DeGiro is a European brokerage company, based in Amsterdam. It is a low-cost broker that has become very popular in the UK due to its low rates.

- Low commissions for stock trading

- Perfect for long-term investments

- Grows fast and develops the platform

- The platform needs improvements

- Slowly getting into CFDs

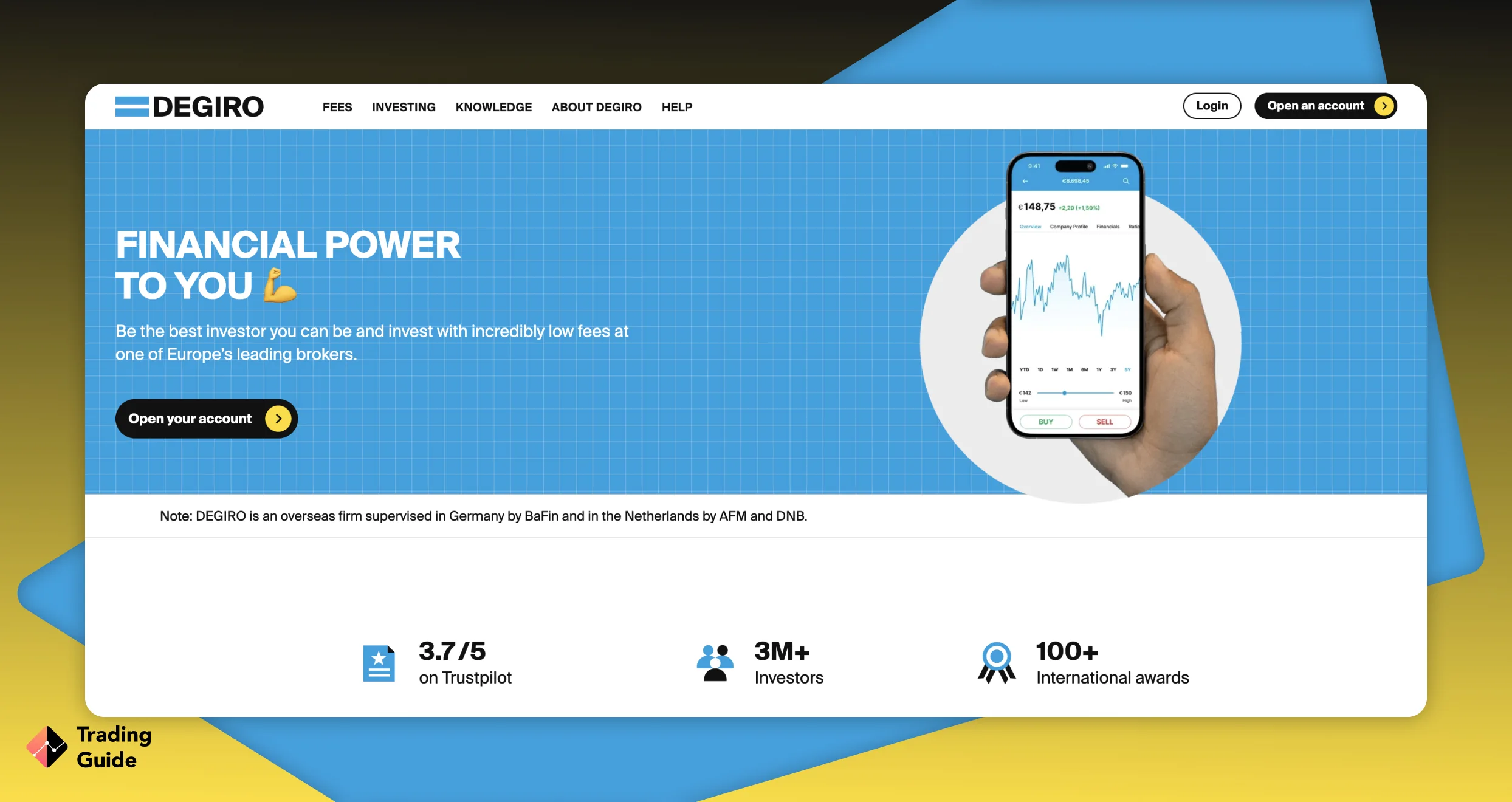

DeGiro has been in business since 2008 and currently offers online access to more than 60 security exchanges from all over the world. Moreover, DeGiro charges some of the lowest commission fees for bonds, gilts, ETFs, and shares.

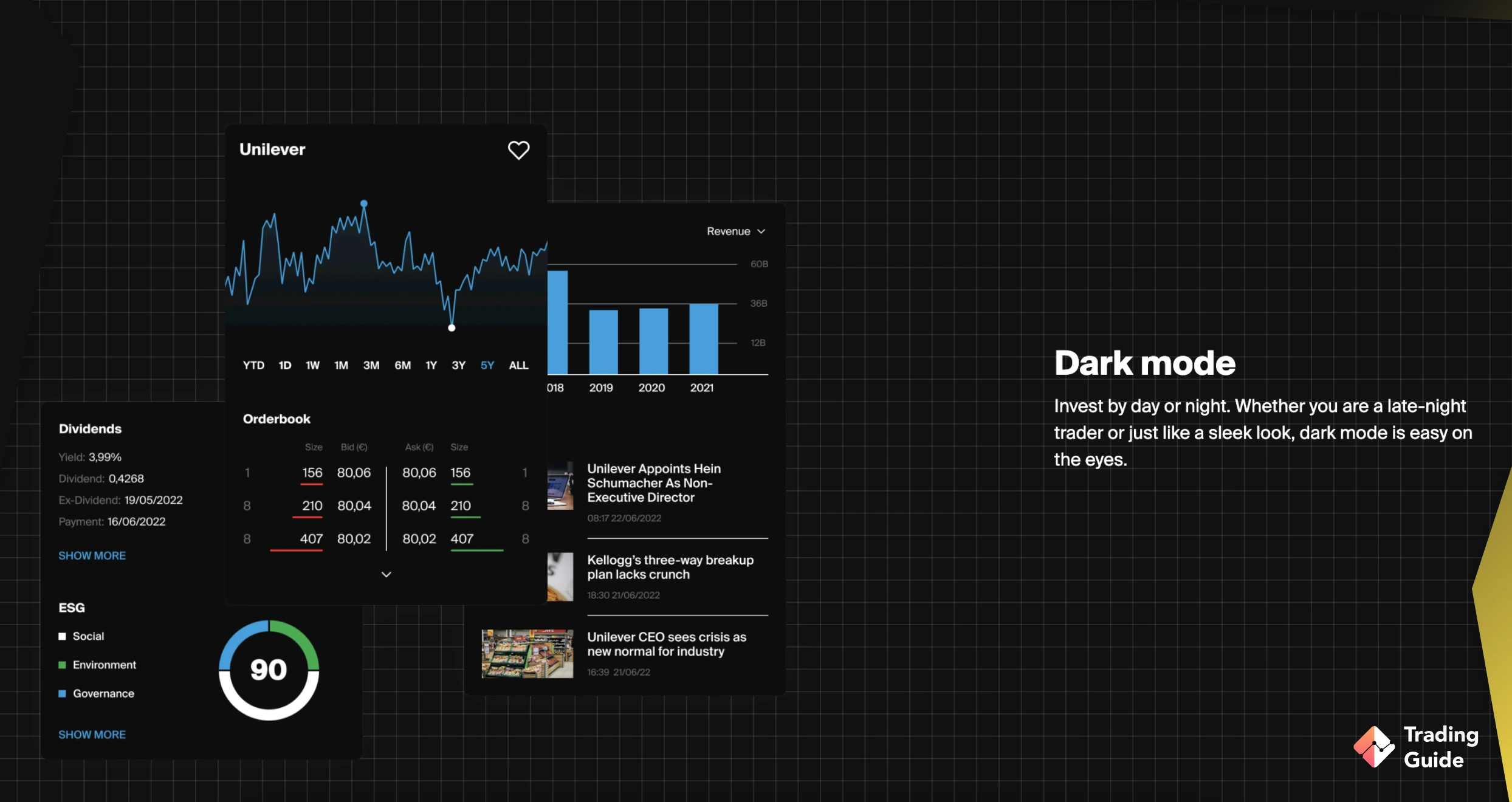

The first thing our experts noticed when researching this broker was DeGiro’s fresh, new look. This is deliberate – the company wanted to create something different and unique. And they have managed to do just this.

Our team of experts have spent several hundred hours studying this trading platform in detail, to bring you the results of our work in this article.

DeGiro – Who Are They?

DeGiro was founded in the Netherlands in 2008 by a group of five former employees of BinckBank, to service the professional market.

DeGiro is a broker that has managed to radically change the Netherlands and UK markets by providing low-cost stock trading.

It is the fastest growing online brokerage on the market, and it’s easy to understand why. It not only has beneficial conditions, but also an array of innovative trading and investment tools, which make DeGiro so popular.

Compare DeGiro Features With Other Brokers

Compare brokers

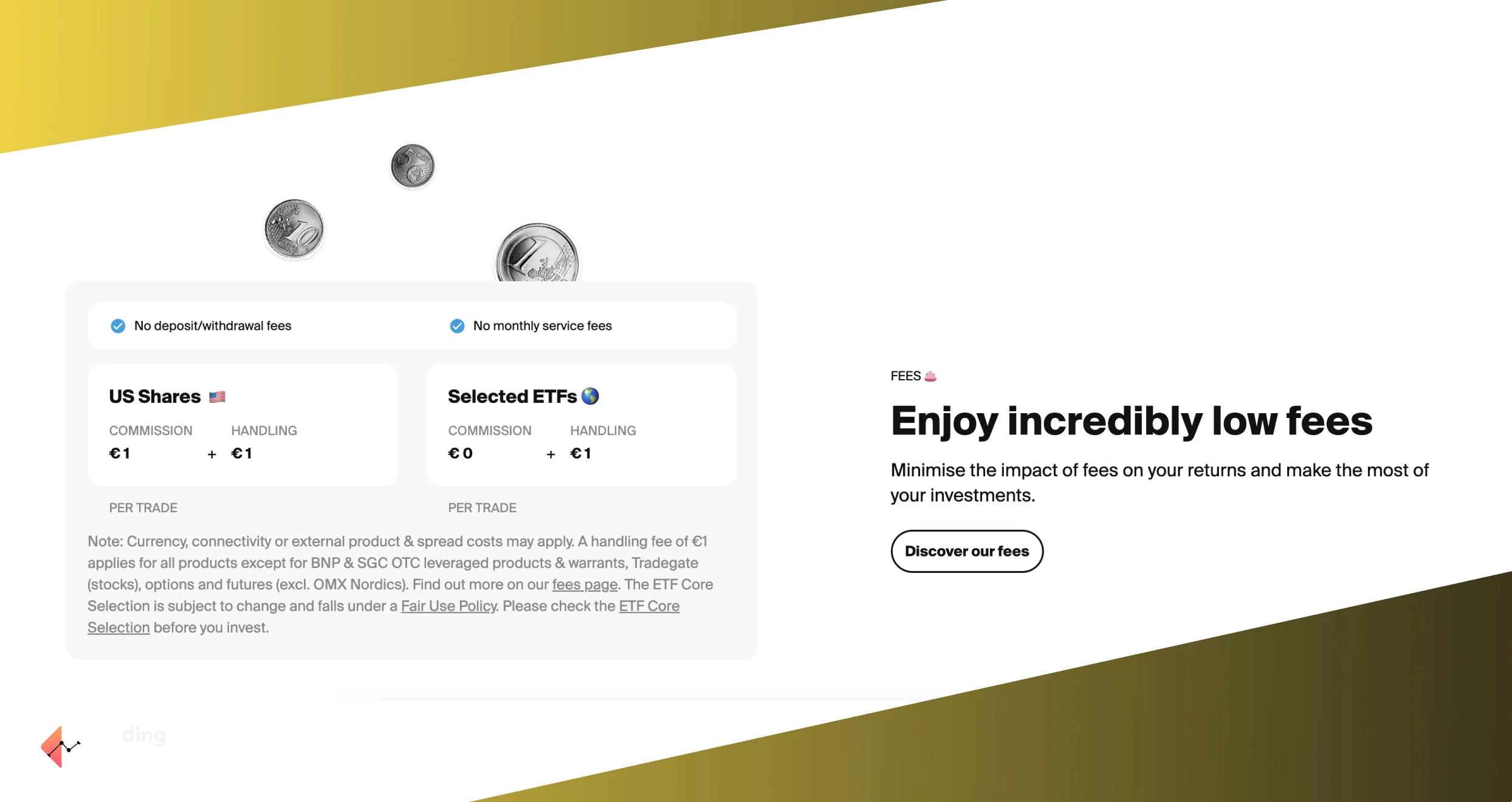

Commissions and Fees

| Type | Fee |

|---|---|

| Minimum deposit | €0 |

| Withdrawal fee | €0 |

| Inactivity fee | €0 |

| Deposit fee | €0 |

| Custody fee | €0 |

| Currency conversion | 0.25% |

Our Opinion About DeGiro

DeGiro is a fast-growing online broker that provides excellent investment opportunities for many investors, including European ones. It is the number one wholesale stock broker for private investors, and unlike CFD and Forex brokers, DeGiro allows you to invest in securities directly on exchanges.

Currently, DeGiro is more suitable for long term investments and should not be used for day trading. It also means that the com = mission for day trading here can be higher than your average online broker.

FAQs

Yes. Degiro is licensed by several regulating bodies, including the Financial Conduct Authority (UK), Financial Markets Authority (Netherlands), and Federal Financial Supervisory Authority (Germany). Therefore, you can rest assured that the broker will keep your funds protected in segregated accounts.

While DEGIRO can be used for day trading and swing trading, its commission for these short-term strategies can be higher than your average online broker. Thus, DEGIRO is best suited for long-term strategies.

DEGIRO is based in Amsterdam, Netherlands. It was founded in 2008 by a group of five former employees of BinckBank. In December 2019, German online stock broker Flatex AG acquired 100% of DEGIRO but kept the brand intact.

You cannot directly buy Bitcoin or other cryptocurrencies with DEGIRO. However, the broker allows customers to make an indirect investment in cryptocurrencies through trackers, such as exchange-traded funds (ETFs) and exchange-traded notes (ETNs).

I would say it's good and trusted. It is also however quite expensive and restrictive in my opinion.

I moved all my trading to Forex.com now as it's way cheaper. I do still sometimes go on their website though to look at the analysis and sentiment

A loyal broker with rules. I trust them, work for over five months. The results are not stable yet, but I'm on right track. Everyone trading with an DeGiro broker here will sooner or later get their results.

No brokers actually would suit all traders, as the demands are different, thus it's quite cool that I can choose. DeGiro has tight spreads and single account for all need, I hate when brokers try to confuse you with a lot of data and options. Btw, anyone knows about fees on withdrawing money? Any hidden fees?

Investing in banks comes with more expensive and more complicated software to use. Degiro makes it very easy to place orders and sell quickly, and even set them for when the market is open. In my opinion, this is the easiest service out there.

Would like to see quicker payments and better options trading possibilities, but it's one of the best platforms for what it does. It's a top-quality trading platform, easy to use, and they answer questions quickly. Highly recommend it!

I have used Oanda for years now, they have always been quite good, offering me good service and good customer support. Trading conditions aren't the best ever but never really had any issues.

I joined Degiro about 10 months ago, looking for a self-managed investment account with low currency exchange fees. Degiro met that requirement. The platform is easy to use. It is a good value for money.

Excellent product and service .

Low transaction costs and it is easy to track and check the status of your portfolio at anytime from anywhere.

Easy to use for different investors.

Incredibly good value-for-money broker for US, UK, and Europe stocks with margin facilities. Very low dealing fees mean I can invest small amounts without eating into the investment too much. But there is one problem: money transfer both ways is a bit slow in comparison with other platforms. I would recommend it to investors.

It is a first-class service here. Easy to use platform, low fees, no bull. DeGiro is more suitable for long-term investments and for me it is great news.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal