Microstrategy Incorporated is a business intelligence company located in the US. It offers cloud-based, mobile software, and business intelligence services to various global businesses. The company has been around since 1989, and with technological advancement, many investors see growth potential. As a result, they are looking for ways to invest in Microstrategy stock to potentially make profits in the future.

Our comprehensive guide below takes you through the best way to invest in MicroStrategy stock. Whether you want to purchase the company’s shares or trade them by taking short-term positions, you will get the best guidance to suit your needs.

Top Brokers for Investing in Microstrategy Stocks

Investors looking to purchase Microstrategy stock requires a stockbroker with access to the NASDAQ exchange, where the company’s shares are listed under the ticker MSTR. Using stock brokers is the best way to invest in MSTR shares because you get to enjoy quality resources to help with your market analysis and strategy. In addition, besides using brokers to purchase Microstrategy stock, they allow you to trade the shares as derivatives, whether CFDs or indices.

Unfortunately, many stock brokers in the UK have access to the NASDAQ exchange, making it challenging for investors to find the best. Keep in mind that it is crucial to find a stockbroker that also meets all your investment requirements for the best experience. Since the research procedure can be lengthy and overwhelming, we took it upon ourselves to test and compare as many stock brokers as we could in the UK. Below are our top four picks to consider for investing in Microstrategy stock.

1. Plus500

*Illustrative prices

Although Plus500 doesn’t allow you to invest and own the shares of MSTR, you can trade the asset as CFDs and indices. We tested the broker and had a seamless experience with as little as £100 as the required minimum deposit. We can also attest that the broker is user-friendly and customisable, making it accessible to traders of all types. Moreover, Plus500 has beginners’ interests at heart by listing quality learning tools and a virtually-funded demo account to get started with.

Besides the MSTR shares, Plus500 lists additional CFD assets, including commodities, more popular shares, forex, and more, for portfolio diversification. Leverage limit on share CFD trading goes up to 1:5 for retail traders and 1:20 for professionals. When it comes to support service, Plus500 has the best team available 24/7 and offers relevant solutions that will aid in making the best decisions. On top of that, trading MSTR stocks is commission-free, but expect to incur spreads for the service.

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro

eToro is one of our top recommendations when it comes to purchasing Microstrategy stock. The broker has access to the NASDAQ exchange, meaning it allows you to buy MSTR shares and take ownership. With eToro, you can also buy the shares in fractions, thus giving low-budget investors an opportunity to explore the stock market. On top of that, there are no commission charges on share investments, and you can also trade them as CFDs or indices.

eToro is a user-friendly stock broker regulated by the Financial Conduct Authority and other global regulatory authorities. Additionally, it hosts plenty of learning resources, from guides to webinars for skills development. Besides giving you exposure to shares of global companies, eToro offers additional asset classes for portfolio diversification, including forex, commodities, cryptocurrencies, etc. You simply have to register for an account and make a minimum deposit of $100 to get started.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

3. IG Markets

IG Markets is a pioneer and award-winning stock broker that allows you to trade MSTR shares as CFDs. Like AvaTrade, it has no access to the NASDAQ exchange but lists numerous global company shares to trade. Using IG Markets also gives you exposure to additional +17,000 assets across diverse global markets, including forex, commodities, cryptocurrencies, etc. It is an excellent CFD broker for portfolio diversification, although you must deposit at least £300 to get started.

IG Markets offers newbies and professional traders extensive trading tools for maximum experience and potential. These include research tools, learning materials, and advanced platforms (L-2 Dealer, MT4, and ProRealTime). Like eToro, IG Markets hosts an IG Community platform where you will meet like-minded traders and share trading ideas to improve your experience. The only pitfall of IG Markets is its high trading charges that can shun away budget-conscious traders.

Your capital is at risk

How to Buy Microstrategy Stocks With eToro

Investing in Microstrategy shares can be challenging, especially if you have minimum knowledge on how to go about it. As mentioned earlier, you need the best broker with access to the NASDAQ exchange, where MSTR stock is listed, to make a purchase. The above-referenced stock brokers are reliable and have straightforward buying procedures. Below, we use eToro as an example to help you understand how to buy Microstrategy shares using a stock broker.

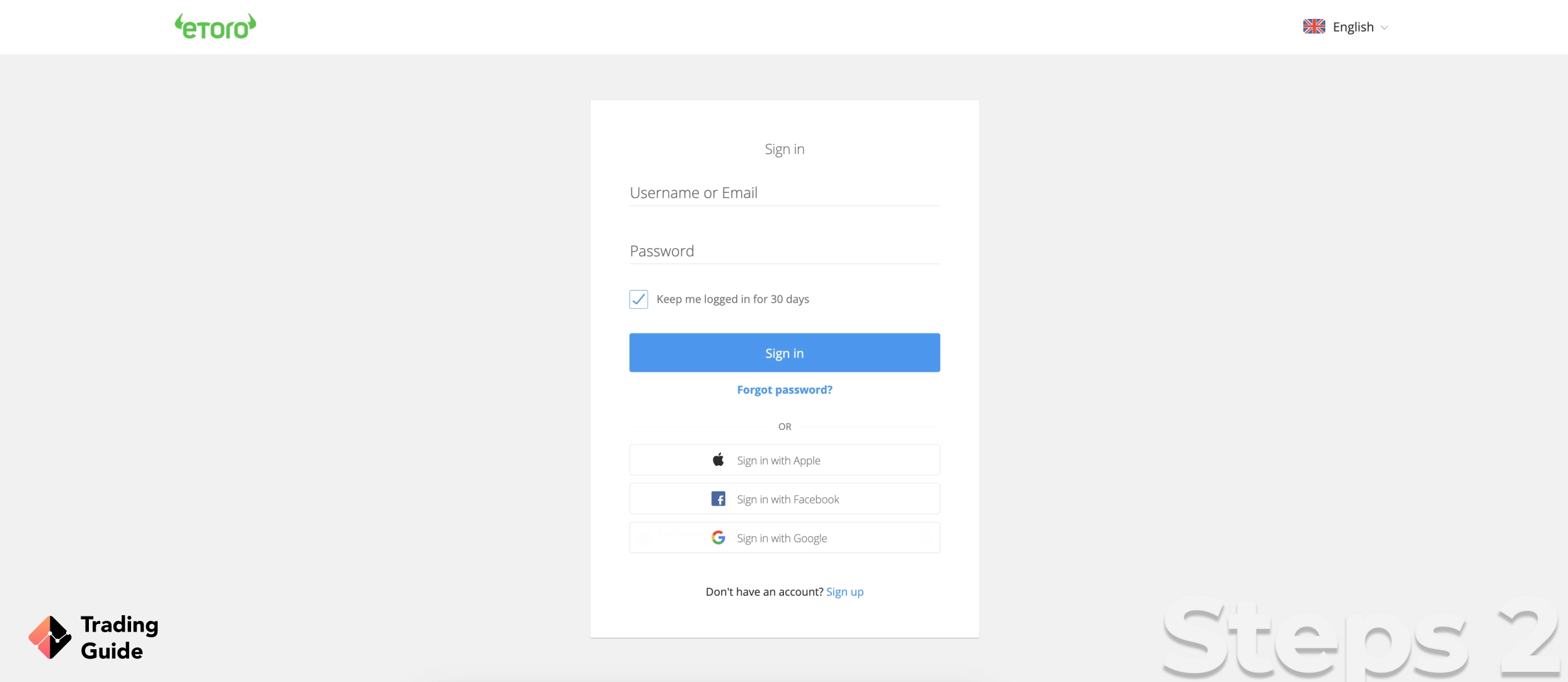

It’s easy to sign up for a trading account with eToro. Therefore, follow the links provided on this page and be redirected to eToro’s website. You can also download the broker’s app from Google Play and the App Store to easily manage your investments whenever you step away from your trading station. Most importantly, read and understand eToro’s terms and conditions to avoid future inconveniences once you have already invested your money with the broker.

Once fully prepared, begin the account registration process by sharing your personal details, including your name, date of birth, email, etc. eToro also requires that you create a username and password to secure your account from unauthorized access. Always provide accurate information since the broker will require you to verify them before fully activating your investment account.

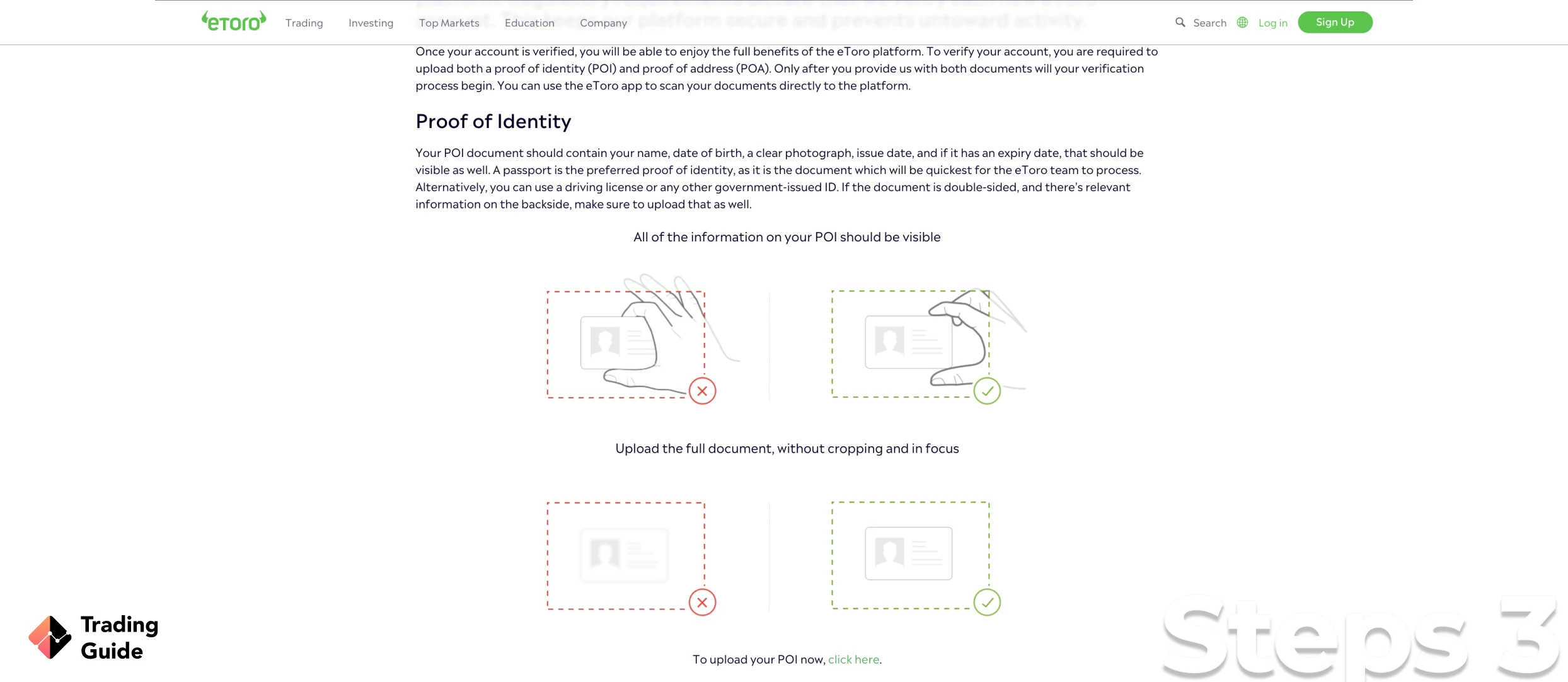

To ensure your account is protected, eToro will require you to verify your identity to start trading. This is a standard procedure for all FCA-regulated brokers, meaning that you will participate in it when registering an account with any stock broker regulated by the FCA. Therefore, you will upload a copy of your ID, passport or any other officially issued photo. Additionally, eToro will require a copy of your recent utility bill or bank statement to prove your place of residence.

eToro also has a questionnaire to fill out in order to select the best service package for you. There is also a basic knowledge test regarding margin trading to determine your leverage limits. Keep in mind that verification can take up to two days to complete, and a notification will be sent to your email upon approval.

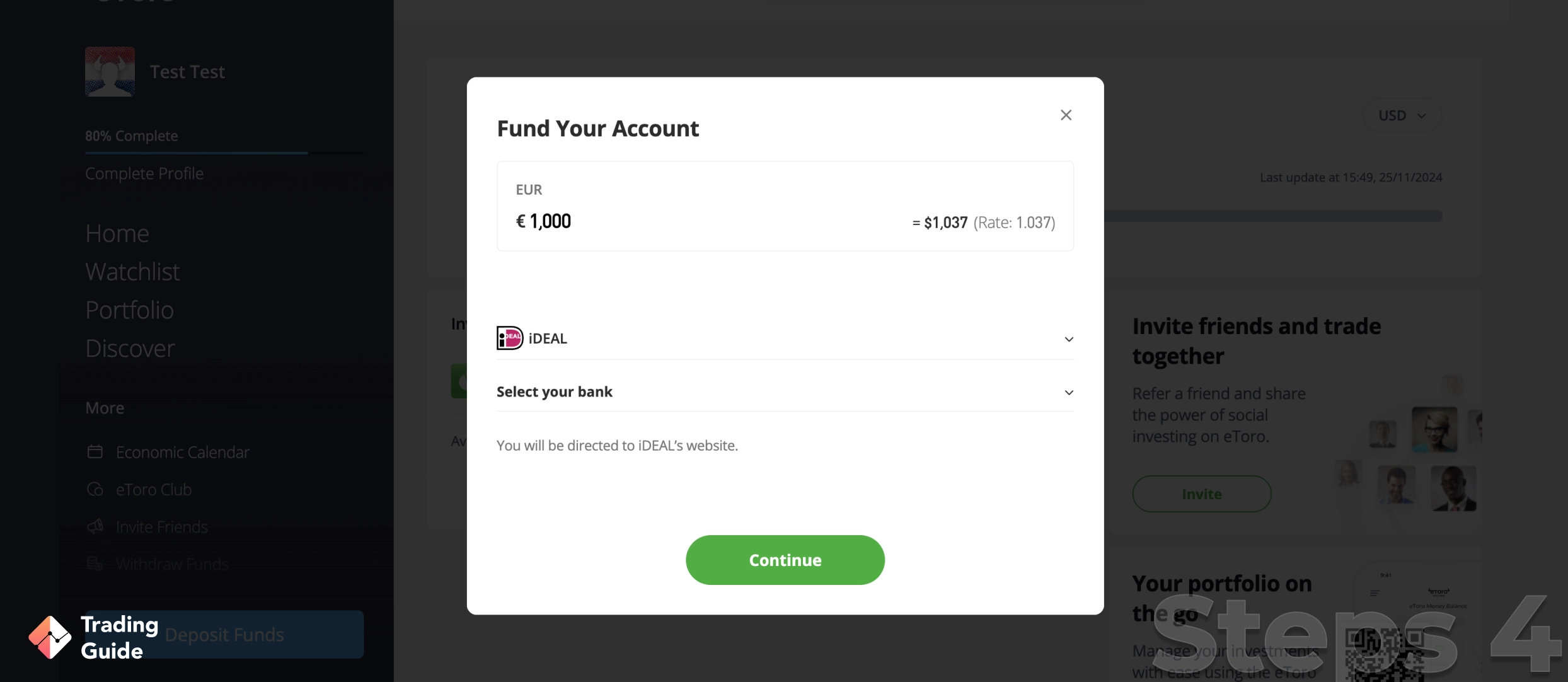

Once your account is verified and activated, you will be free to make a deposit and start investing in the Microstrategy shares. For eToro, only a $100 minimum deposit is required to access the NASDAQ exchange and buy the shares. Do not worry about your personal information or deposited funds getting exposed because eToro is highly encrypted and regulated. Furthermore, eToro accepts deposits using various payment methods, including debit cards, e-wallets, and bank transfers.

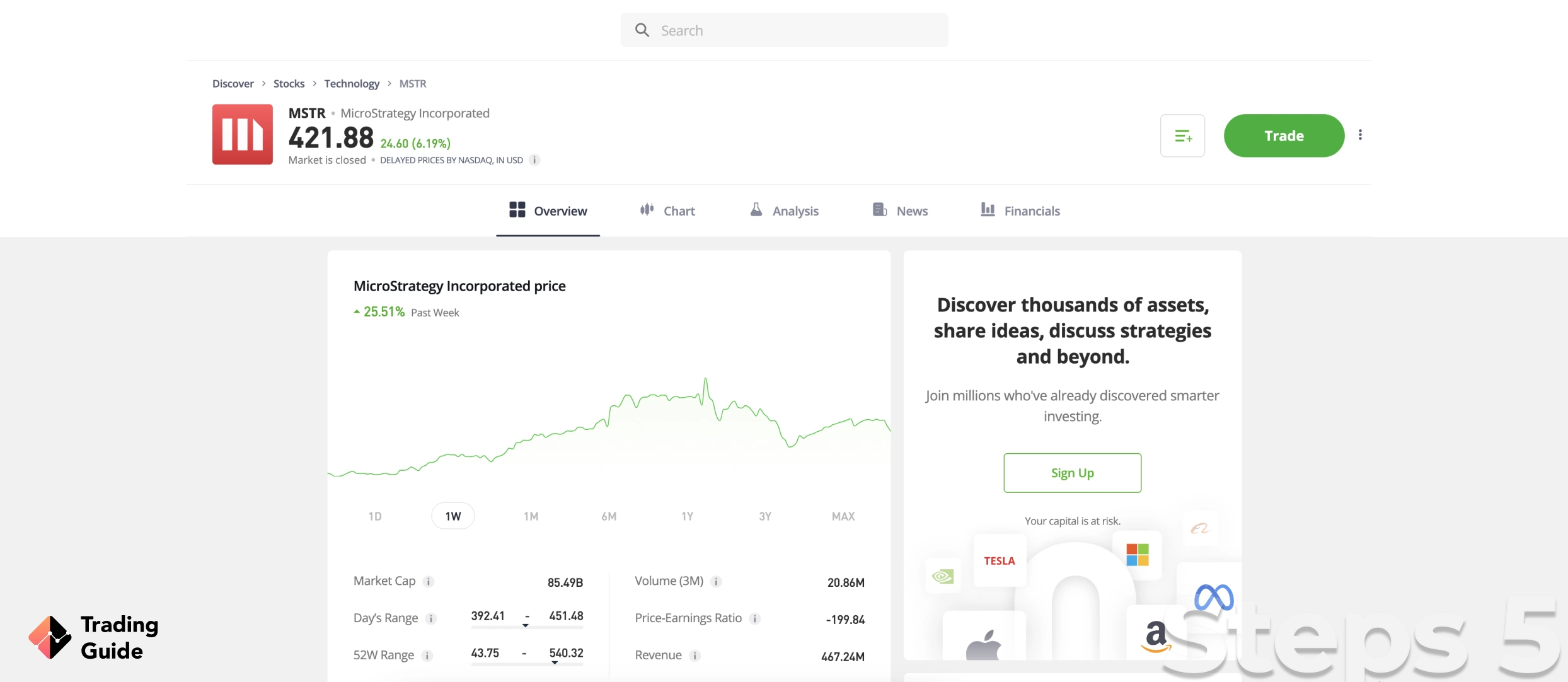

Once your deposit is confirmed, you will be redirected to the NASDAQ exchange, where you will select the number of MSTR shares you can afford to buy. If you prefer taking CFD positions, eToro also allows you to do so, but ensure you understand all the risks that come with CFD trading before choosing it as your prefered investment option. You can also trade the Microstrategy stock as indices, whereby you get to combine several stocks in the same investment.

Tips on How to Choose the Best Stock Broker to Invest in Microstrategy Stocks

If you have been investing in the financial industry, you probably know that finding the best stock broker to invest in MSTR stock in the UK is an uphill climb. Our research process to find the top brokers recommended here was lengthy, with many procedures involved. This includes reviewing and comparing the brokers’ features to see which ones suit our set requirements.

Below are the significant elements we looked at when reviewing and comparing stock brokers in the UK. You can use them to quickly find the best broker for buying Microstrategy shares should you decide to forego our recommendations.

The best stock broker for buying Microstrategy shares in the UK must guarantee your safety and that of your trading funds. Note that many unregulated brokers pretend to offer brokerage services, but in reality, they aim to lure you into committing to them hence stealing your money. To be safe, only consider a broker that is regulated by the Financial Conduct Authority (FCA). Such brokers also provide the best trading environment, and it’s easy to take legal action against them in case of an agreement breach.

If you are looking for a stock broker to buy Microstrategy stock with, ensure the one you select has access to the NASDAQ exchange where it is listed. However, for traders looking to take CFD and index positions, confirm whether the broker you are considering allows you to do so. Also, find a broker with additional asset classes so you can easily diversify your portfolio with other assets.

A stock broker for buying Microstrategy shares must host a platform that is user-friendly and improves your experience. It should also execute trades fast, especially if taking short-term positions like CFDs. Most importantly, the best trading or investment platform must offer quality resources to maximize your chances of earning profits from MSTR stock. If you are always on the move, only choose a broker with a trading app, so you can install it on your mobile device to invest and trade on the go. A demo account will also help you boost your confidence and experience, especially if you are a newbie.

Having a budget before starting your investment ventures in the UK will help you have a plan and find a broker that will give you the best experience. Using your budget, find a stock broker by considering its trading and non-trading charges, including minimum deposit requirement, spreads, commissions, inactivity fees, transaction costs, etc. This way, you do not overspend and risk losing a huge amount of money.

Investing in MSTR shares is challenging, but you can maximise your potential with the best broker in your corner. Besides the above features, the best stock broker for buying Microstrategy shares must have a reliable support service that provides relevant solutions to any arising issues. It is also essential to ensure the support service fits into your investment schedule and can be reached via different channels.

While finding a stock broker that meets your investment requirements as listed above is crucial, consider reviewing what current and previous investors have to say about their experiences with a broker. You might discover some strengths and weaknesses of a broker that you couldn’t do during research and make the best choice. To analyze user comments and reviews, visit Google Play, the App Store, and Trustpilot.

Microstrategy Stock Price Today

Microstrategy stock price is challenging to predict since the stock market keeps changing, thus affecting the company’s share value. For this reason, we share below a live chart indicating the current share price of Microstrategy Incorporated. You can also access the stock’s historical data and other data points to assist in your analysis, hence making the best investment decisions.

About Microstrategy

Microstrategy Incorporated is an enterprise analytics software and service company established by Michael J. Saylor, Thomas Spahr, and Sanju Bansal in 1989. The company offers its users with modern analytics experience that gives them insights to help make the best decisions and optimize business processes. These tools for delivering insights include automated report distributions, scorecards, ad hoc queries, interactive dashboards, and highly formatted reports and alerts.

Microstrategy products include HyperIntelligence, embedded analytics, consulting, education, cloud, and Business Intelligence and Analytics tools. You can access the company’s services and applications via web and mobile devices and access APIs and gateways to integrate its functionality with third-party tools to boost your business operations.

Keep in mind that Microstrategy is the largest independent publicly-traded business intelligence company with the leading enterprise analytics platform. It is tailored for on-premise and cloud deployment and features elements to help you make fast business decisions. The company is trusted by over 4,000 enterprises globally and partners with various professionals to ensure its products and services are delivered to consumers across the globe.

FAQs

Yes. You can buy Microstrategy stock in the UK using a broker with access to the NASDAQ exchange, where the shares are listed under the ticker MSTR. The stock broker must meet your investment needs and be regulated by the FCA. We list our top recommendations above to choose from.

Yes. Microstrategy is a public company headquartered in Tysons Corner, Virginia, United States. Its shares are listed on the NASDAQ exchange, and you can easily purchase or trade them using the best stock broker like the ones we recommend in our mini reviews above.

Yes. Based on our analysis, we consider MSTR a good stock to buy since it has growth potential in the business technology industry. However, it is crucial to conduct additional research on the company before putting up your money to ensure you are making the best investment decision.

No. Unfortunately, Microstrategy Incorporated does not currently pay dividends to its shareholders.

There are various MSTR shareholders, but the top ones include Vanguard Group Inc, Susquehanna International Group, Capital International Investors, BlackRock Inc., Citadel Advisors LLC, Renaissance Technologies LLC, Group One Trading, and IMC-Chicago, LLC.

Conclusion

Microstrategy Incorporated has existed for over three decades and is becoming increasingly popular with technological advancement. With its measures to fit into developing trends, the company has growth potential and investing in it now can pay off in the future. However, ensure you conduct additional research on the company to clear all doubts before making an investment.

The good news is that using stock brokers to invest in Microstrategy shares gives you an opportunity to risk a small amount of money on fractional shares. You can also start trading MSTR stock as derivatives and see whether it is worth investing in long-term. You simply have to find the best stock broker that meets your requirements to maximize your potential and enjoy your experience.