Investing in Shell or Royal Dutch Shell Group, one of the world’s largest energy companies, can be a strategic move to benefit from the potential growth and stability of the oil and gas industry. With the company’s success history, many investors are trying to be part of it and, hopefully, earn profits in the future. But, how do you go about this investment venture? Discover the key considerations, steps to get started, and top stock brokers that will help you make informed decisions.

5 Simple Steps for Buying Shell Shares in the UK

Before you invest in Shell shares UK, you must be well-versed in the stock market and know when to make a move for maximum potential. You also need the best stock broker with access to the LSE or NYSE where the Shell PLC shares are listed. Most importantly, learn the steps for getting started using your broker. Below are the 5 simple steps for buying Shell shares in the UK. We will discuss the procedures later in this guide for better understanding.

- Learn more about Shell company’s performance, including the difference between Shell A and B shares

- Find a credible stockbroker with features suitable to your needs

- Create an investment account on the broker’s website

- Make a deposit per the broker’s minimum deposit requirement

- Buy Shell A or B shares

Top Brokers to Invest in Shell Shares

When it comes to investing in Royal Dutch Shell shares, choosing the right broker is essential. A reputable and reliable broker can provide you with the necessary tools, resources, and support to make informed investment decisions. Plus, it must be licensed and regulated by the Financial Conduct Authority (FCA) to guarantee your funds’ safety. If you want to buy Shell stock and take full ownership, you should also ensure that the stock broker you select has access to the NYSE or LSE, where Shell oil shares are listed under the symbol SHEL.

With so many stock brokers in the UK, finding the best to invest in Shell stock can be challenging. In this regard, we decided to conduct market research on your behalf. Below are our top three recommendations based on multiple tests and comparisons.

1. eToro

eToro is widely recognised as one of the best brokers for buying Shell shares. With its renowned copy and social trading features, eToro is an ideal platform, particularly for newcomers looking to gain insights into the stock market before investing. The platform’s user-friendly interface and educational resources make it easy for beginners to understand the dynamics of stock trading. Additionally, eToro offers a range of trading tools and analysis options that cater to the needs of experienced traders, enabling them to maximise their potential.

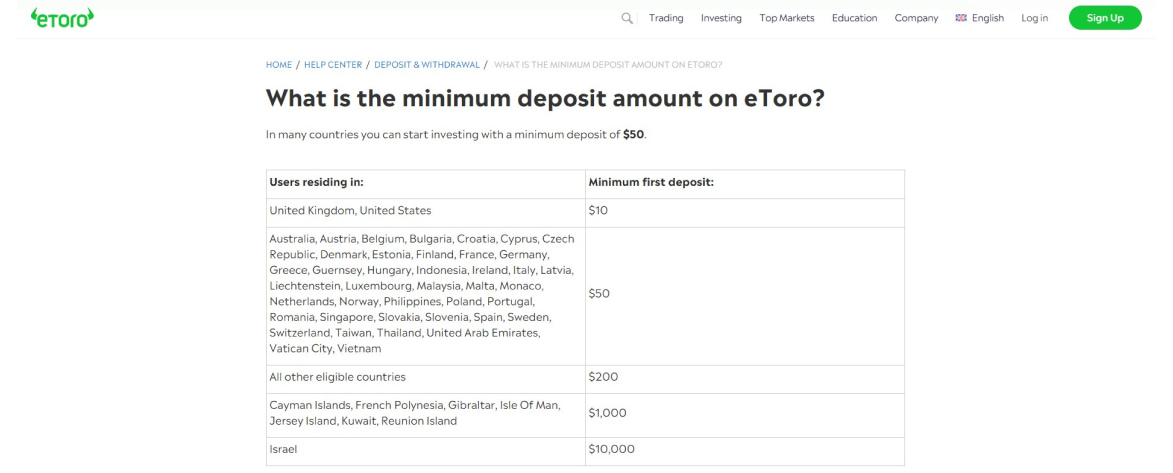

Note that there are withdrawal charges and relatively high spreads. To access the copy trading platform, a minimum deposit of $200 is required, and a minimum trade amount of $500 is recommended. Despite these considerations, eToro’s reputation as a reliable and reputable broker, coupled with its diverse range of tradable assets, including cryptocurrencies, commodities, and forex, solidifies its position as a top choice for individuals interested in purchasing Shell stock and engaging in various other trading opportunities.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- $100 minimum deposit requirement

- User-friendly and intuitive design platform

- Award-winning social and copy-trading platforms

- Commission-free share investment services

- Withdrawal fees apply

- Limited advanced investment resources for professional investors

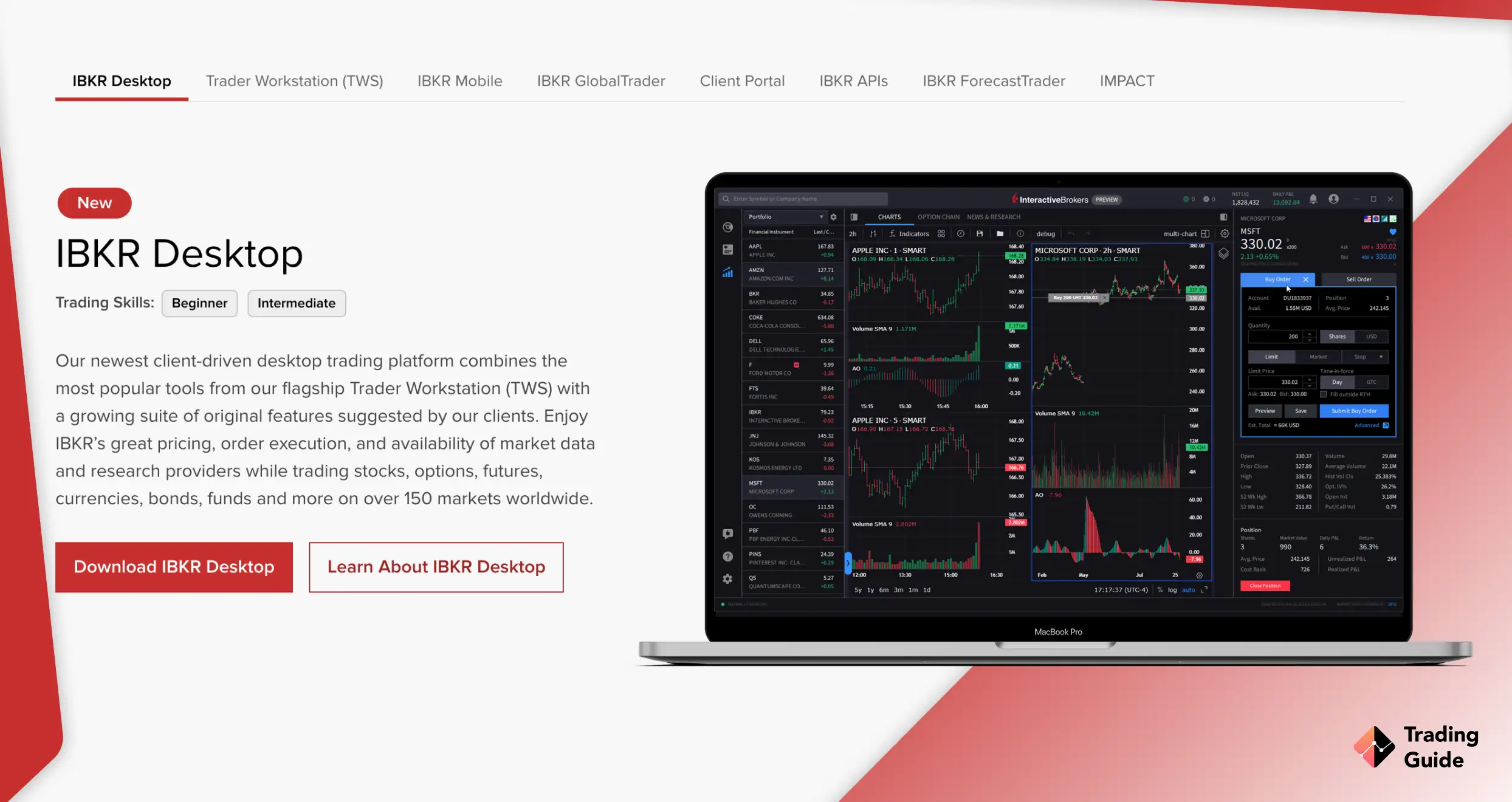

2. Interactive Brokers

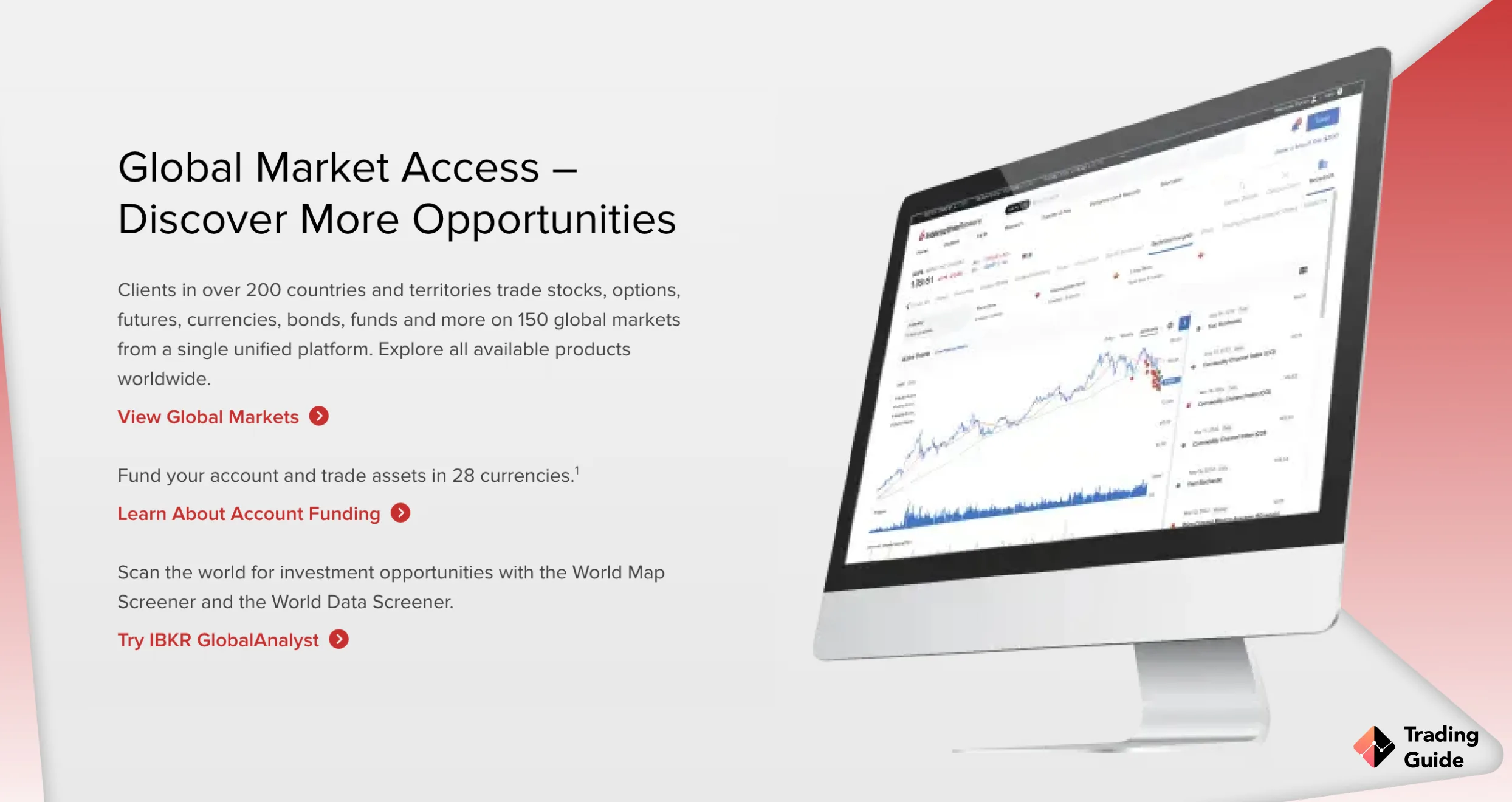

Interactive Brokers (IBKR) offers a range of quality trading tools and platforms, thus guaranteeing an exciting experience. On the IBKR Lite platform, investing in the shares of Shell is commission-free, and the option to buy fractional shares adds flexibility for investors. Plus, the broker has no minimum deposit requirements, and all transactions are free. This makes it an attractive choice for low-budget traders looking to invest in Shell.

IBKR offers a diverse range of tradable assets, including currencies, options, futures, cryptocurrencies, and more, allowing investors to diversify their portfolios. However, it’s worth noting that the platform’s complexity can be challenging for newcomers to navigate. Additionally, IBKR’s support service operates on a five-day-a-week basis, which may be a limitation for traders who require assistance outside these hours.

- No minimum deposit requirement

- Commission-free Shell stock investment services

- Availability of quality learning and research materials

- Plenty of additional assets for portfolio diversification

- A challenging platform for beginners to explore

- Customer service response rate can be improved

3. CMC Markets

CMC Markets is another highly regarded stock broker for individuals interested in buying SHEL stock. This platform offers the option to spread bet or trade Contracts for Difference (CFDs) on Shell shares without any commission fees. Note that CMC Markets has no minimum deposit requirement, allowing traders to invest in Shell shares with any amount they can afford. To enhance the trading experience, the broker provides excellent research tools and educational materials on its Next Generation and MT4 platforms, enabling traders to stay informed and make well-informed decisions.

CMC Markets also offers additional 8,000+ global shares to explore. Traders using this platform can diversify their portfolios by trading these shares and other assets, including forex, indices, commodities, ETFs, and cryptocurrencies. Note that CMC Markets does not facilitate the direct purchase and ownership of Shell shares.

- No minimum deposit requirement

- Plenty of additional assets for portfolio diversification

- A pioneer stock broker hosting quality research and learning materials

- Free deposit and withdrawal services

- Only derivative trades supported

- Customer service operates only five days a week

What is Shell PLC?

Founded in 1907 via a merger between the Royal Dutch Petroleum Company and Shell Transport and Trading Company, Royal Dutch Shell Group or Shell PLC is a global energy company that operates in the oil and gas industry. It is among the biggest publicly traded companies globally and plays a significant role in the exploration, production, refining, and distribution of petroleum and petrochemical products.

Shell’s headquarters is in London, the United Kingdom, although it has a widespread presence across over 70 countries globally. The activities of Shell encompass every stage of the oil and gas value chain. Exploration and production involve searching for and extracting hydrocarbon resources from beneath the earth’s surface. Shell has significant expertise in offshore drilling and has been involved in major projects worldwide.

In recent years, Shell has expanded its operations into renewable energy sources and technologies. Recognising the need for a transition to cleaner energy, Shell has invested in biofuels, wind power, and electric vehicle charging infrastructure. Its goal in the energy transition is to diversify its portfolio and reduce its carbon footprint. Moreover, the company is involved in community development projects and supports education, health, and social welfare initiatives.

As a publicly traded company, Shell is listed on several stock exchanges, including the LSE, NYSE, and Euronext Amsterdam. It has a strong reputation for delivering value to its shareholders and has a dividend payment history dating back several decades. The company’s shares are categorised as A and B, whereby Shell A shares were subject to withholdings from the Dutch government, whereas Shell B shares were primarily listed in London (LON: SHEL).

How to Start Investing in Shell

Investing in Royal Dutch Shell stock can be a rewarding venture, and with the right approach, it can be a relatively straightforward process. Here are the procedures for investing in Shell using eToro, a popular and user-friendly platform. Remember, the process is similar for all FCA-regulated brokers with access to the LSE or NYSE. You simply have to find the best broker for your investment needs.

Begin by visiting eToro’s website* or downloading its app from Google Play or the App Store. Sign up for a trading account by providing your personal details, including your name, age, phone number, email, and creating a username.

*{etoroCFDrisk}% of retail CFD accounts lose money.

To ensure security and compliance with regulations, eToro requires you to verify your identity. Upload a copy of your ID, passport, or any other officially issued photo identification. Additionally, provide a recent utility bill or bank statement as proof of your place of residence. eToro may also ask you to complete a questionnaire and a basic knowledge test on margin trading to determine your leverage limits. Verification typically takes up to two days, and you will receive an email notification upon approval.

Once your account is verified, you can make a deposit and start trading SHEL shares. eToro requires a minimum deposit of $100 to access the shares. Rest assured that eToro’s platform is highly encrypted and regulated, ensuring the security of your personal information and deposited funds.

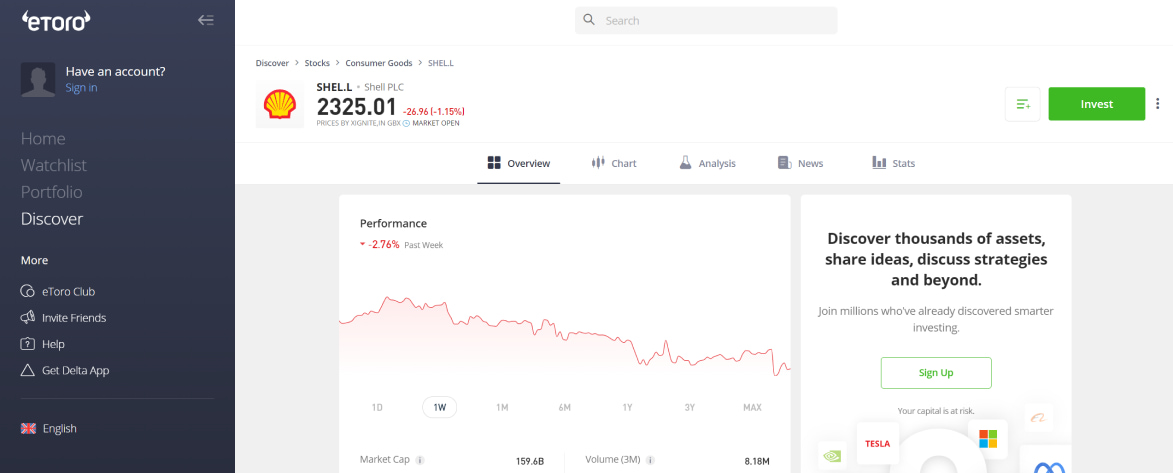

Navigate to eToro’s platform and search for Shell shares using the ticker symbol SHEL. You will find various options, including buying the shares and taking ownership or trading them as CFDs or through index investments that combine multiple stocks.

When buying the shares of Shell, determine the number of shares you can afford based on your available funds. If you opt to trade the shares as CFDs or through indices, allocate the appropriate amount of money and be aware of the associated risks before initiating the trade.

What Do You Need to Start Investing in Shell?

To start investing in Shell PLC LSE stock, there are a few key elements you will need to ensure a smooth and successful investment journey. Here are the essential requirements.

- Capital – Investing in Shell or any other company requires capital. You need to have funds available to purchase the shares. Determine the amount of capital you are willing to invest in Shell and ensure it aligns with your overall investment budget.

- Reliable Stock Broker – To buy or trade the shares of Shell, you’ll need to open a brokerage account with a reputable and reliable broker. Choose a broker that offers access to Shell shares and provides a user-friendly trading platform with robust features and tools. Consider factors such as commission fees, account minimums, research resources, and customer support when selecting a brokerage account.

- Research and Knowledge – Before investing in Shell, it’s crucial to conduct thorough research and gain knowledge about the company. Familiarise yourself with Shell’s business operations, financial performance, industry trends, and other relevant information. Stay updated on news and announcements that may impact the company’s stock price.

- Investment Strategy – Develop an investment strategy tailored to your goals and risk tolerance. Determine whether you want to invest in Shell for the long term or engage in short-term trading. Consider factors such as dividends, growth potential, and overall market conditions when formulating your strategy.

- Risk Management – Understand the risks of investing in Shell or any other stock. Markets can be volatile, and share prices can fluctuate. Set realistic expectations and establish risk management techniques such as diversification, setting stop-loss orders, and regularly reviewing and adjusting your portfolio.

- Patience and Discipline – Successful investing requires patience and discipline. Be prepared for potential fluctuations in the stock price and avoid making impulsive decisions based on short-term market movements. Stick to your investment strategy and stay focused on your long-term goals.

Benefits and Risks of Investing in Shell Stock

Investing in Shell stock can offer both benefits and risks. Understanding these factors is crucial for making informed investment decisions. Here are the key benefits and risks associated with investing in Shell stock.

Benefits

- Potential for Dividends: Shell has a history of paying dividends to its shareholders. As an investor, you may receive a portion of the company’s profits in the form of regular dividend payments.

- Exposure to the Energy Sector: Shell is one of the world’s largest integrated energy companies. By investing in it, you gain exposure to the energy sector, which can be advantageous if you believe in the industry’s long-term growth prospects.

- Potential Capital Appreciation: If the value of Shell stock increases over time, you can benefit from capital appreciation.

Risks

- Volatility in Energy Markets: The energy industry, including oil and gas, is subject to significant price volatility. Therefore, you should be prepared for potential fluctuations and market uncertainties.

- Company-Specific Risks: Shell is exposed to company-specific risks that may affect your investment. These include management changes, operational disruptions, legal issues, or adverse events impacting the company’s reputation. As an investor, always stay updated on Shell’s performance and closely monitor any developments that may impact the stock’s value.

Choosing the Right Brokerage Account

Choosing the right brokerage account is a crucial step when it comes to investing in Shell or any other stock. The brokerage account you select will serve as your platform for buying, selling, and managing your Shell investments. Here are some key factors to consider when choosing a brokerage account.

Prioritise the security measures implemented by the brokerage. Look for brokerages that employ robust encryption protocols and have appropriate regulatory oversight. Consider whether the brokerage is regulated by the Financial Conduct Authority (FCA) to ensure the safety of your funds and personal information.

Look for a brokerage with a strong reputation and a track record of reliable service. Research customer reviews, ratings, and industry rankings on Google Play, the App Store, and Trustpilot to gauge the reputation of the brokerage. A reputable broker will provide you with a secure and trustworthy platform for your Shell investments.

Evaluate the fee structure of the brokerage account. Consider factors such as account maintenance fees, commission charges per trade, and additional costs for services like research tools or market data. Choose a brokerage that offers competitive pricing and aligns with your investment budget.

Consider the range of investment options available on a broker’s platform. If you are to buy Shell shares, ensure the brokerage provides access to the NYSE or LSE where the stock is listed. It is also crucial to find a broker allowing you to invest in the stocks of Shell as CFDs or indices and list additional assets for portfolio diversification.

Assess the usability and functionality of the brokerage’s trading platform. A user-friendly platform with intuitive navigation, real-time data, and advanced order execution capabilities can enhance your trading experience. Look for features like customisable watchlists, research and learning tools, and mobile trading options that align with your preferences and trading style. A demo account availability is also crucial to familiarise yourself with the stock market before investing real money.

Evaluate the level of customer support offered by the brokerage. Check if they provide multiple support channels like phone, email, or live chat. Responsive and knowledgeable customer support can be beneficial when you have questions, encounter technical issues, or need assistance with your account.

Price Chart

The live chart below provides a visual representation of the current value of Shell shares, enabling investors to track its performance. Observing the price movements displayed on the chart allows you to analyse historical data and identify trends or patterns that may impact their trading decisions.

FAQs

Shell’s biggest shareholder is BlackRock Inc. You can also be part of the company by purchasing its shares via a credible broker like the ones referenced in our mini-reviews above.

Absolutely. Shell is a globally recognised company that has been existing for decades. The company’s strategies to increase its revenue and ability to pay dividends continue to attract investors, making it a safe investment asset. However, note that investing in any stock involves risks, and conducting thorough research and analysis is essential before putting up your money.

Shell has a history of paying dividends to its shareholders, which may attract income-oriented investors seeking regular cash flows. As an energy company, investing in Shell exposes you to the energy sector, which can be advantageous for investors who believe in the long-term growth potential of this industry. Plus, the company operates in various countries worldwide, thus benefiting from diverse revenue streams and access to different markets.

Yes. Although determining whether Shell stock is a suitable investment at a given time depends on numerous factors, we believe Shell buy is worth it. However, ensure you conduct thorough research, consider expert opinions, and evaluate your own share Shell investment strategy before deciding whether to buy SHEL stocks.

Conclusion

Investing in Shell shares today can be rewarding if you understand the company’s performance and how to get started. As a beginner, invest a small amount of capital to avoid risking too much money. The best element about investing with our recommended brokers above is that they allow you to purchase the shares of SHEL in fractions. Plus, take your time to conduct thorough research and develop solid strategies. Remember, investing in Shell shares, like any other investment, carries risks, and following the tips in our guide above will help you make informed investment decisions.