Investing in the stock market can be a lucrative way to build your nest egg over the long term. However, not everyone feels comfortable buying and owning individual company stocks. For those seeking an alternative, the Vanguard S&P 500 ETF is a popular option that provides exposure to a diversified portfolio of large-cap U.S. stocks with low expense ratios.

Below, we shed light on how to invest in Vanguard S&P 500 ETF using the best brokers in the UK. Whether you’re a seasoned investor or new to the game, our ultimate guide below will help you get started and choose a broker that ensures an exciting investment experience.

Top Brokers to Invest in Vanguard S&P 500 ETF

Vanguard S&P 500 ETF is listed on the NYSE under the ticker VOO. Therefore, to buy the ETF, you need a credible ETF broker with access to this exchange to efficiently complete your purchase.

We understand that the UK financial market hosts numerous ETF brokers, and selecting the best suitable for your investment needs can be a daunting task. In this regard, we conducted the research for you and list below the top ETF brokers we consider the best.

Note that we tested and compared hundreds of ETF brokers in the UK to come up with the list below. We then combined our findings with user testimonials on Google Play, Trustpilot and the App Store to ensure our recommendations are not biased.

1. Plus500

*Illustrative prices

Plus500 is one of the top brokers for investing in Vanguard S&P 500 ETF, providing a seamless platform. With its intuitive interface and efficient trade execution, this broker ensures a smooth trading experience. You can take advantage of its low spreads and commission-free trades to explore the ETF market without investing much capital. Besides, Plus500 has a low minimum deposit requirement of £100, which makes it cost effective.

Besides the VOO ETF, Plus500 hosts additional ETFs and asset classes for portfolio diversification. Its leverage limit goes up to 1:5 for retail traders and 1:150 for professionals. This makes it easier for you to capitalise on the markets and potentially maximise your profitability. Simply ensure you understand the risks of leverage trading before taking that route. We also like Plus500’s professional 24/7 customer support and its commitment to transparency and security. As a beginner, we advise you to test the broker’s performance via its demo account before making a full commitment.

- Low spreads and commission-free trades

- Favourable leverage options for all traders

- Diverse range of ETFs and investment options

- 24/7 customer support

- No support for third-party trading platforms

- Inactivity fee of £10 monthly applies after only three months, making Plus500 suitable for active traders

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro

Established in 2007, eToro is one of the best ETF brokers in the UK that allows you to invest in the Vanguard S&P 500. With eToro, it’s also easy to diversify your portfolio since the broker lists plenty of ETFs and additional instruments, including forex, stocks, commodities, cryptocurrencies, and more. On top of that, beginner ETF traders have access to plenty of educational content and a demo account to practice ETF trading before taking the plunge. There is also a social trading platform where you can interact with other ETF investors to learn different investment ideas.

eToro’s minimum deposit requirement is $100 and allows transactions using multiple payment methods. Unfortunately, the broker charges high fees for ETF trading and accessing the social trading platform requires a deposit of at least $200. In addition, eToro charges withdrawal fees.

- Low minimum deposit requirement

- An award-winning social and copy trading platform

- Excellent selection of learning resources

- Free deposits* using multiple payment methods, including e-wallets, bank transfers, and debit cards

- Limited advanced trading resources

- High ETF trading fees

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

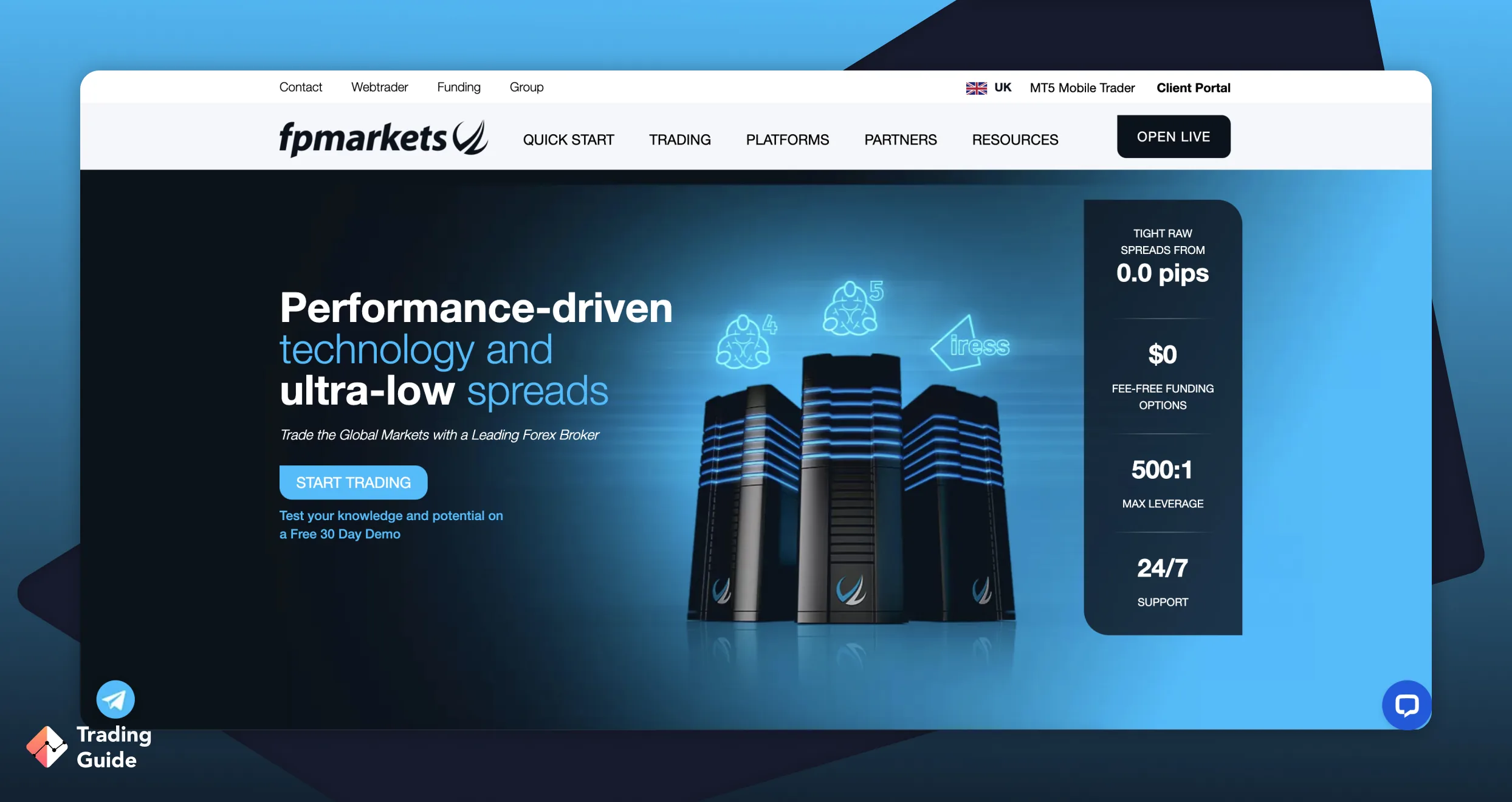

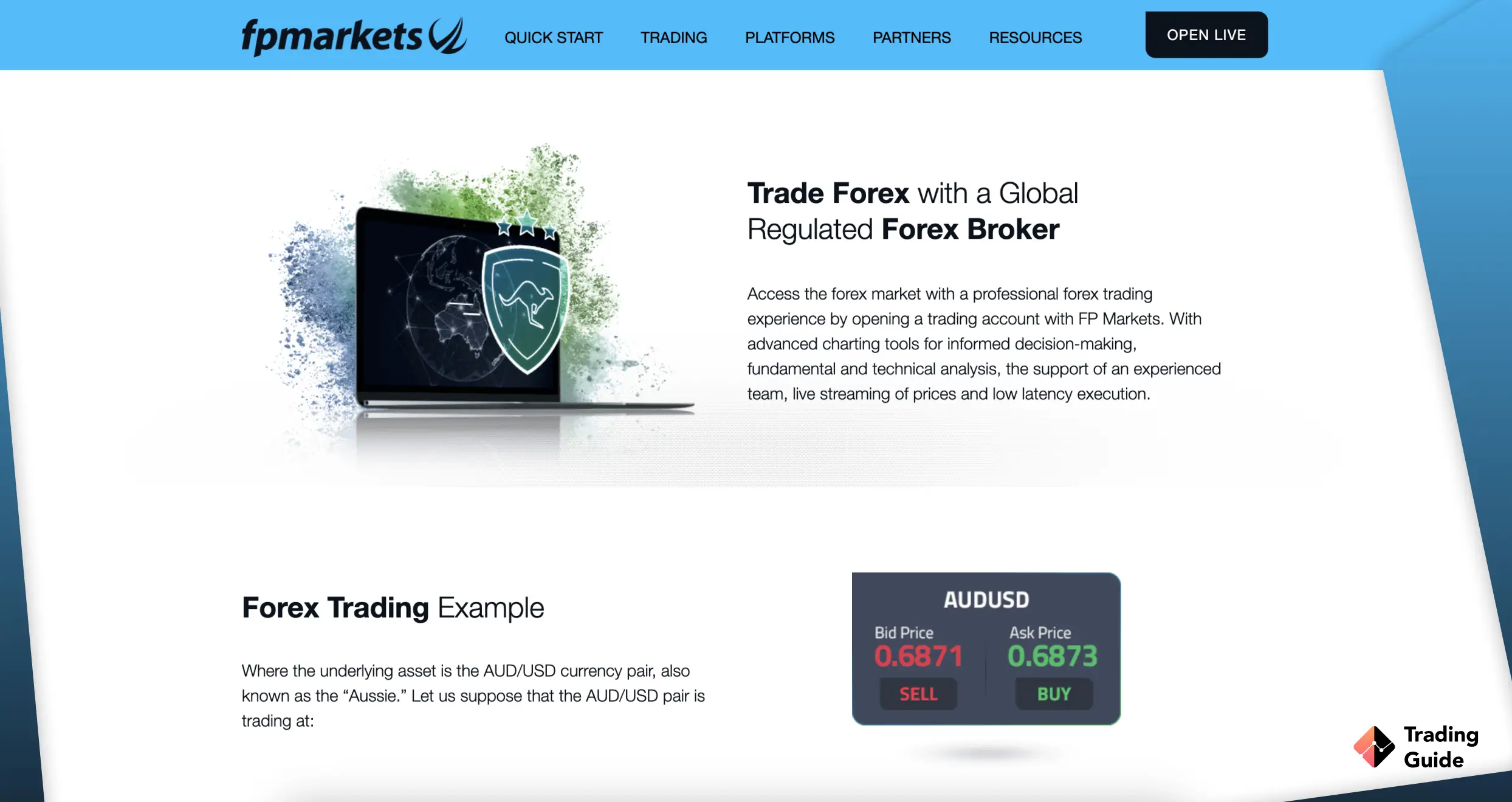

3. FP Markets

FP Markets is another excellent broker for investing in Vanguard S&P 500 index ETF. It offers low spreads, fast execution, and excellent trading conditions. The best element about this broker is that it has a user-friendly and intuitive design platform. The minimum deposit requirement is also £100, and you can transact using multiple payment methods free of charge.

Besides listing 290 ETF products, FP Markets offers additional trading instruments, including forex, commodities, shares, and indices for portfolio diversification. You can get started on its virtually funded risk-free demo account to decide if investing in the Vanguard S&P 500 ETF is worth risking your money for. Remember, FP Markets is a flexible ETF broker and offers multiple trading platforms to choose from. These include the MT4, MT5, Iress, and cTrader platforms.

- Over 290 ETFs plus additional thousands of instruments to explore

- Low minimum deposit requirement

- Compatible with desktop and mobile devices

- A user-friendly and intuitive design platform

- No ETF price plan

- No two-step login procedure

4. IG Markets

IG Markets is a well-established broker that has been around for more than four decades. Like eToro and FP Markets above, the broker is highly encrypted and regulated by top-tier financial regulators, including the FCA, CySEC, ASIC, and more. All you have to do is register for a trading account and deposit at least £300 to get started.

The best element about IG Markets is that it lists over 5,400 ETF assets. You can also explore additional 11,000+ instruments, including forex, shares, indices, commodities, and cryptocurrencies, to select the best ones for your portfolio diversification. Sadly, IG Markets charges high fees for ETF trading. Its advanced resources may also be challenging for newbies to explore. You can test the broker via its demo account to ensure you are making the best choice.

Your capital is at risk

- Thousands of ETF assets to choose from

- Plenty of learning and research tools

- Availability of advanced platforms, including MT4, ProRealTime, and L2 Dealer

- Hosts a social trading platform for interacting with other ETF traders

- High minimum deposit requirement and ETF fees

- Not as user-friendly, especially for newbies

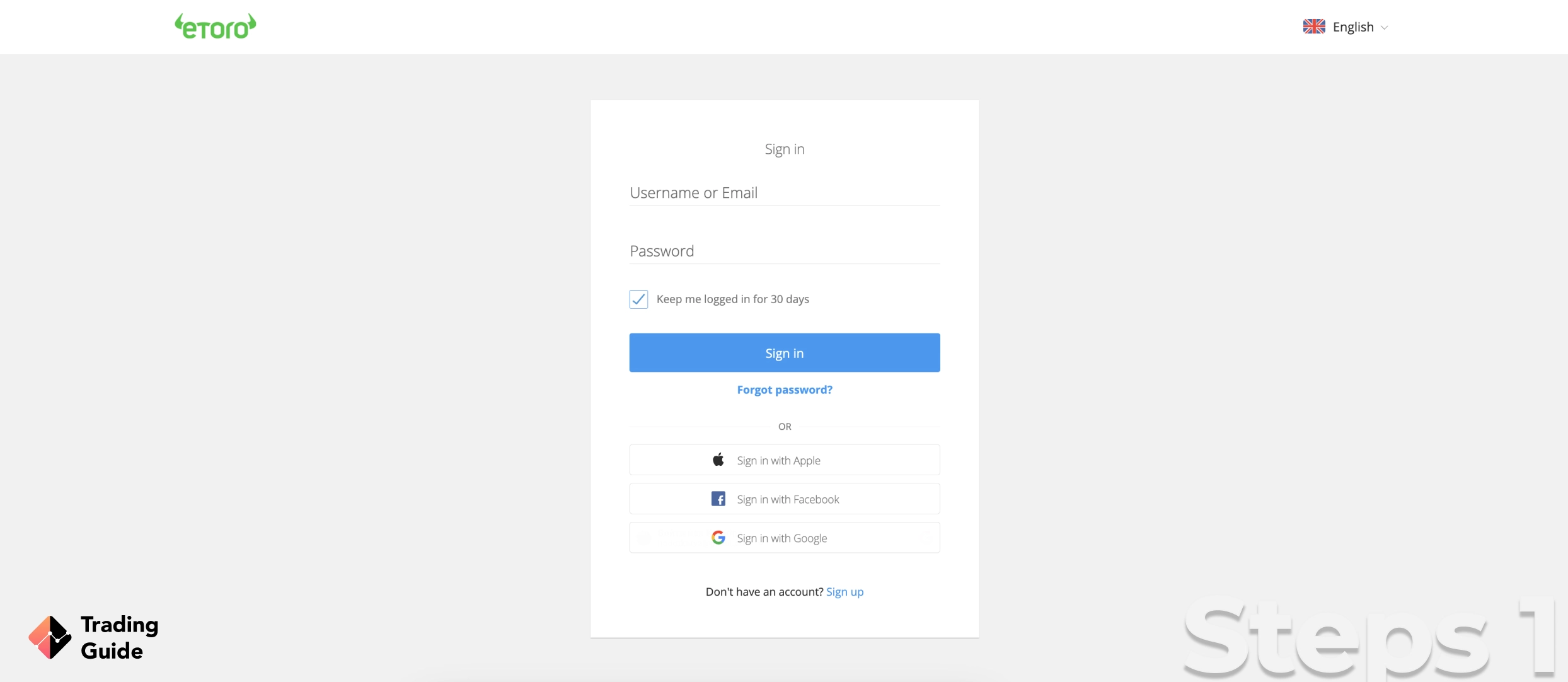

How to Buy Vanguard S&P 500 With eToro

New ETF investors looking to put their money into Vanguard S&P 500 ETF need credible and reliable brokers like the ones listed above to get started on a good note. You must also master the steps involved in buying the ETF to seamlessly create an account and make your first investment. Below, we take you through the step-by-step procedures on how to buy Vanguard S&P 500. You can apply these tips to any FCA-regulated ETF broker. We only use eToro as an example.

You need to sign up for an account with eToro to buy Vanguard S&P 500 index ETF. This can be done easily by clicking on any link we’ve shared on this page and be redirected to the broker’s site. On the site, click “join now” and start the registration procedure by sharing your name, age, phone number, email address, and more. eToro will also require you to choose a username and select a strong password to secure your account.

As with all FCA-regulated brokers, eToro requires you to verify your identity before you can access Vanguard S&P ETF to complete your purchase. In this regard, you will upload a copy of your ID or passport and a recent utility bill or bank statement to prove your address. There is also a questionnaire you must complete to determine a suitable trading package for you and a basic knowledge test on margin trading to determine your leverage limits. Note that verification can take up to two days to complete, and you will receive an email notification upon approval.

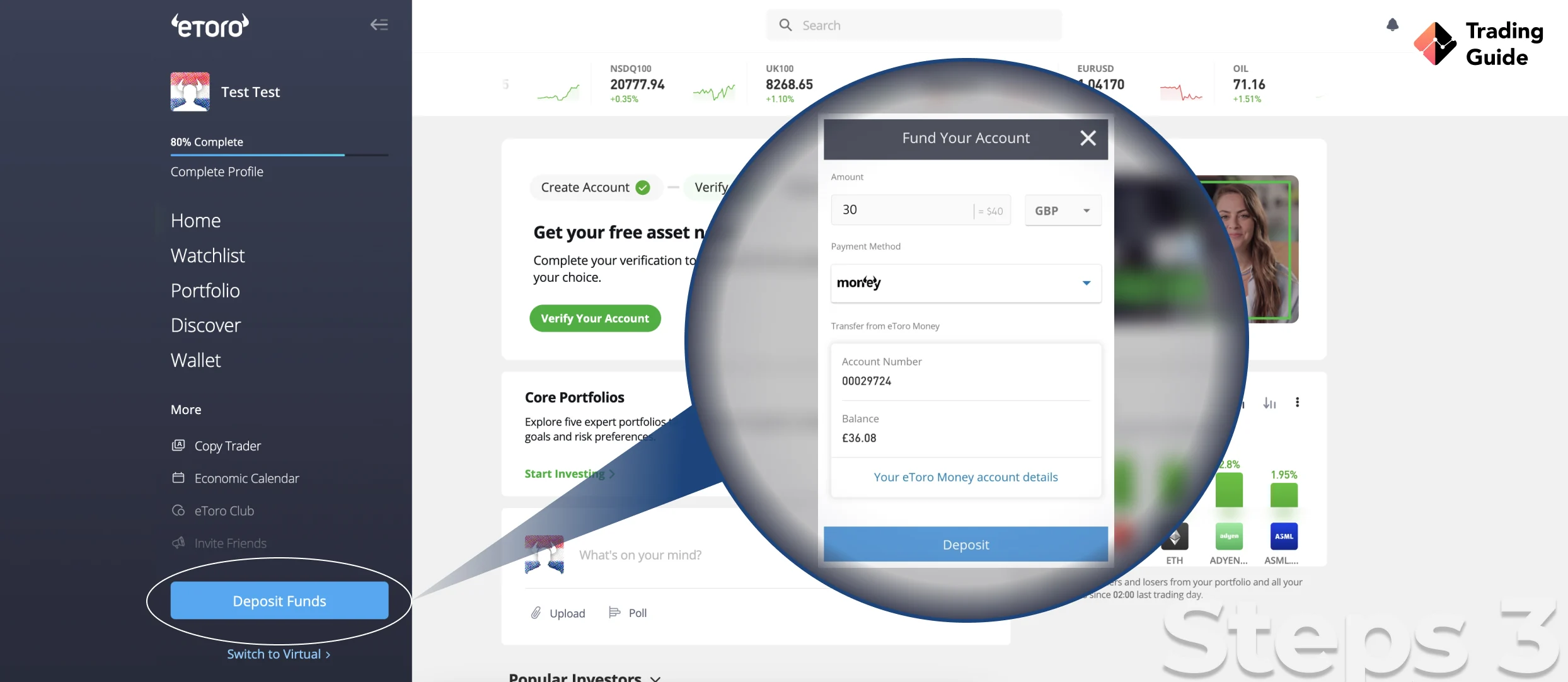

Once your account is verified, you can deposit at least $100 per eToro’s requirement and access the ETF to purchase. Note that eToro is one of the most flexible ETF brokers in the UK, meaning you can transact using multiple payment methods, including debit cards, bank transfers, and e-wallets.

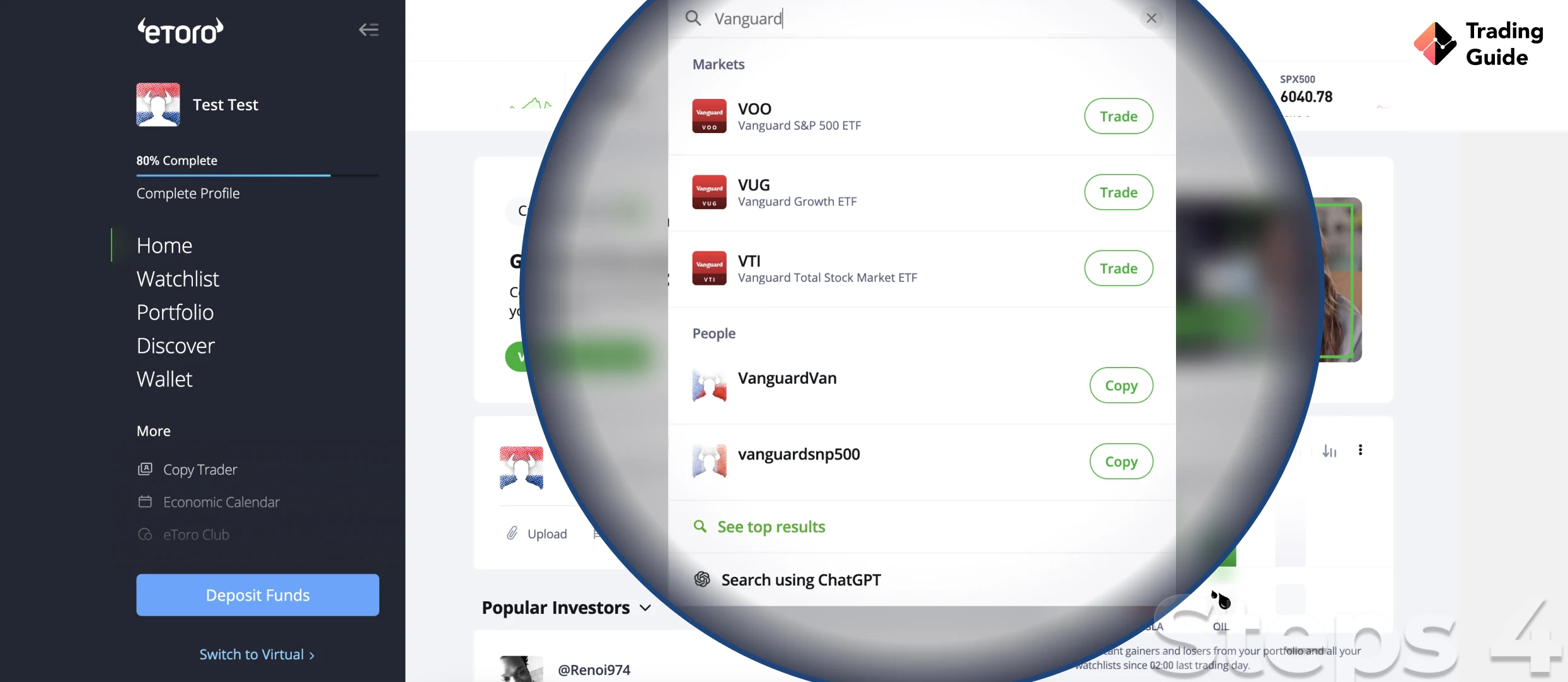

eToro will automatically redirect you to where it lists Vanguard S&P 500 ETF for purchase once your deposit has been confirmed. Alternatively, you can find the asset via the broker’s search bar using the ticker VOO or Vanguard S&P 500.

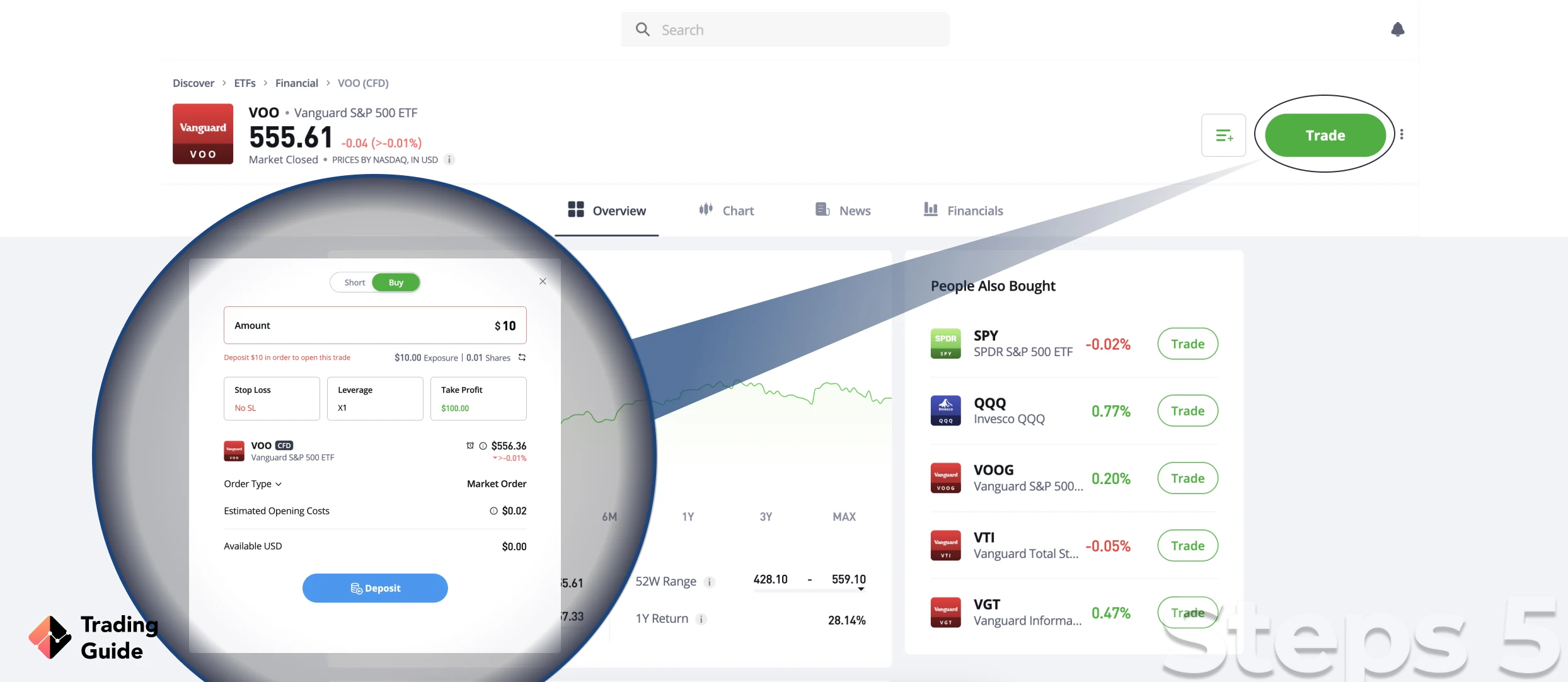

Decide how much you want to invest in the ETF and click on the “BUY” button. As an investor, investing safely is crucial to maximise your potential and limit massive losses in case your position turns out against your speculations. Therefore, always apply risk management controls such as stop-loss and take-profit orders. Most importantly, monitor your position to ensure everything works out as expected.

How to Choose the Best ETF Broker to Invest in Vanguard S&P 500

ETFs can be like a basket of opportunities, but remember, they’re not immune to market shifts. Just as the seasons change, so can the value of your ETF investments. Before diving in, take time to explore what’s inside the basket – understand the assets, their track record, and potential pitfalls.

Think of ETFs like a treasure map; you want to ensure you’re not led astray. Watch out for hidden costs and tracking errors, as these can be the dragons on your path to returns. A careful approach to ETF investing is your compass through the market’s wilderness, helping you navigate potential risks while optimising your investment journey.

As mentioned earlier, choosing the best ETF broker to invest in Vanguard S&P 500 is crucial for an exciting experience. Below, we list some of the essential factors you must consider during your research.

The first thing you must check when choosing an ETF broker is whether they are regulated in the UK market. Regulation is important as it ensures the broker adheres to financial standards and protects investors from fraudulent activities. The Financial Conduct Authority (FCA) is the primary regulator in the UK market. However, some brokers may be regulated by other authorities in different jurisdictions, which also adds to their credibility.

Different brokers offer different asset selections for trading. As an investor, it is crucial to confirm whether the ETF you wish to invest in is available on the broker’s platform. You can do this by checking via the broker’s demo account, which is usually provided free of charge. Besides, it is always advisable to go for a broker with a diverse selection of assets, as this offers you more options to trade and diversify your portfolio.

Trading platforms are essential when it comes to ETF trading. You need to choose an ETF broker with a user-friendly and easy-to-navigate platform. The platform should also allow you to execute trades quickly and efficiently, especially when taking short-term positions. Most importantly, find an ETF broker with an excellent selection of research, educational, and analysis tools to help you plan your trading strategies. Having reliable customer support that is available when you need it is another element to never overlook.

ETF brokers have different trading and non-trading charges, depending on the type of ETF trading you are interested in. Therefore, it is essential to check these charges beforehand and ensure that they are in line with your budget. Choose a broker that offers reasonable fees and charges and allows you to trade without incurring high costs.

User recommendations are an essential aspect of choosing the best ETF broker. Through user reviews, you get an honest insight into a broker’s trading platform and what to expect when trading with them. You can check user recommendations on various platforms, including the App Store, Google Play Store, or Trustpilot. However, don’t rely on one user’s review. Instead, sample a few reviews to get a well-rounded view of the broker.

What is the S&P 500?

The S&P 500, also known as the Standard & Poor’s 500, is a stock market index that tracks the performance of 500 large-cap companies listed on the US stock exchanges. It is widely considered one of the most important benchmarks of the US stock market, as it represents about 80% of the total market capitalisation of the US stock market.

The companies included in the index are chosen by a committee and maintained by the S&P Dow Jones Indices. These index components are selected based on various criteria, including market capitalisation, liquidity, and sector balance. The S&P 500 index is weighted by market capitalisation, meaning that companies with a higher market capitalisation have a greater impact on the index’s performance.

The S&P 500 is used as a measure of the overall health of the US stock market and is often used as a benchmark for investment portfolios. Investors can invest in the S&P 500 index through ETFs or mutual funds that track the index’s performance. Note that this index has historically provided strong long-term returns, but like any investment, it is not without risk. Various factors can affect the Vanguard S&P 500 index fund, such as economic indicators, geopolitical events, and company-specific news. As such, investors should conduct thorough research and seek professional advice before investing in it.

About the Vanguard S&P 500

The Vanguard S&P 500 is an ETF that tracks the performance of the S&P 500 index. The ETF is managed by Vanguard, one of the world’s largest investment management companies, and aims to provide investors with exposure to the US stock market’s large-cap segment. The Vanguard S&P 500 ETF invests in the same stocks that make up the S&P 500 index and is, therefore, subject to the same risks and rewards as the index.

Note that the Vanguard UK S&P 500 ETF is known for its low turnover rate, meaning that it has a long-term investment approach and tends to hold stocks for longer periods. As with any investment, investors should carefully consider their investment objectives, risk tolerance, and financial situation before investing in the Vanguard S&P 500 ETF. This is to ensure they make the best decision that could potentially bring about good profits.

Equity Sector Diversification

Equity sector diversification is a strategy used by investors to reduce the risk of their equity investments by investing in a variety of sectors. Sectors are groups of companies that operate in similar industries, such as technology, healthcare, finance, and energy. By diversifying across sectors, investors can spread their investments across different parts of the economy and avoid concentrating too much of their portfolio in any one sector. This can help to mitigate the impact of economic, regulatory, or industry-specific factors that may affect any one sector.

Investors can achieve equity sector diversification through various investment vehicles, including mutual funds, ETFs, and individual stocks. For example, an investor may choose to invest in a mutual fund through mutual fund brokers that hold stocks from various sectors or invest in several ETFs that track different sectors of the economy. Alternatively, investors may choose to purchase individual stocks from different sectors and hold them in a diversified portfolio.

While equity sector diversification can help to reduce risk, note that diversification does not guarantee a profit or protect against losses in a declining market. This means that you should always conduct thorough market analysis and research on an investment asset to ensure you are making the best decision.

FAQs

Yes. Vanguard S&P 500 is considered a solid investment option for long-term investors who want exposure to the U.S. stock market. We believe that it is a good investment since it offers broad diversification that limits the risks that come with investing in a single company’s stock. However, as an investor, we advise you to conduct a thorough market analysis to ensure you invest your money where you will potentially make good profits.

Yes. Vanguard offers a range of ETFs that are available for purchase in the UK. These funds can be bought through an ETF broker like the ones we recommend above. Remember, ETF brokers in the UK have varying features, and comparing them before making a final choice is crucial for maximum experience.

Vanguard charges 0.15% annually of the value of your account holding up to £250,000. However, if you want to trade Vanguard ETF in real-time using the quote and deal service, expect to incur a 7.50% fixed charge.

Yes. Vanguard S&P 500 ETF (VOO) pays quarterly dividends to VOO shareholders. Note that it is not Vanguard that pays the dividends but the companies included in the S&P 500 index.

Conclusion

Vanguard S&P 500 ETF provides investors with an opportunity to diversify their portfolios and gain exposure to the US stock market. By investing in this ETF, you can benefit from the low expense ratio and low turnover rate, which can help maximise your returns over the long term. However, note that this investment carries the risks of losing money, and you must understand how ETF investment works and conduct thorough research before investing. With a disciplined and patient approach, you can potentially achieve your investment goals and build a strong, diversified portfolio with the Vanguard S&P 500 ETF.