Palladium is one of the rarest precious metals used in producing various industrial and electronics products. Over the years, the commodity has seen a high increase in demand, thereby attracting the attention of investors looking to invest in palladium.

In this guide, we show you how to invest in palladium using online brokers. In addition, you will learn more about the best palladium stocks for 2025 and the top stock brokers to get you started. Hopefully, at the end of this guide, you will be able to decide whether to trade the asset as a commodity or a stock.

Brokers for Investing in Palladium

One of the reasons most investors fail to succeed in their investments is the poor choices of online brokers. The best broker should give you an excellent experience and maximise your profit potential.

Note that you must conduct thorough research to find a suitable online broker that meets your trading needs. Since the research procedure can be overwhelming and time-consuming, our professional analysts made things easier for you by testing and reviewing UK stock brokers, thus handpicking the top brokers for investing in palladium. They include:

1. Plus500

*Illustrative prices

For traders looking for a cost-effective way to trade palladium, Plus500 offers a reliable platform. Not only is it highly regulated, but it is also among the most user-friendly with customisable interfaces. Moreover, Plus500 has a demo account that allows beginners to get started easily without spending their hard-earned money. And when you are ready to take the risk, the broker will enable you to easily transition to the live trading account with a minimum deposit of only £100.

While testing Plus500, we enjoyed commission-free trades on palladium and incurred low spreads as our trading charges. Although palladium is only available to trade as CFDs, Plus500 lists additional commodities and other asset classes like shares CFD, forex CFD, indices CFD, and more for portfolio diversification. The best part is that professional traders get access to advanced trading resources and a leverage limit of up to 1:20 for palladium and other commodities. Its support team is also among the best, as they respond promptly and provide relevant solutions to any concerns or challenges raised.

- User-friendly platform design

- Low minimum deposit requirement of £100

- Virtually-funded demo account for practice

- Professional 24/7 customer support

- Limited to trading palladium as CFDs; no option for asset ownership

- No third-party trading tools or platforms

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro

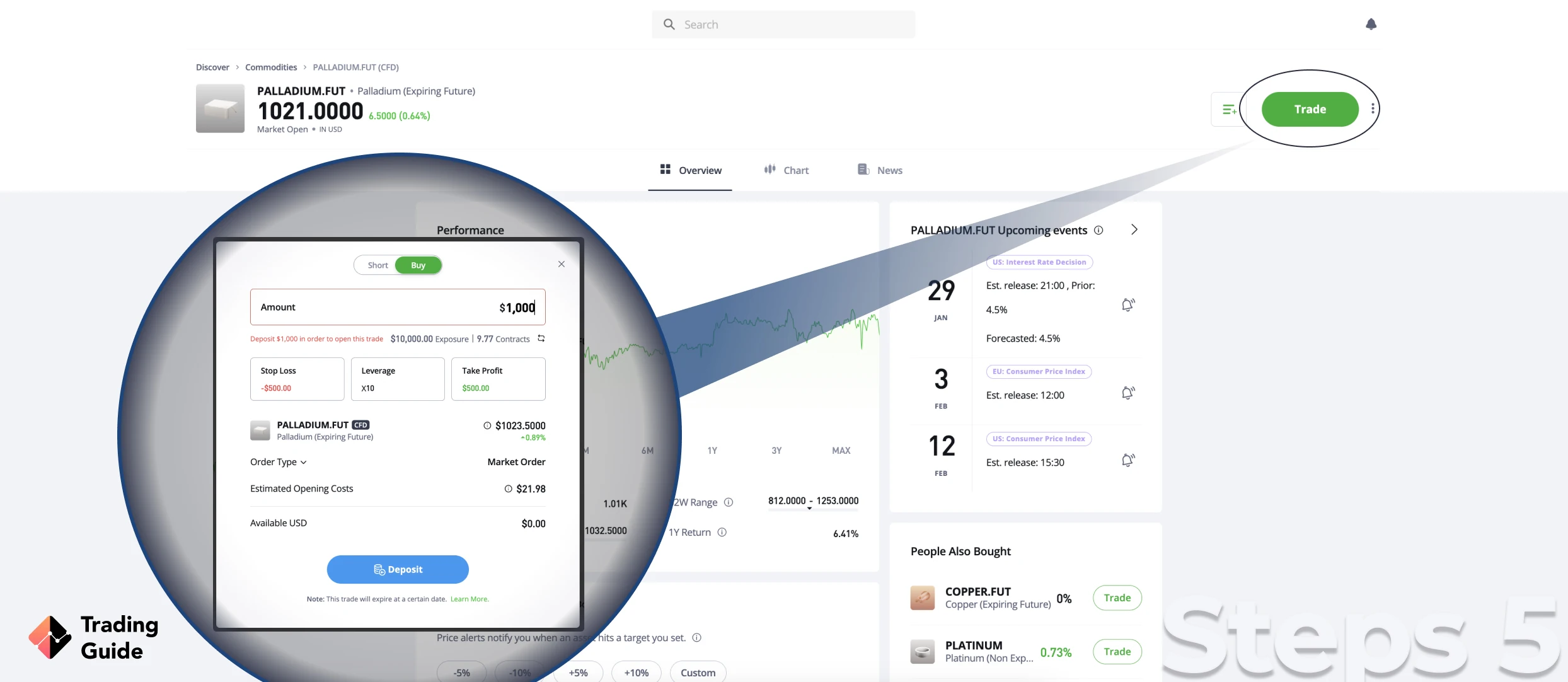

eToro has one of the best platforms to help you maximise your trading potential when investing in palladium. For instance, it has a user-friendly demo account to get newbies started without spending their hard-earned money. In addition, you can benefit from the social and copy trading platform that allows you to network and share investment ideas with other traders. You can also follow the expert investors and mirror their positions if need be.

eToro allows you to purchase palladium physically or invest in its shares. Moreover, you can trade the asset as CFD, ETFs or indices. You can start to trade with a minimum deposit of $100. However, expect high spreads and a high minimum deposit for the copy trading platform.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- Making deposits at eToro is free* of charge using various supported payment methods, including debit cards, e-wallets, and bank transfer

- Low minimum deposit requirement of $100

- Highly secured, user-friendly platform that suits all types of traders

- Excellent collection of learning resources and an award-winning social trading platform to help in skills development

- No advanced platforms like MT4 for professional palladium traders

- Making withdrawals attracts a fee

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

3. Pepperstone

Like eToro, Pepperstone features social and copy trading to help you have the best trading experience. It has various user-friendly platforms with fast order execution speed, including cTrader, TradingView, MT4 and MT5. With These platforms, you are guaranteed quality research resources and learning materials to advance your skills. To get started with Pepperstone, a minimum deposit of £200 is required. Commissions for palladium investing are low, and you get to enjoy additional 800+ trading securities, namely forex, stocks, indices, commodities, and ETFs.

On the flipside, Pepperstone has limited asset offerings and only allows trading of palladiums shares as CFDs. So, if you want to invest and take ownership of palladium or its shares physically, you may want to consider other brokers. But, all in all, Pepperstone has excellent features to maximise your potential and is definitely worth trying.

- Features a wide range of educational materials to help newbies quickly improve their skill levels and become independent

- Low spreads for trading Palladium commodity

- Availability of multiple user-friendly platforms, including cTrader, TradingView, MT4, and MT5, for all types of traders

- High minimum deposit requirement, which might shun away low-budget traders

- Only CFD and spread betting allowed. No buying and taking ownership of Palladium

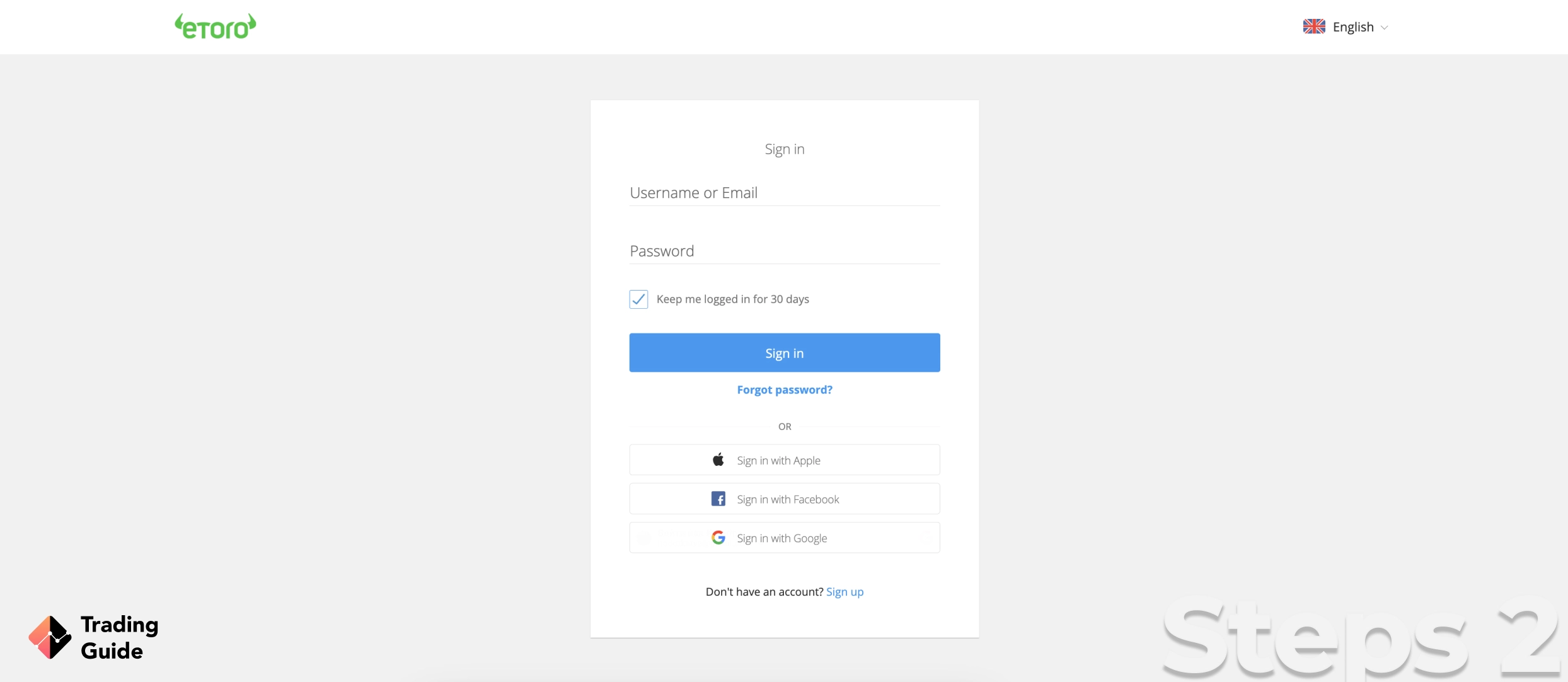

How to Buy Palladium With eToro

Buying Palladium requires the best stock broker like eToro that supports you with all the necessary tools to maximise your experience. Note that FCA regulated brokers have similar procedures for buying palladium commodity or its shares except for a few requirements based on a broker’s preferences. Below, we explore the step-by-step procedures of buying palladium with eToro, hoping that it will prepare you to dive into the share markets and start investing.

Find your way to eToro’s website and complete the account registration process to buy palladium. For quick access, we have shared links to redirect you to eToro’s website. Note that the broker is reliable and has a trading app that we encourage you to install on your mobile device. This is so that you can alternate with the desktop platform, especially when you step away from your trading station.

Before you create a trading account, it is crucial that you read, understand and accept eToro’s terms and conditions to avoid future conflicts with the broker. Then, eToro will lead you through the signup process, where you will be required to share personal details, including full names, email, phone number, date of birth, employment details, etc.

Additionally, you will create a username and password and engage in simple knowledge and margin trading tests. These tests are meant to gauge your skills level, thus determining the best trading package and leverage limit for you.

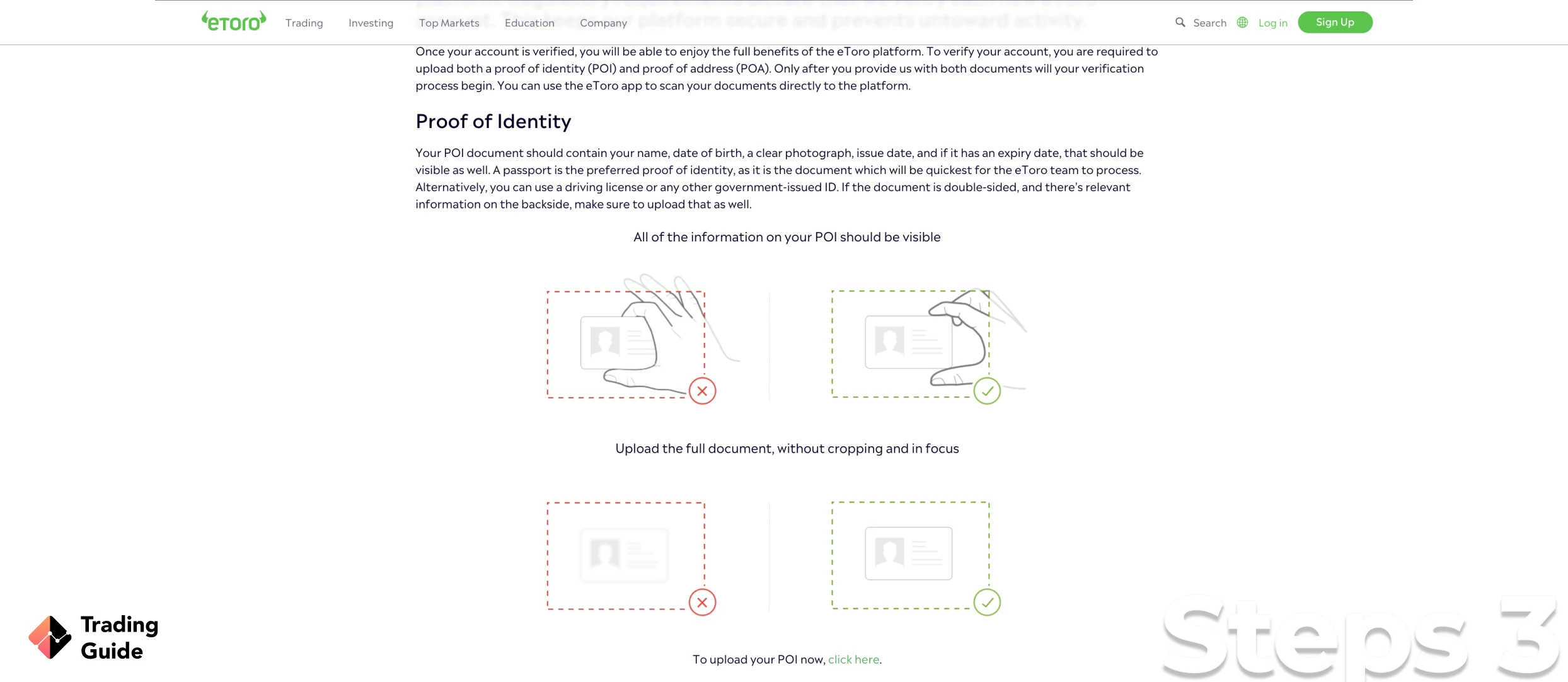

All FCA regulated brokers are required by the authority to verify the identities of trades before fully activating their trading accounts. For this reason, eToro will need a copy of your original ID card, passport, or driving license to verify your identity. You will also share a recent utility bill or bank statement that confirms your jurisdiction area.

It will take upto two days to have your account fully activated, and when this happens, eToro will notify you via email. At this point, you are free to make the required deposit to buy palladium. Note that eToro’s minimum deposit requirement is $100, and there are no deposit fees*. So, identify the best payment method from the provided options for quick and efficient transactions.

Note: it usually takes a lot less than 48 hours to be verified and your account to be activated.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

Once eToro confirms your deposit, you will be redirected to the exchanges where palladium is listed. The good news is that eToro also allows you to purchase palladium stocks and trade them as CFD or indices.

Tips on How to Choose the Best Stock Broker to Invest in Palladium

Trading commodities carries risks such as market volatility, leveraged positions, and the potential for substantial losses. To manage these risks, diversify your investments, use stop-loss and take-profit orders, and trade with funds you can afford to lose. Additionally, stay informed about market factors, adhere to a well-defined trading plan, and guard against emotional decision-making.

It is also crucial to comply with market regulations and be cautious of counterparty risk. Regularly reassessing your risk tolerance and trading strategies will help you trade responsibly and maximise profitability.

Investing in palladium can be simplified if you have the best stock broker in your corner. Such brokers meet your investment needs and offer the best trading conditions to ease your experience. Unfortunately, finding the best stock brokers in the UK to invest in palladium is not easy, especially with many research processes involved. For this reason, we share below tips on how to choose the best stock broker to invest in palladium.

Always settle for a stock broker in the UK that is regulated by the FCA. This is because many brokers dominate the UK market, and some are mere scammers. Besides, the only legal way to invest in palladium in the UK is by using an FCA regulated broker. With such brokers, you can easily take legal actions against them in case of a conflict.

Having a budget and knowing how much you will spend on palladium investment allows you to plan beforehand. The last thing you want is to dig deep into your savings and end up traumatised should your investment go against your expectations. So, make sure you confirm a broker’s trading and non-trading charges and whether they fit into your budget.

The best stock broker should have a trading platform that allows you to quickly take advantage of arising opportunities and make profits. This means that it should be fast in executing trades and offer quality materials for technical and fundamental analysis. What’s more, consider a platform with a demo account, especially if its charges are high. This is so that you can easily test the broker without putting up your money.

Obviously, you must find a stock broker that allows you to invest in palladium, whether you want to purchase its stocks or trade the commodity as derivatives. However, as an investor, we encourage you to explore other markets to find more opportunities for profits. In this case, your broker of choice should host additional securities like forex, more stocks and commodities, cryptocurrencies, mutual funds, etc.

Trading and investment challenges are inevitable, and it is crucial that you prepare yourself to handle them when they occur. In this regard, choose a broker with committed and reliable customer service to help you effectively manage any trading issues. Whether a broker’s support service runs round the clock or is only available five days a week, simply ensure they align with your investment schedule.

Palladium is one of the most unique and precious metals that continues to be in demand by most investors. Knowing how to trade palladium prepares you for when the time is right, and opportunity arises.

Most investors trade palladium stocks by identifying palladium mining companies and investing in their shares. However, you can also trade the commodity as CFD, ETFs, or indices. You simply have to identify the best broker that supports your preferred trading methods.

Another way to trade palladium is by purchasing it as a physical commodity. However, this trading method is rare among investors since it involves overwhelming procedures of identifying safe storage and insuring the commodity.

Palladium Stock Price Today

Palladium stock price is influenced by various factors, including industrial demand and US dollar value. This means that the commodity’s share price keeps on fluctuating. With many investors looking to invest in palladium, knowing the current share price of the asset will help you make the right investment decisions and improve your profit potential.

That being said, below is a live chart indicating today’s palladium share price and historical data to effectively develop the best strategy for your investment.

Best Palladium Stocks for 2025

2025 looks promising for palladium investment, considering that its demand has attracted many investors not only in the UK but globally. If you are looking to invest in palladium stocks, you should find those with high potential for profits. Luckily, we did our own research and handpicked the best palladium stocks for 2025. Feel free to conduct further market analysis on these stocks to choose the one you fully understand.

- Sibanye Stillwater

Founded in 2013, Sibanye Stillwater is one of the leading producers of palladium that also specialises in platinum and gold. It is located in South Africa, and its shares are listed on the Johannesburg Stock Exchange and the New York Stock Exchange. Other extended operations are in the US, Argentina, Canada, and Zimbabwe. The company also owns Stillwater and East Boulder mines, which are the only palladium mines in the US.

- Ivanhoe Mines

Ivanhoe Mines is located in Canada and focuses on developing and exploring metals and minerals, including palladium, platinum, gold, rhodium, copper, and nickel. The company’s operations are primarily done in Africa, and has managed to partner with various global miners to diversify their services across the globe. Founded in 1993, Ivanhoe Mines has a bright future and investing in its shares can bring about profits.

- Anglo American Platinum

Anglo American Platinum stock is also one of the largest global palladium producers that focuses on producing platinum, rhodium, osmium, iridium, and ruthenium. The company was founded in 1995 and has its headquarters office in Johannesburg, South Africa. It also extends its services across the US, China, Finland, and Europe. Anglo American Platinum is also a leading recycler and processor of used PGM catalytic converter materials.

- A-Mark Precious Metals

A-Mark Precious Metals was founded in 1965 and is currently located in the US and listed on the NASDAQ exchange under the ticker AMRK. This company focuses on marketing and distributing commodities, including palladium, silver, and gold, to industrial and commercial users. It serves global countries, including the UK, Australia, Canada, Austria, China, Mexico, South Africa.

- New Age Metals

New Age Metals was founded in 1996 and headquartered in Vancouver, Canada. The company owns one of the largest undeveloped palladium projects in the US. In addition, New Age Metals commodity exploration activities are funded by Mineral Resources Limited, a mining company based in Australia. With 100% ownership of all its projects, the company is dedicated to diversifying its services across various regions globally.

FAQs

Absolutely. You can either purchase palladium as a commodity or its shares from mineral companies like those listed above. To buy stocks, you need the best stockbroker with access to the right exchanges where they are listed.

The stock price of palladium keeps on fluctuating based on various factors that affect its share price. For this reason, we share a live chart above indicating the current share price of the commodity. This is so that you can be able to create the best strategy that has the potential for profits.

Palladium can be traded in various forms using online brokers. Besides purchasing the commodity or its stocks, you can trade palladium shares as CFDs. Palladium share CFD trading involves speculating on the asset’s share price movement and profiting from the price difference. Alternatively, some brokers will also let you trade palladium as indices, where multiple stocks are combined in an investment.

The easiest place to trade palladium is through online brokers. In the UK, finding the best broker to trade palladium is a daunting task, and for this reason, we share the top three brokers above to give you the best experience.

The stock symbol for palladium is PA, and you can find the commodity’s stocks listed on various exchanges globally, depending on a company’s location.

Yes. Palladium’s demand has been increasing throughout the years, and for this reason, it has a good potential for profits in 2025. However, it is important that you conduct a thorough analysis of the best palladium stock before investing your money.

Conclusion

Palladium is becoming more popular among investors and has made many of them gain exposure to different types of precious metals, considering that silver and gold have become crowded. With a good potential for value and share price increase in 2025, we encourage you to give this investment a try. But, you must ensure that you conduct thorough due diligence before investing in palladium stocks. On top of that, you need to find the best stock broker with plenty of investment tools and resources to maximise your experience.