Rolls-Royce is one of the world-renowned engineering, aerospace, and defense companies that has been around for over a century. Rolls-Royce’s continued growth throughout the years has attracted investors looking to buy or sell Rolls-Royce shares. The shares are listed on the London Stock Exchange under the ticker LON: RR and trading Rolls-Royce shares is an excellent investment opportunity.

If you are looking for ways to buy/sell Rolls-Royce shares, this guide will walk you through all the steps. You will also get to know more about the company and what makes Rolls-Royce stock an attractive investment. On top of it, we also recommend the top three stock brokers to get you started.

Top 3 Brokers for Buying/Selling Rolls-Royce Shares

Investing in the shares of Rolls-Royce is easier when using an online stockbroker with access to the London Stock Exchange, where Rolls-Royce stock is listed. Trading with an online broker also allows you to trade Rolls-Royce stock off the exchange as CFDs or indices. Fortunately, we have reviewed the top three brokers that we believe will maximise your potential. Our experts chose them based on their reputation and the services they provide. Take a look below.

1. eToro

eToro is a social and copy trading broker that allows investors to buy Rolls-Royce shares commission-free. Founded in 2006, the broker serves millions of active traders every day — a clear indication of quality service. Its easy-to-use interface with excellent trading tools for investing in Rolls-Royce shares makes it perfect for all types of traders.

To buy shares in Rolls-Royce, a minimum deposit of $100 will be required by eToro. Making deposits is free of charge* but you will pay fees for withdrawal depending on the payment method you are using. eToro also charges high spreads and access to the copy trading platform requires a minimum deposit of $200, which can be costly for most traders.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

- eToro’s social and copy trading features allow users to connect and copy positions of successful traders

- Over 3000 asset offerings, including additional global stocks, cryptocurrencies, ETFs, and more for portfolio diversification

- A user-friendly platform, making it easy for beginners to navigate and place trades

- eToro’s fees can be higher than other brokers’, especially for trading stocks.

- Limited research tools compared to other brokers like IG Markets

2. IG Markets

IG Markets is a well-known broker that has been operating for more than 40 years. The broker has an easy-to-use interface that makes Rolls-Royce shares accessible even if you’re new to trading. Additionally, Rolls-Royce shares are traded as CFDs commission-free. And on top of it, you get to experience some of the quality platforms, including MT4, ProRealTime, and L-2 Dealer. These platforms host outstanding trading tools for research and skills development.

Unfortunately, trading shares in Rolls Royce require a minimum deposit of £300, which most traders consider high. You should also be an active trader to enjoy IG Markets since it charges a subscription fee should you fail to trade at least three times within three months.

Your capital is at risk

- Wide range of assets, including additional global shares to trade as CFDs or indices

- Advanced research tools for technical and fundamental analysis

- Regulated by the FCA

- High fees for Rolls Royce share trading

- High minimum deposit requirement

3. Plus500

Plus500 is another stockbroker that allows investors to buy or sell Rolls-Royce shares commission-free as CFDs. Its spreads are also low with zero transactions for deposits and withdrawals, attracting budget conscious traders. Additionally, you only need to deposit £100 to access Rolls-Royce shares. All trading activities are conducted on an easy-to-use interface that hosts adequate trading tools.

Unfortunately, you cannot trade Rolls-Royce stock as physical assets, instead you trade them as CFDs. Additionally, Plus500 charges fees for overnight positions and its single proprietary platform limits traders looking for advanced features. It also has a $10 monthly inactivity fee that starts to accumulate after three months of no account activity. The broker also charges currency conversion and stop-order fees.

- Low spreads starting from 0.0 pips on stock trading. There are no commissions

- User-friendly platform that is easy to navigate, making it a good choice for beginners

- Plus500 offers a superior mobile app, allowing you to access your share trading account from anywhere

- Limited asset offerings compared to its peers

- A single proprietary platform that doesn’t feature plenty of advanced tools suitable for professional share traders

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How to Trade Rolls-Royce Shares With eToro?

eToro is a good option for trading Rolls-Royce shares because there are no commissions and you also get to trade the shares as CFDs and indices. The broker is also easy to use, so it’s perfect for investors who want to trade Rolls-Royce with minimal effort. Let’s take a look below at the step-by-step procedures for buying or selling Rolls-Royce stock with eToro.

The first thing you’ll need to do to trade shares in Rolls Royce is open a trading account with eToro. This means you will have to visit the broker’s website by clicking on the links provided on this page. Before you get started, ensure you understand and agree to eToro’s terms and conditions.

Once you fully understand what it means to trade with eToro, you will sign up for a trading account. The broker will request for your personal details, including name, phone number, email, source of income information, and more. You will also be required to create a username.

eToro usually selects the best trading package for you and in this regard, you will be required to complete a basic knowledge test. The results from the test will determine a suitable trading package based on your skills level.

In addition, eToro allows CFD trading which involves trading with leverage. Leverage trading is risky and if you are not keen, you might end up with huge losses. For this reason, you will also complete a margin trading test to determine a suitable leverage limit. Simply put, the basic knowledge and margin trading tests are there to protect you and ensure you enjoy your experience.

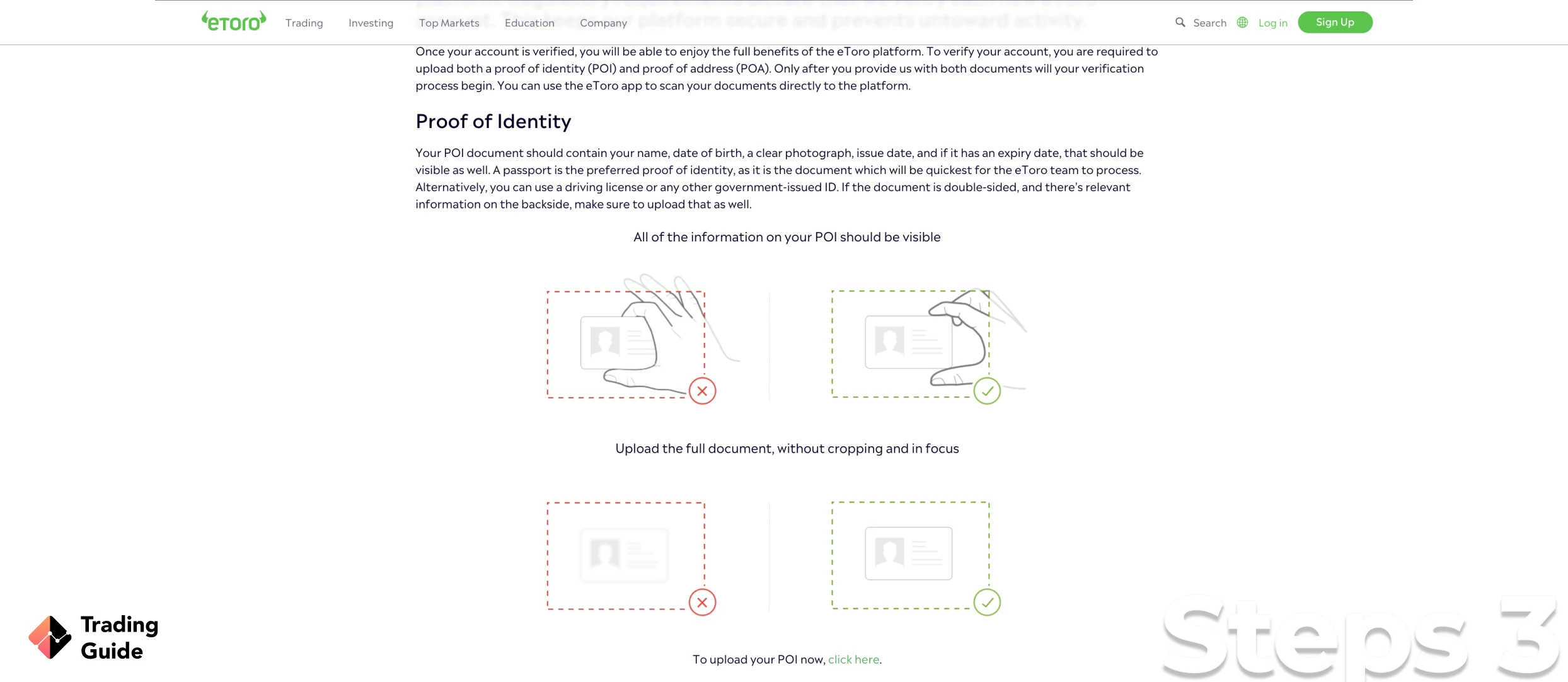

One of the regulations put in place by the Financial Conduct Authority (FCA) is to have brokers verify traders’ identities as a way to protect their accounts and keep off individuals with fake identities. Since eToro is one of the brokers regulated by the FCA, it will require you to share a copy of your ID card or passport to prove your identity. You will also be requested to upload a copy of a recent utility bill or bank statement to verify your area of jurisdiction.

Once your account is fully activated and you have received a notification via email, it’s time to deposit money into the trading account and trade shares in Rolls Royce. With eToro, only a minimum deposit of $100 will be required which you will deposit free of charge*. The good news is that there are multiple options for funding the account, including bank transfers, or debit cards.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

Once you’ve funded your Rolls Royce trading account, you will access the London Stock Exchange where Rolls Royce stock is listed to complete your purchase. Click on the market section of eToro and select “buy”. You will then type in how much money you’d like to invest in Rolls Royce stock before confirming the purchase order. eToro charges a 0% commission on Rolls Royce trades, but you still have to budget accordingly since the spreads are relatively high.

Alternatively, eToro allows trading of Rolls Royce shares as CFDs and indices whereby multiple stocks are listed in a single investment.

Tips on How to Choose the Best Stock Broker to Buy/Sell Rolls-Royce Shares

Many companies in the UK claim to offer brokerage services to traders looking to buy or sell shares in Rolls-Royce. However, how do you identify the best among the pool of stock brokers? Well, the following tips will help you choose the best Rolls-Royce stockbroker to build your portfolio.

Any broker that guarantees the security of your trading funds is worth considering. Therefore, the stock broker of your choice should be regulated by the Financial Conduct Authority. Not only do such brokers keep your trading funds safe in a segregated account, but they also offer the best trading conditions to ensure you have the best experience.

For starters, the best stock broker for trading shares in Rolls Royce should provide access to the London Stock Exchange where you will trade the shares. If the broker does not allow purchasing of Rolls Royce stock as a physical asset, it should at least let you trade the shares as derivatives. You can also consider brokers with additional trading assets like forex, commodities, ETFs, and more to diversify your trading portfolio.

Other than offering Rolls Royce shares, you want a broker that will give you the best experience. For this reason, check the performance of its platform and see if it is fast in executing trades. The platform should also support you with adequate tools that will be valuable in strategy development. There should also be a demo account, just in case you want to test how a broker works or want to practise share trading before moving into the real market.

Generally, trading is challenging and you need a broker that offers support, especially when you encounter trading issues and need help resolving them. The best way a broker can show support is by hosting a responsive customer service that offers relevant solutions when contacted. However, you must ensure they are reachable during flexible hours and days.

The cost associated with trading Rolls Royce shares vary widely. Hence, it’s important to compare fees before deciding which investment option would be right for you. Look at margin rates and other charges like commissions and spreads to see how much the investment will cost you. Also, make sure there are no hidden fees.

The Rolls Royce stock broker should have a positive reputation in the Rolls Royce stocks trading community. Read through customer reviews to see if other investors are satisfied with their services. Look for comments about the ease of use, level of security and overall satisfaction when choosing an investment firm. To sample user reviews and comments, feel free to visit Google Play, the App Store, and Trustpilot.

Rolls-Royce Shares Price Today

Rolls-Royce shares are traded on the London, New York and Frankfurt stock exchanges. The company is currently valued at over £10 billion with a share price of around £129 as of December 7th, 2021. The live chart below shows the current Rolls-Royce share price, which you can use to track the company’s performance. With this chart, you will also be able to find additional data that are crucial in strategy development.

About Rolls-Royce

Rolls-Royce Holdings PLC is one of the world’s leading high technology, defence and engineering solutions. Rolls-Royce was founded in 1904 by Henry Royce and Charles Stewart Rolls under their original name -The Rolls-Royce Company Ltd. However, after several mergers with other notable UK businesses, it became what we know today as Rolls-Royce.

This company has three main subsidiaries, including Rolls-Royce Power Systems, Rolls-Royce Aero Engines, and Rolls-Royce Marine Propulsion. Rolls-Royce is currently involved with several projects, including the T45 engine used in the Lockheed Martin F-35 Lightning II Joint Strike Fighter. The company has also partnered up with Airbus to build engines for their new fleet of A320neo aircraft. This shows the company has a high growth potential and investing in its shares could pay off in the long run.

The Rolls-Royce group employs over 50,000 people worldwide and it’s one of the UK’s most notable brands as well as a world leader in the aerospace and defence industry. Its current CEO is Warren East, who took over the leadership in July 2015.

FAQs

Yes. Although Rolls Royce share price has been on the decline in recent years, its current market standing shows it has a growth potential. Therefore, investing in Rolls Royce stock now may earn you good profits in the long run.

Causeway Capital Management LLC is currently the majority shareholder of Rolls Royce with a 7% stake in the company. Rolls Royce shareholders are mainly large-scale financial institutions, including banks and investment groups.

Yes, Rolls Royce does offer dividends. Rolls Royce current annual yield makes it an excellent choice for investors looking to generate passive income. This makes Rolls Royce stock an even greater long-term investment choice.

Rolls Royce stock offers its shareholders a bi-annual dividend excluding the specials. The company’s dividend cover is usually at about 1.9, which is great news for potential investors.

Yes. BMW now owns Rolls Royce after the German car manufacturer bought it in 1998. The Rolls Royce brand belongs to BMW AG and is part of their luxury product portfolio, including brands such as BMW and Mini. BMW was able to purchase Rolls Royce Mini and Bentley Motors Ltd.

Yes, Rolls Royce plc is a UK-registered company. They are currently headquartered in central London and have over 50,000 employees, with most based out of their manufacturing plants located across Europe (including Germany & Switzerland).

Conclusion

If you’re looking to invest in a long-term, stable and reliable company, then Rolls-Royce is the perfect choice for you. The company’s stock has been rising for many years and tends to increase even more in times of geopolitical instability due to increased defence spending. Rolls-Royce dividends are also some of the highest returns available right now, making them an ideal choice for passive income seekers.

The stock’s volatility has been steadily declining and is expected to continue as the company further stabilises. This makes Rolls-Royce stock an ideal choice for those looking to invest in something that will grow over time without taking huge risks.