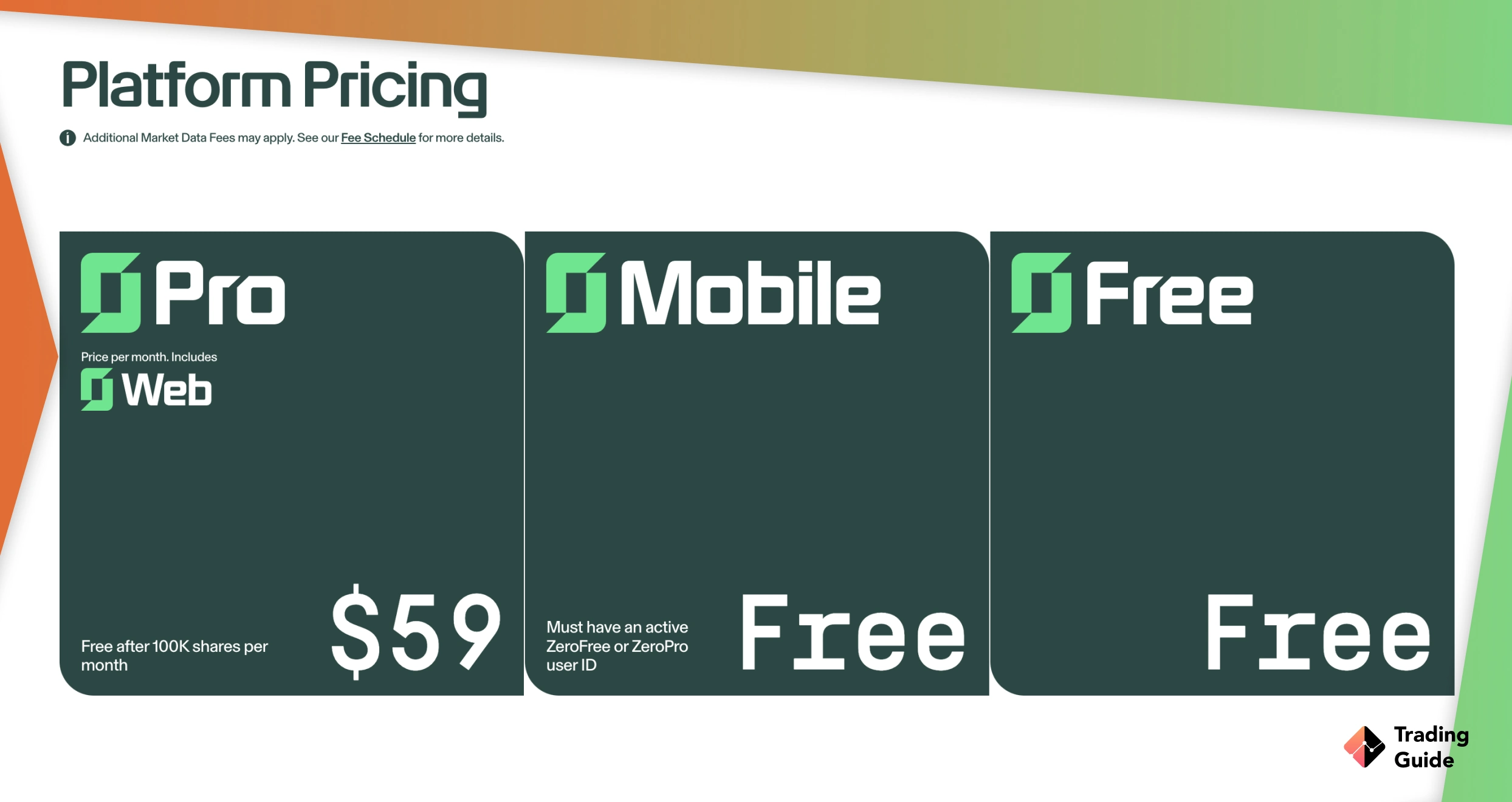

TradeZero Fees, Commission, and Spread

TradeZero trading services are commission-free whether you select stocks, ETFs, or cryptocurrencies. Its transparency regarding trading charges is one of the reasons thousands of traders trust the platform. Its account registration is free, and you will not incur any fee when making deposits.

In addition, TradeZero does not charge an inactivity fee, but it is advisable to remain an active trader to quickly improve your trading skills and become independent. Sadly, you will pay a £50 withdrawal fee with this broker. Therefore, ensure TradeZero’s spreads and additional charges fit your budget to enjoy your experience.

| Type | Fee |

|---|---|

| Minimum deposit | £500 |

| Deposit fee | £0 |

| Withdrawal fee | $50 |

| Inactivity fee | £0 |

| Overnight fee | £0 |

Deposit Methods and Supported Currencies

TradeZero allow transactions through bank transfers only. You will not make deposits or withdrawals using other options such as debit/credit cards or e-wallets like PayPal. Remember, making deposits is free, but you will incur withdrawal charges. Plus, deposits are only accepted through an account registered in your name. Therefore, ensure your name on the trading account matches the one in your bank account for streamlined transactions.

When it comes to supported currencies, TradeZero only allows transactions in USD. This means that if you make deposits in other currencies, a currency conversion fee applies.

Platform and Research Tools

TradeZero’s trading platform is user-friendly with an intuitive design. Its search function is also excellent and offers various order types, including stop-loss orders to mitigate massive losses. Besides operating on the web via its ZeroWeb platform, TradeZero is also compatible with mobile devices, and you can enjoy it through the ZeroMobile platform. For desktop users, the broker offers a ZeroPro platform for seamless trading activities.

When it comes to trading tools, the broker features an excellent interactive chart and quality news flow. Unfortunately, it doesn’t host additional advanced resources to help with skills development. The good news is that newbies will benefit from its quality learning resources and a virtually-funded demo account to test the broker and gauge their skill level before investing their real money. TradeZero also has a dedicated and reliable support service operating 24/7 via phone, email, and live chart.

How To Register a TradeZero Account

TradeZero account opening procedure is pretty straightforward and will only take minutes to complete. To ensure you are fully prepared, we explain all the procedures below. However, before getting started, ensure TradeZero is suitable for your needs and install its trading app on your mobile device if you want to trade on the go. Also, read and understand its terms and conditions to avoid future inconveniences once you are fully invested.

- The first thing you need to do to register for an account with TradeZero is to visit the broker’s website. We share links on this page to help you quickly access the TradeZero website.

- Once on the website, begin the registration procedure by selecting your preferred account based on your jurisdiction. The account can be TradeZero America, TradeZero International, or TradeZero Canada.

- Share your personal details, including your name, email, phone number, etc. It is also mandatory to create a username and password for securely logging into your trading account.

- The next step is to verify your identity by sharing a copy of your original identity card, passport, or driver’s license. As part of its protocol, TradeZero also requires that you verify your location by sharing a copy of a recent utility bill or bank statement.

- TradeZero will review your shared documents for verification and fully activate your account. At this point, you can make a deposit (£500) using the bank transfer method at zero charges.

- Once your deposit is confirmed, TradeZero will automatically redirect you to the respective exchanges that list various stocks to trade. You will also have access to its platform for other asset offerings to choose from.

Remember, before investing real money, test TradeZero via its virtually funded demo account. When placing trades, take advantage of its featured stop-loss and take-profit orders to curtail massive losses in case a trade doesn’t work in your favour.

Editor’s note

Traders and investors sceptical about using TradeZero should note that the broker is safe. In addition, it offers commission-free trading services to options, stocks, ETFs, and cryptocurrency traders. Its platform is also user-friendly and features adequate trading tools to boost your skills and experience. However, if you are a professional trader, TradeZero might not be an excellent choice since it offers limited advanced research resources.

Although many traders may find TradeZero costly due to the high minimum deposit requirement and withdrawal fees, its mobile app is reliable and helps you trade on the go. We also like the broker’s support service operating round the clock, thus ensuring you get all the assistance you need at any time. Overall, we recommend TradeZero but ensure it suits your trading needs before making a commitment.

FAQs

How we test?

Our test process is really based on two different aspects: our independent tests and research, as well as user reviews from Google Play, the App Store, and Trustpilot, etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than 200 hours on every article. We pay special attention to the specific function or the criteria that we’re comparing during the comparing stage. This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here.

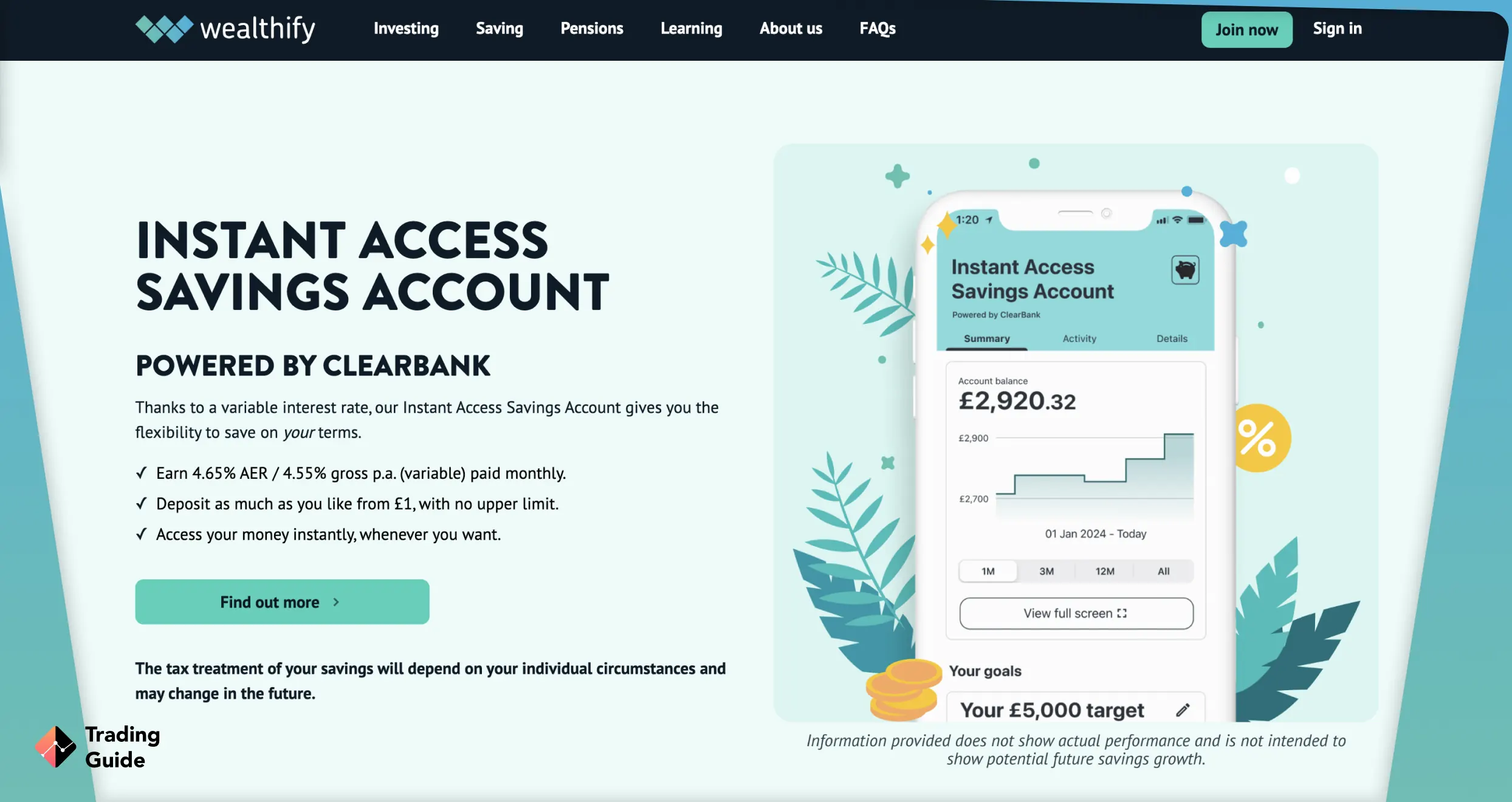

Wealthify is a robo-advisor company located in the UK. Its existence continues to make investing enjoyable for individuals who want to avoid taking a risk at trading various assets in the financial market. With Wealthify, you have various investment plans to choose from, all of which have original and ethical versions. Plus, there is no minimum investment amount limit, meaning you can start your investments with as little as £1.

So, are you looking for the best investment platform with minimal input? We review Wealthify below to give you a complete understanding of its operations. In the end, you should be able to decide whether this financial services company meets your investment needs and is worth investing with.

Wealthify – Who Are They?

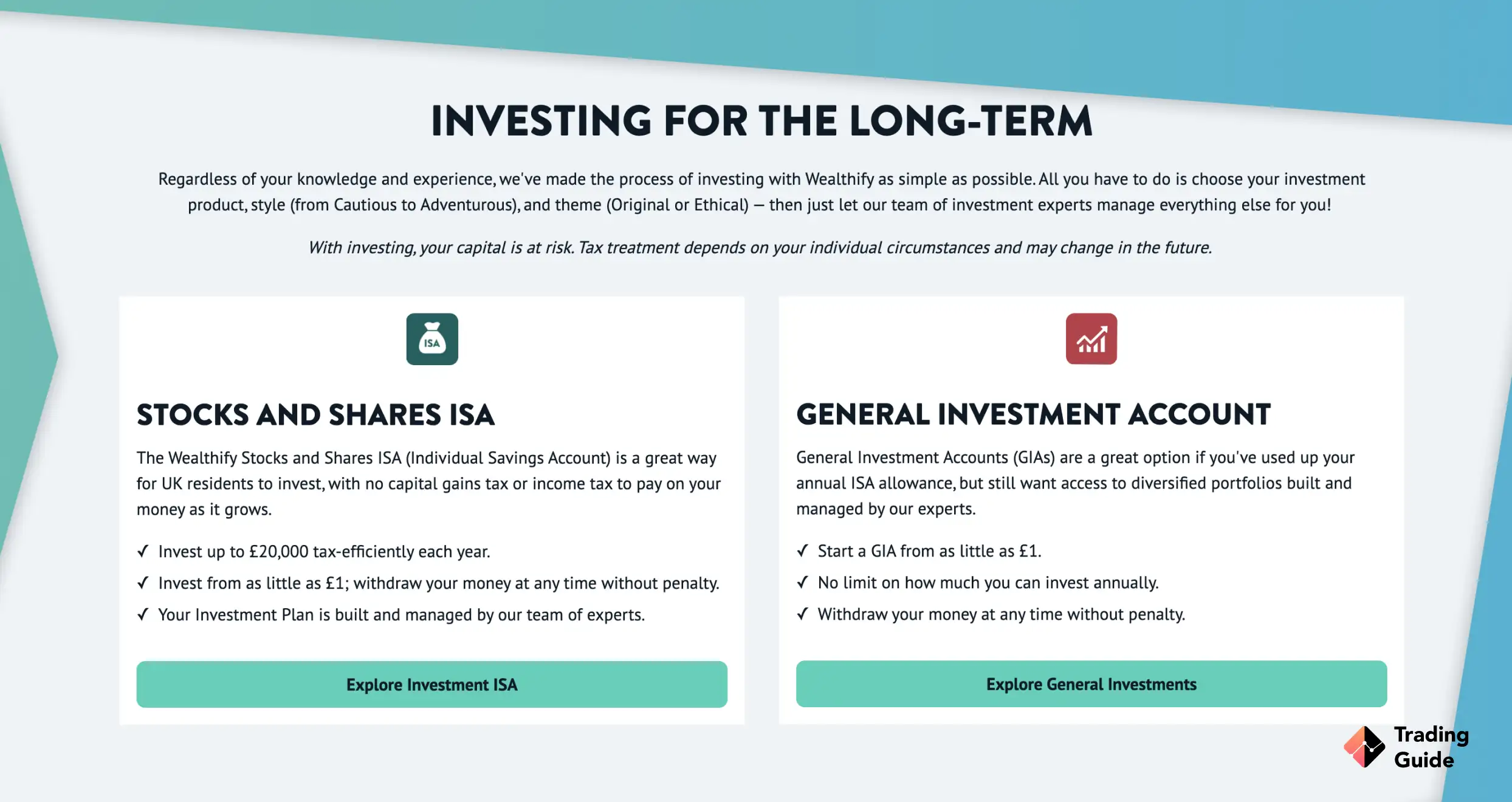

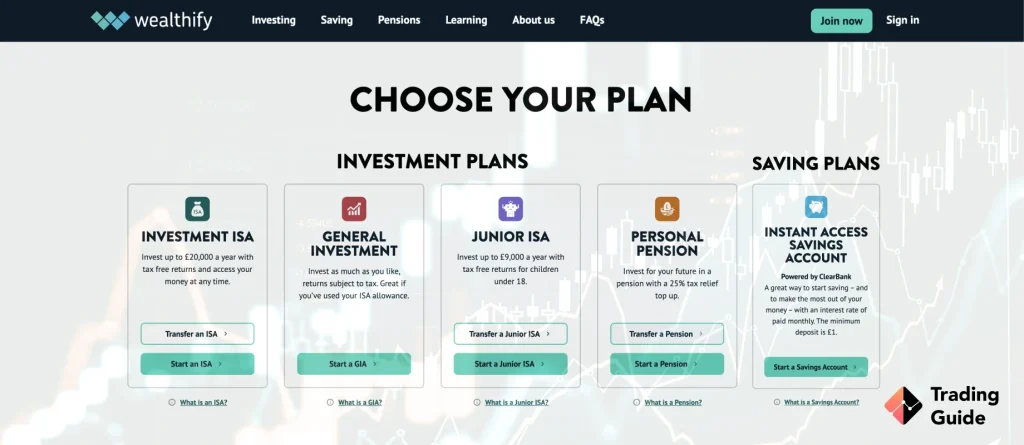

Founded in 2016 by Richard Theo, Michelle Pearce-Burke, and Richard Avery-Wright, Wealthify is a UK-based independent robo-advisor financial company offering effortless investment options to UK clients. With the company, you get to choose your risk profile and then allow the platform to manage it for you. The investment plans Wealthify offers investors include general investment account, stocks and shares ISAs, junior stocks and shares ISAs, pension, and ethical investments.

Note that Wealthify is owned by Aviva — a transition made in 2020 to ensure its users get the best investment options. Plus, the platform is compatible with mobile devices, allowing you to manage your investments on the go. On top of that, Wealthify is user-friendly with an intuitive user interface, thus attracting newbies with minimum experience. Remember, the company is backed up by professionals to handle your investment with the money you deposit.

Compare Wealthify with Similar Brokers and Platforms

Compare brokers

Licenses and Security

Wealthify is one of the safest financial institutions in the UK since it is highly encrypted and regulated by the Financial Conduct Authority (FCA). All investment funds deposited by its clients are secured in segregated accounts so you can easily have access to them in case the company goes bust. Moreover, Wealthify ensures your investment worth more than £85,000 is protected under the Financial Services Compensation Scheme (FSCS). It also adheres to UK’s anti-money laundering policies.

Another element that makes Wealthify a credible investment platform is excellent testimonials from users on Google Play, the App Store, and Trustpilot. The fact that the company is backed up by Aviva proved its credibility even further. On top of that, Wealthify requires that you verify your information during the account sign-up process since this is one way to keep its investment platform free from imposters.

Securities Offered

Wealthify allows you to decide on the type of investor you want to be and build an investment plan for you. Whether you prefer being adventurous or cautious, the company has a team of professionals to manage your investment for you. You will also have access to ethical plans so that you can make investments based on your values.

Take a look below at the investment plans offered by Wealthify.

- General investment account

- Stocks and shares ISAs

- Junior stocks and shares ISAs

- Pension

- Ethical investments

Keep in mind that Wealthify features robo-advisors that apply algorithms in selecting a pre-made portfolio that suits investors’ attitude to risk. It spreads your investments across cash, government bonds, shares, real estate properties, and corporate bonds.

Wealthify Fees, Commission, and Spread

As mentioned earlier, Wealthify has flat management fees of 0.60%. This fee applies irrespective of the amount you are investing. Overall, its fees are low compared to what some of its peers charge. Not only is this attractive to newbies but also budget-conscious investors. Moreover, the service provider doesn’t have a minimum deposit requirement, thus allowing you to invest with as little as £1.

| Minimum Deposit | £1 |

Besides charging management fees, investors also get to incur investment costs, including fund charges and market spreads. The only concern about Wealthify’s investment fees is that it keeps rising the more you invest. Therefore, ensure you confirm the rates to ensure it fits your budget.

| Type | Fee |

|---|---|

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | No inactivity fees |

| Annual Fee | 0.6% |

Deposit Methods and Supported Currencies

Wealthify allows you to make deposits and withdrawals using debit cards and bank transfer methods. Fortunately, all transactions are free, and there are no limitations on deposit or withdrawal amounts. When it comes to supported currencies, Wealthify accepts deposits in GBP since it so far accepts clients from England, Scotland, North Ireland, and Wales.

Platform and Research Tools

Wealthify offers robo-advisor services for the best investment option, meaning that all the legwork is done for you. Once you choose your risk level, you cannot control your investment since the provider will decide where to allocate your money. For this reason, Wealthify doesn’t offer research resources you will get to explore on other platforms that allow you to take complete control of your investment.

The good news is that you can still stay abreast with developing news on its blog section. Plus, the investment platform hosts adequate learning materials to help you improve your investment skills. On top of that, Wealthify has a well-detailed FAQ section that is easy to navigate thanks to its nicely arranged categories on the left side of the page.

How To Register a Wealthify Investment Account

Wealthify account registration process is straightforward and takes a few minutes to complete. Remember, the platform operates seamlessly on desktop and mobile devices. Therefore, ensure you install its app on your mobile device to monitor your investments on the go. Also, read and understand its terms and conditions before beginning the account registration process via the procedures below.

- Visit Wealthify official website via the links we’ve shared on this page and click “sign in” to begin the account registration

- Click “create account” and enter your name and email address to proceed

- An email will be sent for verification and to create a password for securing your account

- You will then be redirected to the Wealthify dashboard page, whereby you will click “create a new plan” to choose your preferred account.

- Once you select an account, choose an investment style using the provided sliders

- Participate in the provided questionnaire so that Wealthify can identify the best investment option for you.

- Once you make your deposit, monitor how your investment grows, then decide whether to top up your capital.

Editor’s note

Undoubtedly, we consider Wealthify a hassle-free investment platform that allows you to explore various stock assets with as little as £1. The financial service provider is user-friendly and has a modern interface for the best experience. Plus, its charges are low, especially for individuals with lower investments. For this reason, we recommend it for beginner investors with limited time to conduct research on the best investment options. Advanced investors are also free to use it, but ensure you can afford it before taking the plunge.

Keep in mind that Wealthify takes complete control of your investment, thus not suitable for investors looking to control where their money is going. The platform is safe since it is regulated by the FCA and adheres to FSCS and UK anti-money laundering policies. Regarding its support service, you can reach it via email, phone, and live chat from Mondays to Saturdays. Wealthify is definitely worth investing with thanks to its simple procedures, highly rated support service, and low fees for investments below £10,000.

FAQs

How we test?

Our test process is really based on two different aspects: our independent tests and research, as well as user reviews from Google Play, the App Store, and Trustpilot, etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than 200 hours on every article. We pay special attention to the specific function or the criteria that we’re comparing during the comparing stage. This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here.

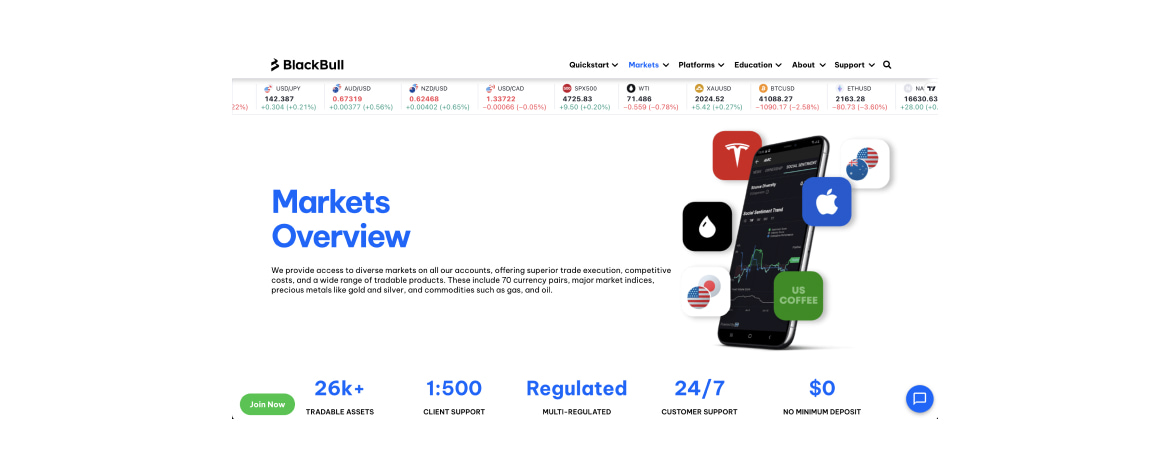

Blackbull Markets is one of the best brokers offering quality trading resources and advanced trading platforms for all types of traders. Founded in 2014, the broker offers forex, index, commodities, and share trading instruments, all of which you can also trade as CFDs. The broker is highly encrypted and regulated by top-tier authorities, making it safe for your investment funds.

If you are considering Blackbull Markets as a trading partner, we review the broker below so you can fully understand its features and decide whether it is worth trading with. These features include broker fees, available assets, security, payment methods, etc. We will also take you through the simple procedures involved in creating a Blackbull Markets trading account to ensure you kickstart your activities on a good note.

BlackBull Markets – Who Are They?

Founded in 2014 in Auckland, New Zealand, Blackbull Markets is one of the best CFD brokers tailored to provide global traders with the best experience. Currently, the award-winning broker serves tens of thousands of clients across over 180 countries globally. The broker also keeps updating its platform to ensure traders access the best resources to maximize their potential.

Blackbull Markets is a fully regulated ECN and CFD broker. With it, you get exposed to more than 26,000 trading securities, including forex, commodities, indices, and shares. Plus, there are various trading platforms supported that you get to choose from based on your skill level. Fortunately, Blackbull Markets hosts a demo account to test it with before deciding whether it is worth investing with.

Compare BlackBull Markets with Other Brokers

Compare brokers

Licenses and Security

As mentioned earlier, Blackbull Markets is a secure broker regulated by world-recognized authorities, including the Financial Conduct Authority (FCA), the Financial Markets Authority of New Zealand (FMA) and the Financial Services Authority of Seychelles (FSA). It also provides negative balance protection for its users, and its long track record in the financial market clearly proves that the broker is trustworthy.

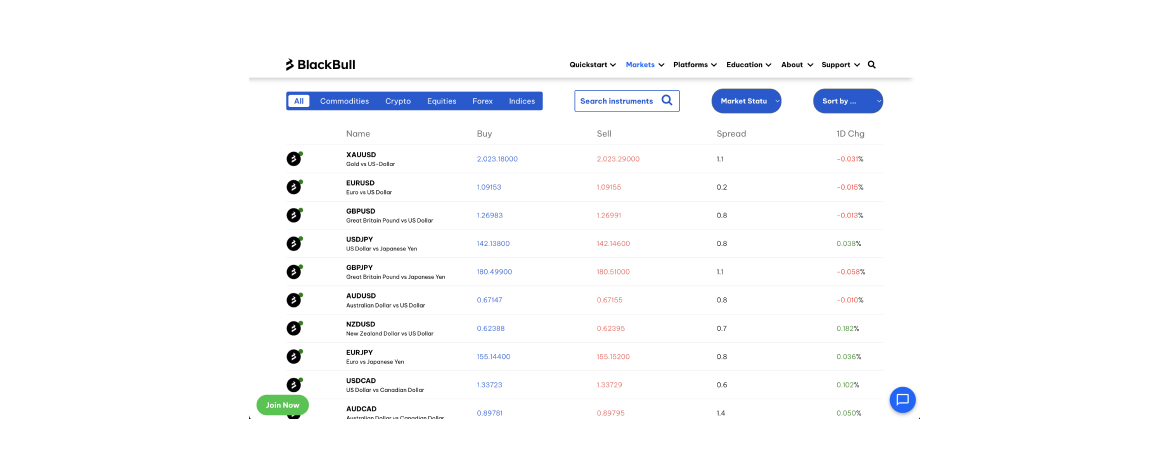

Assets Offered

Blackbull Markets hosts over 26,000 tradable instruments, including over 70 currency pairs, indices, shares, commodities, and precious metals. You can also trade these featured assets as CFDs, thus giving you an opportunity to trade under leverage and maximize your chances of earning massive profits.

However, remember that CFD trading can also leave you with huge losses and debts. Therefore, it is crucial to be confident in your strategy before applying leverage in your CFD trades. If you must trade on margin, ensure you use low leverage to avoid risking amounts you are not willing to lose.

BlackBull Markets Fees, Commission, and Spread

Blackbull Markets is one of the most transparent brokers when it comes to fees and charges. There are no hidden costs, meaning it is easier for you to budget with the fees displayed on its platform. Plus, you get exposed to a risk-free demo account loaded with £100,000 virtual funds to gauge your skill level and test the broker with.

| Type | Fee |

|---|---|

| Deposit Fee | $0 |

| Withdrawal Fee | $5 |

| Inactivity Fee | No inactivity fees |

| Overnight Fee | No |

Blackbull Markets has no minimum deposit on its standard account, but you should expect to pay £2,000 as a minimum deposit on its prime account. All deposits, regardless of the payment method you use, are also free of charge and trading fees are also low, with spreads starting from 0.0 pips. However, there are withdrawal fees of £5 for credit/debit cards or electronic wallet transactions and £20 for international bank transfers.

BlackBull Markets Minimum Deposit by Account Type

| Account Type | Deposit (USD) |

|---|---|

| Standard | $0 |

| Prime | $2,000.00 |

| Institutional | $20,000.00 |

Deposit Methods and Supported Currencies

Depositing funds in your Blackbull Markets account is easy and straightforward. The broker understands that every trader has their own needs, so it accepts multiple deposit methods so you can transact with the most convenient one for you. Remember, making deposits with the supported payment methods is instant except for the bank transfers method, which takes 1-3 days to process.

That being said, here are the supported payment methods on Blackbull Markets.

Traders can deposit their account by:

1. Credit Cards Payment Method

- Visa

- Mastercard

2. Cryptocurrency

- Bitcoin

- Bitcoin Cash

- Ethereum

- Litecoin

- Ripple

- Dogecoin

- Cardano

- Polkadot

- Chainlink

- EOS

- Stellar

3. Deposit via Payment Service Providers

- AstroPay

- Beeteller

- Boleto

- China Union Pay

- Crypto

- Deposit channel

- FasaPay

- FXPay 88

- Help2Pay

- Interac

- Neteller

- Skrill

- OpenPayd

- PaymentAsia

- PicPay

- PIX payment

- Poli

- Thai QR Payment

- Transferência Eletrônica Disponível

4. Bank Transfers

Regarding currencies for deposits, Blackbull Markets accepts USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD, and ZAR. Remember, Blackbull Markets adheres to stringent AML regulations. This means that when making withdrawals via credit/debit cards and e-wallets, you can only withdraw up to the same amount of money you deposited. Any additional amount must be sent via the bank transfer method to an account proven to be yours.

| Withdrawal Method | Withdrawal Fee |

|---|---|

| Credit Card | 5.00 Base Account Currency |

| Neteller | 5.00 Base Account Currency |

| Skrill | 5.00 Base Account Currency |

| International Bank Transfer | 5.00 Base Account Currency |

Platform and Research Tools

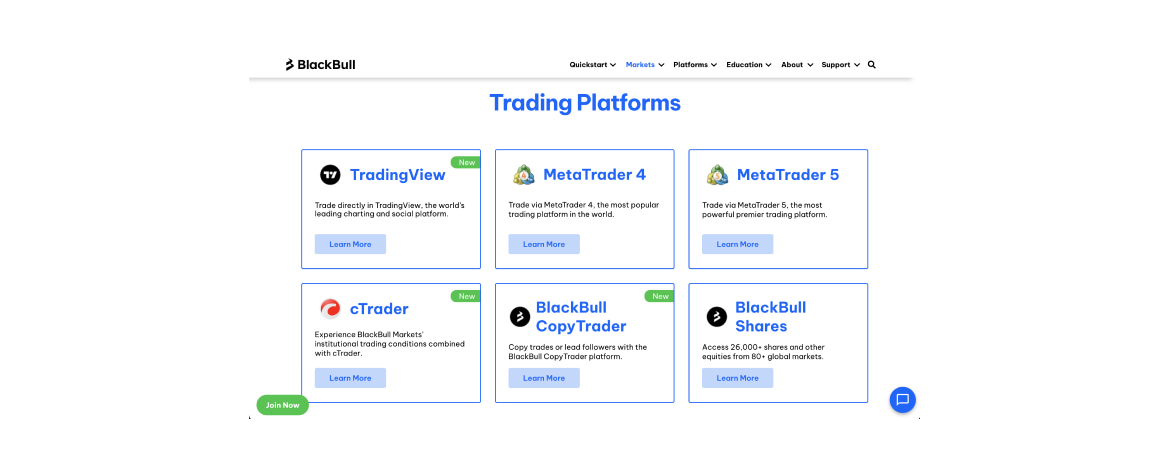

Blackbull Markets allows you to trade the way you want by offering you a wide range of trading platforms to choose from. These include the TradingView, MT4, MT5, MT4 MultiTerminal, WebTrader, and Blackbull shares. In addition, you get to ensure a social and copy trading platform, whereby you get to interact with experienced traders from global regions and follow them so you can easily mirror their positions with high-profit potential.

Regarding research tools, Blackbull Markets features a Blackbull Research platform that exposes you to plenty of tools to help with your strategy development. These include trading ideas, market analysis tools, a news feed, and an economic calendar. You can also access its Blackbull Shares platform via mobile device to manage your positions on the go.

How To Register a BlackBull Markets Account

Creating a Blackbull Markets account is pretty straightforward and will take only a few minutes to complete. Various trading accounts are offered, including the Standard, ECN Prime, Islamic, and Institutional accounts. Below, we take you through the procedures for creating a Standard account to ensure newbies get the procedures right and kickstart their activities on a good note. Remember, the standard account has no minimum deposit requirement and doesn’t charge commissions.

- Visit Blackbull Markets’ website via the links shared on this page to begin the account registration process.

- Before beginning the process, ensure you understand the broker’s terms and conditions and confirm whether it supports the asset you want to trade.

- Click “join now” to register for an account using your personal details, including your name, date of birth, email, phone number, jurisdiction, etc.

- A verification link will be sent to your email to confirm whether all the details you provided are accurate.

- The broker will review your application by analyzing the documents you share for verification, including your ID card or passport and a utility bill or bank statement.

- Once your account is approved, an email will be sent as a notification, after which you will deposit any amount you can afford to trade. Remember, various deposit methods are supported, all of which you get to transact with free of charge.

- You will then get access to the listed assets to choose from and trade. Remember, ensure the broker’s fees fit your budget to enjoy your experience. Also, start trading on its demo account to boost your confidence and avoid risking money without experience.

Editor’s note

Blackbull Markets is an excellent forex and CFD broker because of its comprehensive offerings. Its support service, operating 24/7, is backed up by a team of friendly professionals dedicated to offering you the assistance you need to maximize your experience. Besides offering a highly secure trading environment, you are guaranteed quality trading and learning resources.

Overall, we recommend Blackbull Markets to forex and CFD traders looking for a broker with low fees and MetaTrader platforms. Feel free to test it via its demo account and analyze user testimonials regarding their experience on Google Play, the App Store, and Trustpilot. We assure you that it is worth trading with. All you have to do is ensure it meets your trading requirements.

FAQs

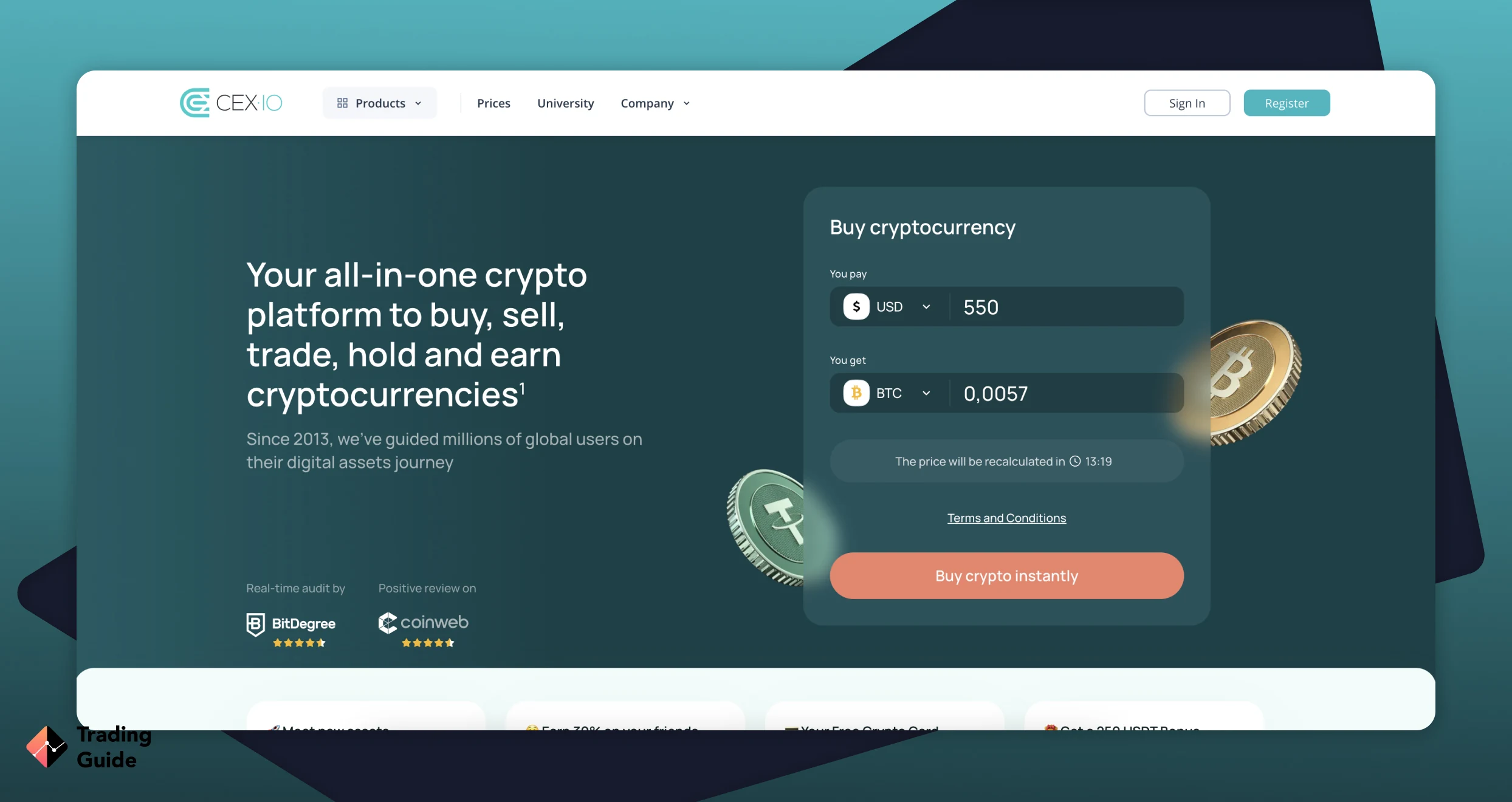

CEX.IO is one of the most established cryptocurrency exchanges in the market. It has been operating since 2013, providing users with a platform to buy, sell, and trade digital assets. The exchange offers a range of features and tools to meet the needs of both novice and experienced traders. In this CEX.IO review for 2025, we’ll take an in-depth look at its services, security measures, fees, and more, to help you determine if it’s the right exchange for your cryptocurrency investment needs.

CEX.IO Overview

Founded in 2013 as a centralised exchange, CEX.IO is a cryptocurrency exchange platform based in London, UK. It has evolved throughout the years and now serves over 5 million users across 194+ countries globally. The company offers a wide range of services and features that cater to both individuals and businesses in the crypto space. Besides being a crypto exchange, the company specialises in application management.

One of the unique aspects of CEX.IO is its multi-functional approach to cryptocurrency trading. The platform not only provides a traditional spot trading experience but also offers margin trading and a crypto debit card service. This makes it a one-stop shop for all your crypto needs.

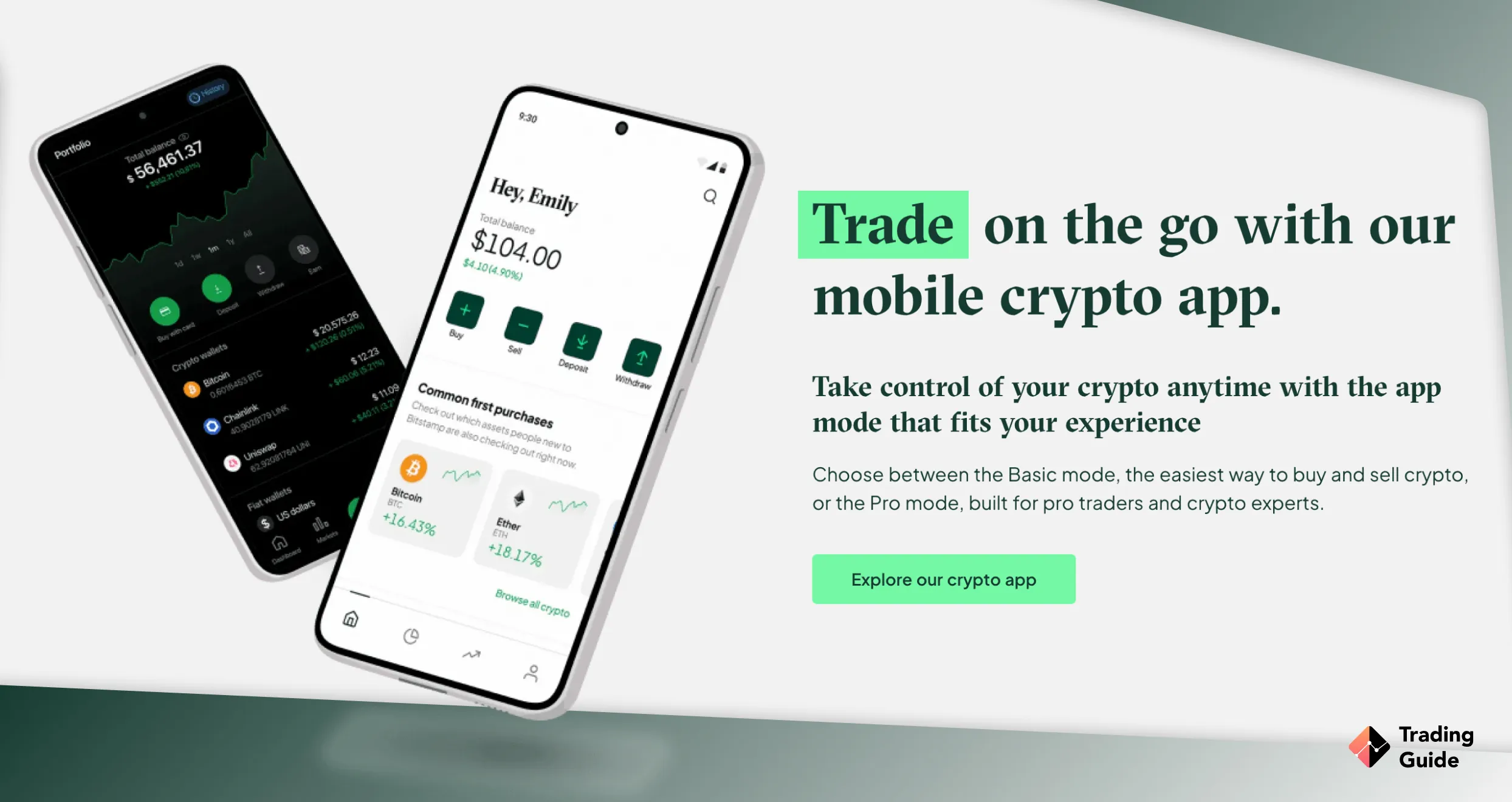

CEX.IO also provides a mobile application for iOS and Android devices, allowing users to trade on the go. The CEX.IO app is designed with the same user-friendly approach as the desktop platform, making it accessible and convenient for users on the move.

Compare CEX with Other Exchanges:

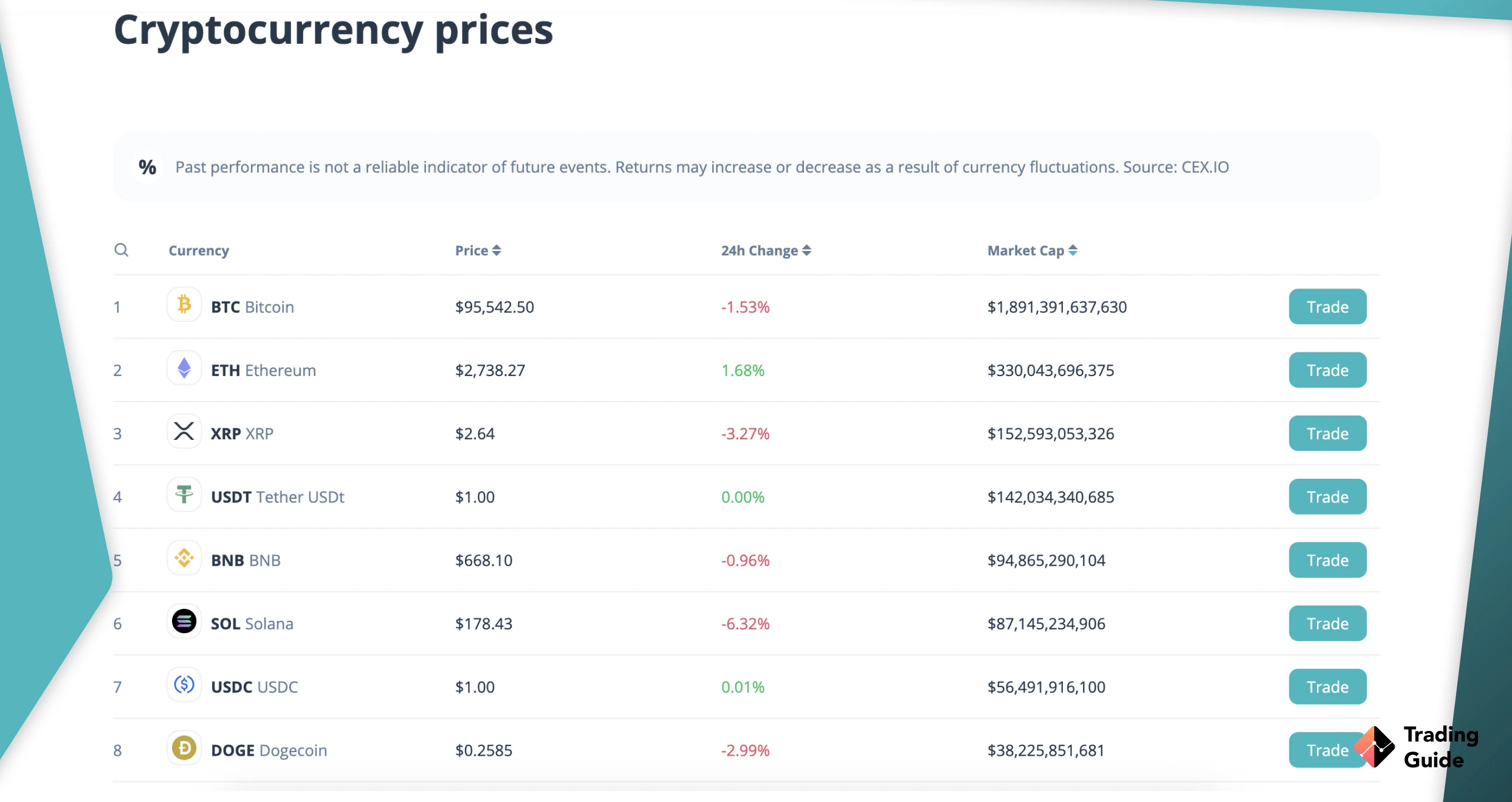

Cryptocurrencies Available

As mentioned earlier, CEX.IO exchange hosts 200 cryptocurrencies, giving you plenty of options to choose from. Some of the most popular cryptocurrencies available on CEX.IO include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Cardano (ADA)

- Chainlink (LINK)

- Binance Coin (BNB)

- Polkadot (DOT)

- Tether (USDT)

Note that CEX.IO supports both fiat-to-crypto and crypto-to-crypto transactions when making purchases on its platform. This makes it accessible and flexible to a wide range of users. Some of the fiat currencies you can use in buying cryptocurrencies at CEX.IO include USD, GBP, and EUR.

Fees

CEX.IO follows a transparent pricing model by offering a tiered fee structure, where users can receive discounts on fees based on their 30-day trading volume. Based on our analysis, you will incur high maker and taker fees with a low 30-day trading volume. However, the more you invest, the less fees you will incur.

Keep in mind that there is no registration fee when you sign up for an investment account at CEX.IO. The exchange’s minimum deposit requirement is also low (£20), thus making it a viable option for beginners or low-budget investors. However, ensure you confirm whether you can afford CEX.IO’s trading fees before taking a plunge.

When it comes to transaction charges, UK investors will not incur any fees for deposits and withdrawals when using the Faster Payments method. Using other payment options attracts a fee, which you must confirm since they vary with the provider. On top of that, expect currency conversion fees and inactivity charges for accounts that remain inactive for over 12 months.

Payment Methods

CEX.IO supports various payment methods, including Visa, Mastercard, Apple/Google Pay, Skrill, Bank Transfer, PayPal, etc. Unfortunately, transactions here are not free, except for the Faster Payments method. You may also incur additional fees, such as currency conversion fees when depositing or withdrawing funds in a different currency besides the GBP, EUR, and USD.

Security

CEX.IO strives to provide its users with a secure and reliable platform for buying and selling cryptocurrencies. The exchange is registered with over 30 global financial regulators, including the Financial Conduct Authority (FCA) in the UK. Moreover, it uses SSL encryption technology to secure all sensitive users’ information, such as personal details and financial transactions.

CEX.IO also implements multi-factor authentication to ensure that only the account owner can access their account. Users can enable this function through their account settings. On top of that, the exchange performs regular security audits and updates its security measures to avoid potential threats.

Lastly, you are guaranteed the safety of your funds with CEX.IO since it has cold and hot wallets for storage. Most user funds are secure in the cold wallet since it is offline-based, making it more secure.

Customer Support

CEX.IO has a 24/7 support service operating via email and online support tickets. You can submit a support ticket through the platform’s website, and a representative from the support team will get back to you as soon as possible. Additionally, the exchange also has a comprehensive FAQ page that provides answers to common questions and issues.

Based on our review, CEX.IO’s support service is reliable and responsive via the supported channels. You will get quality assistance on a wide range of topics, including account registration, deposit and withdrawal processes, security, and more. You can also reach out to its team via social media handles, including Twitter, Facebook, LinkedIn, and Telegram.

Education

CEX.IO is committed to providing its users with an excellent collection of learning resources to help them learn more about cryptocurrency trading and the platform’s services. You will have access to articles, tutorials, and guides covering a wide range of topics related to cryptocurrency investing.

In addition, CEX.IO offers a demo trading feature, which allows users to practice trading and gauge their skill level without risking any real funds. We can confidently recommend the exchange to beginner cryptocurrency traders since the platform is also easily navigable.

How to Open a CEX Account*

When engaging with cryptocurrencies, it’s crucial to recognise that these digital assets are characterised by their extreme volatility and speculative nature. This can result in swift and substantial price fluctuations. To safeguard your crypto holdings, it is imperative to utilise reputable wallets and exchanges, prioritising the security of your investments.

Also, exercise vigilance and due diligence to guard against crypto-related scams and fraudulent schemes that can potentially threaten your financial well-being. You can also spread your investments across multiple digital tokens and avoid making decisions based on emotions.

It’s easy to register for an investment account at the CEX.IO exchange. We explain the procedures below to ensure you are fully prepared to kickstart your cryptocurrency investment activities.

Before you start signing up for an account, ensure you confirm whether the exchange is suitable for your needs. Also, consider installing its app on your mobile device to easily manage your activities on the go.

- The first thing you need to do is visit the CEX.IO website using the links we’ve shared on this page.

- Click the “Register” button in the upper right corner of the home page to start the registration process.

- On the next page, you’ll be asked to provide your full name, email address, password, and country of residence. Ensure you provide accurate information, as CEX.IO may need to verify your identity later.

- CEX.IO requires all users to set up two-factor authentication (2FA) to add an extra layer of security to their accounts. You can set this up by downloading an app like Google Authenticator or Authy.

- Link a credit or debit card for making deposits and withdrawals.

- CEX.IO will send a verification email to the address you provided. Follow the instructions in the email to verify your account.

- Once your account is set up and verified, you can add funds using various supported payment methods, including bank transfers, credit cards, and cryptocurrency.

- At this point, you are free to access the featured cryptocurrencies to complete your purchase. You can also trade the assets if you do not want to take full ownership. Simply ensure you invest with amounts you can afford to lose.

*Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Editor’s Note

It’s almost a decade since CEX.IO came into existence, and so far, the exchange has grown exponentially to become one of the most popular in the UK market. Many crypto traders and investors praise it for being user-friendly, reliable and trustworthy. Based on our experience with the exchange, we couldn’t agree more with this opinion, thus recommending it to any new trader.

We also believe CEX.IO is best for newbies due to the availability of learning and research resources. You see, the exchange only features basic research tools, including candlestick charts, indicators, and TradingView integration. Therefore, if you are a professional crypto trader, we advise you to consider other options with more advanced resources.

Overall, CEX.IO is a well-established and reputable exchange suitable for both new and experienced cryptocurrency traders. However, as with any exchange, it is crucial to thoroughly research the platform, its fees, and security measures to ensure it suits your needs before making a decision to trade on the platform.