Cryptocurrencies, such as Bitcoin and Ethereum, have captured the attention of investors worldwide, offering exciting opportunities to participate in the digital asset revolution. For those in the UK, PayPal has become a popular payment method for seamlessly buying and managing cryptocurrencies. It is easy to use, has robust security features, and is widely accepted.

Today, we are taking you through how to buy cryptocurrency using PayPal in the UK. This is while highlighting some of the top-rated sites that accept PayPal payments. In the end, you should be able to easily walk through the process and make informed decisions.

How to Buy Crypto with PayPal using Crypto Brokers

The UK has seen unparalleled growth in cryptocurrency adoption, with more individuals than ever engaging with digital assets as an investment choice. Over 12% of UK adults now own cryptocurrency, according to a Financial Conduct Authority (FCA) report. This is up from 10% in earlier surveys. Even knowledge of crypto has grown, with 93% of adults now having heard of digital assets, up from 91% in previous surveys.

To get started in the crypto world, choosing the right broker is a good place to begin. PayPal has become a preferred means of payment for many investors since it is convenient, safe, and widely accepted. However, not every broker accepts PayPal, and selecting one that does your job requires a keen eye.

To simplify your search, we’ve handpicked the top three crypto brokers that accept PayPal in the UK. These platforms have been thoroughly tested and compared based on key factors such as regulation, user experience, asset variety, and additional features. All three are regulated by the FCA, ensuring a secure and compliant trading environment. Beyond PayPal support, they offer unique tools and functionalities that cater to both beginners and experienced traders.

1. eToro

When I first started buying crypto with PayPal at eToro, its easy-to-use deposit process left me amazed. Unlike a couple of websites that make you jump through hoops, I could deposit via PayPal instantly. No waiting for banking transfers or deposit delays. Trading funds were available to me in seconds.

What really sealed the deal for me was how eToro handles PayPal withdrawals, too. So many exchanges have PayPal available for deposit only, but here, I could withdraw my crypto profits back to PayPal. In my test, a £200 withdrawal was credited to my PayPal account within one business day.

The broker converts GBP to USD for trading purposes, but at a minimal spread of about 0.75% based on my experience. This is, however, counterbalanced by the absence of deposit fees at eToro – something unheard of among PayPal-friendly brokers and exchanges. I appreciated the convenience of being able to buy more than 100 cryptos, including Bitcoin, Ethereum, and the top altcoins, using the very same simple interface.

There are also other 7,000+ asset classes available for diversification, including stocks, forex, commodities, and so forth. The only major disadvantage that I noticed was the £5 withdrawal fee, which I still believe is worth it for the convenience and FCA regulation of eToro.

Note that PayPal is not available for the UK and FCA users.

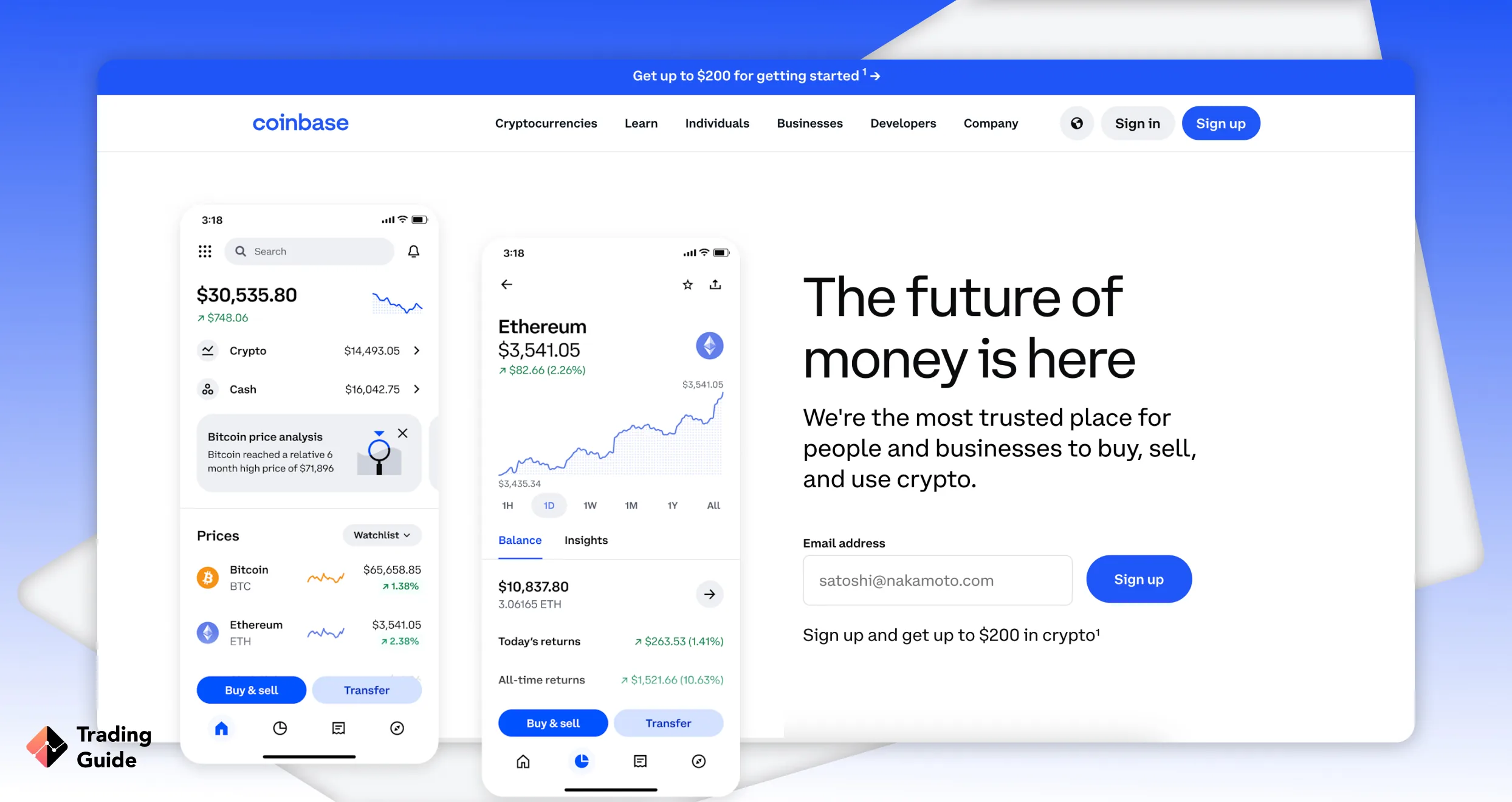

2. Coinbase

Coinbase is also a pretty cool exchange for buying cryptocurrency with PayPal. Unlike some platforms that make you wait for bank transfers, I managed to complete my purchase in less than a minute, as the tokens were instantly accessible. What I was most surprised at was how smooth the process was. With a few clicks, transactions were completed without any messy steps.

Coinbase’s speed does come with a transaction fee, which is visibly indicated prior to executing every transaction. Though not the most affordable, the ease made the cost worth it when every minute counted. I liked the way the exchange will automatically tabulate how much crypto you’ll end up with before completing, avoiding guesswork.

One pitfall I encountered was that I could not withdraw directly to PayPal, and Coinbase’s support staff confirmed to me that this is presently not an option for UK clients. Its FCA registration did make me feel reassured when making bigger buys, though. The insurance policy covering digital assets in their wallets also provided me with extra peace of mind that most rivals do not offer.

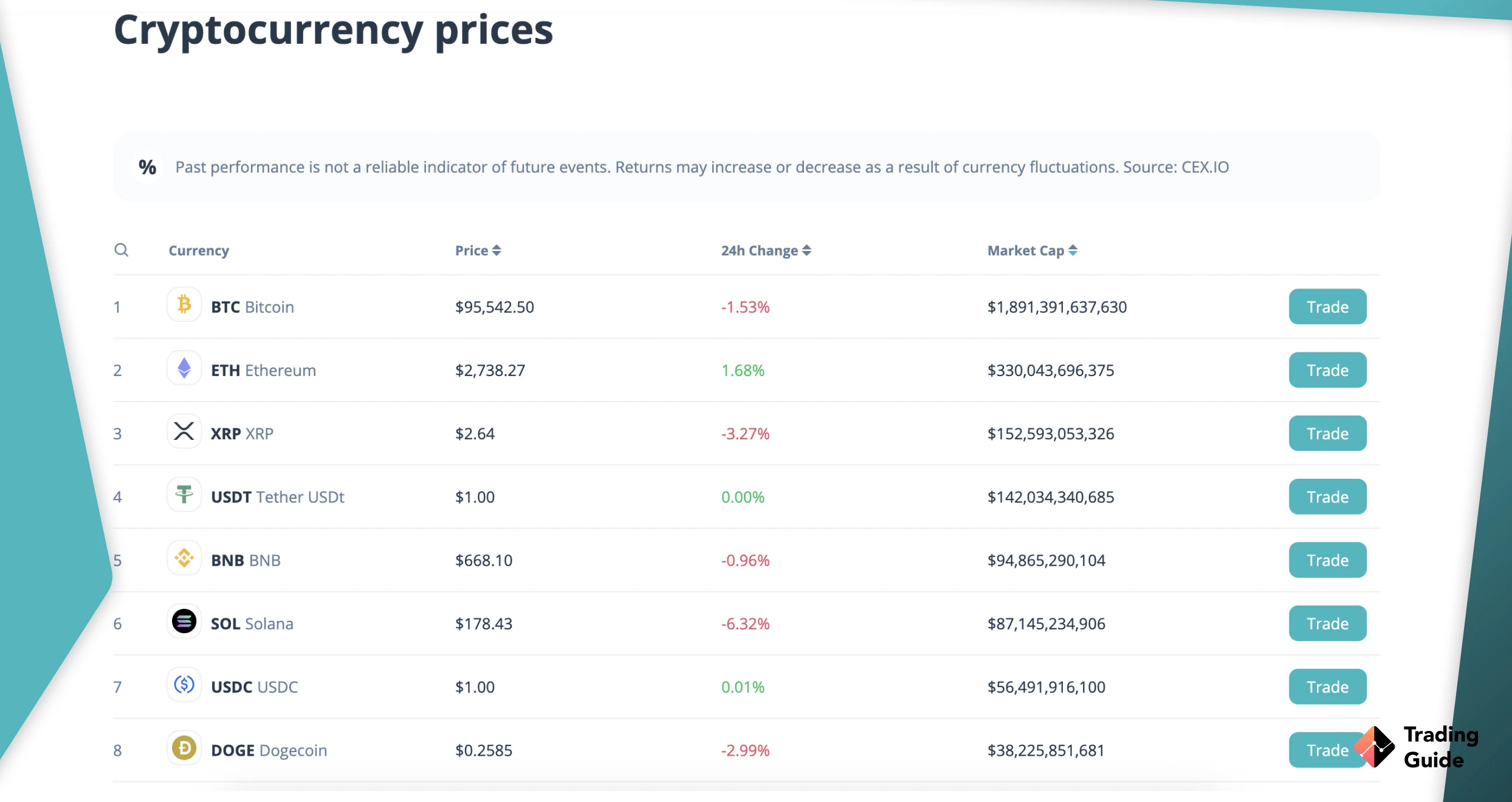

3. CEX

CEX is a new Bitcoin and cryptocurrency exchange that claims to have the easiest-to-use cryptocurrency trading platform worldwide. It’s a 3.99% deposit fee that first got my attention, but the quality of the trade execution swung it back. When I bought Ethereum at a moment of volatility, the spread was very much narrower than anywhere else.

What impressed me most was how CEX handles large trades. I sent a £2,000 deposit through it, and the funds cleared within 15 minutes. That is much faster than how bank transfers typically are. I also like the exchange’s advanced charting features, which help make entry timing more accurate. And being able to set limit orders via PayPal funding removes the stress of needing to keep an eye on markets constantly.

Another highlight of CEX is that it has a proportional fee structure. The more you trade, the lower your fees will be, which benefits users financially as their activity ramps up. Another advantage of using this exchange over the other recommended brokers is that you are purchasing the actual cryptocurrencies rather than speculating on the price action.

You can read about How to Open a Bitcoin Account in our other guide.

PayPal Crypto Fees

When engaging with cryptocurrencies, it’s crucial to recognise that these digital assets are characterised by their extreme volatility and speculative nature. This can result in swift and substantial price fluctuations. To safeguard your crypto holdings, it is imperative to utilise reputable wallets and exchanges, prioritising the security of your investments.

Also, exercise vigilance and due diligence to guard against crypto-related scams and fraudulent schemes that can potentially threaten your financial well-being. You can also spread your investments across multiple digital tokens and avoid making decisions based on emotions.

PayPal charges transaction fees to customers who buy or sell cryptocurrency on its platform. The cost is tiered, with small transactions charged flat fees and larger ones charged percentages that decrease slightly with increasing size.

Additionally, PayPal comes with an exchange margin rate in the displayed rate of conversion. Thus, the final price to be paid will be slightly lower than the market price. Note that there are no fees for holding cryptocurrencies in a PayPal account.

Below are the fees to be incurred when buying cryptos directly through PayPal.

| Transaction Amount | Applicable Fee |

|---|---|

| 1.00 – 4.99 GBP | 0.49 GBP |

| 5.00 – 24.99 GBP | 0.99 GBP |

| 25.00 – 74.99 GBP | 1.99 GBP |

| 75.00 – 200.00 GBP | 2.49 GBP |

| 200.01 – 1,000.00 GBP | 1.8% |

| 1,000.01 GBP | 1.5% |

Generally speaking, the aforementioned PayPal crypto fees only apply when buying crypto directly from PayPal’s platform. If, however, you fund your account with PayPal into a third-party broker or exchange (like eToro or Coinbase), then there are additional fees levied, most commonly by the broker itself.

For instance, a few platforms charge a percentage-based deposit fee for PayPal transactions, whereas others may have fee-free deposits but charge spreads or trading commissions. Always check the fee structures of PayPal and your desired broker before making a purchase. Costs can make a big difference to your investment.

Read about list of the best Bitcoin wallets in the UK 2026 and Best Crypto Wallets in the UK in our other articles.

Step-by-Step Guide on Buying Crypto on PayPal Itself

Purchasing cryptocurrency with PayPal is a very easy process for UK users. The service offers the user the convenience of buying, selling, and holding digital currency in their PayPal account. Below is a step-by-step guide to purchasing crypto with PayPal in the UK.

First, ensure you have a live PayPal account. If not, you can sign up for free on the PayPal website or mobile app. Sign-up requires a valid email address, phone number, and linked bank account or debit card. UK customers are not permitted under Financial Conduct Authority (FCA) regulations to use credit cards or PayPal Credit to finance crypto purchases.

Log in and look for the cryptocurrency section. On the website, it may be under “Finance” or there may be a separate “Crypto” tab. On the app, look for the cryptocurrency sign or in the wallet area.

PayPal has accepted several cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). Click on the one you wish to purchase.

You can set the amount you wish to spend in GBP or input the amount you wish to spend in crypto. PayPal will show you the current exchange rate, along with any fees, before you proceed. Check the information carefully, as the rate might have a small spread markup.

After verifying the amount and fees, proceed to confirm the purchase. The cryptocurrency will be instantly credited to your PayPal account. A confirmation email will also be sent for your records.

Once you purchase cryptocurrency through PayPal, your holdings remain within PayPal’s in-wallet. You can leave them as an investment, cash them out (with fees applying), or use them where cryptocurrency is accepted.

Note: For UK clients, PayPal is not currently enabling external wallet transfers, so your crypto must stay within their domain. It is thus better suited to occasional buyers rather than frequent traders, who would need freedom of wallets.

Find out more about the best cryptocurrency apps in the UK in our other article.

FAQs

Yes. You can easily purchase Bitcoin with PayPal through online brokers that meet your investment needs. Finding such brokers can be an uphill climb, and for this reason, we recommend the top above to choose from.

Absolutely. PayPal is one of the most preferred payment options for making online purchases in the UK. However, note that you cannot use it to buy Bitcoin anonymously but create a PayPal account and link it with your preferred broker.

Yes. PayPal is a safe payment option since it only allows you to use it once you create a PayPal account and fully verify it. This protocol secures the platform and keeps away fraudsters. Plus, the system has two-factor authentication, which we highly recommend you enable for more safety.

Yes. PayPal will charge you a commission based on the amount of cryptocurrency you purchase. Also, some brokers charge commissions or spreads for transactions. Therefore, always confirm these charges and ensure they fit your budget.

No. You do not need a bank account to sign up with PayPal or make deposits and withdrawals. However, you are free to link your bank account with your PayPal account so that you can easily transfer funds when need be. Remember that PayPal to bank transactions and vice-versa may attract some additional charges. Therefore, it is essential that you confirm these fees before linking the two accounts.

Yes. Currently, investors can buy cryptocurrencies not exceeding $100,000 using PayPal on a daily basis. This limit is up from its previous $20,000 daily purchases, allowing investors to put more money into the assets.

Our Opinion

Although PayPal is a convenient way of getting your feet wet in cryptocurrency, we typically recommend using a regulated broker instead. Here’s why:

PayPal’s crypto service is convenient and secure. However, its restrictions, such as no wallet transfers, high fees, and only four coins, limit it for serious investors. You’re actually purchasing crypto “IOUs” and not actual assets you own.

For most UK investors, brokers and exchanges like eToro or Coinbase, both of which allow PayPal deposits, are better options. You’ll get:

- Lower fees overall

- Freedom to transfer coins to your own wallet

- More cryptocurrency options

- Better trading features

All things considered, we suggest making small, test purchases using PayPal if you’re just beginning with crypto. However, if you’re seriously investing or trading on a regular basis, register with a reputable crypto broker such as those mentioned above. Regardless of the path you choose, understand that the crypto market is highly volatile, and losses are inevitable. So, only invest what you can lose and choose FCA-regulated platforms for security.

Related Articles:

How we test?

Our test process is really based on two different aspects: our independent tests and research, as well as user reviews from Google Play, the App Store, and Trustpilot, etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than 200 hours on every article. We pay special attention to the specific function or the criteria that we’re comparing during the comparison stage. This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here.