Cardano (ADA) has generated growing interest among UK investors for its focus on real-world utility. Known for its academic roots and energy-efficient design, it offers more than just price speculation.

Buying ADA is now a straightforward process, with FCA-registered platforms making access easier and safer. You don’t need technical expertise to get started.

This guide outlines what Cardano is, its place in the cryptocurrency landscape, and how UK beginners can invest in it securely and confidently.

How to Buy Cardano

Buying Cardano in the UK is far simpler than it used to be. You don’t need a technical background or financial qualifications. What matters is choosing a trusted platform, understanding the steps involved, and knowing how to protect your investment.

Start by finding a cryptocurrency trading platform that supports ADA. Not all UK brokers list it, so look for one that’s registered with the Financial Conduct Authority (FCA), has transparent fees, and offers a user-friendly interface. We’ll explore some of the top options shortly.

After choosing a platform, create an account and complete a standard ID check. Most ask for a copy of your passport or driving licence and proof of address, including a copy of a recent utility bill or bank statement. The process is usually quick and only needs to be done once.

You can deposit money using a UK debit card or bank transfer. Some platforms also accept PayPal or Apple Pay. Check the fees and expected processing times to avoid any surprises.

When your account is ready and funded, search for Cardano or ADA on the platform. You’ll see the current price. Enter the amount you want to invest, review the details, and place your order.

If you’re not planning to trade frequently, it’s best to transfer your ADA to a private wallet. Leaving funds on an exchange can expose you to unnecessary risk. We’ll cover the different wallet types in the next section.

Note: While the steps above will guide you in purchasing ADA, thorough research is crucial. This is so you can determine the best time to make a purchase. Remember, the cryptocurrency market is highly volatile. With prices constantly changing, you want to make informed decisions to maximise your chances of earning profits.

Best Brokers to Invest in Cardano in the UK

With more platforms now offering Cardano, choosing where to invest can be confusing. Many look similar at first, but differences in fees, usability, and storage options can matter, especially for beginners. Below are three well-known cryptocurrency trading platforms trusted by UK investors.

1. eToro

eToro has established itself as one of the go-to platforms for UK retail investors interested in both traditional markets and crypto. It supports a wide range of digital assets, including Cardano, alongside shares, ETFs, and commodities, all in one place. The platform is regulated by the Financial Conduct Authority and includes a built-in wallet for storing crypto.

eToro’s clean interface and social trading tools let users copy experienced investors, an appealing feature for beginners. It’s a useful way to learn, though you should understand the risks before following another trader’s moves.

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

- Has a simple interface, which is suitable for beginners

- It gives access to a range of assets beyond crypto

- Hosts copy trading tools for hands-on learning

- No commission on crypto (only spread applies)

- External wallet transfers require a separate process

- Charges a £5 withdrawal fee on each transaction

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

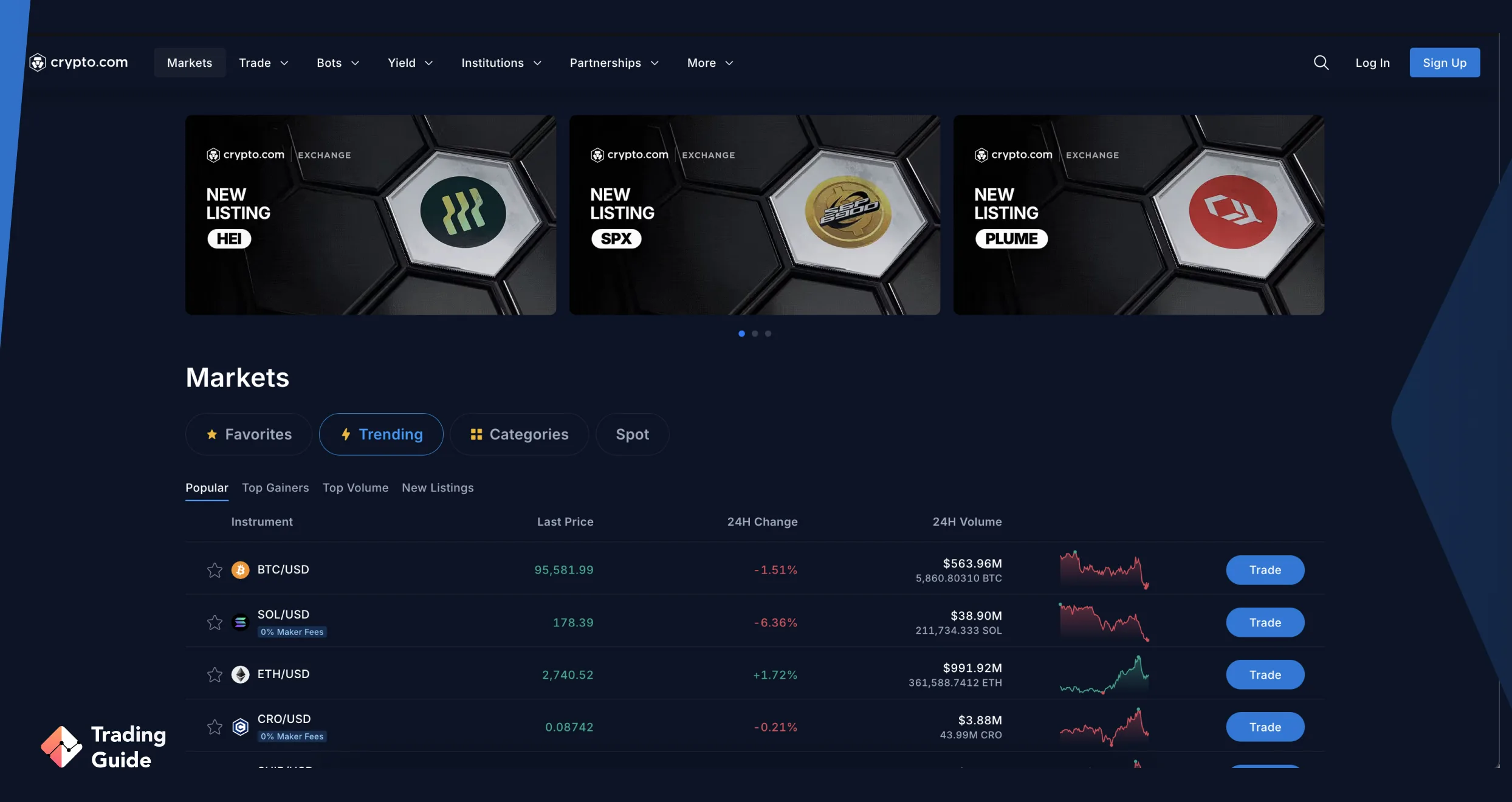

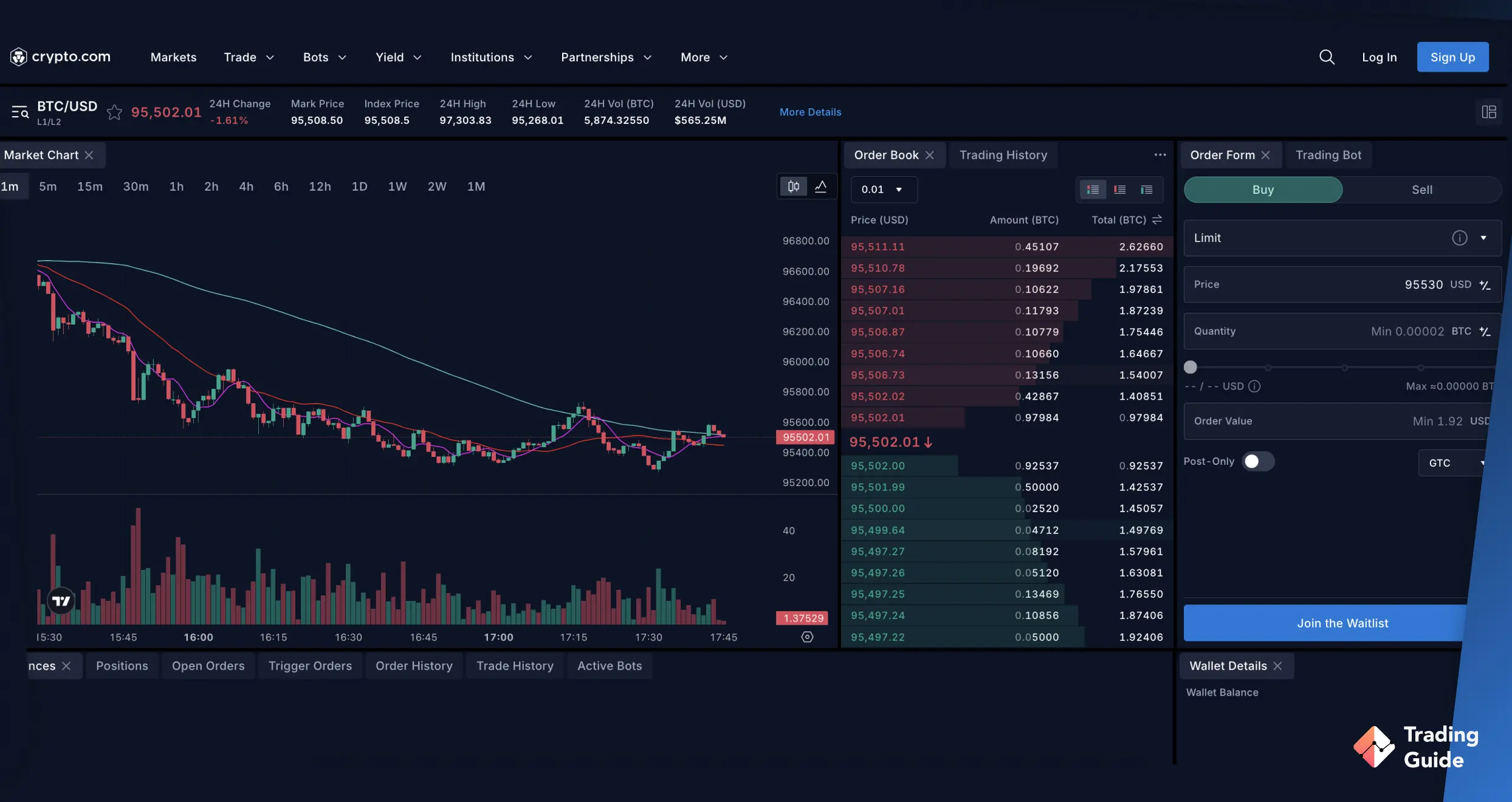

2. Crypto.com

Crypto.com is a fast-growing crypto-specific platform with a strong presence in the UK. It provides access to a wide selection of coins, including Cardano, and has gained popularity through its rewards programme, Visa card perks, and crypto cashback offers.

Its mobile app is designed for regular users and long-term holders. You can set up recurring buys, track prices in real time, and even earn interest on your holdings through staking and DeFi products. However, those who prefer desktop trading may find the experience a bit limited.

- Recurring buys are ideal for building a position over time

- It features built-in rewards and staking options

- Competitive fees on larger trades

- The desktop version is limited

- Some tools are locked behind verification levels

| Type | Fee |

| Minimum deposit | £1 |

| Deposit fee | No |

| Withdrawal fee | Depending on the crypto you trade |

| Maker fee | 0.04 – 0.20% |

| Taker fee | 0.10 – 0.20% |

| Inactivity fee | £5 |

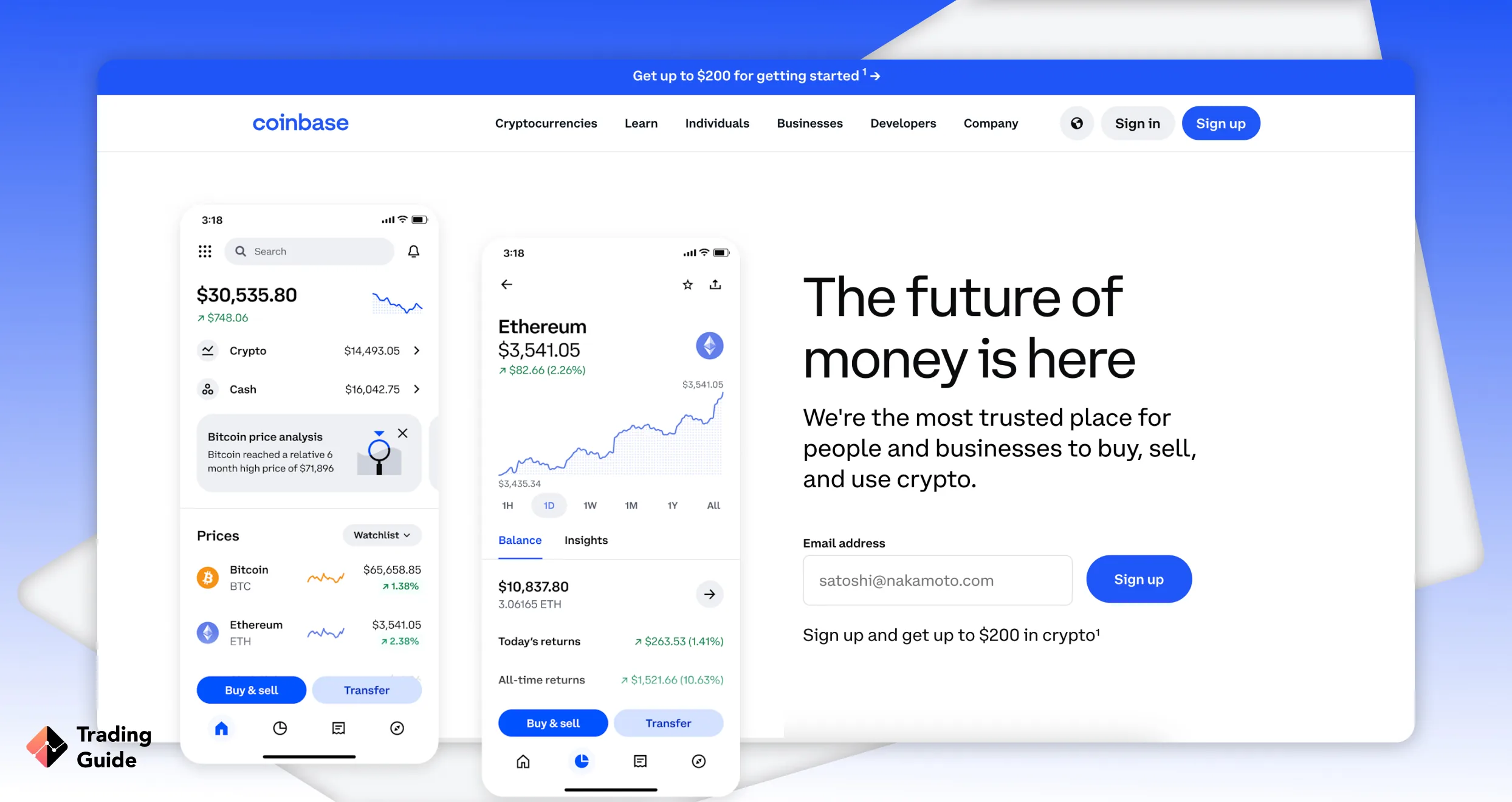

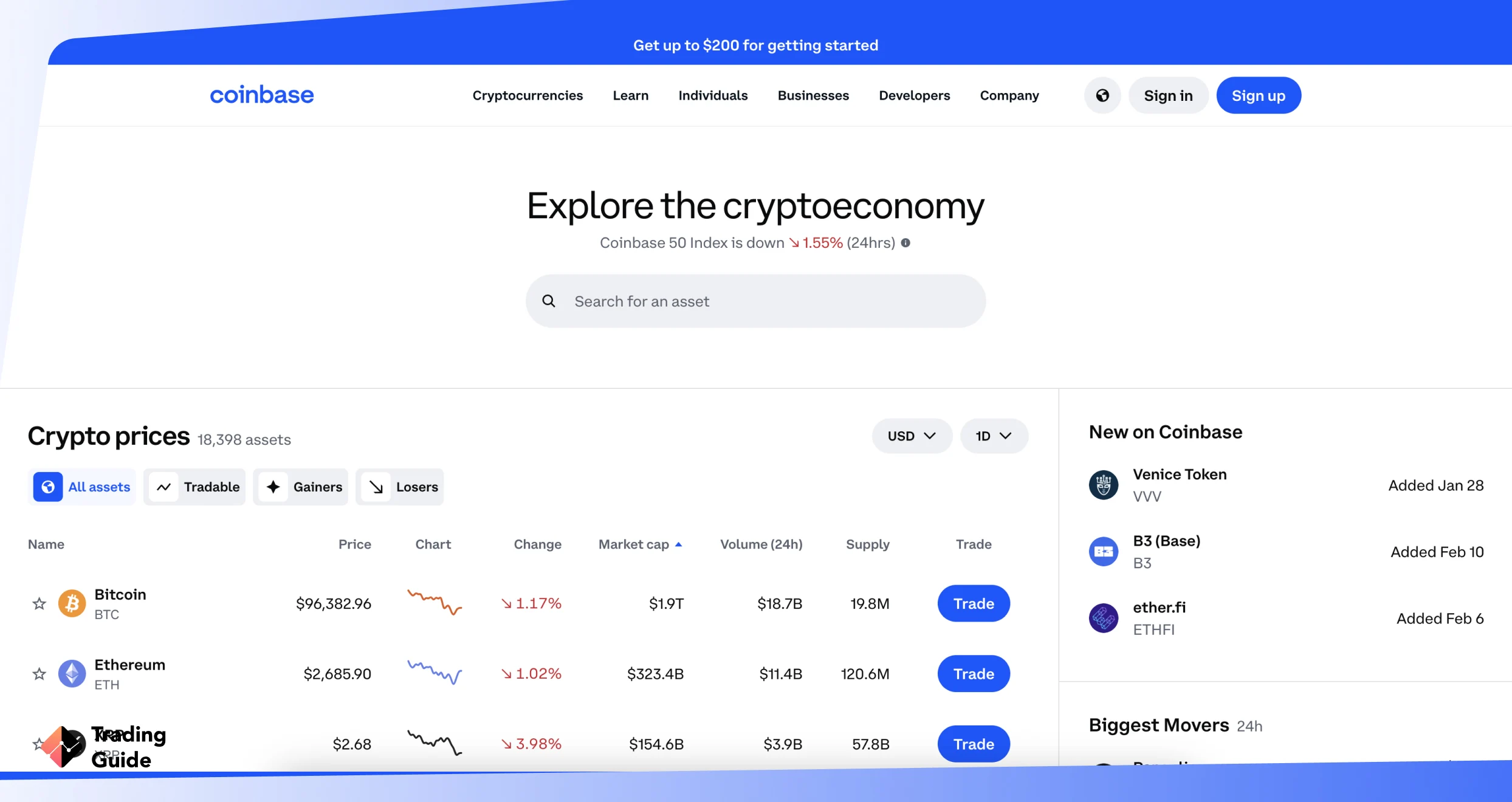

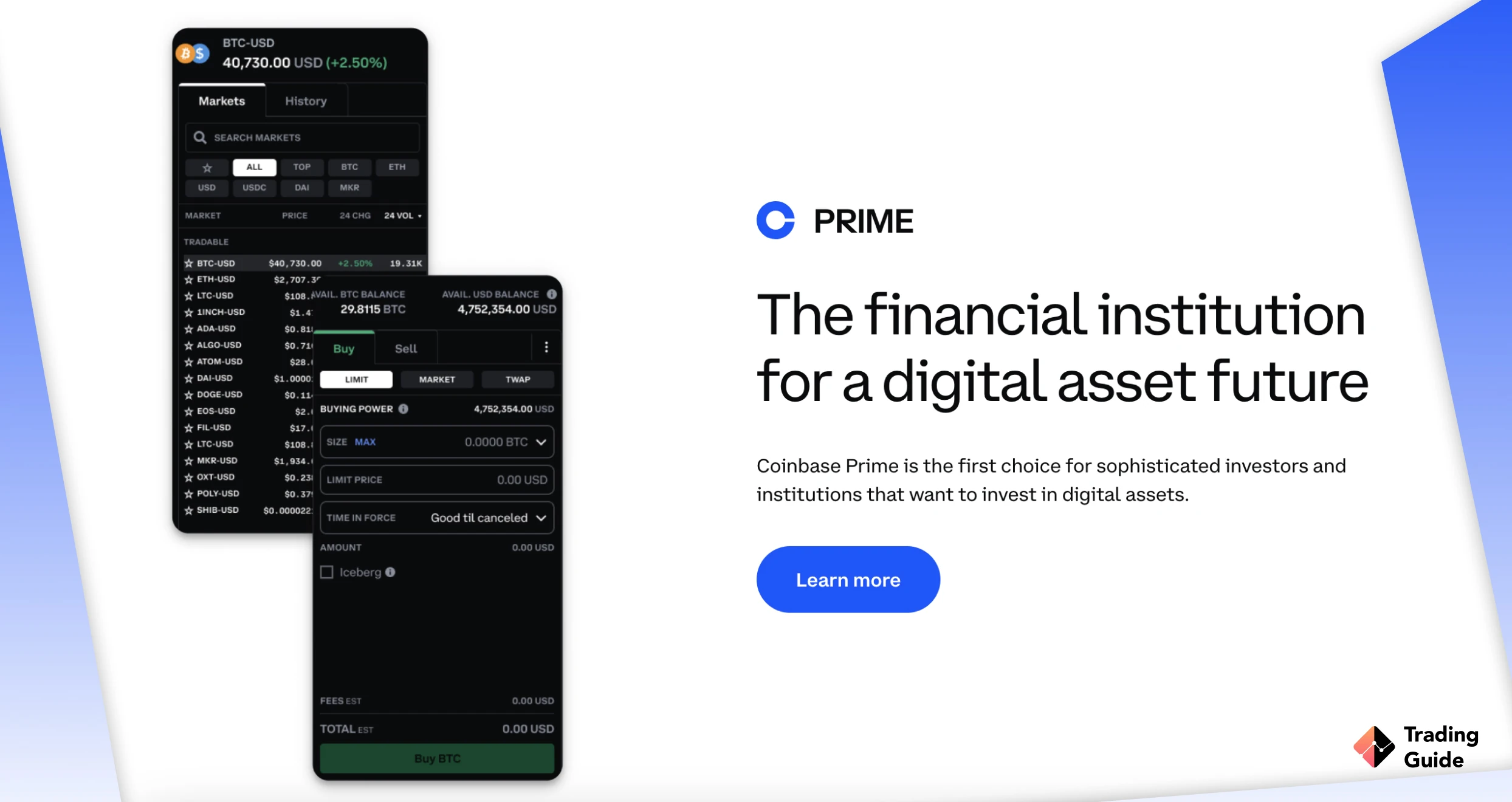

3. Coinbase

Coinbase is one of the most recognised crypto exchanges and remains a popular choice for beginners. UK users benefit from quick registration, local payment options, and a strong focus on security and ease of use.

A standout feature is Coinbase’s educational rewards. Users can take short tutorials on crypto, including Cardano, and earn small tokens in return, ideal for those who want to learn before investing.

That said, fees on the standard platform are higher than many competitors. For lower costs, users need to switch to Coinbase Advanced, which may feel less intuitive at first.

- Trusted name with strong security

- Has a fast account setup and supports local payment options

- Quality educational tools with small crypto rewards

- It charges higher fees unless using Coinbase Advanced

- Its fee structure can be unclear for small trades

| Type | Fee |

| Minimum deposit | $2 |

| Transaction fee | 1% |

| Credit transactions | 2% |

| Inactivity fee | Free |

| Maker fee | Yes |

| Taker fee | Yes |

Each of these cryptocurrency brokers offers a safe and user-friendly way to buy Cardano in the UK. Your choice will depend on how hands-on you want to be and whether you value mobile tools, advanced features, or multi-asset access.

About Cardano (ADA)

When engaging with cryptocurrencies, it’s crucial to recognise that these digital assets are characterised by their extreme volatility and speculative nature. This can result in swift and substantial price fluctuations. To safeguard your crypto holdings, it is imperative to utilise reputable wallets and exchanges, prioritising the security of your investments.

Also, exercise vigilance and due diligence to guard against crypto-related scams and fraudulent schemes that can potentially threaten your financial well-being. You can also spread your investments across multiple digital tokens and avoid making decisions based on emotions.

Cardano is a third-generation blockchain platform launched in 2017 by Charles Hoskinson, a co-founder of Ethereum. Built on peer-reviewed research, it adopts a careful, academic approach to development, prioritising long-term utility over short-term gains.

The platform supports decentralised applications and smart contracts, programs that run automatically when certain conditions are met. Its focus is on building a secure, scalable network with real-world use in areas like supply chains, digital identity, and finance.

ADA is Cardano’s native token. It’s used for transaction fees, staking, and network governance. If Bitcoin is digital gold and Ethereum a decentralised computer, Cardano aims to be infrastructure, a foundation for future blockchain development.

Cardano Price Today

Cardano trades around the clock, and like most cryptocurrencies, its price can shift quickly. ADA’s value typically ranges between £0.30 and £0.82, though this can change within hours depending on global demand, investor sentiment, and wider market trends.

Crypto is more volatile than stocks or bonds, with daily swings of 5 to 10 per cent. Beginners should approach with caution and only invest what they can afford to lose.

To see the most accurate value before buying, refer to the live Cardano price chart below. It updates in real time and reflects current market conditions.

How to Safely Store Cardano?

Once you’ve bought ADA, the next step is storing it securely. While most platforms offer built-in wallets, long-term holders often prefer to move their assets elsewhere for better control and protection.

These are apps you install on your phone or computer. Options like Yoroi (built for Cardano) and Exodus give you direct access to your crypto. They’re convenient for regular use but rely on the security of your device.

For long-term storage, hardware wallets are often the safest option. Devices like the Ledger Nano S or Trezor keep your crypto offline, away from most online threats. They cost around £50 – £100 and are ideal if you plan to hold ADA over time.

Some investors keep their ADA on the platform where they bought it. This is fine for short-term trades, but your funds may be at risk if the exchange experiences downtime or a breach. You also don’t control the private keys.

If you’re not trading frequently, it’s safer to move your ADA to a personal wallet. It gives you more control and reduces the risk of unexpected issues with the platform.

Risk Management in Crypto Investing

Like all cryptocurrencies, Cardano can be highly volatile. Sharp price swings are common, which adds both excitement and risk. For beginners, a careful approach is essential.

Here are a few key principles:

- Start small: Only invest what you’re prepared to lose. Small early trades can help you learn how the market behaves without taking on too much risk.

- Use limit orders: Instead of buying at the current market price, set a price you’re willing to pay. This helps you avoid overpaying during sudden spikes.

- Avoid overexposure: Diversify your crypto holdings rather than putting everything into ADA. Spreading risk across assets can help protect your portfolio.

- Secure your data: Use strong passwords, enable two-factor authentication, and never share your wallet recovery phrase.

- Stay calm under pressure: News and social media can fuel panic or hype. Stick to your strategy and avoid reacting emotionally.

Investing in crypto puts you in charge. Managing risk is just as important as choosing when and what to buy.

FAQs

Yes. Cardano is legal to buy and hold in the UK. While it isn’t considered legal tender, it’s treated as a digital asset. Any gains may be subject to Capital Gains Tax, so it’s worth keeping clear records.

Not necessarily. Most platforms include a built-in wallet. But if you’re holding ADA for the long term, using a private wallet offers more control and better security.

No. Cryptocurrencies are not allowed in Stocks and Shares ISAs or SIPPs under current HMRC rules. You’ll need to invest through a regular trading account.

That depends on your goals and risk tolerance. Cardano can be volatile, and timing the market is rarely easy. A steady, long-term approach often proves more effective.

Conclusion

Buying Cardano is now straightforward, but a clear plan matters just as much as access. Whether you view ADA as a tech investment or a short-term trade, the key is to stay informed and manage your risk.

Choose a regulated broker, store your assets securely, and invest only what you’re comfortable risking. In crypto, control brings opportunity and responsibility.