I first heard of Chia in 2021, when this crypto shattered records by breaching the £1,000 mark and made headlines. I researched the crypto and realised it is associated with one of the most reputable gurus in the world of crypto investing, Bram Cohen. Additionally, it’s built on a blockchain that utilises one of the most sustainable and eco-friendly mechanisms available today, PoST.

Since discovering Chia coin’s unique features and specifications, I’ve consistently followed and invested in this cryptocurrency. If you’ve just found this asset, I’ll guide you through how and where to buy it in this guide. I’ll also introduce you to other indispensable aspects, from what Chia is to whether it’s a good buy.

How to Buy Chia Coin: Step-by-Step

When engaging with cryptocurrencies, it’s crucial to recognise that these digital assets are characterised by their extreme volatility and speculative nature. This can result in swift and substantial price fluctuations. To safeguard your crypto holdings, it is imperative to utilise reputable wallets and exchanges, prioritising the security of your investments.

Also, exercise vigilance and due diligence to guard against crypto-related scams and fraudulent schemes that can potentially threaten your financial well-being. You can also spread your investments across multiple digital tokens and avoid making decisions based on emotions.

I often buy and sell Chia on different platforms to take advantage of slight price differences. While purchasing this cryptocurrency from different service providers over the years, I noticed that the process is quite similar and straightforward. Here’s a boiled-down version:

To buy Chia, you must have access to a broker that offers this crypto. Most of the service providers in the UK don’t have it, so don’t sign up without checking availability. I also recommend checking the regulatory status and reputation of every broker. Only trust companies that are authorised and regulated by credible authorities. Also, read as many reviews and testimonials as you can before signing up.

I place utmost importance on choosing a regulated and reputable broker, as many unscrupulous providers are out there. If you’re not keen, you might register on a platform that will steal your money and data, or expose you to costly and frustrating issues, such as high fees and poor support. Avoid such problems by signing up with one of the credible, licensed brokers I’ve recommended in this guide.

Visit your chosen broker’s official website to sign up. Before you take the first step, explore the site and its offerings. Double-check Chia’s availability and vet the range of the other supported assets. Check if everything you need to build your portfolio is available. If you’re all set, hit the registration button.

Your broker will ask you to sign up with your personal details, including your name, email address, and phone number. Share correct information and set up a strong password for your investment account. Also, read the terms and conditions print thoroughly. Never trade with a site without a clear idea of the binding rules it has, like withdrawal and account closure policies.

I always recommend regulated brokers, and they have mandatory KYC. Regulators require service providers to verify the identity and address of every new client. KYC is compulsory because it helps authorities and brokers curb issues such as money laundering, fraud, and identity theft.

To complete KYC and get access to a verified account, you’ll need specific documents. Most of the providers I’ve encountered and used ask first-time users to verify identity with a valid passport, driver’s license, or national ID. They also demand proof of address documents, such as copies of recent bank statements or utility bills. Without completing KYC, you might have access to your chosen trading site, but you’ll be unable to fund your account, trade, cash out, etc.

Verification might take anywhere from a few minutes to hours. If it takes too long, please contact your broker’s support. After successful verification, you can proceed to funding. Review the list of supported payment methods and select the one that best suits your needs. Consider factors such as minimum deposit requirements, transaction fees, and processing times.

The amount you deposit should align with your budget and financial goals. If you’re a newbie, I recommend starting with less than 20% of your total income. Crypto prices often experience wild swings, so never risk more than you can afford to lose.

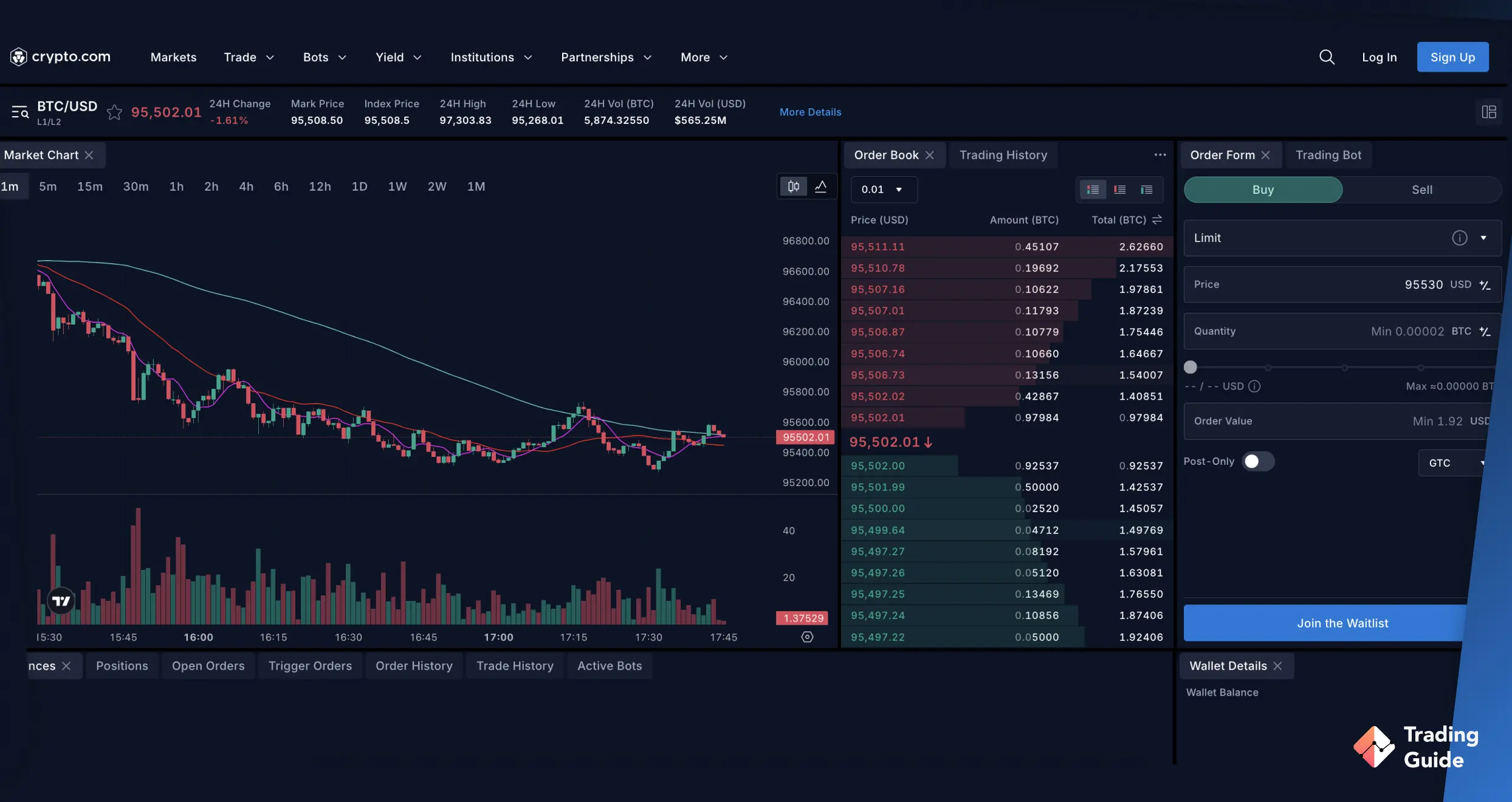

Buy Chia and either keep it in your exchange account or move it to an external wallet. You can either purchase your crypto at the going rate via a market order or use a limit order to buy when prices drop below a certain level. If you want to make an instant purchase, I recommend using the market order option.

After your first buy, Chia should appear in your wallet. If you plan to hold this crypto for a long time, consider moving it to an external non-custodial wallet, where you’ll have complete control over everything, including your private keys. I urge investors who plan to buy large amounts of Chia to stick to top-tier hardware wallets like Trevor.

Best Brokers to Invest in Chia Coin in the UK

I’m here to help you find the most reliable and trustworthy broker. I vetted countless providers based on Chia availability, licensing status, and reputation. I also factored in costs, support quality, and asset variety. After researching and testing the available options, I picked the best of the best: Crypto.com and HTX.

HTX

HTX is a leading cryptocurrency exchange platform that has gained a strong reputation for offering seamless trading services to UK-based traders and investors. The broker offers traders a user-friendly interface, advanced trading tools, and exceptional customer support. Its platform also allows users to buy Chia coins using various payment options, including bank transfers, credit cards, and crypto deposits.

I also recommend Chia because, besides XCH, its users have access to hundreds of other crypto assets, from BTC, ETH, and HTX to TRUMP, ADA, and SOL. In addition, HTX offers competitive trading fees, thereby attracting traders seeking to maximise their profits on a limited budget.

While investing in Chia and other assets on HTX, you will be protected by robust security measures. The platform utilises advanced security protocols to safeguard users’ assets and personal information against cyber threats. Its users also enjoy unique offerings such as P2P trading, OTC loans, and staking rewards. This exchange is licensed and authorised by authorities in multiple jurisdictions, including Lithuania, Dubai, and South America.

- 700+ digital assets, including Chia coin

- User-friendly and intuitive design platform

- Mobile app available on Google Play and the App Store

- Reasonable staking rewards

- P2P, spot, and margin trading are supported

- Limited support channels

- High fees for low-volume crypto trades

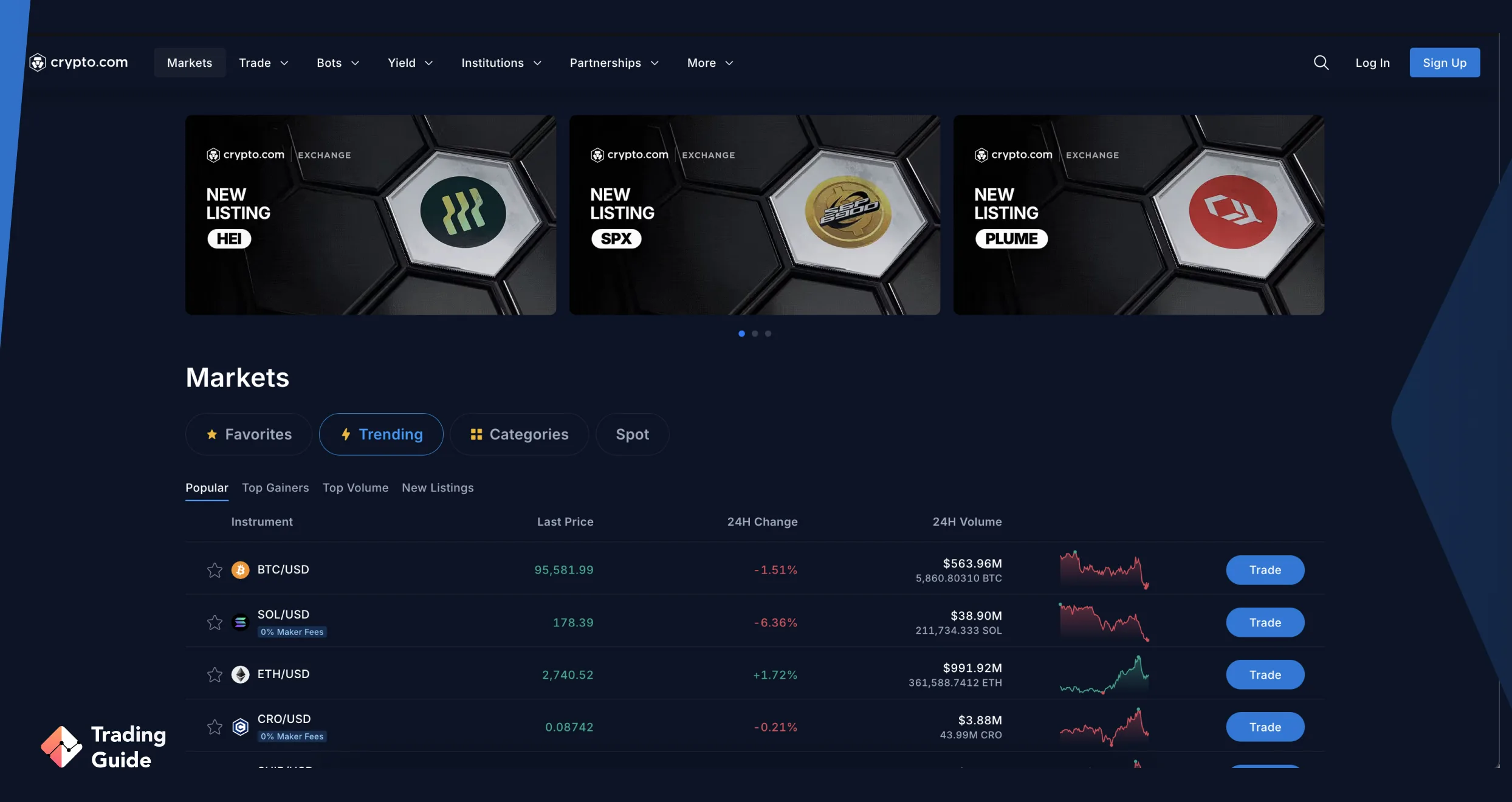

Crypto.com

FCA-licensed Crypto.com is one of the most popular exchanges worldwide. I strongly recommend it to both novices and experts due to its design and offerings. The platform has a user-friendly, stylish UI that first-time users can navigate without any difficulties. Individuals who like trading on the go will find the broker’s IOS and Android apps indispensable, courtesy of features like easy buy, send, swap, stake, and more.

Chia is available on Crypto.com, but it’s not the only asset offered by the platform. After signing up, you’ll also have access to over 400 unique cryptocurrencies, including BTC, XRP, and ETH. You also get the chance to swap 10,000 tokens on different chains and earn juicy rewards from staking assets like Solana, USD Coin, and VVS Finance.

I also consider Crypto.com a premier provider since it offers unique crypto cards to its users. These items streamline shopping, allowing crypto enthusiasts to spend their cryptocurrency at millions of global merchant shops and earn cashback. You can also withdraw up to £10,000 per month at ATMs in the UK with any Crypto.com card, including entry-level options such as Midnight Blue and Ruby Steel.

- Licensed and authorised by the FCA and other tier-1 authorities

- Chia investors also have access to hundreds of other cryptocurrencies

- Offers crypto cards for streamlined ATM withdrawals and shopping

- Users can swap 10,000+ tokens

- Incentives staking with up to 212.10% p.a. in rewards

- Limited support channels for entry-level users

- High fees for credit and debit card purchases

About Chia (XCH) Crypto

As mentioned earlier, Chia cryptocurrency (XCN) is a relatively new digital currency launched in 2021. It was created in 2017 by Bram Cohen, the founder of the popular BitTorrent file-sharing protocol. Chia was designed as an eco-friendlier alternative to other cryptocurrencies, such as Bitcoin, which require a significant amount of energy to mine.

Instead of using a Proof of Work (PoW) consensus algorithm, Chia uses a Proof of Space and Time (PoST) algorithm, which allows users to “farm” or create new coins by allocating unused hard drive space instead of processing power. That makes Chia more accessible and sustainable while still providing a secure and decentralised platform for transactions.

Chia has gained popularity in recent years due to its unique approach to mining and its potential as a long-term investment. Its focus on sustainability has also attracted the attention of environmental advocates who are concerned about the energy consumption of other cryptocurrencies. As with any investment, it’s essential to do your own research and carefully consider the risks before investing in Chia. However, with its innovative technology and growing community, Chia is undoubtedly a digital currency to watch in the years to come.

Chia Price Today

I can’t give you a definite, up-to-the-minute Chia price because, like any other cryptocurrency, this is highly volatile and subject to rapid fluctuations, but you can use our chart above. In other words, the value of 1 XCH can fluctuate by a significant margin in seconds. That said, the price of 1 Chia coin has been going for less than £50 since mid-2022.

I have included a live chart below that displays the current value of the token, as well as historical data. It will help you identify your investments’ best entry and exit points and track the token’s performance over time. Remember that past performance does not indicate future results, and it’s essential to do your own research and make informed investment decisions.

Is Chia a Good Coin to Buy?

As a seasoned expert, I consider Chia a good buy for several reasons. The network and coin are associated with one of the most respected names in the cryptocurrency space, Bram Cohen, who is also credited with founding BitTorrent. Rest assured, you won’t be exposed to issues that are often associated with shoddy digital assets, including sudden collapses and rug pulls.

I also recommend Chia because it’s more eco-friendly than many popular alternatives, including Bitcoin. This crypto’s core consensus mechanism is Proof of Space and Time (PoST), which is more energy-efficient than Proof of Work (PoW). Note that this cryptocurrency has low liquidity compared to options like BTC and has yet to regain the momentum it achieved in 2021 when it breached the £1,000+ threshold.

How to Store Chia?

Buying XCH is one part of the equation; the other involves storage. You have to keep your crypto in a safe digital wallet where it can’t be stolen. If you want to avoid unnecessary hassles or are new to crypto investing, you can leave your Chia coins on your exchange account. But remember to optimise safety and security with as many credentials as possible, with a strong password and 2FA at the top of the list.

You can also purchase Chia on your preferred exchange and then use an external wallet for storage. The options at your disposal are many and varied, from the official Chia wallet to hardware and third-party wallets. When selecting the best solution for you, consider key factors such as security, compatibility, and reputation. If you’re a novice, prioritise ease of use and beginner-friendliness.

FAQs

XCH’s current uses include paying transaction fees on the Chia Network and incentivising people who participate in Chia farming.

The price of Chia, like any other cryptocurrency, can be affected by various factors, including market sentiment, global economic conditions, and regulatory changes. In the case of Chia, its price has been affected by concerns about the scalability of the Chia blockchain and the potential for centralisation due to the high hardware cost required for farming.

Chia mining is no longer as profitable as it used to be for a variety of reasons, including massive network growth, falling XCH prices, and high hardware setup costs.

Chia was created by Bram Cohen, the founder of the popular BitTorrent file-sharing protocol. However, Chia is a decentralised cryptocurrency, meaning ownership is distributed among its users and stakeholders. The Chia Network, which is responsible for the development and maintenance of the Chia blockchain, is governed by a community of users and developers.

Bitcoin, the dominant store of value in the cryptocurrency space, relies on PoW (Proof of Work). Its counterpart, Chia, uses a much greener alternative known as PoST (Proof of Space and Time).

Expert Opinion

Chia is not like most of today’s cryptos that focus on virality and short-term pumps. This is a grounded digital asset that relies on one of the most eco-friendly consensus mechanisms today. I recommend investing in this crypto, but before you do, research its perks and risks. Additionally, note that this cryptocurrency is still in its infrastructure phase and has yet to become an asset that can be used in day-to-day life. Widespread adoption might take time, but I believe it will happen someday.