If you’re new to the crypto landscape and eager to explore the potential of Ethereum, you’ve landed in the right place. This comprehensive guide is designed specifically for beginners, offering you a step-by-step journey into understanding Ethereum, navigating its ecosystem, and making informed investment decisions. Besides the fundamentals and how to invest in Ethereum, we will guide you on the best Ethereum brokers, how to choose the right option and more. Our goal is to equip you with the knowledge and confidence to confidently embark on your Ethereum investment journey.

5 Simple Steps to Buy Ethereum in the UK

As an Ethereum investor, being well-informed about the process of acquiring this digital asset is crucial for making prudent investment decisions. Understanding the steps involved in purchasing Ethereum allows you to plan effectively before initiating your initial investment. Drawing upon our extensive experience as seasoned cryptocurrency investors, we’ve outlined the fundamental 5-step process below. Rest assured, we’ll delve into each step comprehensively later in this guide, ensuring you grasp the intricacies of investing in Ethereum.

- Select a reputable UK-based cryptocurrency exchange or broker like the ones we recommend in this guide.

- Sign up and verify your account on the chosen exchange by providing the necessary details and completing identity verification.

- Deposit funds into your exchange account using preferred payment methods like bank transfers or cards, ensuring it’s in GBP or supported currency.

- Locate Ethereum in the exchange or broker platform, specify the amount to purchase, and execute the buy order.

- Consider transferring your purchased Ethereum to a secure wallet for enhanced safety. Hardware wallets (e.g., Ledger), software wallets (e.g., Exodus), or mobile wallets (e.g., Trust Wallet) are popular options.

Best Brokers to Invest in Ethereum

Selecting a reliable broker to invest in ethereum UK is fundamental. A reputable broker not only hosts Ethereum but also operates within the UK market under the authorisation of the Financial Conduct Authority (FCA). Beyond these prerequisites, several other factors influence the ideal choice, and we’ll delve into these aspects later in this guide.

Given the multitude of brokers offering Ethereum, pinpointing the best option can be daunting. To streamline your selection process, we’ve conducted extensive research and compiled a list of our top choices. These brokers have been carefully chosen to simplify your decision-making process.

1. eToro

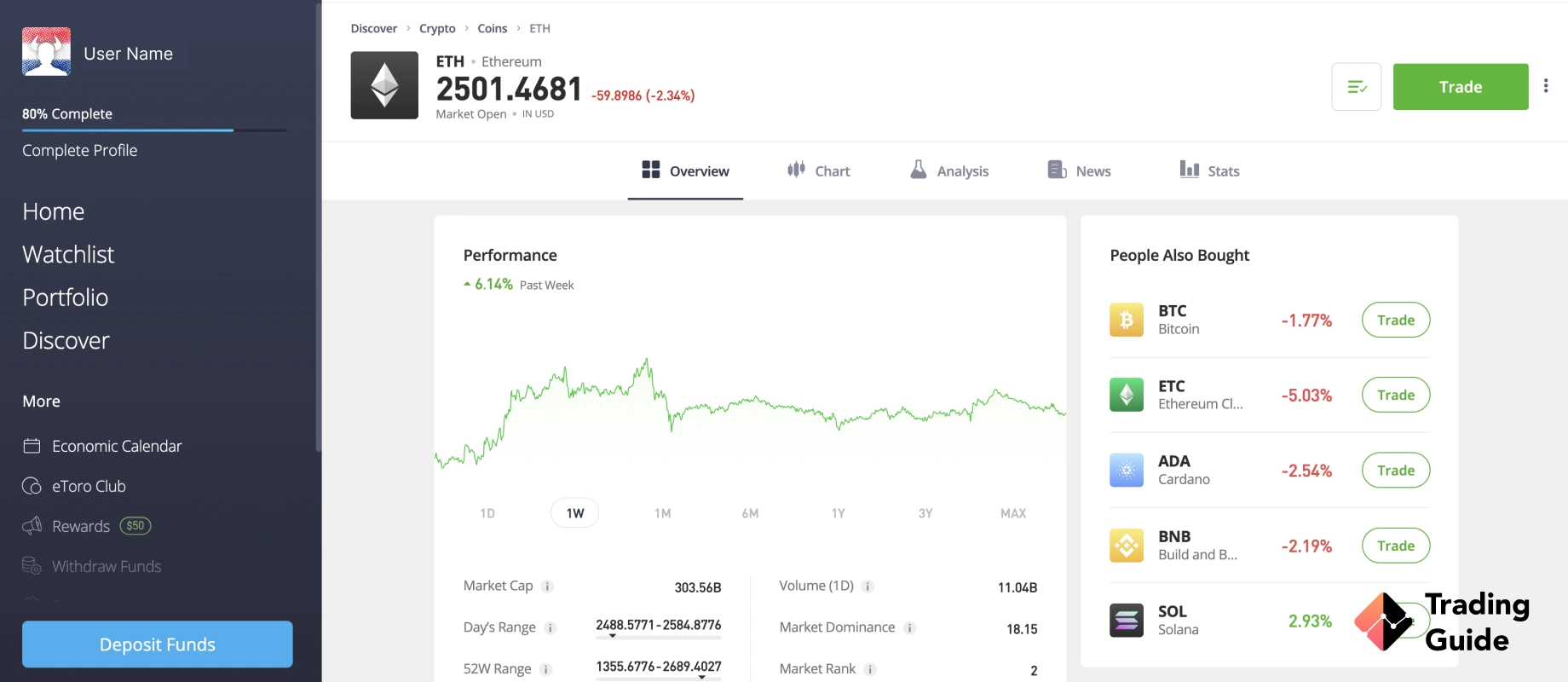

Based on our exploration and experience testing eToro as an Ethereum broker in the UK, we found it to be an exceptional platform. Besides Ethereum, eToro lists over 33 cryptocurrencies, encompassing popular options like Bitcoin, Litecoin and more. There are also additional asset classes like stocks, commodities, forex, and more, which offers ample opportunities for portfolio diversification.

We like eToro’s award-winning social and copy trading platforms that provide an innovative edge for investors, allowing for seamless interaction and the ability to learn from others. With a minimum deposit requirement of $100 and free deposits*, eToro ensures accessibility for investors**, especially newcomers. Its user-friendly interface caters perfectly to beginners, simplifying the trading process. Additionally, eToro provides a digital wallet, enhancing convenience and security for asset storage.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

**Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

- Free deposits* and inactivity fee kicks in after 12 months, which we believe is fair

- A user-friendly and customisable Ethereum trading platform

- Features an award winning social and copy trading platform

- $5 withdrawal fees apply

- It does not host third-party platforms like MT4 and MT5

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

2. FP Markets

Having explored FP Markets as an Ethereum trading platform in the UK, our experience has been quite promising. With a minimum deposit requirement of £100, FP Markets offers a gateway to trade Ethereum and other cryptocurrencies through Contracts for Difference (CFDs). Alongside Ethereum, users can diversify their portfolios using forex, commodities, shares, indices, and more, all presented with competitive spreads within an unparalleled trading environment.

We also like the fact that FP Markets offers multiple trading platforms such as cTrader, MT4, and MT5, catering to different trading styles and preferences. The low spreads on offer contribute to cost-effective trading, aligning with the platform’s commitment to providing favourable trading conditions. Its comprehensive learning and research tools serve as a valuable asset, equipping traders with insights crucial for informed decision-making in the volatile crypto market.

- Fast trade execution speed

- Features social and copy trading

- A reliable and responsive 24/7 support service

- A user-friendly and customisable Ethereum trading platform

- You can only trade Ethereum as CFD. No buying and taking full ownership

- Limited cryptocurrencies for traders looking for options to diversify their portfolios

3. XTB

We also tested XTB, and it stands out as a prominent choice for Ethereum traders in the UK due to its distinctive features and user-friendly interface. What immediately caught our attention is that XTB doesn’t impose a minimum deposit requirement, making it accessible to traders of varying budgets. This accessibility is further enhanced by the availability of over 10 Crypto CFDs, including popular options like Bitcoin, Stellar, Dogecoin, and more. All these are available to trade on its xStation 5 and xStation Mobile platforms.

XTB’s cryptocurrency trading fees start from 0.22%, which we consider high compared to its peers. The good news is that all deposits are free of charge and inactivity fee kicks in after 12 months. Beyond Ethereum and other cryptocurrencies, XTB provides access to an extensive array of over 5500 additional assets, including forex, shares, commodities, and more. This broad spectrum allows for portfolio diversification, enabling traders to explore various markets and investment opportunities.

- A user-friendly and intuitive design Ethereum trading platform

- No minimum deposit requirement

- Fast trade execution speed

- Great research materials

- Ethereum trading costs can be high for low-budget traders

- A £10 monthly inactivity fee applies after 12 months of no account activity

What is Ethereum?

Ethereum has been one of the most influential and transformative innovations in the realm of blockchain technology since its inception in 2015. Created by Vitalik Buterin, Ethereum represents much more than just a digital currency; it’s a decentralised platform that facilitates smart contracts and decentralised applications (dApps) via its native cryptocurrency, Ether (ETH).

At its core, Ethereum serves as a decentralised, open-source blockchain network that enables developers to build and deploy smart contracts. These smart contracts are self-executing contracts with the terms directly written into code. They automatically execute and enforce agreements without requiring intermediaries, enhancing transparency and reducing the need for trust between parties.

Ethereum’s functionality goes beyond simple financial transactions, allowing developers to create various decentralised applications, ranging from decentralised finance (DeFi) platforms and non-fungible token (NFT) marketplaces to gaming applications and more.

Like Bitcoin, the Ethereum blockchain operates on a proof-of-work (PoW) consensus mechanism, where miners validate and add transactions to the blockchain. It recently also transitioned to a more energy-efficient and environmentally friendly proof-of-stake (PoS) consensus mechanism with Ethereum 2.0. This upgrade improves scalability, security, and sustainability by replacing miners with validators who are chosen to create new blocks based on the amount of ether they hold and are willing to “stake” as collateral.

When it comes to digital tokens, Ethereum has Ether (ETH), which is used to compensate miners/validators for their work, pay transaction fees, and execute smart contracts within the ecosystem. The Ethereum platform has spurred a vibrant and ever-expanding ecosystem, attracting developers, investors, and enthusiasts alike due to its potential to revolutionise various industries beyond just finance. Its flexibility, innovation, and community support continue to drive its growth and solidify its position as a pioneering force in the blockchain space.

How to Start to Invest* in Ethereum

For newcomers, the idea of investing in Ethereum might feel like entering uncharted waters. However, here’s the good news: with a bit of preparation and the following guidelines, you’ll find yourself on a much smoother journey.

- Education is Key: Start by understanding Ethereum – its technology, applications, and significance. A grasp of fundamental concepts like blockchain and Ether (ETH) functionality will serve as a solid foundation.

- Embrace Risk Awareness: The crypto market is known for its volatility. It’s essential to acknowledge the potential fluctuations in value and only invest what you’re comfortable potentially losing.

- Informed Decision-Making: Research different platforms, assessing their features, fees, security measures, user experiences, and more. The choice of a best trading platform for Ethereum significantly impacts your investment journey.

- Diversification Strategy: While Ethereum might be an appealing investment, consider spreading your investments across various assets. Diversification helps mitigate risks.

- Security First: Prioritise security by implementing two-factor authentication (2FA), robust passwords, and exploring hardware wallets to safeguard your Ethereum holdings.

*Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

How to Buy Ethereum With eToro

Investing in Ethereum via online brokers like the ones we recommend is a straightforward process. While we briefly touched on how to invest in Ethereum UK above, here’s a detailed step-by-step guide to help you start your Ethereum investment journey using eToro as an example.

Before you start putting your money into Ethereum investment, familiarise yourself with Ethereum’s technology, its purpose, and its potential for growth. Select eToro as your broker and consider a secure wallet (hot or cold) to store your acquired Ethereum.

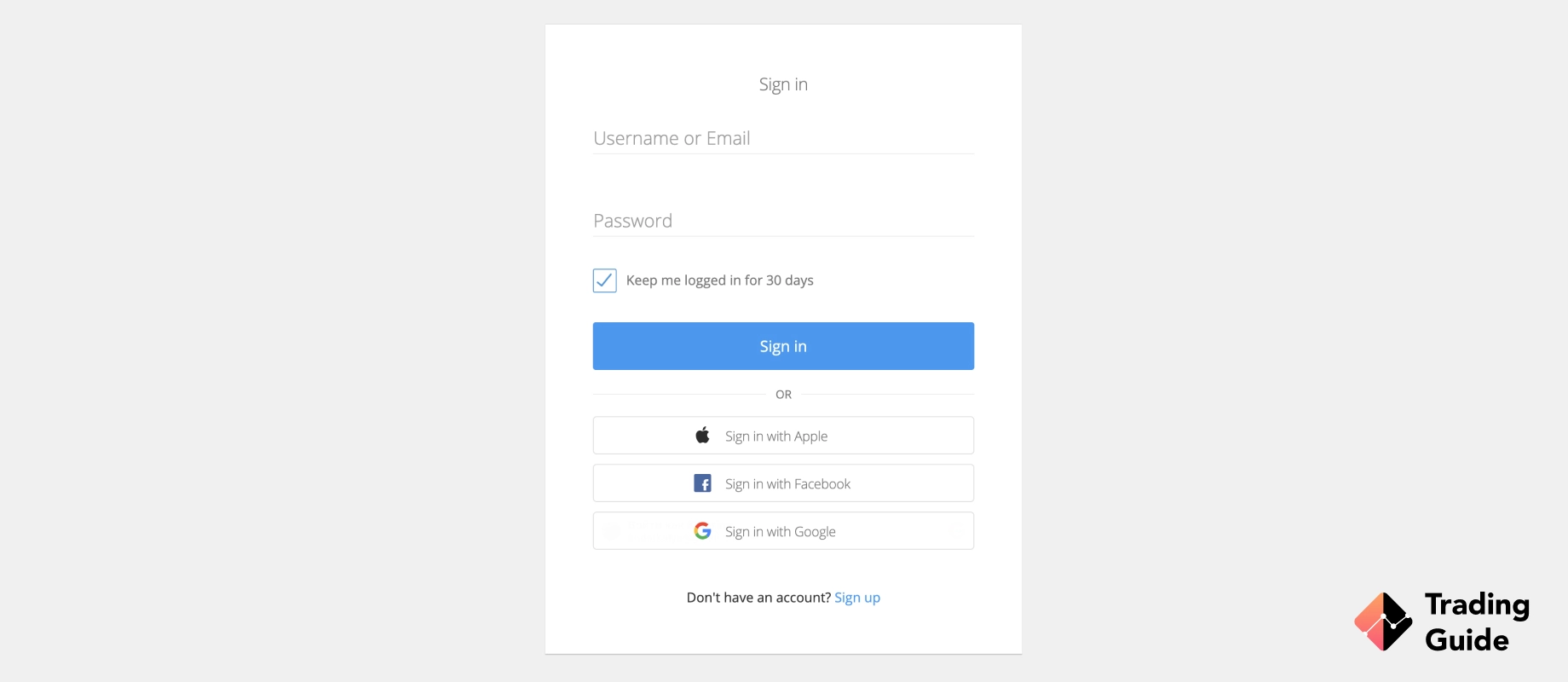

To begin your Ethereum investment journey with eToro, create an investment account on its platform. You can easily access the broker’s website by following the provided link or by searching “eToro” via a search engine. Take note of essential elements that eToro offers and ensure they align with your investment objectives. Review the platform’s terms and conditions, which provide crucial information regarding usage, fees, and services offered. Plus, consider optimising your experience by installing the eToro mobile app on your device for convenient access and trading capabilities.

Once you’ve familiarised yourself with eToro’s terms and confirmed its suitability for your investment needs, proceed to register for an account. During registration, provide accurate personal information, including your full name, email address, location, phone number, and source of income. It’s essential to ensure accuracy as this information will be used for account verification. Also, establish a strong username and password to safeguard your account and investment activities.

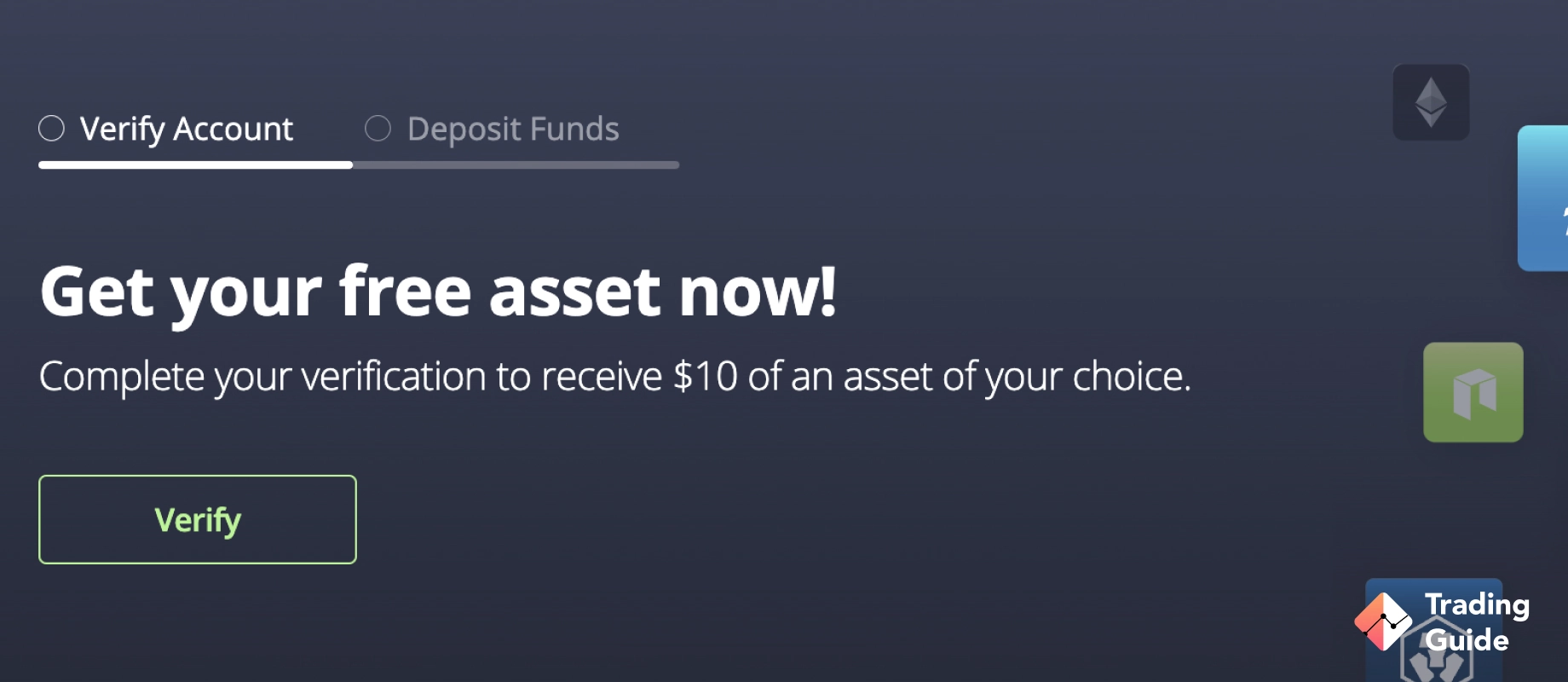

To comply with FCA regulatory standards, eToro requires account verification. This involves providing proof of identity, such as a copy of your ID card or driving licence. Additionally, submit documents like a recent utility bill or bank statement to verify your location.

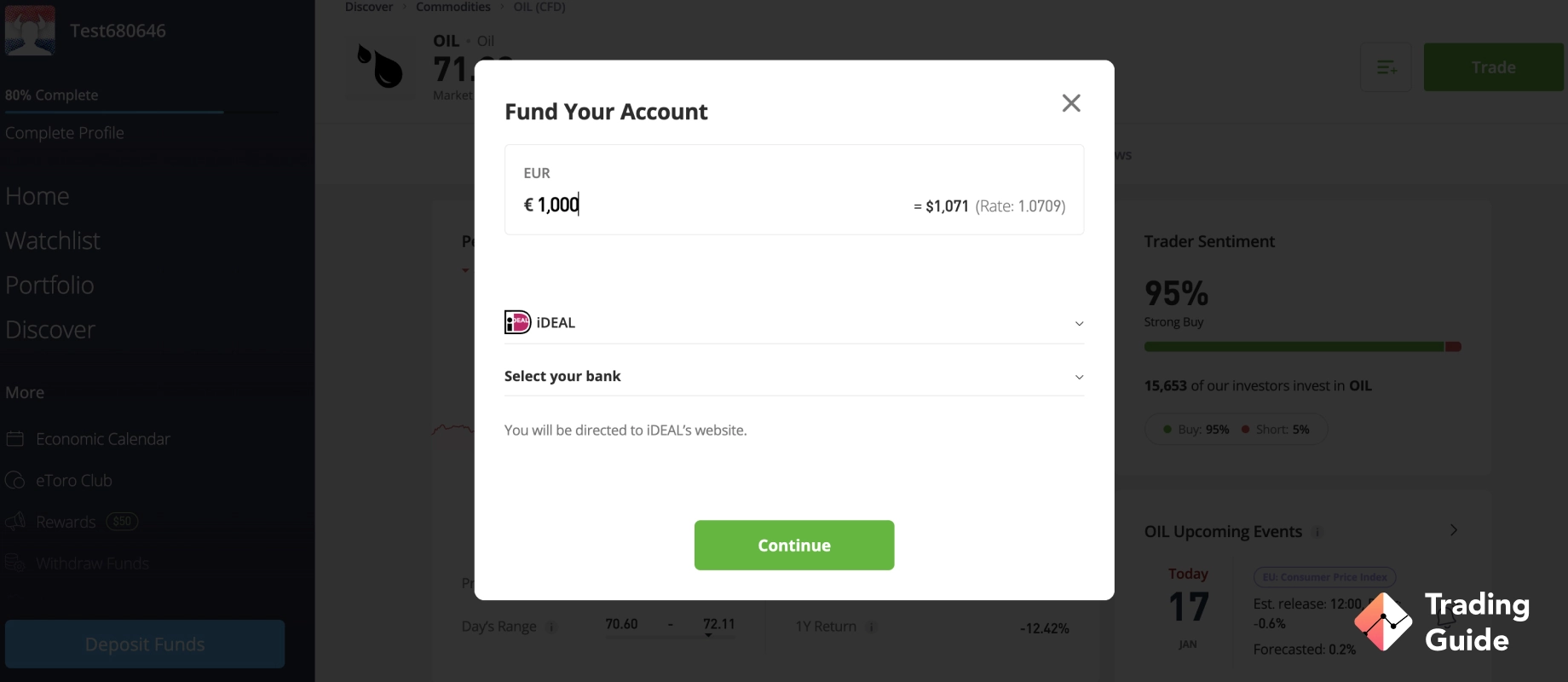

Upon successful account verification, eToro will notify you via email. At this stage, you can deposit funds into your account. The minimum deposit required is $100, and eToro doesn’t charge fees for deposits*. You can also transact using various payment methods such as debit cards, e-wallets, and bank transfers.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

eToro will confirm your deposit after which it will give you access to the exchanges that list Ethereum to complete your purchase. Whether you want to buy Ethereum or trade it as derivatives, ensure you fully understand how it works and conduct a thorough analysis for the best strategy. This way, you get to enjoy your experience and boost your profit potential. For investors purchasing the cryptocurrency, ensure you own a crypto wallet to store the asset.

How to Choose the Right Platform for Investing in Ethereum

When engaging with cryptocurrencies, it’s crucial to recognise that these digital assets are characterised by their extreme volatility and speculative nature. This can result in swift and substantial price fluctuations. To safeguard your crypto holdings, it is imperative to utilise reputable wallets and exchanges, prioritising the security of your investments.

Also, exercise vigilance and due diligence to guard against crypto-related scams and fraudulent schemes that can potentially threaten your financial well-being. You can also spread your investments across multiple digital tokens and avoid making decisions based on emotions.

The financial market is flooded with various cryptocurrency brokers to invest in Ethereum, presenting a challenging task for investors in selecting the most suitable option. While this guide provides top recommendations, it’s crucial to know how to critically evaluate a broker to ensure it aligns with your Ethereum investment goals. In this regard, we list some of the factors to consider in your choices so that you can have a worthwhile experience.

Begin by verifying an Ethereum broker’s regulatory status. Opt for those regulated by esteemed authorities such as the Financial Conduct Authority (FCA) in the UK. Regulatory compliance offers a safeguard against potential malpractices, providing investor protection and a level of credibility.

In addition, examine the broker’s security protocols. Ensure robust encryption, two-factor authentication (2FA), and secure storage of funds wallets. Verify the platform’s track record in handling security breaches and its commitment to safeguarding user assets.

Evaluate the range of assets offered beyond Ethereum. A diverse selection of cryptocurrencies and additional investment options can fortify your portfolio. Consider the availability of other tokens, fiat currencies, stocks, commodities, and more to diversify your investment strategy.

Assess the Ethereum broker’s trading platform. It should be user-friendly, intuitive, and equipped with advanced trading tools and features. Seamless navigation, real-time data, charting capabilities, and order execution speed are essential for a fulfilling trading experience. For beginners, confirm the availability of learning tools and a demo account to ensure you get started on a good note.

Understand the fee structure comprehensively. Ethereum brokers may charge commissions, spreads, or fees for transactions, withdrawals, or inactivity. Examine fee details for deposits, trades, and any hidden charges. Opt for platforms offering transparent and competitive fee models aligned with your trading frequency.

Evaluate the responsiveness and availability of customer support. A reliable support system, accessible through various channels like live chat, phone, or email, is indispensable. Prioritise platforms with efficient customer service to promptly address queries or issues that may arise.

Explore user reviews and testimonials from existing clients on Google Play, the App Store, and Trustpilot. Analysing these feedback on various forums helps you to gain insights into the Ethereum broker’s performance, reliability, and user satisfaction. Consider both positive and negative reviews to gauge the overall sentiment.

Ethereum Stock Price Today

Ethereum, a prominent cryptocurrency after Bitcoin, experiences significant price fluctuations influenced by demand, supply, mining costs, and market dynamics. To aid your investment strategy, we present a live chart showcasing Ethereum’s current price. Use this real-time data to analyse historical trends, determine optimal entry and exit points, and devise a well-informed investment plan. Stay updated and make informed decisions leveraging Ethereum’s live market insights.

By the way, here is the list of the best bitcoin brokers in the UK.

Pros and Cons of Investing in Ethereum

Investing in Ethereum presents an array of opportunities and risks. Understanding its pros and cons will help you make informed decisions aligned with your risk tolerance and investment goals. See some of the advantages and pitfalls below.

- Ethereum’s blockchain supports smart contracts and decentralised applications, showcasing advanced technological capabilities

- Widely adopted across industries, Ethereum offers potential for long-term growth due to its utility and use cases

- Ethereum’s versatility allows for various applications, expanding its adoption in finance, healthcare, and more

- Supported by a vibrant developer community, Ethereum continually evolves and improves its platform

- Transitioning to Proof of Stake (PoS) enables staking, offering investors passive income opportunities by securing the network

- Ethereum, like most cryptocurrencies, is subject to significant price swings, leading to potential volatility and unpredictability

- Evolving regulations may impact Ethereum’s legality and acceptance, creating uncertainty in various jurisdictions

- Emerging blockchain platforms pose a competitive threat, challenging Ethereum’s market dominance

FAQs

New investors trying to venture in Ethereum should understand that they need to be familiar with how this market works before making their first significant investment. In addition, you need the best broker like the ones we recommend in our mini-reviews above for maximum profitability. Once you choose a reliable broker and make your deposit, you will access Ethereum to complete your purchase. Note that some brokers offer share and CFD trading, so ensure you go for the best investment method based on your skill level.

Yes. Buying Ethereum online is safe as long as you are using brokers that are licensed and regulated by the FCA. Risking your funds with unregulated brokers puts you in a vulnerable position of getting scammed. We recommend the best brokers for buying Ethereum online in our mini-reviews above. However, if they dont suit your investment requirements, use our tips above to identify the best broker.

You will need a crypto digital wallet to store your Ethereum once you make a purchase. Note that online brokers like eToro that support purchasing of the physical asset have crypto wallets for storing your Ethereums.

Absolutely. 2026 looks promising for many Ethereum companies, especially those that were hit hard by the 2020 COVID-19. Good examples of top Ethereum stocks to invest in are listed above. However, ensure you conduct additional research on the companies to ensure that you are making the right investment.

Yes. Ethereum trading in the UK is considered a business activity. Therefore, all the profits you earn from this investment must be subjected to capital gains tax.

Yes. Ethereum investments can easily be hacked if you are using an Ethereum exchange or unregulated brokers. For this reason, ensure you consider licensed and regulated brokers by the FCA. Investing with such brokers is not only safe but you get to enjoy the best conditions for maximum profitability. Also, using licensed and regulated brokers is legal, thus giving you the opportunity to take legal action against the brokers if need be.

Conclusion

We hope you are now familiar with how to buy Ethereum UK and more as shared in our guide above. Since investing in Ethereum presents both potential rewards and risks, a strategic approach is crucial for success. So whether you opt for long-term holdings or shorter trading strategies, remember the inherent volatility and apply solid strategies to optimise your profitability. Timing also plays a crucial role in Ethereum investments. Consider purchasing when prices dip to maximise gains as the market trends upward. Most importantly, acknowledge the unpredictability of returns. While Ethereum holds potential for profits, there’s no guarantee of success.