British Airways is one of the most popular companies in the UK that has managed to survive various challenges, including the 2020 COVID-19 pandemic. Being in the airline industry — one of the growing sectors, every investor in the UK wants a stake in the company. The good news is that buying shares of British Airways is easy, although you will not find the shares listed on any exchange. This is because the company is a subsidiary of the International Airlines Group (IAG), and you can only get exposure to it by investing in IAG stocks.

Below, we explain in detail how to invest in British Airways and list some of the top brokers in the UK to invest with. In addition, we give you a brief history of the company and more so you can decide whether now is the right time to make a move.

Top 3 Brokers for Investing in British Airways

As mentioned above, British Airways is owned by IAG. Therefore, to invest in its shares, you need a stock broker with access to the London Stock Exchange (LSE) where IAG stocks are listed under the symbol IAG. The best element about investing using stock brokers is that they allow you to trade British Airways stocks off the exchange. This means trading IAG shares as CFDs, indices, or spread betting.

Sadly, there are many stock brokers in the UK with varying features, making it challenging for investors to find the best for their needs. We will guide you on essential tips to consider when selecting a stock broker for investing in British Airways. But first, here are our top three recommendations based on multiple tests and comparisons.

1. eToro

eToro features various elements that make it an excellent stock broker for investing in British Airways. For instance, the broker is user-friendly and hosts an intuitive design and customisable platform for all types of traders and investors. Additionally, it features social and copy trading for maximum experience since you get to connect with other stock investors globally.

When it comes to hosting British Airways shares, eToro offers access to the London Stock Exchange, where you will invest in the stock of IAG. All you have to do is register for an account and deposit at least $100 to get started. The broker also allows you to trade IAG stock as CFDs. You can also invest in the FTSE 100 index that lists the stock of IAG and more to minimize the risks of losing money in a single investment. If you are looking for additional asset classes for portfolio diversification, eToro lists cryptocurrencies, commodities, forex, etc, to choose from. Keep in mind that eToro offers commission-free stock investing but its spreads are relatively high.

2. Plus500

*Illustrative prices

Plus500 popularity goes beyond the UK market since it is trusted by millions of users globally. The best element about this broker is that it is affordable, thus giving low-budget traders an opportunity to invest in British Airways. Moreover, Plus500 is highly rated as one of the best for mobile trading. You can download its trading app from Google Play or the App Store to trade on the go.

With Plus500, you can only invest in IAG shares as CFDs or indices as CFD with as low as £100 as the minimum deposit. Additional 2000+ assets are offered for portfolio diversification, including more popular stocks, forex, commodities, cryptocurrencies, etc. When it comes to trading charges, Plus500 is affordable and highly recommended to low-budget CFD traders. There are no commissions, and spreads are also low. Plus, deposits and withdrawals are done free of charge.

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

3. IG Markets

IG Markets is another broker to consider if you want to invest in British Airways by purchasing the shares of IAG. We primarily recommend this broker to advanced CFD and indices traders since it features advanced resources that could be helpful in maximizing your experience. Unfortunately, IG Markets does not have access to the LSE, so you cannot use it to purchase IAG stock. Plus, the broker has a high minimum deposit requirement of £300, and its charges are also high for low-budget traders.

Besides investing in British Airways, IG Markets hosts additional 17,000+ assets across diverse markets. Furthermore, it offers plenty of research tools, learning materials, and advanced platforms (L-2 Dealer, MT4, and ProRealTime). Like eToro, IG Markets hosts an IG Community platform where you will meet like-minded traders and share trading ideas to improve your experience. However, note that you must be an active trader to fully benefit from IG Markets since a quarterly subscription fee of £50 will be imposed should you fail to trade at least three times within three months.

Your capital is at risk

How to Buy British Airways With eToro

Buying British Airways stock is easy with the right broker in your corner. You should also be familiar with how the stock market works to develop solid strategies to maximise your potential. The above stock brokers are excellent choices to get you started, so compare their features to choose the one suitable for your trading or investing needs.

If you are a newbie, we take you through the procedures involved in purchasing the shares of British Airways below. We will use eToro as an example since this process is the same for all FCA-regulated stock brokers.

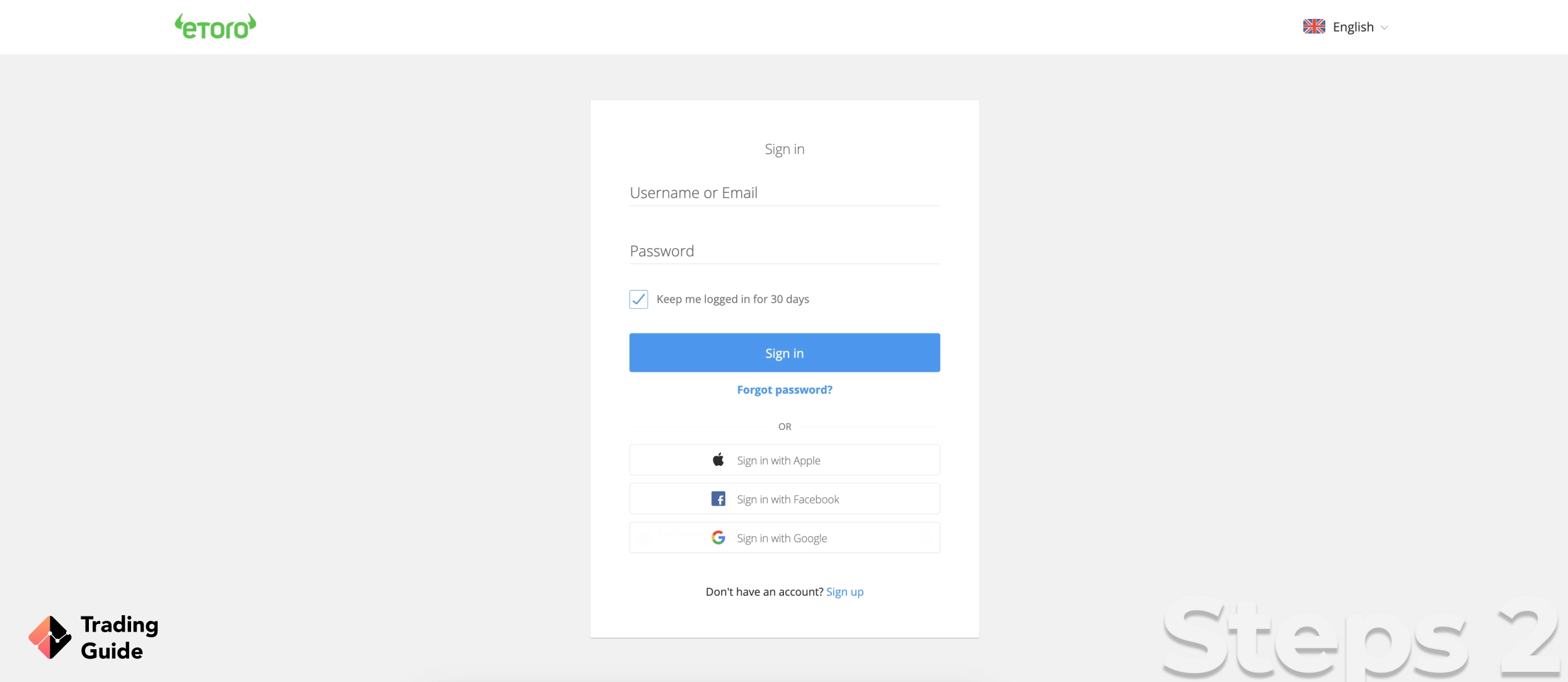

To create an account and invest in British Airways, you must go to eToro’s website. You can click on any of the links we’ve shared on this page for quick access. Before creating an account, ensure you go through the broker’s terms and conditions and agree to them. Also, download and install its trading app on your mobile device if you are always on the move to streamline your investment activities.

Once ready, click “join now” to begin the account registration procedure. With eToro, registration requires that you share your personal details, including your full name, email, location, address, phone number, etc. You will also be required to provide information about your income, create a username and password.

To ensure you enjoy your experience, eToro will give you a basic knowledge test on margin trading to complete. This will help determine your leverage limit because of the potential risks that come with margin trading. You will also fill out a questionnaire to determine the best trading package for your skill level.

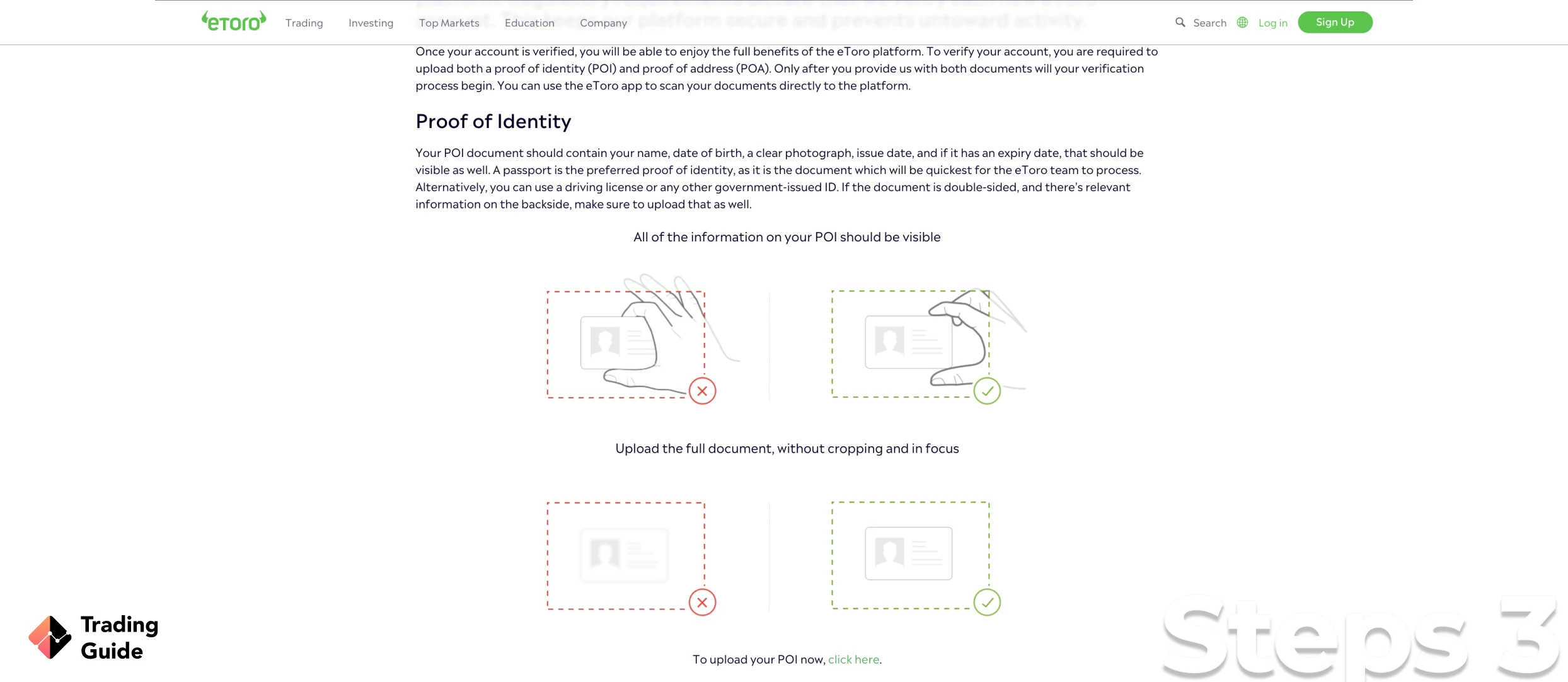

Before fully activating your account, eToro must verify your identity and location, as this is a standard protocol set by the FCA. This procedure helps keep online trading platforms safe from imposters who have dominated the market. That being said, you will share a copy of your ID or passport and a utility bill or bank statement. eToro will then review your documents and send you an email notification once your account is fully activated.

As soon as eToro activates your account, you are free to make a deposit and invest in British Airways. Based on the broker’s requirements, you must deposit at least $100 to access the London Stock Exchange and buy the shares of IAG, British Airways’ parent company. Note that deposits with eToro are free*, and you can transact using various payment methods, including debit cards, e-wallets, and bank transfers.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

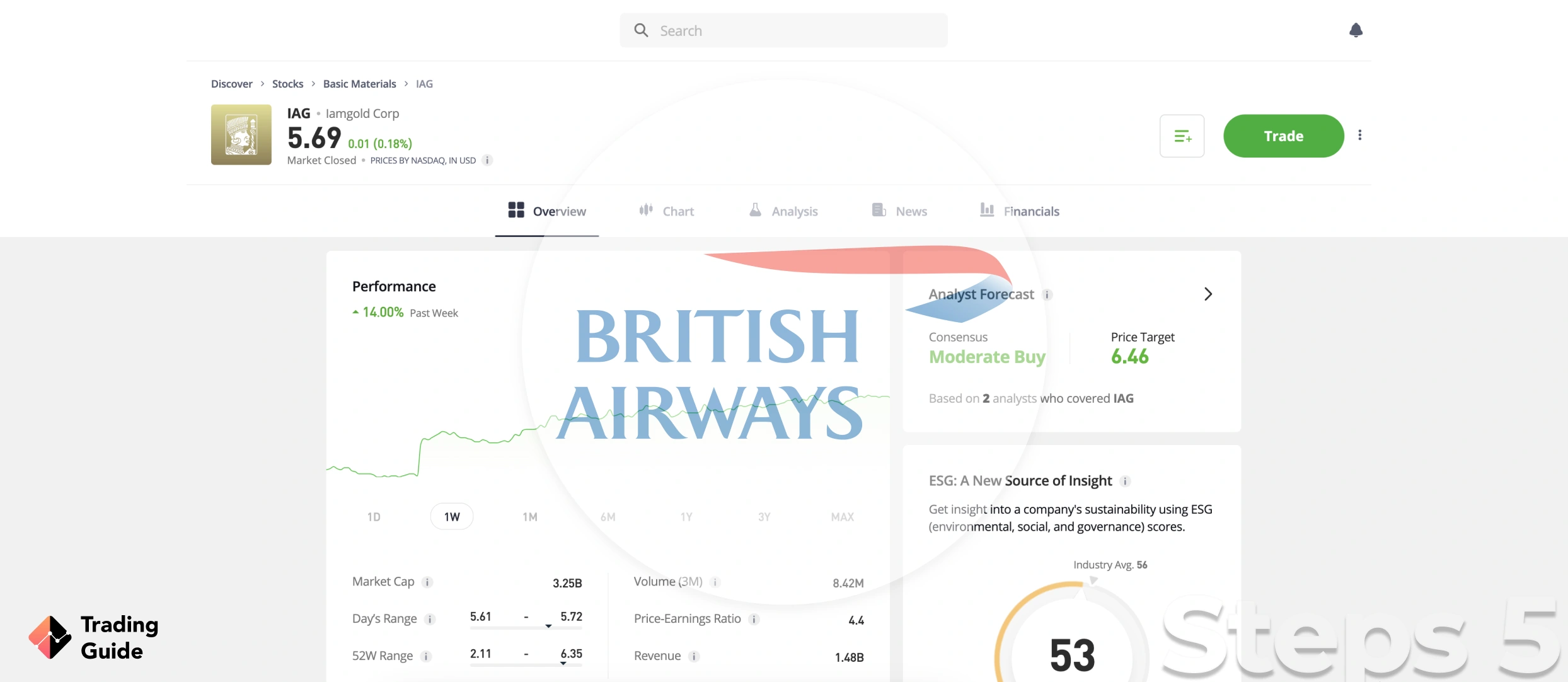

eToro will confirm your deposit and automatically redirect you to LSE to purchase the shares of IAG. You can also use the broker to invest in British Airways by trading IAG shares as CFDs or indices. Whichever method you prefer investing in British Airways, ensure you are fully familiar with it and understand all the risks. Most importantly, have a budget and let it guide you in buying the right amount of IAG shares.

Tips on How to Choose the Best Stock Broker to Invest in British Airways

Although we recommend the best stock brokers to invest in British Airways above, not all of them will suit your investment needs. In this regard, you must conduct research to find a suitable stock broker. To help you get started, here are essential tips to consider so you can quickly complete the process and start investing in British Airways.

For your funds’ safety and trading under the best conditions, ensure a stock broker is licensed and regulated within your jurisdiction area. In the UK market, the best stock broker should be licensed and regulated by the Financial Conduct Authority (FCA). Failure to choose a licensed and regulated stock broker means that you will be trading illegally, and there is no way you will acquire assistance from the government in case your broker goes against your agreement.

You shouldn’t limit yourself to trading British Airways shares only since portfolio diversification is important in mitigating trading risks. Try other markets as well, and you never know where your new interest will lie. Therefore, choose a stock broker that not only allows trading of British Airways shares but other assets as well, including forex, commodities, cryptocurrencies, etc. You should also be able to trade the assets physically and as derivatives.

Nowadays, mobile trading is becoming popular since it allows you to manage your activities on the go. So, while you need a platform with an intuitive design and is user-friendly, ensure it features the same elements on its app. A stock broker’s platform should also host plenty of research and educational materials. Having a demo account is also a plus since you can practise how the broker works before taking the plunge.

Whether you are new to trading shares or are experienced, it is important to have a budget and stick to it. This means you should choose a stock broker that fits into your budget or one you can afford. It is a habit that will help you trade successfully without spending a lot of money. Therefore, confirm all the charges and requirements in a stock broker before committing.

Any stock broker you choose should have customer service to contact whenever you encounter any trading issues. You can test its response rate and reliability before making a commitment. Also, make sure the broker’s support service availability complements your trading schedule. They should also be contacted via different communication channels, including phone, live chat, WhatsApp, email, etc.

The way previous and current stock traders review a broker will help you make informed decisions. By analysing their comments on Google Play, the App Store, and Trustpilot, you will know what to expect before signing up for a trading account with a stock broker.

About British Airways

British Airways is a global airline company headquartered in London, England. It was founded in 1974 as a result of a merger between four companies, including the British Overseas Airways Corporation, the British European Airways, the Cambrian Airways and the Northeast Airlines. Having served people for over 40 years, British Airways company prides itself on being one of the best when it comes to connecting diverse cultures globally.

Based on its fleet size and the number of passengers British Airways carries, the company is considered the second-largest UK-based carrier. Originally, British Airways was a government-run company but was later privatised before beginning to trade publicly in 1987 on the London Stock Exchange.

However, in 2011, British Airways merged with Iberia to create the International Airline Group (IAG), a holding company registered in Spain. This means that British Airways does not have its own stock, but you can get exposure to its shares by investing in IAG stock through a broker with access to the London Stock Exchange. Traders can also invest in IAG shares through the FTSE 100 index.

In addition to considering investing in British Airways, it may also be worthwhile to explore Marks and Spencer shares or Unilever shares, which can provide you with insights into investing in another notable company and diversifying your investment portfolio.

FAQs

British Airways stock is owned by its parent company, the International Airlines Group (IAG). IAG is a Spanish-registered company with its shares traded on the London Stock Exchange. To purchase the shares, you need to register for an investment account with a stock broker with access to the LSE.

No. Unfortunately, you cannot find British Airways company stocks on any exchange globally. However, since it is a subsidiary of IAG, you can get exposure to its shares by investing in IAG stock through a broker with access to the London Stock Exchange, where the shares of IAG are listed.

British Airways’ symbol is BA. Founded in 1974, it is an airline company headquartered in London, England. British Airways is also considered the second largest UK-based carrier company based on the number of passengers it carries and its fleet size.

Yes. In 2011, British Airways merged with Iberia Airlines to create the IAG. Other airline brands that are under IAG include LEVEL, Aer Lingus, and Vueling.

Conclusion

Investing in British Airways through its parent company IAG is an excellent opportunity to grow your money. Based on our analysis, the company has growth potential in the coming years, and we believe that purchasing IAG shares now could earn you good profits. However, it is crucial to conduct additional research before putting up your money, considering that IAG’s performance is based on its subsidiaries’ performance.

The good news is that investing using stock brokers like the ones referenced above gives you an opportunity to purchase IAG shares in fractions. You can also trade the shares as CFDs or indices if you are skeptical about purchasing the shares and taking full ownership.