The Industrial Select Sector SPDR Fund ETF is a popular investment option for those looking to gain exposure into the industrial sector of the stock market. This ETF provides investors with an easy and cost-effective way to invest in a diversified portfolio of industrial stocks, which can include companies involved in aerospace, defence, machinery, and more.

Below, we have prepared this guide to equip you with the necessary information and steps to get started in investing in Industrial Select Sector SPDR Fund ETF. Not only will you understand what Industrial Select Sector SPDR Fund ETF is, but you will also meet our top ETF brokers to consider in the UK.

In this guide

How to Invest In Industrial Select Sector SPDR Fund ETF

Top Brokers to Invest in Industrial Select Sector SPDR Fund ETF

Investing in the industrial sector ETF is pretty straightforward if you are well-versed in the procedures involved. For beginners, we will take you through how to buy Industrial Select Sector SPDR Fund ETF in a bit, but first, here are the top ETF brokers to consider for maximum experience.

Note that we tested and compared hundreds of ETF brokers in the UK so you can avoid the lengthy and overwhelming research process. The brokers listed below are highly secured and have access to the NYSE, where the ETF is listed under the ticker XLI. Plus, they list additional assets for portfolio diversification and numerous tools to ensure you become more skilful and strategic.

1. Plus500

*Illustrative prices

Plus500 offers a seamless platform for ETF traders looking to explore the Industrial Select Sector SPDR Fund ETF (XLI). With its intuitive interface and user-friendly platform, this broker ensures a smooth trading experience for professional ETF traders. Moreover, Plus500 enables commission-free ETF trading with spreads from 0 pips. Its minimum deposit requirement is also £100, which we believe makes it one of the most cost-effective ETF brokers in the UK.

Besides the XLI, Plus500 hosts a diverse range of ETFs as CFDs and other CFD asset classes for portfolio diversification. With leverage options reaching up to 1:5 for retail traders and 1:150 for professionals, traders can maximize profitability, considering associated risks. The broker’s professional 24/7 customer support and commitment to transparency and security further solidify its position as a top choice for ETF traders. We encourage beginners to utilize Plus500’s demo account to test the platform’s performance before fully committing.

- Commission-free ETF trades with low spreads from 0 pips

- Favourable leverage options for traders

- A virtually funded demo account for testing the broker’s performance

- 24/7 customer reliable and responsive support service via phone, email, and live chat

- No support for third-party trading platforms

- Inactivity fee kicks in after only three months, making Plus500 suitable for active traders

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. Pepperstone

Pepperstone is one of our preferred ETF brokers for investing in the XLI ETF. The broker is beginner-friendly and lists additional 100+ ETFs for portfolio diversification. Although you can only trade the Industrial Select Sector SPDR Fund ETF as CFDs, Pepperstone hosts plenty of learning resources to boost your ETF trading skills. You will also have access to social and copy trading platforms to interact with other traders and mirror positions from expert traders with increased profit potential.

Pepperstone has a minimum deposit requirement of £500 for UK traders, which might seem high for low-budget ones. The good news is that it doesn’t charge deposit and withdrawal fees, and its commission for ETF trading is also low. On top of that, users get to explore multiple platforms, including cTrader platform, MT4, and MT5.

- Copy and social trading platforms for maximum experience

- Additional asset classes, including forex, shares, commodities, and more, to explore

- Features advanced platforms with advanced trading tools for professional traders

- Low commission for ETF trading

- High minimum deposit requirement

- Limited ETF offerings if you want to explore numerous options

3. eToro

eToro allows you to invest in XLI ETF commission-free. With this broker, there are no hidden fees, thus making it easier for investors to budget and effectively plan for their activities. You will also make a deposit starting from $100, which is relatively low compared to other brokers. Although eToro charges withdrawal fees, all deposits via bank transfers, e-wallets, and debit cards are free of charge*.

The best element about investing in the Industrial Select Sector SPDR Fund ETF using eToro is that you get to buy and own the ETF. This is because eToro has direct access to the NYSE, where the asset is listed under the symbol XLI. You can also use eToro to trade XLI as CFDs, whereby you get to speculate on the direction of the ETF without taking ownership of the underlying asset.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- Low minimum deposit requirement

- Hosts social and copy trading platforms for investors looking for extra features to maximise their experience

- Additional 300+ ETFs for portfolio diversification

- Commission-free ETF investing

- Users get to pay withdrawal fees

- Limited resources or tools for advanced ETF traders and investors

4. IG Markets

IG Markets prides itself on being a fast, reliable and secure ETF broker in the UK. The broker has been around for decades, and using it to trade XLI ETF guarantees maximum security for your funds and data. Moreover, the broker features quality trading resources that helps in skills and strategy development. Professional ETF traders also have an opportunity to explore advanced trading platforms, including the L-2 Dealer, ProRealTime, and MT4. On top of that, you can diversify your portfolio with IG Markets’ additional 12,000+ assets, including forex, shares, commodities, cryptocurrencies, and more.

Unfortunately, you can only trade XLI ETF as CFDs with IG Markets. The broker also has a high minimum deposit requirement of £300, which can limit low-budget UK traders. Furthermore, ETF trading charges are relatively high but this is all worth it as you are exposed to quality and advanced resources. For newbies, you will benefit from the broker’s social trading platform that connects you to other global traders.

Your capital is at risk

- Additional 5,000+ ETFs to explore

- A highly secured platform compatible with desktop and mobile devices

- Plenty of research and learning materials

- Features a social trading platform to connect and learn from other global traders

- High minimum deposit requirement and ETF fees

- XLI ETF is available to trade as CFD only

How to Buy Industrial Select Sector SPDR Fund ETF With Pepperstone

Many investors in the ETF industry want to put their money into the Select Sector SPDR industrials ETF but have no idea how to get started. Whether you are new to ETF investment or have been in the industry for a while, the below procedures shed light on how to buy XLI ETF. You can apply the techniques below on any of our top recommended brokers above. We use Pepperstone as an example.

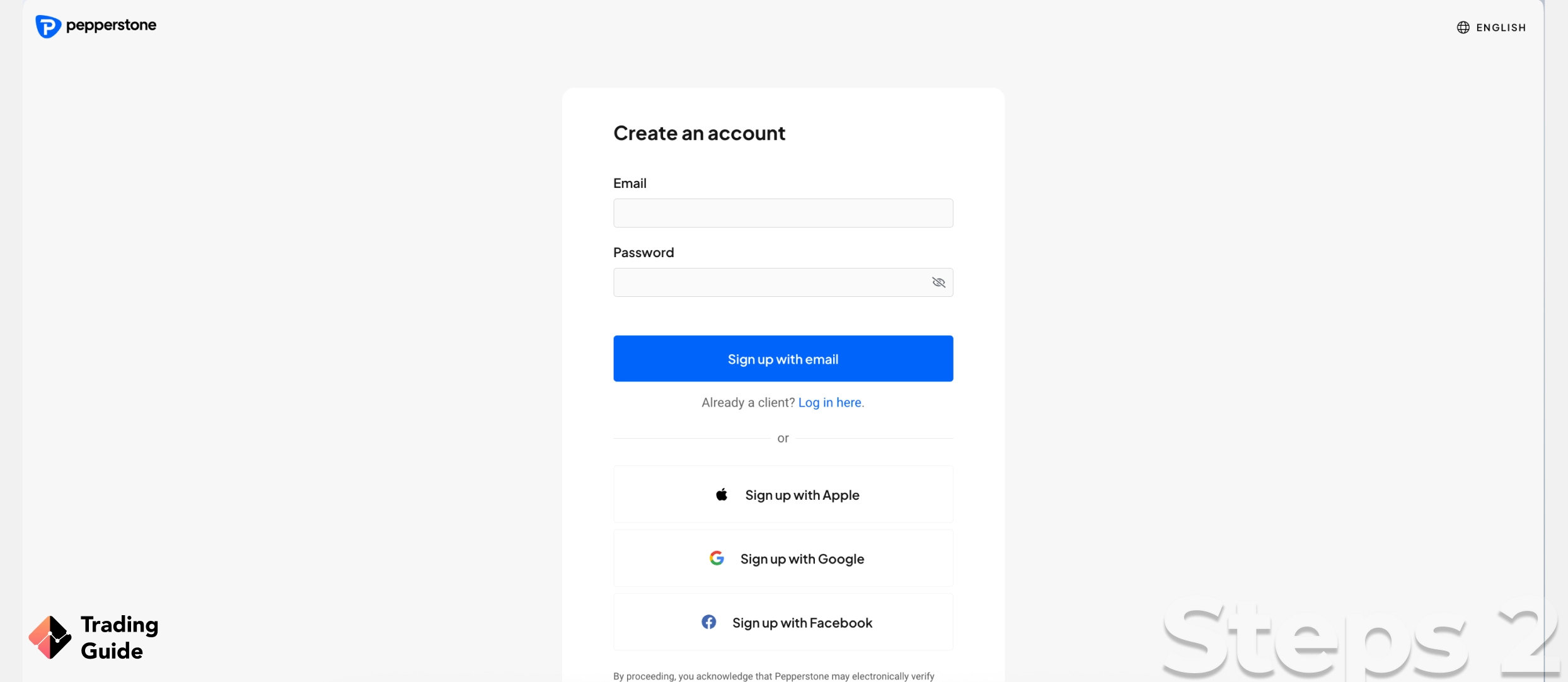

To create an ETF investment account and make your purchase with Pepperstone, you must visit the broker’s website. You can click on any link shared on this page for quick access or simply google the broker and access its website. Remember, Pepperstone is a flexible ETF broker. Therefore, consider installing its app on your mobile device to efficiently invest on the move. It is also crucial to understand the broker’s terms and conditions before beginning the account registration.

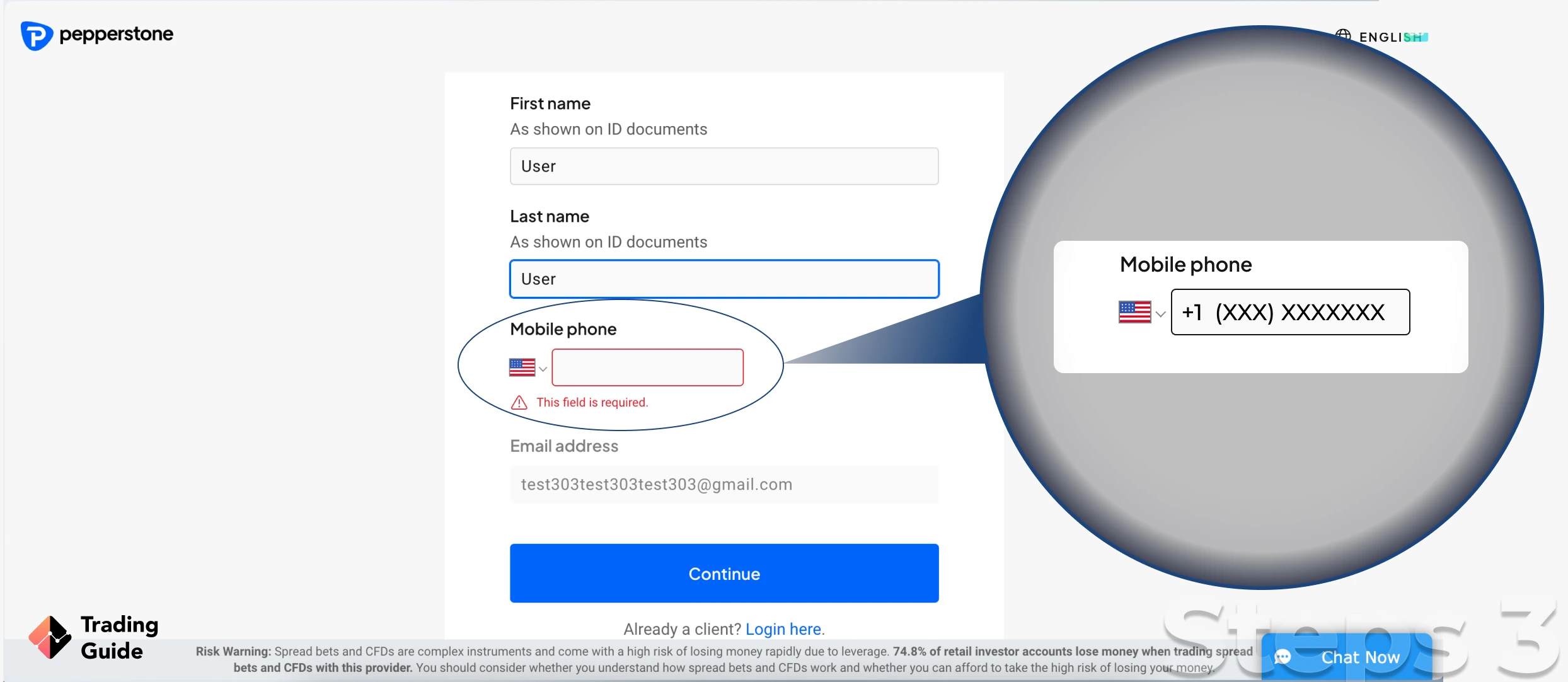

Once you have completed the above step, click the “JOIN NOW” button on Pepperstone’s website to start the account registration process. Fill in all the required personal information, including your name, email, phone number, country of residence, and more. Pepperstone will need to verify your identity before you can start investing, so make sure you provide accurate information.

As a standard protocol, all FCA-regulated brokers are required by the authority to verify users’ information before fully activating their accounts. In this regard, Pepperstone will ask you to verify your account before you can make any deposits. You can do this by uploading your identification documents, such as a passport or driver’s licence.

You will also verify your location by uploading a copy of a recent utility bill or bank statement. Note that this process is necessary to ensure all transactions are legitimate and comply with regulatory requirements.

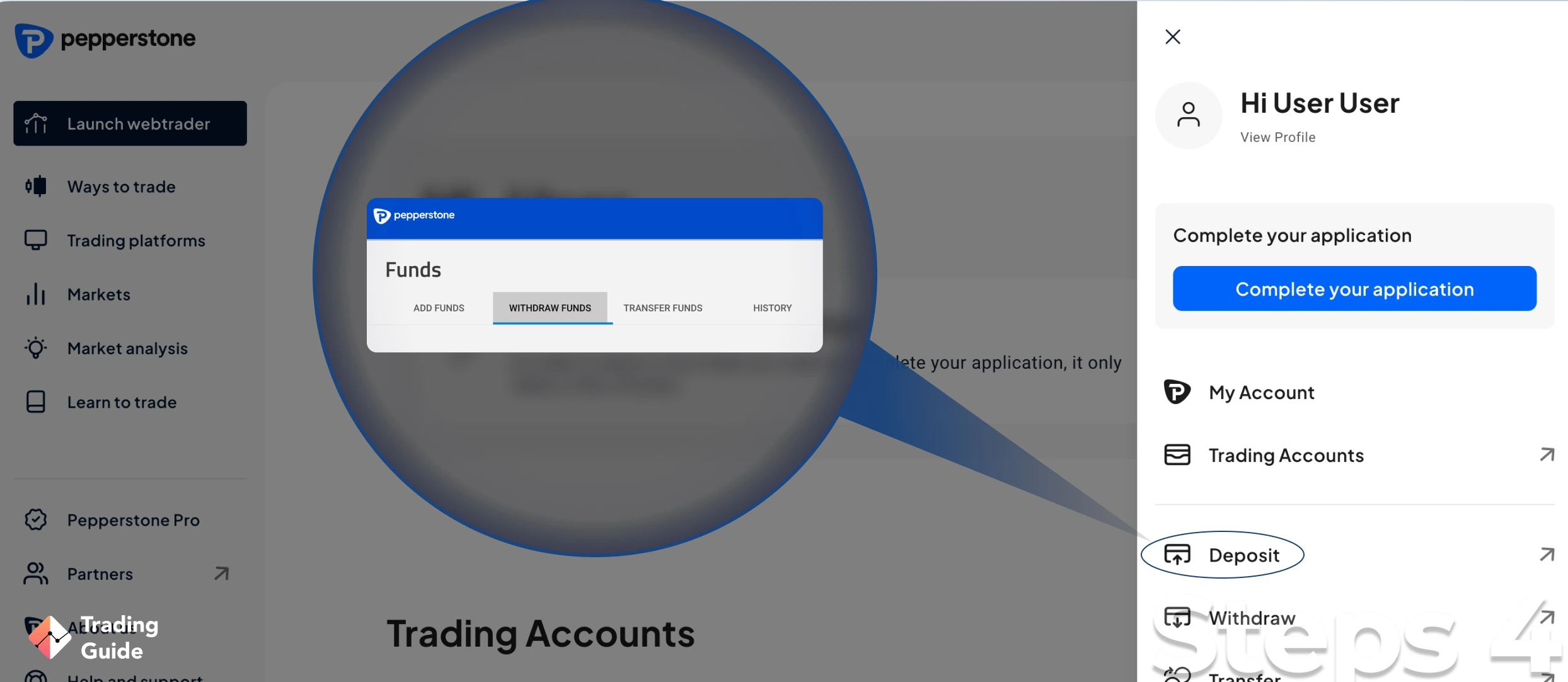

Once your account is verified, make a deposit. Pepperstone’s minimum deposit requirement is £500, and the broker allows transactions using multiple deposit options, including bank transfers, credit/debit cards, and e-wallets. Choose a deposit option that suits you best and enter the amount you want to deposit.

After making the deposit, navigate to the ETF section of Pepperstone’s website and search for the Industrial Select Sector SPDR Fund ETF using the symbol “XLI”. Once you find it, click the “Buy” button, enter the amount you want to invest, and review the transaction details. Ensure you understand the fees and risks involved before clicking the “Confirm” button to complete your purchase.

Remember, you will only trade this ETF as CFDs with Pepperstone. This means that if you want to take ownership of XLI ETF, consider investing using other brokers like eToro with direct access to the NYSE where the asset is listed. Additionally, conduct your analysis on the XLI stock price before investing to ensure you are making a potentially profitable decision.

Read about what is a Dividend ETF at our trading blog.

How to Choose the Best ETF Broker to Invest in Industrial Select Sector SPDR Fund ETF

ETFs can be like a basket of opportunities, but remember, they’re not immune to market shifts. Just as the seasons change, so can the value of your ETF investments. Before diving in, take time to explore what’s inside the basket – understand the assets, their track record, and potential pitfalls.

Think of ETFs like a treasure map; you want to ensure you’re not led astray. Watch out for hidden costs and tracking errors, as these can be the dragons on your path to returns. A careful approach to ETF investing is your compass through the market’s wilderness, helping you navigate potential risks while optimising your investment journey.

When it comes to investing in the Industrial Select Sector SPDR Fund ETF, choosing the best broker is crucial to your success. With so many options in the market, it can be challenging to determine which one will suit your investment requirements. Here are some tips on how to choose the best ETF broker for your XLI investment:

Your funds’ safety should be a top priority when selecting a broker. Ensure that the ETF broker you choose is licensed and regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK. You can also check its reputation and ratings on trusted platforms such as Google Play, the App Store, and Trustpilot.

Investors looking to put their money in the XLI SPDR ETF should expect to incur fees or charges such as transaction charges, commission/spreads, and minimum deposit. Therefore, before selecting a broker, it’s essential to understand the costs associated with using their platform. Compare the charges with other brokers to ensure you are not paying excessively.

The broker’s platform is where you will conduct all your ETF transactions and activities. Therefore choose a user-friendly platform that matches your skill level. The platform should also offer a demo account to test it out before investing real money. Additionally, it’s essential to have access to quality resources and tools to help you develop your investment strategies.

It’s critical to confirm that the broker you choose lists the Industrial Select Sector SPDR Fund ETF. If you prefer diversifying your ETF investment portfolio, ensure the broker also lists additional ETFs and asset classes such as forex, stocks, commodities, and more.

Investing can be complex, and it’s essential to choose an ETF broker with a reliable and responsive support service. Check the broker’s communication channels and operating hours to ensure they are convenient for you.

Consider user recommendations on trusted platforms like Google Play, the App Store, and Trustpilot. Read reviews from other users to determine whether a broker is trustworthy and reliable.

About the Industrial Select Sector SPDR Fund

The Industrial Select Sector SPDR Fund is an exchange-traded fund (ETF) designed to track the performance of the industrial sector of the S&P 500 index. This fund is one of the nine sector-specific SPDR ETFs offered by State Street Global Advisors. It invests in companies involved in producing and manufacturing industrial products, including aerospace and defence, machinery, construction, transportation, and more.

Note that investing in the Industrial Select Sector SPDR Fund provides investors with exposure to a diversified portfolio of industrial stocks. The fund has low expenses and is easy to trade, making it an attractive option for investors looking for a cost-effective way to invest in this sector.

However, like all investments, the Select Sector SPDR industrial ETF comes with risks, and investors should carefully consider their investment objectives and risk tolerance before investing. The ETF is traded like regular stocks through online ETF brokers with access to the NYSE exchange. You can identify the asset using the ticker XLI.

FAQs

Absolutely. The XLI SPDR ETF is one of the most popular and widely traded ETFs. It tracks the performance of the S&P 500 index, which includes 500 of the largest publicly traded companies in the US. Based on our comprehensive review, SPDR S&P 500 ETF can be a good investment option for investors who want exposure to a diversified portfolio of large-cap US stocks.

The dividend yield for the Industrial Select Sector SPDR Fund ETF is approximately 1.66%. The XLI pays its dividend every three months, and the most recent ex-dividend date was March 20th, 2023. Note that the dividend yield for XLI can vary over time depending on changes in the performance of the underlying stocks in the fund. Therefore, always monitor the fund’s dividend payment schedule and review its performance regularly.

A select sector SPDR fund is an ETF that invests in companies within a specific sector of the economy, such as healthcare, technology, or energy. These ETFs are designed to expose investors to a particular sector of the stock market, allowing them to diversify their portfolios and potentially earn returns.

Yes. Like any investment, the S&P 500 ETF comes with risks you must understand to limit your chances of making losses from its investment. The good news is that the S&P 500 ETF is often considered a lower-risk investment option compared to individual stocks, as it provides diversification and exposure to a broad range of industries and sectors.

Conclusion

Getting started with investing in the Industrial Select Sector SPDR Fund ETF requires a good understanding of the process. We hope our ultimate guide above has provided you with all the information to make your first investment in this fund. However, note that investing in ETFs comes with risks, meaning you could earn profits or losses. To maximise your investment potential, track the XLI stock price performance to identify the best entry and exit points. Plus, select a credible and reliable ETF broker and apply risk management controls to mitigate massive losses.