Robinhood is a US-based stock and cryptocurrency broker that is popular globally.

- Free trading services, including zero commissions and spreads. There is also no transaction charges or inactivity fees

- No minimum deposit requirement

- Easy-to-use and modern design platform to improve your experience

- Over 18 million registered clients, proving its credibility

- No desktop trading

- No demo account

- Available in the US only

Robinhood has emerged as a prominent platform, democratising financial markets for millions of users. Since its launch in 2013, the broker has redefined the industry with commission-free trading, expanding its offerings and introducing new features. As trading experts, we decided to review Robinhood by exploring its features, usability, fees, investment options, and more. This is so we can provide insights to help you assess if it aligns with your trading needs and preferences.

Our Opinion About Robinhood

Testing and reviewing Robinhood was a lengthy process since we had to sign up for accounts to give you accurate information. Based on our experience with the broker, we are impressed with what Robinhood has achieved since its establishment in 2013. Robinhood has so far attracted over 18 million clients, making us believe that the broker is trustworthy and worth trading with.

Moreover, the broker’s ability to accommodate trading using mobile devices is a solid proof of its efficiency.

We can also confidently say that Robinhood has a user-friendly platform that is loaded with adequate resources to help you navigate the financial markets. Its account sign-up procedure is pretty straightforward compared to many brokers we have encountered. You only need to share your personal details and some basic documents for account verification. Don’t worry; we will walk you through this procedure later in this guide.

Our tour of Robinhood’s learning resources was fulfilling, and we recommend the broker to traders looking to improve their skills. Plus, the broker offers adequate research materials to help you conduct research and develop solid strategies. This is especially on its Robinhood Gold platform, which is loaded with advanced tools for professional traders.

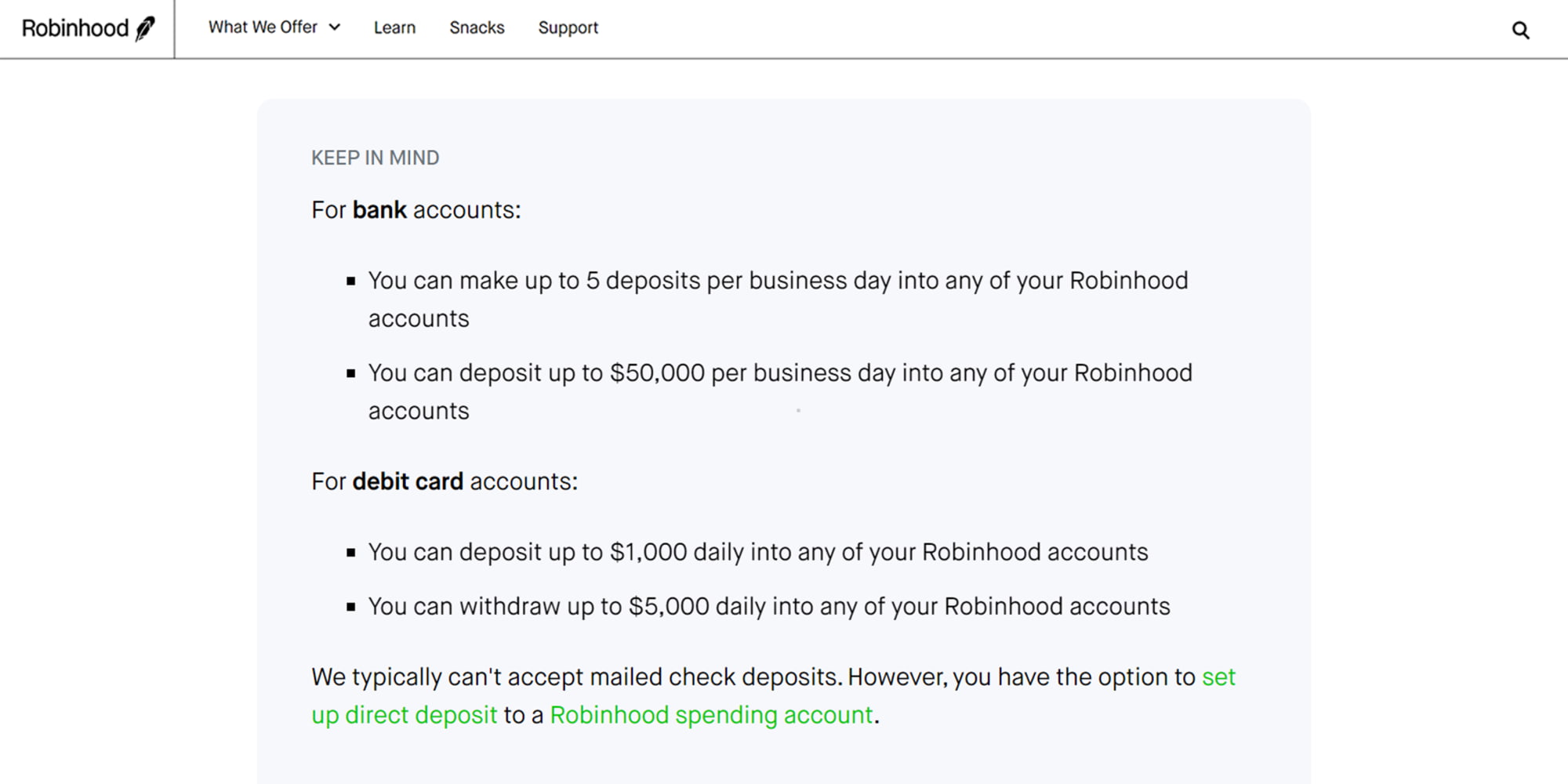

We also like the fact that Robinhood doesn’t charge commissions, and there is no minimum deposit requirement. No wonder it keeps attracting new traders, especially those who were sceptical about trading in the first place. While trying to make deposits, we noticed that Robinhood only supports bank transfers. The good news is that all deposits and withdrawals are free of charge.

It is disappointing that Robinhood only serves US clients, and we hope to see its presence not only in the UK but other global countries. Having it add more financial instruments to its existing list will also be a plus for Robinhood since no trader will be limited from enjoying what it offers.

Overall, we primarily recommend Robinhood to stock investors, considering the broker features thousands of options to explore with $0.

What We Like

- Commission-free trading services: One of the key advantages of Robinhood is that it offers commission-free trading services, meaning users can buy and sell financial instruments without paying any commissions. This can significantly reduce the costs associated with trading and investing, allowing users to keep more of their profits.

- No minimum deposit requirement: Robinhood does not impose a minimum deposit requirement, meaning users can start trading or investing with any amount (£0) they feel comfortable with. This makes Robinhood a viable choice for budget-conscious investors.

- Easy-to-use and modern design platform: The broker is designed with a user-friendly interface that is intuitive and easy to navigate. The modern design enhances the overall user experience, making it easier for both novice and experienced traders to access the various features and tools available. This can help users make informed decisions and execute trades more efficiently.

- Over 18 million registered clients: The fact that Robinhood has over 18 million registered clients demonstrates its credibility and popularity among users. A large user base indicates that the platform has gained the trust and confidence of a significant number of individuals who choose to trade and invest through it. This can provide reassurance to new users considering the platform for their financial activities.

What We Don’t

- No desktop trading: One limitation of Robinhood is that it does not offer a desktop trading platform. Currently, Robinhood primarily operates as a mobile app-based platform, which means that users can only access and trade through their smartphones or tablets. This can be a drawback for individuals who prefer or require the flexibility and advanced functionality typically offered by desktop trading platforms.

- No demo account: Another aspect where Robinhood falls short is the absence of a demo account feature. Without the demo account, users may need to rely on real money to experiment with their trades. This can be a potential disadvantage for beginners who prefer a risk-free environment for learning.

- Available in the US only: Robinhood is currently limited to users within the United States. This regional restriction may limit its accessibility for international users interested in utilising Robinhood’s services or have heard about its benefits.

Robinhood In-Depth

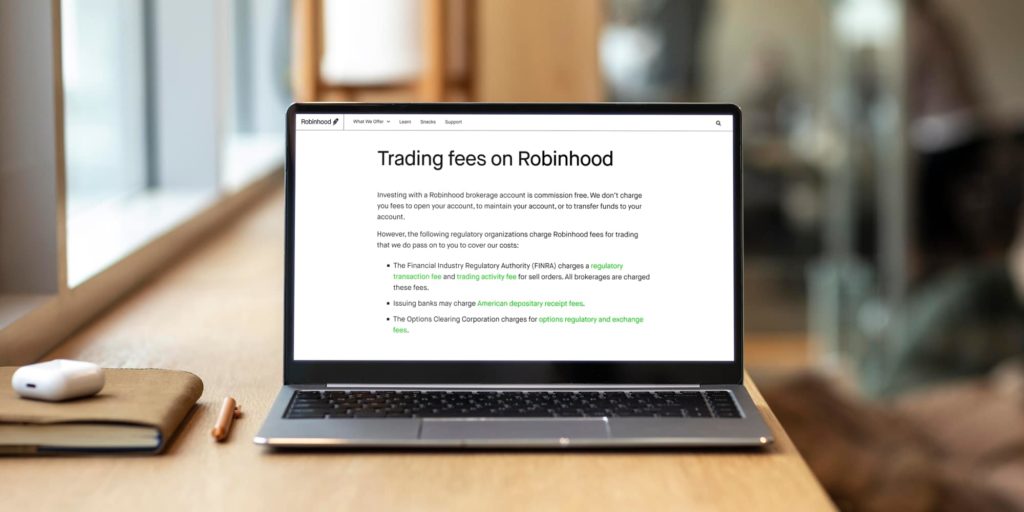

Robinhood is a commission-free broker with no minimum deposit requirement. It doesn’t impose charges on users’ accounts’ inactivity, and making deposits is also free. The only sources of revenue for Robinhood are spreads and interests from margin lending and customers’ funds.

This feature has made the company attract millions of traders, including low-budget ones.

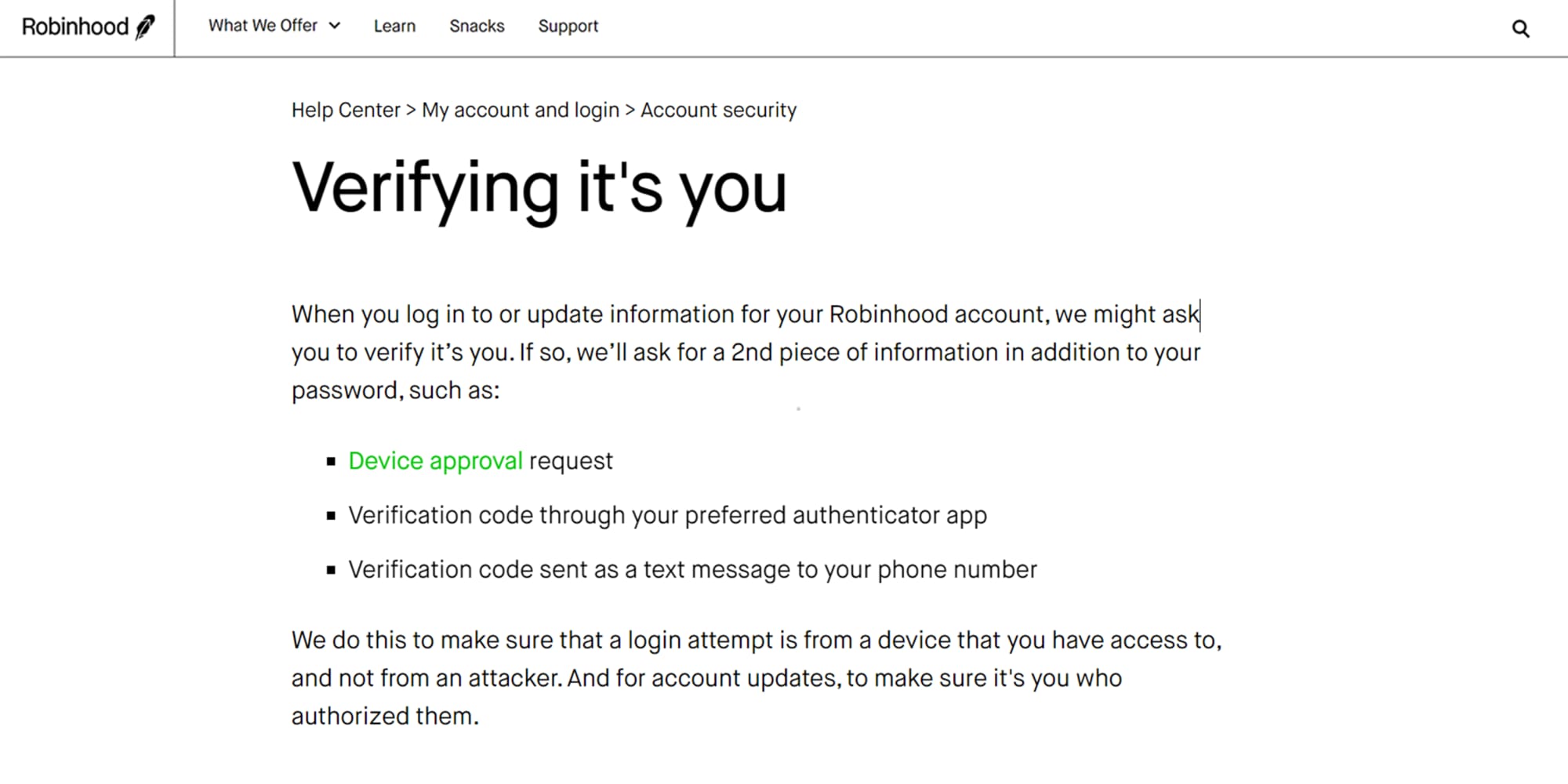

Note that Robinhood is among the safest US-based brokers and has implemented a 2-factor login procedure to help safeguard users’ data. Here is a table that briefly explains this broker’s features for better understanding.

| Feature | Availability |

|---|---|

| Minimum deposit requirement | £0 |

| Licences | FiNRA, SEC |

| Demo Account | None |

| Advanced Platforms | Single proprietary |

| Trading Securities | Stocks, Options, Cryptos, ETFs, |

| Support Service | Email and Live Chat |

| Mobile App | Yes (Google Play and the App Store) |

| Stock investment cost | £0 |

Security

Security is critical to any online financial platform, and Robinhood takes it seriously. While exploring the broker, we noticed that it employs industry-standard encryption protocols to ensure secure transmission of data between our devices and its servers. Furthermore, Robinhood has implemented multi-factor authentication as an additional layer of security.

We can also confirm that Robinhood adheres to stringent regulations of FiNRA and the Securities and Exchange Commission (SEC). This is to ensure its trading platform remains safe from imposters or money laundering activities. We give it a 4.5-star rating when it comes to protecting its clients.

Platform and Account Types

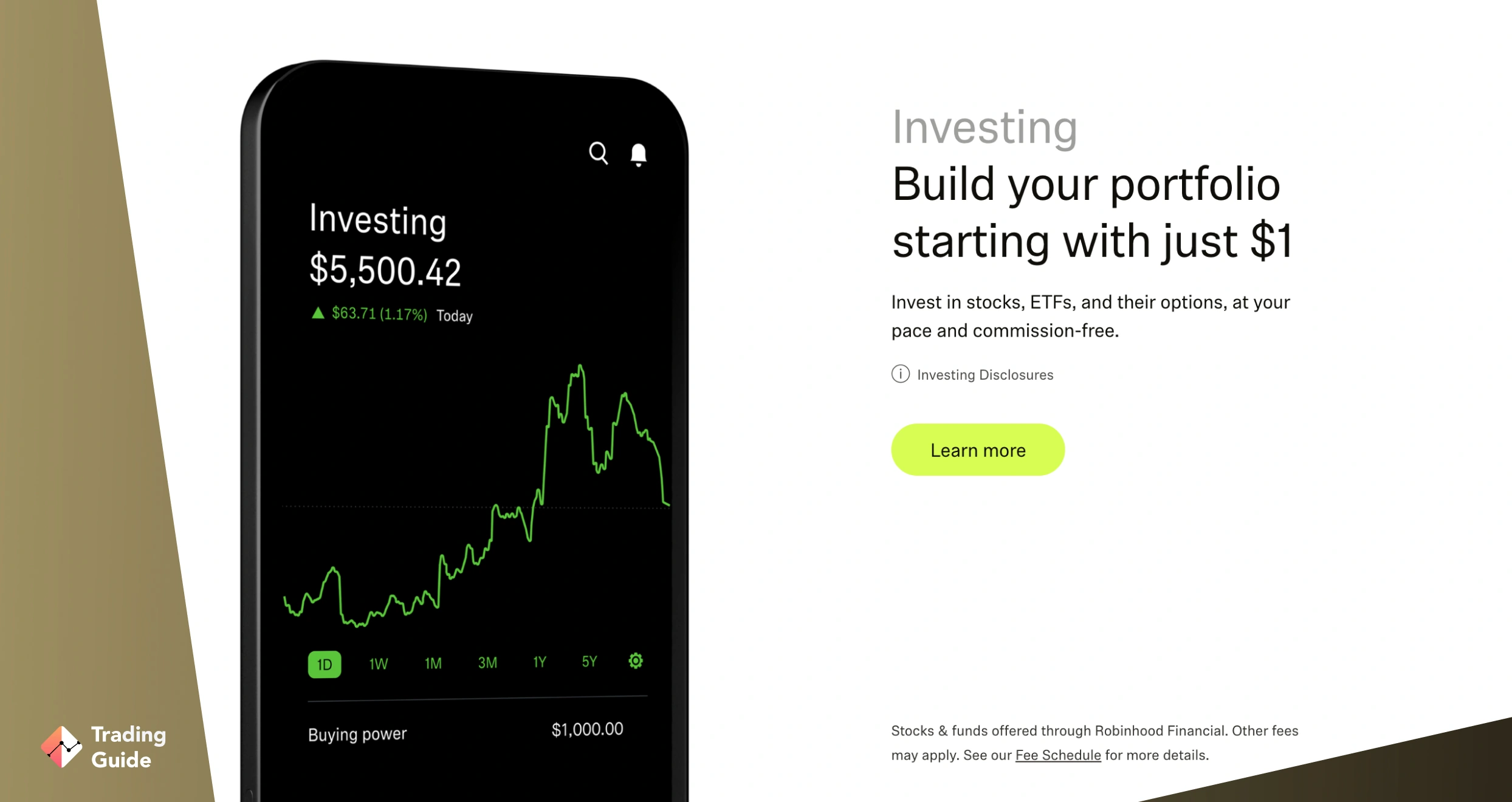

Our experience with Robinhood’s platform was smooth, and we believe that it is user-friendly. Its modern design interface suits all types of traders, guaranteeing an exciting experience. Robinhood’s platform also provides users with real-time market data, customisable watchlists, and easy-to-understand charts to help them make informed investment decisions.

We tried exploring Robinhood’s featured securities, and its trade execution speed is super fast. In this regard, we recommend the broker to traders looking to take short-term positions, as it will be easier to manage your activities.

Sadly, Robinhood has no demo account, which could inconvenience investors looking to test the broker without spending real money. The good news is that we liked our experience with its Cash Account. You can also upgrade to the broker’s Robinhood Gold to explore advanced features, including extended trading hours, margin trading, and access to professional research and data. Since Robinhood doesn’t support third-party platforms compared to its counterparts like IG Markets, we give a 3.5-star rating.

Fees

We compared Robinhood’s fees with other brokers’ and can confidently say it is one of the most affordable. All trading services are commission-free, and we recommend the broker to investors seeking cost efficiency. However, the broker charges spreads that are low compared to its peers. Other fees to expect with Robinhood include withdrawal charges, interest on margin borrowing, financing charges for positions left overnight, and currency conversion.

We explored the Robinhood Gold platform and noticed that its services are available to users at a monthly fee ranging from £5 – £50. By imposing low charges on users, we give this feature a 4.5 rating.

| Type | Fee |

|---|---|

| Deposit | £0 |

| Withdrawal | £0 via bank transfers ($50 for international wire transfers) |

| Inactivity | £0 |

| Overnight Charges | $20 for US clients and $50 for non-US clients |

| Margin Rate | 11.5% |

Mobile Compatibility

Since Robinhood doesn’t have a desktop version, we tested its compatibility with mobile devices. We signed in to our trading accounts using both Android and iOS devices and experienced seamless and intuitive trading.

Both mobile devices enabled us to enjoy a clean and user-friendly interface, allowing us to easily navigate through various features and execute trades with a few taps. We could easily access real-time market data, customisable watchlists, and interactive charts, which are crucial resources in making the best trading decisions. With many users recommending the Robinhood app plus our seamless experience, we give this feature a 4.5 rating.

Product Offerings

Robinhood offers a diverse range of investment products, which makes it easier for us to explore various markets and investment strategies. From its roots as a commission-free stock trading platform, the broker has expanded its offerings to accommodate different investment preferences. Here are other products we found on Robinhood.

- Stocks – Robinhood lists over 6,000 stocks to invest in. You can research and invest in companies you believe in.

- Exchange-Traded Funds (ETFs) – The broker also provides access to over 4,000 ETFs, which are investment funds that trade on stock exchanges. ETFs offer diversification by pooling together multiple assets, such as stocks or bonds, into a single fund.

- Options – You will find level 2 and 3 options listed on Robinhood, allowing you to trade contracts based on the future price of underlying assets. Options provide opportunities for advanced trading strategies, including hedging and speculation.

- Cryptocurrencies – Robinhood allows users to invest in over 15 cryptocurrencies like Bitcoin, Ethereum, and more. You can buy, sell, and hold digital currencies directly through the platform, providing exposure to this rapidly evolving asset class.

- Cash Management – Robinhood also offers a cash management feature that allows users to earn interest on uninvested cash in their accounts. This feature provides a convenient way to potentially earn a return on idle funds.

Unfortunately, we couldn’t find mutual funds or bonds on Robinhood. The broker also does not list stocks trading on foreign exchanges and royalty trusts. You can click here for a comprehensive list of assets not offered by the broker. We don’t consider Robinhood’s product offerings expensive. Therefore, we rate this section with 3 stars.

Education Tools

We visited Robinhood’s “Learn” section and discovered a range of learning resources perfect for beginners to build their knowledge and make informed investment decisions. These educational materials include articles, guides, and tutorials, covering various investment topics. The resources cover fundamental concepts, investment strategies, and market analysis, helping users understand the basics of investing and navigate the complexities of the financial markets.

The broker’s commitment to providing learning resources will definitely empower users to enhance their financial literacy and make more informed investment decisions. Compared to its peers like eToro and Plus500, we give Robinhood’s learning tools a 4-star rating.

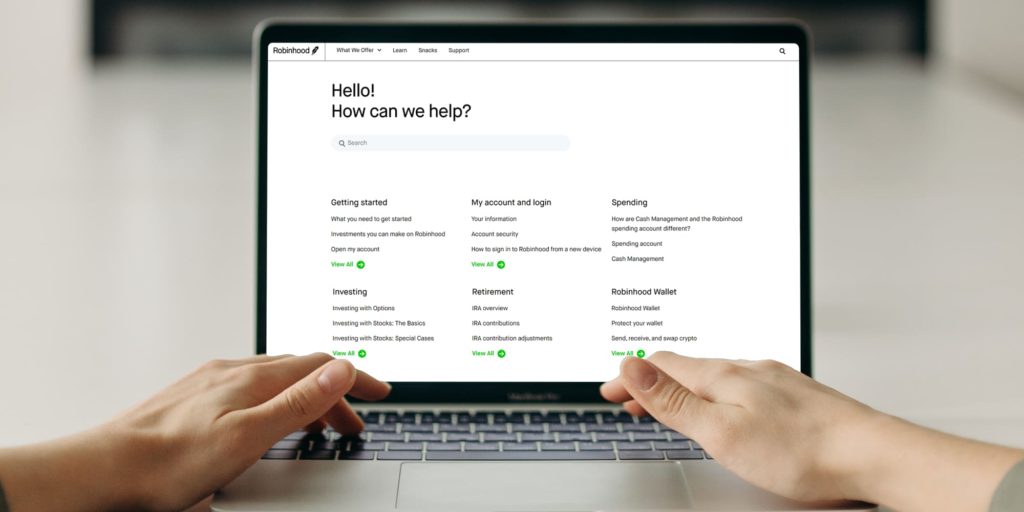

Customer Service

We couldn’t stop our research without contacting Robinhood’s support service team. We reached out via the “support” section on its platform and were redirected to a form that emailed the team. The section was also loaded with quick answers to FAQs, which made it easier to get most of the answers to the questions we had. Sadly, Robinhood support service lacks phone or live chat support. The good news is that our emails were replied to within 2 hours, which is promptly compared to our experience with other brokers. We highly rate Robinhood’s support service with 4.6 stars.

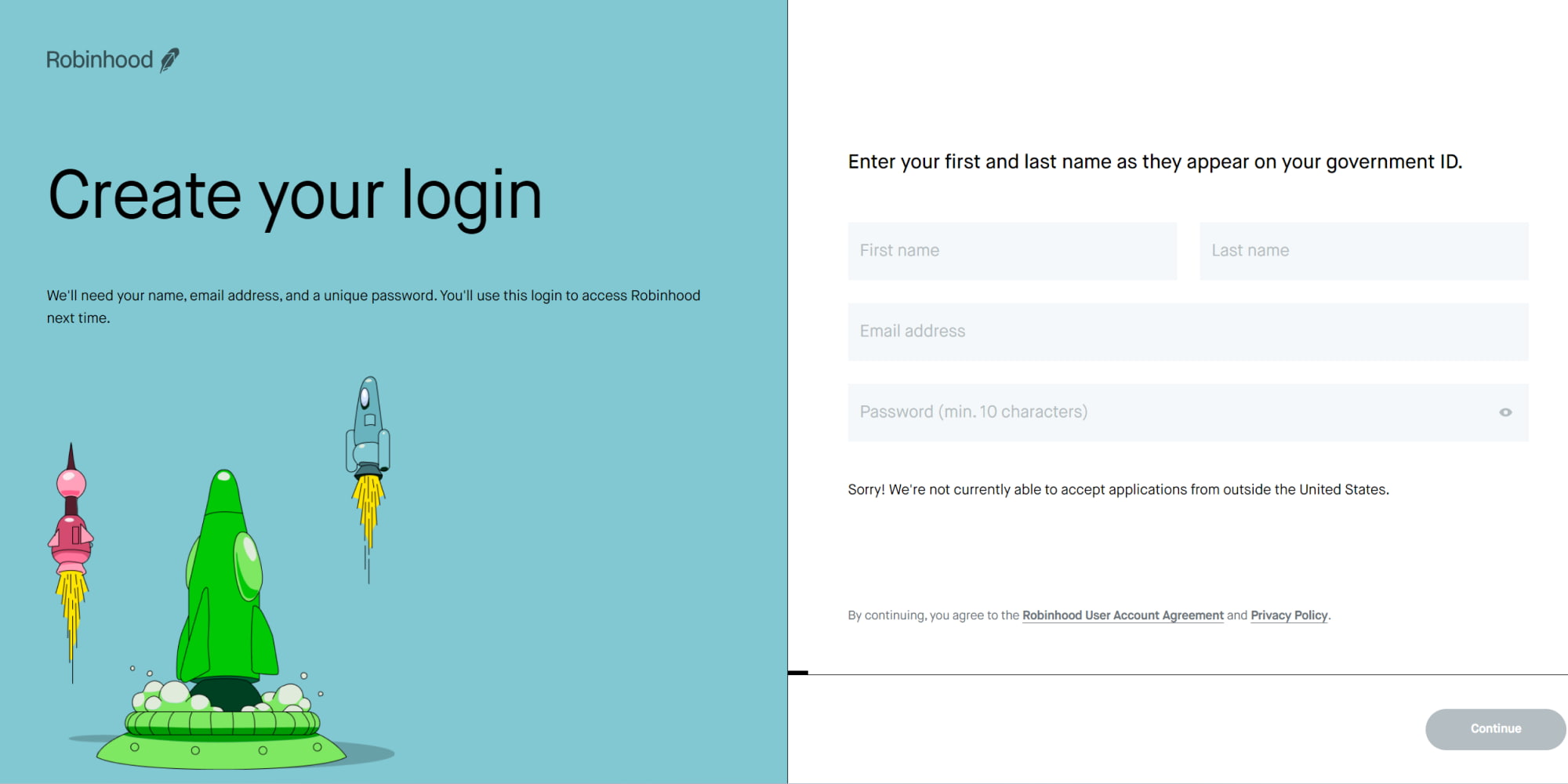

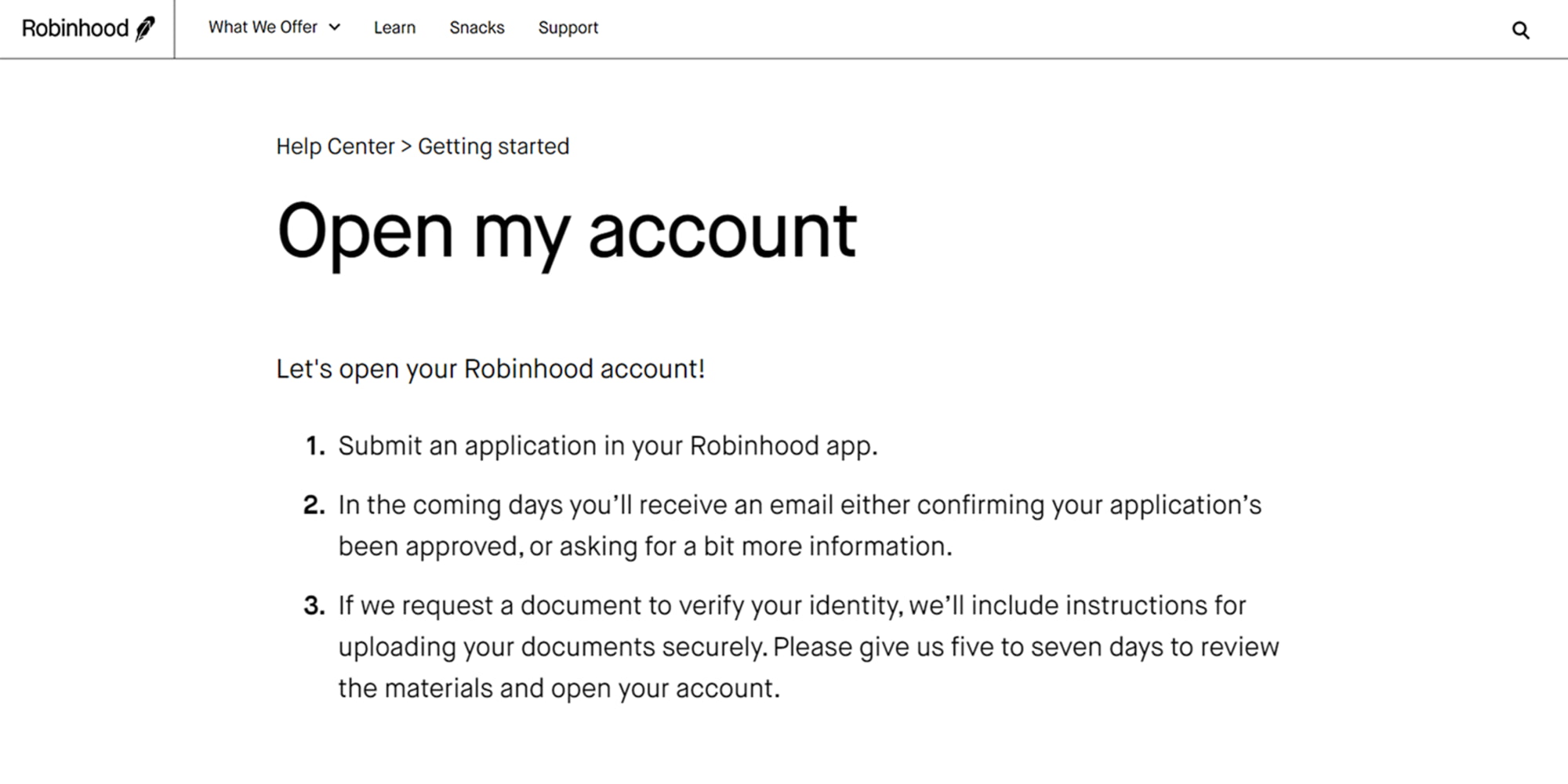

How to Sign Up For an Account at Robinhood

As mentioned earlier, we signed up for investment accounts with Robinhood and can confirm that the procedures are straightforward and take minutes to complete. In fact, we give the account registration process a 4-star rating since Robinhood requested basic information as compared to other brokers like eToro.

If you are considering investing with Robinhood, here’s a guide on how to sign up for an account.

Visit the Robinhood website and click on the “Sign Up” button to begin the account setup process. You will be required to share your name and email address. Robinhood also requires that you create a username and password for added security.

In this section, you will share additional personal information, including your physical mailing address and phone number. You will also answer basic questions regarding your employment status.

Robinhood will require you to verify your identity. This typically involves providing your Social Security number or Individual Taxpayer Identification Number. Account verification is a standard protocol required by all brokers to keep away imposters or terrorists trying to access the stock market. You will also share your citizenship and marital status, date of birth, and number of dependents.

Link your bank account to your Robinhood account to deposit funds. This will allow you to start investing once your account is approved. Remember, Robinhood doesn’t have a minimum deposit requirement, allowing you to deposit any amount you can afford. All deposits are also free.

Review your information and submit your application. Robinhood will review and verify the provided details.

Once Robinhood approves your application, it will send you an email notification within 48 hours. You will then be redirected to a page to download the Robinhood app and start investing. Remember, the investment app is in Android or iOS, so ensure your device is compatible.

Open the app on your mobile device and log in using the credentials you created during the account setup in step 1. Your account is now ready to use for trading and investing.

Alternative to Robinhood

Although we consider Robinhood one of the best brokers available, it might not be suitable for your trading needs since every trader has their own preferences. Our goal is to ensure every reader finds a credible and reliable broker. Therefore, we have prepared a table below listing some of our highly rated alternatives to Robinhood.

| Broker | Minimum Deposit | Demo Account | Mobile App | Commission/Spread |

|---|---|---|---|---|

| eToro | £50 | Yes | Yes | Yes |

| Plus500* 80% of retail investor accounts lose money when trading CFDs with this provider. | £100 | Yes | Yes | Spreads Only |

| IG Markets | £0 | Yes | Yes | Spreads Only |

Is Robinhood Good For You?

Determining whether Robinhood is a suitable platform for you depends on various factors, including affordability, availability of tradable instruments, safety, and more. Based on our experience with the broker, we recommend it primarily to stock investors since it features over 5,000 shares to invest in with as little as $1.

Beginners will also enjoy using the broker, considering the availability of quality learning tools and a user-friendly platform. For investors seeking advanced third-party platforms such as MT4, MT5, and more, you might consider other brokers since Robinhood only has single proprietary and Robinhood Gold platforms.

Although the broker doesn’t have a demo account, its cheap services make it easier for you to get started and have a worthwhile experience. Remember that losses are inevitable, whether you choose Robinhood or other brokers. So, always have a solid plan and conduct extensive research and analysis before opening a position.

FAQs

Yes. We consider Robinhood a good broker for beginners. The platform’s user-friendly interface and intuitive mobile app make it easy for beginners to navigate and understand. It provides a simplified trading experience, making it accessible to those new to investing.

Yes. It is possible to make money with Robinhood by investing in various assets such as stocks, ETFs, options, and cryptocurrencies. However, profitability depends on factors like market conditions, investment strategy, and individual decisions. Therefore, always conduct extensive market research, diversify your portfolio, and stay informed on the latest financial market developments to increase the likelihood of success.

Robinhood does not have a minimum deposit requirement. Users can start trading on the platform with any amount they choose, making it accessible for investors with varying capital levels.

Yes. Although Robinhood has been the subject of some controversy in the past, the broker is legit and trustworthy. Robinhood is highly regulated by world-recognised authorities and has implemented various security measures to protect user data, funds and assets.

I really like this broker because no account minimum + streamlined interface. In its early stages, Robinhood stood out as a disruptor in the brokerage industry. Its biggest competitive advantage was not charging commissions for stocks, options, and cryptocurrency trading. New investors are attracted to Robinhood because of its low fees, zero balance requirement to open an account, as well as and easy-to-use interface.

My country regulation is very strict and it has an adverse impact on local brokers. They have to make their trading conditions less favorable for traders. In particular, they have to decrease their leverage size. Fortunately, there’s a good way! Foreign brokers. They are not restrained by tight restrictions and respectively can afford providing much better trading conditions. I also chose this option and found a foreign broker. I read Robinhood reviews. I found its trading conditions very suitable and signed up. I have been already trading with this broker for more than three months and I have a positive impression about it.

In my opinion, for beginners maybe it is not a good platform. But they have an excellent trading platform, a great app, and a good support team - they are fast and polite.

Very easy to use platform for investors. It is a user-friendly broker with a simple interface. I am content that they often release new features. Mobile friendly, and commission free investing.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal